and the distribution of digital products.

State of Raydium Q4 2024

- Raydium averaged $3.2 billion in daily volume in Q4, up more than 29x year-over-year from roughly $110 million in the fourth quarter of 2023.

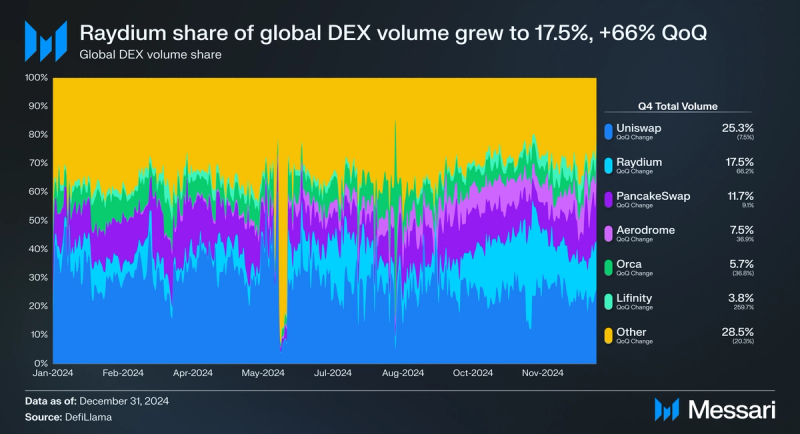

- Raydium’s share of global DEX volume increased more than 66% QoQ to over 17% as it flipped PancakeSwap to become the second-largest DEX by volume share in Q4, trailing only Uniswap.

- Q4 was Raydium’s second quarter in 2024 with the majority of Solana’s daily DEX volume and its third straight as the leader in daily DEX volume.

- In January, Raydium released its public beta for trading perpetual futures with no fees on maker trades and 2.5bps in fees on taker trades during the beta phase. Raydium Perps is powered by Orderly Network’s liquidity layer and features gas-free trading with up to 50x leverage on more than 70 trading pairs.

- In October, Raydium launched Burn and Earn support for its constant product market maker (CPMM) pools. Burn and Earn enables project teams to increase trust regarding liquidity provision by permanently locking liquidity while trading fees earned by the locked position remain fully claimable.

Raydium (RAY) is the largest automated market maker (AMM) decentralized exchange (DEX) on Solana. First launched in 2021, Raydium allows users to permissionlessly create new liquidity pools, provide liquidity to existing pools, swap tokens, and trade perpetual futures. Liquidity providers earn trading fees on each swap made in a pool as well as RAY (the protocol’s token) and/or other tokens if the pool is incentivized. RAY holders can also stake RAY to earn additional RAY tokens.

In May 2024, the Raydium V3 application launched alongside revamped constant product market maker (CPMM) pools that support the Token-2022 token program and include a built-in price oracle. In addition to CPMM pools and its legacy standard AMM pools (AMM V4), which offer uniform liquidity distribution, Raydium offers Concentrated Liquidity Market Maker (CLMM) pools that allow for liquidity concentration at specific price points. CLMM provides lower slippage for traders and higher fee earnings for LPs, though the risk of higher impermanent loss is magnified by this design. Trading and routing are also available via the Raydium API.

Website / X (Twitter) / Discord / Telegram

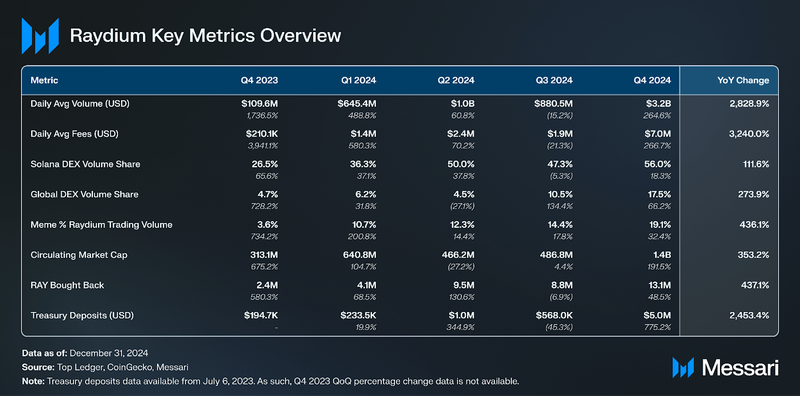

Key Metrics Performance AnalysisVolume and Market Share

Performance AnalysisVolume and Market Share

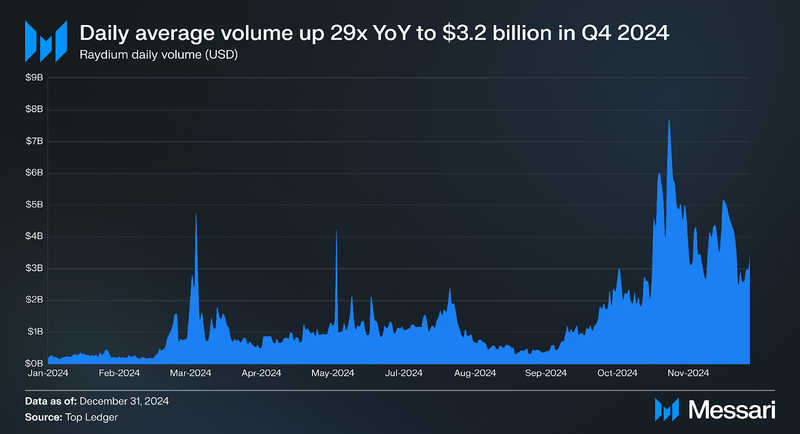

As the leading DEX on Solana, Raydium’s trading volumes are a key reflection of the network's overall activity. In Q4, daily average volume grew 265% QoQ to $3.2 billion and is up more than 29x year-over-year from roughly $110 million in the fourth quarter of 2023. While remarkable on its own, the growth in daily average volume in Q4 was particularly notable as last quarter (Q3) was the first quarter daily average volume on Raydium had declined in the last year compared to the previous quarter. Following the U.S. presidential election on November 5, 2024, daily volume surged and peaked at $7.7 billion on November 19. Thereafter, daily volume maintained above $2.5 billion each day for the remainder of the quarter, suggesting the establishment of a new base level in daily trading volume on Raydium.

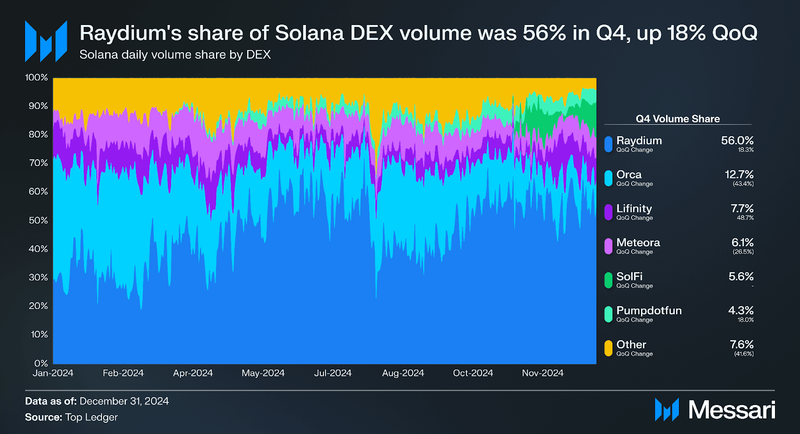

In the fourth quarter, Raydium’s share of Solana DEX volume was 56% (+18% QoQ), its second quarter in 2024 with the majority of Solana’s daily DEX volume and its third straight as the leader in daily DEX volume. Prior to March 2024, Orca was the leading DEX by volume on Solana largely because it was the first to offer concentrated liquidity pools, which were made fully available in April 2022. Concentrated liquidity pools provide lower slippage for traders and higher fee earnings for LPs, though the risk of higher impermanent loss is magnified by this design. Raydium made its Concentrated Liquidity Market Maker (CLMM) pools product fully available in November 2022.

From March 6, 2024, onwards, Raydium has had consistently more daily volume than Orca. At this same time, the token launch platform Pump.fun began its rapid growth. Pump.fun simplifies the process for deployers, who need only select a name, ticker, and image to commence trading on a bonding curve for just a few dollars. On Solana, when enough users buy the token to reach a market capitalization of $69,000, $12,000 is then added to a standard AMM pool on Raydium, which supports asset pricing between zero and infinity. These pools and subsequent ones with tokens first launched on Pump.fun have generated significant trading volume on Raydium.

Another catalyst came on March 26 when Raydium released its V3 user interface in beta. This interface introduced a new portfolio page for users to view and manage liquidity positions, a liquidity page that consolidates all Raydium liquidity pools in one place, support for exact swap amounts, and charts for all tradable token pairs. In May 2024, Raydium V3 fully launched alongside revamped constant product market maker (CPMM) pools that support the Token-2022 token program and include a built-in price oracle. Like Raydium’s legacy standard AMM pools, CPMM pools offer uniform liquidity distribution and asset pricing from zero to infinity.

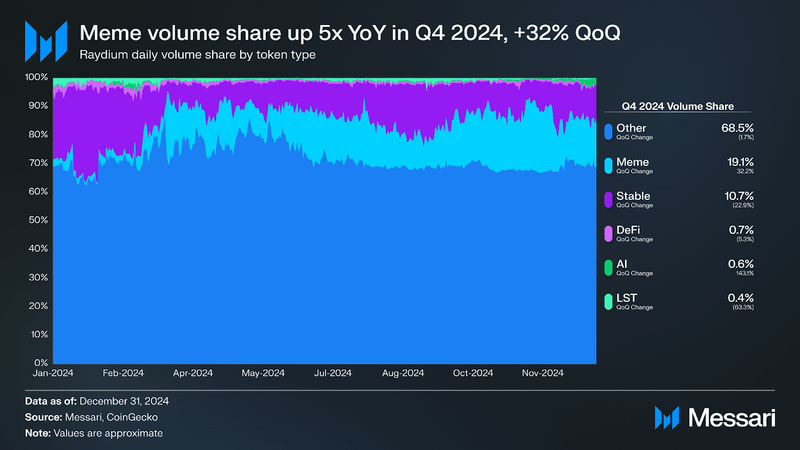

Volume share by token type is an important metric to understand which tokens are trending on Raydium. On an annual basis, meme volume share on Raydium is up more than 5x from 3.6% of trading volume in Q3 2023 to 19.1% in Q4 2024 (+32% QoQ). Additionally, AI tokens emerged in Q4 with a 143% increase QoQ in volume share. In contrast, the volume share of all other token types declined in the fourth quarter. This difference in volume share growth between the narratively hot categories of memes and AI compared to all other token types reinforces the commonly held view that attention drives trading activity in crypto, particularly on Solana.

Outside of memes and AI, some notable tokens to first launch liquidity pools on Raydium in Q4 include Coinbase’s wrapped BTC token cbBTC, Circle’s Euro-pegged stablecoin EURC, Solayer Labs’ interest-bearing sUSD stablecoin, Orderly Network’s ORDER token, Magic Eden’s ME token, and Pudgy Penguins’ PENGU token.

Raydium’s share of global DEX volume increased more than 66% QoQ to 17.5%. Only Lifinity had a larger increase in volume share among the top six global DEXs in the fourth quarter. Additionally, Raydium flipped PancakeSwap to become the second-largest DEX by volume share in Q4, trailing only Uniswap. Raydium’s increased volume share reflects both the relative strength of Raydium to other DEXs on Solana as discussed above, and Solana’s increasing share of DEX volume across all chains. In Q4, Solana's share of weekly DEX volume across all chains surpassed Ethereum every week, whereas in Q3 Solana only did so in three weeks. Solana’s flippening of Ethereum DEX volume marks a critical point in a trend that first emerged in December 2023 following airdrops like JTO that brought millions in liquidity to Solana spurring a wealth effect that resulted in a massive uptick in network activity.

Financial

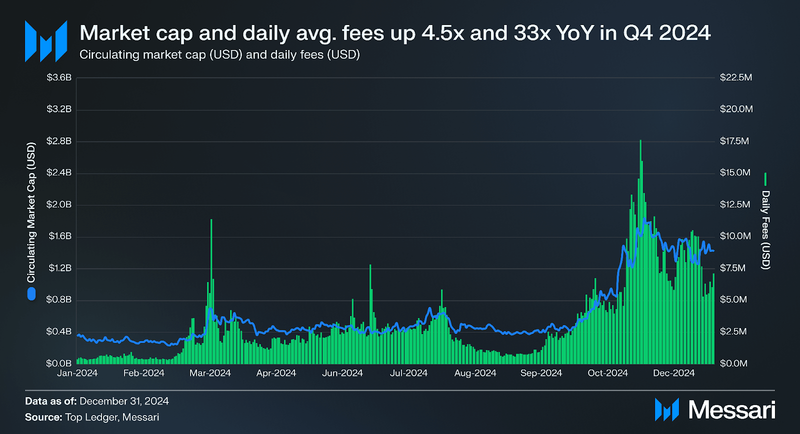

In the fourth quarter, RAY’s circulating market cap increased 190% QoQ to $1.4 billion. Year-over-year, RAY’s market cap is up more than 4.5x from $313 million at the close of Q4 2023. Likewise, daily average fees are up more than 33 times year-over-year from an average of $210,000 in Q4 2023 to $7 million. This growth in daily average fees is approximately in line with daily average volume (discussed above), which is up 29 times year-over-year from an average of 109.6 million in Q4 2023 to $3.2 billion. In contrast, in the first three quarters of 2024, RAY’s market cap remained relatively flat even as the protocol collected increased fees relative to trading volume.

On Raydium, the RAY token has a number of functions.

- Stake RAY to earn RAY: RAY holders can stake RAY to earn additional RAY tokens at an APR of approximately 5%.

- RAY Liquidity Provision Rewards: Liquidity providers can earn RAY when allocated by the project team to reward liquidity providers in a particular pool. Pools incentivized with RAY and/or a third-party token can easily be seen on Raydium’s Liquidity Pools page.

- Other RAY Rewards: The protocol may also offer other ways to earn RAY at its discretion. For example, during the public beta phase of Raydium Perps, anyone can submit UI/UX bugs to earn RAY with one participant each week earning 50 RAY, ten participants earning 10 RAY, and 50 participants earning 5 RAY. Additionally, Raydium’s bug bounty program can pay rewards in RAY, SOL, or USDC on Solana.

- Governance: Raydium has an offchain governance process facilitated via Realms, where users must deposit RAY to participate. A minimum of 1.00 million RAY is required to create a proposal, while each token equals one vote for active proposals. As of the close of Q3, there have been two proposals.

Of RAY’s 555 million maximum supply, 188.7 million RAY (34%) is allocated to a mining reserve, with ~1.9 million emitted each year. At the end of Q4, approximately 291 million RAY (52% of the maximum supply) was circulating. The project’s documentation states that the “Team” and “Seed” allocations, which together make up 25.9% of the maximum supply, fully vested in February 2024. Additionally, the documentation states “The majority of the locked supply remains allocated to the Mining Reserve, Partnership & Ecosystem, and Advisors.” Together these allocations make up 66% of the maximum supply (366.3 million RAY).

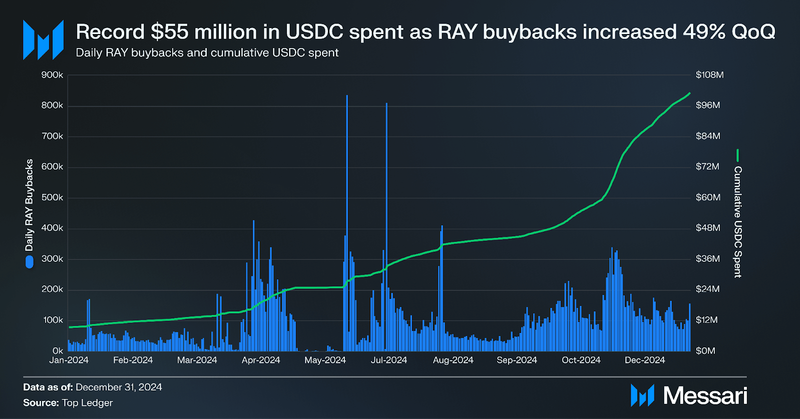

In the fourth quarter, a record $55 million in USDC (+245% QoQ) generated from protocol fees was spent buying back RAY from the open market. This resulted in a record 13.1 million RAY bought back in Q4 (+49% QoQ), even as the price of RAY increased from $1.85 to $4.88 (+164%) QoQ.

On Raydium, pool creators can select the pool’s trading fee from a number of fee tiers depending on the pool type:

- Standard AMM (AMM V4): 0.25%

- Concentrated liquidity (CLMM): 0.01%, 0.02%, 0.03%, 0.04%, 0.05%, 0.25%, 1%, 2%

- Constant Product (CPMM): 0.25%, 1%, 2%, 4%

For all pool types, 12% of the fee is allocated to RAY buybacks. Trading fees allocated to buybacks are automatically claimed when the value reaches $10 and transferred to intermediary wallets to “programmatically” buyback RAY. For AMM V4, the remaining 88% of the fee is distributed to the pool’s liquidity providers pro rata, while for CLMM and CPMM it is 84%, with the remaining 4% allocated to the treasury. Treasury fees for CLMM and CPMM pools are automatically swapped to USDC and held in treasury accounts controlled by the protocol multsig. 5.0 million was deposited to the treasury in Q4, a 775% increase from the $568,000 deposited in Q3, and 5x the previous all-time high of $1 million deposited in Q2.

On Jan. 1, 2024, a trial pool creation fee of 0.68 SOL was instituted for standard AMM pools to prevent pool spamming. This pool creation fee was reduced to 0.4 SOL on Feb. 16, 2024, while a 0.15 SOL fee was implemented for CPMM, which fully launched in May (there is no pool creation fee for CLMM). Fees are held in accounts controlled by the protocol multisig and reserved for protocol infrastructure costs. By the end of 2024, Raydium had generated more than 204,000 SOL in pool creation fees.

Qualitative AnalysisRaydium Perps Public Beta LaunchOn January 10, 2025, Raydium released its public beta for trading perpetual futures, a type of derivative contract that allows traders to speculate on an asset’s price without an expiry date. Raydium Perps is powered by Orderly Network’s liquidity layer and features gas-free trading with up to 50x leverage on more than 70 trading pairs. During the beta phase there are no fees on maker trades and 2.5bps in fees on taker trades charged by Orderly Network. To begin trading, prospective users can connect a Solana wallet, register and generate an API Key, and deposit USDC, the only accepted form of collateral. Notably, a swap and bridge feature to deposit any asset converted to USDC collateral is intended for future release. Also during public beta, anyone can submit UI/UX bugs to earn RAY with one participant each week earning 50 RAY, ten participants earning 10 RAY, and 50 participants earning 5 RAY.

TeleportOn Oct. 2, 2024, Raydium announced the launch of Teleport, a new feature enabling token transfers from EVM networks to Solana. Teleport integrates Circle’s Cross-Chain Transfer Protocol (CCTP) for the stablecoin USDC via CCTP’s native mint and burn mechanism, as well Wormhole Connect, a React widget for cross-chain asset transfer via Wormhole.

Burn and Earn LaunchOn Sept. 11, 2024, Raydium launched Burn and Earn, which allows any liquidity provider to permanently lock the NFT representing the underlying position while all trading fees earned by the position remain claimable. In doing so, Burn and Earn enables project teams and token creators to increase community trust regarding liquidity provision while still allowing for the claiming of fees. Initially, Burn and Earn only supported CLMM pools. Support for CPMM was added on Oct. 23, as were transferable NFTs for fee claiming of underlying locked positions. Transferable NFTs are minted to the wallet that locked the position, and are “meta-agnostic,” allowing the NFT holder to distribute or transfer fee-claiming rights. API support is also enabled for users and third parties seeking to track burnt liquidity for any pool (CLMM or CPMM).

New Fee TiersOn Aug. 1, 2024, the protocol introduced additional fee tiers of 0.02%, 0.03%, 0.04%, 2% for CLMM (concentrated liquidity market maker) and 1%, 2%, and 4% for CPMM (constant product market maker). For both CPMM and CLMM, 84% of the trading fee for each swap goes to liquidity providers, 12% to RAY buybacks, and 4% to the treasury. The 4% allocated to the treasury is automatically swapped to USDC and transferred to two accounts controlled by the protocol multisig.

BlinksOn July 1, 2024, Raydium announced support for creating Blockchain Links (Blinks) for all assets. Blinks are shareable links that convert Solana Actions into metadata-rich URLs and were first launched by the Solana Foundation in partnership with Dialect at the end of Q2. On the Raydium website users can copy their unique trading link and earn 1% rewards in SOL when it’s used on “X” (Twitter) with Blink to complete a trade. The referral fee is part of the transacting user’s swap from SOL and then sent to the referrer account.

Integrations, Partnerships, and UpgradesRaydium has made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations, partnerships, and upgrades:

- UNCX Network Integration (Oct. 11) - UNCX Network, a multichain service provider, integrated Raydium’s “Burn and Earn” feature, which allows users to lock liquidity.

- Moonshot Integration (Oct. 16) - Moonshot announced its OpenBook Market savings now go directly to the developer for migrations to Raydium.

- Wasabi Protocol Integration (Nov. 15) - Wasabi Protocol, a spot leverage DEX, announced settlement of its leveraged trades on Raydium.

- GoPlus Security Integration (Nov. 15) - GoPlus, a user security network, integrated Raydium’s Burn and Earn token locking feature to its Solana Token Security API.

- Krystal Integration (Nov. 26) - Krystal, a liquidity launchpad and management tool integrated Raydium.

- Rugcheck Integration (Dec. 7) - RugCheck, a tool for avoiding token scams and rugs, added Raydium’s Burn and Earn token locking feature to its tool that allows users to assess a token’s risk factors.

- Definitive Integration (Dec. 11, 2024) - Definitive, a trading platform that offers gas-free trading and advanced order types, integrated Raydium

- RAY Listings - In Q4, RAY was listed by the exchanges HTX (Dec. 7) and Bithumb (Nov. 19). Drift, a perpetual futures exchange on Solana, also added RAY perpetual futures on Dec. 3.

Raydium averaged $3.2 billion in daily volume in Q4, up more than 29x year-over-year from roughly $110 million in the fourth quarter of 2023. Q4 was also Raydium’s second quarter in 2024 with the majority of Solana’s daily DEX volume and its third straight as the leader in daily DEX volume. Moreover, Raydium’s share of global DEX volume increased more than 66% QoQ to over 17% as it flipped PancakeSwap to become the second-largest DEX by volume share in Q4, trailing only Uniswap.

Additionally, new features and upgrades were made to improve the protocol’s functionality and user experience. Key among them, Raydium released its public beta for trading perpetual futures with no fees on maker trades and 2.5bps in fees on taker trades during the beta phase. Also, Raydium launched its Burn and Earn feature for constant product market maker (CPMM) pools, which allows pool creators to increase trust by permanently locking liquidity while trading fees earned by the locked position remain fully claimable.

From becoming the leader in daily DEX volume on Solana in Q2 to capturing the majority of Solana’s daily DEX volume in two quarters, 2024 was a year of massive growth for Raydium. Looking to 2025, Raydium is positioned well as it aims to surpass Uniswap and become universally recognized as the number one DEX by volume share across all chains.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.