and the distribution of digital products.

Agoric: The cross-chain orchestration engine

- Agoric is a blockchain product company building seamless cross-chain applications, powered by Agoric Orchestration.

- The Orchestration SDK abstracts cross-chain operations into a single contract, allowing developers to coordinate actions like staking, swapping, and transferring assets across networks without requiring users to manage each step.

- Fast USDC uses Agoric’s infrastructure to cut stablecoin transfer times from EVM to Cosmos chains to under one minute. It achieves this through automated liquidity provisioning and secure settlement using Circle’s CCTP and Agoric Orchestration.

- At its core, Agoric is a Layer-1 blockchain built using the Cosmos SDK that enables cross-chain orchestration of smart contracts using Hardened JavaScript.

- Agoric has begun the process of sunsetting its dual-token model in favor of centering its tokenomics around BLD. The sunset of IST, the Inter Protocol, and transition away from the dual-token system is expected to be complete by mid-2025.

Agoric exists to turn fragmented crypto workflows into automated, intuitive actions for power users and developers.

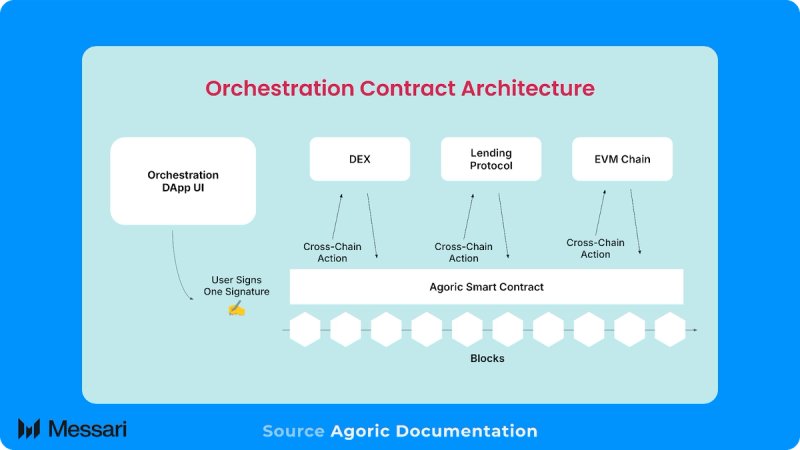

This is made possible through Orchestration — Agoric’s cross-chain automation engine that coordinates complex tasks like yield optimization, staking, and payments into seamless, asynchronous workflows across multiple blockchains. The Orchestration SDK enables smart contracts to coordinate multi-block cross-chain operations asynchronously, widening the solution area to key UX and composability challenges in Web3. These capabilities allow Agoric smart contracts to execute operations like account creation, transfers, staking, swapping, and bridging from a single user interaction, simplifying the development process and user experience across blockchain ecosystems.

Fast USDC is Agoric’s first end-user product that showcases the power of the Orchestration SDK by cutting the USDC transfer times from EVM to Cosmos chains from 20-plus minutes to under one minute.

Agoric’s orchestration engine capabilities are powered by specific properties unique to its Cosmos SDK based Layer-1 blockchain. Firstly, Agoric simplifies the development of smart contracts and decentralized applications by using Hardened JavaScript, a more secure subset of JavaScript. Secondly, the Agoric virtual machine adopts an object-capability security model, enabling a secure Hardened JavaScript runtime that restricts access to only explicitly granted capabilities to enhance security. This architecture optimizes for asynchronous, cross-chain functionality as its smart contracts make calls to other blockchains and wait for a few blocks for a response before continuing the execution. Agoric’s design enables complex cross-chain workflows, setting it apart from traditional blockchains.

Agoric is a Proof-of-Stake (PoS) blockchain secured by CometBFT consensus and natively supports the Inter-Blockchain Communication (IBC) protocol for multichain interoperability with other IBC-enabled blockchains. Agoric smart contracts can interact with non-IBC-compatible blockchains, such as Ethereum, through third-party libraries like Axelar's JavaScript SDK, expanding Agoric's multichain interoperability beyond IBC-enabled blockchains.

Website / X (Twitter) / Discord / Blog

Agoric Orchestration is the underlying technology that enables cross-chain multi-block workflows. It provides developers with an SDK and platform for writing smart contracts that can coordinate operations asynchronously across multiple blockchains and multiple blocks. Rather than requiring users to interact manually with different chains and interfaces, Orchestration allows a single Agoric contract to manage complex, cross-chain multi-step workflows. For example, a contract on Agoric could create an account on another chain, transfer funds, initiate an action such as staking or swapping, and return the result, all triggered by a single interaction. The user does not need to manage multiple wallets or track the progress of each step, improving the UX. The contract handles these operations asynchronously and resumes execution once external events are completed. Several features of the Agoric virtual machine make this possible. Agoric smart contracts are long-lived processes that support asynchronous operations using JavaScript's async and await syntax. This allows a contract to pause and wait multiple blocks for an external event, such as an IBC message or an Axelar General Message, and then continue the execution. In contrast, traditional EVM contracts are stateless and cannot pause and resume across blocks. Agoric also includes built-in onchain Timer Services to schedule future tasks or periodic actions. The Orchestration SDK exposes higher-level functions for remote account management, enabling contracts to create and control addresses on other chains and interact with modules or contracts via IBC, Axelar, or similar messaging layers.

Together, these features allow developers to write applications that span multiple chains via a unified interface and an improved end user experience. This approach reduces the complexity of building multichain applications and avoids the need to implement custom logic for each external step. Developers can coordinate time-dependent inter-chain actions such as staking across networks, executing cross-chain swaps, or handling multi-hop token transfers via onchain timers and within one contract. Orchestration supports composability across fragmented ecosystems and is already in production through use cases like Fast USDC (detailed below). Additional use cases include automated asset deployment, cross-chain portfolio strategies, coordinated yield workflows, subscriptions, and cross-chain DAOs.

Fast USDC: Accelerating Cross-chain Transfers from EVM to CosmosFast USDC is a joint initiative between Agoric and Noble, the Cosmos-native issuer of USDC, aimed at significantly reducing transfer times for USDC moving from EVM-based networks into the Cosmos ecosystem. Announced in late 2024, Fast USDC shortens the typical bridging duration from 15–20 minutes to under one minute for transfers originating on Ethereum, Base, Optimism, Arbitrum, and Polygon. The system leverages Circle’s Cross-Chain Transfer Protocol (CCTP) for secure mint-and-burn operations across chains, integrated with Agoric’s onchain Orchestration contracts to coordinate the process. Agoric's Orchestration layer enables composable transaction flows, where bridging can be integrated with downstream actions such as staking, swapping, or application interaction, allowing applications to coordinate multi-step user interactions within a single transaction. The system allows users to deposit USDC on a supported EVM chain and receive native USDC minted on Noble within approximately one minute. Instead of waiting for standard bridge finality, deposits are detected and USDC is advanced from a liquidity pool to the destination chain. In the background, the CCTP protocol completes the burn on the source chain and the mint on Noble. This architecture minimizes transfer latency while maintaining the security guarantees of the Agoric network. Liquidity providers supplying USDC receive fees in return, creating a market-driven incentive to maintain liquidity. The workflow is executed entirely through Agoric smart contracts, requiring no centralized intermediary to complete or expedite the transfer. Transfers via Fast USDC are subject to both fixed and variable fee. A flat fee of 0.01 USDC is applied to every transaction, while a variable fee of 0.1% is calculated based on the transferred amount. 20% of fees are distributed to the contract, while the remaining 80% goes to the pool, increasing the available liquidity and, subsequently, the value of the LP tokens. Blockchain reorganization events occur when a previously confirmed block is replaced by a different block or series of blocks, potentially excluding transactions that were initially considered final. In the context of Fast USDC, this could result in a situation where USDC is advanced to a user based on a transaction that is later removed from the source chain. To address this risk, Fast USDC uses a set of chain-specific risk management controls designed to prevent unrecoverable losses in such cases. Each transaction is subject to a cap of 20,000 USDC. Confirmation thresholds are set conservatively for each supported chain to ensure that only finalized transactions trigger liquidity advances. The system also uses a rolling block window to monitor total exposure over time. Within this window, the aggregate advance amount is limited to 50,000 USDC to reduce potential losses in the event of a reorganization or similar issue.

Fast USDC launched in March 2025 through Noble’s Express Bridge. It supports transfers from Ethereum mainnet and leading Layer 2 networks to more than 20 Cosmos chains, including Agoric and Osmosis. Agoric plans to make Fast USDC a standalone integration for other applications and chains, contributing to broader interoperability across the interchain ecosystem.

TokenomicsAgoric previously operated under a dual-token system consisting of BLD, the native staking and governance token, and IST, a USD-pegged stablecoin used primarily for transactions and network fees. However, following the passing of Proposal #93 on May 1, 2025, the community voted to sunset the Inter Protocol and transition Agoric toward a single-token system centered around BLD.

BLDBLD is the native token used in Agoric’s CometBFT PoS consensus. Holders delegate BLD to validators who secure the chain and process transactions. Validator rewards are primarily driven by inflationary issuance. Previously, BLD stakers received additional rewards from fees generated from the Inter Protocol, the governing body of the IST stablecoin. These fees were related to IST activity, such as interest and token swaps. However, moving forward, Agoric will focus on making BLD the center of the Agoric economy with changes to Agoric and BLD tokenomics. BLD stakers vote on Agoric, and previously Inter Protocol, upgrades. Voting power for BLD stakers is directly proportional to the number of BLD they have staked. For a vote to be valid, a quorum of one-third of all staked BLD must cast a vote.

ISTIST was an overcollateralized stablecoin pegged to the US dollar and served as the primary fee token within the Agoric blockchain ecosystem. Users minted IST via the Inter Protocol by creating collateralized debt positions (CDPs) or depositing external stablecoins (e.g., USDC or USDT) into the Parity Stability Module (PSM). Protocol-governed vaults ensured IST’s peg through automated liquidation procedures triggered whenever collateral values fell below defined thresholds.

Sunsetting Inter Protocol and ISTThe initial proposal to sunset IST was due to declining market demand for decentralized stablecoins, high operational complexity and costs, and challenges integrating IST with Agoric’s Orchestration layer. The proposal was designed by the Decentralized Cooperation Foundation (DCF), Economic Committee, Agoric OpCo, and community stakeholders to responsibly transition Agoric to a single-token model centered around BLD. With the passing of Proposal #93, Agoric has begun a coordinated wind-down process set to conclude by mid-2025, ceasing IST minting, disabling new vault creation, and systematically closing existing vaults through incremental increases in liquidation ratios. Additionally, the plan provides comprehensive user support and transparent communication throughout a 60-day transition period, alongside the deactivation of associated infrastructure. Moving forward, Agoric will replace IST with BLD for protocol-level functions, including gas fees, Swingset execution, and wallet provisioning.

Token Allocations

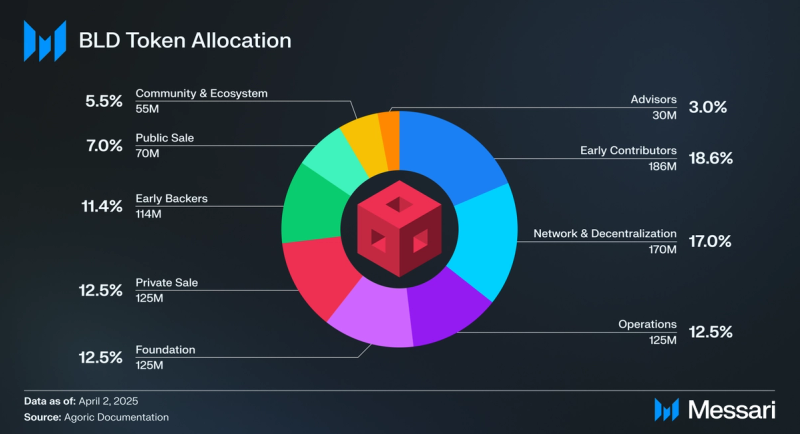

The BLD token generation event (TGE) was on November 1, 2021. The BLD supply is allocated as follows:

- Early Contributors: 18.6%

- Network & Decentralization: 17%

- Private Sale: 12.5%

- Foundation: 12.5%

- Operations: 12.5%

- Early Backers: 11.4%

- Public Sale: 7%

- Community & Ecosystem: 5.5%

- Advisors: 3%

All token allocation categories have now been fully unlocked except for early contributors, advisors, and certain private sale investors. Notably, all locked and vested BLD have been available for staking since the TGE, with staking rewards not subject to lockups or vesting.

ConclusionAgoric is building a developer-focused platform for multichain smart contract execution, designed to simplify cross-chain development through familiar JavaScript tooling and a secure execution environment. Its Orchestration SDK enables smart contracts to coordinate operations across multiple blockchains, including account creation, asset transfers, and interactions with remote modules. This functionality is already live in production through applications like Fast USDC, which shortens cross-chain USDC transfer times and improves the user experience.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.