and the distribution of digital products.

DM Television

Unbound Finance: The Cross-Chain Aggregator Layer For AMMs

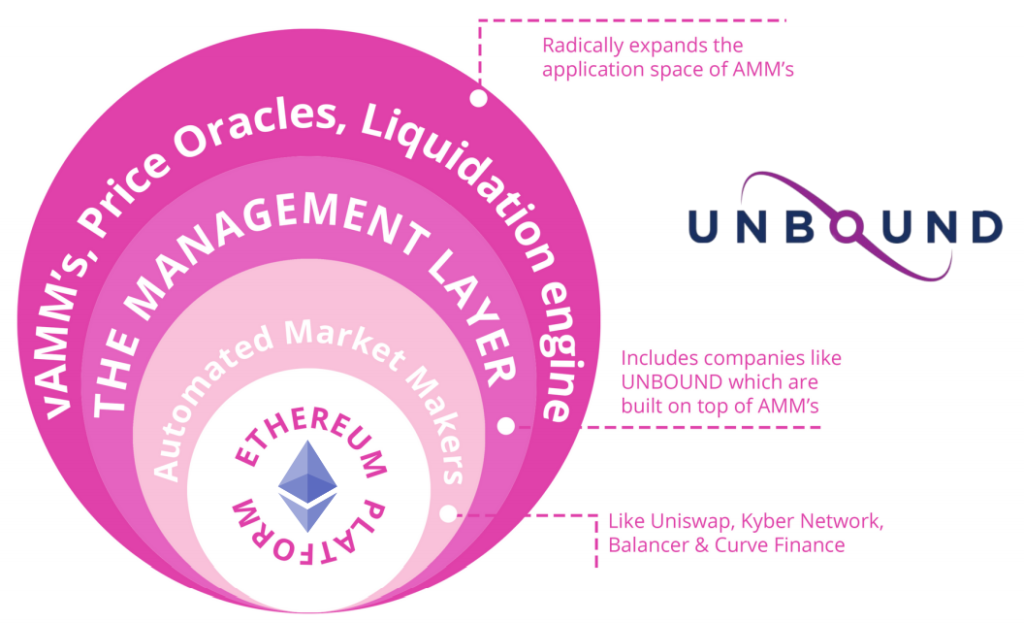

The decentralized Finance (DeFi) sector has been growing higher since October. Recent charts have shown the values reaching all-time highs in terms of liquidity kept on these protocols. According to Defi Llama, Total Value Locked (USD) has reached a new high, surpassing $276 billion on December 2, 2021. Automated Market Makers (AMMs) have revolutionized the DeFi sector. Liquidity Provider (LP) tokens are used to redeem the underlying liquidity tokens and represent a portion of the liquidity. But users can still not fully utilize the true potential of their capital. Unbound Finance is creating the next money lego by assisting liquidity providers in making better use of their LP tokens to enhance the capital efficiency of AMMs. In this article, we will get a complete understanding of Unbound Finance.

IntroductionUnbound Finance is a decentralized, cross-chain liquidity protocol that is building the next money lego by unlocking the liquidity from AMMs.

Unbound Finance

Unbound Finance

- It is the First-Ever-Debt-Free Liquidity Provision System that collateralizes LPTs to generate synthetic assets.

- It charges no interest and is liquidation-free.

- It is building the next money lego through unlocking the TVL (Total Value Locked) within the DeFi.

- It is building a derivative layer on top of AMMs such as Uniswap, Balancer, etc. and unlocking locked liquidity from existing AMM pools and giving loans on existing Liquidity Pool Tokens (LPTs) as collateral.

Also, read Decentralized Exchanges (DEX) Definition

Problems in Present Defi Ecosystem- Locked Liquidity in AMM Pools

- High Demand for a Decentralized Stablecoin

- Users’ Collateral is being Liquidated due to extreme Price Wicks caused by Market Volatility.

- Synthetic assets such as a Stablecoin (UND), uETH, etc.

- AMM Pools that are cross derived from multiple AMMs.

- Oracle Price Feeds based on free markets and path independent value discovery.

- Building Financial Instruments for compounding yields and margin trades.

Unbound has developed a robust architecture that does not involve a Liquidation Engine. Instead, it includes a combination of collateral ratio, risk control via chosen stablecoin-ERC20 LPT pairings, and SAFU fund offering a far more resilient support system than traditional crypto assets under identical conditions.

Key HighlightsIn this section, we will understand the key highlights of Unbound Finance.

- Debt-Free: Borrowed funds are interest-free, resulting in a debt-free situation for users.

- Liquidation-Free: It does not have a Liquidation Engine. As a result, users are not at risk of liquidating their collateral.

- Perpetual Borrowing: Unbound loans do not mature. As a result, users can unlock the underlying collateral at any time by repaying the loan.

- Stablecoin UND: UND is a cross-chain stablecoin that is soft pegged to the US dollar.

- Factory Smart Contracts: It uses Liquidity Lock contracts designed to be permissionless and supports EVM-based AMMs like Uniswap, Balancer, etc. Unbound will launch support for Non-EVM-based AMMs soon.

Key Highlights

Key Highlights

- Minting Cross Chain Synthetic Assets: Unbound will employ oracles and native bridges to execute UND and other synthetic assets cross-chain transfers.

- Secured Price Oracles: Unbound employs Uniswap’s TWAP and Chainlink to receive highly secured price feed, which protects the platform against flash attacks and lowers the reliance on a single price oracle. To know more about Price Oracle Solutions for Unbound Finance, Click here.

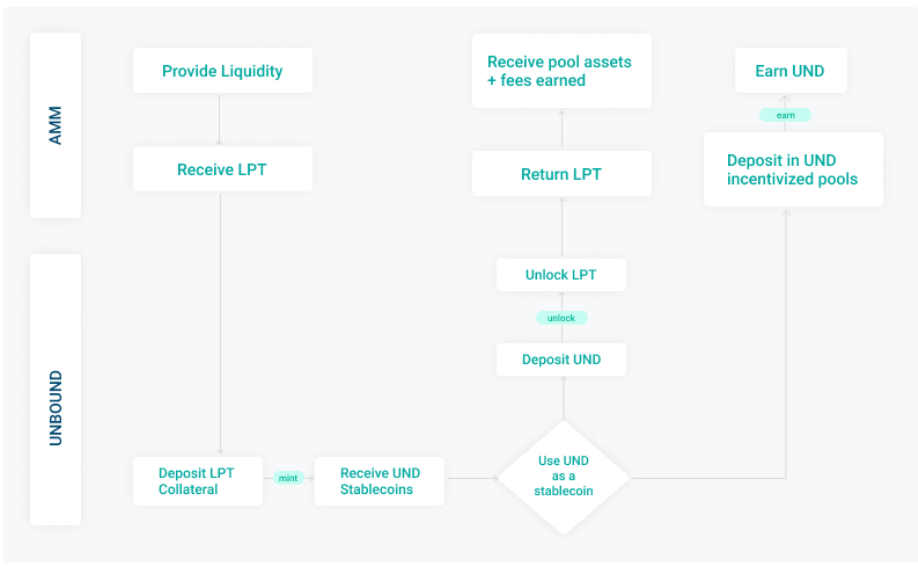

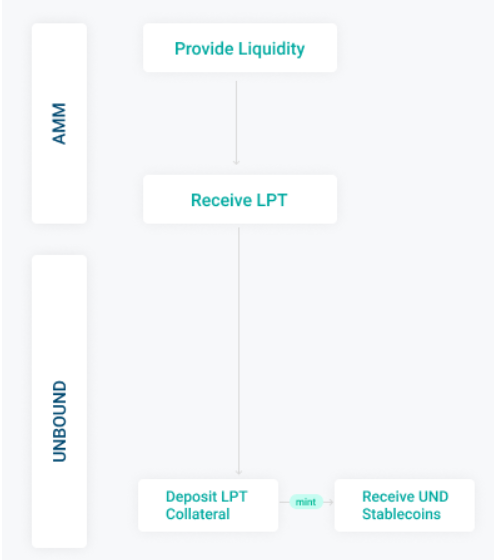

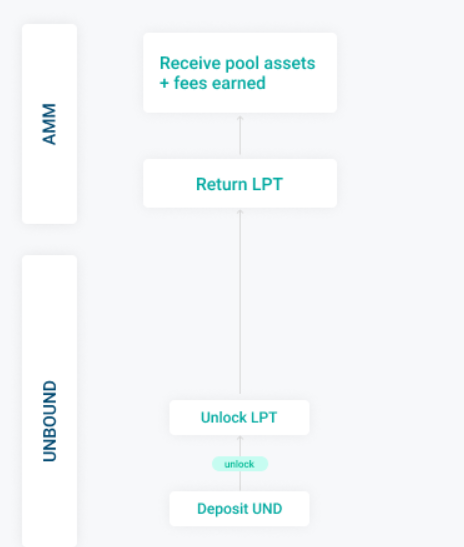

Unbound adds a treasury layer on top of existing AMM platforms by using LPT’s as collateral. The platform provides liquidity to AMM LPTs and issues a Stablecoin (UND) in the form of a minted token. When the UND is returned, the platform unlocks the LPTs, regardless of time.

How does Unbound Works?

How does Unbound Works?

- Unlock LPT Liquidity: LPTs are the ideal collateral and are great for funding but are not unsuitable for trading. Unbound will use smart contracts to collateralize LPTs, providing more liquidity while maintaining security.

- Mint Stablecoin by Locking LPTs: Contracts will lock LPTs and mint a stablecoin (UND).

- No Liquidation Engine for LargeCap Pairs (Eth/Dai, USDT/USDC, etc.): Smart contracts unlock collaterals whenever the minted UND is returned. Unbound does not charge any penalties if the collateral value falls below a particular amount.

- SAFU fund: In the event of a very sharp decrease in collateral value, the SAFU fund will absorb some or all of the losses without liquidating the user collateral.

Unbound offers three major services in the form of completely automated Smart Contracts that do not require the participation of a third party. In this section, we will understand the core features of Unbound Finance.

Unbound Finance Core Features

Minting

Unbound Finance Core Features

Minting

- When users offer their LPT as collateral, UND tokens and other synthetic assets, including uETH, are minted. UND token is a stablecoin that is pegged to the USD value.

- Unbound will initially issue UND loans to its users. With the inclusion of new collateral categories, Unbound will give uETH and other synthetic assets as loan issuance tokens.

Minting

Unlocking

Minting

Unlocking

- UND is burned during the unlocking process when users give back their minted funds (including the minting fees). This process removes the minted UND from circulation, and the user receives their collateralized LPT back. There will be no additional fees charged to users when they unlock their LPT.

- Unbound smart contracts are perpetual, which means they do not have a maturity date on the money that has been minted. Hence, there is no deadline to return funds, and users can continue to benefit from their LPT.

- Unbound users have the option of repaying the entire loan amount in installments over time. Users can unlock assets worth the amount they have paid back. Smart contract estimates the amount of collateral freed at each instance by recalculating the collateralization ratio based on price feed from oracles.

Unlocking

Earn

Unlocking

Earn

- Earn feature rewards users for contributing liquidity to the UND pools. Users can add their UND in the Unbound liquidity pools. In exchange, they receive UND rewards proportionate to the value of their deposit.

- Users can withdraw the deposit made to the liquidity pools at any time, including the rewards.

- Earn incentives are initially set to 60% of minting fees. The present yield rate is variable and subject to change in the future by community voting.

In this section, we will understand Liquidation Free Liquidity is achieved in Unbound Finance. It is a 3 step process.

- Locking up LPT tokens from large market cap pairs (Eth/Dai,ETH/USDT,DAI/USDT, USDT/USDC, etc).

- LTV ratio that does not risk the collateral even during steep corrections.

- Maintain a SAFU Fund that with time can act as an insurance fund.

The most significant aspect of utilizing LPT tokens as collateral is calculating the impermanent or divergence loss that could decrease the collateral’s value.

To make it clearer Unbound Team has performed 3 test simulations. The goal of these video simulations is to demonstrate how we calculate impermanent loss by simulating the price drop in Ethereum ETH for an ETH-Dai pool.

- Simulation 1: 88% Loan To Value. Click here to watch the 1st simulation.

- Simulation 2: 75% Loan To Value. Click here to watch the 2nd simulation.

- Simulation 3: 50% Loan To Value. Click here to watch the 3rd simulation.

To know more about complete calculations and results in these simulations, Unbound Team has compiled this docs file.

Terminologies Used in these simulations- Loan To Value Ratio (LTV): Loan Minted/Value of The Locked Liquidity Pool Tokens (LPTs)

- Breakeven Price of ETH: Price at which the Impermanent Loss causes the value of the loan amount equivalent to the value of LPT tokens locked.

- Loan Minted: Value of LPT Tokens at Breakeven Price

- Value of The Locked Tokens: Value of LPT Tokens At Start

To know more about complete mathematics used in Liquidation Free Liquidity, Unbound Team has compiled this docs file.

SAFU fund is an insurance fund that can be beneficial in the case of any unpredictable events. The fund will expand indefinitely as a percentage of all minting fees are assigned. This fund maintains the dollar’s peg and produces constant buying pressure on UND. The percentage is initially set at 40% and will change as the ecosystem grows.

Block Limit Lock Mechanism- It is one of the protocol’s essential elements for protecting it from flash loans that occur during a single transaction.

- It is a security protection measure that requires the user to wait for at least three to five blocks for confirmation before interacting with the smart contracts again.

- The block limit lock has been implemented in Unbound’s Liquidity Lock Contracts (LLC), and the block limit can be altered or withdrawn at any moment based on market conditions.

If a user previously dealt with Mint and wishes to interact with it again at the same moment, they must wait for at least five blocks for confirmation.

Block Limit Lock Mechanism

Block Limit Lock Mechanism

Similarly, in order to unlock again, the user must wait for at least five-block confirmations.

TokenomicsUnbound Protocol is a dual token ecosystem. It uses UND as a Stablecoin and UNB as a Governance Token.

UND Token- It is a stablecoin pegged to USD and collateralized by LPT (Liquidity Pool Tokens).

- Value of UND minted is based on the value of the deposited LPT.

- Amount of UND minted when the LPT was deposited is the amount that the user must pay back to get their original LPT.

- Minted UND will be burned once deposited in the Unlock contract before the user returns the original collateral.

- Arbitrageurs in AMM pools ensure that the Dollar peg is maintained.

- It encourages token holders to participate in decision-making to address concerns.

- Token holders will be able to vote on proposed policy changes and implementations and boost the protocol’s efficiency.

- After two years, a perpetual inflation rate of 4% per year will begin, ensuring continued engagement and contribution to Unbound.

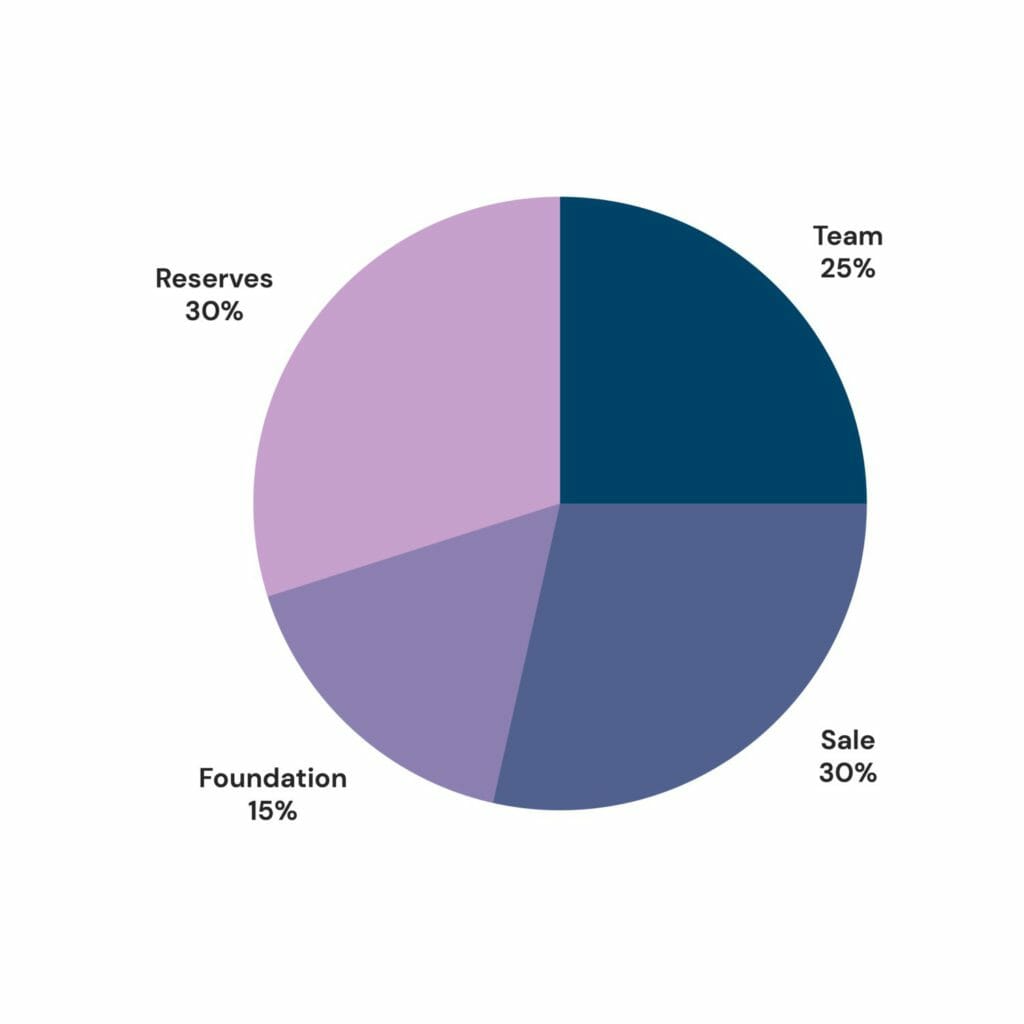

- Total Supply: 10,000,000,000 UNB

- Fees collected from minting is distributed as follows:

- SAFU Fund (40%)

- UND-DAI Liquidity Pool (40%)

- Team Fund (20%)

UNB Token Distribution

Unbound Finance Upgrades

UNB Token Distribution

Unbound Finance Upgrades

Till the end of 2021, Unbound Finance has completed all the steps of its 2020-2021 Roadmap. We can see the image below.

In this section, we will understand the New Developments in Unbound Protocol that are coming in the next few years.

Unbound V1This version will focus on:

- Creation of a First-Ever Debt-Free Liquidity Provision System.

- Unlocking Liquidity from existing largecap AMM Pools for the UND stablecoin.

- Production of Fee-Earning, Non-Tradeable Collateral

- Implementation of a SAFU fund.

This version will focus on:

- Unbound Virtual AMM (vAMM): It will introduce a Vault mechanism that will work autonomously, providing automatic liquidity algorithmically.

- Unbound Price Oracles: Unbound will develop an on-chain price oracle to query other Smart Contracts to find the latest and most accurate prices to minimize the risk of losses to users.

- Unbound Liquidation Engine (for Volatile Pairs): When a specific token value falls below a threshold, Unbound will initiate the liquidation process. Unbound’s community governance will decide which volatile assets will be subject to the liquidation protocols.

Unbound Finance Upgrades

Unbound Governance Model

Unbound Finance Upgrades

Unbound Governance Model

In this section, we will see how Unbound will implement its DAO (Decentralized Autonomous Organization) in the future.

- This Model allows UNB token holders to vote on platform policies and protocols.

- A user’s holdings of UNB tokens are proportionate to their voting power on the platform. A user’s voting power grants them the right to engage in policy making, suggestions, and a say in the platform’s future direction.

- DAO keeps track of the transaction records and regulations that must be executed on the blockchain for Unbound’s protocols to work.

- DAO stores UNB tokens and releases them when new policies and community improvement ideas are approved. These will be used to fund platform developments.

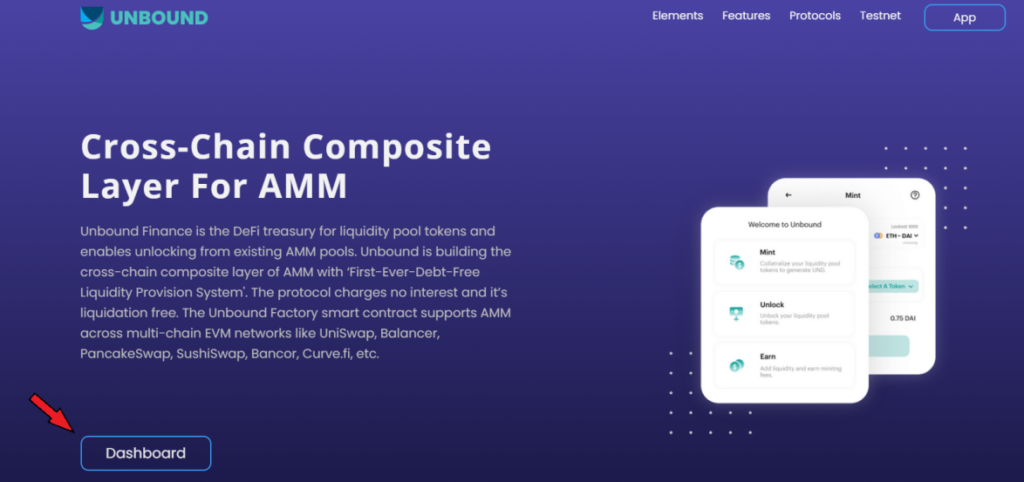

The protocol has been live on testnet since December 2020. It launched its final Zeta testnet in April 2021. In this section, we will understand how to use its Testnet and use core features.

NOTE: It should be noted that the steps for using core features will stay the same in the mainnet. In this article, we will be using Faucet to claim testnet tokens for participating in the testnet.

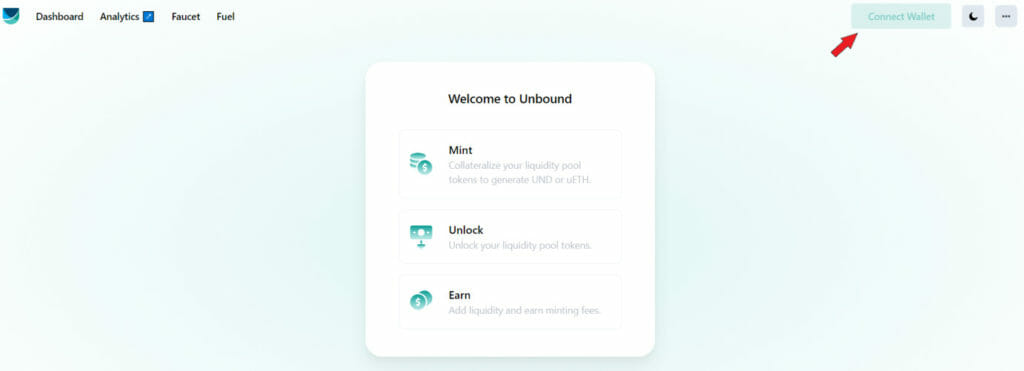

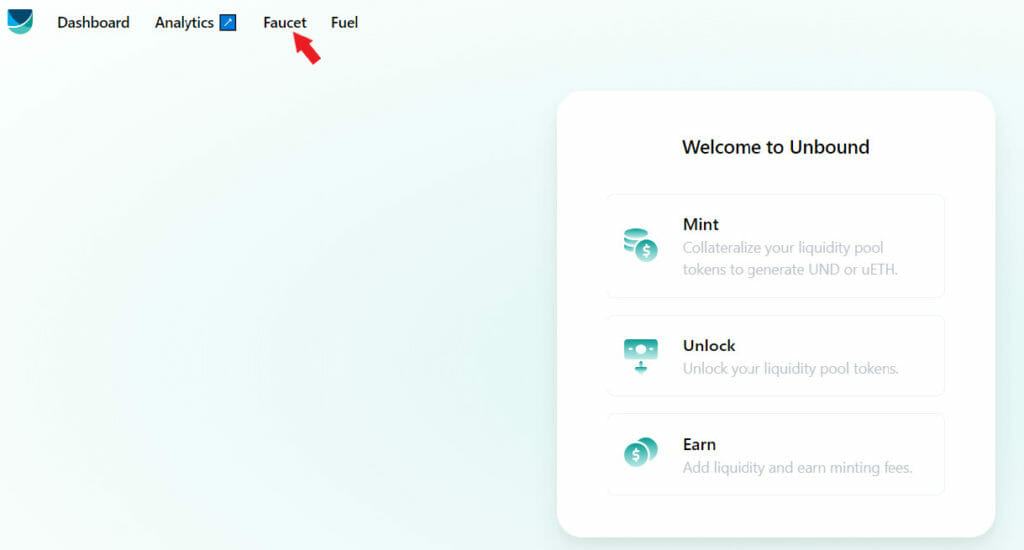

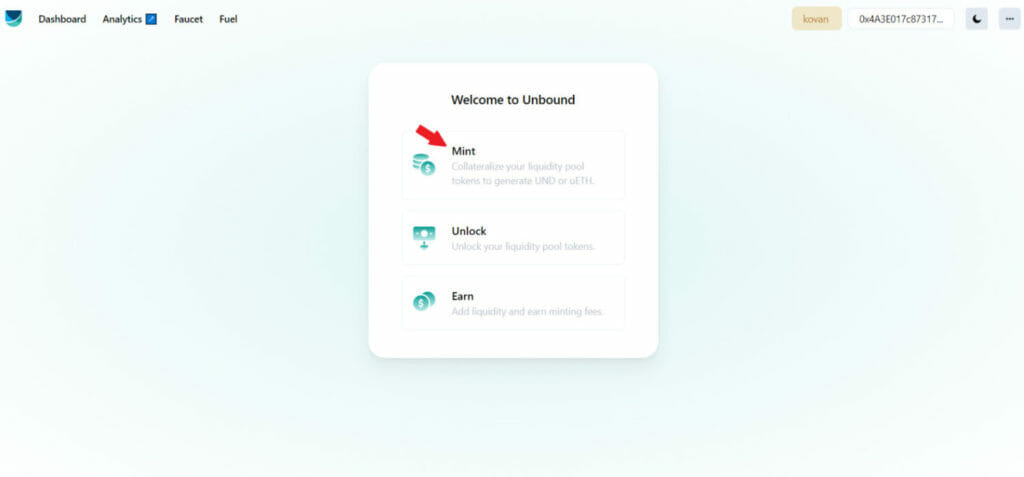

- Step 1: Go to Unbound Finance and click on Dashboard.

Unbound Finance Testnet

Unbound Finance Testnet

- Step 2: Connect Metamask wallet with Unbound by selecting the connect option on the Unbound Dashboard.

Connect Metamask wallet

Connect Metamask wallet

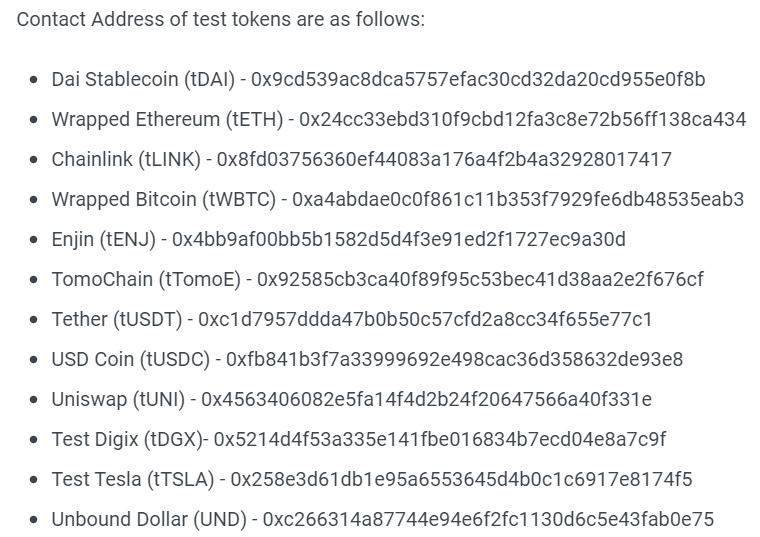

- Step 3: Adding Test Tokens To Metamask.

Adding Test Tokens To Metamask

Adding Test Tokens To Metamask

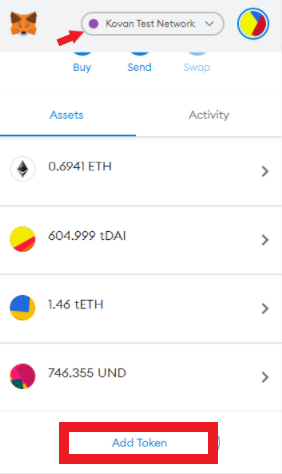

- Step 4: Select Kovan Testnet and Click on Add Token.

Kovan Testnet

Kovan Testnet

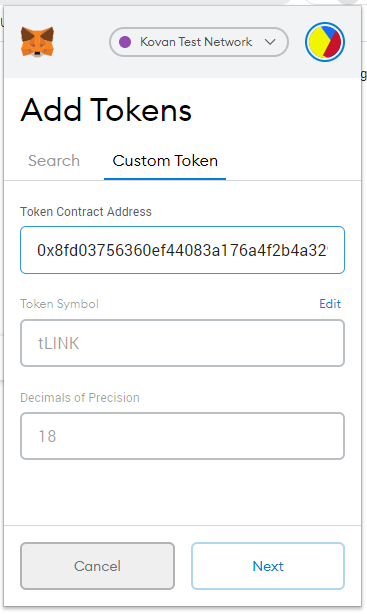

- Step 5: Go to the Custom Token tab and put the required contact address. Click Next and Add Tokens.

Go to the Custom Token

Go to the Custom Token

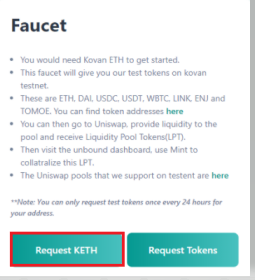

Disclaimer: Test Token will be added to the Metamask. Now we will request the test tokens from the Unbound Finance Faucet. Firstly we will need kETH to pay the gas fees for transactions.

- Step 6: Go to Faucet.

Go to Faucet

Go to Faucet

- Step 7: Click on Request kETH.

Request kETH

Request kETH

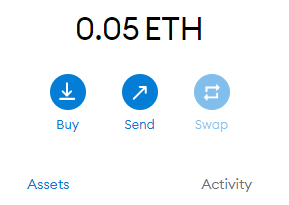

- Step 8: 0.5 kETH will be sent to Metamask wallet.

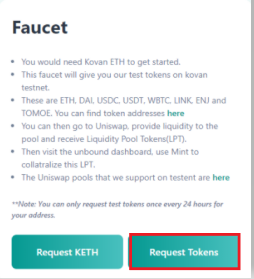

- Step 9: Go to Faucet and Click on Request Tokens.

Go to Faucet

Go to Faucet

- Step 10: We will receive test tokens as per the table given below in our Metamask wallet.

List of Tokens

List of Tokens

Disclaimer: We will use these tokens to create LP tokens in Uniswap. To add tokens in Uniswap, we will use the same contract addresses. To know how to acquire LP tokens on Uniswap, Click here.

Minting- Prerequisites: Liquidity Providers lock their LP tokens to mint UND and uETH. We should have enough LP tokens in our wallet.

- Step 1: Select MINT on the Dashboard.

Select MINT

Select MINT

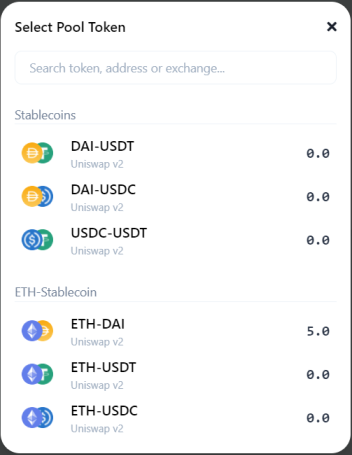

- Step 2: Select Collateral Asset type from the available list.

Select Collateral Asset type

Select Collateral Asset type

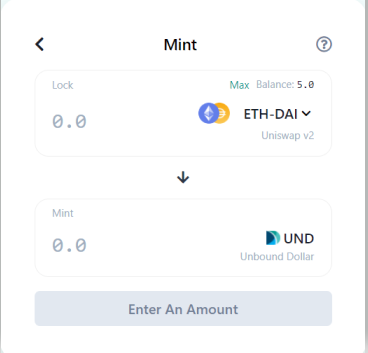

- Step 3: Enter the token amount to lock. Select Max to use the full token balance as collateral.

Enter the token amount to lock

Enter the token amount to lock

- Step 4: Unbound displays the amount of UND that can be minted based on the Loan-To-Value (LTV) ratio. This ratio is variable for different collateral types.

NOTE: Unbound loans are Debt-Free. But it charges a minimum borrowing fee called ‘minting fee’ that is calculated as a percentage of the total loanable amount. This fee is deducted at the time of minting the UNDs.

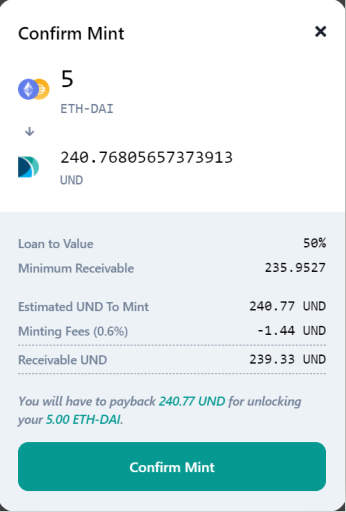

- Step 5: Click on MINT, Unbound redirects us to the confirmation page.

Click on MINT

Click on MINT

- Step 6: Click on Confirm Mint to confirm the minting transaction.

Disclaimer: Minting UND is successful. We can now use the Unbound stablecoin for trading on DEXs and other staking initiatives. We can also earn incentives for providing liquidity to the UND pools.

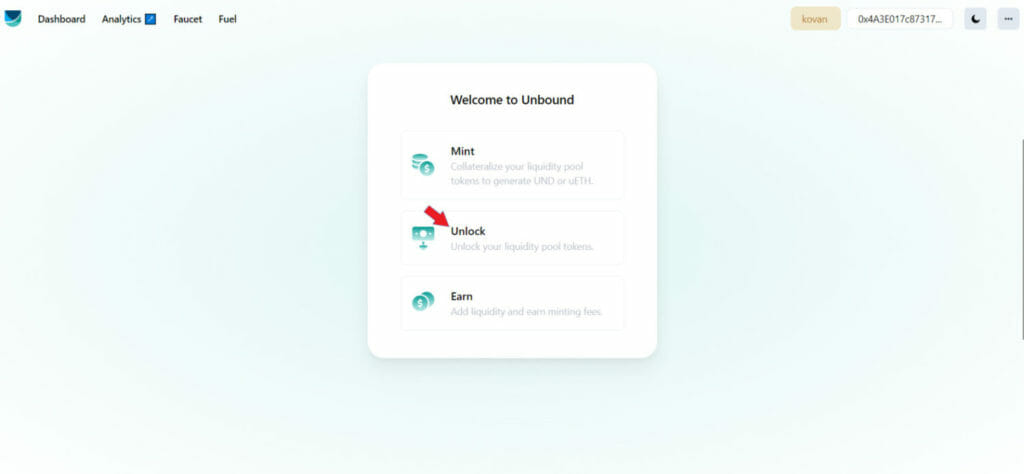

Unlocking- Step 1: Select Unlock on the Unbound dashboard.

Select Unlock

Select Unlock

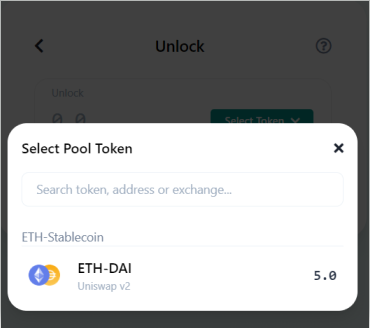

- Step 2: Select the collateralized LP token to unlock.

LP token to unlock

LP token to unlock

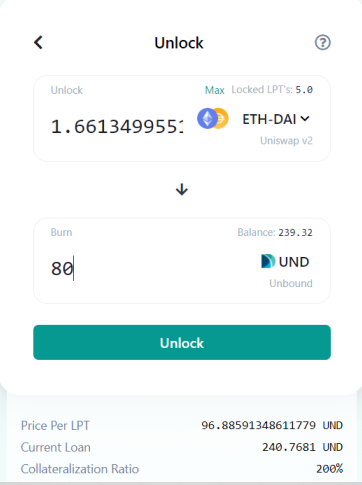

- Step 3: Enter the amount of debt to repay in the form of UND. Alternatively we can also enter the amount of collateral to unlock. We can also click on Max and choose to autofill the amount input box with the complete outstanding debt value.

NOTE: It is possible to repay the capital loaned in separate portions, at separate times. Unbound uses the Collateralization Ratio (CR) to calculate the amount of collateral to be unlocked proportionally to the UNDs being paid back.

Enter the amount of debt to repay

Enter the amount of debt to repay

- Step 4: Click on the Unlock tab to confirm the transaction and our LP tokens are unlocked.

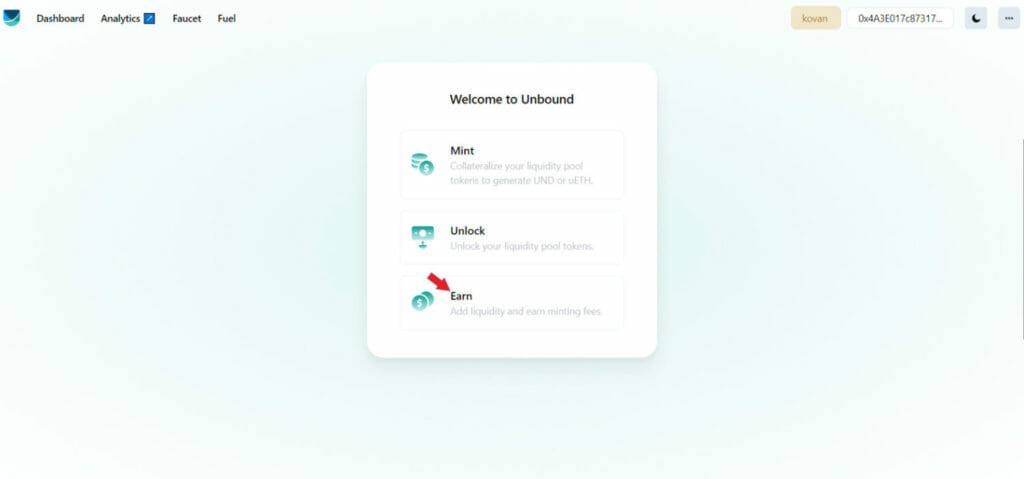

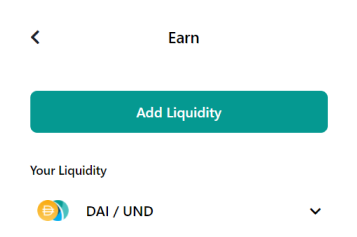

- Step 1: Select Earn on the Unbound dashboard.

Select Earn

Select Earn

- Step 2: Click on Add Liquidity.

Add Liquidity

Add Liquidity

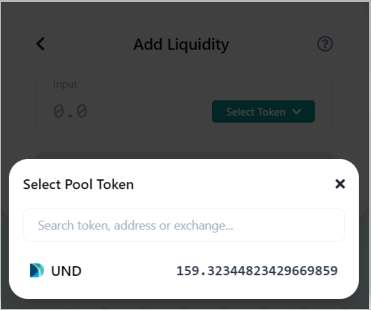

- Step 3: Select the token from the list.

Select the token

Select the token

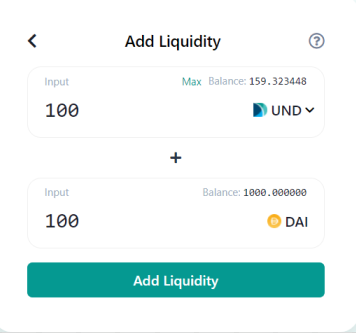

- Step 4: Enter the amount of UND to add to the UND liquidity pool. Unbound will automatically fill the DAI input box with an equivalent amount. We should have enough DAI in our wallet to execute this step.

Enter the amount of UND

Enter the amount of UND

- Step 5: Click on the Add Liquidity and confirm the transaction. We can now earn rewards for liquidity.

On India’s Independence Day, Unbound Finance announced its collaboration with India’s biggest crypto project, i.e., Polygon.

Unbound Finance to Launch First-Ever Cross-Chain Stable Coin UND on Polygon

- Sandeep Nailwal, COO of Polygon said: “AMMs are here to stay and the amount of liquidity it has been able to get on DEXs and possibility of various tools such as yield farming or earning fee on market making for a regular user shows that they are here to stay. Unbound’s dedicated development team has created something that makes all AMMs efficient and will make interesting money legos in the space further.”

- Tarun Jaswani, Founder and CEO of Unbound Finance said: “We have built UND to be one of the most decentralized cross-chain stablecoins on the market. With strong fundamentals, Polygon users will leverage the benefit of a fast, borderless stablecoin which will act as a great fiat on and off-ramp bridge. UND will also open up the benefits of DeFi through Unbound.Finance.”

Unbound Finance Integrates With Harmony Blockchain To Accelerate Inter-blockchain Operability And Profitability

- Sahil Dewan, co-founder of Harmony said: “We are excited about joining forces with Unbound Finance, a promising protocol with a powerful vision in the Defi sector. The partnership will build a foundation for cross-chain yield generation and profitability providing a broad exposure to digital money users to endlessly leverage Automated Market Makers to their full potential”.

- Tarun Jaswani, Founder and CEO of Unbound Finance said: “The amalgamation of Unbound finance and Harmony will present a new paradigm in the fast-growing cross-chain crypto ecosystem bequeathing greater profit potential for digital currency investors and traders”.

Unbound Finance Enhances Liquidity for $UND on KyberSwap with $1M in Rewards

KyberSwap will be the only venue on Ethereum to add liquidity for the UND token and farm $1 million rewards in $KNC and $UNB. Users can now use the minted UND to provide liquidity to the UND/KNC and UND/USDC pools at Kyber DMM and earn additional incentives.

Unbound Finance x AvalancheUnbound Partners With Avalanche To Open UP New Frontiers Of Cross-Chain Yield Generation

The partnership will also effectively lead to inter-blockchain operability and profitability through the use of UND, the protocol’s decentralized, cross-chain stablecoin. Unbound will be launching its stablecoin UND on the Avalanche blockchain. Additionally, its governance token UNB will also be tradeable on the Avalanche network.

- Tarun Jaswani Founder and CEO of Unbound Finance said: “We have designed UND as a promising cross-chain, yield generating vehicle in the fast-growing DeFi sector, one that will be pivotal in unlocking the liquidity trapped in DeFi AMMs, making them a lot more capital efficient”.

Unbound has undergone four security audits till now.

- Audit 1: By Peter Kacherginsky

- Audit 2: By Securings

- Audit 3: By Lucash Dev

- Audit 4: By Securings

All of them have reviewed the code of Unbound vaults for security vulnerabilities and successfully completed the audit.

Unbound Telegram Ambassador Program- Unbound Team is looking for passionate and enthusiastic individuals who would actively contribute to the further expansion of our global community, spread awareness and educate the community about Unbound Finance.

- The program is designed to identify and reward the 10 most active and loyal Unbounders on Telegram who are able to make a meaningful contribution to the protocol by diligently participating in conversations and activities over Telegram.

- Selected candidates will win specially designed Unbound ambassador NFTs. Become the official representatives of Unbound and earn the title of Ambassador.

Unbound Telegram Ambassador Program

Unbound vs Competitors

Unbound Telegram Ambassador Program

Unbound vs Competitors

Unbound vs Competitors

Pros and Cons

Conclusion

Unbound vs Competitors

Pros and Cons

Conclusion

Unbound Finance is one of the most promising projects in the crypto space. On Coin Market Cap, about 1.85 million users added $UNB to their watchlist. One of the first ways for DeFi users, such as Liquidity Providers, to use assets that they have already locked up in DeFi protocols such as Uniswap, etc. Furthermore, it proposes a potential framework for the open flow of liquidity across a wide range of DeFi products and the future of highly composable and cross-chain DeFi.

Frequently Asked Questions How Does Unbound Work?It works on the derivative layer of AMMs. It collateralizes LPT and mint synthetic assets. It does not create a debt position as it does not have a liquidation engine.

Why should we switch to Unbound Finance?It offers features like Debt-Free Loans, Liquidation-Free, Minting Cross Chain Synthetic Assets, Secured Price Oracles, Perpetual Borrowing, etc.

How is UND different from DAI?Although, Both are stablecoins. But the main distinction is that UND does not have a Liquidation Engine.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.