and the distribution of digital products.

DM Television

Understanding Rootstock: A Comprehensive Overview

- Rootstock is a Bitcoin sidechain launched in January 2018 designed to bring more expressive programmability to the Bitcoin network without compromising its security.

- Rootstock uses merged mining for consensus, and its transactions are facilitated by RBTC, a bridged version of BTC.

- The Rootstock ecosystem supports a variety of decentralized financial services, including lending, borrowing, trading, data tools, and stablecoins, with significant contributions from projects like Money On Chain and Sovryn.

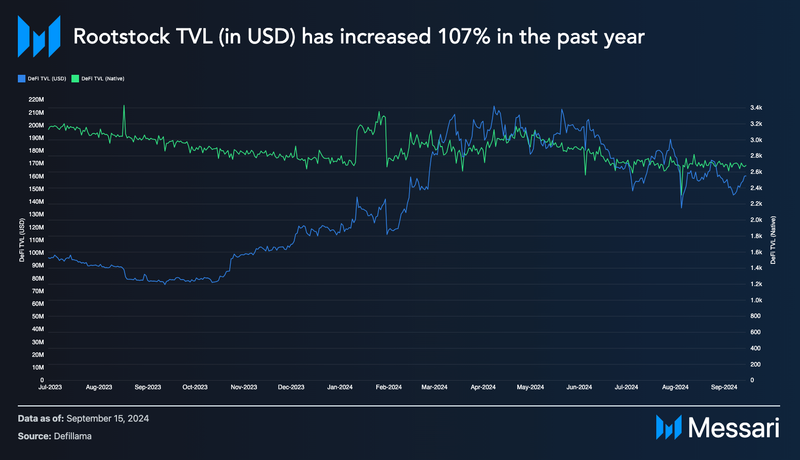

- Rootstock’s TVL has seen significant growth, growing over 107% over a year($77.0M to $160.3M).

- RootstockLabs has partnered with Fairgate to create BitVMX, an altered version of BitVM aiming to build a trust-minimized bridge between the Bitcoin mainchain and Rootstock sidechain using ZK proofs.

Bitcoin is the largest cryptocurrency by market cap, but it does not support arbitrary programmability. Rootstock is a Bitcoin sidechain that addresses users’ desire for additional programmability by running an EVM-compatible sidechain in parallel to the Bitcoin mainchain. Rootstock uses merged mining as a consensus mechanism and RBTC as a fee token.

Often referred to as “digital gold,” Bitcoin's narrative has been built around its robustness, security, and role as a store of value. To prioritize the safety of peer-to-peer payments, Bitcoin was intentionally created with extremely limited programmability to avoid introducing bugs and reduce network congestion. Its programming language, Bitcoin Script, is non-Turing complete, leaving developers who seek to build more complex applications to choose other blockchains that offer greater flexibility and functionality.

However, with the introduction of the Ordinal Theory in 2022 and BitVM in 2023, there has been a renewed interest in programmability within the Bitcoin ecosystem, highlighted by the launch of Ordinals (inscriptions like NFTs and digital artifacts) and discussions about the potential of soft forks. Yet, the goal of increased programmability is not new; Bitcoin layer solutions like the Rootstock (RSK) protocol have been striving to achieve this since the launch of Ethereum. As the community debates enhanced smart contract functionality, Rootstock stands out by offering improved scalability and faster transactions for Bitcoin since 2018. Like many upcoming layers, it is expected to adapt to BitVM, further innovating its offerings in the evolving Bitcoin ecosystem.

BackgroundRootstock is a permissionless Bitcoin sidechain launched on mainnet in January 2018 with the intention of bringing smart contract functionality to the Bitcoin network without compromising the security of the Bitcoin mainchain. It does not have its own unique native gas token, opting instead to run on “Smart Bitcoins” (RBTC) which maintain a two-way peg to Bitcoin itself.

A group of Argentinian engineers and entrepreneurs first conceived Rootstock in 2014 and published the whitepaper in November 2015.

In 2016, members of Rootstock’s core team formed RSKLabs to support the network’s growth. In November 2018, IOVLabs (later rebranded to RootstockLabs) acquired the assets and IP of RSKLabs. Today, RootstockLabs remains one of the core contributors to the Rootstock network and the RIF economy.

Before its acquisition, RSKLabs received $4.5 million in funding. In 2016, it raised $1.0 million in a seed round led by Bitmain Technology, with investors including Digital Currency Group and Coinsilium. In 2017, RSKLabs secured an additional $3.5 million in a Pre-Series A round.

Sergio Lerner, RootstockLabs’ Chief Scientist and Co-founder, has a long history in crypto. In 2013, he created QixCoin, a PoW Turing-complete cryptocurrency, contributed to Ethereum’s mining algorithm, and worked as the fourth full-time Bitcoin core developer for the Bitcoin Foundation. The current RootstockLabs executive team also includes Chairman and Co-founder Diego Gutierrez, CEO Daniel Fogg, CFO Matthias Rosenthal, CPO Tim Paymans, and CTO Henrik Jondell.

TechnologyRootstock’s technology has three main components:

- Merged mining: Rootstock’s consensus mechanism.

- Powpeg: Rootstock’s design to handle bridging from its sidechain to Bitcoin’s mainchain, involving a two-way peg maintained by a Federation and secured with custom hardware security modules (HSM) modules.

- Rootstock virtual machine (RVM): Rootstock’s method of computing smart contracts that is compatible with EVM at the op-code level.

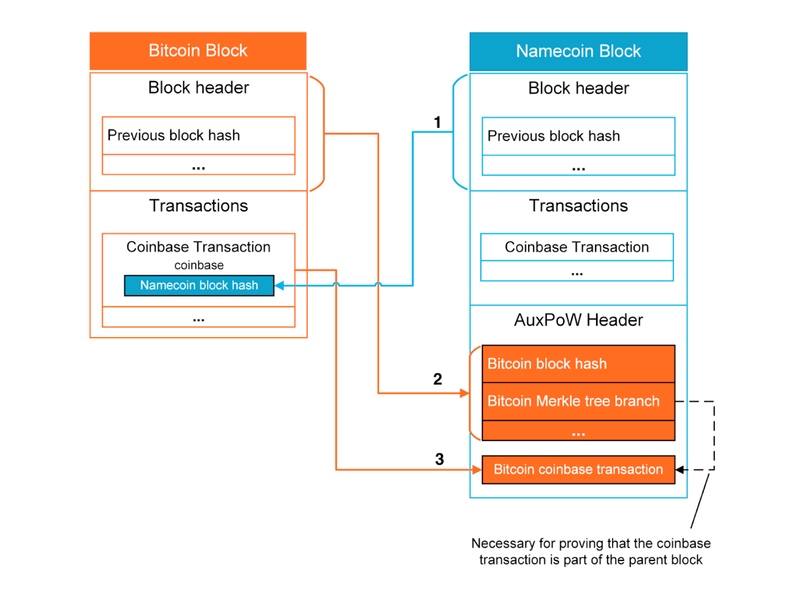

Rootstock uses DECOR+ (Deterministic Conflict Resolution) consensus, which is a proof-of-work protocol that maintains the Bitcoin block format (merged mining). Merged mining is a process where a miner mines for two or more blockchains during the same session using the same computational resources. The rationale behind merged mining is to improve energy and time efficiency by leveraging the hash power of the Bitcoin network. Miners are incentivized by the prospect of increased profitability while the consensus is aligned with the principles of the original parent chain.

Source: TariLabs

Block production on Rootstock is permissionless, allowing anyone to participate in block building. If interested miners do not possess enough hashpower to competitively solo mine, they can join a mining pool that supports Rootstock merged mining.

Rootstock has been able to secure a quarterly average of over 61% of the total Bitcoin hashrate. In essence, Bitcoin miners representing 61% of total Bitcoin mining power secure the Rootstock network using the same hardware and energy inputs. As one of the core contributors to Rootstock, RootstockLabs has defined three phases for the growth of merged mining: the bootstrap phase (less than 30% of the Bitcoin hashrate), the stable phase (between 30% and 60%), and the mature phase (greater than 60%). Presently, Rootstock is in its mature phase, leveraging a significant portion of the Bitcoin network’s hashing power to enhance its security. Major Bitcoin mining pools, such as Antpool, Luxor, Braiins, F2Pool, and Binance Pool, have adopted the merged mining setup, enhancing Rootstock's security alongside Bitcoin.

Rootstock miners receive rewards solely from transaction fees, as the network does not issue its own native currency. Transaction fees are allocated to the federation and miners to ensure continued network security, while 20% is dedicated to RootstockLabs to support ongoing maintenance and development of the network.

Rootstock employs the Reward Manager Smart Contract (REMASC) to reward miners. Each block executes REMASC, which records the Reward Balance account. This account adjusts its value with each new block production. When a block reaches maturity, rewards are distributed according to the rules specified by REMASC. The distribution of the Full Block Reward is as follows:

- 20% goes to RootstockLabs

- 0.8% to the Powpeg Federation

- and 79.2% to the block producers which are miners and mining pools.

These block rewards are not distributed to the pool all together in a single block, rather they are distributed through a technique called “fee smoothing.” Fee smoothing is a mechanism designed to distribute mining rewards more evenly across blocks, addressing issues caused by high transaction fees in a single block.

When a miner solves a block, they receive 10% of the transaction fees from that block, plus 10% of the accumulated unpaid fees from previous blocks. This creates a "shared" pool where all miners contribute and draw from, preventing large spikes in rewards.

The main purpose of fee smoothing is to prevent what's called a Miner Atomization Attack, where miners could be incentivized to re-mine a block with high fees, causing instability. With the smoothing fee, Rootstock reduces incentives for miners to engage in malicious behavior.

Rootstock’s average block rate is currently one block every ~30 seconds, which is fast compared to Bitcoin’s rate of one block every 10 minutes. The miner can vote to increase or decrease the block gas limit by up to 1% at each mined block. The block gas limit is 6.8 million gas units per block. A simple RBTC transaction consumes 21,000 gas, so the Rootstock platform can execute 11 transactions per second today. This limit could be increased by activating one of several improvement proposals, such as the parallel transaction proposal specified in RSKIP-144 or increasing the block gas limit.

While merged mining has some benefits, there are also considerations that have been disputed in the blockchain community. One is the possibility of the parent chain (Bitcoin) influencing the child chain's (Rootstock) operations through exposure to maximum extractable value (MEV) injections. However, these interactions are a part of the broader discussion on optimizing consensus for all participants. The Armadillo system is designed to monitor such attack vectors.

Armadillo MonitorArmadillo is a monitoring system integrated into the Rootstock network designed to protect against malicious mining activities. It analyzes block headers from the Rootstock network and Coinbase information from the Bitcoin network to measure the percentage of honest merge-mining activity (mining conducted by non-malicious actors) to prevent double-spend attacks. If the percentage of honest activity falls below 50%, it signals that a majority of miners may be attempting to attack the network by creating a hidden chain or censoring transactions. When such a threat is identified, Armadillo generates alerts and notifications to inform network participants, including miners, node operators, and the Rootstock development team.

The Armadillo system enhances the security of the Rootstock network by providing timely and precise information to both the nodes and the broader community. Rootstock nodes can use data from Armadillo to adjust their security settings and reject blocks that are not adequately visible. The community can leverage Armadillo’s insights to monitor the network’s health and take proactive measures to mitigate the risk of attacks.

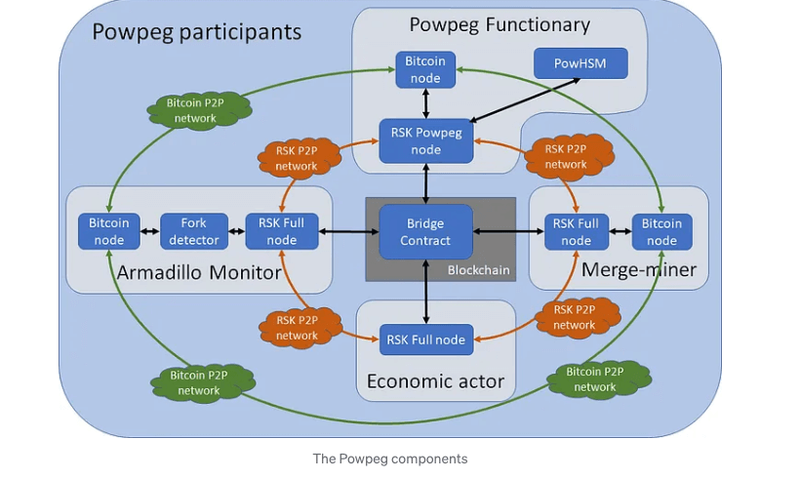

PowpegRBTC is a bridged version of BTC used for gas fees on Rootstock, in place of a custom native token. Powpeg is the bridging system used to mint and burn RBTC, communicating between Bitcoin and Rootstock. Rootstock uses a 5-of-9 federated peg system referred to as the Proof-of-Work (PoW) peg (Powpeg) to secure the bridge of BTC into the Rootstock network, where it is represented as RBTC, and vice versa. This mechanism ensures that BTC can be securely locked on the Bitcoin blockchain and an equivalent amount of RBTC is minted on the Rootstock network. The execution of transactions is funded by the RBTC token, which maintains a 1:1 peg with Bitcoin. The Powpeg is managed by specialized nodes known as Powpeg functionaries, which include entities like BlockVenture, Collider, Constata, Luxor, MyContainer, pNetwork, RootstockLabs, Sovryn, and Xapo. Each Powpeg functionary operates a node that combines a Rootstock full node with a Proof-of-Work Hardware Security Module (PoWHSM). The open-source PoWHSM firmware was developed by IOV Labs, and can only be used by functionaries to ensure that Bitcoin private keys are used securely, preventing unauthorized transactions. PoWHSM also has firmware attestation, which is a feature that allows any community member to validate that private keys are stored in genuine devices running a known version of the firmware.

Withdrawal requests must be approved by a majority of Powpeg functionaries. When a request is sufficiently confirmed on the Rootstock blockchain, an online PoWHSM will automatically sign the withdrawal transaction. The HSM's only sign withdrawal transactions when commanded by enough cumulative PoW. At present, it takes ~35 hours of equivalent PoW for the device to sign withdrawal requests. This makes it difficult and expensive to cheat the devices, minimizing the attack possibilities coming from Powpeg member collusion or device theft.

To protect BTC in the Powpeg bridge, an emergency 3-of-4 federated multi-sig system is in place. If most PoWHSM devices are unresponsive for a year, the emergency multi-sig gains authority to manage the funds. The emergency signers include RootstockLabs, Money On Chain, Jameson Lopp, and Adrian Eidelman. This system acts as a safeguard against device failures or external threats.

Conversion Process:

- BTC to RBTC: Users send BTC to a multi-sig address managed by the Powpeg functionaries. After verification, the corresponding amount of RBTC is minted on the Rootstock network.

- RBTC to BTC: Users send RBTC to a designated address on the Rootstock network to burn the tokens. The functionaries then verify the burn and release the equivalent BTC from the multi-sig address on the Bitcoin network.

Source: Blockgeeks

As of now, Rootstock does not allow unilateral exits due to their permissioned federation approval system, but they can if Bitcoin undergoes an upgrade(s) that enable such a mechanism.

RVMThe Rootstock Virtual Machine (RVM) is a forked version of the Ethereum Virtual Machine (EVM). Since it uses the same bytecode and opcodes, Ethereum smart contracts are fully compatible. This allows for more efficient onboarding of existing projects and developers, as 87% of blockchain developers work on at least one EVM chain.

In addition to maintaining compatibility with the EVM, the RVM incorporates several enhancements tailored to the unique needs of the Rootstock ecosystem. It includes native support for Bitcoin opcodes, which enables more complex and versatile smart contract functionalities that can interact directly with Bitcoin's scripting language. The RVM also features precompiled contracts for elliptic curve cryptography.

TokenomicsRootstock has two tokens that are core to its ecosystem: the RBTC token and the RIF token. RIF is the utility token that powers the Rootstock Infrastructure Framework (RIF), a set of open source, decentralized tools and technologies that make it easy to build accessible DeFi products and services on the blockchain. It is designed to enable and facilitate the wide range of decentralized services available on the RIF platform. Importantly, RIF is not required for the Rootstock network to function.

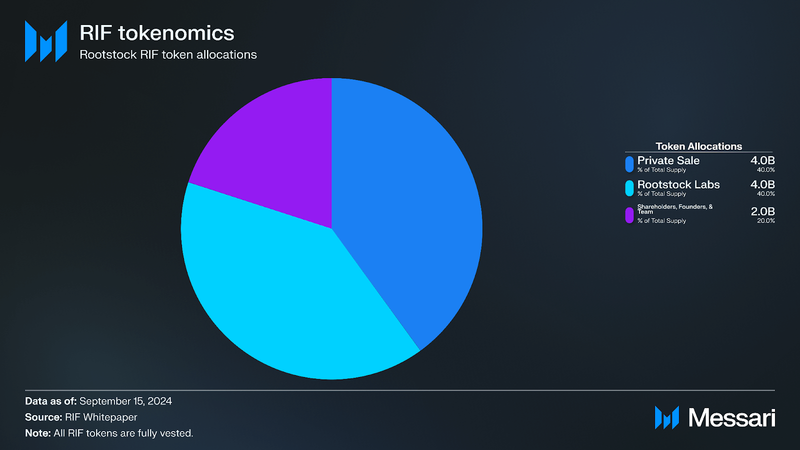

The initial distribution of the RIF token is 40% to private sale contributors, 40% to Rootstock Labs, and the remaining 20% to RSK Labs’ shareholders, founders, and management team. RIF has a fixed supply of 1 billion tokens and is fully vested as of January 2024.

The primary use case of the RIF token is to enable users to consume services that integrate with RIF Protocols, including third-party infrastructure services and decentralized applications (dApps) such as RIF Wallet, RNS, and third-party-developed infrastructure services. It is an ERC-677 token that can be transferred across smart contract platforms.

Network Activity

Rootstock’s total number of accounts shows a steady and continuous increase over the past year. The steady growth can be attributed to longevity in the Bitcoin DeFi space and Rootstock’s consistent growth in partnerships and offerings. As of September 20, 2024, the total number of accounts has surpassed 90,000.

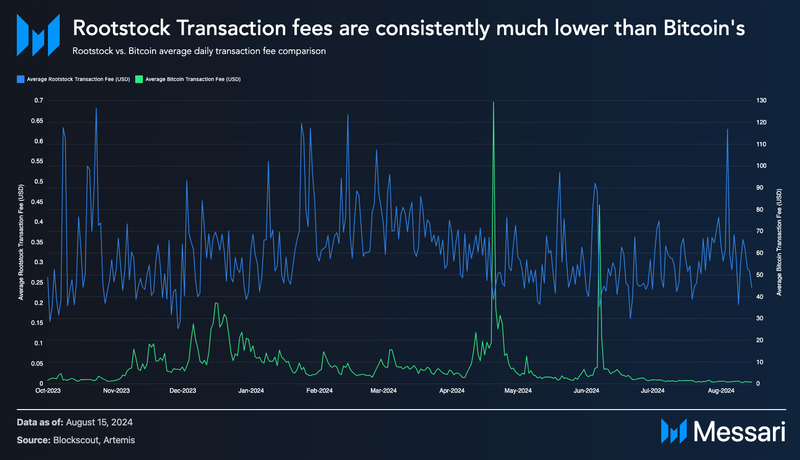

Over the past year, Rootstock transaction fees have remained significantly lower than the average daily transaction fees on the Bitcoin blockchain, with the average Bitcoin transaction fee being $7.86 compared to Rootstock’s average fee of $0.32 during the same period. Additionally, Bitcoin transaction fees have been more volatile, with notable spikes in April 2024 and June 2024, where fees peaked at $129.35, a 16.5x increase from its average. In contrast, Rootstock’s fees have remained relatively stable, peaking at $0.68, a 2.1x increase from its average.

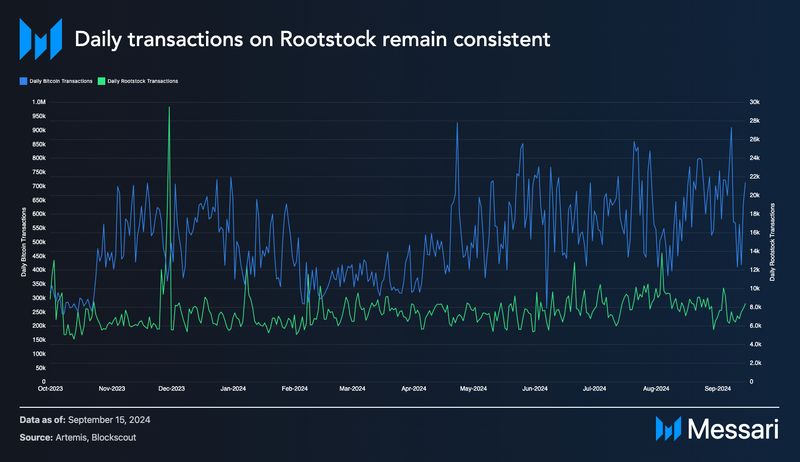

Comparing Rootstock to Bitcoin can help understand the dynamics and performance of the protocol within the Bitcoin ecosystem. When examining Rootstock alongside its parent chain, it is evident that Bitcoin transactions exhibit more variability with multiple spikes, particularly notable in 2023, where daily transaction volumes frequently approached 800,000. In contrast, Rootstock transactions show a more stable pattern with lower volumes, typically ranging between 4,000 and 24,000 transactions. Rootstock maintains a consistent level of activity with occasional peaks, reflecting steady usage and indicating that the recent increase in transaction volume on Bitcoin has not yet transferred over to Rootstock.

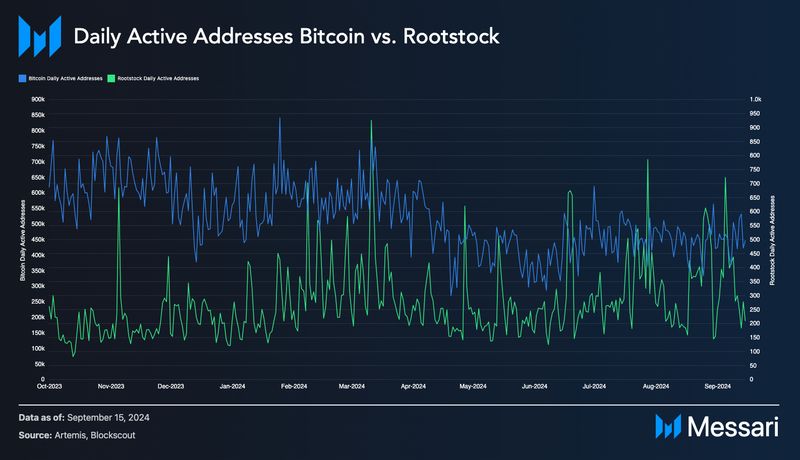

Rootstock has experienced consistent user activity on the network. While it may experience some positive peaks in active addresses, the base levels suggest that there is a strong, active, growing community of users. With the first half of September experiencing at least 150 minimum active addresses.

EcosystemThe Rootstock ecosystem includes projects on both the Rootstock base ecosystem and the RIF ecosystem. The latter is a suite of infrastructure tools built by RootstockLabs to help developers make dApps compatible with other projects on the network. Rootstock focuses on enabling decentralized financial services and supports a range of DeFi apps, DEXs, stablecoins, wallets, and bridges.

DeFi

Rootstock is home to traditional DeFi applications, such as lending, borrowing, and DEXs. Over the past 12 months, Rootstock’s TVL has increased by 107% in USD from $77.0 million to $160.0 million. This can be attributed to Rootstock’s successful onboarding and partnerships with various protocols such as Sushi and Uniswap. Uniswap has seen exceptional growth on Rootstock capturing over $14.5 million in TVL since its launch in December 2023. Liquidity within the Rootstock ecosystem has seen strong growth, demonstrating demand for Bitcoin-based DeFi applications. The surge in USD-denominated TVL can also be attributed to Bitcoin’s price increase, driven by factors such as its ETF in early 2024. The USD value of TVL reached $215.0 million on April 8, 2024.

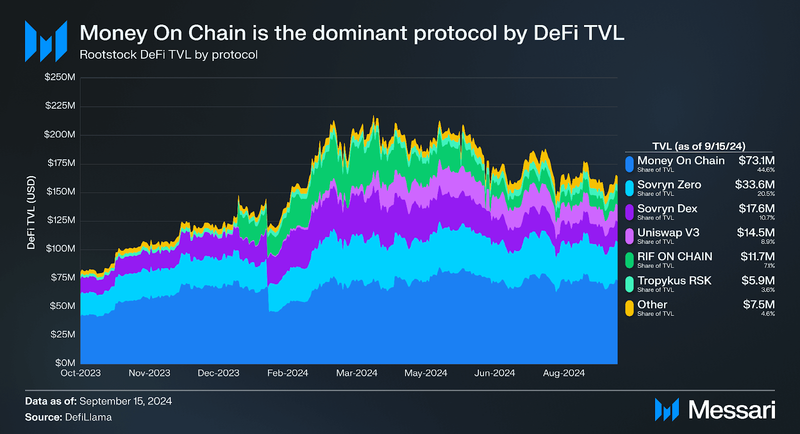

For the past four years, Money On Chain and Sovryn have accounted for the majority of Rootstock TVL, but this dominance began to shift in 2024, with projects like Uniswap V3 providing more liquidity to the space.

Sovryn launched in April 2021 as the first financial application on Rootstock and one of the first permissionless financial apps bridged with Bitcoin, the Lightning Network, Ethereum, and BNB Smart Chain. It is a non-custodial and permissionless smart contract based system for Bitcoin lending, borrowing, and margin trading. Sovryn contributes $51.2 million to Rootstock’s DeFi TVL, which is over 33% of the TVL in 2024.

Users can buy the native token SOV and swap or trade it for other tokens such as DoC, BPRO, rUSDT, xUSD, and MOC. Money On Chain has recently become the largest contributor to Rootstock’s TVL. Money On Chain is a Bitcoin-collateralized stablecoin. It is the largest project by TVL on Rootstock sitting at $73.1 million. The platform offers various financial products:

- Dollar On Chain (DoC): A stablecoin pegged to the US Dollar

- BitPro (BPro): A token designed for Bitcoin holders seeking passive income

- Money On Chain Token (MoC): Used for governance and earning a share of platform fees

Dollar on Chain (DoC) is a key player in the stablecoin ecosystem on Rootstock, enhancing the overall value of Money On Chain. Despite a decrease in stablecoin metrics for DoC over the past year, DoC remains a significant contributor to the stablecoin ecosystem with $1.8 million in TVL.

RIF on Chain, powered by Money on Chain, is a stablecoin on the Rootstock network fully collateralized with RIF tokens instead of BTC. Its stablecoin, USDRIF, is pegged 1:1 to the US Dollar. Unlike other DeFi protocol stablecoins, which require collateralized debt positions similar to DAI, USDRIF can be directly acquired by spending RIF. This unique feature allows users to obtain stablecoins without needing to provide additional collateral, offering a more straightforward and user-friendly experience. RIF on Chain currently accounts for $11.7 million of Rootstock’s TVL.

Uniswap, a leader in decentralized exchanges (DEX), is known for pioneering the automated market maker (AMM) model and launched on Rootstock in December 2023. Liquidity providers earn fees by adding tokens to liquidity pools, facilitating decentralized and trustless exchanges. Although the protocol only launched on Rootstock in January of this year, it is already the third largest TVL provider on Rootstock at $14.5 million.

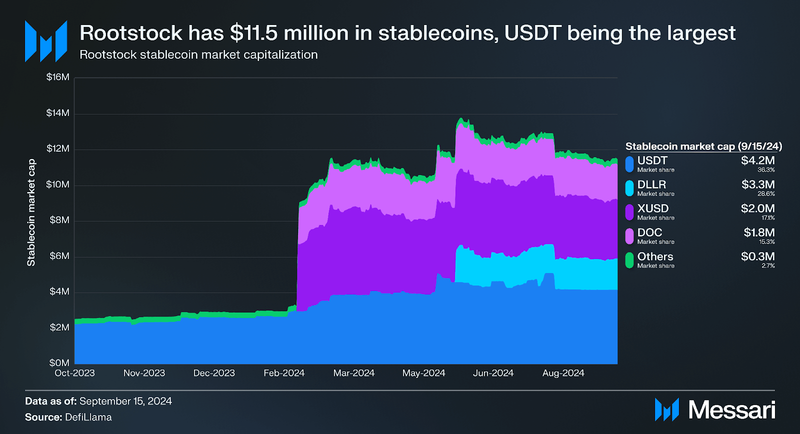

Rootstock has a variety of well-established stablecoins. Since June 2022, Dollar-On-Chain (DoC) has significantly increased its market share, reducing the dominance of USDT, which previously held the majority share. During the same period, DAI maintained a steady market capitalization of around $330,000. This year has seen notable additions to the stablecoin landscape, with new projects like USDRIF, XUSD, and DLLR contributing significantly to the total stablecoin market capitalization on Rootstock. These developments have pushed the total market capitalization to $11.5 million, showcasing the network's growing diversity and strength in the stablecoin sector.

Dollar on Chain (DoC) is collateralized with Bitcoin, maintaining a 1:1 USD peg. Unlike other stablecoins like USDT and USDC that rely on fiat, DoC's collateral is comprised entirely of Bitcoin, providing crypto-native collateral. DoC currently holds $1.8 million in market capitalization which corresponds to around 15.3% of the total market capitalization.

BabelFish is a cross-chain protocol that consolidates stablecoin liquidity from various issuers and chains into a single token: XUSD. XUSD is a USD-pegged stablecoin that functions as a decentralized aggregator and distributor of different stablecoins. It can be exchanged and redeemed 1:1 with any of the underlying stablecoin tokens backing it via smart contracts, allowing users to easily bridge multiple stablecoins from Rootstock and Ethereum networks to XUSD, and in reverse. It currently holds a market capitalization of $2.0 million or around 17.1% of the total market capitalization.

The Sovryn Dollar (DLLR) is a decentralized stablecoin fully backed by Bitcoin, created by aggregating various BTC-collateralized stablecoins into a single asset. It was developed by the Mynt smart contract system and governed by Sovryn Bitocracy. It leverages the strengths of existing BTC-backed stablecoins like DoC and ZUSD, each produced by different methods such as atomic redemption and overcollateralized loans, respectively. As of September 2024, it holds a market capitalization of $3.3 million which is equivalent to 28.6% of the total stablecoin market capitalization.

Additionally, there are also other interesting projects on the Rootstock platform ranging from wallets, other smaller DeFi projects, and data analysis tools.

Ecosystem ProjectsDeFiDeFi continues to be a large sector within the Rootstock ecosystem. Rootstock has seen major growth in this sector with projects such as Uniswap and Sushi launching on the chain.

- Tropykus: Specializes in savings and loans in dollars for Latin America.

- Rubic: Enhances crypto swaps by aggregating over 80 blockchains and 220+ DEXs, supporting over 15,500 crypto assets for efficient trading.

- Buenbit: A user-friendly platform for making crypto investment more accessible to everyday users in LATAM.

- Gamma: A protocol for active liquidity management and market-making strategies. Gamma offers non-custodial, automated, and active concentrated liquidity management services.

- Merkl: A protocol that allows users to earn rewards by participating in different campaigns and protocols.

- OpenOcean: A dex aggregator on the Rootstock blockchain.

- RootstockCollective: Announced by its founder Sascha Götz (former member of RootstockLabs) on Sept. 12, 2024, RootstockCollective is a DAO on Rootstock that empowers Bitcoin developers to build EVM-compatible applications. The treasury plans to use its $10 million in funds to bootstrap the community and prioritize grants and developer incentives. The DAO serves as a decentralized decision-making platform for value capture within the Rootstock ecosystem. The DAO allows RIF token holders to participate in governance by staking RIF to mint stRIF at a 1:1 ratio. The stRIF token helps with integrating RIF-enabled protocols, like RIF Name Service and RIF on Chain, into the ecosystem. Voting is based on stRIF balances at the time of a "snapshot" block, which the DAO uses to prevent manipulation and double voting. Early adopters of the RootstockCollective will receive perks, including NFT membership cards starting on Sept. 19, 2024.

- Money on Chain: A Bitcoin-backed stablecoin project governed by a DAO which uses the MoC token for governance.

- SushiSwap: A leading multichain DEX with cross-chain swaps and advanced trading solutions, operating on over 30 blockchains including RSK.

- Symbiosis: A cross-chain AMM DEX pooling liquidity from various networks, enhancing liquidity and trading options within the RSK ecosystem.

- Woodswap: A DEX built on Rootstock with features such as the Discretized Liquidity Automated Market Maker (DLAMM) mechanism that maximizes liquidity efficiency and reduces slippage for swaps. As well as liquidity mining to improve yields.

- Oracles Money On Chain (OMoC): Delivers reliable data feeds for the Money on Chain platform, supporting accurate and efficient DeFi operations.

- API3: Offers decentralized API services, enabling smart contracts to access real-world data and enhancing the ecosystem's overall functionality.

- RedStone: RedStone oracles provide data feeds to blockchains and layer 2 scaling solutions across the entire blockchain ecosystem that are both EVM and non-EVM compatible.

- Umbrella Network: A decentralized oracle service providing customizable data for Web3. Umbrella Network also offers real world data for smart contracts.

- MetaMask: A widely used browser extension and mobile wallet, MetaMask facilitates interaction with Ethereum and other EVM-compatible blockchains.

- Math Wallet: Supports over 50 blockchains and 2000+ dApps, including Rootstock, ETH, Polkadot, Near, Solana, and more. Its extensive support makes it a versatile choice for users.

- Beexo Wallet: The first wallet to integrate RIF Relay, allowing users to pay transaction fees using ERC-20 tokens.

- D’Cent Wallet: A secure hardware wallet providing robust protection for digital assets.

- Liquality Wallet: A multichain wallet with built-in swaps, offering a seamless and integrated trading experience.

- Ledger: A wallet that can buy, exchange, grow, and manage 5,500 coins and tokens.

- Wallby: A wallet solution where you can access Bitcoin and all its layer 2 networks and sidechain protocols.

- Exodus Wallet: A multichain Web3 wallet that supports over 50 networks.

- GetBlock: Provides infrastructure for accessing blockchain nodes, facilitating smooth and reliable interactions with the blockchain.

- Tenderly: A development platform for debugging, monitoring, and managing smart contracts, ensuring robust and efficient contract execution.

- Covalent: Delivers a unified API for comprehensive transparency and visibility of assets across blockchain networks.

- Nownodes: Offers blockchain-as-a-service solutions for accessing full blockchain nodes, simplifying the integration and interaction with different blockchains.

- Gelato Network: A Web3 cloud platform enabling developers to create advanced smart contracts that are automated, gas-efficient, and capable of operating offchain.

- Thirdweb: A full stack, open source Web3 development platform.

- Etherspot: Account abstraction development platform.

- The Graph: An indexing protocol for organizing blockchain data and making it accessible with GraphQL.

Alongside acting as the governance token for the RootstockCollective DAO, the Rootstock Infrastructure Framework (RIF) project team is developing a growing toolkit of protocols that offers a variety of fundamental products and services on the blockchain.

- RIF Wallet: Allows users to build their own cryptocurrency wallet with RIF’s SDK libraries.

- RIF Rollup: Plans to make crypto payments quickly and with low transaction costs.

- RIF Flyover: A fast and secure way for users to transfer BTC in and out of the Rootstock Ecosystem.

- RNS (RIF Name Service): Replaces complicated cryptocurrency addresses with easy-to-remember nicknames, simplifying digital asset transactions.

RIF Relay: Facilitates sponsored transactions, enabling users to pay fees with ERC-20 tokens, streamlining the transaction process, and improving user experience.

Competitive LandscapeWhile Rootstock is an early entrant into the Bitcoin sidechain space, competitors have emerged that have made decisions in their consensus mechanism which influence the speed, transaction fees, and decentralization of activity on the network. Some of the competitors for scaling or adding functionality to Bitcoin include Lightning, Liquid, Stacks, Core Chain, and BOB.

- Core Chain is a sidechain using a permissionless multi-sig to bridge BTC. Its native token, CORE, is used for transaction fees, staking, and governance. It has a hybrid consensus mechanism called Satoshi Plus, leveraging both Delegated Proof-of-Work (DPoW) and Delegated Proof-of-Stake (DPoS). Core Chain does not support unilateral exits, requiring users to trust Core Chain validators for transaction inclusion. Fast block times (every three seconds) and lower fees (on the order of cents) are key features that make the Core Chain stand out from Rootstock and other protocols.

- Liquid is a sidechain managed by a permissioned federation and does not use Bitcoin's mainchain for security. It employs federated multi-sig for BTC custody and issues its own version of bridged BTCs (L-BTC) on the sidechain. Block production is permissioned, with no native token. Liquid's Elements tech stack supports more expressive smart contracting applications, such as confidential transactions, tokenized assets, and atomic swaps. Governance is operated by a predetermined, permissioned group known as functionaries, with additional members participating in network upgrades and elections.

- Stacks is a sidechain that allows for permissionless block production that differentiates itself by using a Proof-of-Transfer (PoX) consensus mechanism based on Proof-of-Burn, which involves Bitcoin miners bidding BTC for the right to mint a Stacks block. It has its own token (STX) to pay for transaction fees, smart contract execution, and reward miners who participate in the PoX consensus mechanism. Stacks has no consensus-enshrined BTC bridge and uses two third-party bridges, which are both custodial multi-sigs. It uses Clarity, which is a non-Turing-complete language that is a subset of Lisp rather than Solidity for its execution environment, which makes it less compatible with the EVM, but is still expressive enough to build complex smart contracts. As of now, it does have slower transaction times, roughly 10 minutes per block.

- BOB is an optimistic rollup on Ethereum which currently relies on permissioned block production by one operator. It uses bridged BTCs, tBTCs, which maintain a two-way peg by a three-of-five multi-sig, and wBTCs which are managed by a central custodian, Bitgo. BOB’s sequencer is currently managed by one entity, but there is an anticipated future development called Optimine, which will allow Bitcoin miners to finalize production by verifying blocks that were signed optimistically by the BOB sequencer. BOB was launched in May 2024 on mainnet and had big initial traction, hitting $30 million in TVL just a week after launch. As of September 2024, the protocol has $37.6 million in TVL.

- Lightning Network is a permissionless state channel that enables users to open payment channels with counterparties for unlimited payments within the channel. Lightning is different from Rootstock in the sense that it is a network of channels secured by the Bitcoin mainchain rather than a sidechain connected to the mainchain with a two-way peg mechanism secured through merged mining. In addition, it does not have its own native token. Unlike the other Bitcoin layers listed above, it is classified as a Layer-2 because it enables unilateral exits through uncooperative channel closure transactions and employs a challenge-response mechanism to settle disputes. Users pay onchain transaction fees to miners when opening and closing channels, making it suitable for small or high-frequency transactions due to low fees and near-immediate confirmations.

As a general trend, the development on Bitcoin has proliferated since the start of last year and there are over 30 projects in development on testnet that are anticipated to be released onto mainnet within the next couple of years. Newer layers like BOB have focused more on the potential of building trustless rollups on Bitcoin, a feature that is not currently possible, but could be possible with a potential OP_CAT soft fork — which enables recursive covenants that can manage and update their state autonomously.

RoadmapWith the Bitcoin programmability space becoming more relevant due to Ordinals and the growing number of Bitcoin scaling solutions, there is increased competition. To maintain its competitive edge, Rootstock’s roadmap features several technical upgrades as well as further research into its own version of BitVM, BitVMX.

BitVMXBitVM is a strategy that performs arbitrary computation offchain and then verifies it on the Bitcoin network, paving the way for new bridging mechanisms and strategies validating transactions. RootstockLabs is exploring how BitVM can be used to benefit Rootstock's Bitcoin bridge. RootstockLabs has partnered with Fairgate to develop their own version of BitVM called BitVMX, which optimistically executes arbitrary programs on Bitcoin, but differs from BitVM by not relying on Merkle trees or signature equivocations and instead uses hash chains to balance programming costs vs. complexity.

BitVMX implements a message-linking protocol for authenticated communication. Both parties pre-sign all inputs and outputs using one-time signature schemes (e.g., Lamport, Winternitz). This fixes transaction IDs from the start, enabling sequential transactions with dependencies and facilitating state information communication.

The RootstockLabs team asserts that future BitVMX research will focus on economic incentives including deposit sizes, verifier bounties, capital costs for operating bridges between Bitcoin and sidechains or rollups, and cryptoeconomic security. In Q1 2025, BitVMX is planned to support multiple verifiers and introduce a shift to a trust-minimized Bitcoin/Rootstock bridge, relying on the 1-of-n trust assumption. Success in these areas could enable Rootstock to influence the development of other L2 solutions and significantly contribute to the shift towards increased programmability, especially given its history as the first Bitcoin sidechain.

With its endeavors to significantly contribute to increased programmability on Bitcoin, Rootstock has also completed the first Zero-Knowledge SNARK on Bitcoin using BitVMX. Using BitVMX, the team was able to demonstrate knowledge without revealing the specific information as well as not having the prover and verifier interacting at all.

Additionally, the team has mentioned that they will continuously explore the implementation of the most decentralized technology, including OP_CAT, if it becomes available on Bitcoin.

Network Features and IntegrationIn October 2024, Rootstock is expected to have an upgrade that will introduce stable minimum gas prices denominated in fiat and lower the minimum amounts required for peg-in and peg-out transactions. Additionally, Rootstock will add the Lightning Network to the peg-in and peg-out experience to allow users to select their preferred method for entering Rootstock based on their expertise and transaction type.

In Q4 2024, a Bitcoin Native Assets Bridge will be introduced which will facilitate seamless cross-chain transfers of Bitcoin assets (Runes/Taproot Assets) into Rootstock, offering users easy access to a scalable platform with a dynamic DeFi ecosystem. RSKj, the Rootstock protocol reference implementation, will also introduce a snap sync mode that enables full synchronization of Rootstock nodes in a few hours. Lastly, RSKIP-144 will introduce a protocol for safely parallelizing transactions, increasing the block gas limit and enhancing Rootstock’s scalability by boosting transaction throughput.

In 2025, a group of core contributors to Rootstock have proposed RSKIP-144, which will increase speeds and reduce fees on the Rootstock network. They will enable HSM cloud setup through Intel SGX-based PoWHSMs that will simplify the addition of new federation members and diversify HSM manufacturers. This improvement proposal will enable faster blocks and higher transaction throughput, reducing confirmation times from 30 seconds to just 5 seconds. RSKIP-305 will also upgrade the Powpeg to a SegWit-compatible 2-Way Peg, increasing the number of entities overseeing Bitcoin transaction signing to over 60. This upgrade will enhance decentralization and reduce peg-out transaction fees by up to 70%.

All adopted changes are published on the Rootstock proposal site here.

Closing SummaryRootstock was created to address the desire for increased programmability in the Bitcoin ecosystem. It is a merge-mined network that is EVM-compatible and leverages a federated multi-sig to secure its bridge with Bitcoin through a Proof-of-Work Peg. As one of the first sidechains with full Turing-complete functionality, Rootstock enables the execution of complex smart contracts and decentralized applications on the Bitcoin network. With its founding scientist deeply involved in the development of Ethereum and a team dedicated to advancing programmability since 2018, RootstockLabs could potentially be in a position to support the needs and evolution of Bitcoin layers.

A crucial factor in the protocol’s success will likely be the underlying technology of upcoming BitVM iterations, including BitVMX, developed by the RootstockLabs team in partnership with Fairgate. In the future, Rootstock plans to upgrade their Powpeg to a SegWit-compatible 2-Way Peg as well as release more features that will enable faster transfers between RBTC and BTC.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.