and the distribution of digital products.

State of Sei Q1 2025

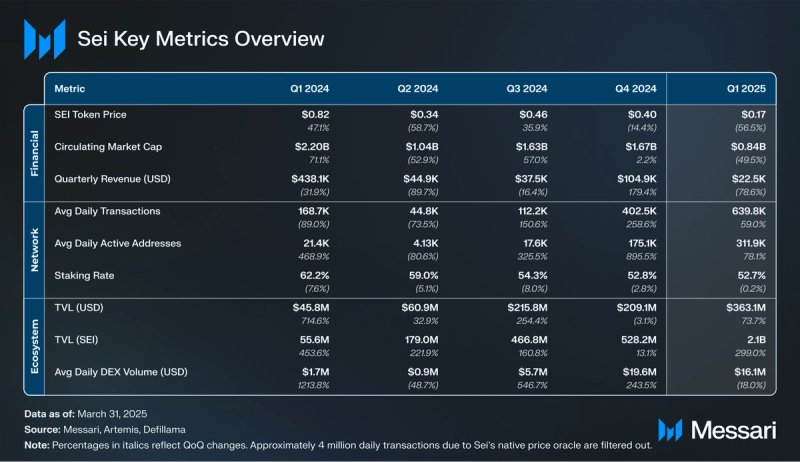

- Sei Labs achieved 5.4 gigagas per second, approximately 115,000 TPS, and 700 milliseconds time-to-finality. Meanwhile, Sei Foundation established Sapien Capital, a $65 million venture fund focused on decentralized science (DeSci).

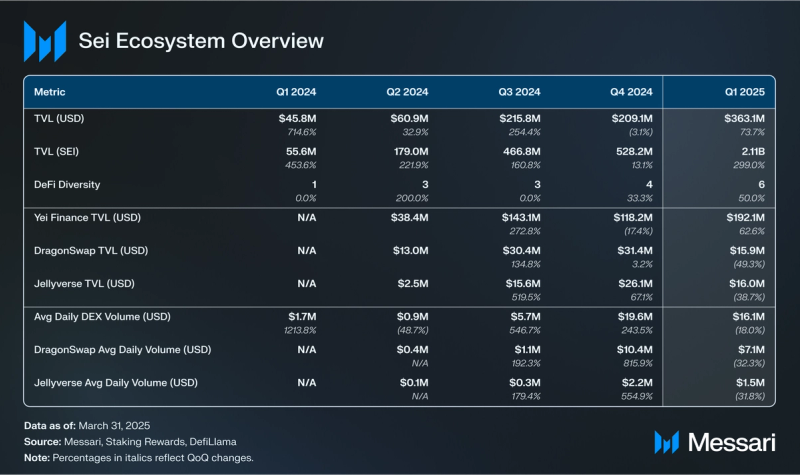

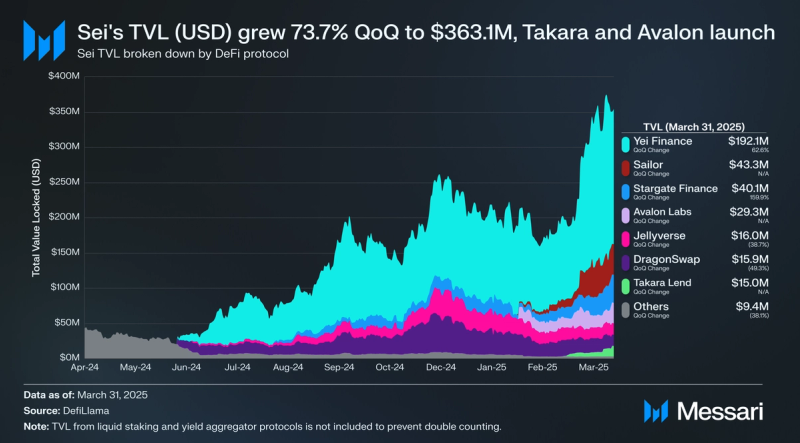

- TVL (USD) increased 73.7% QoQ from $209.1 million to $363.1 million, with stablecoin market cap (USD) reaching an all-time high of $178 million. As SEI’s price decreased 56.5% QoQ to $0.17, TVL (SEI) rose a much greater 299% to 2.11 billion.

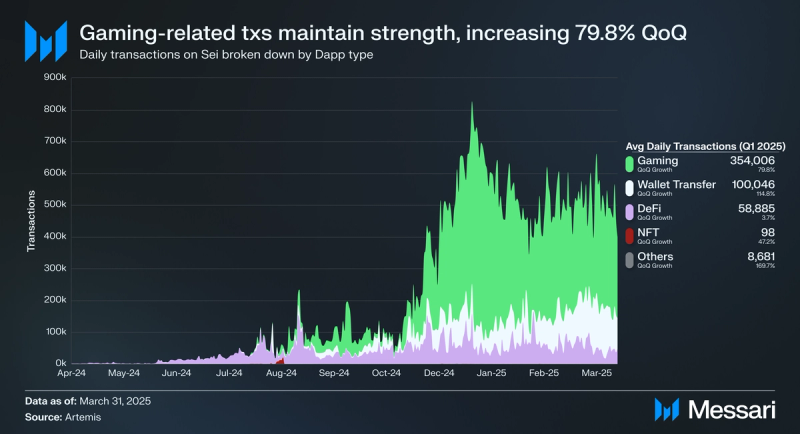

- The gaming sector has been a major contributor driving network usage, as average daily active addresses (DAAs) increased 78.1% QoQ to 311,900 while average daily transactions were up 59% to 639,800.

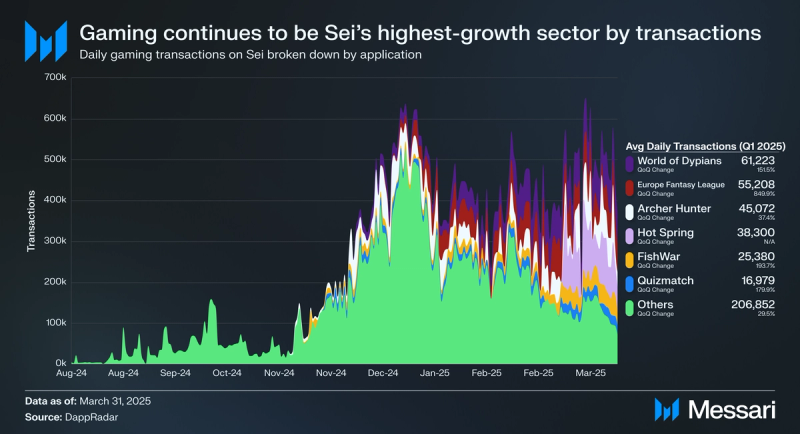

- Average daily transactions in the gaming sector increased 79.8% QoQ to 354,000, outpacing all other categories. Sei had a Gaming Diversity score of 8 (i.e., the number of applications making up 90% of Sei’s quarterly gaming-related transactions).

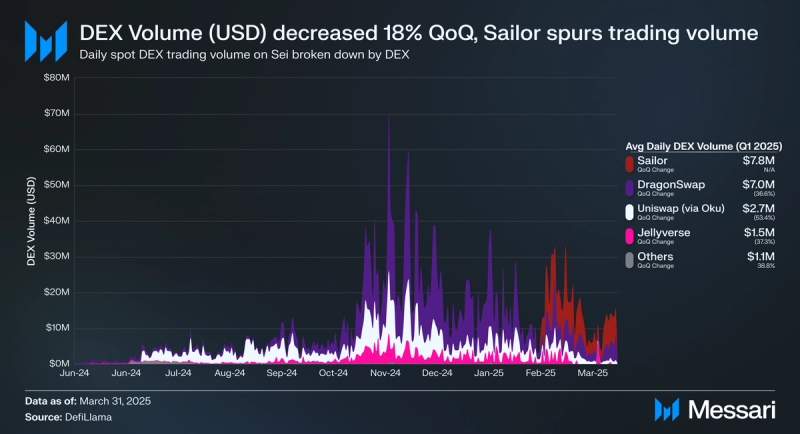

- Average daily DEX volume (USD) decreased 18% QoQ to $16.1 million, but largely sustained the elevated levels seen in Q4’24. Sailor led average daily DEX volume (USD) as the incumbents, DragonSwap, Uniswap, and Jellyverse, lost market share.

Sei (SEI) is a general-purpose Layer-1 network that combines the best of Ethereum and Solana. Specifically, the developer tooling, mindshare, and network effects of the Ethereum Virtual Machine (EVM), with the performance and scalability of high-performance networks like Solana. For a full primer, refer to our Initiation of Coverage report.

Sei launched in August 2023 alongside SEI, its native token that serves functions related to (i) transaction fees, (ii) staking, (iii) rewards, and (iv) governance. Sei V1 was based on the Cosmos SDK and Tendermint Core protocol. The network's built-in features, such as Twin-Turbo Consensus and transaction parallelization, reduce latency and increase throughput.

The Sei V2 upgrade introduced three major upgrades to the network in May 2024: (i) compatibility with Ethereum Virtual Machine (EVM) smart contracts written in Solidity, (ii) optimistic parallelization, and (iii) a re-architecture of the network’s storage interface with SeiDB.

In the future, Sei plans to launch Giga, an upgrade that aims to include a new EVM client that offers a 50x improvement in throughput. The project’s vision for 2025 features a heavy focus on builders, creators, and contributors, which will help utilize Sei’s technical innovation to drive practical adoption.

Website / X / Discord / Telegram

Key Metrics Ecosystem Analysis

Ecosystem Analysis

The category with the highest transaction levels has shifted several times since Sei’s inception. The shift has been from NFTs, which led activity in Sei’s early days and Q1’24, to DeFi activity in Q3’24 upon the launch of Sei V2 and its introduction of EVM compatibility, to gaming activity ramping up in Q4’24. In Q1 2025, Average daily transactions in the gaming sector increased 79.8% to 354,000, surpassing all other categories combined.

Gaming

Sei had a Gaming Diversity score of 8 (i.e., the number of applications making up 90% of the network’s quarterly gaming-related transactions) in Q1’25. In December 2024, Galxe launched the Arcade, a two-month campaign focused on onchain gaming tasks. Two highlights in Sei’s gaming ecosystem have been World of Dypians and Archer Hunter:

- World of Dypians: A multiplayer role-playing game (MMORPG) available on Epic Games. Similar to World of Warcraft, players control heroes to interact with the game world. The game is multichain, available on many networks including Sei, and features onchain elements such as the WOD token and two NFT collections. World of Dypians led gaming transactions on Sei in Q1’25 with an average of 61,220 per day, a 151.5% QoQ increase.

- Archer Hunter: A mobile game available on the Apple App Store and Google Play where users play in a roguelike style game in various modes. Archer Hunter saw an average of 45,070 transactions per day in Q1’25, a 37.4% QoQ increase.

Other notable gaming ecosystem highlights include projects like Europe Fantasy League, Hot Spring, FishWar, Quizmatch, Dragon Slither, Seiyara, Piratopia, SpinCity, Cat VS Monsters, Astro Karts, Grand Gangsta City, Dawnshard, and Helium Wars. All-in-all, Sei’s gaming sector has been a major contributor in driving up the network’s average daily active addresses (DAAs) 78.1% QoQ to 311,900 and its average daily transactions up 59% to 639,800.

DeFi

DeFi activity on Sei has been steadily growing since the launch of Sei V2. In Q1 2025, TVL (USD) increased 73.7% QoQ to $363.1 million. Despite SEI’s price falling 56.5% QoQ to $0.17, TVL (SEI) rose a much greater 299% to 2.11 billion. This indicates the total amount of assets being utilized in DeFi continues to grow. Sei’s DeFi Diversity score (i.e., the number of protocols making up 90% of a network’s TVL) increased 50% in Q1’25, from 4 to 6, indicating continued diversification as the ecosystem matures. Furthermore, stablecoin market cap (USD) on Sei grew to an all-time high of $178 million by the quarter’s end.

Borrowing & LendingBorrowing and lending activity on Sei has always been dominated by Yei Finance, and still is. Yei continued to grow in Q1’25, as the protocol continued its points program that began on June 17, 2024, as well as token incentives provided by Sei Foundation. While Yei’s partnership with OKX Wallet that offered 8.2 million SEI in incentives expired at the end of 2024, Yei announced a new partnership with Binance Wallet offering 1.3 million SEI in incentives in March 2025. Helped by Yei’s various incentive programs, the protocol ended Q1’25 with a TVL of $192.1 million, up 62.6% QoQ for a total share of 53.2% of Sei’s TVL.

Notably, the following new borrowing and lending protocols emerged in Q1’25:

- Takara Lend: A borrowing and lending protocol offering six assets (SEI, iSEI, USDT, USDC, fastUSD, and uBTC). Takara also offers an in-app swap feature powered by Symphony Exchange, a DEX aggregator. Takara ended the quarter with a TVL of $15 million for a total share of 4.2% of Sei’s TVL, and continues to see steady growth.

- Avalon Finance: A DeFi protocol focused on Bitcoin borrowing and lending, and collateralized debt positions (CDP). Avalon primarily offers borrowing and lending for Solv Finance's SolvBTC and SolvBTC.BBN. It also enables the users to mint its CDP products, which are USDa and sUSDa. Avalon ended the quarter with a TVL of $29.3 million for a total share of 8.1% of Sei’s TVL.

There was a major shift in market share over spot DEX volume in Q1’25. Average daily DEX volume (USD) on Sei decreased 18% QoQ to $16.1 million, but largely sustained the elevated levels seen in the Q4’24. Sailor led average daily DEX volume (USD) as the incumbents, DragonSwap, Uniswap, and Jellyverse, lost market share.

- Sailor: Launched in January 2025, Sailor took over spot trading volume on Sei in Q1’25 as it focused on majors and stablecoins and averaged $7.8 million in daily trading volume. Sailor's largest liquidity pool consisted of Avalon’s USDa and sUSDa tokens for much of the quarter. The protocol ended the quarter with a TVL of $43.3 million for a total share of 12% of Sei’s TVL.

- DragonSwap: Continuing a points program that began on June 25, 2024, along with various token incentives, DragonSwap averaged $7 million in daily trading volume in Q1’25, a decrease of 36.6% QoQ. The protocol ended the year with a TVL of $15.9 million, down 49.3% QoQ for a total share of 4.4% of Sei’s TVL. Notably, DragonSwap’s total market share of TVL fell 71% QoQ.

- In March 2025, DragonSwap introduced dollar cost average (DCA) and limit order features via an integration with Orbs.

- In February 2025, DragonSwap introduced xDRG, a pre-TGE version of its upcoming DRG token.

- Jellyverse: A DEX that serves as Balancer’s friendly fork on Sei, averaged $1.5 million in daily trading volume in Q1’25, down 37.3% QoQ. The protocol ended the quarter with a TVL of $16 million, down 38.7% QoQ for a total share of 4.4% of Sei’s TVL. Notably, Jellyverse’s total market share of TVL fell 65% QoQ.

- In February 2025, Jellyverse launched jAssets V2, which introduced token incentives and various usability upgrades.

- In January 2025, Jellyverse launched its jAssets primitive, which are tokens that bring real-world assets onchain. Powered by Pyth’s price oracles, users could mint tokenized stocks such as jTSLA and jMSTR.

Sei’s vision for 2025 features a heavy focus on builders, creators, and contributors, which the project hopes will utilize Sei’s technical innovation to drive practical adoption. This deepened commitment to empowering its community was on display in Q1 2025, with SEI incentives being distributed through programs like the Creator Fund, Builders Fund, Sei Street Team, and Sei More Campaign:

- In March 2025, Sei announced the Sei More Campaign, which aims to incentivize content creation related to Sei on X. The program is tracked via Sei’s Katio Leaderboard, and rewards the top 50 content creators over a three-month period.

- In March 2025, LayerZero announced it added support for SEI as an Omnichain Fungible Token (OFT).

- In March 2025, Sei announced HelloMoon added data analytics support for Sei.

- In March 2025, Sphere announced that it had integrated payment support on Sei.

- In March 2025, Sei shared that Unchained Music, an onchain artist payments protocol built on Sei, was featured in MusicWeek

- In February 2025, Round 1 of a Sei Builders Fund was held in partnership with Gitcoin. The program aims to retroactively reward Sei-native builders. Each round pools donations from the community which are then matched by Sei Foundation.

- Spanning Feb. 27 to March 12, 2025, Round 1 featured a $750,000 matching pool denominated in SEI, and focused on a consumer track and infrastructure & tooling track. In total, the round saw over 3,000 donors across 64 projects, raising $73,990 from the community.

- In February 2025, Sei announced it had integrated Alchemy and introduced developer tooling for the network.

- In February 2025, Sei announced it had integrated with elizaOS, enabling autonomous AI agents to operate on the network.

- In February 2025, Sei announced that Chainlink’s Cross-Chain Interoperability Protocol (CCIP) went live on the network.

- In January 2025, Round 5 of the $10 million Sei Creator Fund was held in partnership with Gitcoin. The program was first announced in April 2024, and aims to empower creators and builders working on NFTs and social content (content creation, in-real-life (IRL) events, etc.) Each round pools donations from the community which are then matched by Sei Foundation.

- Spanning Jan. 28 to Feb. 10, 2025, Round 5 featured a $250,000 matching pool denominated in SEI. In total, the round saw 1,550 donors across 95 projects, raising $18,397 from the community.

- In January 2025, Sei announced Sapien Capital, a $65 million venture fund that is focused on decentralized science (DeSci)

- In March 2025, Sei disclosed it was in the process of exploring an acquisition of 23andMe along with its scientific user data.

- In February 2025, Eleanor Davies joined Sei Foundation as Head of Decentralized Science (DeSci). She will head-up Sapien Capital, and released her Vision for DeSci V2 in March 2025.

- In January 2025, Sei announced Sei Street Team, a $250,000 initiative to support Sei creators by incentivizing attendance and content creation of in-real-life (IRL) events.

- In January 2025, Sei announced an integration with Turnkey, enabling developers to leverage its Embedded Wallet Kit.

SEI Token

SEI Token

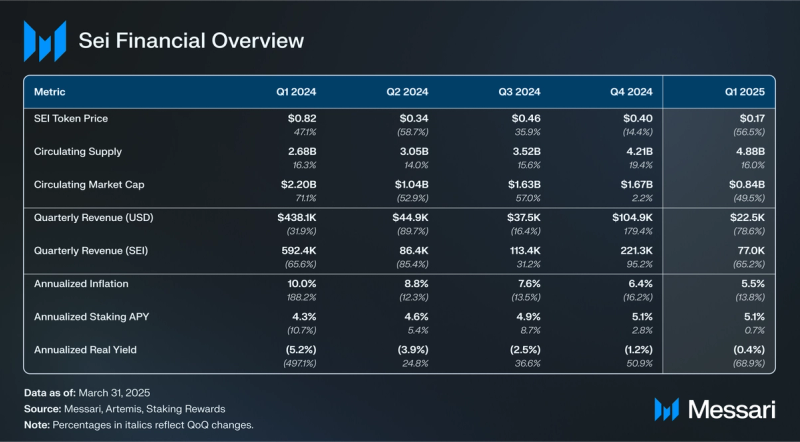

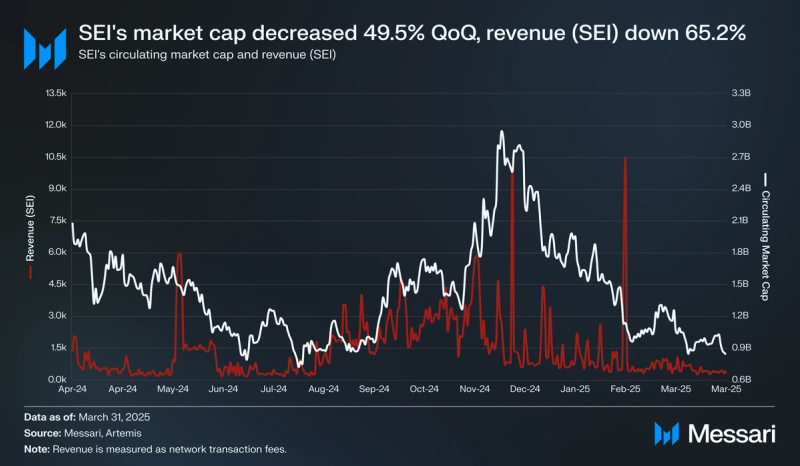

SEI’s price decreased 56.5% to $0.17 in Q1 2025. The token’s price fell continually throughout the quarter, reaching a high of $0.47 on Jan. 4 and a low of $0.17 on March 31. Meanwhile, Sei’s quarterly revenue (USD) decreased 78.6% QoQ to $22,500, while quarterly revenue (SEI) decreased by 65.2% QoQ to 77,000.

Due to a circulating supply increase of 16% QoQ to 4.88 billion, SEI’s circulating market cap decreased a lesser 49.5% QoQ to $0.84 billion. However, the token’s circulating market cap rank fell from 66th to 72nd, indicating underperformance of the broader market.

Token Supply

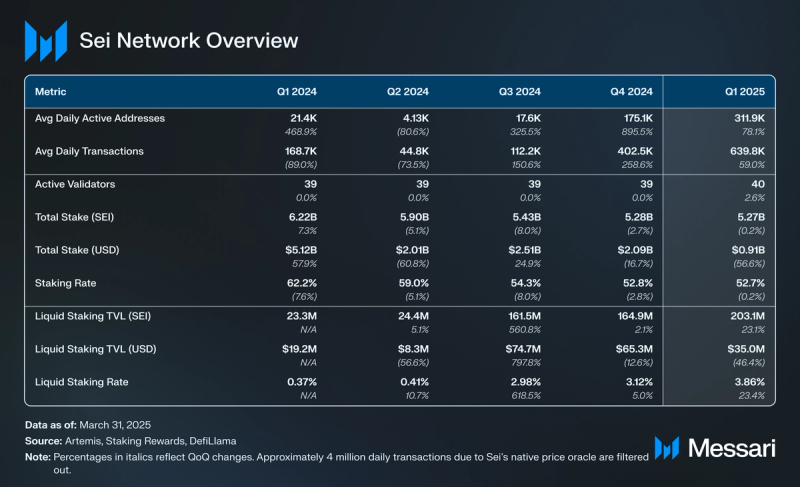

Annualized inflation decreased 13.8% QoQ from 6.4% to 5.5%. Combined with a 0.2% QoQ decrease in the amount of staked SEI, annualized staking APY stayed flat at 5.1%, resulting in an annualized real yield of negative 0.4% at the end of Q1’25.

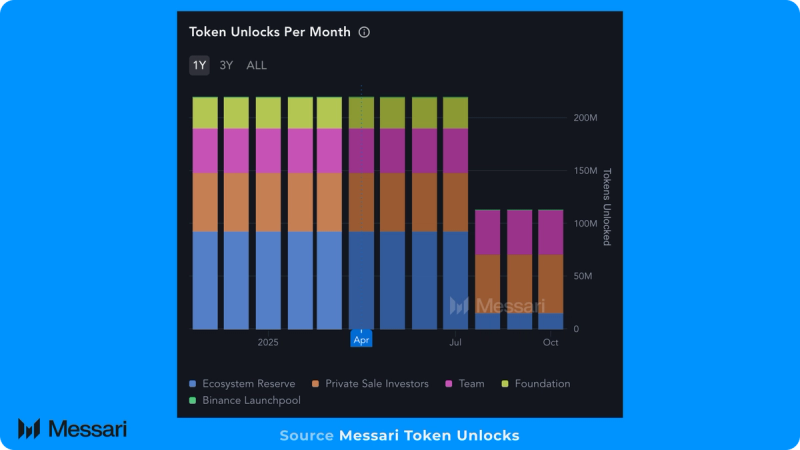

SEI’s circulating supply increased 16% QoQ to 4.88 billion due to a mix of token unlocks and staking rewards. In Q1’25, 659 million SEI vested, and the investor and project team allocations are vesting at a rate of 97.8 million SEI per month. Ultimately, SEI tokens will continue to vest until Aug. 14, 2033, and another 659 million is scheduled to vest in Q2’25.

Network Analysis Usage

Usage

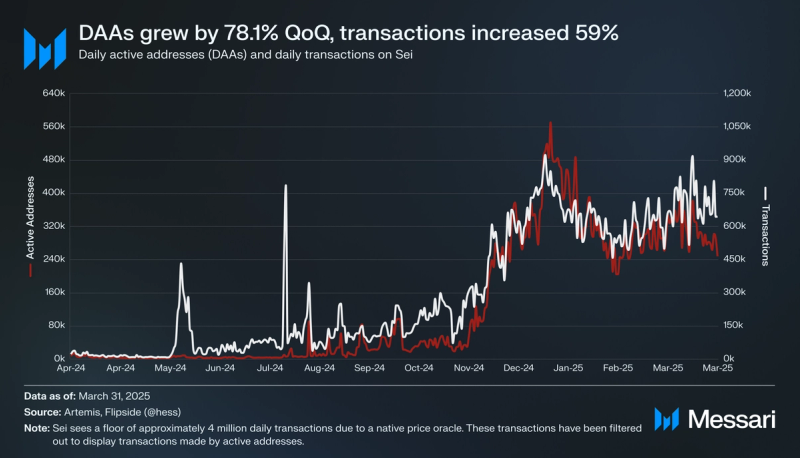

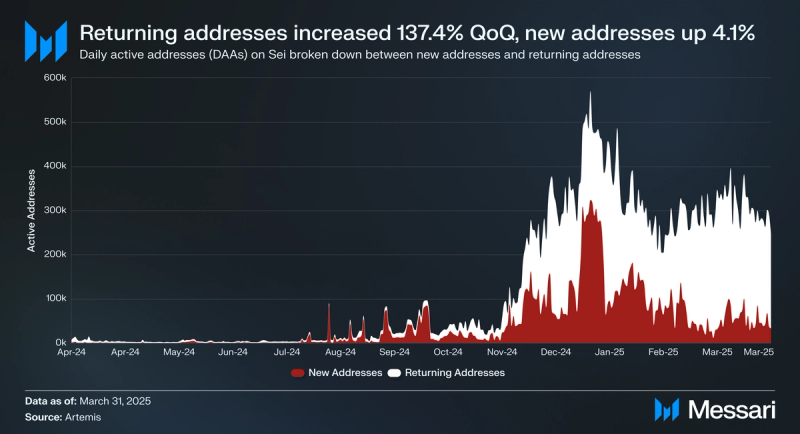

Average daily active addresses (DAAs) increased 78.1% to 311,900 in Q1 2025, while daily transactions made by active addresses increased 59% to 639,000. A major uptrend in DAAs and transactions began in mid-November, reaching a peak of 486,760 DAAs and 738,990 transactions on January 10th. While DAAs didn’t surpass this initial peak the rest of Q1’25, transactions exceeded the January peak on March 17, which saw 917,480 transactions. The growth spurt that began in Q4’24 was sustained in Q1’25, with activity at levels much higher than Sei experienced the majority of 2024.

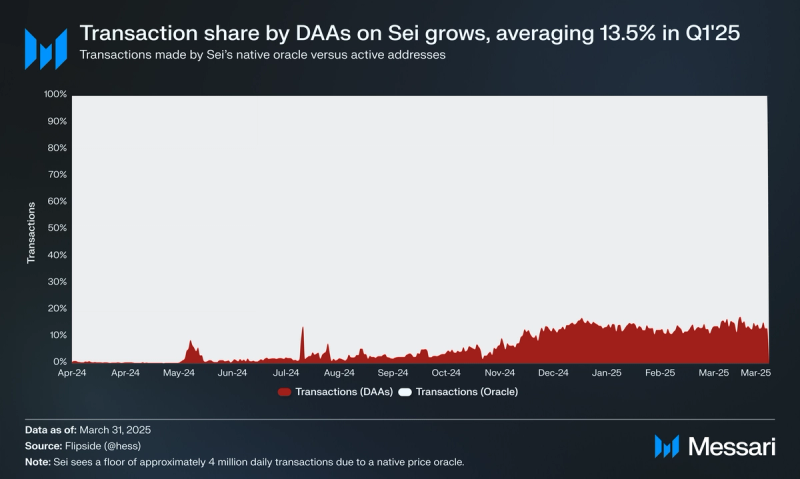

Notably, Sei sees a floor of approximately 4 million daily transactions due to a native price oracle. All validators are required to participate as oracles by sending vote transactions and providing updated price data in every other block. Transactions made by active addresses are indicative of real users on the network, and averaged 13.5% of all transactions on Sei in Q1’25, up 54.1% QoQ from 8.8%.

Average daily returning addresses increased 137.4% QoQ to 230,720, while average daily new addresses rose by a lesser 4.1% QoQ to 81,160. This indicates that new users on Sei dwindled in Q1’25, but many new users from Q4’24 were successfully retained after the new year. Overall, the positive changes in average daily transactions and DAAs show that Sei continued to grow at a rapid pace once again in Q1’25, after the prior quarter saw active addresses increase 895.5% QoQ and transactions increase 258.6%.

StakingIn February 2025, Proposal 95 was passed, increasing the active validator set from 39 to 40. Sei’s total stake (SEI) decreased by 0.2% QoQ to 5.27 billion. Combined with the aforementioned decrease in SEI’s price, total stake (USD) decreased 56.6% QoQ to $0.91 billion. Notably, these metrics include unvested, locked SEI tokens that can be staked to earn liquid rewards.

Copilot Insights: What are the most recent governance proposals or network upgrades on Sei?Liquid Staking

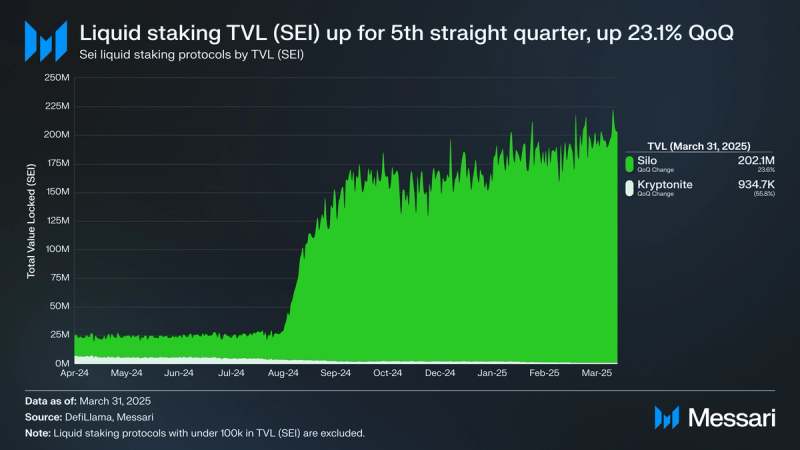

By the end of Q1’25, 203.1 million SEI had been liquid staked, a 23.1% QoQ increase from the 164.9 million SEI that had been liquid staked by the end of Q4’24. Compared to Sei’s total stake (SEI), the liquid staking rate increased for the fifth straight quarter, up from 3.12% to 3.86%.

Silo allows users to stake SEI in return for their liquid staking token, iSEI, which can be redeemed to receive the underlying SEI after a 21-day unbonding period. Liquid staking TVL (SEI) on Silo increased 23.6% QoQ to 202.1 million as it continues to dominate as the only relevant player in Sei’s liquid staking sector.

Notably, in November 2024, Silo introduced the SiloSearcher Library, an open-source tool for building maximal extractable value (MEV) strategy bots. While MEV was possible prior to this, in the month after launch, approximately $125,000 was generated by MEV searchers.

In January 2025, Silo’s parent company, Mevvy, raised a $2.8 million Seed Round led by Multicoin Capital. Mevvy is an MEV searcher execution platform aiming to facilitate efficient, cross-chain MEV strategies. Silo’s 2025 roadmap includes MEV-related features supported by Mevvy.

Technical DevelopmentsIn December 2024, Sei Labs announced Giga, an in-development upgrade that plans to offer a 50x improvement in throughput over other EVM-compatible networks. Specifically, Giga aims to reach a maximum capacity of five gigagas per second. Gigagas is a measure of a blockchain’s computational capacity that replaces the commonly used measure of transactions per second (TPS). However, the anticipated maximum TPS post-Giga is approximately 250,000.

This level of performance will be achieved by revamped execution, consensus, and storage workstreams. Key upgrades include intelligent transaction parallelization that predicts dependencies, the decoupling of consensus over transaction ordering from transaction execution, and the introduction of the first-ever instance of multiple concurrent proposers on an EVM Layer-1 network, allowing multiple validators to propose transactions simultaneously.

In February 2025, Sei achieved 5.4 gigagas per second, approximately 115,000 TPS, and 700 milliseconds (ms) time-to-finality in an internal devnet environment. This was achieved using a validator set of 40 that was distributed across the United States, Europe, and Asia Pacific.

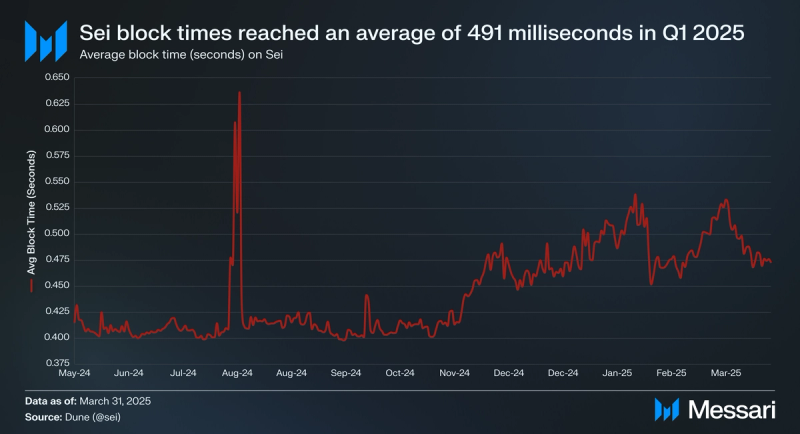

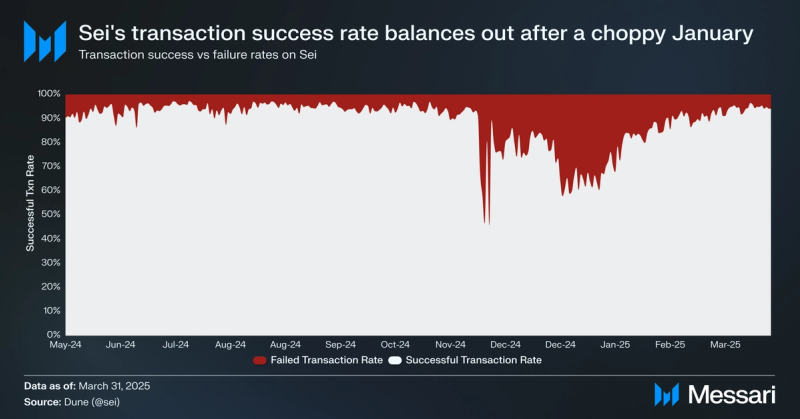

In Q1 2025, Sei experienced an increase in average block times from 438ms to 491ms, a 12.2% QoQ increase. Sei also saw transaction failure rates surge in December and January, to 22.7% and 29.7%, respectively. However, transaction failure rates have since normalized, falling to 12.5% in February and 6.4% in March.

Proposal 93 was passed in February 2025. It updated EIP-1559 parameters that were introduced with the v6.0.0 upgrade in November 2024, including the network’s gas target and maximum upward gas adjustment.

Lastly, in November 2024, Sei Labs and Sei Foundation announced the Sei Research Initiative. The initiative aims to “reimagine the EVM across all layers—storage, consensus, and execution” through open-source research contributions from Sei Labs, Sei Foundation, and the broader industry. Several research reports were published in Q1 2025, such as those on machine learning, ECDSA signature verification, AI agents, collaborative intelligence, MEV, gas fees, and more.

Closing SummarySei saw significant growth within its gaming and DeFi sectors in Q1 2025. Gaming was a major contributor driving network usage, as average daily transactions in the sector increased 79.8% QoQ to 354,000, outpacing all other categories. In DeFi, TVL (USD) increased 73.7% QoQ from $209.1 million to $363.1 million as new protocols like Sailor and Takara Lend launched and quickly gained traction.

The quarter also saw exciting developments from Sei Labs, which achieved 5.4 gigagas per second, approximately 115,000 TPS, and 700 milliseconds time-to-finality in an internal devnet environment. This feat was achieved in pursuit of the Giga upgrade, which aims to offer a 50x improvement in throughput.

Meanwhile, Sei Foundation established Sapien Capital, a $65 million venture fund focused on decentralized science (DeSci). On the community side, Sei continued to incentivize involvement through its Sei More Campaign, Sei Builders Fund, and Sei Creator Fund. Looking forward, users can continue to expect Sei to pursue its vision for 2025 that features a heavy focus on builders, creators, and contributors.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.