and the distribution of digital products.

Rocket Pool Vs. Lido : Which ETH staking solution is the best?

Two prominent initiatives in the Ethereum space that enable users to stake their Ether (ETH) and earn rewards are Rocketpool and Lido DAO. This article will explore a detailed Comparative Analysis: Rocket Pool Vs. Lido, exploring their respective features, functionalities, and tradeoffs. Both platforms aim to provide a decentralized way for users to participate in Ethereum’s proof-of-stake (PoS) consensus mechanism, but their approaches and offerings differ.

Summary- Rocketpool is an Ethereum-based decentralized staking network where users can stake their ETH with a minimum staking threshold as small as 0.01ETH.

- Lido DAO is a decentralized platform that empowers users to stake their ETH in a fluid state, preserving their flexibility and liquidity while reaping staking rewards.

- Minimum Staking Requirement: Rocketpool has a requirement 0.01 ETH , and Lido DAO has no requirement.

- Liquidity and Flexibility: Rocketpool offers rETH tokens, and Lido provides stETH tokens.

- Node Operator Complexity: Rocketpool allows users but needs expertise; Lido collaborates with pros.

- Governance: Rocketpool uses RPL, and Lido DAO employs LDO for decisions.

- Centralization Risks: Rocketpool aims for decentralization, and Lido may raise centralization concerns.

- Token Volatility: RPL and LDO tokens are both subject to volatility.

- Performance Dependency: Rocketpool relies on node operators’ uptime, and Lido ensures high performance through collaboration.

- Rocketpool is a decentralized staking network built on Ethereum that permits users to stake their ETH with a minimum staking amount as low as 0.01 ETH.

- It was launched to make Ethereum 2.0 staking more accessible to a wider audience, including those with smaller amounts of ETH.

- Rocketpool operates as a network of node operators who pool ETH from users and manage the staking process.

Comparative Analysis: Rocket Pool Vs. Lido

Features

Comparative Analysis: Rocket Pool Vs. Lido

Features

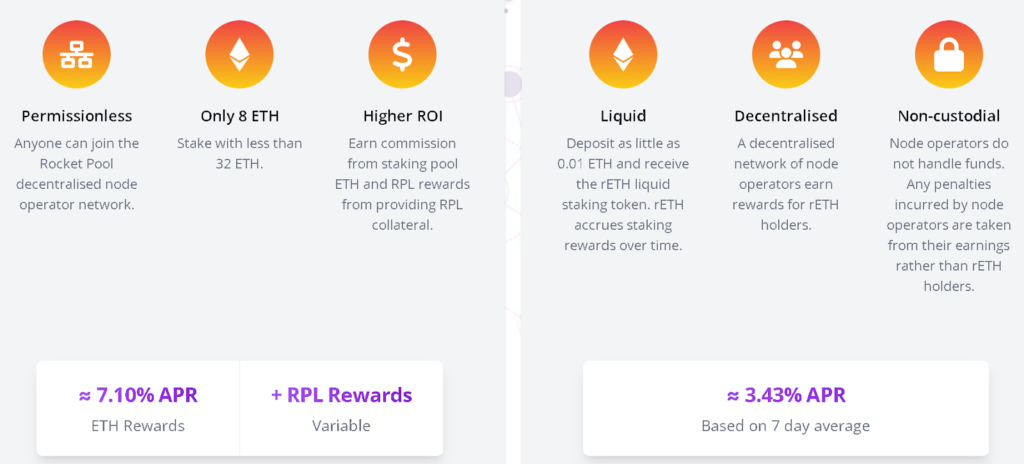

- Rocketpool stands out for its inclusivity, allowing users to start staking only 8 ETH with less than 32 ETH to create a new validator, making it accessible to both large and small ETH holders.

- Rocketpool has its native utility token, RPL, which is used for governance and network participation.

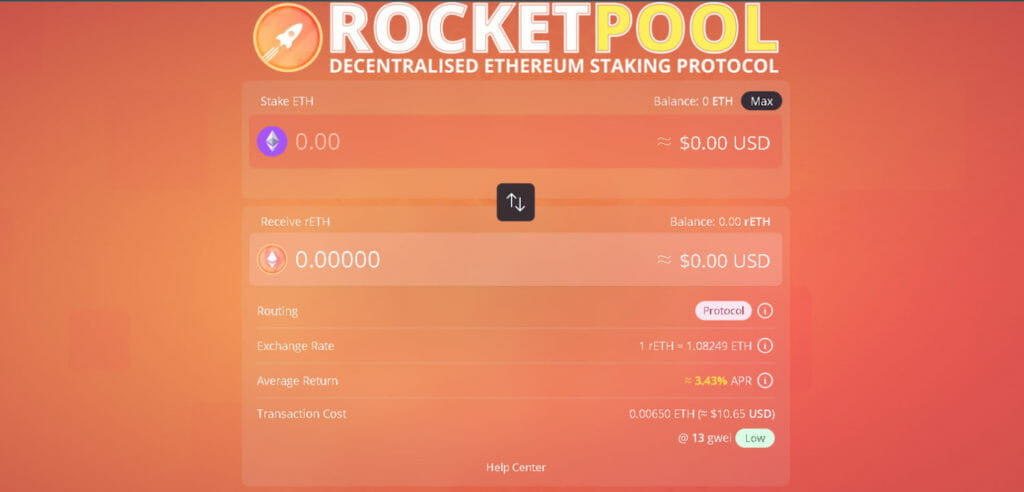

- ETH Staking with Rocketpool allows users to earn rETH tokens, representing their staked ETH, which can be traded or utilized in DeFi applications, requiring just a 0.01 ETH deposit, with rETH accruing staking rewards progressively.

- Owning the rETH token allows you to earn staking rewards.

- The token can be purchased on Uniswap or other platforms, borrowed from Aave, etc. Anyone holding the token earns a 3.82% staking reward.

- It is beneficial for node operators as they don’t need the full 32 ETH to participate.

- Non-node operators can also buy the token at any time as it represents staked ETH.

- Rocketpool is a decentralized network of node operators responsible for running validator nodes and maintaining the network’s security and performance.

- Rocketpool uses smart contracts to manage nodes, rewards, and penalties, ensuring a transparent and secure staking process.

- Node operators earn their commission from the rewards generated when 16 or 24 ETH is pooled from stakers who aren’t node operators. This commission always stays at 14%.

- The annual percentage rate (APR) for staking with this model is currently 3.50%.

- Individuals possessing at least 8 ETH can participate in staking and run a node, which provides an APR of 7.48%, surpassing the stake-only model and variable RPL rewards.

Comparative Analysis: Rocket Pool Vs. Lido

Tradeoffs

Comparative Analysis: Rocket Pool Vs. Lido

Tradeoffs

- Running a Rocketpool node requires technical expertise, which can be a barrier for some potential operators, hence the smaller number of available nodes.

- The value of RPL tokens can be volatile, impacting users’ earnings and governance participation.

- Rocketpool’s performance depends on the reliability and uptime of its node operators. Any downtime can affect the network’s overall staking efficiency.

Comparative Analysis: Rocket Pool Vs. Lido

What is Lido?

Comparative Analysis: Rocket Pool Vs. Lido

What is Lido?

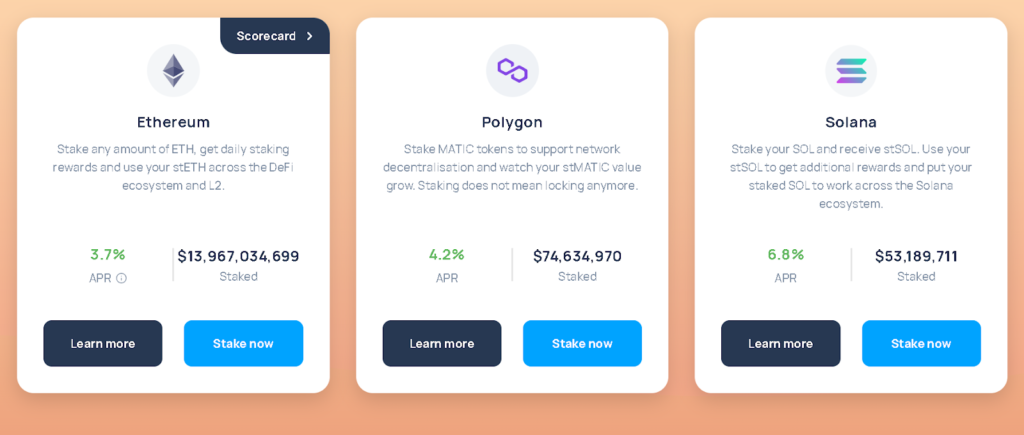

- Lido is a decentralized platform that enables users to stake their ETH in a liquid form, allowing them to retain flexibility and liquidity while earning staking rewards.

- Lido is a set of open-source software tools operating on Ethereum, Solana, and Polygon blockchains.

- Lido users receive stETH tokens in exchange for their staked ETH, which can be easily traded or used in DeFi applications.

- Lido also involves a governance token, LDO, allowing token holders to engage in decision-making processes.

Comparative Analysis: Rocket Pool Vs. Lido

Features

Comparative Analysis: Rocket Pool Vs. Lido

Features

- Lido allows you to stake their ETH while retaining its liquidity. stETH tokens can be freely traded on various decentralized exchanges (DEXs).

- Lido’s smart contracts are designed to be secure and trustless, ensuring the safety of users’ assets and rewards.

- Lido operates a liquid staking pool that aggregates ETH from users and stakes it on Ethereum 2.0 on their behalf. A group of professional node operators manages this pool.

- Lido utilizes the LDO token for governance. LDO holders can vote on proposals and decisions about the platform’s operation.

- Lido collaborates with professional node operators to ensure the highest staking performance and security level.

- A 10% fee is charged on staking rewards.

- Lido allows users to stake native tokens from Ethereum, Polygon, and Solana networks without permission.

- stETH is a non-rebasing token, meaning its value remains constant and does not change over time.

- The number of stETH tokens a user holds remains the same, regardless of any changes in the value of the underlying assets.

- wstETH (wrapped stETH) is a token that represents a user’s stake in the Ethereum 2.0 Beacon Chain, but with a rebasing mechanism meaning its value adjusts periodically based on the performance of the underlying assets.

- The number of wstETH tokens a user holds can change over time, as the value of the underlying assets increases or decreases.

Comparative Analysis: Rocket Pool Vs. Lido

Tradeoffs

Comparative Analysis: Rocket Pool Vs. Lido

Tradeoffs

- Lido imposes a minimum staking requirement for users to participate, which may exclude smaller ETH holders from benefiting.

- While Lido works with professional node operators, some users may have concerns about centralization risks associated with relying on a select group of operators.

- The governance process can sometimes be slow and complex due to the need for token-holder consensus, which may hinder quick decision-making.

Comparative Analysis: Rocket Pool Vs. Lido

Comparative Analysis: Rocket Pool Vs. Lido

Rocket Pool Vs. Lido : Minimum Staking Requirement

Comparative Analysis: Rocket Pool Vs. Lido

Comparative Analysis: Rocket Pool Vs. Lido

Rocket Pool Vs. Lido : Minimum Staking Requirement

- Rocketpool has a minimum staking requirement of 0.01 ETH, making it more inclusive for all ETH holders.

- Lido has no minimum staking requirement, potentially excluding smaller ETH holders.

- Rocketpool offers liquidity by issuing rETH tokens, representing staked ETH that can be used in DeFi applications.

- Lido DAO provides liquidity through stETH tokens, allowing users to trade their staked ETH without waiting for the lockup period to end.

- On Rocketpool, users can become node operators, but it requires technical expertise, potentially limiting the number of available nodes.

- Lido DAO collaborates with professional node operators, ensuring the expertise for reliable staking operations.

- Rocketpool utilizes the RPL token for governance, giving token holders a say in network decisions.

- Lido DAO employs the LDO token for governance, allowing token holders to take part in decision-making processes.

- Rocketpool operates as a decentralized network of node operators, reducing centralization risks.

- Lido DAO collaborates with professional node operators, potentially raising concerns about centralization.

- The value of RPL tokens on Rocketpool can be volatile, affecting users’ earnings and governance participation.

- The LDO token on Lido DAO may also experience volatility, impacting users’ participation in governance.

- Rocketpool relies on the uptime and performance of its node operators, with any downtime potentially affecting network performance.

- Lido DAO collaborates with professional node operators to ensure high-performance staking.

To conclude the comparative Analysis: Rocket Pool Vs. Lido, Rocketpool offers inclusivity with minimum 0.01 ETH requirement but requires technical expertise for node operators and faces RPL token volatility. In contrast, Lido DAO focuses on liquidity via stETH tokens and collaborates with professional node operators and has no minimum staking requirement and centralization concerns. Users should consider their priorities to choose between Rocketpool’s inclusivity and flexibility or Lido DAO’s liquidity and professionalism when pursuing decentralized staking in the dynamic DeFi landscape.

How does rocket pool work?Rocketpool is an Ethereum-based decentralized staking network that permits users to participate in ETH staking without imposing any minimum criteria. Node operators manage pooled ETH, earning commissions. Users receive rETH tokens, tradeable in DeFi. RPL token enables governance. Rocketpool enhances ETH 2.0 staking accessibility while relying on node operator reliability for performance.

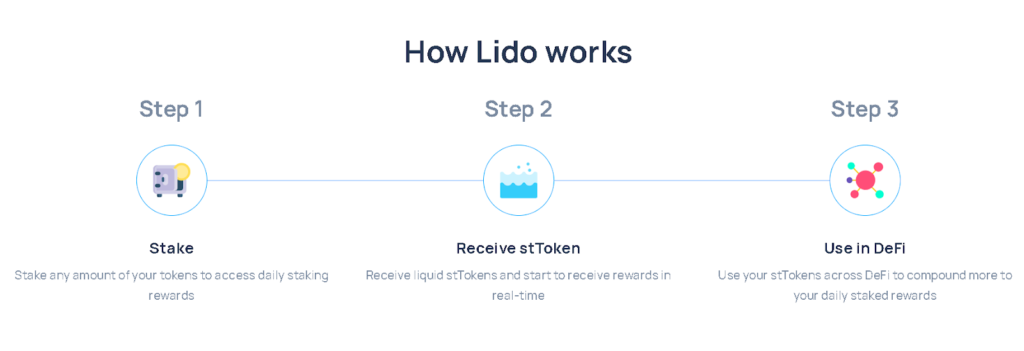

How does Lido work?Lido operates as a decentralized platform for Ethereum staking. Users stake their ETH with Lido, receiving stETH tokens in return, which can be traded or used in DeFi. Lido employs professional node operators for secure staking and utilizes the LDO token for governance, allowing token holders to participate in decision-making processes.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.