and the distribution of digital products.

AscendEX Review : Is it Safe?

AscendEX is a Singapore-based cryptocurrency exchange, formerly known as BitMax Exchange. Spot trading, margin trading, staking, DeFi yield farming, and futures trading fall under the umbrella of AscendEX products. In today’s review, we will explore all these services along with their features, customer support, security, fees, and pros & cons.

AscendEX Launches Tether (USDT) Staking and USD Coin (USDC) Staking with 8% Est. APR. Check Here.

Summary- AscendEX(BitMax) is a Singapore-based crypto platform supporting over 150+ crypto assets, trading pairs, and countries.

- It offers a wide array of services. For example, it allows spot trading, margin trading, and futures perpetual USDT-based trading. Apart from these, It supports staking, DeFi yield farming, native utility token, OTC Desk, Mobile application, and many other passive income options.

- Moreover, It has an option for copy trading, where traders can use automatic trade execution of the desired trader.

- The platform is easy to use with a standard and professional trading view. Moreover, It allows crypto purchases through credit/ debit cards.

- The platform is secure. AscendEX adopts safety measures like cold storage for funds, 2-FA, and verification to ensure security.

- AscendEX(BitMax) extends robust customer support, especially the Telegram community, with 24*7 support agents.

AscendEX is a comprehensive crypto exchange with the disposal of 150+ crypto assets and trading pairs. It supports 200+ countries and gives several fiat payment opportunities to traders as well. Moreover, It has many services to attract high trading liquidity.

AscendEX exchange

AscendEX Review: Services

AscendEX exchange

AscendEX Review: Services

The platform extends many services, but not too much to confuse beginners. The services categorize into a trading platform, investment products, and fiat payment.

- The trading platform supports spot trading, margin trading, futures trading, and copy trading with dedicated standard and professional interfaces.

- Investment products include the ASD ecosystem, staking, and DeFi yield farming.

- Fiat payments have credit/ debit card purchases and an OTC desk in store for traders.

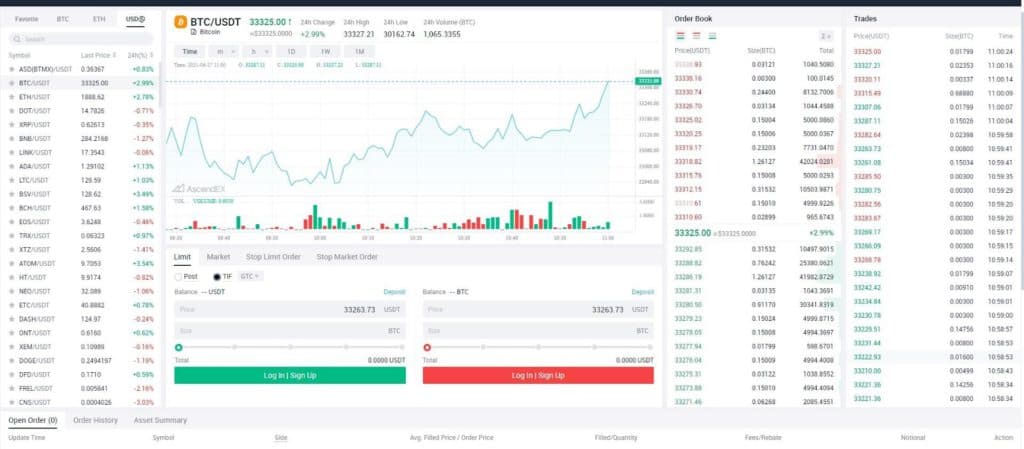

AscendEX offers a comprehensive trading platform. The trading terminal covers trading pairs (on the left-hand side), a chart by TradingView, buy/ sell boxes, order book (right-hand side), transaction history, open orders, and asset summary (at the bottom). In addition, it supports spot trading, margin trading, and futures trading. Traders can execute trades in four different order types- Limit, Market, Stop Limit Order, and Stop Market Order.

AscendEX Review: trading terminal

AscendEX Review: trading terminal

In spot trading, the limit order classifies into Post and TIF. The post indicates that orders are added to the order book without execution with a pre-existing order immediately. TIF expands further into GTC, IOC, and FOK.

- GTC (Good Till Cancel) indicates open order until filled or canceled.

- IOC (Immediate Or Cancel) implies complete or partial order execution with an unfilled part of the order canceled.

- FOK (Fill Or Kill) signifies absolute execution or cancelation of the order immediately.

The margin trading can function on leverage of up to 25X, while futures up to 100X. Moreover, futures trading includes perpetual contracts based on USDT. Contrarily, margin and spot trading orders are based upon USDT, ETH, and BTC.

Moreover, It allows copy trading where traders can copy their favorite traders for auto-execution of traders in one click. Traders can choose from a list of traders on the website to copy their trade orders and execute them automatically.

Try AscendEX AscendEX Review: ASD EcosystemAscendEX has a functional native token for users with a wide array of benefits- the ASD(BTMX) token. Traders that hold this token are qualified for higher VIP levels and lesser transaction fees. ASD(BTMX) can yield daily rewards in

- Point Card for 50% discounted margin interest.

- AscendEX Auction

Moreover, if you stake the token you’ll be getting an additional bonus. Furthermore, you can purchase Investment Multiple Cards with ASD(BTMX), which multiplies investment profit by 5 with one card.

Staking at AscendEXLike any other platform, AscendEX offers a staking service for traders. It enables them to stake and earn rewards in digital assets. However, what differentiates AscendEX is that it provides flexibility to the staked digital assets.

Further, You can remove funds from the stake or transfer them almost immediately. AscendEX sustains a liquidity pool of crypto assets for immediate access to digital assets.

Staking at AscendEX

Staking at AscendEX

Moreover, AscendEX allows traders to use staked assets as margin collateral. Traders can trade and earn staking rewards for selected crypto assets. Users also have the option to compound their staking bonus. AscendEX reinvests the staking rewards to enhance yield. Users can choose to activate or deactivate COMPOUND MODE.

Note: Staked assets are not tradable directly; however, they are eligible as collateral for margin trading.

Try AscendEX AscendEX Review: DeFi Yield FarmingAscendEX provides a DeFi yield farming for traders to earn maximum return on capital through DeFi protocols leverage. These protocols include:

- Lending protocols,

- Decentralized liquidity pools, and

- Derivatives protocols.

Traders receive a reward for their liquidity contribution in the form of multiple tokens from relevant DeFi protocols dispensed as fees, interests, or incentives.

Moreover, traders do not have to pay gas fees, thus maximizing their yield. Traders can earn rewards in one as AscendEX manages all backend integration with DeFi protocols. You can enhance gains by employing yield-driven leveraged strategies to increase farming exposure.

AscendEX Review: DeFi Yield Farming

Additional Services at AscendEX

AscendEX Review: DeFi Yield Farming

Additional Services at AscendEX

Apart from the above-mentioned, AscendEX offers other tools and products for higher crypto income.

- Over-The-Counter Desk: AscendEX partners with Prime Trust, an independent US-regulated trust/ custodian, to offer OTC trading solutions in limited digital assets: BTC, ETH, and USDT. Traders can use OTC solutions with a minimum transaction size of 100,000 USD and connect to the team at [email protected]. However, there are compulsory KYC/ CIP/ AML protocols.

- BitTreasure: BitTreasure allows traders to earn interest on underlying digital assets where the rate of return is based on the selected token and investment duration. It distributes the principal and interest to account after the end of the term (varying from 30/90/180-day). Thus, it enables flexible investment periods and interest on a variety of tokens for investments.

- AscendEX Mobile App: Many traders wish to trade on a mobile application for mobility and real-time interaction. AscendEX extends a fully functional mobile application for iOS and Android devices. It holds a regular trading view and many of the services to keep utility intact.

AscendEX Mobile App

How to use AscendEX Exchange?

AscendEX Mobile App

How to use AscendEX Exchange?

Bitmax (earlier ascendex) crypto exchange is a fairly easy-to-use platform with essential services at traders’ disposal. In addition, AscendEX focuses on diversity rather than advancement. As a result, the trading platform is easy to use and navigate.

How to create an account on AscendEX Exchange?- Create an account on AscendEX(BitMax) either through a mobile number or email ID.

- Fund your accounts to start trading.

- Complete verification (optional) to increase the trading limit.

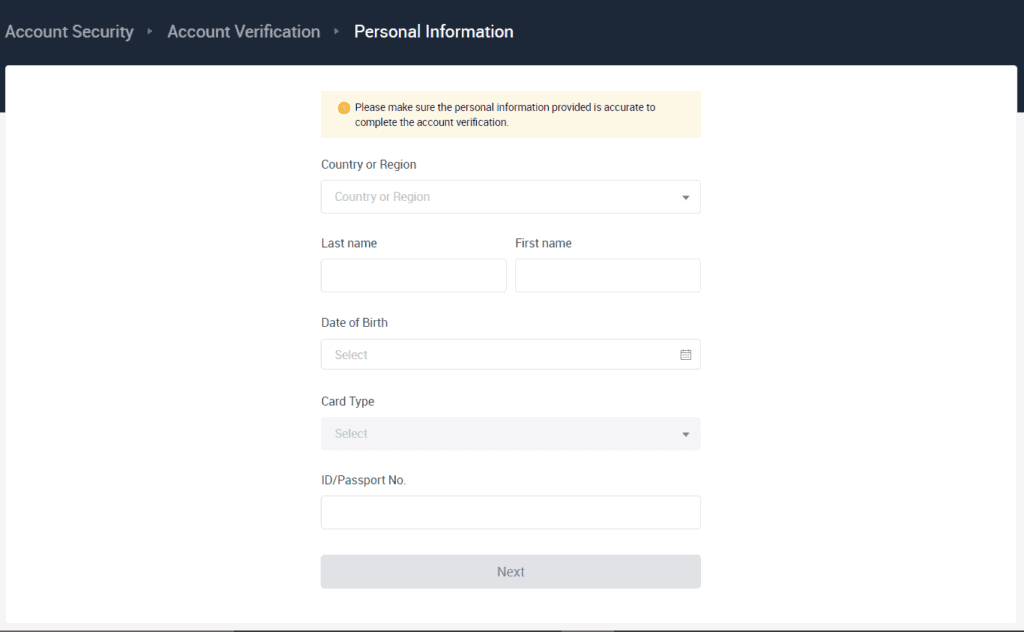

AscendEX(BitMax) has an optional verification process. Traders can complete verification to become certified members and enjoy additional benefits. Verification is a tiered VIP level-based structure.

- A government-issued ID and proof of address.

- A selfie holding ID Documents.

- An elaborate procedure by contacting customer support.

Identity verification on AscendEX

How to deposit bitcoin on AscendEX?

Identity verification on AscendEX

How to deposit bitcoin on AscendEX?

- Tap on ‘balance’ on AscendEX, where total asset value displays.

- Tap on ‘deposit’ and select a desired crypto asset from the list.

- Select Chain Type. To deposit, either scan the QR code or copy the address.

- Tap on ‘balance’ on the trading platform, where total asset value displays.

- Tap on ‘withdraw’ and select a desired crypto asset from the list at AscendEX.

- Select the Chain type and enter the withdrawal amount. Here, the Network fee displays at the bottom of the screen.

- Add the wallet address. The transfer completes after due verification and blockchain confirmations.

AscendEX operates in over 200+ countries with over 8+ language support. However, It prohibits a few countries on the platforms for example the USA. For more information visit the AscendEX help center.

Apart from this, AscendEX supports credit/ debit cards for crypto purchases. Furthermore, AscendEX supports over 150+ cryptocurrencies and trading pairs, including BTC, USDT, ETH, XRP, and many more. Moreover, It extends an additional native utility token- ASD(BTMX). This token has many benefits like lower fees and yields many rewards.

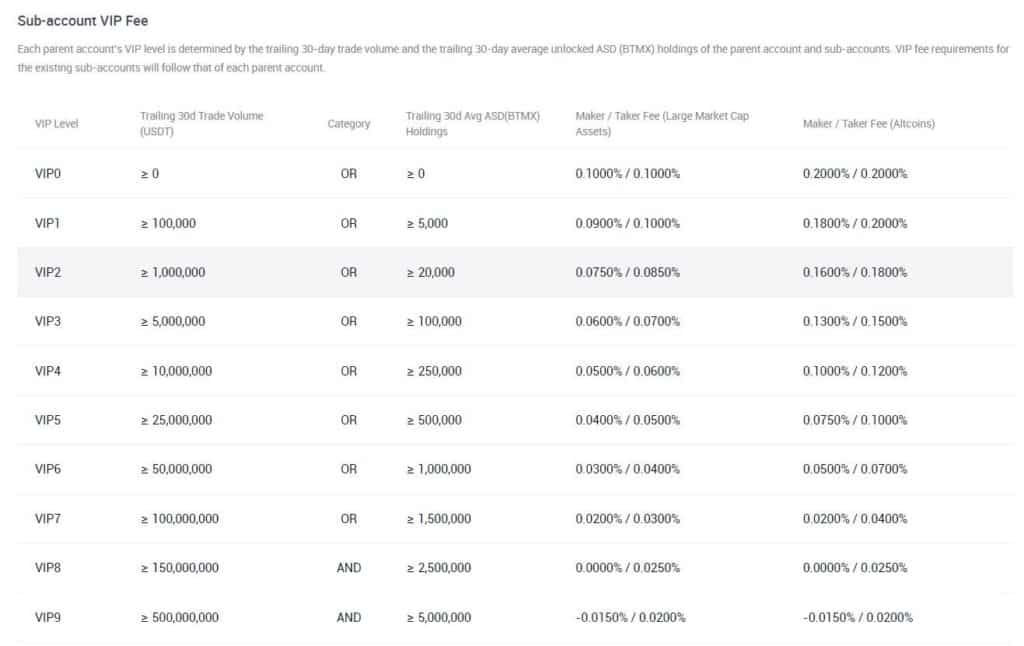

Try AscendEX AscendEX Review: FeesAscendEX has a tiered VIP fee structure for the traders.

VIP tiers get discounts against base trading fees. It bases upon 30-day trade volume (in USDT) & average unlocked ASD(BTMX) holdings. Following are the requirements and fees depending upon VIP level.

Trading FeesAscendEX charges the same fees on spot and margin trading. The fee structure is based upon the VIP level structure. Apart from this, the transaction fee for UAT/USDT is 0.2% and ASDP(BTMXP)/USDT is 0.5%.

Trading Fees

AscendEX Review: Interest Rates

Trading Fees

AscendEX Review: Interest Rates

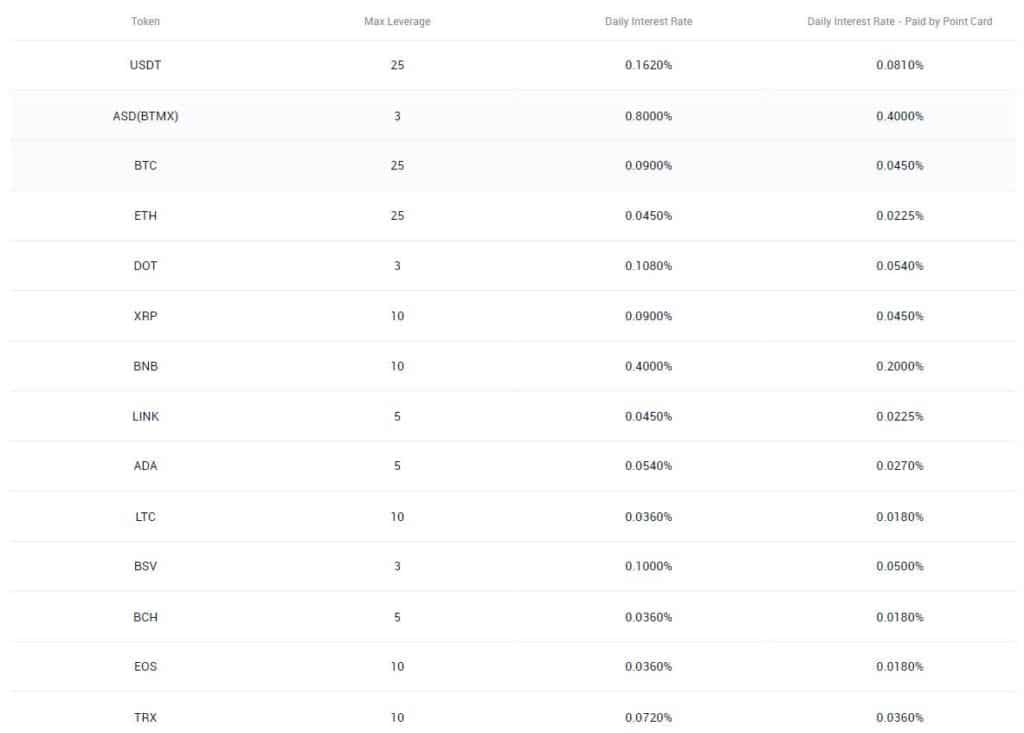

AscendEX imposes daily interest rates for margin trading, subject to change without notice. They adjust varyingly upon the market conditions. Hence, it is advisable to check them regularly at the AscendEX fees rate.

Interest Rates

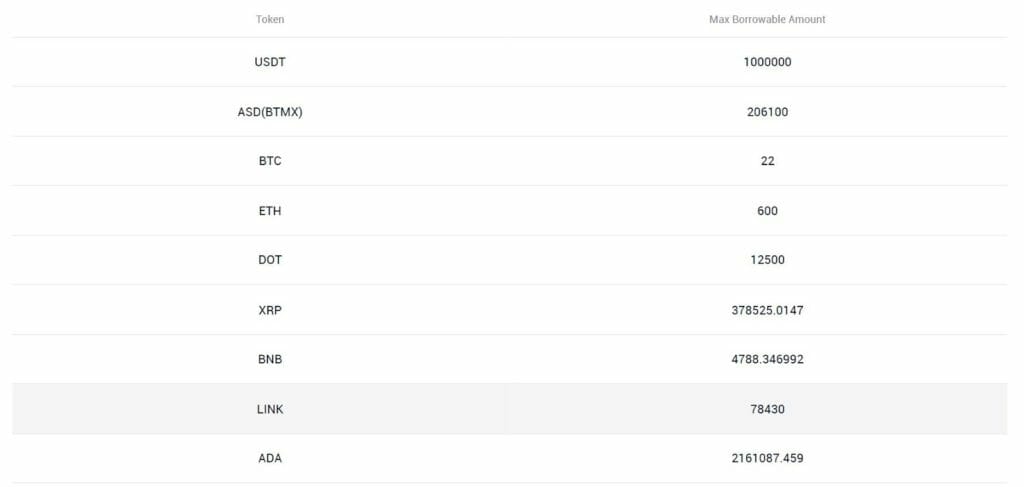

Maximum Borrowable Limit

Interest Rates

Maximum Borrowable Limit

The maximum Borrowable Limit is subject to change without notice. Hence, it is advisable to check them regularly below:

Maximum Borrowable Limit

AscendEX Review: Withdrawal fees

Maximum Borrowable Limit

AscendEX Review: Withdrawal fees

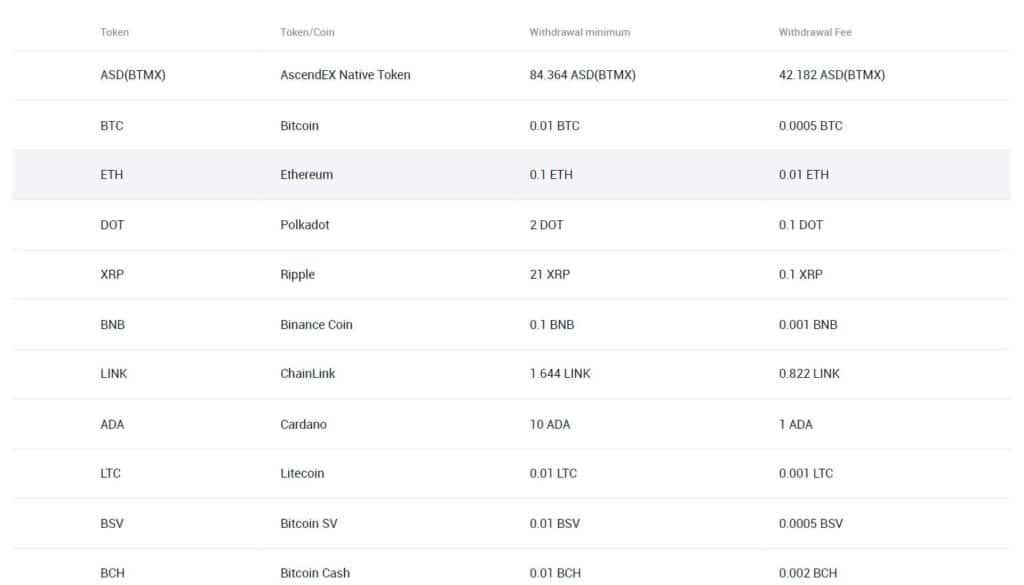

AscendEX imposes withdrawal fees, subject to change based on blockchain network conditions.

Withdrawal fees

AscendEX Review: Security

Is AscendEx (BitMax) safe?

Withdrawal fees

AscendEX Review: Security

Is AscendEx (BitMax) safe?

Yes, AscendEX (BitMax) creates a secure environment on the exchange through several safety measures. Furthermore, it ensures the protection of customer funds and data by adopting some strategies, which are:

- Cold Storage for Funds: AscendEX follows safety protocols and stores maximum trader funds in cold storage. Only a partial amount of funds are in the hot wallet to provide liquidity.

- Two-factor authentication: AscendEX extends 2-FA with Google Authenticator, where users need a 6-digit code to log in each time.

- Email confirmation for withdrawals: AscendEX ensures the security of customer funds. Henceforth, before any crypto withdrawal, traders need to confirm an email confirmation link.

Moreover, It demands a unique password for the account with a combination of numbers and characters. In addition to this, AscendEX (BitMax) has a verification procedure, especially for OTC Desk.

AscendEX Review: Consumer SupportCustomer Support is essential for crypto exchanges. It is one of the touchpoints between the platform and users. AscendEX (BitMax) has a decent customer support base.

- AscendEX has an onsite form where traders can submit grievances along with attachments. Here, traders can inform about issues through images or pdf attachments.

- AscendEX has a robust community of the team and traders on Telegram. The group is 24*7 active, with agents solving customer queries in 8-10 languages. Languages supported are Korean, Turkish, Vietnamese, Italian, English, Japanese, Arabic, and Spanish.

- The platform always provides email support through [email protected].

Apart from these, AscendEX (BitMax) regularly uploads blogs on medium.

Try AscendEX AscendEX Review: Pros & Cons Pros- AscendEX (BitMax) offers a simplified interface suitable for beginners. Additionally, It extends two different trading views- Standard and Professional.

- Verification is not compulsory.

- AscendEX(BitMax) offers a native utility token ASD(BTMX) to traders.

- The exchange offers a wide variety of crypto assets and trading pairs, over 150+.

- It allows traders spot, margin trading, copy trading, staking, Defi yield farming, and futures trading.

- AscendEX(BitMax) provides users with a functional mobile application.

- AscendEX(BitMax) is operational globally in 200+ countries. However, It prohibits users from some countries, including the US (due to regulatory issues).

- AscendEX (BitMax) enables credit/ debit card crypto purchases. However, It does not accept any direct fiat payments.

AscendEX (formerly BitMax) is a Singapore-based crypto exchange with various services at traders’ disposal. The platform is secure and extends a responsive customer support base. Furthermore, the platform is beginner-friendly but lacks advanced tools. It supports 200+ countries along with 150+ crypto assets and trading pairs. With optional verification, AscendEX (BitMax) invites anonymous traders to trade on the portal. Moreover, AscendEX (BitMax) supports ten different languages for the trading and customer support community.

Overall, The platform is suitable for beginners who wish to explore the crypto market with primary services and products. However, It will not excite experienced and anonymous traders much.

Try AscendEX Frequently Asked Questions Does AscendEX(BitMax) support fiat deposits/ withdrawals?AscendEX does not accept any fiat payments, neither for deposits or withdrawals. The only fiat support is through credit/ debit cards. Traders can make crypto purchases through credit/ debit cards on the platform.

Does AscendEX (BitMax) accept US citizens?AscendEX is operational in over 200+ countries globally. Moreover, It supports nine different languages on the platform and community base. However, It prohibits US traders from the exchange. Nevertheless, US traders can modify VPN settings to access the platform.

Does AscendEx (BitMAx) have a KYC/ AML/ verification process?AscendEX extends a discretionary verification procedure. Traders can verify their accounts voluntarily to become certified members and access additional benefits. It is not compulsory to get verified. However, on the OTC Desk verification process is compulsory. Whether an institution or an individual, they need to complete the KYC/ AML process for purchase.

Is Ascendex(BitMax) decentralized?AscendEX is a decentralized platform because it operates on computer-managed codes spread across the globe.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.