and the distribution of digital products.

DM Television

Understanding Amnis Finance: A Comprehensive Overview

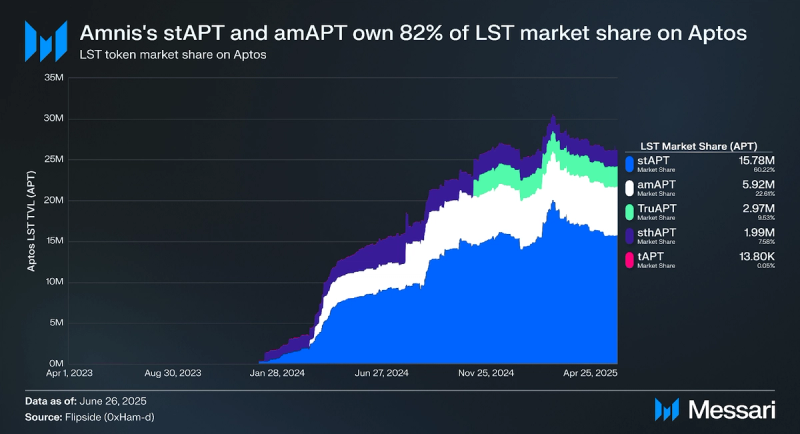

- Amnis dominates Aptos liquid staking, with over 82% of the Aptos LST market and more than 34.1 million APT staked across its amAPT and stAPT tokens, underscoring its position as the network’s core staking infrastructure.

- Amnis’ dual-token model unlocks both liquidity and yield. amAPT offers liquid staking flexibility, while stAPT compounds rewards automatically through a vault-based model.

- Decentralized governance is now live and fully functional. The launch of Amnis governance allows AMI token holders to participate in Amnis Finance governance and stAPT and amAPT holders to participate in Aptos protocol governance.

- Amnis’ protocol revenue model is sustainable and aligned. Amnis collects a 7% performance fee from staking rewards, with additional yield routed to the DAO treasury from amAPT.

- Amnis Strategy Vault will automate advanced yield generation. The upcoming Strategy feature introduces automated leveraged staking through a single transaction interface.

Amnis Finance is the dominant liquid staking protocol on Aptos, designed to maximize staking utility without locking up capital. By enabling users to stake APT and receive liquid derivatives, amAPT for flexible DeFi use and stAPT for auto-compounded yield, Amnis removes the traditional tradeoff between yield and liquidity. Its architecture supports integration with the broader Aptos DeFi ecosystem, offering users powerful tools to earn, borrow, lend, and provide liquidity without forfeiting staking rewards.

Since launching in October 2023, Amnis has become a foundational layer in the Aptos ecosystem, driving adoption through deep integrations with key DeFi platforms like Aries Markets, Meso Finance, Echelon Market, Cellana Finance, Liquidswap, and Hyperion. The protocol’s real-time liquidity, dynamic staking vaults, and dual-token model have made it the go-to solution for capital-efficient APT staking.

With the newly launched Amnis governance enabling AMI tokenholders to vote on Amnis-specific proposals and stAPT and amAPT holders to vote on Aptos network decisions, Amnis has evolved to become a community-directed protocol.

Website / X (Twitter) / Discord

Amnis Under the HoodAt its core, Amnis Finance is a smart contract-based liquid staking protocol that manages APT deposits, validator delegation, and token issuance with a focus on efficiency, flexibility, and security. When users stake APT through Amnis, the protocol automatically delegates those tokens to a curated set of whitelisted validators on the Aptos network. Validator performance is continuously monitored onchain, and the delegation strategy is dynamically optimized to maximize staking yield while mitigating risk. Upon staking, users receive amAPT on a 1:1 basis, tokenizing their staked position and enabling continued liquidity across DeFi platforms. This core mechanism ensures users retain full exposure to staking rewards without being locked out of financial activity.

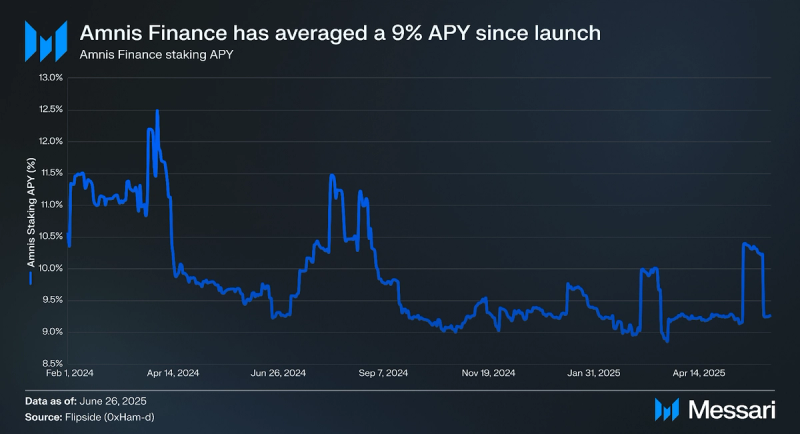

Since launching in February 2024, Amnis Finance has offered an average APY of 9% and a peak APY of 12%. Amnis distributes staking rewards every two hours, in sync with Aptos epochs, with a 7% performance fee routed to the protocol’s DAO Treasury. Users have two options for accessing their staked APT: either initiating a 30-day withdrawal cycle through the protocol's smart contracts or opting for immediate liquidity by swapping amAPT for APT through decentralized exchanges like Cellana Finance and Hyperion. This dual exit strategy balances protocol-level security with user-level flexibility. On the security front, Amnis has undergone multiple third-party audits from firms such as Ottersec, Movebit, and Hacken, reinforcing the trustworthiness of its infrastructure and staking logic.

amAPT: Liquid Staking DerivativeamAPT is the liquid staking token issued by Amnis Finance, representing a 1:1 claim on APT deposited into the protocol. When users stake APT, an equivalent amount of amAPT is minted, maintaining a soft peg to APT. This design ensures that the circulating supply of amAPT matches the total APT held within Amnis, providing users with liquidity while their assets continue to participate in staking.

To uphold the 1:1 peg, Amnis employs a reserve mechanism that can buy back amAPT from the market during periods of significant demand fluctuations. Additionally, the protocol utilizes AI-powered algorithms and monitoring alerts to maintain price stability by responding to market conditions in real time.

amAPT is composable within the Aptos DeFi ecosystem. Users can deploy amAPT in various DeFi strategies, including providing liquidity on decentralized exchanges like Cellana Finance and Hyperion or using it as collateral in lending protocols such as Aries, Meso, and Echelon. This allows users to earn additional yields while retaining exposure to staking rewards.

stAPT: Auto-Compounding Yield TokenstAPT is a yield-bearing token that represents a share in Amnis Finance's staking vault. Users can convert amAPT to stAPT by depositing it into the stAPT vault, where it is exchanged based on a dynamic exchange rate. This vault structure enables the auto-compounding of staking rewards, eliminating the need for manual restaking.

The reward distribution mechanism allocates 100% of the validator rewards to stAPT holders, plus 80% of the rewards generated by amAPT. The remaining 20% of amAPT's staking rewards are directed to the Amnis treasury to support future protocol incentives. As staking rewards accrue, additional amAPT is minted and added to the vault, causing the exchange rate of amAPT per stAPT to increase over time. This mechanism ensures that stAPT holders passively accumulate staking rewards.

stAPT maintains composability within the Aptos DeFi ecosystem. It can be used as collateral in lending markets like Aries, Meso, and Echelon, allowing users to borrow funds while earning staking rewards. Additionally, stAPT can be used in liquidity pools on DEXs such as Cellana and Hyperion, contributing to market depth and generating additional yield.

By offering a seamless, auto-compounding staking experience, stAPT plays a crucial role in Amnis Finance’s dual-token model, catering to users who prioritize long-term staking growth and capital efficiency.

Protocol Revenue and Fee FlowsAmnis Finance generates protocol revenue through a 7% performance fee on staking rewards, applied at the point of distribution every two hours. This fee is taken only from yield, not user principal, and flows directly to the Amnis DAO Treasury. As total APT staked grows, so does this revenue stream, creating a scalable and recurring source of funds to support the protocol.

The treasury accumulates these fees in APT and amAPT, which can be deployed under DAO governance for contributor payments, liquidity incentives, audits, or protocol upgrades. This fee structure ensures the protocol remains lean for users while continuously reinforcing its financial base.

stAPT earns 100% of the staking rewards from the underlying APT, plus 80% of the rewards generated by amAPT. The remaining 20% of amAPT’s rewards go to the Amnis treasury to fund future incentives.

This setup gives stAPT holders higher returns while allowing Amnis to use amAPT for ecosystem growth. It’s a design that benefits both users and the protocol, boosting yield for stakers and flexibility for incentives. By tying revenue directly to staking activity, Amnis creates a feedback loop where protocol usage funds protocol growth, without reliance on inflationary emissions.

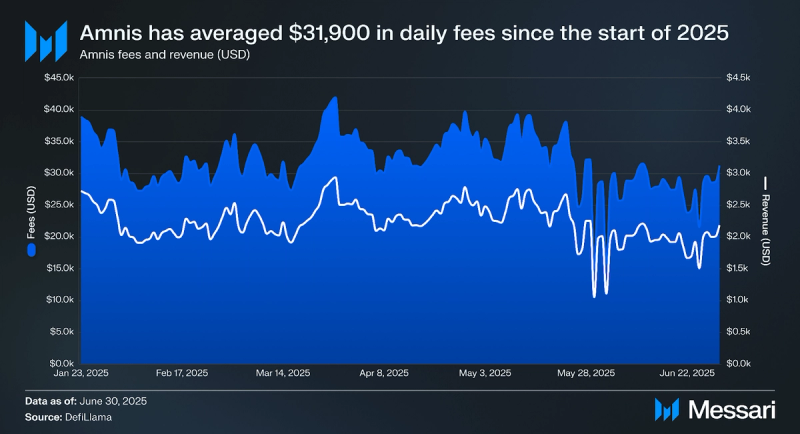

Since the beginning of 2025, Amnis Finance has generated an average of $31,900 in daily fees and $2,237 in daily protocol revenue. Amnis Finance also leads all Aptos protocols in cumulative fees, having earned a total of $13.2 million since launch. This steady performance reflects ongoing demand for APT staking and reinforces Amnis’s position as the leading liquid staking platform on Aptos. The consistency of these earnings highlights strong user engagement and a resilient fee model that continues to support protocol sustainability.

Amnis Governance: Empowering Decentralization Through AMI and Liquid Staking TokensWith the launch of its liquid governance portal, Amnis enables holders of its native staking derivatives, amAPT and stAPT, to actively participate in Aptos Improvement Proposals (AIPs). This innovation allows users to retain their staking yield while simultaneously influencing the evolution of the Aptos blockchain. Voting power is calculated through a simple formula that values both amAPT and stAPT according to their respective market parity with APT. Users can seamlessly lock their tokens, cast votes on live proposals, and unlock them as soon as the voting period ends, all without fees, lockups, or custodial risk. The system covers a wide range of network-level decisions, from validator parameter changes to code upgrades and the deployment of new modules. It removes the traditional tradeoff between liquidity and governance power, giving Aptos stakers the ability to engage meaningfully in decision-making without sacrificing capital efficiency.

In parallel, Amnis Finance has launched the Amnis DAO, a decentralized governance structure powered by the AMI token. The DAO is tasked with overseeing the protocol’s development, including the selection of node operators, allocation of service fees, design of incentive programs, and approval of protocol upgrades. Voting power is proportional to AMI token holdings, and proposals follow a three-tiered governance process designed to balance deliberation with execution speed. The Standard Process spans six weeks and includes community discussion, offchain polling, and final onchain voting. For urgent or time-sensitive decisions, the Contributor Process allows proposals to skip preliminary phases, though such fast-tracked decisions can be blocked if five percent of the AMI supply votes against them. Additionally, the Easy Track pathway gives vetted contributors the ability to propose changes around treasury operations or node delegation without going through the full governance cycle, as long as the community doesn’t veto the proposal with 0.5% of AMI supply.

This layered model gives stakeholders influence over both the base Aptos network and the Amnis protocol that sits atop it. It ensures that governance is not only participatory but composable, rooted in both infrastructure-level decisions and the economic mechanics of liquid staking. The system is designed to be fully non-custodial, slippage-free, and frictionless, embodying Amnis Finance’s ethos of adaptable, approachable, and responsible decentralization.

With the governance framework now live, Amnis Finance users can shape the roadmap of Aptos and its leading liquid staking protocol using the assets they already hold. Participation is open, real-time, and impactful, ushering in a new era where DeFi users don’t just interact with protocols; they govern them.

Aptos’s Liquid Staking Landscape

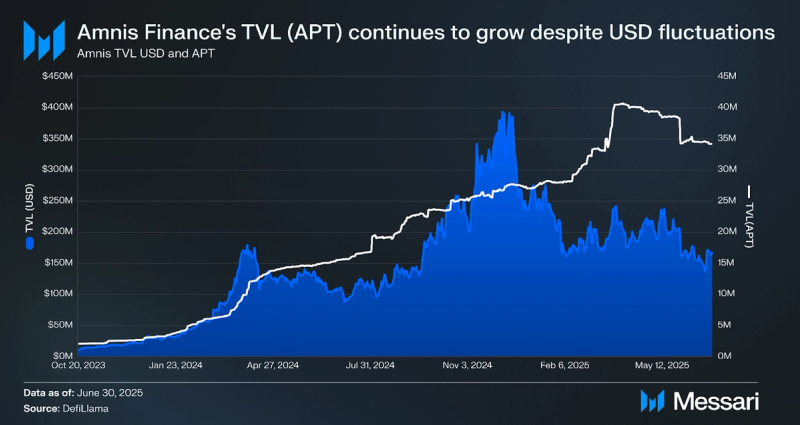

As of June 30, 2025, Amnis Finance has a Total Value Locked (TVL) of approximately $168.44 million. Although TVL in USD has declined significantly from a peak of $393.53 million on Dec. 7, 2024, due to a decrease in the price of APT, TVL measured in APT has continued to rise, growing to a peak of 41.82 million on May 15, 2025.

Notably, amAPT alone accounts for over 20.1% of the protocol’s current TVL, underscoring its role as a core liquidity vehicle within the ecosystem. Despite the recent downturn, the protocol has sustained a significant base of locked capital, suggesting stickiness among core users and a resilient foundation for growth as market conditions improve.

This sustained multi-hundred-million-dollar TVL, combined with deep integrations across Aptos lending and DEX platforms, reinforces Amnis’s status as a primary source of staking yield and DeFi utility on the network.

Liquid Staking Tokens on Aptos

Amnis Finance is the dominant liquid staking protocol on the Aptos blockchain. Since the end of January, the liquid staking ecosystem on Aptos has expanded to 26.19 million APT staked (4% of the APT circulating supply). Of that 26.19 million, 21.70 million APT (82%) has been staked with Amnis Finance across stAPT and amAPT with a combined USD value of $113.97 million. The total supplied value across these tokens has continued to expand, reflecting growing user adoption and capital inflow into liquid staking primitives.

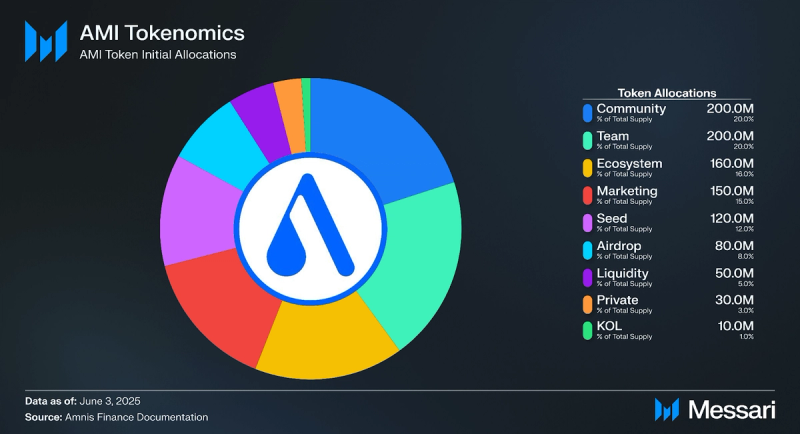

AMI TokenTokenomics

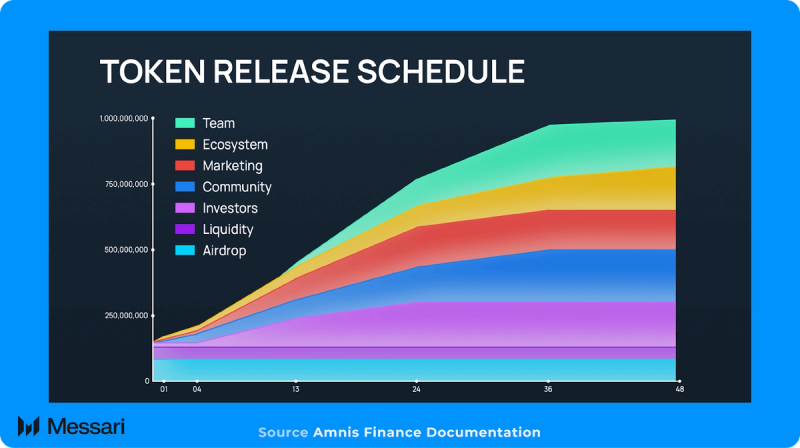

The AMI token is the cornerstone of Amnis Finance’s decentralized governance and incentive structure. With a fixed supply of 1 billion tokens, AMI is strategically allocated to ensure sustainable growth, robust community engagement, and long-term protocol development.

- Community Rewards (20% – 200 million AMI) Dedicated to incentivizing user engagement with Amnis Finance’s core products, fostering active participation within the ecosystem.

- Team (20% – 200 million AMI) Reserved for the core team to ensure long-term commitment and alignment with the protocol’s success.

- Ecosystem (16% – 160 million AMI) Allocated for grants, partnerships, and initiatives that promote ecosystem expansion and integration.

- Marketing (15% – 150 million AMI) Set aside for incentive programs and activities aimed at user acquisition and retention.

- Seed Round (12% – 120 million AMI) Provided early-stage funding to support the initial development of the project.

- Airdrop (8% – 80 million AMI) Distributed to early adopters and earmarked for future community distributions.

- Liquidity (5% – 50 million AMI) Reserved to facilitate trading activities on centralized and decentralized exchanges.

- Private Sale (3% – 30 million AMI) Allocated to select investors during exclusive investment rounds.

- KOL (1% – 10 million AMI) Designated for key opinion leaders and influencers to promote the protocol.

AMI Utility

AMI UtilityThe AMI token serves as the backbone of Amnis Finance’s decentralized ecosystem, fulfilling two primary functions: governance and incentives.

GovernanceThe AMI token is the cornerstone of governance for the Amnis Finance protocol. It grants holders the ability to shape the platform’s strategic direction through voting rights tied directly to token ownership. AMI holders govern all major decisions within the Amnis DAO, including protocol upgrades, fee structures, node operator assignments, and treasury allocations. Governance proposals can be introduced and voted on through a structured process that balances transparency with execution efficiency.

IncentivesBeyond governance, AMI tokens are used to bootstrap the adoption of Amnis Finance's liquid staking ecosystem. They serve as rewards for users engaging with the protocol, such as staking APT, providing liquidity, and participating in DeFi activities within the Aptos ecosystem. This incentivization model reinforces demand for amAPT and stAPT, ensuring active user engagement and fostering the growth of the Amnis Finance ecosystem.

By integrating governance and incentive mechanisms, the AMI token plays a crucial role in sustaining Amnis Finance's decentralized structure and accelerating the adoption of its liquid staking solutions on the Aptos network.

AMI Price

As of June 30, 2025, the AMI token is trading at $0.1078, reflecting a 43.4% gain over the past 30 days and an 11.4% increase in the past week. This recent uptrend signals growing investor confidence and increasing demand for governance exposure within the Amnis Finance ecosystem.

Following its initial volatility post-TGE, where AMI dipped to a low of $0.0399, the token has climbed significantly, recently approaching its all-time high of $0.1216. AMI has now established higher support in the $0.10 range, indicating maturing price action and strong market absorption of early supply.

This appreciation trend suggests the token is entering a new phase of market traction, supported by rising TVL, growing governance participation, and deeper integration of AMI into the broader Aptos DeFi ecosystem.

RoadmapAmnis Yield Vault (Strategy)Amnis Finance is set to launch its new Strategy feature, a yield vault designed to automate leveraged staking on Aptos. This upgrade simplifies what has traditionally been a complex and manual process, staking, borrowing, and restaking, by consolidating it into a single, user-friendly transaction. Users will be able to deposit APT, amAPT, or stAPT, choose a target leverage, and instantly execute a multi-step loop to increase their staking exposure via stAPT.

The strategy system is fully non-custodial. Amnis acts only as an interface and automation layer, while all capital and positions remain in decentralized lending protocols such as Aries Market, Echelon, and Superposition. This ensures that custody, interest rates, and liquidation risks are managed entirely by the underlying platforms.

The vault supports flexible customization; users can select the collateral asset, borrowing token (APT or amAPT), and desired leverage level. Positions can be adjusted or closed anytime directly through the Amnis dashboard, with real-time feedback on risk metrics like loan-to-value (LTV). A 0.1% protocol fee applies to the base asset for each strategy initiation or adjustment.

By abstracting away gas costs, execution complexity, and monitoring overhead, the Amnis Strategy feature unlocks advanced staking yields in a DeFi-native, permissionless framework. It brings institutional-grade leverage mechanics to retail Aptos users without sacrificing transparency or control.

Closing SummaryAmnis Finance has firmly established itself as the backbone of liquid staking on Aptos. By combining protocol efficiency, deep DeFi integrations, and a forward-thinking governance model, it unlocks new dimensions of yield, utility, and community ownership. Its dual-token system, with amAPT providing liquidity and stAPT delivering compounding yield, offers unmatched flexibility for users seeking to maximize APT staking rewards while remaining active in the broader Aptos ecosystem.

The launch of the AMI token and the accompanying DAO framework marks a significant step toward decentralization. It places key protocol decisions and funding control directly in the hands of its most engaged users. Governance now spans both the Amnis protocol and the Aptos network itself, allowing stakeholders to influence technical upgrades, validator policies, and treasury strategy through a non-custodial, capital-efficient system.

Even with recent market volatility, Amnis continues to hold a substantial share of total staked APT and maintains a high level of locked capital, signaling user confidence and protocol resilience. The upcoming Amnis Strategy vault will build on this foundation by automating leveraged staking. This feature removes the need for manual looping, enabling users to amplify yield exposure through a single, streamlined interface.

Together, these innovations position Amnis Finance as more than a liquid staking protocol. It is becoming the core liquidity engine and governance layer of the Aptos ecosystem. As the network scales and matures, Amnis is not just keeping pace; it is setting the benchmark for how staking, yield, and decentralized ownership should operate in the next phase of DeFi.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.