and the distribution of digital products.

What are Real-World Asset Tokens?

In recent years, blockchain technology has evolved far beyond its original use case as a foundation for cryptocurrencies like Bitcoin. One of the newer applications of blockchain technology is the creation of real-world asset tokens, which have the power and visio l to transform traditional financial systems. In this article, we’ll delve into the concept of real-world asset tokens, their benefits, and their implications for various industries.

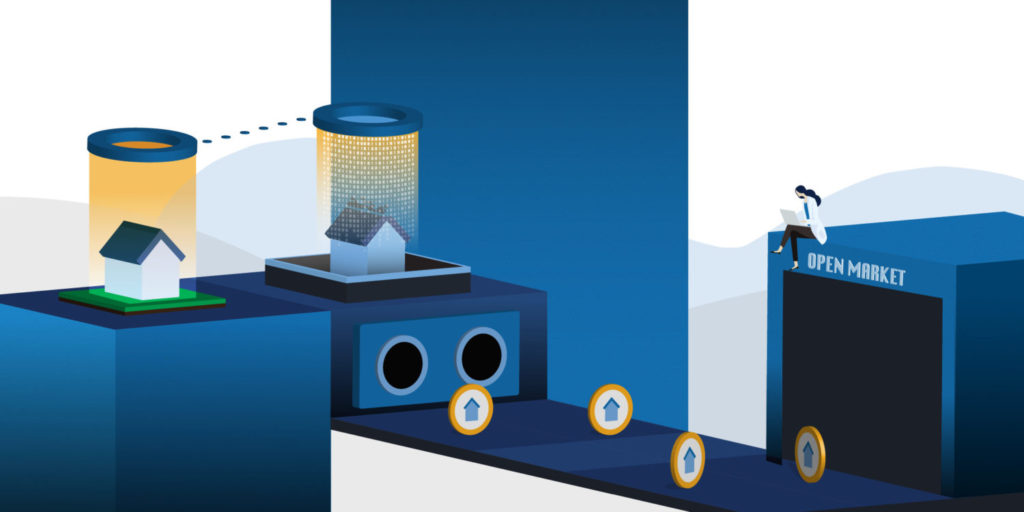

What are Real-World Asset Tokens?Real-world asset tokens, also known as tokenized assets, are digital representations of physical or real-world assets. These assets can include real estate, fine art, commodities, company shares, and even rare collectibles.

By tokenizing these assets, they become divisible, tradable, and transferable on blockchain networks, bringing the benefits of digital technology to the world of traditional assets.

The Tokenization Process- Asset Verification: The first step in tokenization involves verifying the ownership and authenticity of the physical asset. This process often includes legal documentation and compliance checks.

- Smart Contracts: Once verified, the asset is “tokenized” through the use of smart contracts on a blockchain. These contracts define the rules governing the ownership and transfer of the digital tokens.

- Token Creation: Digital tokens representing ownership rights are created, and these tokens are usually backed by the physical asset itself. Each token corresponds to a fraction of the asset.

- Trading Platforms: Tokenized assets can be bought and sold on various online platforms that facilitate trading and ownership transfer of these tokens.

- Liquidity: Tokenized assets can be traded 24/7, offering enhanced liquidity compared to traditional markets with limited trading hours.

- Fractional Ownership: Investors can buy and own small fractions of high-value assets, making investment opportunities more accessible.

- Transparency: The blockchain provides a transparent and immutable ledger, reducing fraud and ensuring the legitimacy of asset ownership.

- Accessibility: Investors from around the world can participate in asset markets, democratizing investment opportunities.

- Real Estate: Tokenization can make real estate investment more accessible and liquid, allowing investors to diversify their portfolios.

- Art and Collectibles: Rare art and collectibles can be divided into tokens, making it easier for art enthusiasts and investors to participate.

- Commodities: Precious metals, agricultural products, and other commodities can be tokenized for trading and investment.

- Equity and Startups: Early-stage companies can use tokenization to offer equity shares to a broader pool of investors.

Real-world asset tokens represent a significant step towards merging traditional and digital economies. They offer various benefits, from increased liquidity and accessibility to greater transparency and security.

As blockchain technology continues to advance, the potential applications of real-world asset tokens will only expand, reshaping the way we invest and manage physical assets in the digital age.

FAQs How can I buy or trade real-world asset tokens?You can buy or trade real-world asset tokens on online trading platforms or marketplaces that facilitate the purchase and transfer of these digital assets.

What kinds of assets can be tokenized?A wide range of assets can be tokenized, including real estate properties, fine art, agricultural products, company shares, and even rare collectibles.

Are real-world asset tokens the same as cryptocurrencies?No, real-world asset tokens are not cryptocurrencies. While cryptocurrencies like Bitcoin are purely digital assets, real-world asset tokens represent ownership of physical assets or commodities.

Are there regulatory considerations for tokenized assets?Yes, tokenization makes it easier for a broader range of investors to participate in asset markets, as they can buy fractional ownership of high-value assets.

Are real-world asset tokens subject to market fluctuations like cryptocurrencies?The value of real-world asset tokens can fluctuate based on market demand and the performance of the underlying asset. However, they tend to be less volatile than some cryptocurrencies due to their connection to tangible assets.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.