and the distribution of digital products.

State of XRP Ledger Q4 2024

- XRP’s market capitalization increased 246% QoQ, outpacing the combined market capitalization of BTC, ETH, and SOL, which increased by 44%.

- RLUSD, Ripple’s USD-pegged stablecoin, launched in December and is available on several platforms, including Uphold, Bitso, MoonPay, Archax, CoinMENA, Independent Reserve, and Bullish, with more platforms to come.

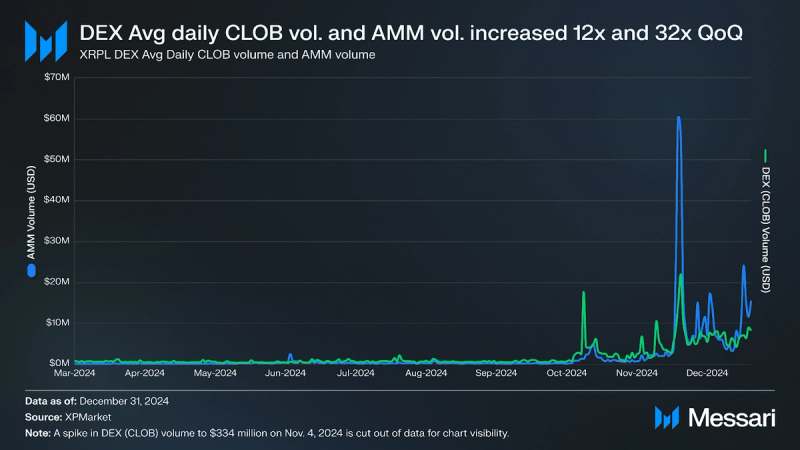

- Average daily CLOB volume and average daily AMM volume increased 1,140% (12x) and 3,100% (32x) QoQ.

- In November, the XRP Ledger Foundation’s incorporation documents were filed in France, establishing a new entity to support the XRPL’s development and operations. Four founding members—XRPL Commons, XRPL Labs, Ripple, and XAO DAO—established the entity.

- A number of real-world assets (RWAs) were tokenized and issued on the XRPL in Q4 such as abrdn’s US Dollar Liquidity Fund (Lux) via Archax. Additionally, in November SG-FORGE announced plans to launch its EURCV stablecoin on the XRPL in 2025.

XRP Ledger (XRP) has been running for over a decade, offering cross-currency and cross-border payments, and tokenization, among other features. Core value propositions of the XRP Ledger (XRPL) include fast and cheap transactions (relative to other currency-focused networks) and native functionalities — such as tokens, NFTs, a decentralized exchange (DEX), escrow functionality, embedded compliance, and token management.

With these capabilities, the XRPL can execute many of the same functions as other networks. NFTs, stablecoins, synthetic assets, and other markets found on programmable settlement layers are available on the XRPL as native functionality with composability through enshrined mechanisms such as a central limit order book (CLOB) and automated market maker (AMM). The XRPL base layer doesn't currently support arbitrary smart contracts, which was a deliberate design choice to prioritize security and stability through simplicity. However, plans to introduce native smart contracts were announced in September 2024, alongside long-standing initiatives to introduce advanced scripting functionality, such as through solutions like Hooks. Additionally, alternative execution environments, via sidechains, add additional functionality and use cases to the overall ecosystem.

The XRPL is supported by various development groups and individuals, including the XRP Ledger Foundation, Ripple, XRPL Labs (and Xaman), and XRPL Commons. It provides a digital payment infrastructure not just for individuals but also for existing financial entities, such as commercial banks and fintechs, with the community's deep interest in B2B and B2C solutions for finance. For a full primer on XRP Ledger, refer to our Initiation of Coverage report.

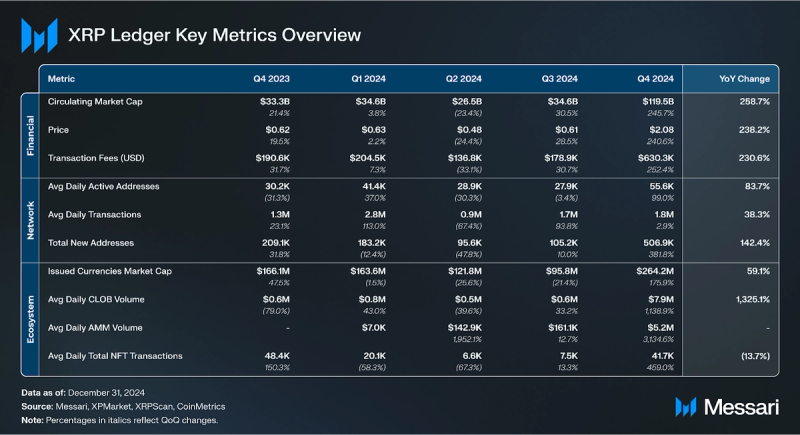

Key Metrics Financial Analysis

Financial Analysis

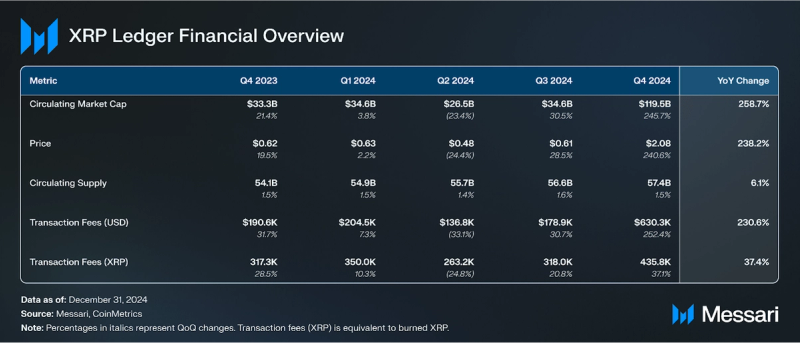

At the close of Q4’24, the XRPL’s native token, XRP, was the fourth largest crypto asset (up three spots from Q3’24) by market capitalization at $119.5 billion. Its circulating market cap increased 246% QoQ, outpacing the combined market capitalization of BTC, ETH, and SOL, which increased by 44%. XRP’s price increased 241% QoQ, with the discrepancy between market cap and price due to a 1.6% increase in circulating supply.

Notably, in December, Wisdom Tree became the fourth company to complete an S-1 filing to launch an XRP ETF following filings from Bitwise, Canary, and 21Shares in October and November. Also in November, WisdomTree’s Physical ETP launched in the European market on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam. Additionally, Robinhood added support for trading XRP on its platform and Bitwise announced its European XRP ETP would receive investment from Ripple. Finally, in September of last quarter asset management firm Grayscale launched its XRP Trust, providing another way for accredited investors to gain exposure to the asset.

On XRPL, transaction fees are systematically burned, applying deflationary pressure to the total supply of 100 billion XRP. Since the XRP Ledger’s inception, about 13.3 million XRP ($27.8 million at the close of Q4’24) has been burned. This low burn rate is due to the relatively low transaction fees (<$0.004 per transaction) on the network. Counteracting the burn rate, 1 billion XRP ($610 million at the close of Q3’24) is released from escrow to Ripple per month. Any XRP not spent or distributed by Ripple in that month is put into new escrow contracts. This system will continue until the remaining ~36 billion XRP becomes liquid. After all escrowed tokens become liquid, the deflationary pressure from burned fees will be the only variable related to supply.

Unlike many other cryptocurrency networks, the XRPL does not distribute rewards or transaction fees to its validators. In Proof-of-Association (PoA), rather than receiving rewards, validators are mainly incentivized by supporting the decentralization of the network, similar to a full node for Ethereum/Bitcoin rather than a validator/miner. The PoA consensus algorithm relies on trust between nodes, organized through unique node lists (UNLs).

XRP’s QoQ market cap increase of 246% outpaced the combined market capitalization of BTC, ETH, and SOL, which increased by 44%. On an annual scale, XRP’s circulating market cap has increased 259% YoY. On the XRPL, transaction fees are burnt and not distributed to stakers like on many other networks. The burning of those fees still decreases the overall supply, adding value to the remaining XRP. In this way, transaction fees still represent a redistribution of wealth from transaction fee spenders to XRP holders.

Network Analysis

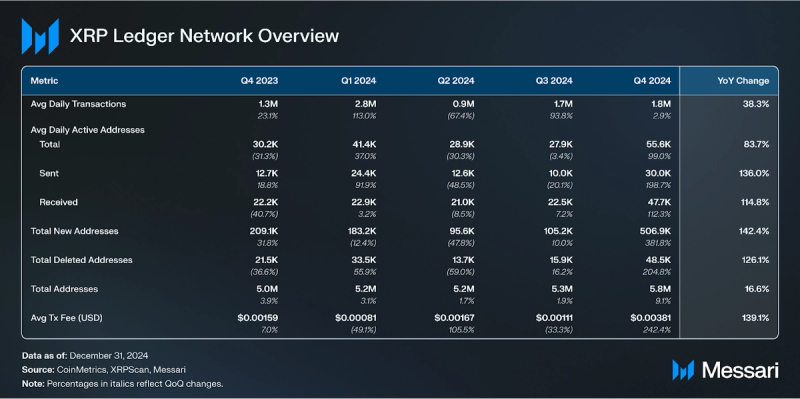

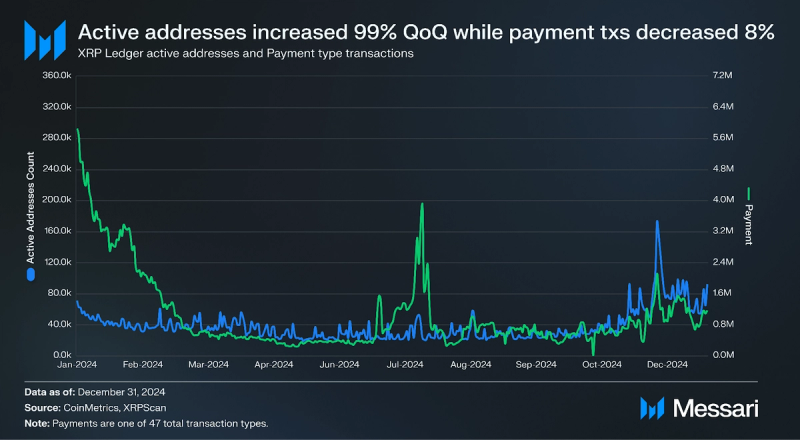

All measured network metrics grew in Q4, the first such quarter since Messari began covering the XRPL in Q1 2023. Chief among them, new addresses increased 382% QoQ to 507,000 suggesting the onboarding of new users. Additionally, total active addresses increased 99% QoQ to 56,000, indicating an increase in both new and existing users. On an annual scale, quarterly new addresses increased by 115%. Account creations and deletions are meaningful on the XRPL (unlike on most networks) as accounts require a 1 XRP deposit to be created, which can be reclaimed after deleting the account. As such, the XRPL’s account metrics are more reliable than other networks where account creations can easily be spammed/Sybiled at zero cost. Notably, the base reserve requirement was lowered from 10 XRP to 1 XRP in December 2024.

Addresses on the XRPL can contain destination tags, which enable a single address to receive and track XRP deposits for an arbitrary number of users. As a result, the number of daily active addresses is skewed downward, given that one account (e.g., a centralized exchange) could be responsible for a large number of users. It should be noted that a unique address is required for receiving tokens on most other networks, like ETH on Ethereum or BTC on Bitcoin.

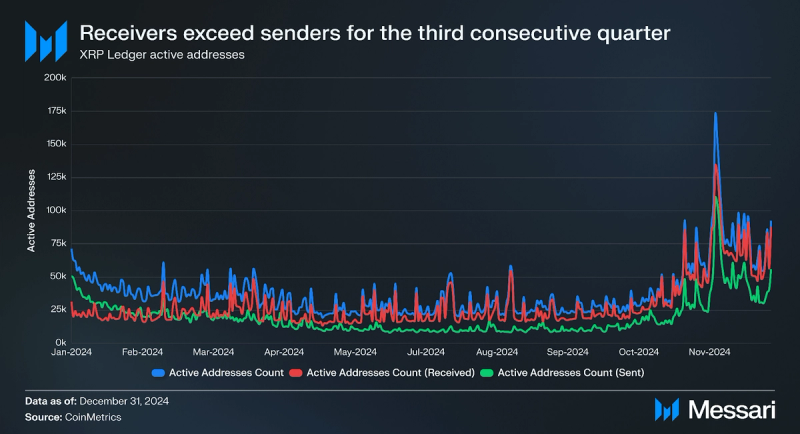

For the third consecutive quarter active receiver addresses exceeded active sender addresses on the XRPL. The active recipient metric is determined by the number of addresses that receive a transfer or other transaction. When recipients outpace senders, it indicates that more previously inactive wallets are receiving tokens distributed by senders than there are senders distributing those tokens. One common reason for this dynamic is airdrops, which are a token distribution strategy to reward and engage community members. Airdrops are more practical on networks with low transaction fees, such as the XRPL, or networks that enable batch transactions.

After increasing 110% in Q3, Payment transactions declined 8% in Q4. In contrast, total active addresses increased by 99% QoQ as mentioned above. Historically, for smaller activity spikes, the difference between the active recipient and sender addresses has been largely due to centralized exchanges and custodians using destination tags and sending Payment transactions. Centralized exchanges and custodians mostly use the Payment transaction type for deposits and withdrawals. As such, the Payment transaction type has consistently had more receiving addresses than sending addresses. In addition, users typically prefer creating wallets on centralized solutions for easy access to the initial XRP required to create a self-custody wallet. After acquiring their initial XRP, many users withdraw to their self-custody wallets, resulting in fewer active senders and many active receivers.

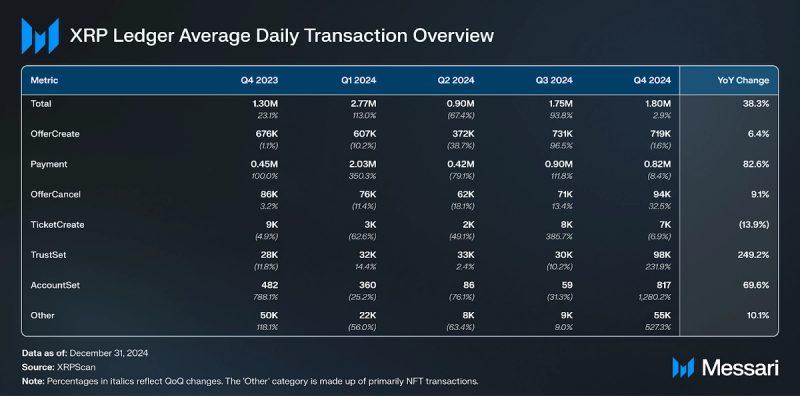

The total daily transactions metric includes 47 different transaction types, such as payments, escrow creations, NFT burns, and account deletions. Average total daily transactions increased 3% QoQ to 1.80 million per day. Prior to Q1 2024, OfferCreate, a transaction type that submits an order to exchange cryptoassets, has consistently represented the bulk of transactions. This transaction type only creates an “Order” on the order book and does not necessarily facilitate an exchange unless it completes an existing open Order. OfferCreate initiates a DEX limit order, and Offer objects represent bids/asks on the order book. Offers are consumed to process transactions such as Payment and OfferCancel (triggered manually or by expirations). If an Offer is only partially consumed by a transaction, a new Offer is created with the remainder of the original, similar to a UTXO. An Offer can be canceled by the OfferCancel transaction. Trust Lines are structures for holding tokens that protect accounts from being sent unwanted tokens, and the TrustSet transaction is used to open or close those Trust Lines.

Payments exceeded OfferCreates for the fourth consecutive quarter though Payments and OfferCreates' share of the overall transaction count decreased 11% and 5% QoQ respectively. Prior to Q1 2024, OfferCreate was historically the most common transaction type. The “Other” category of transactions includes transaction types for NFTs, escrows, multisigs, setting signer keys, and more. These transaction types are covered in depth in the Ecosystem Overview section.

DEXCLOB

A built-in central limit order book (CLOB) processes exchanges on the XRPL for fungible tokens (also called Issued Currencies or simply tokens). This CLOB has been part of the XRPL since inception and comes with the benefit of fewer trust assumptions and consolidated liquidity, rather than the inherent vulnerabilities of smart contracts. The majority of transactions come from the native CLOB. Although there is only one CLOB, there are many marketplaces acting as gateways that facilitate access. Gateways, also known as marketplaces, all share liquidity and provide a viable user interface for the average user. At the end of Q4, the top three gateways by volume facilitated were First Ledger, Magnetic, and XPMarket.

AMM

In addition to the existing CLOB, an automated market maker (AMM) was voted into the protocol in March of Q1, as detailed by the XLS-30 standard. AMMs function through liquidity pools that algorithmically price assets rather than creating offers of preset specifications. Liquidity pools allow holders to earn a share of trade fees on their tokens by offering them as liquidity. Importantly, orders can be partially routed through the AMM and partially through the CLOB, as both work together as part of the DEX.

ServersNodes and validators, known as servers, all run the same client software: rippled. Over 78% of nodes have upgraded to V2.3.0 since its release in November of Q4. V2.3.0 was released one week early on Nov. 25, 2024, as it contained the fix to a bug, which caused several nodes to crash and the network to go offline for approximately 10 minutes that same day. As of the end of Q4, the XRPL is supported by 886 nodes and 182 validators. Nodes increased from 621, and validators decreased from 109 since Q3.

XRPL servers participate in federated consensus as part of the XRPL’s Proof-of-Association (PoA) consensus mechanism. Validators do not stake tokens or receive financial rewards. Instead, the system is based on trust between nodes. Each node sets a list of trusted nodes, known as a unique node list (UNL). Additionally, the Negative UNL is a feature that adjusts servers' “effective UNLs” based on which validators are currently online and operational. The UNLModify transaction, which was called an average of 5.0 times per day in Q4, marks a change in the Negative UNL, indicating that a trusted validator has gone offline or come back online.

Ecosystem Analysis

Although the XRPL’s ecosystem hosts many of the same features as programmable settlement networks — such as Ethereum, Solana, and Cardano — the XRPL does not natively support smart contracts. However, in September, Ripple, along with the broader XRP community, announced its intent to introduce native smart contracts on the XRPL via an upcoming XLS proposal. Smart contracts are intended to be permissionless and provide for easy customization of XRPL’s built-in features such as escrows, NFTs, authorized trustlines, payment channels, the DEX, and AMM.

Historically, arbitrary smart contracts have not been enabled on the base layer as a design choice to ensure maximum security, performance, and stability. Instead, ecosystem artifacts – such as a DEX and Issued Currencies – are natively built into the protocol. The XRPL supports multiple assets through tokens (also called Issued Currencies or IOUs). They are onchain representations of arbitrary currencies, commodities, units, etc.

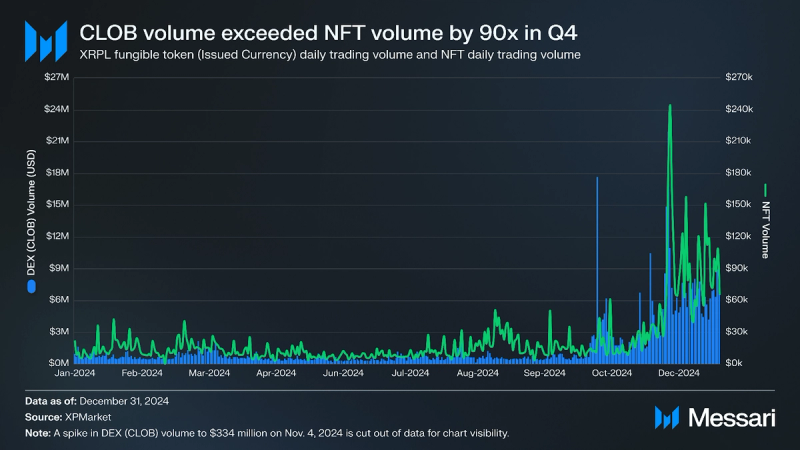

DeFiThe total market cap of fungible tokens, known as Issued Currencies, increased 176% QoQ to $264 million. A large part of this increase can be attributed to memecoins, with both new tokens and old memecoins contributing to the surge. In November, DEX Screener added support for XRPL to allow its users to track the network’s tokens.

There are more than 18,000 listed assets on the XRPL, but the top token, SOLO, accounted for 60% of the total market cap. Combined, the top five tokens accounted for more than 80% of the total market cap.

The top tokens on the XRPL by market cap at the close of Q4 were as follows:

- Sologenic (SOLO) had a market cap of $160.3 million and 220,000 holders. SOLO is primarily used to pay transaction fees on the Sologenic gateway.

- Phoenix (PHNIX) had a market cap of $58.62 million and 12,800 holders. Army is a memecoin.

- Army (ARMY) had a market cap of $34.1 million and 12,300 holders. Army is a memecoin.

- Bitstamp BTC (BTC) had a market cap of $32.0 million and 4,300 holders. Bitstamp BTC is a wrapped version of Bitcoin provided by Bitstamp.

- Coreum (CORE) had $23.9 million in market cap and 66,900 holders. CORE is the native token of the Coreum sidechain, which was also developed by the Sologenic team.

Trust Lines are structures in the XRP Ledger for holding fungible tokens and enforce the XRPL’s rule that someone cannot be forced to hold a token they don’t want. As such, Trust Lines make metrics around token behavior on the XRPL more reliable. While an account’s first two trustlines are free, thereafter the XRPL requires a lockup of 0.2 XRP (owner reserve) for each object, such as an issued currency, that the address owns. A base reserve of 2 XRP is also required to create an address. Notably, in December 2024, the base reserve requirement was lowered from 10 XRP to 1 XRP and the owner reserve from 2 XRP to 0.2 XRP. These requirements make it expensive to enact a Sybil attack on XRPL metrics, such as the number of holders. For this reason, the number of holders is a reliable metric of a token’s adoption on the XRPL. The metric is especially relevant for fungible tokens, which have much higher supplies than NFTs.

Average daily CLOB volume of fungible Issued Currencies increased 1,140% (12x) QoQ to $7.9 million while the average daily amount of CLOB trades declined by 4% to 700,000. Average daily CLOB traders increased 300% QoQ to 9,300. First Ledger, a Telegram trading bot developed by the team behind xrp.cafe, is the leading DEX (i.e., the leading gateway to the native DEX) on the XRPL by trading volume facilitated. Other prominent DEXs (gateways) include MagneticX, XPMarket, and Sologenic.

After its launch in March, AMM volume eclipsed CLOB volume for six days in June and peaked at $2.5 million but ended Q3 with roughly $100,000 in volume. All prominent DEXs (First Ledger, XP Market, MagneticX, Sologenic, etc), and newer platforms, such as Orchestra Finance and Moai Finance, have integrated.

In Q4, average daily AMM volume increased 3,100% (32x), reflecting an exponential increase in usage. Notably, XRP Ledger’s AMM design includes a mechanism that allows the liquidity providers of a respective liquidity pool to bid LP tokens for an auction slot, which grants a discount on trading fees for a 24-hour period. This mechanism is intended to incentivize the account holding the auction slot for a given liquidity pool to keep prices in balance with external markets. Liquidity on the AMM is shared across all DEXs (gateways), just like with the CLOB.

On Dec. 17, 2024, RLUSD, Ripple’s USD-pegged stablecoin launched on both the XRPL and Ethereum. The stablecoin is backed entirely by U.S. dollar deposits, short-term U.S. treasuries, and “other cash equivalents," with monthly third-party attestations. Notably, RLUSD is issued under a New York Trust Company Charter to ensure stringent oversight and regulation. Currently, RLUSD is available on several platforms, including Uphold, Bitso, MoonPay, Archax, CoinMENA, Independent Reserve, and Bullish, with more platforms to follow

Prior to the launch of RLUSD, stablecoins on XRPL had not seen the adoption of major stablecoins on other networks, such as USDT ($125 billion market cap) or USDC ($37 billion market cap). However, the introduction of a trusted stablecoin in a novel execution environment has proven to be a massive liquidity event in many cases (e.g., Cardano’s iUSD in 2023), particularly as a desired pairing asset for AMMs.

However, currently, assets like RLUSD, which have Clawback (a feature on the XRPL that allows token issuers to recover issued tokens after they have already been distributed to accounts) enabled, cannot trade on the AMM as clawback is not supported. For regulatorily compliant assets like RLUSD the clawback feature is required for issuance onchain. Currently, an amendment (XLS-74) is live that if enabled would add support for clawback functionality to the AMM allowing such tokens to be used on the AMM. If clawback support is enabled on the AMM, it will likely spur further growth in AMM volumes as regulatorily-compliant assets like RLUSD can begin trading.

The top stablecoins and wrapped tokens (also known as IOUs) on the XRPL at the close of Q4 were as follows:

- Bitstamp BTC: $32 million market cap and 4,300 holders

- Ripple USD (RLUSD): $22.0 million market cap and 7,800 holders

- Gatehub Fifth (ETH): $21.6 million market cap and 26,000 holders

- Ripple Fox CNY: $4.2 million market cap and 11,800 holders

- Gatehub USD: $4.2 million market cap and 20,000 holders

- Bitstamp USD: $3.7 million market cap and 7,200 holders

Additionally, in November SG-FORGE announced plans to launch its EURCV stablecoin on the XRPL in 2025.

In April 2024, proposals were made to introduce a native lending protocol on XRPL (XLS-66), whereby users could lend and borrow supported assets, such as XRP, wBTC, and wETH using single-asset vaults (XLS-65). Unlike overcollateralized lending protocols like Aave, the protocol is intended to offer onchain fixed-term and rate loans via offchain underwriting, risk management, and an insurance fund — a model akin to that implemented by TrueFi on Ethereum. In September, a number of updates were made to both proposals including single-asset vaults holding assets directly, and both the vault and lending protocol supporting clawback and asset freezing for asset issuers with compliance and regulation requirements.

Finally, Axelar, a full-stack interoperability protocol (i.e., a crypto overlay network), integrated XRPL in Q1 2024. It connected the XRPL ecosystem to the 60+ networks, including the Ethereum and Cosmos ecosystems. As the AMM grows, the Axelar connection makes it easier to source liquidity from many of the highest-TVL networks.

RWAsReal-world assets (RWAs) are being made available on XRPL in several ways. In November, a tokenized money market fund was made available on the XRPL for the first time. Archax is providing access for professional investors to a money market fund from UK Asset manager abrdn comprised of part of £3.8 billion US Dollar Liquidity Fund (Lux). Ripple has allocated $5 million into the fund, which marks the first example of Ripple and Archax’s ongoing partnership intended to bring hundreds of millions of dollars in RWAs to the XRPL over the next year.

Two tokenized U.S. Treasury bill funds have also been launched on the XRPL in recent months. In December Elysia introduced its tokenized U.S. Treasury bills, while in August, OpenEden launched tokenized US Treasury bills (T-bill) on the XRPL, with Ripple committing to allocate $10 million to OpenEden’s TBILL tokens.

In October 2024, Aurum Equity Partners launched a $1 billion combined equity and debt tokenized fund on the XRPL via asset tokenization solution Zoniqx, which is partnered with Ripple to bring RWAs to the XRPL.

In June 2024, Meld Gold announced a partnership with Ripple to bring fungible gold (GLD) and silver (SLV) assets to the XRPL. In September Meld Gold announced it had completed its first onchain transaction as part of the ongoing rollout. Also in September Tiamonds, a tokenized diamond project whereby users can hold NFTs representing real-world diamonds, launched on the xrp.cafe marketplace.

Adjacent to RWAs, the XRPL has also been explored as a tool for other institutional products. Ripple is one of the leading companies developing technologies to leverage the XRPL for institutional and government use cases. The company is focused on utilizing XRP and the XRPL to drive its On-Demand Liquidity service, custody, and tokenization initiatives.

NFTs

On the XRPL, NFTs are built into the core protocol and do not require smart contracts for creation or transfers, like Issued Currencies (also known as native tokens). NFTs were standardized by XLS-20 in October 2022, bringing benefits such as royalties and anti-spam features. These features help users not only avoid unwanted tokens but also help them stay legally compliant by avoiding specific tokens and smart contracts that have been made illegal within specific regions.

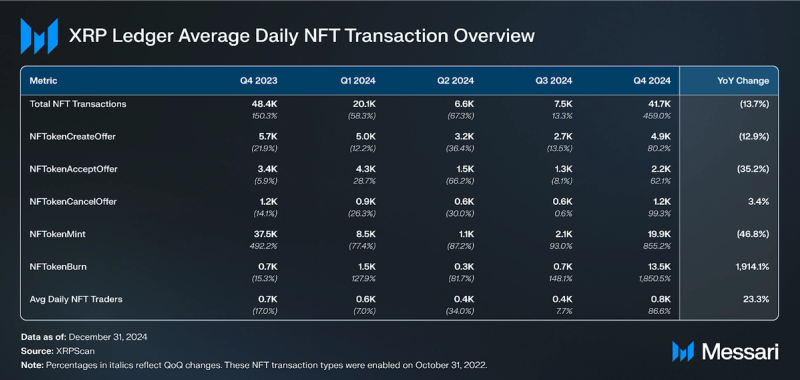

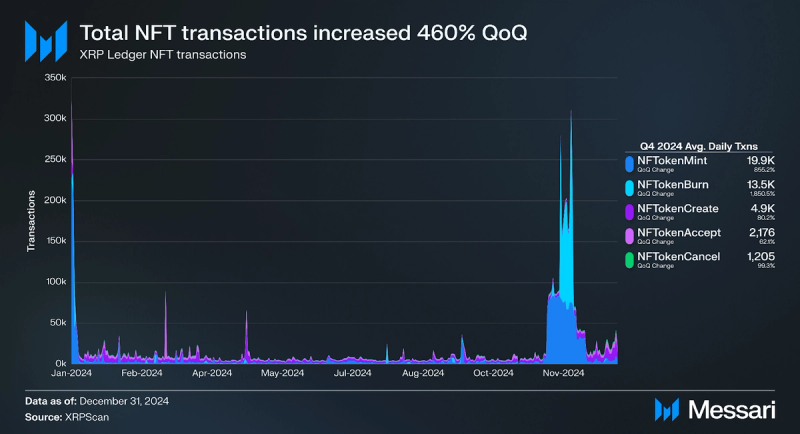

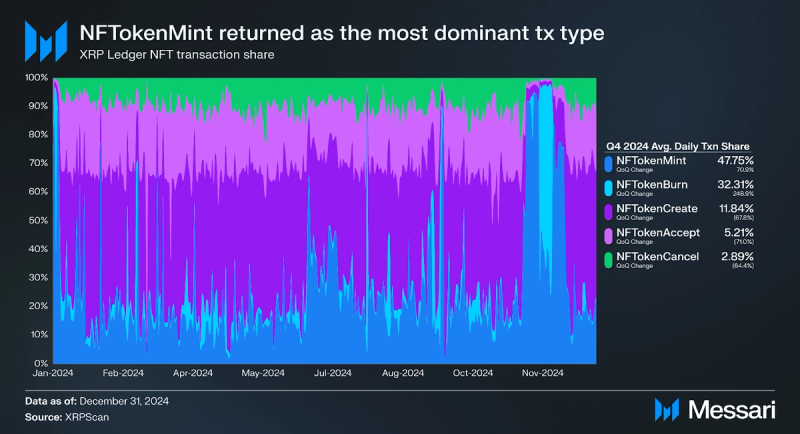

In Q4, total NFT transactions increased 460% driven by NFT mint and burn transactions, which increased 855% and 1,850% respectively. Additionally, NFT create and accept offer transactions increased 80% and 62% respectively, and NFT cancel offer transactions increased 99%.

Like in Q4 2023 and Q1 2024, a massive spike in mint activity led NFTokenMint to surpass NFTokenCreateOffer as the most common NFT transaction type in Q4 2024. Previously, NFTokenCreateOffer was the dominant transaction type in both Q2 and Q3 2024. As of the end of Q4, nearly 7.5 million total NFTs have been minted with the XLS-20 standard. Notably, over 3.4 million of those mints came in Q4 2023.

Notable NFT projects on XRPL include:

- Gaming NFTs such as Zerpmon, a Pokemon-esque game.

- Real-world solutions/assets such as Tiamonds tokenized diamonds or Xange’s carbon credits program.

In Q2 2024 xrp.cafe launched its automated NFT launchpad that allows anyone to launch an NFT collection on XRPL. Bidds also has an NFT launchpad and is the other main NFT marketplace on the XRPL. Additionally, XPMarket features an NFT marketplace and auction mechanism.

SidechainsMultiple sidechains for the XRPL are either in development or were recently launched. To date, the XRPL has maintained minimized L1 complexity, offering increased programmability for both general and specific use cases on sidechains.

CoreumCoreum (CORE) is an enterprise-grade L1 focused on interoperability and scalability. Coreum runs a WASM VM and is secured by a Bonded Proof-of-Stake (BPoS) consensus mechanism. CORE is used for transaction fees, staking, and validator rewards on Coreum.

Coreum was built by the Sologenic team to service user needs that could not be efficiently managed on the XRPL. The network's initial focus is on providing security tokenization, such as tokenized stocks from the NYSE and synthetic assets. In March of 2024, Coreum completed an IBC integration, granting access to all IBC-connected networks such as Cosmos Hub, Ethereum, and BSC. This was followed by:

- Integration with Picasso Network in June 2024 for IBC interoperability with Solana.

- Integration with Band Protocol’s Band Oracle for bridging RWA’s to IBC-integrated chains.

- Coreum’s V4 upgrade in July 2024, which introduced smart contract extensions to tokens, a clawback feature, and dynamic NFT data, among other updates.

- Completion of development of its native DEX in November 2024, which is undergoing a four-phase rollout.

Users can already transfer between Coreum and the XRPL via the noncustodial Sologenic bridge.

XRPL EVM SidechainIn Q2 2024, the Ripple team announced XRPL EVM Sidechain as the official name for Peersyst’s EVM sidechain proposal to bring smart contracts to the XRPL ecosystem. The sidechain aims to grant the XRPL ecosystem access to EVM developers and functionality, with a general-purpose scope. The sidechain is being built on the Cosmos SDK, specifically evmOS, and connects to the XRPL through the XRPL-EVM bridge. The devnet is currently live and is creating blocks every ~3.8 seconds using the Comet BFT PoS consensus mechanism, a variant of Tendermint.

The latest version of Peersyst’s EVM sidechain was deployed on devnet V2 in Q2 2023. Dapps such as identity protocol XRPDomains were deployed on the testnet. Notable additions to the latest version include:

- Support for XRP, IOU, and ERC-20 token transfers via the bridge

- Proof-of-Authority consensus

- Smart contract verification on the block explorer

Cosmos IBC interoperability was enabled in May 2024, allowing for tokens to be bridged from IBC-enabled chains to the XRPL. Additionally, the Ripple team announced in June 2024 that Axelar will replace the currently implemented bridge design proposed in the cross-chain bridges (XLS-38d) specification as the XRPL EVM Sidechain’s exclusive bridge. This will include sourcing the native gas token of the sidechain (eXRP) from the XRPL.

Root NetworkThe Root Network sidechain is a blockchain-based NFT system with a focus on UX and metaverse, run by Futureverse. The Root Network is live in alpha, along with its bridge to XRPL and Ethereum, which was upgraded in September 2024 to allow two-way bridging of any token between the XRPL and The Root Network. Additionally, in October The Root Network’s Asset Register

Built from a Substrate fork, the Root Network uses XRP as the default gas token and has EVM support for smart contracts. The Root Network uses a delegated-Proof-of-Stake (dPoS) consensus mechanism (via the ROOT token). The protocol’s roadmap items are aligned with the XRPL, seeking to integrate the XLS-20 NFT standard and source liquidity from the XRPL DEX. Root Network also plans to offer users social recovery, management of assets, increased wallet flexibility, and a familiar Web2 experience through the account abstraction solution FuturePass.

HooksHooks is a feature developed by XRPL Labs to include smart contract-like functionality for the XRPL transactions. While Hooks are not Turing complete and do not enable arbitrary logic, they do allow conditions and triggers to be attached to transactions — similar to scripts on UTXO chains like Bitcoin and Cardano (pre-Alonzo). In particular, Hooks enable several programmability features, including the scheduling of payments, distributing a set percentage of funds to a creator for royalties, or imposing limits/restrictions on transactions for both volumes and counterparties. In July 2024, the XRPL Labs team launched its latest testnet for Hooks written in JavaScript (JS), one of the most widely used programming languages.

GovernanceThe XRP Ledger (XRPL) uses an offchain governance process that allows community members and organizations to propose changes to the network. Users can submit proposals, otherwise known as Amendments, to the “XRPL-Standards” repository on the project’s GitHub. Block-producing validators on the network can then run versions of the XRPL source code that implement the proposed amendments. If 80.00% or more of the block-producing validators support the amended source code for two weeks, then it is implemented as the new source code for the network. Validators that do not support the amended source code are then blocked from contributing to consensus until they update to the newly changed version.

Recent notable approved amendments include:

- Decentralized Identity (XLS-40): Enabled at the end of October, Decentralized Identity (DID) enables verifiable, self-sovereign digital identities on the XRPL for use cases in compliance, access control, digital signature, and secure transactions.

- Price Oracles (XLS-47): Enabled in November, this amendment brings price oracles to the XRPL for pricing wrapped/bridged assets. Anyone can now call OracleSet to create or update an existing price oracle or OracleDelete to delete an existing price oracle. Subsequently, oracle providers Band Protocol and DIA integrated with the XRPL in December. With oracles enabled, the get aggregate price API call aggregates the price of an asset from all live oracles while discarding any outliers.

Additionally, some notable proposals that have yet to be approved include:

- Multi-Purpose Tokens (XLS-33): A proposal to introduce the multi-purpose token standard (MPT). MPT enables support for metadata to store parameters regarding an issued RWA, such as the maturity date of a tokenized bond. In October, Sofstack GmbH completed a comprehensive security audit for MPT. Coupled with the clawback function enabled in Q1 2024, the XRPL is continuing to add functionality to give regulatorily compliant token issuers more control.

- AMM Clawback (XLS-74): Currently, all tokens that have clawback enabled, such as RLUSD cannot be used on the AMM as clawback is not supported. This proposal would add support for clawback functionality to the AMM allowing such tokens to be used on the AMM.

- Simulating Transaction Execution (XLS-69): Proposes a new simulate API method for developers to safely experiment with transactions for testing and refinement.

- Permissioned Domains (XLS-80): This proposal introduced permissioned domains, which can only be accessed by users based on their Decentralized Identity (DID). Notably, this amendment builds on Onchain Credential Support (XLS-70), which was first proposed in Q2 2024 and also has yet to be enabled. XLS-70 would add support for creating, accepting, and deleting credentials on XRPL as part of identity management first introduced in Decentralized Identity (XLS-40), which was implemented at the end of October.

In November, the XRP Ledger Foundation’s incorporation documents were filed in France, establishing a new entity to support the XRPL’s development and operations. Four founding members—XRPL Commons, XRPL Labs, Ripple, and XAO DAO—established the entity. In previous discussions, these supporting entities and others agreed to transfer previous XRPL Foundation assets to this new entity, which is governed via a board of directors that elects a President, Secretary and Treasurer for two-year terms and operates via committees. Additionally a General Assembly inclusive of community members including developers, users, academics, validators, and infrastructure providers can provide advisory input on decisions. As part of the transition process, the existing XRPL Foundation team established a new Inclusive Financial Technology Foundation (InFTF).

Other Notable UpdatesA number of additional integrations, partnerships, and upgrades also took place in the fourth quarter, enhancing the XRPL ecosystem and the network’s overall utility.

- Peersyst launched XRPL Snap integrating the Metamask wallet with the XRPL.

- In October Ripple hosted its 8th annual Swell conference in Miami Florida highlighting four key themes (digital asset regulation, crypto ETFs and stablecoin growth, RWAs, crypto philanthropy).

- In December, Tenity announced its Tenity Inc Fund II to fund early-stage builders on the XRPL in Asia and Europe with Ripple as a strategic partner.

- Livenet explorer added support to search for specific tokens and issuers on the XRPL.

- Sologenic 2.0 launched with a new user interface to track and trade XRPL tokens.

- Xaman launched the 3.2 version of its wallet introducing memecoin data and tooling to hide spam. Additionally, Xaman integrated Topper’s off-ramp solution for its users in more than 120 countries to off-ramp XRP to US Dollars and Euros.

- Girin Labs launched its Girin Wallet on The Root Network in December.

The XRPL is supported by a number of community support programs funded by Ripple’s commitment of 1 billion XRP in March 2022. These programs include the XRPL grants program established in May 2021 to support development on the XRPL and the XRPL accelerator program, an accelerator for new and existing XRPL ecosystem projects. Other community support programs include XRPL Hackathons and the Aquarium Residency for developers offered by XRPL Commons. The RippleX Bug Bounty Program also pays bounties to individuals or groups that identify and report bugs in the rippled, xrpl.js, xrpl-py, and xrpl4j repositories.

Notably, in May 2024, Ripple announced changes to the XRPL grants program including a revised screening criteria for applicants and rolling applications, among other changes. The XRPL Accelerator program had two tracks in 2024: the Launch Program for early-stage projects and the Scale Program for later-stage projects. The first Launch Program cohort was announced in July while the second Scale Program cohort began in September and concluded with a demo day in November hosted by the Dubai International Financial Centre (DIFC) Innovation Hub, which Ripple had previously announced a partnership with in July. Additionally, in September, the XRPL grants program introduced artificial intelligence (AI) as a new funding track.

In August a partnership with APAC DAO to support developers building on the XRP Ledger in Southeast Asia was launched. In November, APAC DAO announced the winners of its XRPL SEA Hackathon.

Closing SummaryXRP’s market capitalization increased 246% QoQ, outpacing the combined market capitalization of BTC, ETH, and SOL, which increased by 44%. XRP Ledger network and ecosystem metrics also grew significantly. New addresses increased 382% QoQ to 507,000, suggesting the onboarding of new users, while Average daily CLOB volume and average daily AMM volume increased 1,140% (12x) and 3,100% (32x) QoQ.

RLUSD, Ripple’s USD-pegged stablecoin, launched in December, bringing a stablecoin entirely backed by U.S. dollar deposits, short-term U.S. treasuries, and “other cash equivalents," to the XRPL. An amendment to support clawbacks on the AMM is also live that would allow trading of clawback-enabled tokens like RLUSD, likely spurring larger AMM volume. Key amendments were also enabled in the fourth quarter introducing decentralized identity, which enables verifiable digital identities, and price oracles for pricing wrapped/bridged assets.

Additionally, a number of important updates and announcements were made. In November, the XRP Ledger Foundation’s incorporation documents were filed in France, establishing a new entity to support the XRPL’s development and operations. Also, a number of real-world assets (RWAs) were tokenized and issued on the XRPL in Q4 such as abrdn’s US Dollar Liquidity Fund (Lux) via Archax, and SG-FORGE announced plans to launch its EURCV stablecoin on the XRPL in 2025. In the new year, the XRPL is poised for further growth and activity as a continued stream of developments and upgrades brings additional users to the network.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.