and the distribution of digital products.

DM Television

Bitsgap Futures Bot | Binance Futures Trading Bot

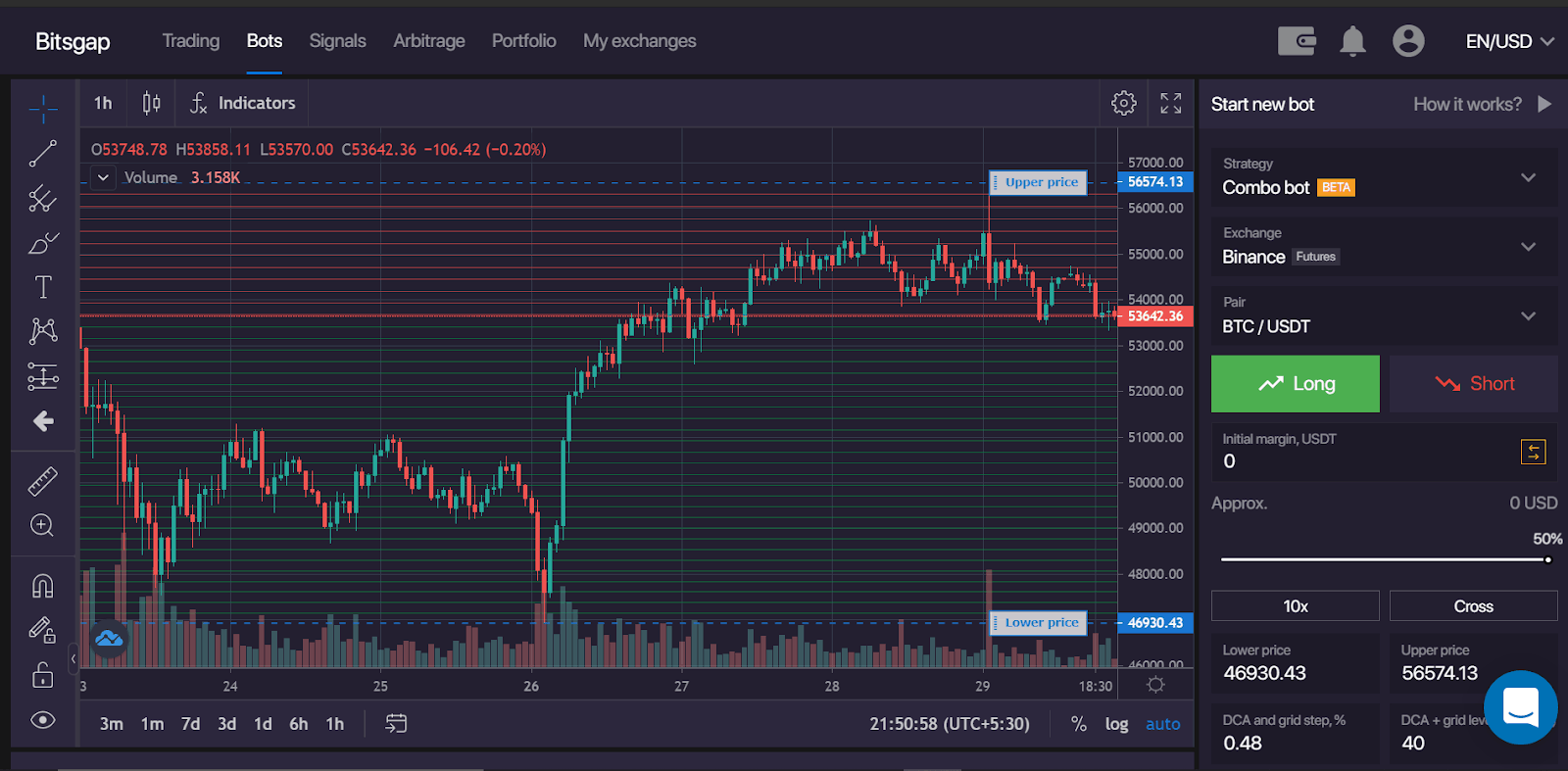

Bitsgap recently came up with Its Binance futures trading bot. The platform allows you to create a Combo trading bot that includes both GRID bot and DCA Trading bot. The platform also provides you many other features such as the shadow and snipper modes, TWAP, arbitrage trading bot, etc.

Table of contents- Summary (TL;DR)

- What is Bitsgap?

- What is Futures Contracts? (Futures Trading Overview)

- Why should you use Binance Futures?

- What is a Trading Bot?

- What is the Bitsgap Futures Trading Bot?

- How does the Bitsgap Trading Bots work?

- Bitsgap Futures Bot: Features

- How to Create the Futures bot using Bitsgap?

- How does the bot maximize your returns?

- What is demo mode at Bitsgap?

- Bitsgap Futures Bot: Pricing

- Bitsgap Futures Bot: Pros and Cons

- Bitsgap Futures Bot: Conclusion

- Frequently Asked Questions

- Bitsgap is a trading platform that also provides automated trading bots to trade on many other popular crypto exchanges.

- A futures contract allows you to buy or sell an asset at some fixed price in the future. Binance offers USD-M and Coin-m futures.

- The Bitsgap futures trading bot allows you to automate Futures trading using GIRD and DCA trading strategies.

- The primary features of this trading bot include longing, shorting, isolated/ cross margin, demo mode, etc.

- To connect Binance and Bitsgap, you need to enter the API and Secret key generated at Binance.

- Bitsgap offers three primary plans, ranging from $19 a month to $110 per month.

Bitsgap is an all-in-one trading platform providing bots, signals, crypto arbitrage, etc. Bitsgap supports more than 25 crypto trading platforms, including Binance, Coinbase, Kraken, etc., and has been dealing in crypto since 2018.

The interface at Bitsgap supports multiple order types and new statistics, which allows a trader to experiment with risk management and unique trading strategies. To get a better understanding of Bitsgap, you can refer to our Bitsgap review.

Bitsgap Futures Bot

What is Futures Contracts? (Futures Trading Overview)

Bitsgap Futures Bot

What is Futures Contracts? (Futures Trading Overview)

A futures contract allows you to buy/ sell a forte at a fixed price in the future. While dealing in the futures contract, you must buy or sell the underlying asset at the contract’s expiration date, and it doesn’t matter what the current market value of the underlying asset is. You can learn more about futures contracts from our guide to margin trading.

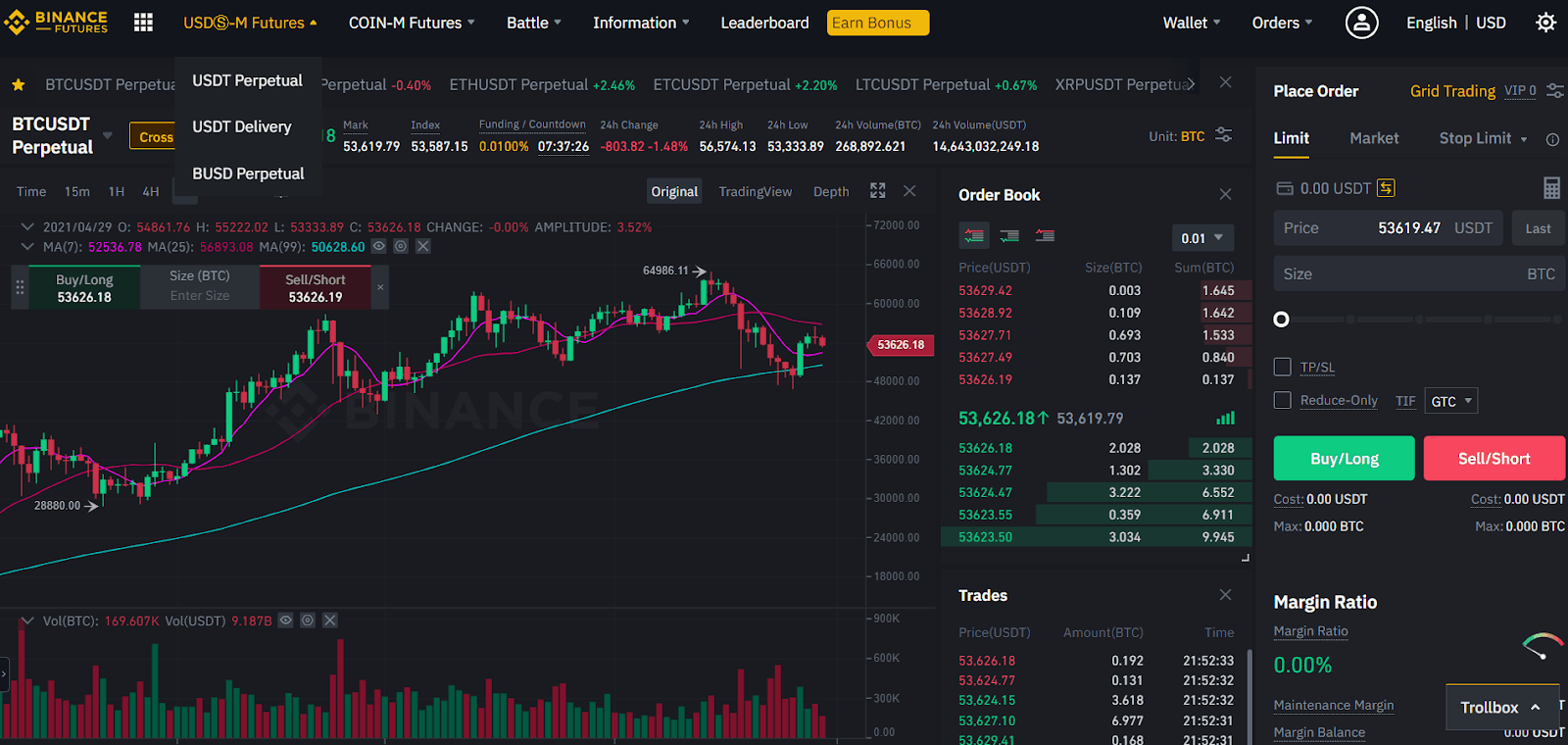

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”] Why should you use Binance Futures?Binance is the best crypto exchange in terms of volume around the globe. The exchange provides all the essential tools, with the best security in the crypto market and the lowest fees. Binance offers two options in the futures, namely:

- USD-M futures: This option provides you with up to 125x leverage and no expiration. It further consists of USDT perpetual, USDT delivery, and BUSD perpetual.

- Coin-M futures: In this case, Coin-M futures Binance offers a 125x leverage and tokens margined with/ without an expiry date. It also consists of two sub-options, Coin-M perpetual and Coin-m delivery.

To learn more about Binance futures, click here.

Binance Futures Trading

What is a Trading Bot?

Binance Futures Trading

What is a Trading Bot?

A trading bot helps you automate your crypto trades and trading strategies. There are many trading bots such as Bitsgap that offer a wide range of trading bots to automate your trade on any crypto exchange.

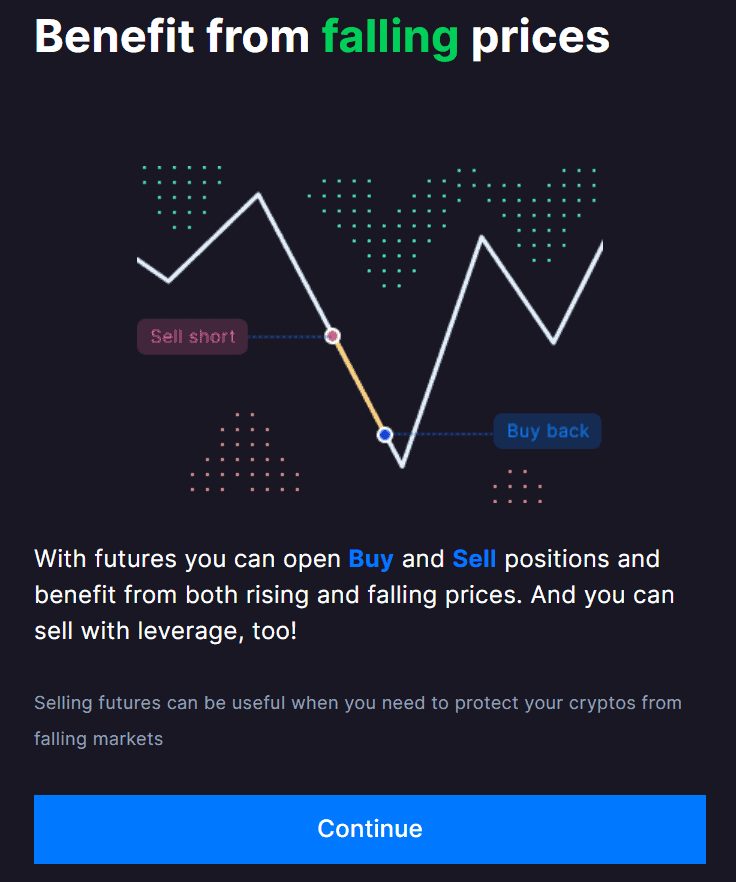

What is the Bitsgap Futures Trading Bot?The Bitsgap Binance futures trading bot is specially designed to gain returns from both rising and falling markets. The bot uses leverage and hence can generate returns up to 1000% faster than the spot market.

The Bitsgap bot entirely automates futures trading; however, as it uses leverage, there are risks involved in using the futures trading bot since it can lead to high returns and, at the same time, high loss.

The Bitsgap futures bot opens and closes hundreds or even thousands of positions in a single day, taking smaller returns from each position. It is physically near too impossible to open or close that amount of positions.

Bitsgap Binance futures trading bot allows you to activate a bot that works with GRID and DCA strategies. Let us understand these strategies one at a time:

GRID Trading StrategyGRID trading strategy helps the bot execute trades on every market move, hence utilizing its full potential. In other words, here, you will create multiple price points to buy and sell the asset. Whenever price reaches our price points, the trading bot executes the trade (Based on price points in buy or sell). This way, the bot performs thousands of small trades and tries to make profits. Usually, this is a technique applied in High-Frequency Trading [HFT]. On Bitsgap The bot uses its built-in trailing function and follows the trend in both the direction. To learn more about the Bitsgap GRID trading strategy, click here.

Bitsgap Grid Trading

DCA Trading Strategy

Bitsgap Grid Trading

DCA Trading Strategy

The DCA or the Dollar Cost Averaging trading strategy allows you to optimize the price to enter a trade by buying/selling assets at a fixed interval.

On Bitsgap, the trailing function allows DCA to follow the market trend in both directions.

Bitsgap Futures Bot: FeaturesBitsgap offers many features to help your trading work efficiently. Some of those features are as follows:

LongYou can choose the long strategy by predicting a rise in the value of the underlying asset. On activating the bot, its algorithm will start selling the previously bought assets and taking returns using the GRID strategy. If the market goes sideways and the prices fall, the DCA orders activate and take a profit by buying during the price fluctuations.

ShortingIf the market seems to go down according to your analysis, you can open a short position. In such a case, the bot will automatically start buying the assets according to the GRID strategy as the asset’s price moves downwards. Now, during minor pumps in price, DCA orders to sell short will come into action to take returns despite the falling prices.

BacktestBitsgap allows you to analyze the expected market returns and the risks involved before opening a position through backtesting. It helps traders understand how the trading pair might move up and down and how well the trading strategy might play out based on the pair’s historical data.

Funding rateAs we know that leverage is basically borrowing funds by keeping your margin as collateral. Hence it must obviously include some interest rate. However, using Bitsgap, you can actually get paid for your trades. You must note that depending on the market conditions, the funding rate might be positive or negative for buyers or sellers.

Margin ModeYou can use the Bitsgap Binance futures combo trading bot in two of the margin modes available. You can switch the margin anytime; however, you must understand that changing the margin would only apply to the selected trading pair.

Cross marginCross margin mode allows you to share your margin balance across all open positions. This means that your entire balance is at risk in the case of liquidations. However, the grid strategy won’t allow that the strategy automatically minimizes your losses if the market goes in the opposite direction.

Isolated marginBy using the isolated margin mode, you can open positions with a particular margin that has no relation to any other open positions. You can manually add or remove margin from positions in this mode, however. If the margin ratio of that particular position reaches 100%, then the position would be automatically liquidated.

How to Create the Futures bot using Bitsgap?You can find creating the trading bot at Bitsgap pretty straightforward, but there can be places where a helping hand would be helpful. That’s where we come in and provide you with a step-by-step guide to managing it all.

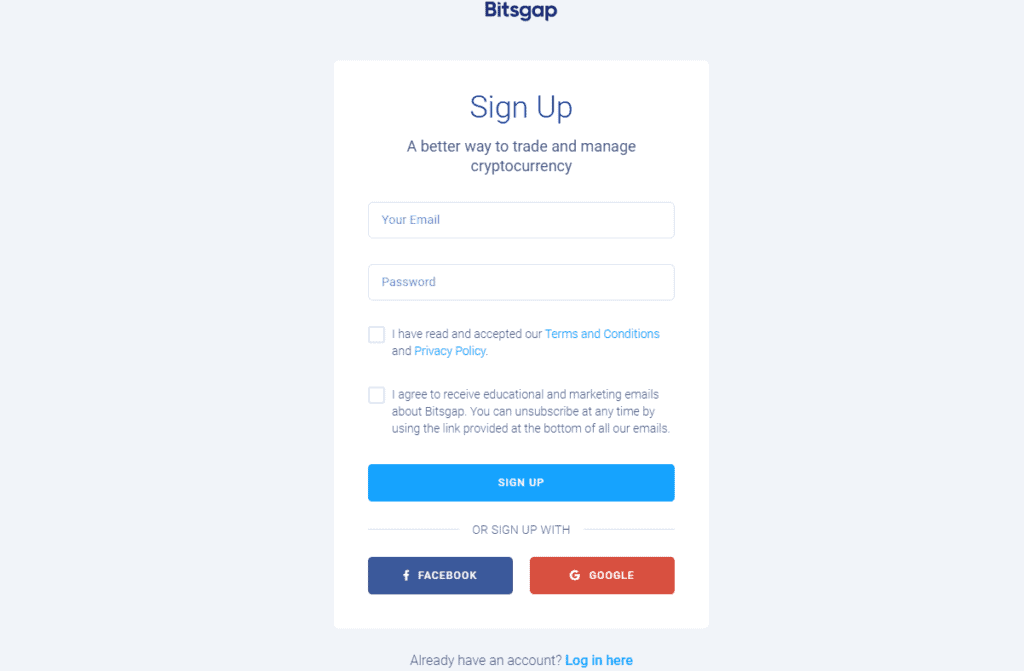

Step 1: Create a Bitsgap accountThe very first thing you need to begin using the Bitsgap trading bot is an account on the platform. So follow the below steps to create one:

- Visit the official website of Bitsgap and click on the signup button.

- Now, enter your email, password, hit the checkbox, and finally click the submit button.

- Then, confirm your email through your mailbox.

- Finally, use your email and password to log into your Bitsgap account.

Bitsgap Sign up

Step 2: Link your Binance Futures Account

Bitsgap Sign up

Step 2: Link your Binance Futures Account

This is a bit complex part where you might get confused, so bear with me and follow all the below steps:

- First of all, log into your account and click on my exchanges at Bitsgap.

- Secondly, in another tab, log into your Binance account and activate the Binance Futures account.

- Now, visit the API management section from the accounts icon in the header.

- Fourthly, enter Bitsgap in the available space, and hit the create API button, and from the next window click on edit restrictions and activate the following:

- Enable Reading on (active by default)

- Enable Spot & Margin Trading on

- Enable Futures on (if needed)

- Unrestricted IP access on

- When ready, click [Save]

Now that we’re all set with the accounts and activated and connected, let’s understand the process to create a trading bot:

- Visit the official website of Bitsgap and log into your account.

- Now, head over to the bots section and choose Binance Futures from the exchange option on the right side of the screen.

- Then, customize all the features such as cross/ isolated margin, take profit, stop loss, margin, leverage, etc.

- Finally, hit the long or short button depending on your market analysis.

Bitsgap Futures Trading Bot

How does the bot maximize your returns?

Bitsgap Futures Trading Bot

How does the bot maximize your returns?

You can maximize your returns by using higher capital and leverage. The futures trading bot at Bitsgap uses the DCA trading strategy to divide your funds into smaller parts and buy the asset over a fixed interval, hence averaging your buy price. On the other hand, the bot uses the Gird strategy to place buy/ sell orders in your chosen range and take smaller returns from every complete trade.

What is demo mode at Bitsgap?Bitsgap offers a demo mode where you can use all the features provided by the exchange without actually putting any of your funds at risk. You can activate the demo mode by clicking on your accounts icon.

Bitsgap Futures Bot: PricingOn creating a new account on Bitsgap, the exchange provides you with a trial membership. However, once this trial period ends, you’ll have to choose one of its three plans which include Basic ($19 per month), Advanced ($44 per month), and Pro ($110 per month). If you are just starting with the bot, then I’d recommend shifting to the basic plan for the first month and then choosing your plan depending on your needs.

Bitsgap Futures Bot: Pros and Cons Bitsgap Futures Bot: ConclusionBitsgap recently came up with its Binance Futures combo trading bot. This futures trading bot uses both Grid and DCA strategies to open and close a maximum number of smaller positions in a day. This allows you to gain small but consistent returns and minimizes your risks.

However, just like any other leverage trades, it also comes with its risks. The exchange offers both cross and isolated margin trading, and you can go long or short or even hedge your positions depending on your market analysis.

Frequently Asked Questions Which trading pair should I pick?Choosing a trading pair entirely depends on your research and analysis of a project that backs the coin. Hence, it can be briefly said that there is no such perfect coin that will give you absolute returns. However, at Bitsgap, you can choose a trading pair based on the percentage change in its value.

How to create a short futures bot?Suppose you wish to go short and predict a fall in the value of the asset. Then you can follow all the steps above in the article, and then you can simply customize the tab on the right side of the screen and hit the Short button.

How to create a long futures bot?Now, to go long, you can customize the tab on the right side of the screen based on your market analysis and research. When you are done doing so, just hit the long button, and the trading bot will start opening and closing positions on your behalf.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.