and the distribution of digital products.

State of Vertex Q4 2024

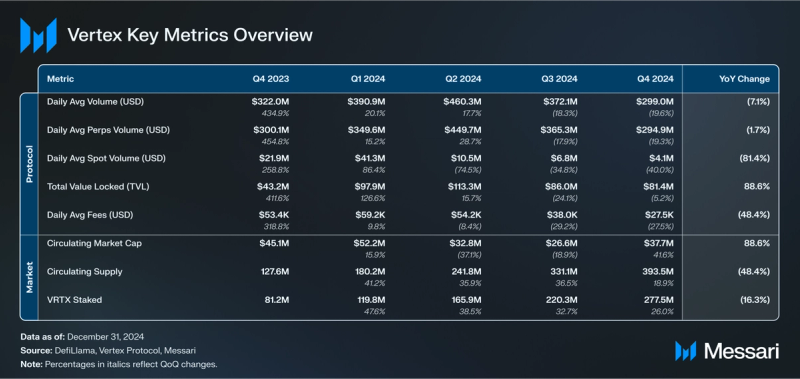

- Vertex's total value locked (TVL) declined 5% QoQ to $81.4 million in Q4 but grew 89% YoY, showcasing substantial annual growth despite short-term declines.

- Open interest (OI) rebounded sharply by 110% QoQ to $133.6 million, reaching an all-time high in December, indicating increased trader demand for leverage.

- Sei surpassed Arbitrum as the leading deployment by volume, with daily average volume on Sei up 76% QoQ to $149.0 million, driven by Vertex’s trading rewards programs.

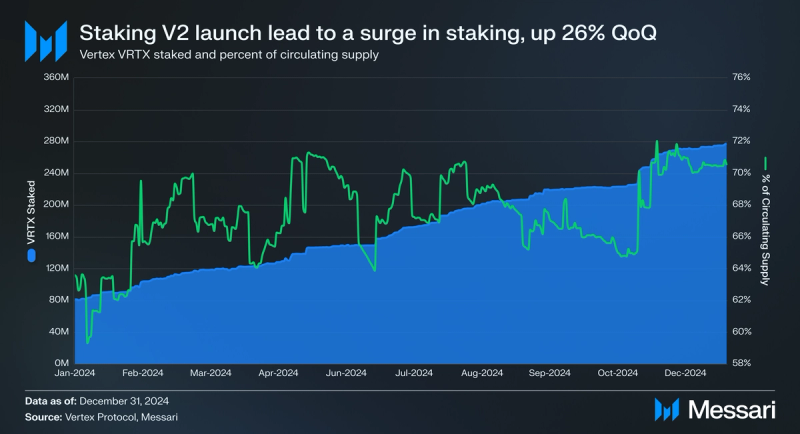

- VRTX’s circulating market cap grew 42% QoQ to $37.7 million in Q4, while the token price increased 20% QoQ to $0.10. Staking expanded significantly, with 71% of the circulating supply staked by year-end, reflecting strong community participation and adoption of Staking V2.

- Strategic initiatives such as Staking V2, Chainlink CCIP integration, Election Outcome Markets, and Sonic deployment plans strengthened Vertex’s ecosystem utility and interoperability, positioning it for further growth in 2025.

Vertex (VRTX) is a decentralized exchange (DEX) that combines spot trading, perpetuals, and a money market into a single vertically integrated platform. It features a hybrid model of a central limit order book (CLOB) and an automated market maker (AMM), enhancing liquidity as positions from LP markets are integrated into the order book. As a non-custodial platform, Vertex ensures that users always maintain control over their assets. The protocol is distinguished by its low-latency trading capabilities and efficient liquidity utilization across a diverse range of DeFi assets. This efficiency is bolstered by an offchain sequencer architecture, which mitigates MEV and supports exceptionally fast trading speeds. Vertex launched Edge in 2024, which aims to consolidate liquidity cross-chain into the application’s order book.

Vertex's main value proposition is bundling three of the most sought-after DeFi services — AMM, perpetual DEX, and money market — into a single DEX. This integration allows users to engage with different financial primitives within one interface. As of this quarter, Vertex is live on Arbitrum, Blast, Mantle, Sei, and Base.

For a complete primer on Vertex, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

Key Metrics Protocol Analysis

Protocol Analysis TVL

TVL

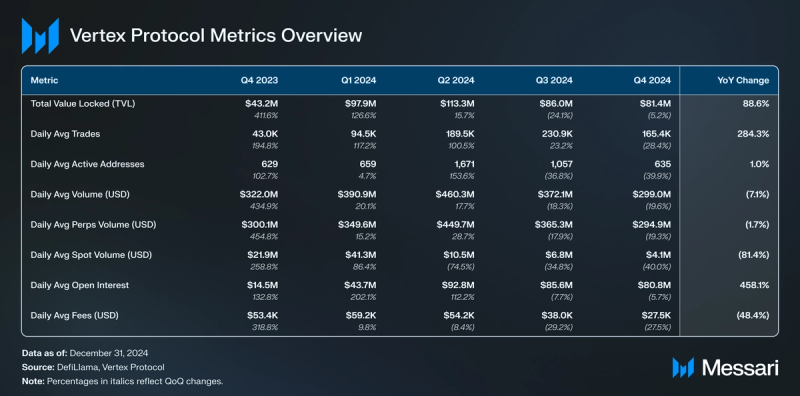

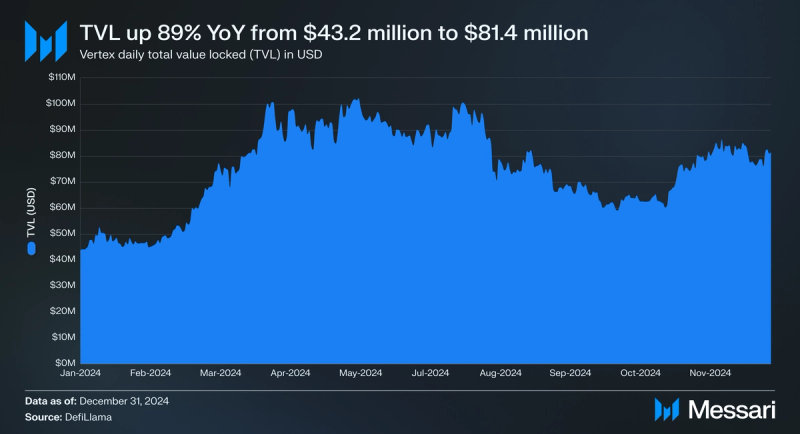

Total value locked (TVL) is a measure of the available onchain liquidity on Vertex at a given moment. Importantly, it does not portray all liquidity on Vertex, as Vertex also utilizes an offchain order book. In Q4, TVL fell from $86.0 million to $81.4 million, a 5% QoQ decrease. However, over the course of the entire year, TVL increased 89% YoY from $43.2 million. Although TVL is an important metric, it is not the sole determinant of success for a perp DEX.

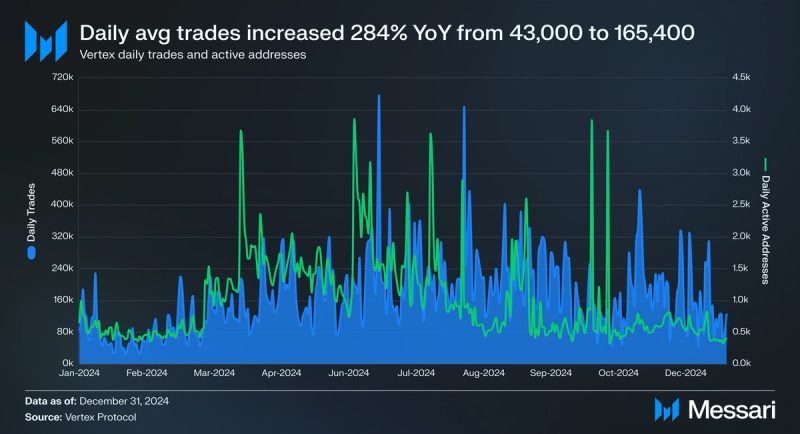

Activity

Activity metrics trended lower in Q4 after significant growth throughout 2024. Growth in 2024 was led by daily average trades, which increased 284% YoY from 43,000 to 165,400. However, for Q4, daily average trades decreased 28% QoQ from 230,00. Similarly, daily average active addresses fell in Q4, decreasing 40% QoQ from 1,100 to 600. For the entire year, average daily active addresses were up 1%. This dynamic suggests that power users represent a larger share of trades on Vertex.

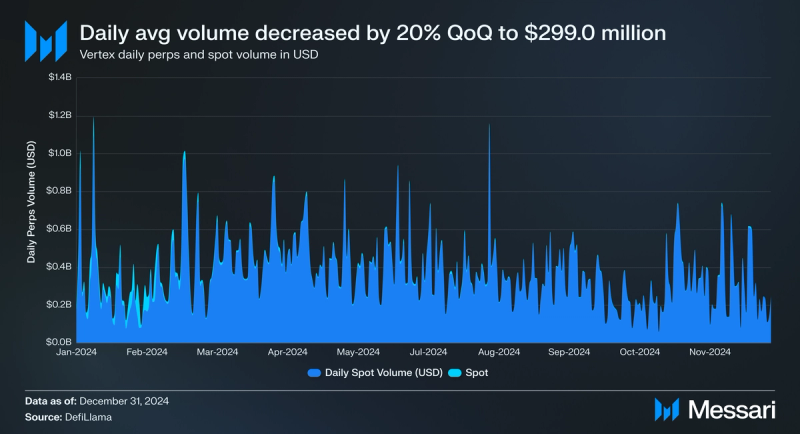

Volume

As a part of its product offering, Vertex offers both perps and spot markets. Across both market types, Vertex averaged $299.0 million daily volume, a 20% decrease from Q3’s $372.1 million. As for YoY, daily average volume was down 7% from $322 million. Perps markets averaged $294.9 million in daily volume, accounting for 99% of volume in Q4. For the quarter, perps volume was $27.13 billion, which was approximately 3.7% of all onchan perps volume ($740.50 billion) in Q4. Vertex’s share of perps volume decreased 35% QoQ 5.7% in Q3.

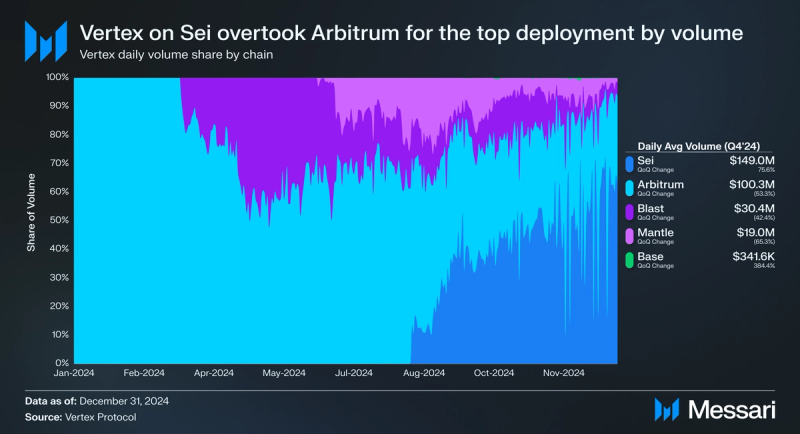

Broken down by chain, the deployment with the most volume in Q4 was Sei. This was the first quarter in which Arbitrum did not lead deployments in volume. Average daily volume on Sei was up 76% QoQ from $84.8 million to $149.0 million, accounting for 48% of all volume in Q4. Last quarter, in early August, Vertex deployed on Sei, an integrated, general-purpose Layer-1 network. Vertex was the first high-profile perp DEX to deploy to Sei, allowing it to easily establish dominance in an untapped market. Furthermore, Vertex has launched multiple seasons of a trading rewards program on Sei:

- Season 2 (Sep. 25 - Oct. 23) - 3 million SEI

- Season 3 (Oct. 23 - Nov. 20) - 2 million SEI

- Season 4 (Nov. 20 - Dec. 18) - 2.1 million SEI

- Season 5 (Dec. 18 - Jan. 15) - 2.1 million SEI.

Across the four seasons in Q4, 9.2 million SEI was distributed as rewards ($3.6 million at Q4 end).

The deployment with the second most volume in Q4 was Arbitrum. Daily average volume on Arbitrum was down 53% QoQ from $214.8 million to $100.3 million. This accounted for 35% of all volume on Vertex in Q4.

The deployment with the highest QoQ growth in percentage terms was Base, which had its average daily volume increase 384% QoQ from $70,500 to $341,600. Despite the QoQ increase, the Base deployment accounted for less than 1% of all volume in Q4. As for Blast (down 42% QoQ to $30.4 million) and Mantle (down 65% QoQ to $19.0 million), they accounted for a combined 17% of volume.

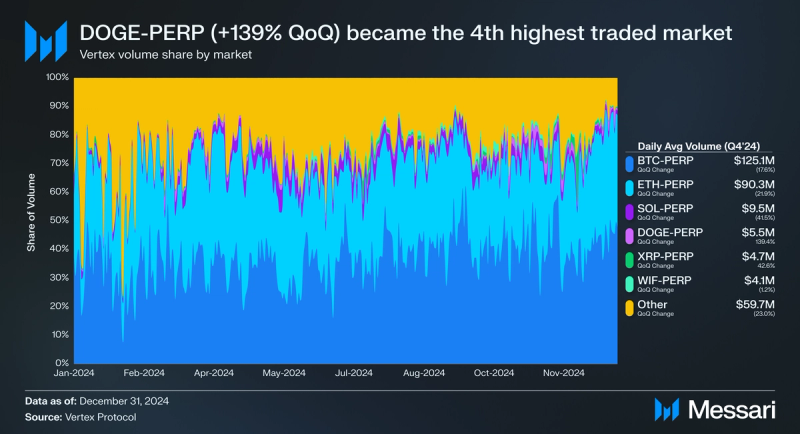

Taking a look at individual markets, the BTC-PERP market was the biggest market on Vertex in Q4. BTC-PERP daily average volume decreased 18% QoQ from $153.1 million to $125.1 million. Despite this decrease, BTC-PERP accounted for 42% of volume in Q4, up 2% QoQ. The second highest traded market in Q4 was ETH-PERP. ETH-PERP’s daily average volume fell 22% QoQ from $115.4 million to $90.3 million. Additionally, its share of volume fell 3% QoQ to 30%. Combined, BTC-PERP and ETH-PERP were 72% of Q4’s volume (flat QoQ). No other individual market surpassed 5% this quarter. A notable gainer this quarter was DOGE-PERP. DOGE-PERP averaged $5.5 million in daily volume, a 139% QoQ increase. DOGE-PERP surpassed XRP-PERP, WIF-PERP, and WBTC to become the fourth-highest traded market in Q4. No spot markets were within the top six overall markets. Lastly, trading volumes across markets became more concentrated in Q4 as the share of volume from markets outside the top six fell 4% QoQ from 21% to 20%.

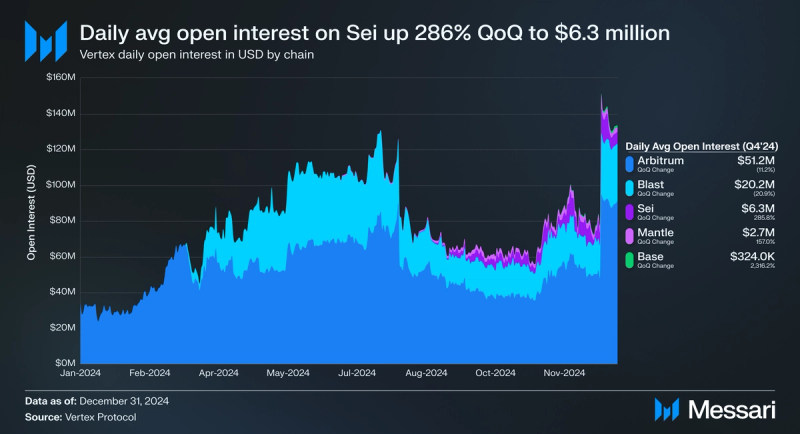

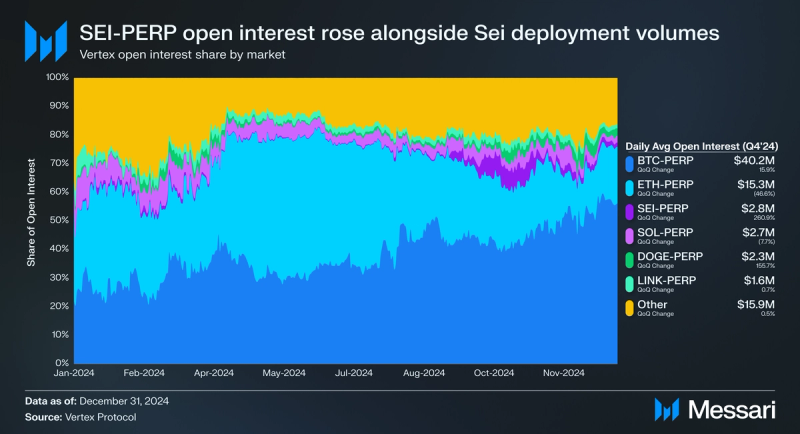

Open Interest

Open interest (OI) represents the total value of active, unsettled derivatives contracts at a given time. For Vertex, OI indicates the dollar amount of all currently open perp contracts. Higher OI reflects both increased risk, as more funds are tied up in funding active positions, and strong demand for perps, as it shows users are actively opening and maintaining perp positions on Vertex.

By the end of Q4, OI was $133.6 million, up 110% QoQ from $62.5 million. OI also set a new ATH ($151.4 million) on December 20 as volatility was heightened during the month of December. For the entire quarter, the daily average OI was $80.8 million (down 6% QoQ from $85.6 million). OI began trending up after the US presidential election on November 5 ($55.9 million in OI on election day). The election of Donald Trump caused a rally in crypto markets. Alongside the price rally, open interest also began to rise as traders increased their risk appetite for leverage. Broken down by deployments, the daily average OI was:

- Arbitrum - $51.2 million (down 11% QoQ and 63% share of OI in Q4)

- Blast - $20.2 million (down 21% QoQ and 25% share of OI in Q4)

- Sei - $6.3 million (up 286% QoQ and 8% share of OI in Q4)

- Mantle - $2.7 million (up 157% QoQ and 3% share of OI in Q4)

- Base - $324,000 (up 2,316% QoQ and <1% share of OI in Q4)

As for perp markets, BTC-PERP had the highest daily average open interest for the second straight quarter. Its daily average open interest in Q4 was $40.2 million, up 16% QoQ from $31.3 million to $40.2 million. Furthermore, BTC-PERP was 50% of the average open interest for Q4. By the end of 2024, BTC-PERP open interest stood at $75.2 million. ETH-PERP daily average open interest declined for the second straight quarter, partially due to ETH price struggling relative to the rest of the crypto market in Q4. Its daily average open interest was $15.3 million, down 47% QoQ from $28.9 million. However, by the end of the quarter, ETH-PERP open interest was $26.3 million, 72% higher than the Q4 daily average. Combined, BTC-PERP and ETH-PERP were 69% of open interest in Q4.

After BTC-PERP and ETH-PERP, SEI-PERP averaged the third most open interest in Q4 at $2.8 million. This figure was up 261% QoQ, and SEI-PERP’s share of open interest in Q4 was up 281% QoQ to 3%. SEI-PERP’s rise in open interest was likely attributable to the Vertex deployment on Sei gaining more popularity and usage. Users on Sei are more likely to want exposure to the SEI token. The only other individual market to eclipse a 3% share of open interest in Q4 was SOL-PERP (down 7% QoQ to $2.7 million).

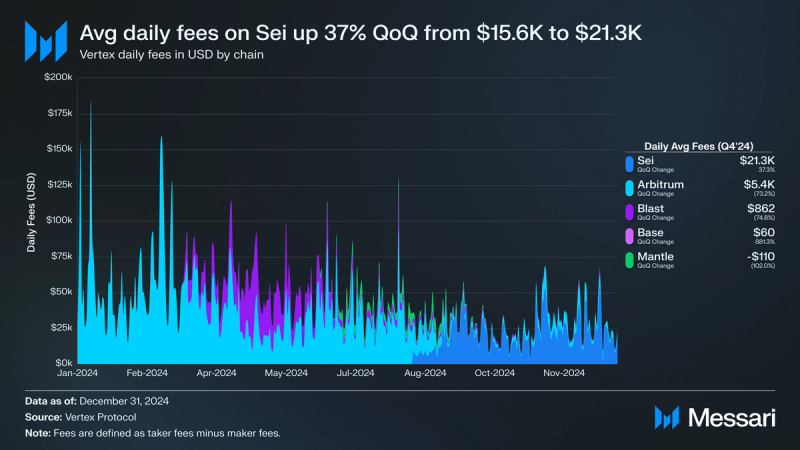

Fees

The Vertex protocol earns from trading fees. Vertex charges a Taker Fee of 2 bps on all taker orders. Maker orders do not have an associated fee. However, a maker rebate of 0.15 - 0.75 bps, depending on the amount of VRTX staked, is given as a rebate on maker orders. As such, fees that accrue to Vertex are taker fees minus the cost of paying out maker fee rebates.

Daily average fees on Vertex were down in Q4, falling 28% QoQ from $38,000 to $27,500. Vertex Q4 fees annualized was $10.1 million. Broken down by chain, the majority of Vertex’s fees (78%) came from Sei. Sei flipped the Arbitrum deployment in fees for the first time in Q4. Daily average fees on Sei were $21,300 (up 37% QoQ from $15,600), while daily average fees on Arbitrum were $5,400 (down 73% QoQ from $20,000). The Sei and Arbitrum deployments accounted for 92% of Vertex’s fees in Q4.

Broken down by markets, BTC-PERP and ETH-PERP took in the majority of fees as they drove the most volume in Q4. Over 73% of Vertex’s fees came from these two markets, up 2% QoQ from last quarter’s 72%. “Other” markets (all non-specified markets on Vertex) accounted for 19% of fees in Q4 (down 13% QoQ), signaling that Vertex has a well-diversified number of fee-earning altcoin markets on the platform.

Market Analysis Market Cap

Market Cap

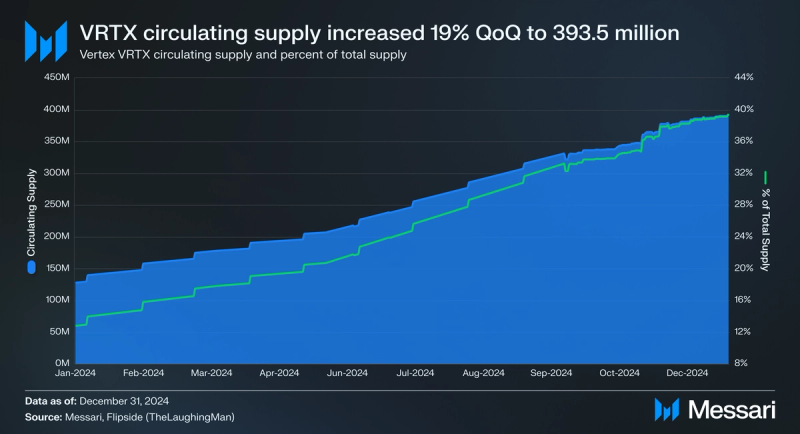

Amidst a market-wide rally, VRTX’s circulating market cap rebounded in Q4, increasing 42% QoQ from $26.6 million to $37.7 million. Additionally, the price of VRTX rose 20% QoQ from $0.08 to $0.10, signaling that the market was able to absorb VRTX supply that unlocked this quarter.

Supply

As previously mentioned, a portion of the VRTX supply was unlocked in Q4. The circulating supply of VRTX increased 19% QoQ from 331.1 million to 393.5 million. As of the end of the quarter, 39.5% of the VRTX supply was in circulation.

Staking Qualitative AnalysisNew Deployments

Qualitative AnalysisNew DeploymentsAlthough Vertex did not deploy on any new chains in Q4, it did announce plans to do so in 2025. On December 18, Vertex announced that they would soon be going live on Sonic, a highly performant EVM L1 blockchain. As a part of this deployment, Vertex was selected as a ‘Sapphire’ winner of the Sonic Boom ecosystem program, which aims to reward the project and its users with S token incentives. Vertex went live on Sonic after Q4 ended in January 2025.

VRTX Vertical ProgramIn Q3, Vertex launched the VRTX Vertical Program, which aims to enhance its tokenomics and promote growth. Stage 1 of the program (effective September 11) reduces VRTX reward emissions by 50% to better align incentives with ecosystem development. Additionally, the distribution of rewards was adjusted to allocate 75% to makers and 25% to takers, shifting from the previous equal split to encourage liquidity provision. The program also transitions reward epochs from monthly to weekly, facilitating smoother onboarding for trading firms and better integration with existing incentive structures.

In Q4, Vertex unveiled Stages 2 and 3 of the program. Stage 2 offers an overhaul of Vertex’s staking system to promote sustainable growth and reward the Vertex community. Key enhancements include:

- Auto-Compounding Rewards: Staked VRTX rewards are automatically compounded to enhance user returns.

- Immediate Access to Maximum Yields: Participants can achieve the highest staking yields from the moment they start staking.

- Flexible Unstaking Options: Users can choose between a 21-day cooldown period for free unstaking or immediate withdrawal with a 10% penalty.

- Diversified Rewards Model: Stakers benefit from three types of rewards: base APY, fee APY (from trading fee buybacks), and loyalty APY (from early unstake penalties).

Staking V2 went live on November 12. As for Stage 3, it focuses on aligning incentives with market makers to enhance liquidity and trading efficiency. By recalibrating rewards and rebates through a dynamic staking model, the program encourages market makers to stake more VRTX tokens, thereby securing better rebates and supporting the protocol's growth. This alignment ensures that as market makers increase their stake, are incentivized to provide deeper liquidity, resulting in improved market conditions for traders and contributing to the protocol's sustainability.

Integrations, Partnerships, & UpgradesVertex made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations, partnerships, and upgrades in Q4:

- Election Markets Launched (Oct. 15) - Vertex launched Election Outcome Markets on Arbitrum and Base, allowing users to predict the winner of the 2024 U.S. Presidential Election by trading TRUMP and HARRIS outcome tokens. The token values reflect market predictions and are redeemable only if the corresponding candidate wins.

- Take Profit & Stop Loss Support Added (Oct. 18) - Users can now set a Take Profit and Stop Loss in the perp order form.

- Passkeys Wallet Partnership (Oct. 21) - Vertex partnered with Passkeys Wallet to streamline user onboarding, enabling effortless wallet creation using FaceID or Touch ID for seamless trading.

- Chainlink CCIP Support (Nov. 8) - Vertex has integrated Chainlink CCIP to enable secure cross-chain transfers of VRTX, starting with Arbitrum, Base, and Blast, enhancing interoperability and accessibility.

2024 marked significant milestones for Vertex, demonstrating strong annual growth and ecosystem advancements despite Q4 slowdowns. Total value locked (TVL) increased 89% YoY to $81.4 million, with open interest surging 110% QoQ in Q4 to $133.6 million, signaling heightened demand for leverage. While trading volumes and daily trades declined QoQ, they reflected robust annual trends, with Vertex’s perps markets contributing $27.13 billion in Q4 volume. Sei’s deployment emerged as a key driver, overtaking Arbitrum in volume due to Vertex’s successful trading rewards programs.

VRTX tokenomics saw notable progress in Q4, with staking adoption rising to 71% of circulating supply following the launch of Staking V2. Strategic initiatives, such as the VRTX Vertical Program and integrations like Chainlink CCIP, strengthened Vertex’s position as a leading decentralized exchange. Additional advancements, including plans to deploy on Sonic and the introduction of Election Outcome Markets, further expanded Vertex’s ecosystem utility. With improved tokenomics, innovative incentives, and a growing ecosystem, Vertex is well-positioned to capitalize on opportunities in 2025.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.