and the distribution of digital products.

Synthetix Q3 2024 Brief

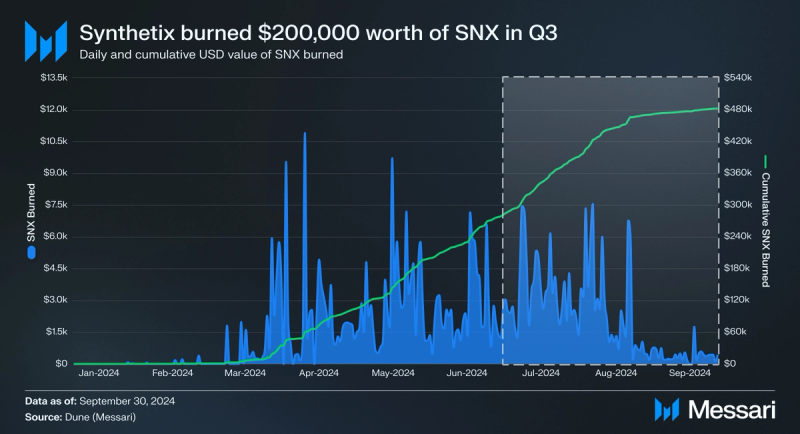

- Synthetix V3 burned $200,000 worth of SNX in Q3, raising the total amount of SNX burned to $480,000 since V3’s launch on Base in Q2.

- Despite Synthetix's overall perp trading volume falling 21% QoQ, V3's perp volume rose to 30% of all perp volume on Synthetix.

- Synthetix V3’s TVL increased by 117%, mainly due to Ethereum LPs migrating from V2 to V3.

- Open interest reached its highest level in over a year to $288 million on July 21, the same day Joe Biden announced his withdrawal from the U.S. presidential election.

- In Q3, the Synthetix DAO approved a governance redesign and overhaul aimed at reducing inefficiencies and increasing governance effectiveness.

Synthetix (SNX) is a decentralized synthetic asset issuance and liquidity protocol that allows users to trade synthetic assets (Synths). Synths track the price of external assets through oracles like Chainlink, Pyth, and Uniswap V3 TWAP. Users can trade in both spot and perpetual futures (perps) markets for synthetic assets. SNX is the native protocol token, used for governance and as collateral backing for the protocol's liquidity.

With the launch of Synthetix V3 on Base in Q2 2024, the protocol transitioned to a new architecture that supports multiple collateral types for minting the Synthetix stablecoin, sUSD. These collateral types now include SNX, ETH, USDC, and yield-generating assets like stataUSDC. Synthetix Perps is the protocol’s leading product. The DAO delegates governance to a seven-member council – the Spartan Council. Four of the seven members are elected by SNX holders, with the other three members hired on by the elected members.

Website / X (Twitter) / Discord

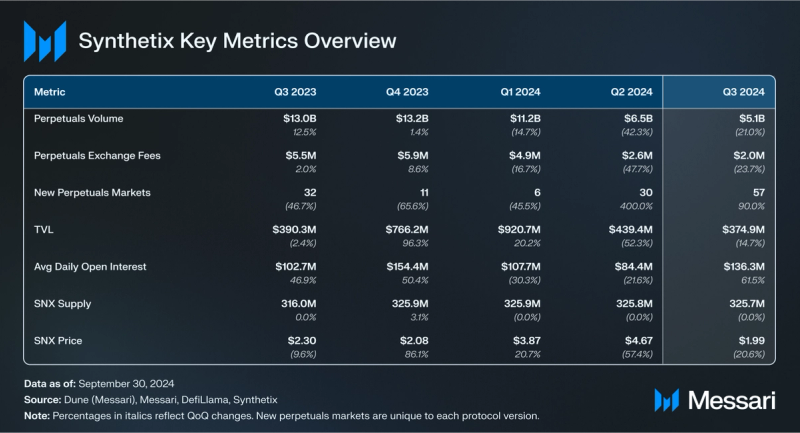

Key Metrics Performance AnalysisPerpetual Futures

Performance AnalysisPerpetual Futures

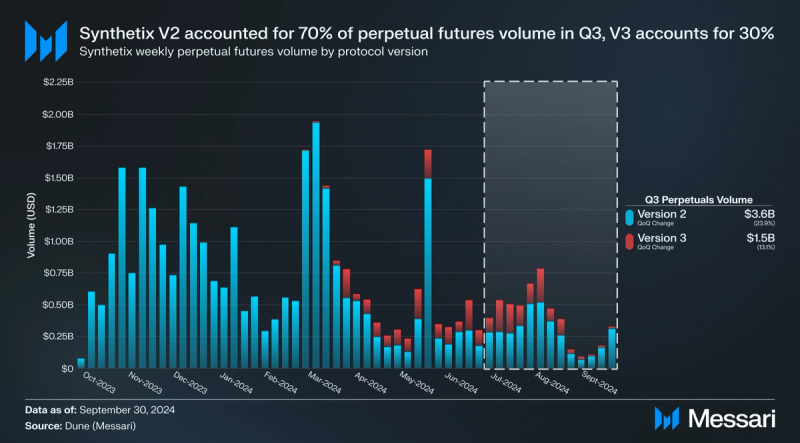

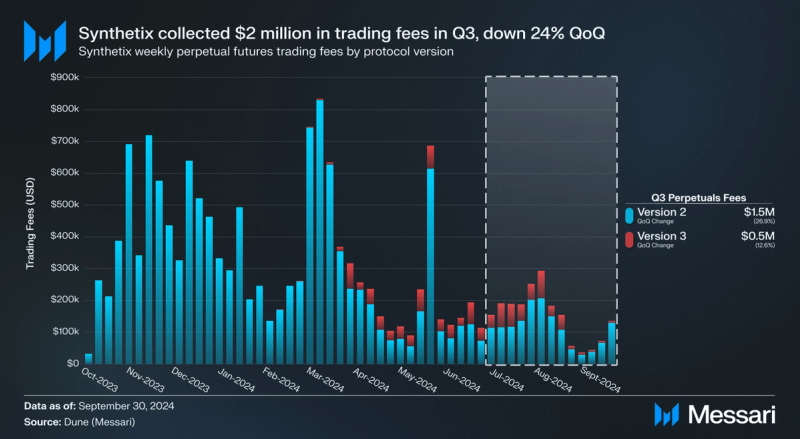

The adoption of Synthetix V3 perps has increased QoQ since launching in Q2. V3 now represents 30% of all perps trading volume as opposed to 27% in Q2. Trading volume for perps dipped QoQ for both V2 and V3, decreasing by 24% and 13%, respectively. Overall, perps volume fell for the third straight quarter to $5.1 billion, down 21% QoQ. According to DefiLlama, onchain perps volume in aggregate fell 18% in Q3. Following the decrease in perps volume were perps trading fees, decreasing 24% QoQ from $2.6 million to $2.0 million.

On the other hand, Synthetix had 57 new perp markets come online, up 90% QoQ from Q2’s 30 new perp markets. All of the new perp markets on Synthetix V3 provide exposure to assets already listed on Synthetix V2. Rather than providing exposure to new assets, the new markets utilize V3’s revamped infrastructure. Moving forward, there will likely be new markets that provide exposure to new assets as a result of the SIP-387. The proposal clearly defines a path for listing new assets: the asset must have a Pyth oracle price feed and be listed on Binance Perps.

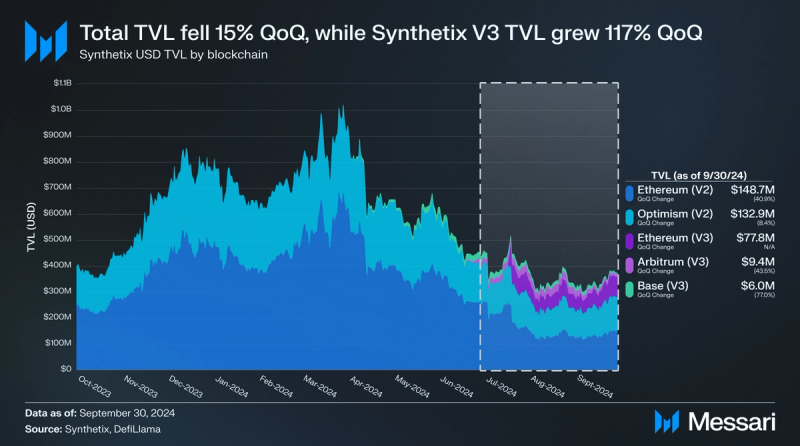

Total Value Locked

Synthetix experienced a 15% decrease in TVL QoQ, moving from $439.4 million to $374.9 million. Despite the total TVL downturn, Synthetix V3 increased TVL by 117% QoQ, rising from $42.9 million to $93.3 million. The TVL increase is due to Synthetix liquidity providers on Ethereum migrating their positions from V2 to V3, which became possible at the end of Q2.

Open Interest

Open interest (OI) represents the total value of active, unsettled derivatives contracts at a given time. For Synthetix, OI indicates the dollar amount of all currently open perp contracts. Higher OI reflects both increased risk, as more funds are tied up in funding active positions, and strong demand for Synthetix Perps, as it shows users are actively opening and maintaining perp positions on Synthetix.

Starting Q3 at $86.6 million, OI peaked at $287.7 million on July 21 — the highest level in the past year — before gradually decreasing through September. Part of the volatility came alongside the turmoil produced by the U.S. presidential election, with Joe Biden dropping out of the race on the same day that OI peaked on Synthetix. Toward the end of the quarter, OI began rising again, finishing at $170.8 million. Additionally, all of the OI was organic in nature as there were no additional incentives offered to traders.

Synthetix V3 Fees

Synthetix V3 on Base takes 40% of fees generated from perp trading and allocates them to buying back and burning bridged SNX. The full V3 perp trading fee structure is as follows:

- 40% for liquidity providers

- 40% for SNX buyback and burn

- 20% for integrators (e.g., Kwenta)

In Q3, SNX burned rose by 31% QoQ, from 89,000 to 129,000 SNX. The SNX burned was valued at $200,000, bringing the lifetime total of SNX burned to $480,000.

SNX’s supply is now deflationary after the protocol stopped inflation in Q4 2023. This quarter marked the third straight quarter of a reduction in the SNX supply, decreasing 0.04% QoQ from 325.8 million to 325.7 million SNX.

Over the course of Q3, V3 perp trading fees totaled $500,000. Consequently, V3 liquidity providers earned $200,000 in Q3.

Synthetix V2 perp trading fees decreased 27% QoQ, dipping from $2.0 million to $1.5 million in Q3. Similarly, Synthetic V3 trading fees fell from $0.6 million to $0.5 million in Q3, tallying a 13% drop.

Qualitative AnalysisWar ModeSynthetix appears to have entered “War Mode” after a series of governance changes to the DAO were put to vote at the end of Q3 and passed a few days thereafter. Historically, the Sythetix DAO has operated under a delegated governance model. Under this model, SNX tokenholders would vote representatives into various councils responsible for performing specific functions for the DAO. For example, the Spartan Council was responsible for voting on and implementing (if passed) various Synthetix Improvement Proposals (SIPs).

Towards the end of Q3, SIP-408 was passed, introducing a new method for making changes to the Synthetix DAO: Synthetix Referendums (SRs). SRs gave voting power for proposed changes to SNX tokenholders, rather than representative Council members. Not long after the passing of SIP-408 and the creation of SRs, a monumental change to Synthetix DAO was proposed and passed, via SR-2: A Synthetix Reboot. Authored by Benjamin Celermajer, this proposal aims to improve Synthetix through a DAO governance overhaul and a list of objective progress goals.

Governance OverhaulUnder SR-2, DAO governance will be streamlined by merging the existing councils into a single, seven-member Spartan Council with equal voting power per member. Four of the seven seats would be directly elected by SNX holders, with the remaining three seats being hired on by the elected council members. Each elected position would have a six-month term, with elections held semi-annually in the first two weeks of April and October. The elected seats would consist of three advisory seats and a treasury seat. The hired seats would consist of a strategy, operations, and technical seat. All council decisions would require a 4/7 multi-signature approval, with all treasury-related actions requiring approval from the treasury council seat. For the first term, each council member will receive a stipend of 2,000 SNX per month, with the potential for a new incentive structure afterward.

Celermajer laid out who he believed should be the founding constituents of the new Spartan Council:

- Strategy Seat: Benjamin Celermajer

- Operations Seat: Cav

- Technical Seat: To Be Commissioned

- Treasury Seat: coKaiynne

- Advisory Seat: Kain Warwick (Co-founder)

- Advisory Seat: Jordan Momtazi (Co-founder)

- Advisory Seat: Spartan Glory

Some of the near-term goals highlighted in SR-2 are:

- Conduct a review of the SNX token design and upgrade the tokenomics such that is at the center of Synthetix. This would involve reimagining how the token can govern, generate revenue, and benefit from the project.

- Restart work on Synth Teleporters.

- Operationalize SnaXchain by adding functionality, migrating SNX, and launching a new stablecoin for use across all V3 deployments. SnaXchain was launched in late Q3 as an optimistic L2 rollup that is part of Optimism’s Superchain. SnaXchain was launched to act as the primary home of Synthetix V3 governance.

- Business development and sales focus to onboard front ends and to build stronger relations with existing integration partners.

- Significantly improve product marketing.

- Launch perps on Ethereum Mainnet.

- Deploy Synthetix on Solana.

- Scale Base and Arbitrum V3 perp markets.

- Perp V3 expansion and V2x depreciation.

- Launch the Synthetix Foundation.

By the end of 2025, the successful execution of SR-2 would yield a revamped token economic model with diversified revenue streams. It would also allow SNX to operate on its dedicated appchain to collect aggregated fees, while providing for a more robust, widely adopted stablecoin. Additionally, the deployment and scaling of V3 perpetual contracts across multiple L2s and major L1s like Ethereum and Solana would be achieved. The ecosystem would see expanded integrations with more product developers and interfaces, and cross-chain messengers would enable more user-friendly asset transfers across chains.

Kwenta AcquisitionAfter the quarter ended, Synthetix governance proposed the acquisition of Kwenta through a discounted token swap. KWENTA token holders would receive SNX for their KWENTA at an exchange rate of 17 SNX for 1 KWENTA. This exchange rate represents a 19% discount to the 30-day average KWENTA/SNX ratio and values Kwenta at approximately $13.2 million. Subsequently, this proposal was passed and accepted by the Synthetix DAO and the Kwenta DAO, respectively.

Closing SummaryThis quarter was marked by monumental governance changes to Synthetix. The DAO has moved to a single Spartan Council, which is partly elected and partly hired. This council addresses past governmental inefficiencies and is collectively unified under a revamped vision for the future. Perp volumes decreased 21% this quarter to $5.1 billion, and TVL dipped by 15% QoQ closing the quarter at $367.2 million. On the other hand, the daily average OI grew 62% this quarter to $136.3 million. The newly streamlined and simplified process for creating new perp markets on Synthetix enabled automated market creation. The SNX token was repurchased and burned to the tune of $200,000 this quarter. Regardless of key metric changes, this quarter was marked by a significant change in the mentality and structure of the Synthetix DAO.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.