and the distribution of digital products.

State of Sei Q3 2024

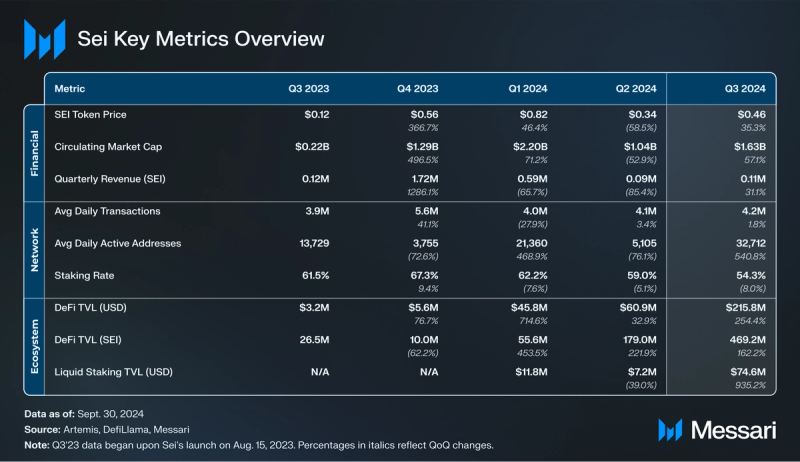

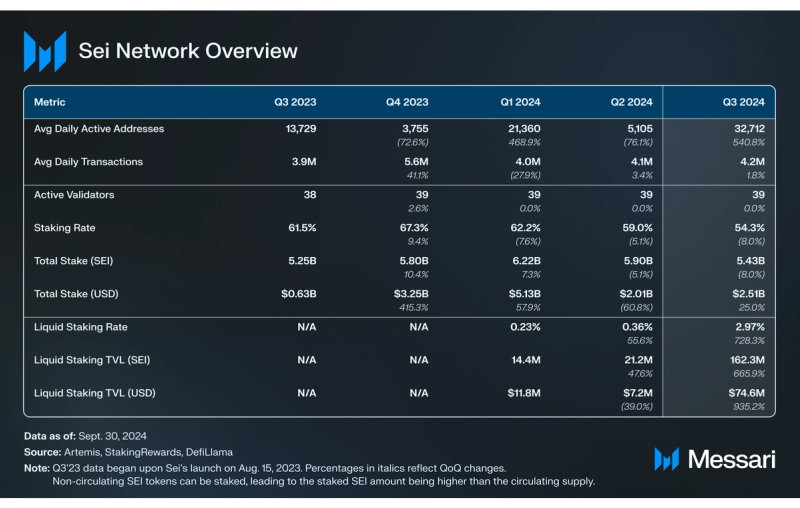

- SEI’s price increased 35.2% QoQ to $0.46, with its market cap rank rising from 69th to 53rd. Meanwhile, daily active addresses (DAAs) rose 540.8% to 32,710, while quarterly revenue (SEI) increased 31.1% QoQ to 0.11 million.

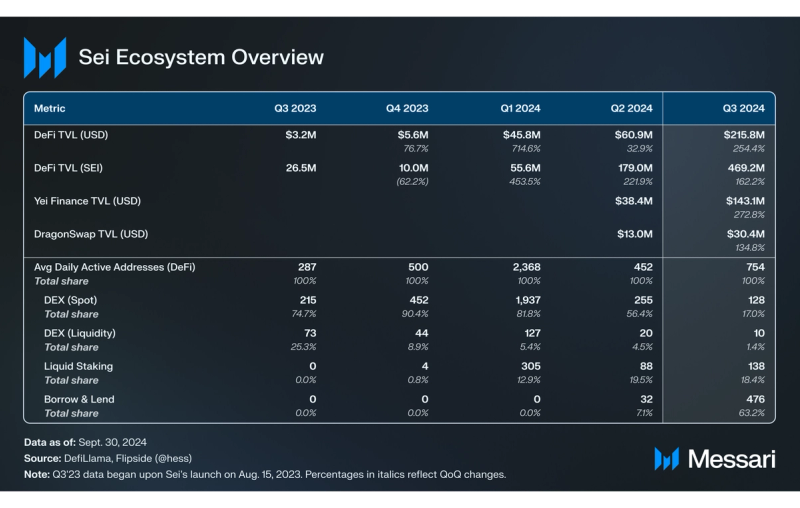

- TVL (USD) increased 254.4% QoQ to $215.8 million, while TVL (SEI) increased 162.2% to 469.2 million.

- DragonSwap and Yei Finance continued to dominate DeFi on Sei, commanding 66.3% and 14.1% of Sei’s TVL, respectively. The DeFi ecosystem continued to diversify as DragonSwap and Yei Finance’s combined TVL dominance fell 4.6% QoQ.

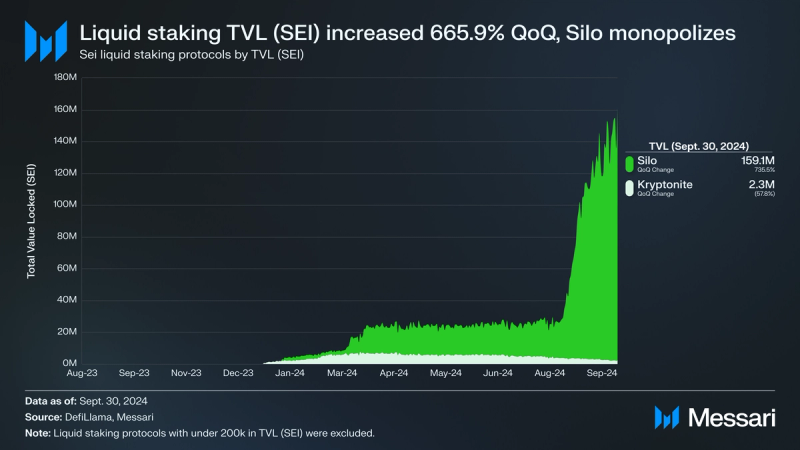

- Liquid staking TVL (USD) increased 935.2% to $74.6 million. Silo Stake holds a monopoly over Sei’s liquid staking sector, commanding 98.6% of Liquid staking TVL.

- Sei Foundation launched a $50 million Japan Ecosystem Fund and a $10 million Sei Creator Fund. These funds are meant to accelerate the growth of Japan-based projects on Sei and empower creators and builders across NFTs and social.

Sei (SEI) is an integrated, general-purpose Layer-1 network that aims to be the fastest network for exchanging digital assets. It is compatible with Cosmos’ Inter-Blockchain Communication (IBC) protocol and was built using forks of the Cosmos SDK and Tendermint Core protocol.

Sei launched in August 2023 alongside SEI, its native token that was airdropped to early users. The SEI token serves functions related to (i) transaction fees, (ii) staking, (iii) rewards, and (iv) governance.

The network's built-in features, such as Twin-Turbo Consensus and transaction parallelization, reduce latency and increase transaction throughput. The Sei V2 upgrade introduced three major upgrades to the network; (i) compatibility with Ethereum Virtual Machine (EVM) smart contracts written in Solidity, (ii) optimistic parallelization, and (iii) a re-architecture of the network’s storage interface with SeiDB. Sei’s upcoming open-source Parallel Stack will enable developers to launch modular Layer-2 networks that serve as EVM-compatible, parallelized execution layers built atop Sei. For a full primer on Sei, refer to our Initiation of Coverage.

Website / X (Twitter) / Discord / Telegram

Key Metrics Financial Analysis

Financial Analysis

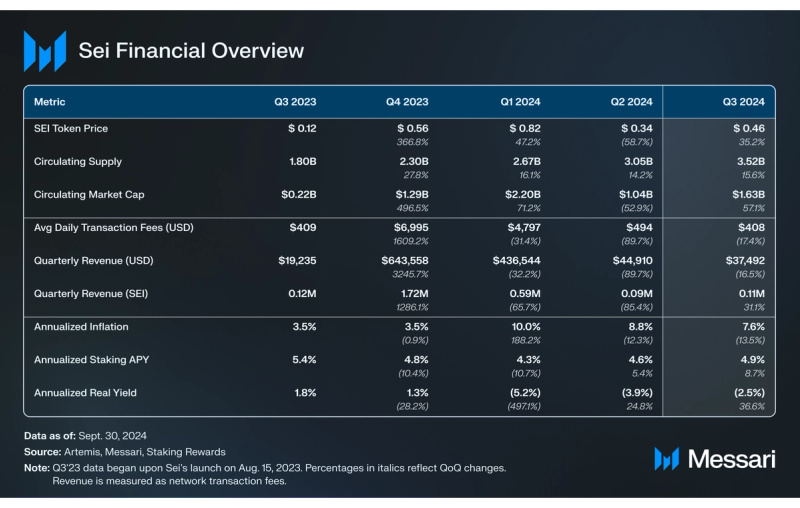

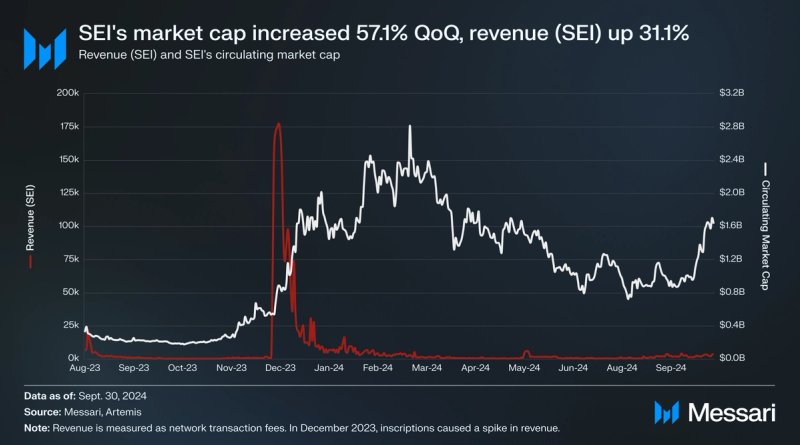

SEI’s price increased 35.2% QoQ to $0.46. The token’s price finished Q3 in a strong uptrend, rising 62.6% in September alone. Crypto market observers have drawn comparisons between the increasing native token prices and activity on Sei, Sui, and Aptos, this cycle’s top alternative Layer-1s (alt-L1s), to Solana's parabolic run as the leading alt-L1 in crypto’s prior cycle.

Consistent with those comparisons, the price increase SEI saw in September coincided with increases across the board in Sei’s TVL, daily active addresses, daily transactions, etc. Due to a circulating supply increase of 15.6% QoQ to 3.52 billion, SEI’s circulating market cap increased by a greater 57.1% QoQ to $1.63 billion. This evidences an outperformance of the broader market, as SEI’s circulating market cap rank trended up from 69th to 53rd.

Sei’s quarterly revenue (SEI) increased 31.1% QoQ to 0.11 million while quarterly revenue (USD) decreased by 16.5% QoQ to $37,490. The nominal increase was led by Proposal 83, which passed on Aug. 14, 2024, and increased the minimum gas price on Sei EVM to 100 gwei to limit spam transactions.

SEI Token Supply

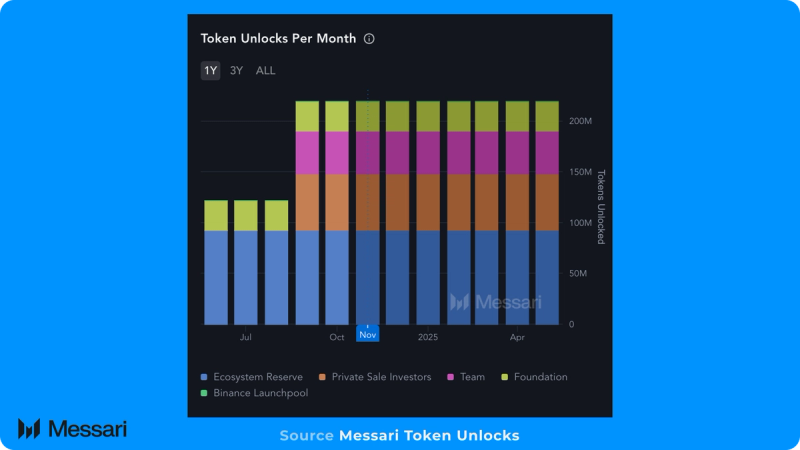

Annualized inflation decreased 13.5% QoQ from 8.8% to 7.6% in Q3’24. Combined with a decrease in the amount of staked SEI, annualized staking APY increased 5% QoQ from 4.9% to 5.1%, resulting in an annualized real yield of -2.5% by the end of Q3.

SEI’s circulating supply increased 15.6% QoQ to 3.52 billion due to a mix of token unlocks and staking rewards. In Q3, 659 million SEI vested. The monthly rate increased from 121.9 million to 219.7 million SEI on Sept. 15, 2024, when the one-year cliff lapsed. Now, the investor and project team allocations are vesting at a daily rate of 97.8 million per month. Ultimately, SEI tokens will continue to vest until Aug. 14, 2033, with another 656.7 million scheduled to vest in Q4’24.

Network Analysis

After being approved by governance, the Sei V2 upgrade went live on May 27, 2024. The Sei V2 upgrade introduced three major upgrades to the network, as described in detail in the State of Sei Q2 2024 report.

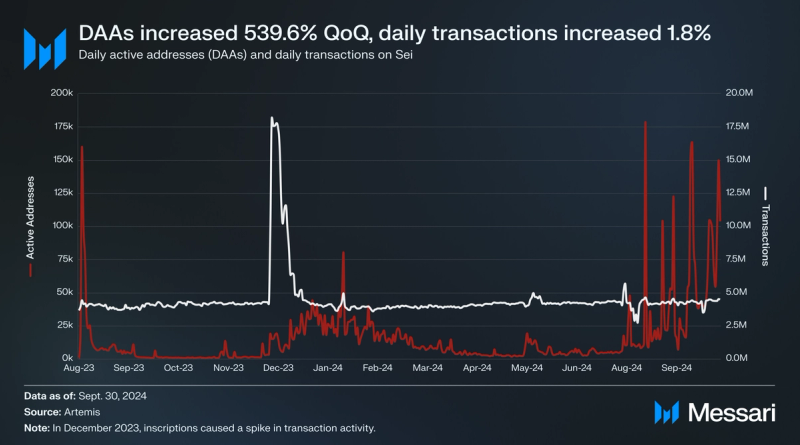

Average daily active addresses (DAAs) increased 540.8% QoQ to 32,710, while daily transactions increased 1.8% QoQ to 4.2 million in Q3. The uptrend in DAAs was sustained throughout the quarter, increasing 489.8% in August and 94.9% in September. Notably, Sei sees a floor of approximately 4 million daily transactions due to a native price oracle. All validators are required to participate as oracles by sending vote transactions and providing updated price data in every other block.

StakingActive validators remained unchanged in Q3 at 39. The total stake (SEI) decreased by 8% QoQ to 5.43 billion SEI. However, combined with the aforementioned increase in SEI’s price, the total stake (USD) managed to rise 25% QoQ to $2.51 billion. Notably, this metric includes unvested, locked SEI tokens that can be staked to earn liquid rewards.

Liquid Staking

Liquid staking protocols Silo and Kryptonite launched around the beginning of 2024. These protocols allow users to stake SEI in return for their liquid staking tokens (Silo’s iSEI and Kryptonite’s stSEI). Both tokens can be redeemed to receive the underlying SEI after a 21-day unbonding period.

As of Sept. 30, 2024, 162.3 million SEI had been liquid staked, a 665.9% QoQ increase from the 21.2 million SEI that had been liquid staked by the end of Q2’24. Compared to the total staked SEI, Sei ended Q3 with a liquid staking rate of 2.97%. Liquid staking TVL (SEI) on Silo increased by 735.5% QoQ, while Kryptonite decreased 57.8%. Silo’s market share increased 26.4% QoQ from 78% to 98.6%, while Kryptonite’s market share fell 93.6% QoQ from 22% to 1.4%. Thus, Silo continued to outperform Kryptonite, securing a monopoly over Sei’s liquid staking sector in Q3.

Ecosystem Analysis

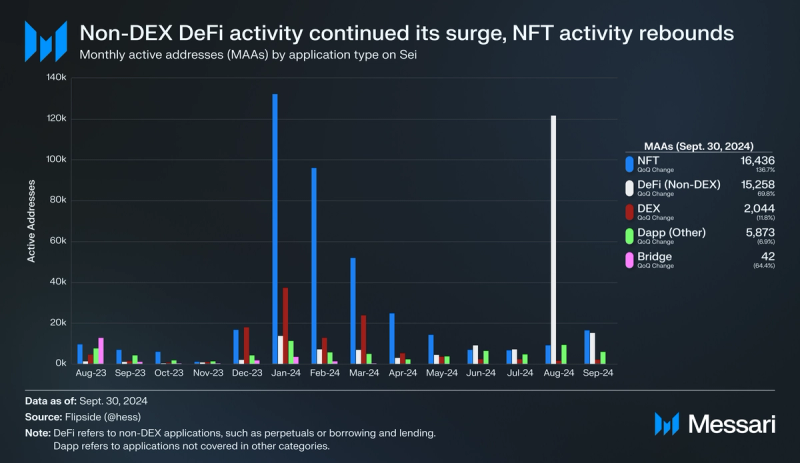

The NFT sector has often led ecosystem activity on Sei. The launch of Sei V2 bucked this trend in June. Monthly active addresses (MAAs) in non-DEX DeFi led monthly ecosystem activity again in July and August. However, NFT activity rebounded in September, capping Q3 as the most active sector.

DeFi

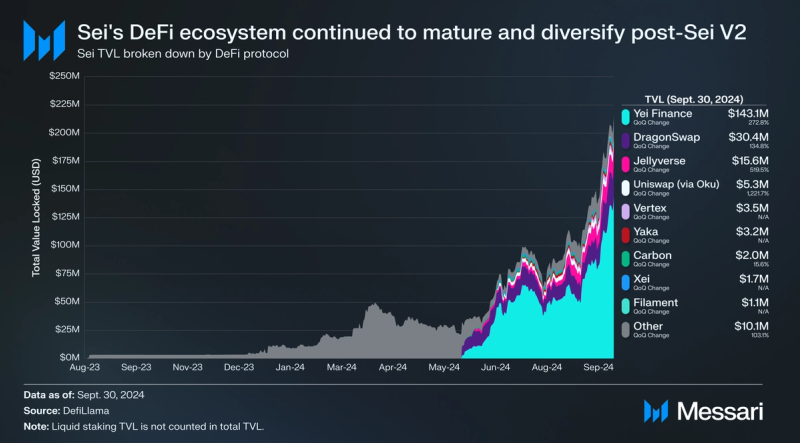

Sei’s DeFi TVL (USD) saw a 254.4% QoQ increase to $215.8 million. While SEI’s price increase led to some of this growth, DeFi TVL (SEI) still rose 162.2% QoQ to 469.2 million SEI. DeFi activity on Sei has been growing ever since the launch of Sei V2 and its introduction of EVM compatibility on May 27, 2024. Sei’s TVL has increased 661.5% since the launch of Sei V2.

Before the launch of Sei V2, Sei had a DeFi Diversity score of 1 (i.e., the number of protocols making up 90% of a network’s TVL). With the launch of several new protocols post-Sei V2, the composition of Sei’s TVL changed, and its DeFi Diversity score increased to 4 in Q2. That number stayed constant in Q3:

- Yei Finance, Sei’s lone borrowing and lending protocol, launched a points program on June 17, 2024. On top of SEI token incentives offered by Yei, OKX Wallet partnered with Sei Foundation to offer SEI token incentives for lenders from Sept. 4 to Nov. 29, 2024. These programs incentivized activity throughout Q3 as Yei Finance ended the quarter with a TVL of $143.1 million, up 272.8% for a total of 66.3% of Sei’s TVL.

- DragonSwap, Sei’s first EVM-compatible DEX that launched on May 29, 2024, continued to be Sei’s top DEX in Q3. The protocol launched a points program on June 25, 2024. This program incentivized activity throughout Q3 as DragonSwap ended the quarter with a TVL of $30.4 million, up 134.8% QoQ.

- Notably, the protocol experimented with prediction markets at the end of Q3.

- Oku, a friendly fork of Uniswap V3 on Sei, introduced incentives in Q3 that distributed UNI tokens to liquidity providers of eligible pools. Uniswap ended the quarter with a TVL of $5.3 million, up 1,222% QoQ.

- Jellyverse, a DEX that serves as Balancer’s friendly fork on Sei, introduced incentives that distributed JLY, SEI, and FXS tokens to liquidity providers of eligible pools in Q3. Jellyverse also introduced incentives that distributed DINERO and iSEI tokens to liquidity providers of eligible pools. Jellyverse ended the quarter with a TVL of $15.6 million, up 519.5% QoQ.

Outside of Sei’s top four DeFi protocols by TVL, Sei’s DeFi ecosystem continued to mature and diversify in Q3:

- Yaka Finance was launched on mainnet after a successful testnet campaign and Yaka Voyager NFT collection launch. Yaka’s spot decentralized exchange (DEX) utilizes a ve(3,3) model. This model distributes trading fees to users that lock the YAKA token, receive veYAKA, and vote on which liquidity pools YAKA token emissions should flow to. The YAKA token was launched via an Initial DEX Offering (IDO) on Sept. 20, 2024, which raised 1.1 million SEI.

- Filament Finance, which raised $1.1 million in seed funding, launched on mainnet in September. Filament is a perpetual DEX that utilizes a compartment-based liquidity pool that enables Filament to operate efficiently even in low-liquidity conditions. The protocol only offered BTC trading with up to 3x leverage upon launching but plans to expand to longer tail assets and launch its token in Q4’24. Filament Finance will compete with Levana Perps, which has been live on mainnet for over a year.

- Vertex, a perpetual and spot DEX that was already available on Arbitrum, Blast, and Mantle, launched on Sei on Aug. 14, 2024. Upon launch, Vertex launched Season 1, which ran from Aug. 14 to Sept. 25, 2024, and featured 5.1 million in SEI token incentives alongside trading rewards in VRTX tokens. Season 2 and Season 3 incentives continue into Q4.

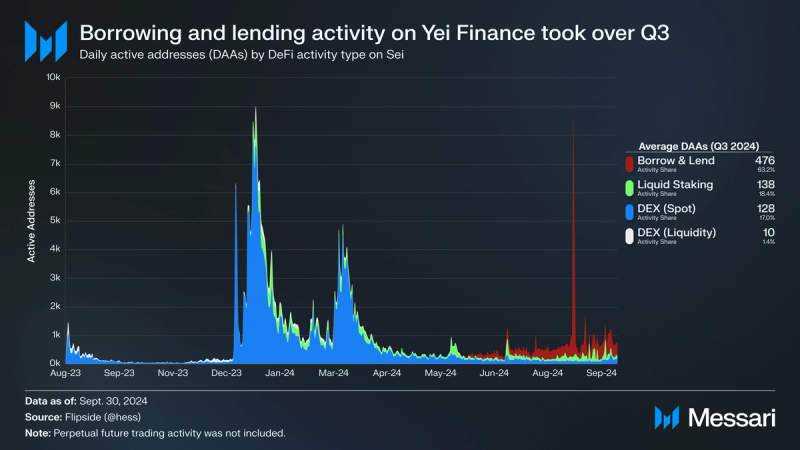

The launch of Sei V2 has also led to a change in the composition of DeFi activity. Borrow and lend activity on Yei Finance continued to grow in Q3, making up 63.2% of DeFi activity share in Q3. When combined with a points program and the aforementioned incentives, Yei Finance has become one of the most used protocols on Sei.

Yei Finance initially featured SEI, iSEI, USDT, and USDC for borrowing and lending, but has since expanded support for WETH, frxETH, FRAX, sFRAX, sfrxFRAX, and fastUSD. Two of those assets come from the new stablecoins and liquid-staked ETH tokens that launched on Sei in Q3. That list includes sETH, ssETH, STONE, frxETH, fastUSD, and syUSD.

Development, Growth, and CommunitySei Foundation supported two grant initiatives in Q3 2024:

- A $10 million Sei Creator Fund to empower creators and builders across NFTs and social (content creation, in-real-life (IRL) events, etc.) was announced in April. Four rounds were held between June and October, pooling donations from the community which were then matched by Sei Foundation:

- Round 1: Spanning June 11 to July 2, 2024, this round featured a $250,000 matching pool denominated in SEI. In total, the round saw 2,710 donors across 63 projects, raising $38,370 from the community.

- Round 2: Spanning Aug. 13 to Aug. 30, 2024, this round featured a $332,500 matching pool denominated in SEI. In total, the round saw 13,160 donors across 181 projects, raising $82,160 from the community.

- Round 3: Spanning Oct. 3 to Oct. 17, 2024, this round featured a $250,000 matching pool denominated in SEI. In total, the round saw 2,750 donors across 73 projects, raising $41,400 from the community.

- Round 4: Spanning Oct. 3 to Oct. 17, 2024, this round featured a $250,000 matching pool denominated in SEI. In total, the round saw 3,840 donors across 198 projects, raising $61,400 from the community.

- A $50 million Japan Ecosystem Fund was launched in July, aiming to accelerate the growth of Japan-based projects on Sei. This venture fund will provide support for startups in the areas of gaming, social, and entertainment use cases. Interested projects can apply here.

Sei experienced increases across most metrics in Q3 2024. Quarterly revenue (SEI) increased 31.1% QoQ to 0.11 million SEI as average daily active addresses rose 540.8% to 32,710. This was reflected in SEI’s price, which increased 35.2% QoQ to $0.46. The token’s price finished Q3 in a strong uptrend, up 62.6% in September alone, as its market cap rank rose from 69th to 53rd.

DeFi TVL (USD) increased 254.4% QoQ to $215.8 million. While SEI’s price increase led some of this growth, DeFi TVL (SEI) still rose 162.2% QoQ to 469.2 million SEI. Yei Finance and DragonSwap continued to dominate, commanding 66.3% and 14.1% of Sei’s TVL, respectively. However, the DeFi ecosystem continued to diversify in Q3 as protocols like Yaka Finance, Filament Finance, and Vertex launched on mainnet.

Looking forward, the community can hope for further growth as Sei Foundation leverages its $50 million Japan Ecosystem Fund and $10 million Sei Creator Fund. DeFi momentum could continue into Q4 as protocols throughout Sei’s ecosystem leverage incentives and points programs that proved to attract new users and assets in Q3.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.