and the distribution of digital products.

Top 4 Technical Analysis and Intraday Trading Tools: Try Now

Finding the best trading software for technical analysis can greatly improve trading accuracy and productivity. These systems give traders access to real-time data analytics and extensive charting capabilities, which enable them to identify market trends and indicators. Check out our guide to the best software programs that automate trading and decision-making procedures.

What is technical analysis trading?Computer programs and platforms created for financial market analysis employing historical price data and indications are referred to as technical analysis trading software. By offering charts, graphs, and statistical models to forecast future price movements based on patterns and trends seen in the data, these tools help traders make well-informed decisions.

What is intraday trading?Buying and selling financial products during the same trading day is known as intraday trading, or day trading. Traders leverage market volatility to take advantage of small price variations in an attempt to profit from short-term price fluctuations. In order to minimize overnight risks, positions are usually terminated before the market closes.

Best 4 Technical Analysis and Intraday Trading Tools 1. Upstox

Upstox is an Indian low-cost broking company that prioritizes technology and offers trading opportunities at competitive pricing. The company offers trading on many markets, including equities, futures, commodities, currencies, and options. These markets are accessible through the Upstox Pro Web and Upstox Pro Mobile trading platforms.

Upstox: Features- The platform provides a wealth of trading capabilities, including trading, analysis, and charting.

- Orders can be easily placed using this platform on mobile devices and online browsers.

- It provides a variety of indications for on-the-go market monitoring.

- It facilitates the development of your own trading application through Python coding.

- It assists traders in learning about spot prices, future prices, vertical rate comparisons, and specifics like market depth, open high low close, and circuit levels. Customers can check Greeks, open interest, measure volatility, and view performance indicators with it.

For slabs of Rs 40,000, the Margin Trading Facility (MTF) is offered at an interest rate of Rs 20 per day.

TRY UPSTOX NOW!Also, you may read 16 Best Paid and FREE Crypto Trading Bots

2. eSignal

The mission of Interactive Data firm eSignal is to give investors and active traders all around the world access to professional-grade decision support, technical analysis tools, including advanced charting and back testing, as well as real-time global market data and stock market screeners.

eSignal: Features- With the help of the platform’s many sophisticated charting tools, traders may do in-depth technical analysis. Because of these tools’ great degree of customization, traders can make charts that are exclusive to a particular trading strategy.

- It offers streaming real-time market data, which is a feature that I’ve found to be quite helpful for making quick trading decisions. Among other asset types, this data covers stocks, currencies, futures, and options.

- Integrating with several brokers is one of eSignal’s unique characteristics.

- A full range of tools for technical analysis are available on the platform. These comprise a range of studies, drawing tools, and indicators that can assist traders in making better judgments.

- It provides an extremely adaptable user interface. Charts, hotkeys, and layouts can all be changed by traders to fit their preferred trading approach.

The pricing for the platform starts at $56 per month.

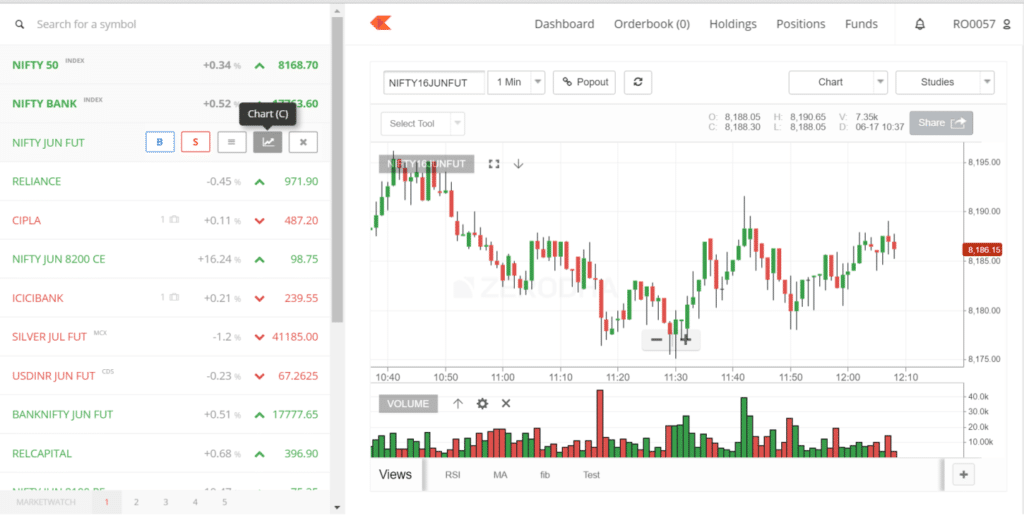

TRY ESIGNAL TODAY! 3. Zerodha Kite

Software for internet trading is called Zerodha KITE. It allows customers to trade at BSE, NSE, and MCX. The front-end application was developed internally by Zerodha engineers. The KITE platform offers 3 main products, all for free, to its customers:

Zerodha Kite: Features- There are iOS and Android versions of the app. A robust and user-friendly mobile trading app is called Kite Mobile. You can access all of Kite Web’s features using the Kite Mobile App.

- It supports up to ten regional languages.

- It offers quantitative access for basic analysis through behavioral analytics.

- ChartIQ and TradingView charts are both accessible on the platform.

- It allows easy integration with third party apps.

The intraday trading facilities of the platform start at a price of 20 rupees.

TRY ZERODHA KITE RIGHT NOW!Also, you may read Top 8 Binance Trading Bots

4. Groww

Groww is an online discount brokerage service provider for equity, initial public offerings (IPOs), and direct mutual funds, with its headquarters located in Bangalore. Groww is the brand name used by SEBI-registered Nextbillion Technology Private Limited.

Groww: Features- Groww provides free mutual fund services, charging nothing for mutual fund redemptions or investments.

- It provides online account opening that is quick and paperless.

- Additionally, it raises customer awareness through instructive eBooks and blogs.

- It offers a function that facilitates the conversion of external regular mutual funds to direct mutual funds.

- Additionally, it offers corporate FD, digital gold, and US stock investments.

There is a maximum brokerage fee of Rs. 20 per trade.

TRY GROWW NOW! Top Technical Analysis and Intraday Trading Tools: ConclusionIn conclusion, your unique needs—such as those related to real-time data accuracy, indication customisation, and charting capabilities—will determine which technical analysis trading program is appropriate for you. Choosing the appropriate platform can have a significant impact on your ability to execute winning trading strategies and produce consistent profits in the market, regardless of your level of experience.

Frequently Asked Questions Is stock trading same as intraday trading?Buying and selling stocks during the same trading day is known as intraday trading, and it is one of the many tactics used in stock trading to capitalize on short-term price changes. Although it includes intraday trading, the word “stock trading” can also apply to longer-term investing techniques that span more than just one day.

What is the top Indian trading software?Angel Broking SpeedPro, Upstox Pro, Sharekhan TradeTiger, and Zerodha Kite are a few of the best trading programs utilized in India. To meet the demands of both novice and seasoned traders in India, these platforms provide features including real-time market data, sophisticated charting tools, order execution capabilities, and mobile trading apps.

What is market volatility?The term “market volatility” describes how much a financial instrument’s or the market’s price fluctuates over a given time frame. Low volatility denotes stability, and high volatility denotes quick price swings. In order to evaluate risk and possible rewards, traders frequently keep an eye on volatility. Then, they modify their methods to take advantage of changes in the market.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.