and the distribution of digital products.

DM Television

Understanding E Money Network: A Comprehensive Overview

- E Money Network is a Proof-Of-Stake (PoS) blockchain designed to facilitate tokenization of Real World Assets (RWAs) by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) processes directly onchain, aiming to bridge the gap between traditional finance and the Web3 space.

- The network leverages a PoS consensus mechanism with Tendermint BFT, and is EVM-compatible, allowing for the deployment of Ethereum smart contracts, while also providing a modular architecture through the Cosmos SDK, offering developers flexibility and interoperability.

- Alongside its blockchain, E Money Network offers several core products, including E Money Wallet, EPay, and E Money Card. E Money Wallet is a multichain wallet with integrated KYC/AML and IBAN functionality.

- E Money Network's diverse partnerships with projects in DeFi, gaming, and RWA tokenization emphasize compliance, interoperability, and secure asset management, strengthening its position as a bridge between traditional and digital finance.

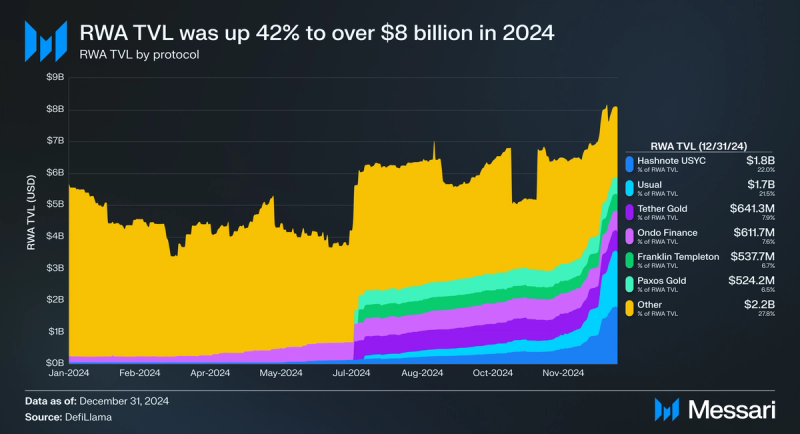

One of the fastest growing sectors in crypto is Real World Assets (RWA). In 2024, RWA TVL increased by 42% from $5.68 billion to $8.07 billion. RWAs have been bolstered by both new project launches and increasing institutional interest. However, despite the impressive growth of RWAs in 2024, the further integration of RWAs remains a complex challenge in 2025. Many existing blockchain platforms lack the necessary infrastructure to support the tokenization of RWAs in a manner that is both compliant with regulations and interoperable across different networks. This gap hinders further adoption of RWAs, limiting the potential for increased liquidity and new opportunities.

E Money Network is a Layer-1 (L1) blockchain that seeks to address these challenges by providing a secure, compliant, and interoperable infrastructure for RWA tokenization. The platform aims to bridge the gap between traditional finance and DeFi, offering a comprehensive ecosystem for both individual and institutional users.

BackgroundE Money Network, formerly known as Scallop, started with a vision to establish an ecosystem where cryptocurrency users can freely use their digital assets without the obstacles that currently hinder their adoption and usage. The project has since evolved into a modular RWA blockchain infrastructure with compliance standards designed to meet the growing demand for RWAs and facilitate the building of sustainable projects that enable the creation of RWAs and RWA-enabled businesses. The primary goal of E Money Network is to bridge the liquidity gap between Web2 and Web3, enabling the tokenization of RWAs and facilitating their integration into the blockchain space.

Scallops’ rebrand to E Money Network was announced in early 2024 and the project team is led by founder and CEO Raj Bagadi, CTO Juri Kopõtko, and CBO Raj Karia, who each brings experience in blockchain development, compliance, and project management. In May, E Money Network announced that it raised $5.2 million in a Bridge Round. Notable investors in the round included Kelsier Ventures, Animoca Brands (who also joined as a lead validator), GBV Capital, Momentum 6, Blockchain Founders Fund, Morningstar Ventures, Kucoin, Blackedge Capital, and Banter Capital.

TechnologyOverviewE Money Network is a modular L1 blockchain built using the Cosmos SDK and CometBFT. The Cosmos SDK is an open-source software development kit (SDK) for building sovereign and public PoS blockchains. The Cosmos SDK is used to build a custom application layer, or state machine, while CometBFT is used to securely replicate that state machine on all nodes in the network. CometBFT, an application-agnostic engine, handles the networking and consensus layers through two main components:

- A consensus algorithm, i.e., Tendermint.

- A socket protocol, i.e., the Application Blockchain Interface (ABCI).

Tendermint validates requests on the source chain and confirms changes on the destination chain. Its consensus provides instant finality and Byzantine fault tolerance. Furthermore, E Money features an EVM-compatible execution environment.

Proof-of-Stake Consensus

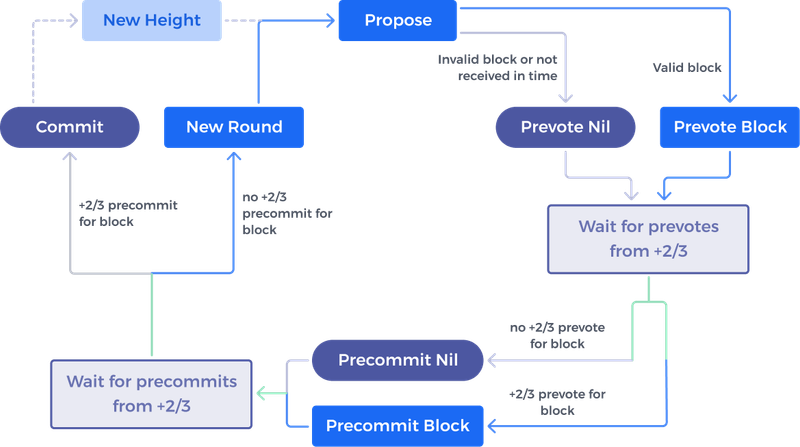

Source: E Money Documents

E Money Network employs a PoS consensus mechanism, utilizing the Tendermint Byzantine Fault Tolerance (BFT) consensus protocol. In this system, validators are responsible for validating transactions and securing the chain. E Money Network can support up to 100 validators.

Validators take turns proposing blocks of transactions and voting on them. The protocol requires two stages of voting: pre-vote and pre-commit. A block is committed when more than two-thirds of validators pre-commit the same block in the same round. Validators may fail to commit a block for various reasons, such as the proposer being offline or network delays. Tendermint allows validators to establish when a validator should be skipped, relying on a timeout mechanism, making it a weakly synchronous protocol. Tendermint-enabled consensus guarantees safety, ensuring that validators will never commit conflicting blocks at the same height, assuming less than one-third of the validators are malicious.

ComplianceA core feature of E Money Network is its regulatory compliance as a public-permissioned blockchain. E Money Network is fully compliant with Markets in Crypto-Assets Regulation (MiCa), a comprehensive European Union framework designed to establish harmonized rules for crypto-assets, ensuring investor protection, market integrity, and legal clarity while fostering innovation across the EU.

E Money Network directly implements Know-Your-Customer (KYC) and Know-Your-Business (KYB) processes onchain. Both users and applications are required to complete identity verification before transacting on E Money Network. The Regulatory Authority Module (RAM) prevents non-verified accounts and smart contracts from conducting transactions on the network. Verified accounts and smart contracts are whitelisted, and validators are only able to accept transactions from whitelisted addresses.

Cross-Chain BridgeTo facilitate cross-chain interoperability, E Money Network utilizes a trustless bridge that employs Chainbridge standard contracts. This bridge supports asset transfers over EVM chains, including Ethereum, Polygon, and BNB Smart Chain. The bridge uses ERC20/EMYC20 handlers, relayers, and generic handlers to enable the locking and unlocking of tokens on source chains and the minting and burning of tokens on target chains. Relayers are used for the validation of transfers across the Chainbridge, and generic handlers allow for customizable behavior upon receiving transactions to and from the bridge.

ProductsE Money Network has developed a series of adjacent products to support the E Money ecosystem.

E Money WalletThe E Money Wallet is a digital wallet tailored for secure, efficient, and regulatory-compliant transactions within the E Money Network ecosystem. Key aspects of the wallet will include:

- IBAN-Linked Wallet Addresses - Upon completing a secure verification process involving ID and biometric data, users receive a wallet address on the E Money Network that also functions as an International Bank Account Number (IBAN). This positions the wallet as a "Bank on the Chain," merging conventional banking identifiers with blockchain addresses.

- E Money Card Integration - The wallet issues cards linked to user wallet addresses, enabling seamless spending of cryptocurrencies in daily transactions. Users can select crypto as a payment option across various platforms, simplifying the use of digital assets for everyday purchases.

- E-Money Tokens - Fiat-to-token transactions are facilitated using e-EUR tokens. When users transfer traditional fiat currencies to their IBAN address, an equivalent amount of E-Money Tokens is minted at a 1:1 ratio. These tokens enable swift, low-cost global transactions and adhere to regulatory standards.

- Multichain Support - In addition to the E Money Network, the E Money Wallet will be multichain and support various L1 and L2 networks, such as Ethereum, Solana, Avalanche, and more.

- Foreign Exchange (FX) and Remittances - Supporting over 100 fiat currencies, E Money Wallet will serve as a versatile solution for foreign exchange and remittance needs. Users can manage currency exchanges and international money transfers efficiently, making it suitable for travelers, cross-border transactions, and sending funds abroad.

EPay integrates fiat and cryptocurrency transactions directly into Telegram. This integration allows users to send and receive cryptocurrency, make purchases, and split bills within Telegram chats, streamlining financial interactions without the need to switch between different applications. The system emphasizes user-friendliness and robust security measures to ensure safe and efficient transactions. By embedding these financial services into a widely used messaging app, E Money Pay aims to enhance the convenience of digital payments.

E Money CardE Money Card is a card that allows users to spend onchain cryptocurrency balances at supported vendors. These cards are directly linked to users’ wallet addresses within the E Money Network and other supported blockchains, integrating digital assets with conventional payment systems. Furthermore, E Money Card supports USDC on both Solana and Base. The E Money Card is accepted in over 150 countries, and users can earn up to 2% in crypto rewards on purchases.

TokenomicsEMYC will be the native token of E Money Network upon mainnet launch. EMYC has a total token supply of 400 million.

As a part of the rebrand from Scallop, SCLP tokenholders will be able to exchange SCLP tokens at a 1:1 ratio for EMYC. At TGE, SCLP tokenholders will immediately receive 12% of any converted holdings. Afterwards, each month, an additional 14.67% will be unlocked, and then in the final month (month 6), 14.65% will be unlocked. Further details about EMYC allocations and vesting schedules have not been disclosed as of writing. The EMYC token has various planned utilities:

Gas TokenAs the native token of E Money Network, EMYC will be used to pay gas fees on the network. All gas fees paid on the network are subsequently burnt.

Staking & Staking RewardsIn order to operate a validator on E Money Network, a minimum of 500,000 EMYC tokens must be staked for a minimum of 30 days. Additionally, users can delegate stake to a validator if they do not wish to operate a validator themselves. Validators and stakers will also receive EMYC tokens as staking rewards. Lastly, validators who engage in malicious behavior or fail to perform their duties properly are subject to slashing, which involves the loss of a portion of their (and delegators’) staked tokens.

GovernanceAs a Tendermint PoS blockchain, E Money Network features onchain governance. EMYC stakers will be able to vote on governance proposals that affect the parameters of the network, such as locking, staking, slashing, and more.

Other UtilitiesEMYC will feature numerous other utilities as well, including but not limited to:

- Participating in regulated crowdfunding campaigns for projects on E Money Network.

- Discounts on E Money Network apps.

- Loyalty and reward programs for EMYC tokenholders.

- Peer-to-peer lending.

- Payment for NFT mints.

The EMYC token’s Token Generation Event is planned for January 23, 2025.

Partnerships & IntegrationsE Money Network has procured a series of strategic partnerships and integrations with varying projects in the ecosystem. These partnerships and integrations highlight the project's focus on compliance, interoperability, and the development of RWA use cases:

- Solana - E Money Wallet integrated with Solana, becoming the first-ever MiCa-compliant wallet on Solana. This integration allows users to access one of the largest public blockchains in a compliant manner.

- Plume Network - Plume Network, a public blockchain focused on the tokenization and integration RWAs, is collaborating with E Money Network to enhance user accessibility to its ecosystem. By integrating E Money Network’s fiat-to-onchain accessibility and crypto card services, the partnership aims to streamline transactions and expand opportunities for users.

- Lumia - Lumia, a full-cycle blockchain for RWAs, is partnering with E Money Network to bridge the liquidity gap between fiat and crypto through E Money Network’s compliant BankFi infrastructure. This collaboration will enable seamless on- and off-ramping of eEUR and other assets.

- Solana Name Service - Solana Name Service (SNS), the SOL domain service, is integrating with E Money Wallet to bring its 100K+ users a seamless and human-friendly transaction experience. This partnership enables users to register and manage .sol domains directly within the E Money Wallet.

- Redbelly Network - Redbelly Network is integrating E Money Wallet into its ecosystem to enhance compliant real-world asset tokenization, aiming to streamline the process of bringing real-world assets onto the blockchain.

- Gala - Gala, a Web3 ecosystem encompassing games, music, and films, is integrating the E Money Wallet to enable users to securely store and utilize their Gala tokens, in-game NFTs, and other digital assets.

- Patex - Patex, an RWA project in Latin America, is integrating with E Money Network's MiCA-compliant blockchain ecosystem to enhance financial inclusivity and innovation in the real-world asset (RWA) space.

- ZetaChain - ZetaChain, an L1 blockchain for chain abstraction, has partnered with E Money Network to enable developers to build simple, secure omnichain applications, enhancing compliance-driven innovation in Web3.

- Yescoin - Yescoin, a Web3 gaming ecosystem with over 13 million users, is partnering with E Money Network to enable seamless swaps of YESCOIN and rewards for fiat (eEUR) via the E Money Wallet.

- Other Partnerships - In addition to the above, E Money Network has also formed partnerships with WeFi, Kima Network, MAIV Finance, RWA Inc., Chorus One, zkCross Network, Xend Finance, Sheertopia, Sharpe AI, PlayZap, Buk Protocol, and Kvants.

E Money Network's roadmap includes several key milestones aimed at expanding its ecosystem and enhancing its capabilities. The project is focused on the upcoming launch of its beta mainnet, which will serve as the foundation for future applications. The launch of the native EMYC token is also a key priority, with the transition from SCLP to EMYC being a significant step in this direction. The E Money Wallet is also set to receive integration for E Money Cards.

In the longer term, E Money Network aims to become a leading platform for RWA tokenization, focusing on interoperability and building a comprehensive ecosystem for compliant Web3 applications. E Money Network partially aims to achieve this through its $2 million RWA Grant Program. This initiative invites developers to submit proposals, with selected projects receiving grants ranging from $5,000 to $50,000, along with mentorship, legal and compliance support, and marketing assistance. The program aims to accelerate innovation in the RWA ecosystem by fostering the creation of compliant and efficient digital asset solutions.

Closing SummaryE Money Network is attempting to address the challenges of RWA tokenization by providing a compliant, interoperable, and secure infrastructure. The project's focus on on-chain KYC/AML, MiCA compliance, and bank-grade security positions it as a potential leader in the emerging RWA space. The integration of the E Money Wallet, with its multichain support and IBAN functionality, aims to provide a seamless user experience for both crypto and traditional finance users. The use of Tendermint BFT consensus, EVM compatibility, and a modular architecture through the Cosmos SDK provides a robust and flexible platform for developers.

The project's strategic partnerships and focus on community engagement highlight its commitment to building a comprehensive ecosystem. The launch of the EMYC token and the upcoming mainnet launch are key milestones in the project's roadmap. Overall, E Money Network presents a compelling approach to RWA tokenization, with a strong emphasis on compliance, interoperability, and security. The project's success will depend on its ability to execute its roadmap, build a thriving ecosystem, and navigate the complexities of the evolving regulatory landscape.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.