and the distribution of digital products.

State of Tezos Q4 2024

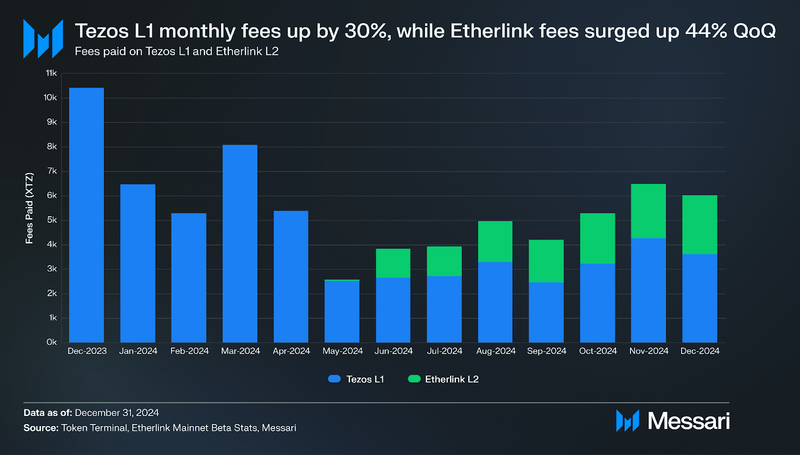

- Tezos Layer 1 experienced a 30.4% increase in revenue from transaction fees QoQ (90.8% in USD terms).

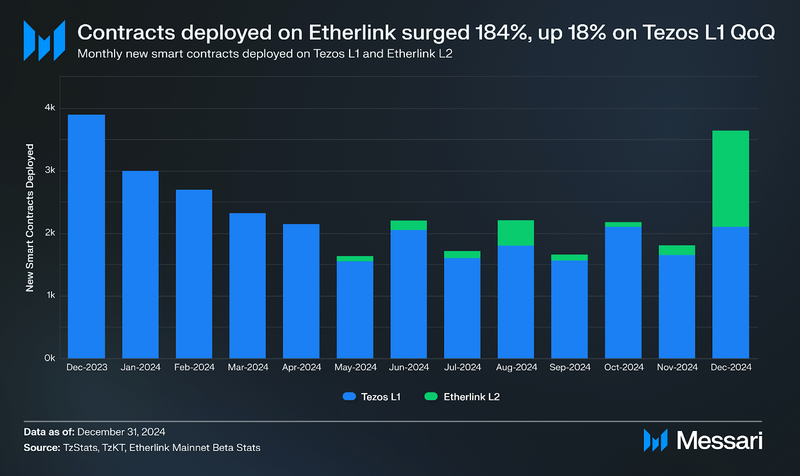

- Etherlink experienced a 184% surge, with over 1,700 new contracts deployed. Tezos saw an 18% rise in contract deployments, totaling over 5,800 new contracts.

- Daily active addresses (DAA) on Tezos Layer 1 grew by 37% QoQ, averaging 1,800 unique addresses per day

- The Quebec protocol upgrade progressed through governance phases, aiming to reduce block time to 8 seconds and refine staking mechanisms.

Tezos (XTZ) is a Liquid Proof-of-Stake (LPoS) blockchain network known for its strong focus on security, upgradeability, and democratic community governance. Its smart contracts on Layer-1 (L1) are implemented using the Michelson language, designed to facilitate formal verification while also offering Ethereum virtual machine (EVM)-compatibility through Etherlink, a community-supported Layer-2 (L2). The network features on-chain governance and self-amending functionality, enabling stakeholders to adopt protocol upgrades without requiring a network hard fork. Recent upgrades on Tezos have focused on scalability and performance through Smart Rollups and a Data Availability Layer (DAL). The Mumbai upgrade introduced Smart Rollups, a L2 scaling solution that enables throughput beyond 1 million TPS and customization to adapt to specific use cases, such as implementing new coding environments. The Paris upgrade reduced L1 block time from 15 to 10 seconds, bringing 20-second finality. It also introduced the DAL, a data-availability solution that boosts Smart Rollup scalability and is part of the Tezos protocol. Finally, the Paris upgrade implemented a new staking mechanism and Adaptive Issuance, which adjusts token issuance based on the staked ratio of XTZ. In Q3, developer teams Nomadic Labs, Trilitech, and Functori proposed the Quebec upgrade, aiming to reduce block time to 8 seconds, enhance staking, and adjust Adaptive Issuance to curb inflation. By the end of Q4, this proposal had moved to the final ‘Promotion’ voting phase. Current R&D work focuses on realizing ‘Tezos X,’ a proposed roadmap for boosting the blockchain’s performance, composability, and interoperability, with the goal of delivering a "cloud-like" developer experience. Leveraging Smart Rollup technology and the data-availability layer, it enables developers to build complex, scalable applications using mainstream programming languages, with improved connectivity across the ecosystem.

Website / X (Twitter) / Discord

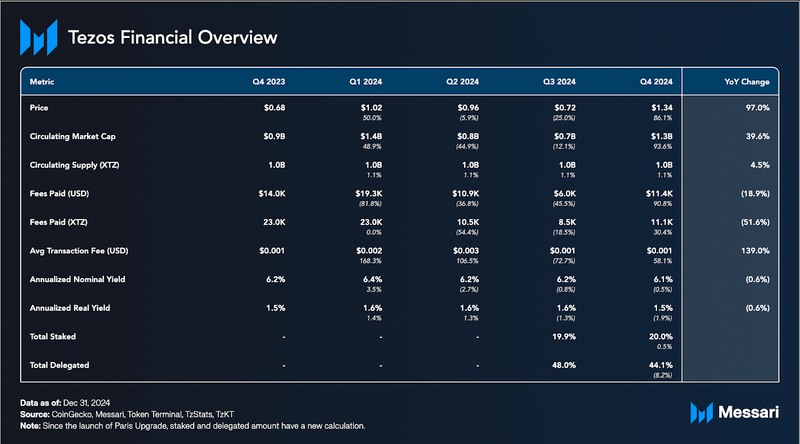

Key Metrics Financial Overview

Financial Overview Revenue

Revenue

In Q4 2024, Tezos L1 transaction fees rose to 11,100 XTZ, marking a 30.4% QoQ increase in XTZ terms (90.8% in USD terms). Etherlink, Tezos' first EVM-compatible, non-custodial smart rollup, experienced a significant 44% QoQ growth, reaching 6,669 XTZ . As a cost-efficient L2 solution, Etherlink Mainnet's rapid growth outpacing L1 aligns with expectations for its scalability and cost advantages.

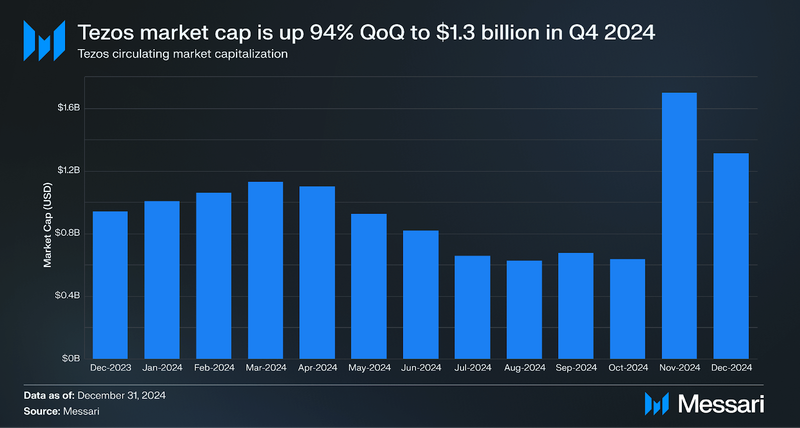

Supply and Market CapitalizationXTZ, the native token of Tezos, is used as a medium of exchange and for staking, delegating, and facilitating governance. As of the end of Q4, the circulating supply was 1.0 billion XTZ. The Paris upgrade introduced the Adaptive Issuance mechanism, which is designed to incentivize a secure network, while keeping inflation at a minimum. The target for staking is 50% of total XTZ supply, and the mechanism dynamically adjusts staking rewards to achieve this with the least possible XTZ issuance. The aim is to minimize the dilution of XTZ, improve liquidity, reduce inefficiencies, and make XTZ better suited for real-world use cases. The annualized real yield for validators remained at 1.5%, with a QoQ decrease of 1.9%.

Tezos' market capitalization reached $1.3 billion in Q4 2024, a substantial 94% increase. YoY market capitalization grew 40%. This growth was driven by increased demand for the gas token, reflecting heightened activity and adoption of the network in 2024.

Network OverviewUsage

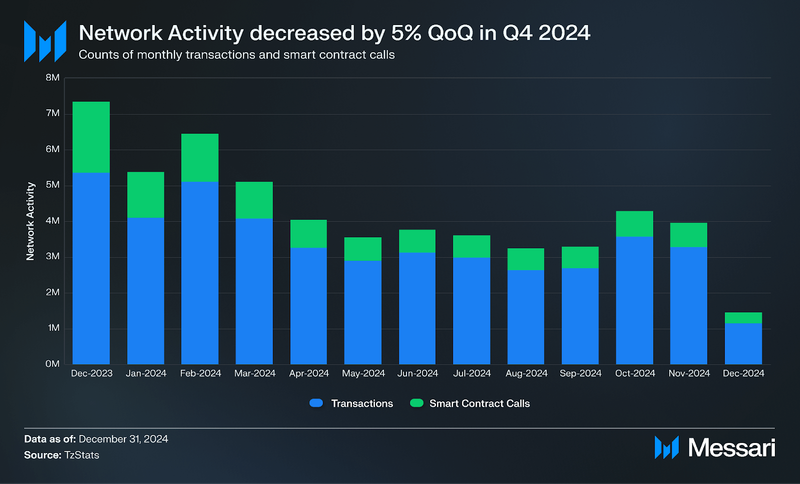

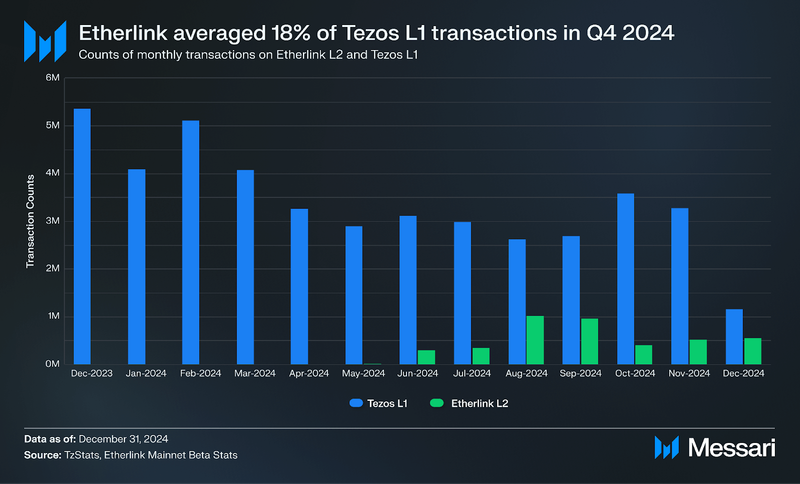

In Q4 2024, overall network activity on Tezos declined by 5% QoQ, with average monthly transactions and contract calls totaling 3.2 million. This trend aligns with expectations as activity shifts to Layer 2 solutions, such as Etherlink, which offers cheaper and faster transactions, supporting the network's scaling objectives.

In Q4 2024, network activity on Etherlink averaged over 485,000 monthly transactions, representing 18% of Tezos L1's transaction counts. This highlights the rapid adoption of Etherlink within just six months of its launch, showcasing its growing role as a scalable L2 solution within the Tezos ecosystem.

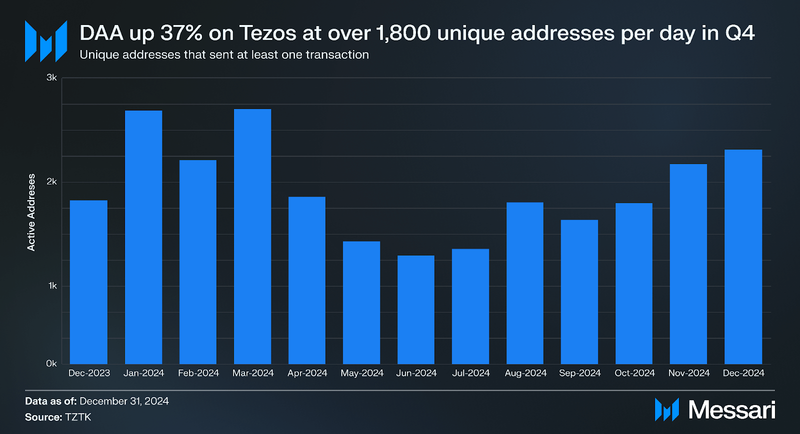

In Q4 2024, Tezos experienced a 37% QoQ increase in daily active addresses (DAA), averaging 1,800 unique addresses per day. Despite declining total transactions, the rise in unique wallets suggests an expanding user base, indicating that more individuals are engaging with the network QoQ.

Network UpgradesQuebec Protocol UpgradeOn Sept. 13, 2024, Nomadic Labs, TriliTech, and Functori proposed the Quebec protocol upgrade for Tezos, marking the 17th protocol upgrade in the network’s governance history. The upgrade aimed to enhance Tezos' performance and staking mechanisms. Two versions, Quebec A and Quebec B, were introduced during the ‘Proposal phase,’ which concluded on Sept. 28, 2024.

The B proposal advanced to the ‘Exploration’ phase, running from September 28 to October 12, but failed to achieve the required 80% supermajority. On Oct. 26, 2024, a modified version of Quebec B, dubbed Qena, advanced to the Exploration phase but also didn’t achieve supermajority. In response, the Quebec developer teams introduced a revised Quebec proposal on November 9, which completed the Proposal phase on November 24. The revised proposal progressed through the Exploration phase until December 8, followed by a two-week ‘Cooldown’ phase ending on December 22. The ‘Promotion’ phase began on December 22, 2024, with voting scheduled to conclude on Jan. 6, 2025, determining if the upgrade will be applied to the Tezos mainnet.

Key Changes Introduced by the Quebec Upgrade:

- Reduced Block Time: Block times were reduced from 10 seconds to 8 seconds, improving transaction throughput and reducing finality time to 16 seconds without requiring significant hardware updates for bakers.

- Adaptive Maximum Issuance: The adaptive issuance mechanism, introduced in the Paris upgrade, was refined. The maximum issuance rate now adjusts based on the network's proximity to the target staking ratio of 50%, reducing inflationary pressure as the network approaches this threshold.

- Reduced Weight for Delegated Funds: The weight of delegated funds in a baker's staking power was reduced from 50% to 33%, decreasing the influence of delegated stake on consensus rights and encouraging more direct staking.

- Improved Delegation Rights Computation: The upgrade adjusted the method for calculating a baker’s minimum delegated balance per cycle, addressing the dilution of delegation rights and improving the staking user experience.

- Increased External Stake Limit: The maximum amount of external stake a baker can accept was raised from five to nine times their self-staked balance, allowing bakers to expand their staking capacity further.

The Quebec upgrade focuses on improving network efficiency, reducing inflation risks, and balancing staking incentives. Many of these enhancements are intended to further progress towards Tezos X and they serve as an illustration of Tezos’ long-term upgradability.

Copilot Insights: Tell me more about how Tezos works.Octez Software UpdatesIn Q4 20244, Tezos experienced multiple updates to its Octez Software, focusing on network performance, stability, and protocol enhancements across three key releases.

- On Oct. 2, 2024, Octez v20.3 was released with an experimental feature allowing the use of a new storage backend called Brassaia. The node’s storage version and snapshot formats were updated to improve compatibility and data management. Several outdated components were removed, including the proxy server binary and older command options related to previous protocol versions like Oxford and Paris. The update also simplified how baker nodes handle staking rounds, improving clarity and reducing unnecessary options. Additionally, refinements were made to the protocol environment, and new remote procedure call (RPC) methods were added to enhance network diagnostics and peer monitoring.

- On Nov. 14, 2024, Octez v21.0 introduced protocol environment version 13 with improvements targeting scalability and rollup performance. The node storage system was upgraded to accommodate the growing number of blocks produced per cycle, enhancing overall storage efficiency. Block propagation speed was improved, while the Data Availability Layer (DAL) node received stability enhancements. For Smart Rollup nodes, the update introduced automated message execution and additional performance metrics for better state and health monitoring. Clearer logging was also added, making it easier for node operators to identify configuration issues. Nodes upgrading from older versions required a manual data migration to align with the new storage structure, with varying completion times depending on the node’s history retention mode.

- On Dec. 17, 2024, Octez v21.1 was released, focusing on improving peering stability and reducing unnecessary reconnection attempts. Changes were made to prevent nodes from repeatedly attempting to connect with unreachable peers and to avoid duplicate peer connections. The release also introduced regular retries for resolving bootstrap node addresses, enhancing initial network connectivity. Additionally, a command-line option related to DAL node timeout settings was removed to simplify node configurations and reduce potential errors.

In Q4 2024, more than 5,800 contracts were deployed on Tezos L1, an 18% QoQ increase. Meanwhile, Etherlink saw over 1,700 new contracts deployed, a remarkable 184% QoQ surge, underscoring strong builder adoption of the L2 solution.

As of November 2024, Tezos has over 167 monthly active developers across over 3,600 repos. From September 2024 to November 2024, average monthly new developers grew from ~38 to 54.

Security

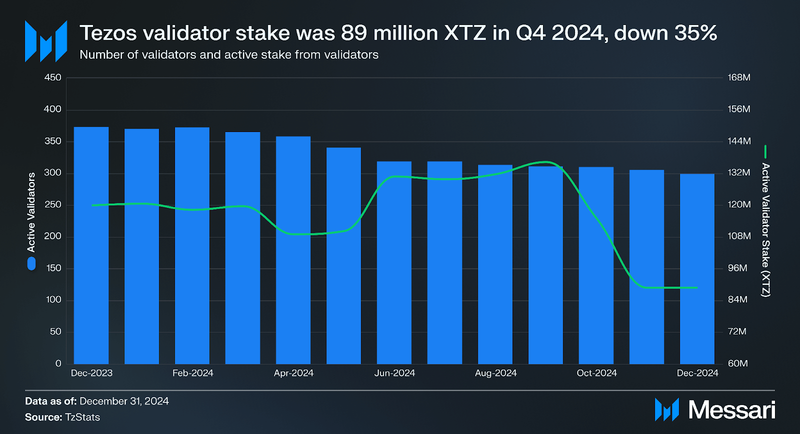

Tezos uses a Liquid Proof-of-Stake mechanism, which requires validators (known as “bakers” in the Tezos ecosystem) and delegators to stake XTZ as collateral to secure the network. Rewards and fees collected from transactions are paid to validators and delegators to maintain the network. Active validators and active validator stake have remained consistent over the last three quarters. In Q4, active validators saw a 4% decrease, and validator stake decreased by 35%, QoQ reaching 89 million XTZ.

Delegators stake XTZ on active validators and receive a portion of fees and rewards collected. In Q4, active delegators decreased by 1.5%, however stake from delegators increased by 2.4% QoQ.

Adaptive Issuance dynamically adjusts the issuance of XTZ based on the proportion of staked tokens to the total supply. At the end of each blockchain cycle, the issuance rate is modified to target a protocol-defined staking level, currently set at 50%. This mechanism incentivizes staking to provide stable security for the network.

The Tezos network has shown consistent year-over-year stability in the number of validators and delegators, as well as in staked XTZ. This stability is crucial for secure and scalable L2 growth. Validators in the ecosystem are also decentralized geographically and by host service providers, further ensuring the network's resilience and security.

GovernanceTezos utilizes a Liquid Proof-of-Stake mechanism, enabling staked XTZ to be used for both network security and governance. The network's self-amending blockchain reduces the need for hard forks by employing onchain governance for protocol upgrades. Users delegate their XTZ to validators who participate in stake-weighted voting. The governance process is divided into five periods, spanning approximately 2 months and 10 days.

To complement protocol governance, Tezos Commons established the Tezos Ecosystem DAO, which manages and allocates XTZ for community projects. The DAO’s initial funding came from NFT sales on Objkt and donations from ecosystem participants.

Etherlink follows an onchain governance model similar to Tezos L1, ensuring fairness and transparency. Governance for Etherlink is self-amending (meaning no hard fork), controlled by L1 bakers, and pilots both upgrades and the sequencer operator. The governance process fully happens on Tezos L1 through dedicated smart contracts, and consists of three stages: a Proposal period, a Promotion period, and a Cooldown period. The Etherlink governance periods are synchronized with L1 governance periods. The first upgrade for Etherlink was implemented successfully shortly after launch.

Ecosystem Overview Etherlink Adoption, Gaming, and NFTs

Etherlink Adoption, Gaming, and NFTsQ4 2024 saw a significant uptick in Web3 gaming and NFT activity on Tezos, with Etherlink playing a key role in expanding the ecosystem. Etherlink, an EVM L2 built on Tezos' Smart Rollup technology, offers 500ms transaction finality and low fees while maintaining Tezos' established security and governance framework. It is designed to support applications requiring high throughput and cost efficiency while enabling developers to deploy Ethereum-based smart contracts directly on the Tezos network.

New integrations and project launches marked this expansion in gaming and NFTs. On Oct. 2, 2024, Etherlink integrated with Rarible, a prominent NFT marketplace, through the launch of the BattleRise Founder Pass, the first gaming NFT on Etherlink. The Founder Pass provided in-game perks, including a share of BATTLE tokens, staking rewards, exclusive items, and the ability to rent the pass via an in-game NFT marketplace. Beyond this launch, the gaming sector on Etherlink continued to grow with projects like Sugarverse, a Web3 gaming platform developing multiple community-driven games. Its first release, Sugar Match, a match-3 puzzle game, incorporates tradable NFTs and reward mechanisms, further demonstrating Etherlink's capacity to support diverse gaming experiences. Etherlink also saw collectible drops including two sold-out collections MDCL and Chapter 00.

Alongside gaming, Tezos also made strides in real-world asset (RWA) tokenization using Etherlink. Uranium.io launched as a decentralized platform allowing fractional ownership of physical uranium stored in regulated depositories, tokenized as Triuranium octoxide (U3O8). Expanding its reach in asset tokenization, VNX, a cryptocurrency platform, launched stablecoins on the Tezos blockchain, reflecting growing institutional interest in leveraging Tezos for financial instruments, though this was not directly linked to Etherlink. The Etherlink ecosystem currently has 100+ projects developing on the network.

Copilot Insights: Tell me more about Etherlink and the Tezos X vision.DeFi

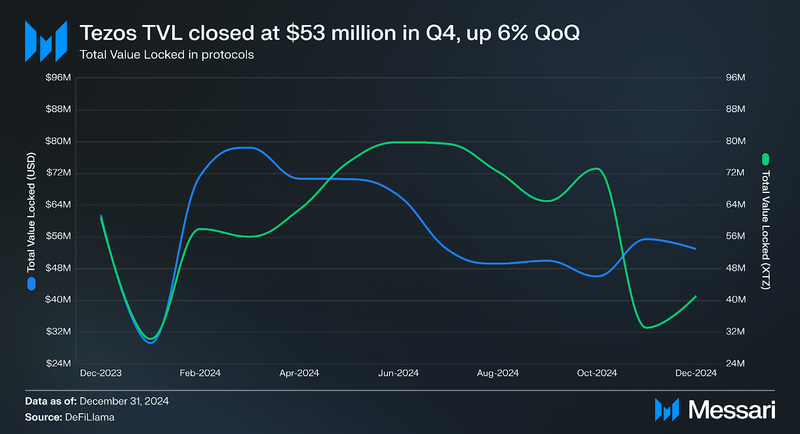

Total value locked (TVL) in USD was up 6% QoQ in Q4 2024, closing at $53.0 million. This increase was driven by the increase in XTZ's price, since TVL in XTZ decreased by 37% QoQ. Etherlink has over $1.5 million in TVL, almost doubling since the end of Q3. This indicates the decrease of TVL on Tezos is due to a movement of liquidity from Tezos to Etherlink, which allows users to take advantage of lower fees and faster transactions.

Most TVL in crypto exists on EVM-compatible networks. The launch of Etherlink gives developers the ability to deploy EVM-compatible protocols on Tezos, attracting new communities to the ecosystem. Etherlink’s launch expands Tezos' reach by drawing users and builders from other EVM networks, increasing its presence in the DeFi space. At the end of Q4, over $2.6 million in assets were bridged from other EVM chains.

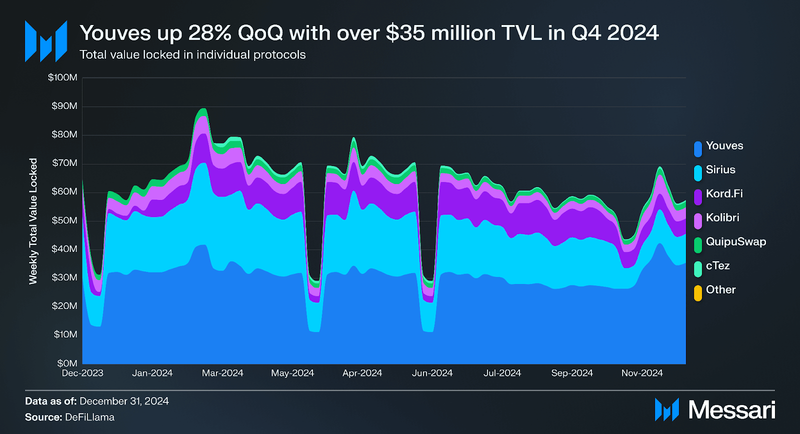

Youves, a decentralized synthetic assets application, is the largest protocol by TVL, securing over $35.4 million in assets, up 28% since Q3. Sirius, a liquidity-baking protocol for XTZ/tzBTC pools, had the second-largest TVL at over $10.1 million. Kord.Fi, another liquidity-baking protocol for XTZ-tzBTC, had the third-largest TVL with over $5.3 million. With the capital efficiency improvements in tzBTC 2.0, these liquidity-baking protocols may provide additional incentives and thus increase their TVL.

The largest protocol on Etherlink is IguanaDEX, a concentrated liquidity decentralized exchange with over $1.12 million TVL and $25.5 million in volume in Q4. Superlend, supported by DeFi Catalyst Explorer (DCA), is the largest lending protocol on Etherlink, with over $187,000 in TVL.

NFTs and Art

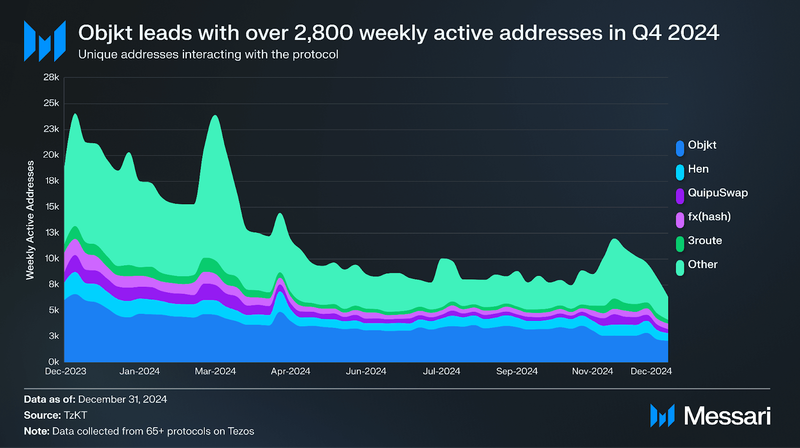

In Q4 2024, Objkt dominated the Tezos NFT market with an average of 2,800 weekly active addresses, capturing 33% of the user market share. NFT sales dropped 12.2% QoQ to $773,000, and unique active users declined 32.3% to 16,500.

Art on Tezos was present at Paris Photo with Objkt.one, curating a booth dedicated to world-renowned digital artist Lorna Mills. During Miami Art Week, six days of programming took place across five different locations, including Scope Art Fair and the Design District with ICA Miami.

The Tezos Foundation announced Paintboxed Tezos World Tour, a partnership with Art Meta, that will see a new generation of creators introduced to the groundbreaking 1980s digital art tool to create iconic images such as the MTV logo. The partnership will culminate in a selling exhibition during Art Basel 2025 in Basel.

The ARTicle Series continued to spotlight digital and generative artists within the ecosystem. Meanwhile, Sotheby's auctioned two artworks on Tezos during its Digital Art Day Auction.

Agoria and InfiniteInk produced a generative AI custom music minting experience with 500 editions. A unique edition was sold as 1/1 and marked the highest music sale on Tezos (8500xtz).

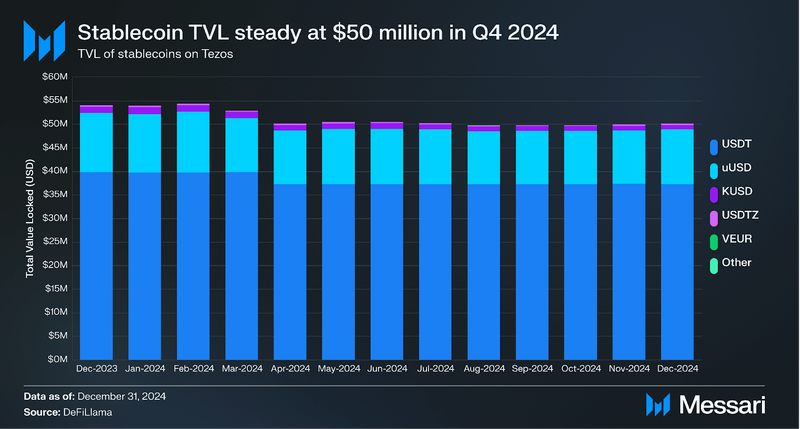

By the end of Q4 2024, Tether's USDT issuance on Tezos exceeded $37.2 million, making it the largest stablecoin on the network. It was followed by uUSD, which reached $11.7 million. The largest stablecoins exclusively issued on Tezos were Kolibri’s kUSD and USDTez’s USDtz, which had over $877,000 million and over $295,000 in stablecoins issued, respectively. In September 2024, VNX, a leading European tokenization platform, launched VNX EUR (VEUR) and VNX CHF (VCHF) stablecoins on Tezos, VEUR closed Q4 with over $2,000.

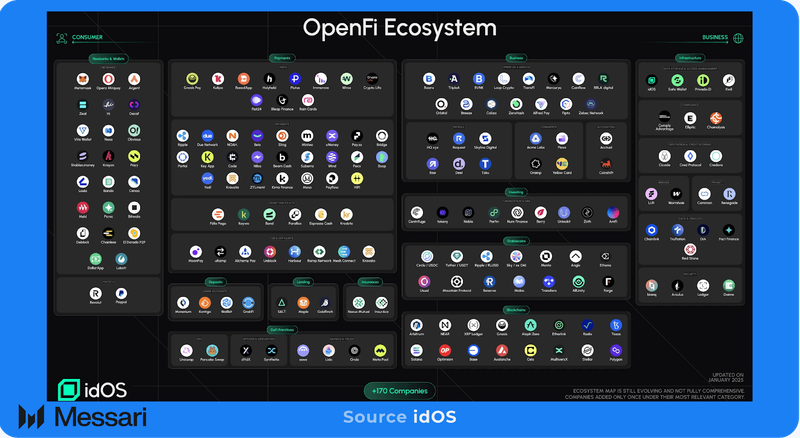

Partnerships and IntegrationsTezos was adopted into the idOS network's OpenFi initiative, an effort to develop a modular, interoperable financial system through collaboration with multiple blockchain entities. Other partners in the consortium include Arbitrum, Circle, Ripple (via its RippleX platform), NEAR Protocol, Aleph Zero, and Radix. OpenFi aims to create a decentralized financial ecosystem where blockchain networks can seamlessly interact and share data, expanding cross-chain functionality for decentralized applications (dApps).

The inclusion of Tezos in the OpenFi initiative signifies the role played by Tezos technology in contributing to the development of the interoperable financial framework.

Tezos' ability to attract institutional interest continued in Q4’2024, with several collaborations highlighting the protocol’s growing presence in traditional finance. As Tezos experiences growth in the gaming sector, with projects like Sugar Gaming and BattleRise expanding on the network, investors such as Quantix Capital have noticed, betting $1 million on Tezos' long-term potential in the gaming sector. This investment, made through TZ APAC, Tezos' Singapore-based adoption hub, aims to boost blockchain gaming innovation on the platform. Quantix Capital’s Managing Director, Jake Seltzer, emphasized that the investment goes beyond financial backing, aiming to empower creators to reshape the future of interactive experiences.

Additionally, partnerships with infrastructure providers and Web3 tool developers ensured that the Tezos developer ecosystem was fully supported in Q4. The Tezos Foundation issued a grant to ECAD Labs to continue developing Tezos Taquito, a Web3 library designed to simplify the interaction between developers and smart contracts on the Tezos blockchain. This tool has become a critical resource for building decentralized applications on the network. The foundation also supported Signatory, a remote signing solution to enhance the security and flexibility of transaction signing within the Tezos ecosystem.

Finally, in the public sector, Electis, a secure electronic voting platform, integrated Tezos' blockchain technology to support voting infrastructure for 60,000 schools across France, with hopes of creating secure, transparent, and verifiable digital elections. Tezos' blockchain is used to ensure vote immutability, while Electis employs encryption and decentralized storage to safeguard data integrity.

Future DevelopmentAs Tezos continues to evolve, several key initiatives are shaping the future of its ecosystem. Here are the major upcoming developments:

- JavaScript Rollup: Jstz, a Smart Rollup, will enable developers to build and deploy JavaScript-based smart contracts on Tezos. The first JavaScript applications are expected to launch, broadening Tezos' developer base by tapping into the vast JavaScript ecosystem.

- Tezos X Roadmap:

- 2025:

- Integration with the Data Availability Layer (DAL), enabling high-throughput communication between Etherlink rollups and the main sequencer, further scaling applications.

- Launch of Michelson Rollup, creating an execution environment compatible with Tezos L1, with instant asset transfer to Etherlink.

- 2026: Introduction of Canonical Rollup, providing an integrated execution environment with instant cross-application transactions across different programming languages.

- 2025:

In Q4 2024, Tezos demonstrated significant ecosystem growth, contract deployments on L1 increased by 18% QoQ, with over 5,800 new contracts launched. Transaction fees collected on L1 surged by 30.4% QoQ in XTZ terms (90.8% in USD terms). Meanwhile, Etherlink, Tezos' first EVM-compatible L2, saw rapid adoption, averaging over 485,000 transactions per month, roughly 19% of L1's activity. Contract deployments on Etherlink rose by an impressive 184%, reaching over 1,700 new contracts, underscoring strong builder adoption within just six months of its launch.

The ecosystem also observed a 37% QoQ increase in daily active addresses, averaging 1,800 unique addresses per day, while Etherlink surpassed 117,000 unique wallets since its May 2024 launch. These metrics highlight growing user engagement across both L1 and L2 solutions.

With advancements in governance, including the ongoing Quebec upgrade, and strides in sectors like gaming, DeFi, and real-world asset tokenization, Tezos continues to strengthen its position as a leading blockchain ecosystem. The network's focus on scalability, interoperability, and builder adoption sets a strong foundation for sustained growth and expansion into 2025 and beyond.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.