and the distribution of digital products.

DM Television

What Separates Winning Fintech Pitches from the Rest?

Raising money in general is difficult. Fintech is one of the most competitive spaces out there. Every year, individual investors hear hundreds of pitches, and most go nowhere—less than one percent of startups get venture capital funding. If your pitch doesn’t grab the attention of the investors in the first 60 seconds, you are out.

\ Most founders think that their idea alone is going to check them. Some nailed it. Most didn’t. The difference? Successful businesses are focused on a clear story, have real market validation, and can point to a revenue model that, at least, makes sense. So, in this article, I break down real cases of my startup accelerator clients presenting on demo days and TechCrunch’s series of Pitch Deck Teardown to show what works, what doesn’t, and why some fintech startups are leaving with millions, while others go home without anything.

\ Meanwhile, I will be tearing down more unique fintech pitch decks and could do that with yours if you wish to submit it and share your story with me.

What Separates Winning Fintech Pitches from the Rest?Ideas only get funded if they are executed. Fintech founders who explain what they are building without proving why it matters, who wants to pay, and how they will make money won’t get it.

\ So, let’s simply go through some real cases regarding fintech startups that got it right.

Party Round — $7M Pre-Seed RoundTen slides. 148 words. No fluff, no filler. An honest razor-sharp pitch that pierced the noise and got Party Round $7 million in pre-seed funding. The secret? Timing, clarity, and a dead simple product that the investors couldn’t ignore.

\ First, they nailed the storytelling. Party Round knew that most founders drown their decks in insufferable walls of text. Their own deck was as tight as a Twitter thread.

\ The product itself was great as well. Fundraising is messy and slow. It often depends on who you know. Party Round flipped that narrative by streamlining the angel investment into a simple, click-and-done process without any of the legal and logistical headaches.

\ What sealed the deal is the why now factor. The startup world leans towards democratized investing: Robinhood made stocks fun, Coinbase made crypto mainstream, and Party Round has shown their role as the obvious next step in how startups will be funded. Once, the old-school gatekeepers of venture capital were losing ground; Party Round just framed itself as how it would happen.

\ What the deck lacks is how the product will be monetized. But this seems to be enough for investors—if the vision is strong and execution is clear, early-stage investors tend to bet that these details will work themselves out.

Analytic Marketing — $200K Seed RoundMore than just riding the hype around AI, Analytic Marketing proves their tech makes money. Rather than broad claims of disrupting finance, they demonstrated tangible progress in something that is actually disrupting finance—predictive marketing tools.

\ Their founders' industry experience made all the difference. They’d been living inside the Fortune 100 for years, learning exactly what the minds of these businesses were. That kind of insider knowledge instills confidence in investors that a startup can win enterprise deals, particularly in such a slow-moving industry as finance. Also, they described in detail how their solution would fit into the existing ecosystem by mentioning already secured symbiotic partnerships.

\ Analytic Marketing understood what their customers were suffering from—they needed better segmenting and secure data partnerships with an emphasis on compliance and easy adoption. Focusing on real problems enabled their early traction. In fact, investors have to see proof — at the earliest stages, it could be real revenue (if you’re lucky), LOI, pilot programs, etc.

Enduring Planet — $2M Seed RoundWhen pitching for funding, Enduring Planet didn’t cruise in with the standard climate fintech pitch. What made the difference? They first messaged the size of the funding gap as a crisis, not just a form of inefficiency. The traditional financing process is downright inaccessible, too slow, or too expensive for most climate startups to be able to raise. It made them feel urgent about being an investor. The entire climate sector stalls if capital doesn’t move faster.

\ Then they had the masterstroke: represent their funding model as the missing gear, and not as an alternative. Unlike VC, their revenue-based financing doesn’t dilute founders. Unlike grants, it’s fast. Unlike bank loans, it’s accessible. It was not “this is better,” it’s rather “this is what the market needs to function.”

\ Enduring Planet made VCs allies, not competitors of startups. Investors weren’t just backing a fintech startup; they were buying into a smarter deal flow engine.

Couplr AI — $250K Seed RoundWith Couplr AI, investors didn’t fall for the hype about AI. They were sold on the idea that could solve a massive, expensive problem. Couplr AI data-driven matchmaking reduces the cost of burning over $3,000 for traditional firms to acquire a single client, which makes them a revenue engine.

\ Their approach was completely different as they opted to get real results—lower acquisition costs, better retention of their advisors, and a system that can scale. The message was that this is not simply a more efficient way of connecting clients and advisors but a fundamental change to how financial services grow.

\ Trust was another key factor. It helped them align with The American College of Financial Services and lock in early partnerships, giving them instant credibility. Investors aren’t inclined to leave it to chance on tech itself. They bet on teams, and Couplr AI’s roster of fintech veterans, behavioral scientists, and veteran engineers made for an easy sell.

\ Couplr AI positions itself as the inevitable future of financial advisory, personalized financial guidance for all that has never been possible. The checks start rolling in when a startup shows not only where they are but where the industry is going and makes it sound all but certain.

Card Blanch — $460K Pre-Seed RoundHow do you consolidate all your credit, debit, and loyalty cards into one? These three things don’t make it on all pitch decks, but Card Blanch had clarity, design, and a compelling story.

\ First off, they have had the market potential nailed. The numbers were obvious and big; in America alone, cards are everywhere, and consumers carry them all for a reason — because each has its own perks. For that reason, the team doubled down on what makes them different.

\ Then came the storytelling. Card Blanch’s “how it works” was a masterclass in simplicity. The entire story of how users could use their card benefits was written on four sleek mockups. No long-winded explanations! That was just a crisp visual journey that investors could easily relate to. This gave them an instant understanding of how the product fits into a user’s daily life.

\ The other high note was the proposal. Most startups make a fuss about this slide, making it either too vague or too ambitious. Balancing the target market is what Card Blanch did. They explained precisely what they were raising and how much. It was sharp, specific, and time-bound but still solid and structured. That’s rare.

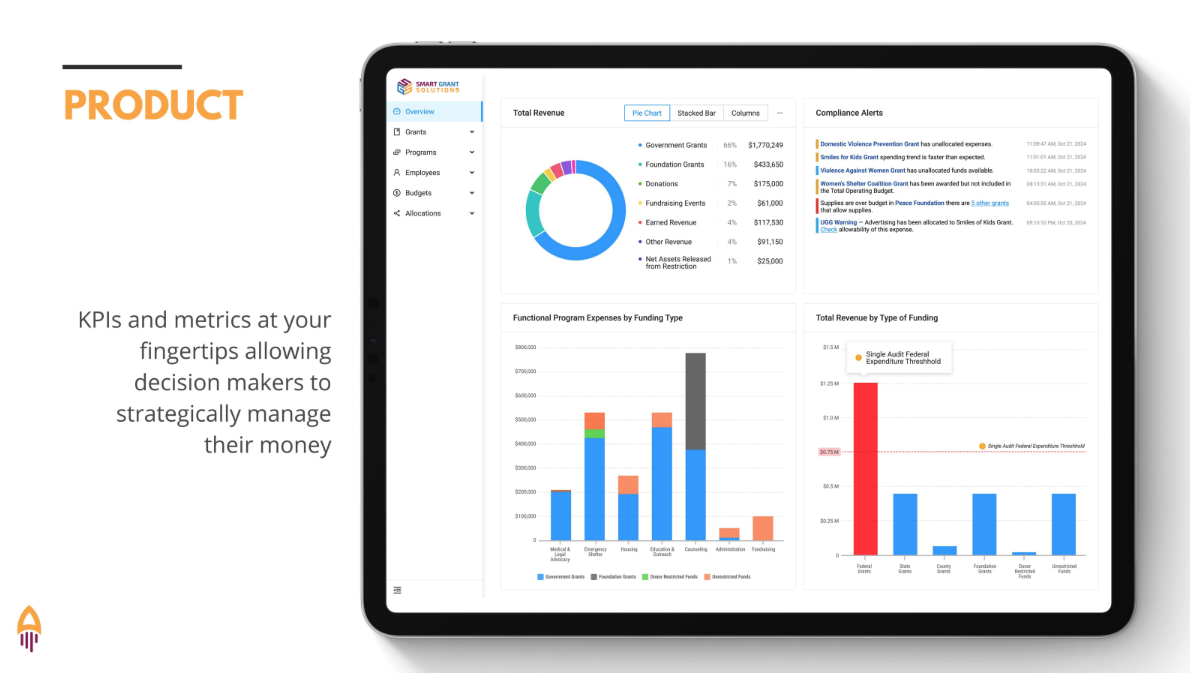

MissionGranted — $1.55M Seed Round (of a $2M goal)Instead of hype, MissionGranted wasted no time showing they could solve a real problem that cost companies big bucks. Grant management’s financial compliance is a nightmare, and they proved to investors how their automation can make it a painless process. Rather than make AI promises that never come true, they had actual customer feedback to back this pitch up, even including one from the founder of a very happy nonprofit. Getting checks written is all about market validation like that!

\ What hooked me was traction. In 2025, investors will not invest in your idea, they will invest in your revenue. MissionGranted has partnerships with organizations handling some of the largest U.S. grants. Investors want to see signals like this that customers aren’t just interested, they’re willing to pay.

\ Investors back not products but people who deeply understand their industry. MissionGranted’s leadership showed their expertise through a structured automated workflow that solves real compliance headaches. Their fundraiser is ongoing, but I’m sure they’ll reach the initial goal of $2 million very soon—they turned the funding conversation into a certainty, not a gamble.

Why You Should Attend Demo DaysIf you want to learn how to nail it with your investor pitches, you need practice. For early-stage fintech founders, you will learn the most attending demo days. There you can get real feedback, make connections, and, most importantly, bring your startup to the people who can actually fund it.

\ I’ve built a company that helps fintech founders raise a round in the brutal fundraising world. I personally strive to help startups get the funding they need to grow in any way, whether they’re involved with our accelerator or not. One such activity is the Fintech Startup Demo Day showcase, where we invite hundreds of accredited investors (so that you never waste your time on irrelevant audiences) and give you the word. Despite we started just a year ago, we’ve helped 20+ fintech companies execute software development strategies, cutting over $30 million in engineering costs and pushing their collective valuation past $100 million.

Key Takeaways for Fintech FoundersMost fintech founders are clueless when it comes to fundraising because they don’t understand how investors think. The ones who do? They get funded.

\ Investors don't care how cool your tech is; they want to know how your startup will make money. A great pitch is simple, impactful, and validated. The good thing about learning from successes and failures in the real world is that they give you insight into what could make your pitch win. Start taking part in demo days, pitch deck teardowns, and multiply your chances of closing vital investment opportunities.

\n \n

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.