and the distribution of digital products.

State of Pyth Q3 2024

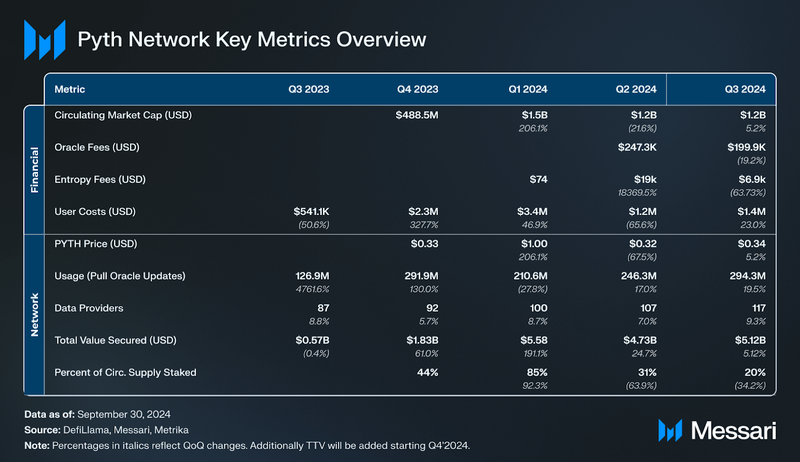

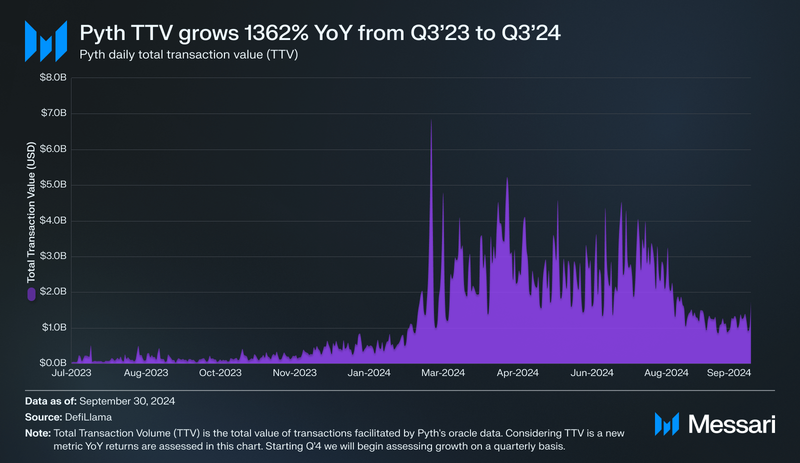

- Pyth Network is shifting from Total Value Secured (TVS) to Total Transaction Volume (TTV) as its primary metric, focusing on transaction frequency and volume to more accurately assess Oracle demand and revenue potential. Additionally, TTV grew 1362% YoY.

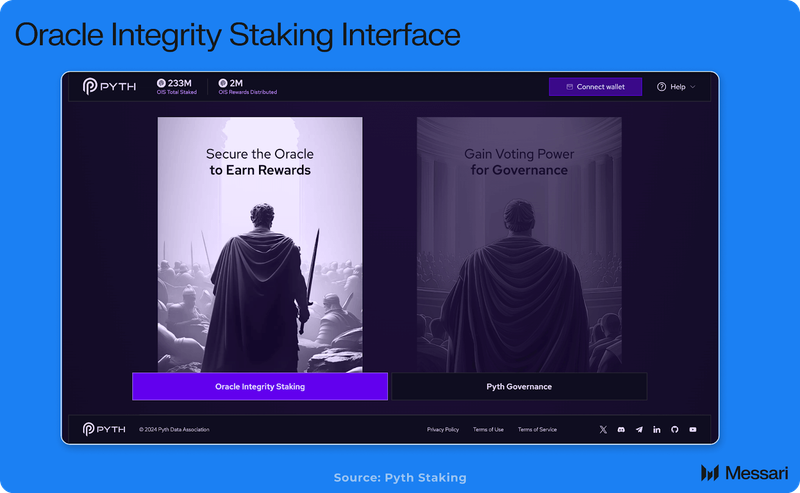

- The launch of Oracle Integrity Staking (OIS) in September 2024 introduced new staking dynamics, allowing participants to stake PYTH tokens toward specific data publishers. At the end of the quarter, OIS had already gathered 135M PYTH tokens of stake, securing DeFi (16% of the program capacity).

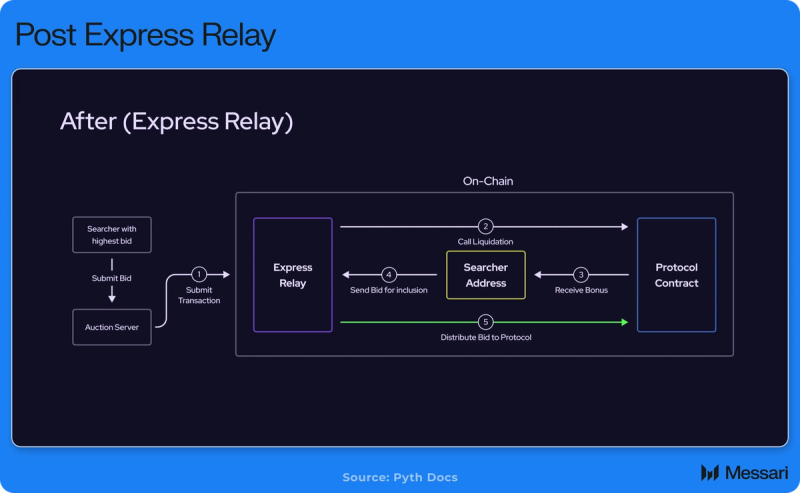

- Express Relay, launched on July 13, 2024, mitigates MEV costs through off-chain priority auctions for transaction sequencing. The system enables efficient handling of high-value transactions, such as liquidations in lending protocols.

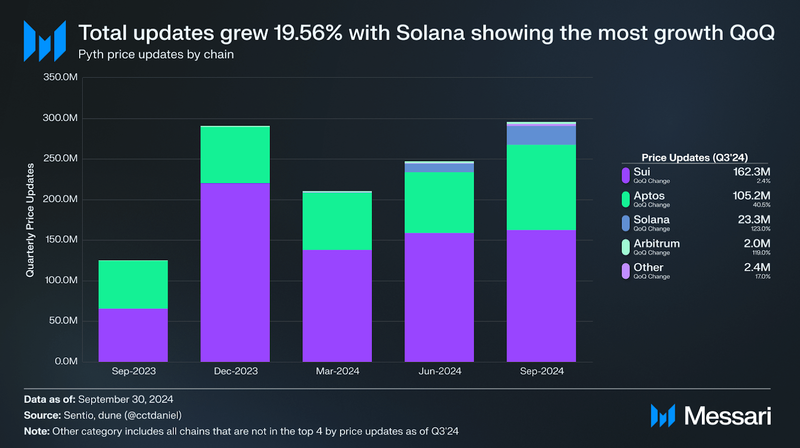

- Total price updates grew by 19.61% QoQ, reaching 295 million updates in Q3. Solana saw the largest increase, up 123% to 23 million updates.

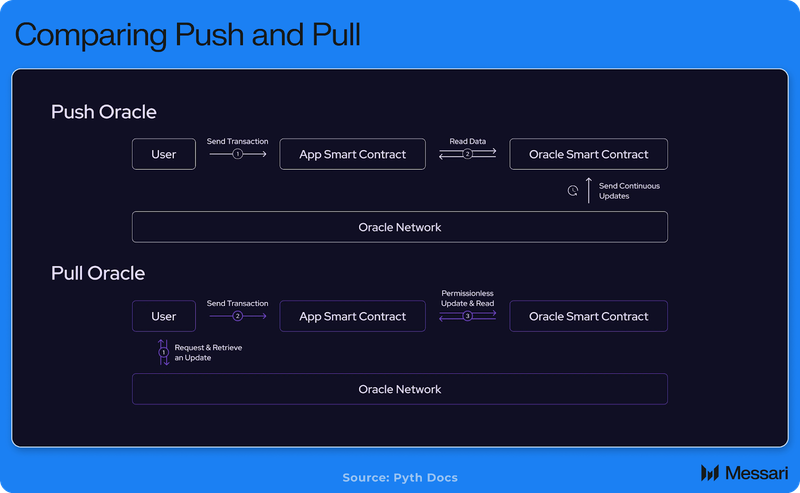

- Pyth drastically reduced its tx share on Solana to ~0% by completing the previously announced migration from the original push-based implementation to a pull oracle, freeing valuable resources on the Solana network

Pyth (PYTH) is an oracle network that aims to offer accurate prices for cryptocurrencies, equities, foreign exchange pairs, ETFs, and commodities. Oracle networks aggregate external data and make it available for onchain application use. Pyth fosters a network of first-party (primary source and aggregator) data providers and coordinates a “pull” oracle model. This model scales price feeds across many chains and lowers network costs by offloading update fees to data consumers (applications and developers). Pyth offers four core products:

- Price Feeds (live updates for smart contracts)

- Benchmarks (historical market data)

- Pyth Entropy (secure random number generator)

- Express Relay (priority auction to eliminate MEV)

The integrity of Pyth’s data is dependent on its contributing publisher network, which comprises over 110 data providers from global exchanges, trading firms, market makers, institutions, and DeFi. A few notable providers include Jane Street, Cboe Global Markets, Binance, Raydium, Osmosis, Galaxy, and 0x. Pyth is focused on making financial market data available to developers on an expanding list of blockchain networks (70+ blockchains as of writing). For a full primer on Pyth, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisTotal Transaction Value (TTV): A New Way of Looking at Oracles

Performance AnalysisTotal Transaction Value (TTV): A New Way of Looking at OraclesTotal Value Secured (TVS) has long been the standard for assessing blockchain oracles, measuring the total value of assets relying on an oracle’s data feeds. This metric provided a useful view of an oracle’s role in DeFi by focusing on the asset value it helped secure, which was especially relevant during the early stages of DeFi when security and value protection were paramount. However, as DeFi applications evolve toward high-frequency and transaction-focused use cases, the limitations of TVS have become apparent. TVS, especially in Pyth’s case, doesn’t accurately capture an oracle’s actual activity or demand since it only reflects asset value rather than transaction volume.

To address these limitations, Total Transaction Volume (TTV) has emerged as a more accurate measure, focusing on the actual transaction volume an oracle enables. One way to think of TTV is as “derivatives volume enabled by protocols,” emphasizing transaction frequency and volume over static asset value. This shift aligns directly with the high-frequency, data-driven demands of modern DeFi applications, such as decentralized exchanges (DEXs) and derivatives platforms. TTV better reflects the true market share and usage of an oracle, showing how much the oracle is relied upon for real-time, on-demand data. Importantly, TTV also aligns more closely with the revenue model of most oracles, which generate income per transaction request rather than by the value of the assets they secure.

To calculate TTV, the first step is to identify protocols using an oracle’s data feeds, especially those supporting derivatives and other transaction-intensive applications. Once these protocols are identified, historical transaction data for each is collected, tracking the transaction volume facilitated by the oracle across applications. By aggregating this data daily or monthly, analysts can build a comprehensive view of the oracle’s supported transaction volume over time. This calculation not only highlights the actual demand for an oracle’s services but also provides a relevant measure for assessing growth, adoption, and revenue potential in the current DeFi landscape.

TTV grew 1,362% year-over-year, rising from $12.42 billion in Q3 2023 to $181.59 billion in Q3 2024. This sharp increase highlights the expanding demand for Pyth’s oracle services, reflecting the protocol's substantial role in facilitating high-frequency transactions across DeFi platforms. Moving forward, TTV will be assessed on a quarterly basis to provide a closer look at changes and trends. However, as this is the first report featuring TTV, observing its annual growth provides essential context for understanding the metric’s baseline and growth trajectory.

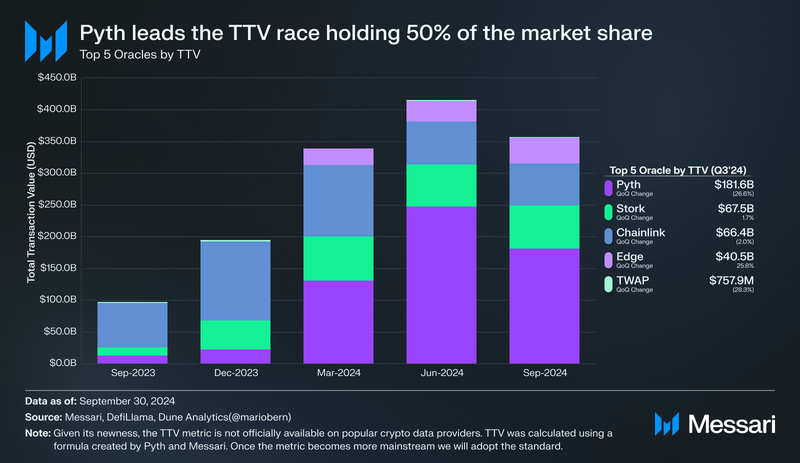

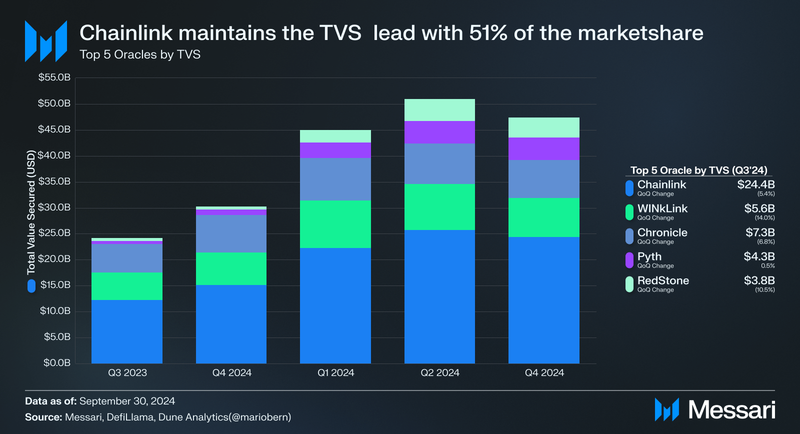

Looking Forward: TTV as the Primary Metric for PythAlthough TTV is emerging as a key metric, TVS remains an essential measure for understanding the overall health of the oracle sector. Going forward, TTV and TVS will be compared quarterly across the top five oracles in each category, providing a dual perspective on both transaction volume and value secured. As the industry gradually adopts TTV, TVS will continue to offer context on the broader oracle sector’s stability within the crypto ecosystem. TTV, however, is particularly well-suited for Pyth and other high-frequency oracles, aligning closely with their focus on transaction-driven applications.

Pyth TTV dropped 26.6% QoQ, reflecting a general trend in the oracle space; however, it maintained dominance in market share, holding 50% of the total TTV. On the other hand, Edge has seen a significant increase in its TTV, 25.5% QoQ. It is important to note that the overall Oracle space for both TTV and TVS has declined QoQ. Chainlink has dropped 5.4% in TVS QoQ, with WINkLink dropping 14.01% QoQ, Chronicle dropping 6.8% QoQ, and Redstone dropping 10.5% QoQ. Only Pyth showed an ever-so-slight positive increase in TVS, growing 0.5% QoQ.

Overall, these fluctuations in TTV and TVS likely stem from changes in market activity, evolving protocol demand, and shifts in DeFi applications, all influenced by broader price volatility in Q3 ’24. As the market develops, these metrics, particularly TTV, should offer even clearer insights into the underlying demand and resilience within the Oracle space.

Price UpdatesAs a pull oracle, Pyth’s demand is reflected by the volume of price updates it provides. In Pyth-secured applications, DeFi users initiate smart contract calls that simultaneously request the latest Pyth price data within the same transaction. This means that each time a DeFi protocol requires updated price information, a call is made to Pyth, and the oracle publishes a real-time price update directly within the transaction.

Pyth oracle demand saw steady growth this quarter, with total price updates increasing by 19.56% QoQ, reaching 295.2 million updates in Q3. Solana led this growth following its transition from a push to a pull oracle model, with a substantial 123% increase to 23.2 million updates, while Arbitrum followed with a 119.03% rise to 2.0 million updates. Aptos Mainnet saw a 40.47% increase, reaching 105.1 million updates, and Sui Mainnet grew by 2.4%, totaling 162.3 million updates QoQ.

In terms of Q3's overall update volume, Sui Mainnet contributed the largest share at 54.98%, followed by Aptos Mainnet at 35.62% and Solana at 7.88%. Arbitrum and Other Chains made up 0.69% and 0.83%, respectively. This expansion across chains reflects the growing reliance on Pyth’s real-time price feeds within DeFi. As Pyth maintains and builds on current partnerships and establishes new ones, it is positioned to continue this growth, further supporting data accuracy and interoperability across blockchain protocols.

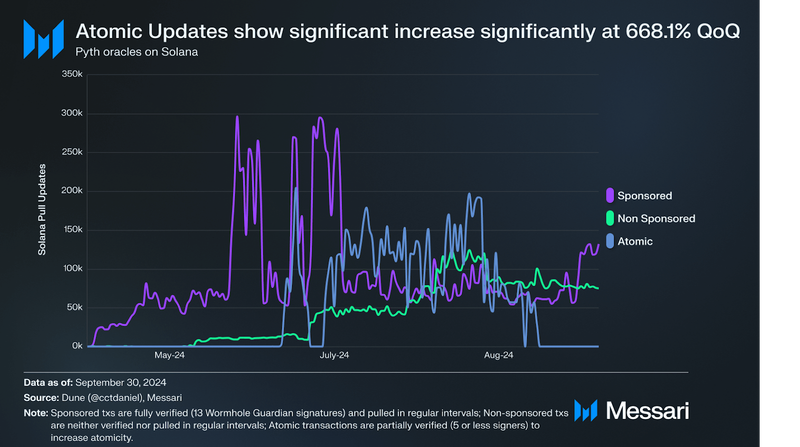

In Q3’24, the Pyth Network experienced a shift in the composition of its price update transactions on Solana, with notable changes across sponsored, non-sponsored, and atomic updates. Sponsored updates, which were the leading type in Q2 with 8.1 million updates, decreased by approximately 5.25% in Q3, bringing their count down to 7.7 million. Sponsored updates are those executed at regular intervals using the Pyth Scheduler, a permissionless off-chain application that ensures continuous price updates for applications requiring consistent data refreshes. These updates are fully verified by 13 Wormhole Guardian signatures, ensuring high levels of security and reliability.

Meanwhile, atomic updates emerged as the dominant transaction type in Q3, increasing dramatically to 7.7 million, a 668.1% rise from Q2’s 1.0 million. Atomic updates, designed for transactions requiring high atomicity and partially verified with five or fewer Guardian signatures. This shift indicates that more applications are prioritizing the speed and efficiency provided by atomic updates.

Non-sponsored updates also saw significant growth, jumping from 700,000 updates in Q2 to 6.8 million in Q3, marking an 860.7% increase. These updates, which are manually triggered smart contract calls that do not utilize the Scheduler, show a growing adoption of flexible transaction models within Pyth’s ecosystem. The shift toward atomic and non-sponsored updates reflects Pyth’s expanding capabilities and the versatility of its oracle solutions. Applications are increasingly leveraging atomic updates for their partially verified nature, while non-sponsored updates offer direct control over data pulls.

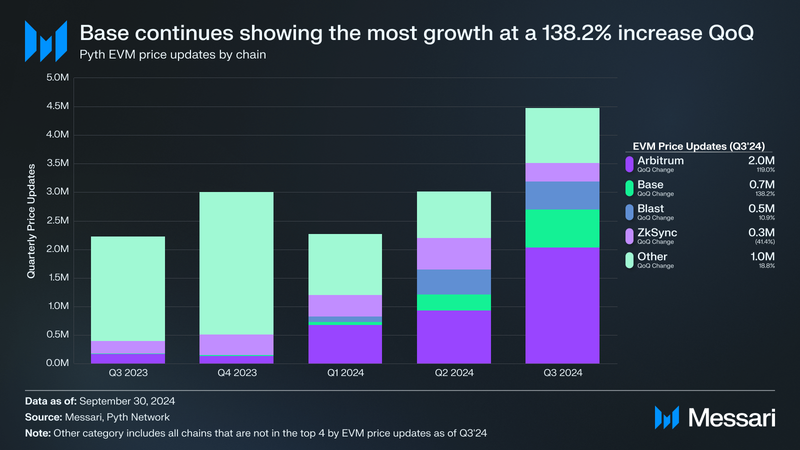

In Q3’24, Pyth’s EVM-compatible integrations showed strong growth, with Arbitrum leading in raw update volume and Base recording the highest percentage increase. Arbitrum updates rose by 119%, from 920,000 in Q2 to 2.0 million in Q3, reflecting increased demand for its DeFi ecosystem. Base, meanwhile, had the largest percentage growth at 138%, with updates rising from 0.28 million in Q2 to 0.66 million in Q3, marking its expanding role within Pyth’s network.

Blast saw a steady 10.92% increase, reaching 490,415 updates in Q3. Conversely, zkSync Era updates declined by 41.4%, from 552,600 in Q2 to 323,900 in Q3, which may indicate shifting usage patterns over to other EVM chains. Overall, the trend has been positive across both EVM and non-EVM chains, showing Pyth’s cross chain applicability.

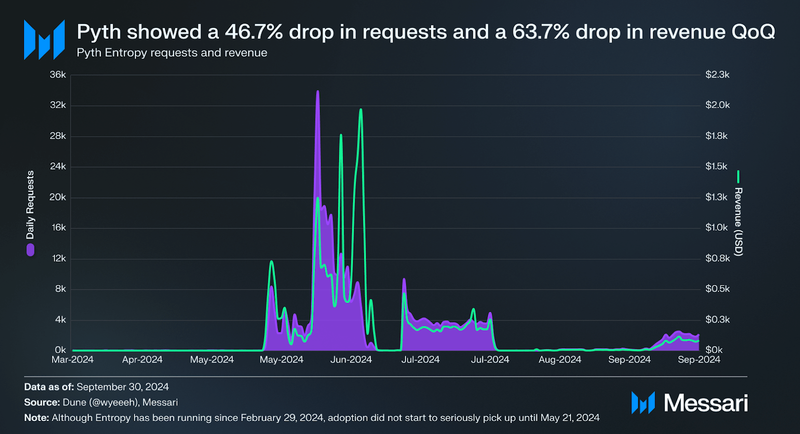

Pyth Entropy offers developers a secure way to generate random numbers on the blockchain, leveraging two-party randomness to ensure trustworthy outcomes. This randomness solution supports applications requiring unpredictability, such as NFT mints, gaming, and consensus mechanisms.

Pyth Entropy's availability has grown QoQ; it is now accessible on 16 EVM networks, up from 13 in Q2.To date, it has processed a total of approximately 406,000 requests across supported chains, with Q2 accounting for 264,758 requests and generating approximately $19,000 in revenue. In Q3, requests dropped to 141,000, which contributed to a decrease in revenue to approximately $6,900, highlighting a potential link between request volume and revenue. As Entropy is still relatively new, its effectiveness in generating revenue will become clearer with time, as two quarters alone are insufficient to fully assess its long-term potential.

User CostsWhile the cost of pulling a Pyth update is minimal, users are still responsible for the gas fees associated with their DeFi transactions that may include the submission of the price updates on-chain. These gas costs apply solely to users, with no expense incurred by Pyth.

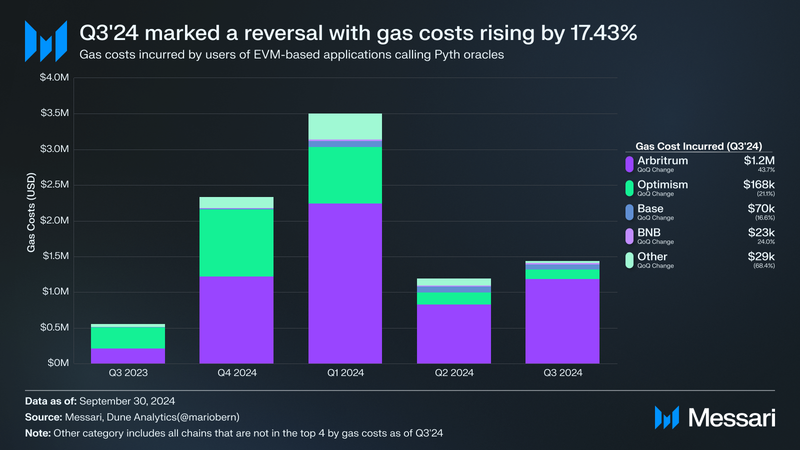

Following the sharp decline in gas costs in Q2'24 due to the Dencun/EIP-4844 upgrade, Q3'24 marked a reversal with gas costs rising by 17.4%. Arbitrum led this increase, with fees growing by 69% in tandem with a 120% jump in EVM price updates, indicating increased activity and demand for Pyth's oracle services on the network. Meanwhile, Base saw a 17% decrease in gas costs, even as its EVM updates surged by 138% QoQ, suggesting that efficiency gains may offset the costs of higher transaction volumes. As gas costs stabilize across networks, these patterns highlight the unique dynamics of each EVM chain and their evolving integration with Pyth's oracle solutions.

Solana Transaction Share

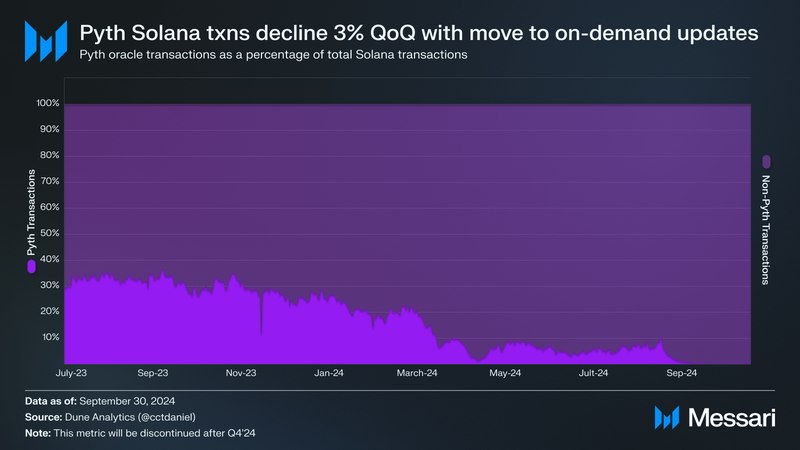

Pyth’s share of Solana transactions has decreased to an average of 3.09% in Q3, down from around 5.65% in Q2. This decline aligns with the protocol’s transition from a push oracle model to an on-demand pull oracle on Solana, which no longer requires constant updates every 400 milliseconds. Under the previous push oracle model, Pyth’s transactions accounted for a significant share of Solana’s total transactions—up to 48% or even 60% on certain days. However, under the pull model, Pyth now publishes updates as required by applications, resulting in reduced transaction volume on Solana.

This reduced share is anticipated to continue as demand-driven updates replace scheduled updates, decreasing Pyth’s impact on Solana’s total transaction count. We plan to provide one final update on this metric in Q4 2024, after which it will be omitted in future reports, as it becomes increasingly less relevant to measuring Pyth's growth and activity on the network.

Introducing Oracle Integrity Staking (OIS)

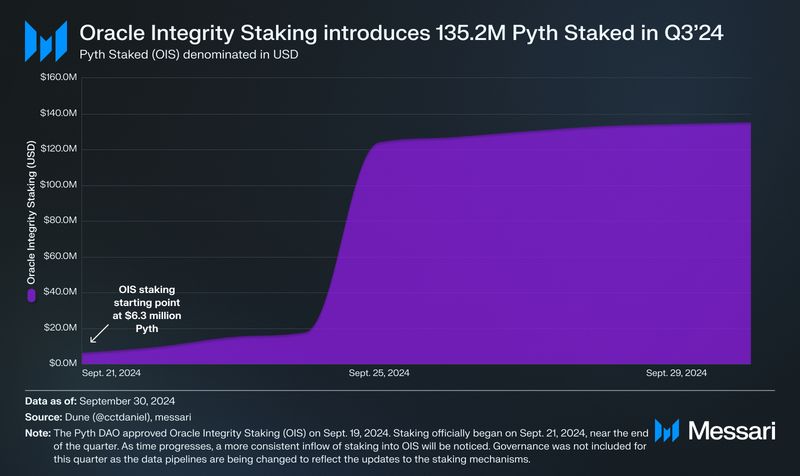

Pyth’s Oracle Integrity Staking (OIS) was launched on September 21, 2024, as a key addition to the network's staking infrastructure. At launch, approximately $6.3 million worth of PYTH tokens were staked under OIS. By the end of Q3'24, this figure had grown significantly, reaching $135.2 million. Further information on OIS can be found in the Qualitative section below.

Governance staking data, another crucial component of network participation, will be included in the next quarterly report. This is due to the ongoing reconstruction of data pipelines following the introduction of OIS, which ensures that governance-related metrics are accurately captured and reported in future analyses.

Qualitative AnalysisProtocol UpdatesLaunch of Express Relay

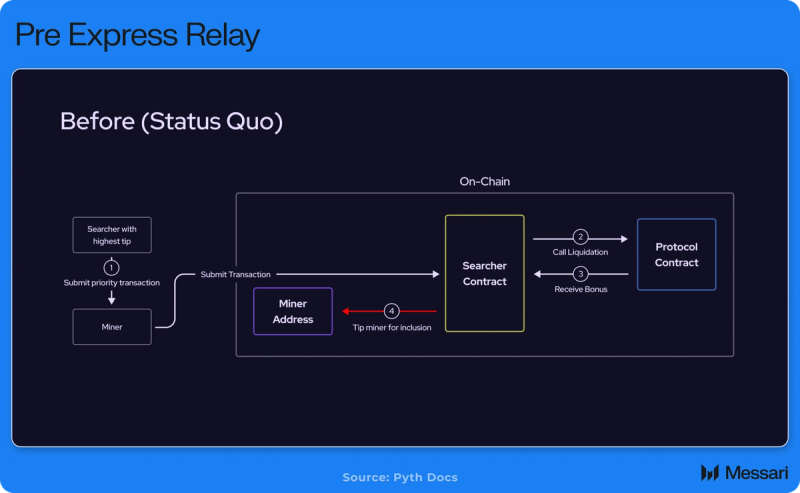

The launch of Express Relay in Q3’24, announced on July 13, 2024, marked a significant advancement for the Pyth Network, directly addressing Maximal Extractable Value (MEV) — a persistent challenge in decentralized finance. MEV arises when transaction ordering can be exploited for profit, often increasing costs for end-users. Express Relay aims to mitigate MEV by using isolated priority auctions, allowing high-frequency traders, known as searchers, to bid for transaction sequencing rights, reducing the impact of MEV-related costs on the network.

Express Relay was implemented on the Pyth mainnet following the approval of CO-PIP 3 on July 1, 2024, with an official launch on July 13. This off-chain priority auction network allows searchers to submit bids for high-value transactions, such as liquidations in lending protocols, by determining transaction priority off-chain rather than through on-chain bidding. Early adopters of Express Relay, including Ionic and Synthetix (currently in the process of integration), are benefiting from reduced costs and enhanced efficiency in transaction processing. In coming quarters, the protocol can be extended to support any arbitrary transaction in the same way that intent-based markets (e.g. UniswapX and CoSwap) operate.

Pull Oracle (Updates)

Pull Oracle (Updates)During Q3’24, Pyth Network saw significant adoption of its pull oracle technology, representing a shift in how blockchain applications interact with external data. Unlike traditional push oracles, which send data at fixed intervals, pull oracles allow smart contracts to request data as needed. This reduces the risk of outdated information and enhances the reliability of data feeds for various applications.

Several platforms adopted Pyth’s pull oracle technology:

- NX Finance (announced July 4, 2024): NX Finance, a Solana-based composable leverage protocol integrating AirdropFI and yield aggregation, adopted Pyth’s pull oracle for its low-latency financial data and secure liquidation engine. This integration supports the protocol’s goal of delivering real-time, accurate data for its core operations.

- Paradex (announced July 12, 2024): Paradex, a ZK-powered Layer 2 network built for high-performance derivatives trading, integrated Pyth’s pull oracle as its primary price feed solution from its launch. The pull oracle is used to set crucial trading parameters such as funding rates, mark prices, margin consumption, and liquidations. This helps ensure that Paradex operates efficiently with accurate and up-to-date data.

Oracle Integrity Staking (OIS) Introduction

On Sept. 19, 2024, the Pyth DAO approved Oracle Integrity Staking (OIS), marking a significant upgrade to Pyth Network’s staking framework with a focus on enhancing data reliability through economic incentives for data providers and stakers. OIS was officially launched on Sept. 21, 2024, featuring a new user interface that allows participants to stake PYTH tokens toward specific data publishers. This process strengthens the accuracy of price feeds by aligning the financial interests of data providers and stakers with the overall integrity of Pyth’s price data. From September 21 to September 26, staked tokens entered a warm-up phase, with the first rewards being distributed after the conclusion of Epoch 10 on Oct. 3, 2024, marking the start of Epoch 11.

Participants in OIS begin by adding their PYTH tokens to the Staking Dashboard, and selecting data publishers to support. Each staker allocates their tokens to publishers based on criteria like stake pool details and quality rankings, aligning their stakes with preferred data providers. After allocation, tokens enter a brief warm-up period before they become fully staked. At the end of each 7-day epoch, which is synchronized with Pyth’s governance voting, rewards are programmatically distributed to publishers contributing high-quality data, while penalties are applied for inaccuracies. The remaining rewards are then allocated to the stakers who supported these publishers. The ability to slash stake for data errors requires unlocked PYTH tokens while staking for governance may use both locked and unlocked tokens.

Oracle Integrity Staking secures all current and future Pyth price feeds, holding individual data publishers accountable for data accuracy. The protocol parameters are captured each Thursday at 0:00 UTC and remain fixed until the end of the epoch. Stakers in OIS share in both the risks and rewards of the publishers they support, with a greater number of publishers contributing positively to the security of a price feed. Additionally, staking in OIS complements governance staking, allowing eligible PYTH tokens to be used for both purposes. It is also important to note that staking in OIS is unavailable for U.S. market participants, and further details are available in the terms of service.

Perpetual Futures and Derivatives

Pyth Network’s real-time price feeds have proven to be a critical asset for perpetual futures and derivatives platforms, which rely heavily on accurate and timely data for precise pricing and effective risk management. The availability of these reliable data feeds allows platforms to offer more competitive and precise trading environments, particularly in the highly dynamic derivatives market.

One notable example is Pyth's partnership with SynFuturesDefi, a protocol that supports cross-chain perpetual trading using any ERC20 token as collateral. SynFuturesDefi integrates Pyth’s price feeds across multiple chains, including Arbitrum, Optimism, and BNB Chain, ensuring accurate and up-to-date pricing for its users. As of Aug. 5, 2024, the platform was processing approximately $1.0 billion in daily derivatives trading volume, highlighting the scale of its operations and the vital role Pyth’s data plays in supporting such high-volume activities. This collaboration enhances the precision and efficiency of derivatives trading, benefiting both the protocol and its users by minimizing risk and ensuring better pricing.

New Price Feeds and Their Significance

In Q3’24, Pyth Network expanded its range of price feeds, introducing the USDY/USD price feed, launched on July 10, 2024, in collaboration with Ondo Finance, which is crucial in bridging real-world assets and DeFi. USDY, a stablecoin pegged to the U.S. dollar, exposes users to tokenized U.S. Treasuries and bank deposits. Available across over 65 blockchains, the USDY/USD feed has supported the stablecoin’s adoption and liquidity across various platforms, enabling more precise pricing in DeFi applications.

Similarly, the JLP/USD price feed, released on Aug. 12, 2024, for Jupiter Exchange's LP token, has enhanced the utility of JLP tokens within the Solana DeFi ecosystem. This price feed has facilitated the use of JLP tokens as collateral and has the potential to boost liquidity across the Solana network.

These price feeds are important because they enable DeFi platforms to provide more accurate asset valuations and offer greater flexibility in how assets are used. By integrating real-world assets and expanding collateral options, these feeds help improve liquidity, reduce risk, and enhance the overall efficiency of DeFi markets, making them more robust and accessible to a wider range of users.

GovernanceThe PYTH token is an SPL token on Solana. The core utility of PYTH is governance. PYTH holders can guide protocol development by staking the asset and voting on Pyth Improvement Proposals (PIPs). Pyth DAO also consists of the Pythian Council and the Price Feed Council. Both councils are responsible for voting for and implementing certain operational PIPs.

Pyth DAO has two types of PIPs: Constitutional and Operational. Constitutional PIPs involve protocol updates, determining structure, and guiding the administration of the Pyth DAO. They require greater than 67% support for implementation. Operational PIPs involve elections and the management of the treasury, Pythian Council, and Price Feed Council. Voting on these PIPs can be delegated to Council members and require greater than 50% support for implementation.

PIPs

Throughout Q3, Pyth approved 2 Constitutional PIPs and 13 Operational PIPs, reflecting its continued governance activity on Solana. The relevant proposals are listed below, showcasing the ongoing development and improvements within the Pyth ecosystem.

Constitutional:

- CO-PIP-3: This proposal implements the first instance of Express Relay on EVM chains, allowing liquidation searchers to compete for liquidation opportunities via off-chain auctions, with Pyth DAO earning 26% of the revenue from each processed liquidation.

- CO-PIP-5: The upgrade to the Pyth Staking Program introduces data integrity staking, enabling participants to stake for both governance and data accuracy, with rewards linked to maintaining reliable price feeds and penalties for inaccuracies.

Operational:

- OP-PIP-16: Asymmetric Research is appointed as the relayer for the Pyth Express Relay (PER) system, leveraging its proven expertise in operating high-trust infrastructure, maintaining over 95% uptime, and providing reliable security and performance across multiple blockchains, ensuring the stability and success of PER on mainnet.

- OP-PIP-17: The proposal transfers 4,000,000 PGAS tokens from the PGAS treasury to the Price Feed Council operational wallet to cover Pythnet operational expenditures for the next 380 days, ensuring continued support for validators, data publishers, and governance message relays.

- OP-PIP-18: The upgrade to the Pyth oracle program transitions the aggregation process to the validator, enhancing performance by reducing latency by 400ms and improving efficiency as Pythnet handles over 3,000 price updates per second.

- OP-PIP-19: The Pythian Council has accepted the governance authority for managing the Pyth Eclipse receiver contract, following the transfer of the upgrade authority, to oversee and administer the contract on Eclipse Mainnet officially.

- OP-PIP-20: 100,000 PGAS has been delegated to 19 new Pythnet validators as part of an effort to improve decentralization and reliability, with each publisher connecting to their own dedicated validator.

- OP-PIP-21: The Entropy contracts on all testnet chains have been upgraded to reduce gas costs by allowing providers to advance their commitment to a more recent sequence number, which lowers the number of hashes required for reveal transactions.

- OP-PIP-22: This proposal deactivates unready Pythnet validators from OP-PIP-20 due to network issues and delegates 100,000 PGAS to two new publisher-associated validators to improve Pythnet's reliability and decentralization.

- OP-PIP-25: 100,000 PGAS has been delegated to 12 new Pythnet validators as part of an ongoing effort to improve decentralization and reliability, with each publisher connecting directly to their own dedicated validator.

- OP-PIP-24: This proposal approves the second Pythian Council, adding four newly elected members from the recent elections held between August 29 and September 4, 2024, joining the existing members to govern the Pyth DAO.

- OP-PIP-23: The Entropy contracts on all mainnet chains have been upgraded to reduce gas costs for reveal transactions by limiting the number of required hashes, following the success of testnet proposal OP-PIP-21.

- OP-PIP-26: 100,000 PGAS has been delegated to 7 new Pythnet validators as part of the ongoing effort to improve decentralization and reliability by ensuring each publisher connects directly to a dedicated validator.

- OP-PIP-27: 100,000 PGAS has been delegated to 14 new Pythnet validators as part of the ongoing decentralization efforts, ensuring that each publisher operates with a dedicated validator to enhance Pythnet's reliability and scalability.

- OP-PIP-28: The on-chain IDL of the Pyth Staking Program has been upgraded to ensure block explorers can properly parse and display transactions in a human-readable format, improving transparency and user experience when interacting with the program.

The Open Network (TON) Collaboration

In Q3’24, Pyth Network and The Open Network (TON) formed a partnership to enhance the DeFi and gaming sectors within the TON ecosystem. Announced on Aug. 14, 2024, this collaboration integrated Pyth's real-time, institutional-grade price data feeds into the TON blockchain, providing developers with reliable and high-precision data for building advanced DeFi services and optimizing in-game economies.

This integration came at a time of growth for TON, with its total value locked (TVL) experiencing significant growth, reaching over $600 million, a 4,226% increase YoY. The incorporation of Pyth’s pull oracle technology added multiple layers of data security and reliability, allowing TON developers to create more sophisticated DeFi applications while maintaining robust data accuracy for a global user base. This collaboration strengthens TON’s infrastructure by supporting the development of data-driven applications across its growing ecosystem.

Sony Group and Soneium Platform Collaboration

Sony Group took a significant step towards integrating blockchain technology into its operations with the launch of Soneium, a blockchain platform developed by Sony Block Solutions Labs. Instead of relying on third-party platforms, Soneium marks Sony's move to create its own blockchain solution, bridging traditional industries with decentralized technologies.

Pyth Network became the first oracle provider to integrate real-time price data into Soneium, announcing the collaboration with Startale Labs on Aug. 28, 2024, to enhance the platform’s capabilities. While specific applications remain undisclosed, the integration of Pyth’s real-time price feeds suggests potential use in financial services and dynamic pricing for digital assets within Sony’s blockchain ecosystem.

In addition, Sony Group and Startale Labs introduced the Soneium Spark incubation program, where Pyth Network serves as an infrastructure partner. This initiative aims to support new blockchain projects by providing access to Sony's resources, Startale's blockchain expertise, and Pyth’s infrastructure, encouraging the development of innovative decentralized applications within the Soneium ecosystem.

AMINA Bank Partnership: Bridging DeFi and TradFi

On July 5, 2024, Pyth Network partnered with AMINA Bank, a FINMA-regulated institution, to facilitate connections between decentralized and traditional finance. This collaboration provides Web3 developers with new tools to integrate regulated financial institutions into blockchain ecosystems.

AMINA Bank, which focuses on digital asset solutions for institutional investors and corporations, brings regulatory compliance and extensive institutional knowledge to the partnership. By joining with Pyth Network, AMINA Bank seeks to enhance the reliability and scope of Pyth’s Price Feeds, creating value for both decentralized and traditional finance users. This initiative aims to drive broader adoption of digital asset solutions among professional investors and institutional clients.

Gaming and Web3 Integrations

Pyth Network expanded its reach into the gaming and Web3 sectors in Q3’24 through several key integrations that enhanced the functionality of blockchain-based games and applications.

Tabichain, for instance, integrated Pyth Entropy’s on-chain random number generation (RNG) on July 17, 2024. This addition allows decentralized applications, particularly in gaming, to access secure and reliable randomness, essential for applications requiring fair distribution or selection processes, such as games, lotteries, and prediction markets.

Similarly, the prediction market platform 4CAST on Solana adopted Pyth Network’s pull oracle. By incorporating Pyth’s pull oracle, 4CAST provides users with a tool to forecast token price movements and build prediction markets. Together, these integrations enhance decentralized applications in gaming and financial forecasting within the Web3 space.

Community Support and Engagement

Pyth Network engaged in a range of initiatives this quarter to support early-stage projects and strengthen its presence within the blockchain community. Through partnerships, incubation programs, and community events, Pyth contributed to building a stronger ecosystem for decentralized finance and Web3.

One example of Pyth’s support for developer initiatives was its participation in the Kakarot ZkEvm SEED program, announced on Aug. 9, 2024. The program provided incentives for developers, with up to $10,000 in prizes per winning project. Pyth Network contributed 15,000 PYTH tokens specifically for projects integrating its low-latency price feeds into dApps built on the Kakarot platform.

Pyth Network supported community-driven events aimed at increasing engagement within the blockchain space. An example of this was the PYTH x PIKENIANS x MONAD PAD Gaming Tournament, held on Pyth's Discord server on July 17, 2024. This event offered a prize pool that included Purple Fren WLs, Undead Pikenians, Scrowl WLs, and Impact Rewards, encouraging participation and interaction among community members and partners like Pikenians and Monad Pad.

Additionally, Pyth Network collaborated with platforms to offer reward programs for its community. Paradex introduced its Ecosystem Rewards Hub in July 2024, providing incentives for Pyth Network supporters, while Merkle Trade ran two trading contests—S14: Pyth Parade and S15: Degen Racing Royale—that distributed PYTH token prizes to top participants. Through these events and collaborations, Pyth Network continued to support active participation and foster a vibrant community within decentralized platforms.

Closing SummaryIn Q3 2024, Pyth Network made significant strides, marked by the introduction of Total Transaction Value (TTV) as a new metric for assessing oracle demand alongside Total Value Secured (TVS). The shift to TTV reflects the increasing importance of transaction volume over locked asset value, especially for high-frequency applications in DeFi. Pyth also expanded its ecosystem through new partnerships with industry leaders like Sony's Soneium platform, highlighting its role in bridging blockchain with traditional sectors. Oracle Integrity Staking (OIS) was launched, enhancing data reliability and aligning financial incentives for stakers and data providers alike.

Key metrics for Pyth this quarter included a substantial 19.6% increase in total price updates across its supported chains, driven by higher demand on Solana, Arbitrum, and Aptos. Oracle Integrity Staking (OIS), introduced on September 21, began with $6.3 million worth of PYTH tokens staked and grew to $135.2 million by the close of Q3. This growth reflects the increasing adoption of OIS and its integration with governance staking.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.