and the distribution of digital products.

State of Sentinel Q2 2024

- In Q2 2024, Sentinel announced the integration of an AI data layer, enhancing its functionality to support peer-to-peer marketplace operations and AI capabilities.

- The Sentinel Growth DAO introduced a new blockchain explorer for Sentinel dVPN, developed in collaboration with Interbloc. Available on the Sentinel website, this tool offers a dedicated platform for monitoring blockchain transactions and related activities.

- Active sessions increased by 9% from 42,000 to 46,000, indicating a rise in user adoption of dVPNs

- Average daily downloads and uploads increased by 40% and 45%, reaching 4,934 GB and 310 GB, respectively.

- Following the approval of the Sentinel Growth DAO's additional funding proposal, Sentinel announced its sponsorship of Cosmoverse 2024 in Dubai.

Sentinel (DVPN), built on the Cosmos SDK, serves as a foundational infrastructure layer for decentralized VPN (dVPN) services and other decentralized applications. Founded in 2017, Sentinel addresses the challenges of centralized VPNs by creating a peer-to-peer bandwidth marketplace through a global node network. Initially launched on Ethereum, Sentinel transitioned to its own chain in the Cosmos ecosystem in 2018.

Sentinel features a zone/hub architecture and employs a Delegated Proof-of-Stake (DPoS) consensus mechanism via Tendermint, with a fixed number of validators. While all applications are currently hosted on the Sentinel Hub, zones can be created to support specific throughput requirements. Decentralized applications (Dapps) can interact via the Inter-Blockchain Communication (IBC) protocol within the Sentinel and Cosmos networks. Sentinel integrates the V2Ray protocol for traffic obfuscation and includes features such as “proof-of-bandwidth,” a relay network, and onchain querying capabilities to minimize reliance on intermediary nodes. For a full primer on Sentinel, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

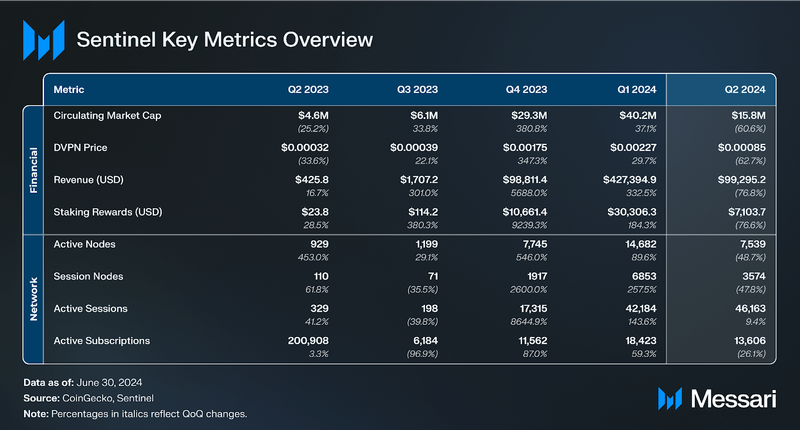

Key Metrics Performance AnalysisNetwork Overview

Performance AnalysisNetwork OverviewThe Sentinel protocol comprises infrastructure SDKs, CLIs, and a consensus mechanism that enables individuals and entities to build and interact with the network. The Sentinel ecosystem includes four key role players:

- Validators: Overseeing governance and consensus within the Sentinel Hub, proposing and validating blocks, and earning DVPN coins as rewards.

- Users: End-users accessing dVPNs or other decentralized applications built on Sentinel.

- Node Operators: Individuals or community members setting up nodes on their devices or external hardware to monetize unused bandwidth.

- Application Developers: Developers creating dVPNs or other decentralized applications using Sentinel infrastructure.

Sentinel creates a peer-to-peer marketplace connecting:

- Demand: Users seeking secure bandwidth and access to geo-restricted content.

- Supply: Node hosts providing bandwidth for Sentinel dVPN or other applications built on the network.

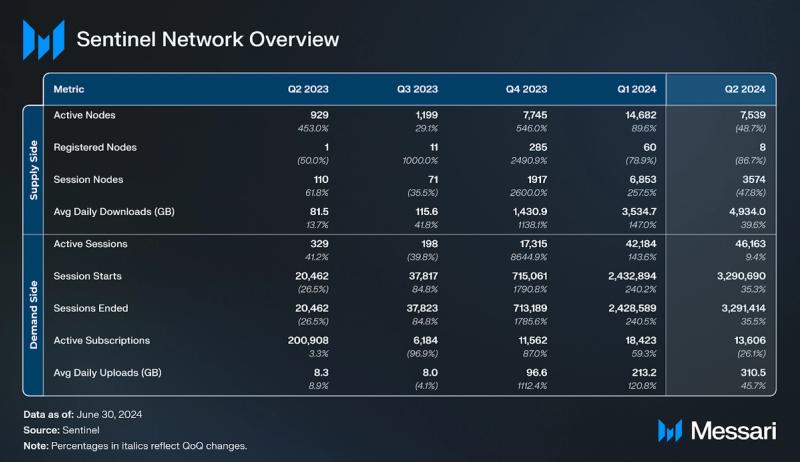

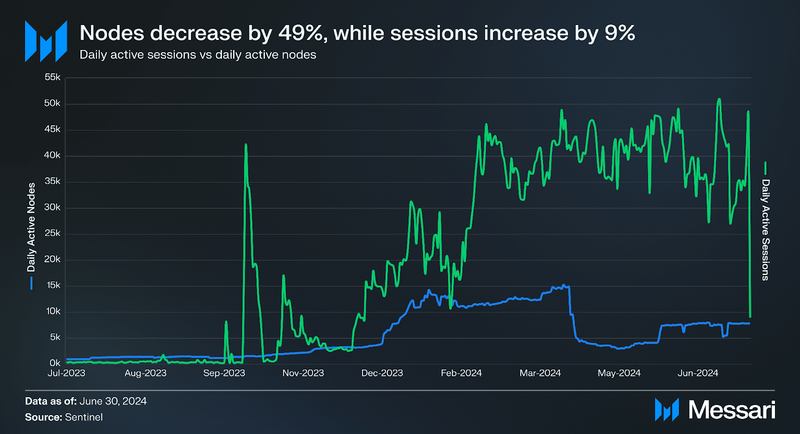

On the supply side, active nodes have decreased by 49%, from 15,000 to 8,000 QoQ. In contrast, active sessions have increased by 9% on the demand side, from 42,000 to 46,000, indicating a rise in user adoption of dVPNs. Sentinel’s average daily downloads and uploads have risen by 40% and 45%, to 4,934 GB and 310 GB, respectively, signifying higher bandwidth consumption for both downloads and data sharing in Q2 2024. However, active subscriptions have dropped by 26%, from 18,000 to 14,000 in Q2 2024.

The decline in active nodes on the supply side and active subscriptions on the demand side, alongside rising usage metrics, suggests a significant shift in consumer behavior and a resurgence in user engagement. However, the decrease in active node hosting was primarily due to the recent limitation on the number of nodes per IP subnet, reduced from unlimited to a maximum of five. This change was implemented to enhance network resilience, as it makes it more difficult for nation-states to block access to the entire network when a subnet can only host five nodes. Additionally, Sentinel leveraged V2Ray and SOCKS5 to bypass the Great Firewall and expand into China, which initially boosted adoption. However, the regulatory challenges, including cease and desist letters, likely contributed to a decline in both user and node adoption in Q2 2024.

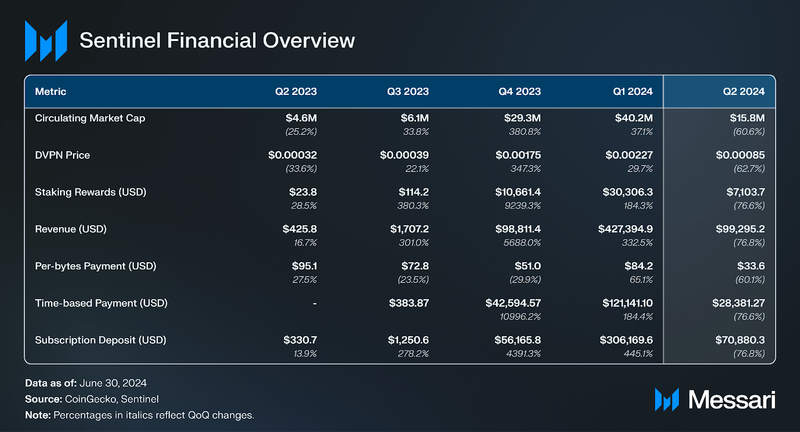

Financial OverviewThe majority of revenue on Sentinel is generated from payments for bandwidth. DVPN tokens can be used to purchase bandwidth from network node hosts, enabling access to dVPN services. There are three primary methods for paying for bandwidth:

- Pay-as-you-go: Users can directly pay for the desired amount of bandwidth.

- Periodic Subscription: Users pay recurring fees in fiat or other currencies, which are then converted to DVPN tokens for node hosts.

- Time-based Payment: Users can pay for bandwidth on an hourly basis.

Revenue generated by the dVPN node hosts, declined by 77% QoQ from $427,000 to $99,000. The decrease in aggregated service provider revenue was mainly due to subnet restrictions and a 77% decrease in subscription deposits, which are the highest revenue generators. This is primarily due to the subnet restriction. Staking rewards also fell, impacted by a reduction in the number of node operators, leading to fewer staked tokens and a 77% depreciation in DVPN’s price.

Apart from price depreciation, which led to a decrease in staking rewards, the reduction in the number of node operators also impacted revenue. As 20% of earnings from dVPN node operators are distributed to DVPN stakers, there was a substantial decrease of 91% QoQ, from $8,000 to $700.

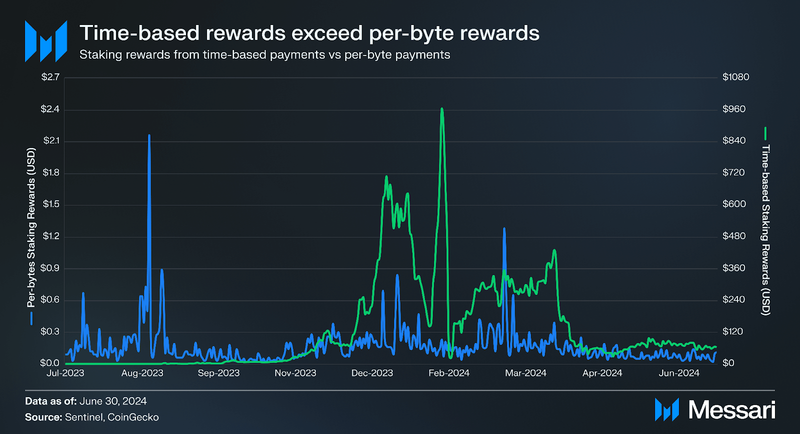

Staking rewards from time-based payments have surpassed those from the pay-as-you-go (per-byte) method, suggesting a shift in user preference and a change in the revenue generation strategy. However, staking rewards have decreased overall across both payment models. For time-based payments, staking rewards dropped from $30,000 to $17,000, reflecting a 45% decrease, QoQ. Similarly, for the pay-as-you-go (per-byte) method, staking rewards fell by 22%, from $21 to $17.

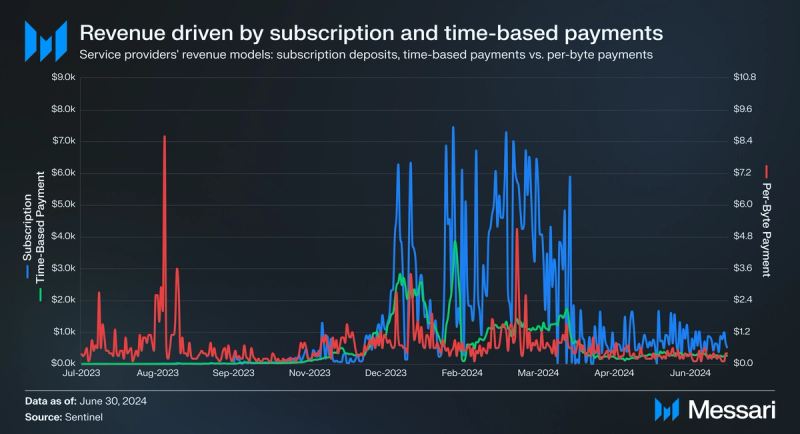

Following the protocol upgrade in September 2023, Sentinel’s session count increased due to the introduction of onchain subscriptions and time-based payments. These new payment models now generate the highest revenue. Previously, Sentinel supported peer-to-peer transactions where community-hosted dVPN nodes priced their bandwidth services per GB. The upgrade enabled nodes to set monthly rates or custom time periods for unmetered bandwidth usage. This change allowed dVPN applications to aggregate nodes, lock tokens with them to create subscription plans, and offer unlimited access at a flat monthly rate.

This model is similar to centralized VPN services, where users pre-pay for bandwidth and applications resell it. This transition indicates a move towards a more familiar Web 2.0 payment approach, as opposed to peer-to-peer bandwidth sharing.

As shown in the plot, the subscription and time-based payment models have significantly surpassed the revenue generated by the original per-byte payment model. In Q2 2024, the subscription-based model generated $71,000, and the time-based payments brought in $28,000, compared to just $37 from the per-byte payment model.

Price vs Market Cap

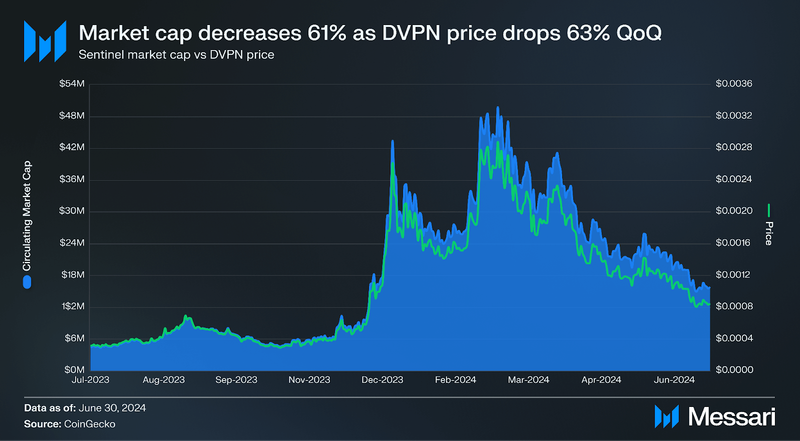

After declining steadily, Sentinel's DVPN saw a significant drop in rank by the end of Q2. DVPN's rank fell from 729 to 854 despite an increase in circulating supply from 17 billion to 18.64 billion DVPN. The market circulating market cap shrank by nearly 61%, decreasing from $40 million to $16 million, while the price of DVPN plummeted 63% QoQ, from $0.0023 to $0.00085. This was likely due to a market correction following high industry-wide activity in Q4 2023.

Qualitative AnalysisGovernanceIn the Sentinel network, governance operates through a DPoS consensus mechanism. This system reduces energy consumption and improves scalability, with blocks created approximately every seven seconds. The network currently has a fixed number of 80 validators. Validators earn the right to validate transactions by staking a minimum of 5 million udVPN tokens, equivalent to 5,000 DVPN tokens. They also gain voting power from delegators who allocate their tokens to chosen validators, enhancing the validators' chances of being selected. Delegation can be done through a Cosmos network-compatible wallet such as Leap, Keplr, or Cosmostation. The active set of validators responsible for transaction validation is determined by the number of tokens staked by both validators and their delegators.

There are three types of validator statuses:

- Active: Validators with enough voting power delegated by themselves and other stakers. They actively validate transactions and earn rewards for themselves and their delegators.

- Inactive: Validators that do not have enough voting power but can become active when their voting power increases. While inactive, they cannot validate transactions or earn rewards.

- Jailed: Validators are punished for malicious behavior. They cannot temporarily validate transactions or earn rewards for themselves and their delegators.

Staking is crucial for the governance mechanism as it grants voting rights to delegators and involves the risk of slashing, where tokens can be lost if a chosen validator acts maliciously or negligently. This encourages careful selection of validators to ensure network security and efficiency. Active participation in staking prevents value dilution, as non-participants risk seeing their token value decrease relative to those actively staking.

This participatory process, facilitated through the Sentinel Hub, has resulted in 45 proposals being passed to date, with three approved in Q2 2024.

Proposal #49: Sentinel Growth DAO Fund Request

In Q2, the Sentinel Growth DAO requested additional funds from the community pool to enhance the Sentinel Network. The funds would be used to support further development of the dVPN app suite, Dragon VPN, V2 APP, Javascript SDK, Native Explorer, dvpn.news, and the launch of Raspberry Pi residential node devices. Additionally, the DAO plans to sponsor Cosmoverse 2024 in Dubai to re-establish its presence in the Cosmos community.

Proposal #51: Reduce Maximum Block Size

This proposal sought to reduce the maximum block size to address performance issues reported as asa-2023-002. Issues observed in chains using CometBFT include RPC downtime and extended block times. Its recommendations include limiting block sizes to 2MB, ensuring validators peer directly with trusted nodes, and raising the gas price per byte. These measures aim to prevent network disruptions and improve overall resilience.

Proposal #52: Increase TxSizeCostPerByte 15x

This proposal was made to address issues affecting chains using CometBFT, including those reported as asa-2023-002. A testing tool, Hardhat, has been developed for performance testing under load. Measures include raising the gas price per byte to 100 to prevent abuse, ensuring validators peer directly with trusted nodes, reducing block and mempool sizes, and improving validator hardware standards. These actions aim to prevent downtime, out-of-memory issues, and other disruptions, enhancing overall network resilience.

Ecosystem ExpansionAI Data Layer: Phase 1.1 of the Sentinel AI Data Layer for Android has begun community testing. This initiative involves retrieving data through DVPN to train LLM models on AKT, using the Jackal token for decentralized storage.

Product Development and App LaunchesSentinel Shield dVPN: The flagship dVPN application is set for approval on the Google Play Store and will soon be available on iOS. It features an intuitive user interface, an in-app $DVPN wallet, and onchain payments.

Independent dVPN: Independent dVPN, originally Bağımsız dVPN, has expanded its service to Windows. This third-party white label has surpassed 100,000 downloads globally.

Recent Developments

Dogwifhat dVPN: Launches on Android. Developed by the Sentinel Foundation, this application supports Dogwifhat Coin (WIF), a Solana-based memecoin, showcasing the efficiency of Sentinel's BasedApps SDK.

Blockchain explorer: Sentinel releases its native blockchain explorer, integrated into the Sentinel website. Developed with Interbloc, this tool offers features tailored for dVPN, moving away from reliance on third-party explorers like Mintscan.

Subreddit: Sentinel has revamped its official subreddit, r/dVPN, introducing new support systems, post flairs, updated rules, and visual improvements.

Closing SummaryDespite significant growth in Q4 2023 and Q1 2024, DVPN experienced a depreciation in Q2 2024, coinciding with a widespread industry market correction. The decrease was also likely influenced by the regulatory ban in China and limitations on the number of IP subnets. During Q2 2024, the Sentinel Network saw mixed results across key performance indicators, with active nodes decreasing by 49% and active sessions increasing by 9% QoQ. Average daily downloads and uploads also rose by 40% and 45%, respectively, indicating higher data usage. However, active subscriptions dropped by 26%.

On the financial front, revenue totaled $630,000 over the trailing twelve months, though declining by 77% QoQ. Staking rewards also fell by 91% QoQ, largely due to a 77% depreciation in the DVPN price. Despite these challenges, Sentinel made several notable advancements. Sentinel launched its flagship application, Sentinel Shield dVPN. The network also announced the integration of an AI data layer to enhance its peer-to-peer marketplace operations. Additionally, following the approval of the Sentinel Growth DAO's funding proposal, Sentinel announced its sponsorship of Cosmoverse 2024 in Dubai.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.