and the distribution of digital products.

THORChain Q3 2024 Brief

- On July 31, 2024, THORChain launched RUNEPool. RUNEPool enables RUNE holders to provide liquidity across various pools, offering yield generation on RUNE via exposure to multiple blue-chip assets like Bitcoin, Ethereum, and USDC.

- THORChain affiliates earned a total of $3.2 million in revenue in Q3, an 18.4% decrease from the $3.9 million earned in Q2.

- THORSwap remained the largest affiliate by total volume in Q3, with a total of $678 million in volume.

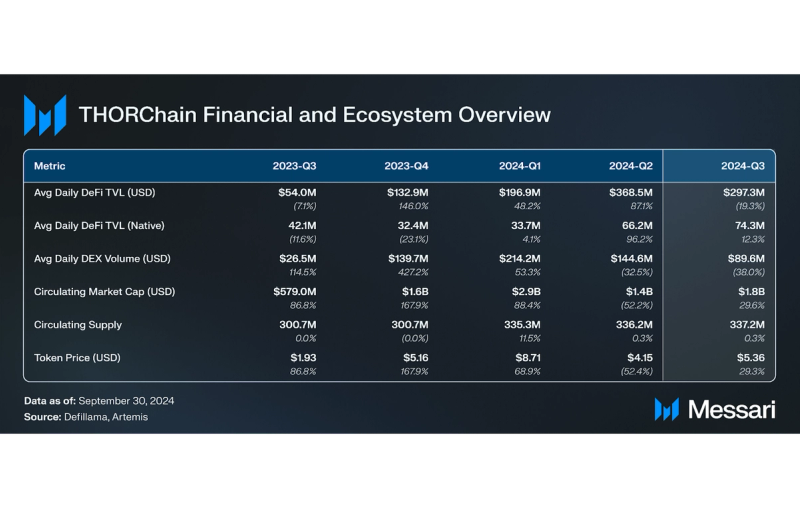

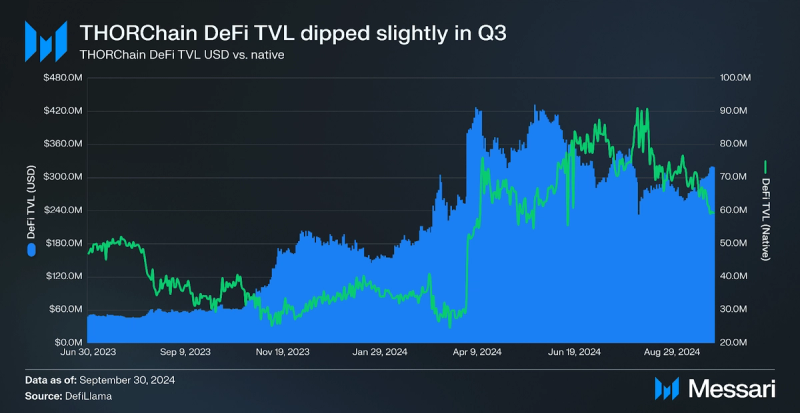

- THORChain DeFi TVL in RUNE increased from 66 million RUNE to 74 million RUNE, a 12.4% rise QoQ, despite a 19.3% drop in USD-based TVL to $297.3 million.

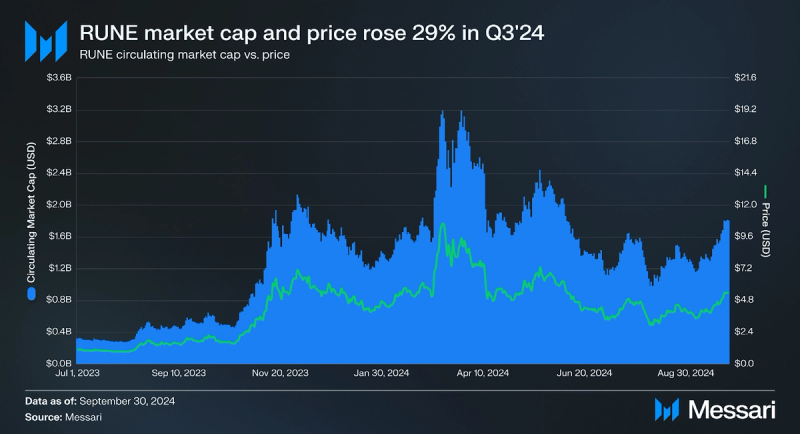

- RUNE price increased 29.3% QoQ to $5.36, significantly outperforming the greater crypto market which decreased by 2.8%.

THORChain (RUNE) is a Layer-1 network designed to facilitate cross-chain DEX swaps without the need for wrapped assets. The blockchain is developed on the Cosmos SDK and utilizes BFT Tendermint consensus engine. Native assets are managed directly in onchain vaults and funds are secured by node’s bonding or staking RUNE.

The network employs Threshold Signature Schemes (TSS) requiring a two-thirds majority of nodes for the movement of funds to and from vaults. Each vault must have a RUNE stake worth more than 1.5 times the value of the vault's funds to ensure they do not collude to steal funds.

THORChain uses continuous liquidity pools (CLP) where all pools are paired with RUNE and provide consistent liquidity to all assets in the network. Furthermore, fees are adjusted according to the liquidity depth of the pool. Additionally, THORChain provides a Savings Product for yield on synthetic assets (synths) and a Lending Product for overcollateralized, 0% interest loans with no liquidations or expiration.

Website / X (Twitter) / Telegram

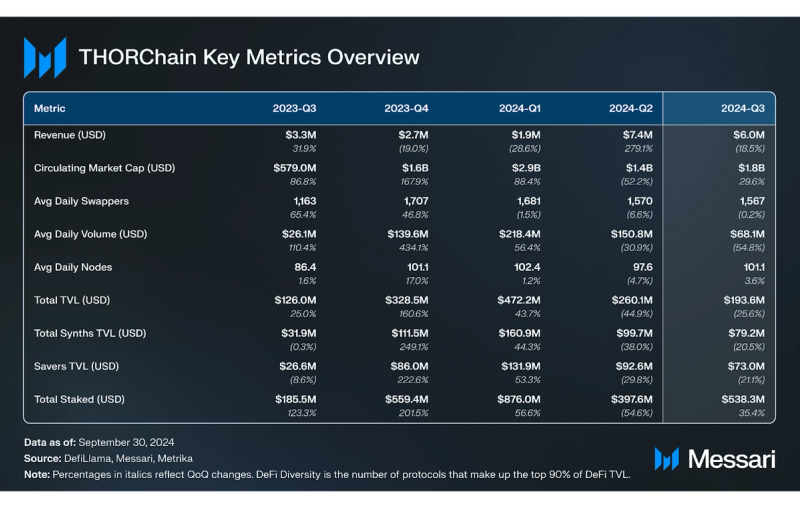

Key Metrics Financial and Ecosystem Analysis

Financial and Ecosystem Analysis

THORChain’s RUNE token had a strong Q3 2024, rising in price to $5.36, a 29.3% increase QoQ. RUNE significantly outperformed BTC (down 0.7%) and ETH (down 24.4%), as well as the broader market which decreased by 2.8%. This growth brought RUNE’s market cap up to $1.8 billion and increased its position amongst all digital assets from 96th to 59th in total market capitalization. RUNE token emissions remained steady QoQ, with circulating supply increasing a modest 0.3% from 336.2 million to 337.2 million.

DeFi

DeFi

THORChain DeFi TVL dipped from $368.5 million to $297.3 million, a 19.3% decrease QoQ. This drop is in line with the rest of the market, which experienced a 10.4% decrease in TVL across all major chains from $97.7 billion to $87.5 billion. In RUNE, THORChain TVL held up better, increasing from 66.2 million RUNE to 74.3 million RUNE, a 12.4% rise QoQ. This increase was due to RUNE’s strong price performance over Q3.

Affiliate Revenue

THORChain users typically interact with exchanges, wallets, or custodial services to broadcast transactions, rather than directly engaging with THORNodes. To incentivize these integrations, THORChain allows wallet developers to include an affiliate address and a custom fee rate. The protocol then collects these affiliate fees in a non-custodial and transparent manner for every transaction processed. To do so, it uses a front end that includes an affiliate address.

THORChain affiliates earned a total of $3.2 million in revenue in Q3, an 18.4% decrease from the $3.9 million earned in Q2. On average, affiliates earned a combined $35,000 per day throughout Q3 with a peak of $151,000 on Aug. 28, 2024, a day of high market volatility. This steady affiliate activity highlights the growing utility of THORChain’s ecosystem and the ongoing value being provided to third-party platforms.

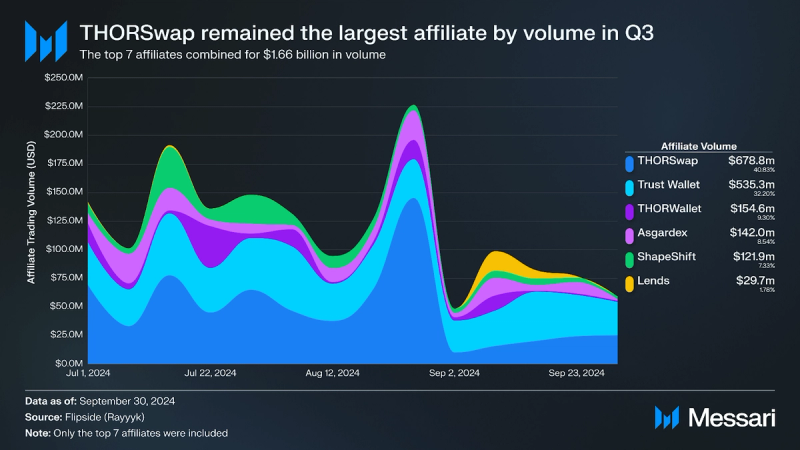

Of the seven largest THORChain affiliates, THORSwap remained the largest in total volume in Q3, with a total of $678.8 million, 40.8% of the total volume of the top seven affiliates. Trust Wallet had the second-highest volume, with $535.3 million. Combined, THORSwap and Trust Wallet accounted for 73% of the total volume amongst the top seven affiliates.

The biggest gainer of the quarter was Lends which jumped from an average weekly volume of $345,000 for the first part of the quarter to a weekly average of $6.6 million for the final four weeks of Q3.

Key DevelopmentsRUNEPoolTHORChain's Q3 launch of RUNEPool introduced a mechanism for RUNE holders to provide liquidity across various Protocol Owned Liquidity (POL)-enabled pools, offering yield generation on RUNE via exposure to multiple blue-chip assets like Bitcoin, Ethereum, and USDC. By diversifying RUNE deposits across major liquidity pools, RUNEPool mitigates impermanent loss risks and enhances liquidity for RUNE, prioritizing onchain liquidity over centralized exchanges.

Users can deposit a minimum of 100 RUNE into RUNEPool, gaining exposure to multiple assets without needing to manage each individually, while the POL mechanism balances RUNE supply to optimize liquidity across the network. The capped system aligns deposits with available POL, holding excess RUNE deposits in a "pending" status until additional POL becomes available. The integration with POL allows RUNEPool participants to benefit from price fluctuations in diverse pools, potentially offsetting impermanent loss through ongoing swap yields. This feature also enables large RUNE holders to leverage the incentive pendulum, balancing network security and liquidity needs.

RUNEPool has a minimum 90-day lock-up period, easing the transition for node operators between security and liquidity provision roles as yields fluctuate. In addition, THORChain launched a dashboard to view the current composition of the RUNEPool.

Other Notable Q3 Updates- THORChain underwent a successful hard fork on Sept. 4, 2024. The hard fork upgraded the Cosmos SDK version and removed unnecessary Cosmos modules and other obsolete legacy code.

- ADR-17 was passed and implemented in Q3, creating a RUNE burn mechanism from system income. A dashboard showing the total amount of RUNE burned can be viewed here.

- THORChain added support for Bitcoin Taproot addresses as part of the aforementioned hard fork.

THORChain had a strong Q3 2024, highlighted by RUNE’s 29.3% QoQ price increase to $5.36. The growth outperformed broader crypto markets and elevated RUNE’s market cap to $1.8 billion, climbing to the 59th position in total market cap. While affiliate revenue experienced an 18.4% QoQ decline to $3.2 million, there was still some fundamental strength to the ecosystem as seen in THORSwap and Trust Wallet accounting for 73% of top affiliate volume and Lends achieving notable growth.

Despite a 19.3% drop in USD-based TVL to $297.3 million, RUNE-denominated TVL increased by 12.4%, bolstered by RUNE’s strong price performance. The introduction of RUNEPool expanded liquidity options, diversifying deposits across POL-enabled pools and offering reduced impermanent loss risks alongside yield opportunities in blue-chip assets like Bitcoin and Ethereum. As THORChain navigates evolving market dynamics, its adaptability and ecosystem growth signal resilience and continued relevance in DeFi infrastructure.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.