and the distribution of digital products.

State of Raydium Q3 2024

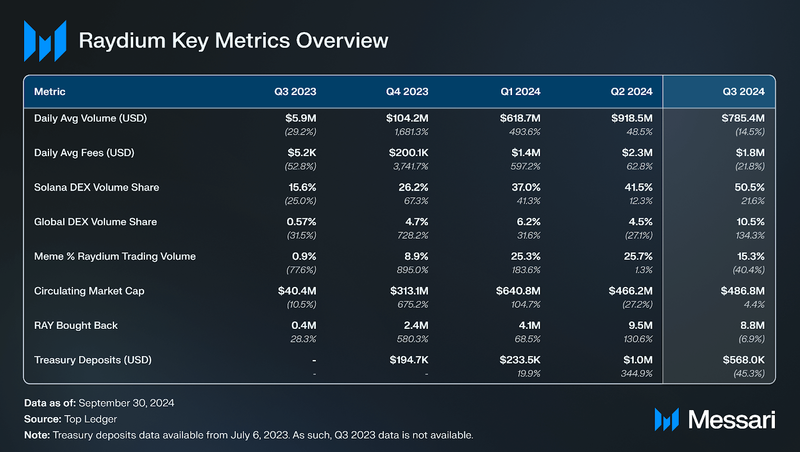

- Raydium averaged $785 million in daily volume in Q3, up more than 100x year-over-year from roughly $6 million in the third quarter of 2023.

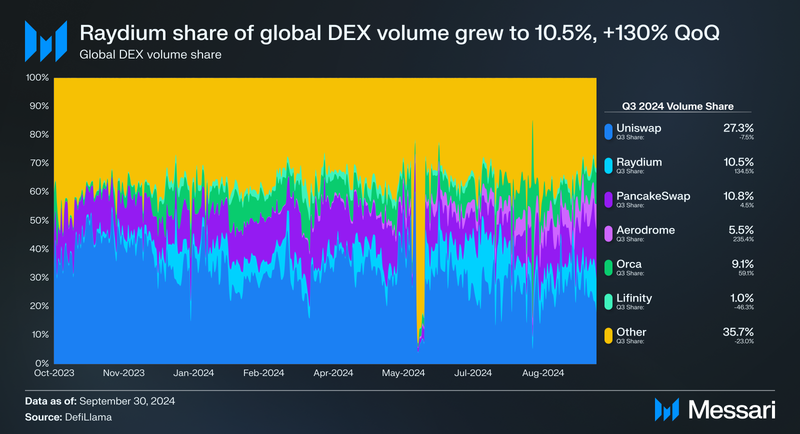

- Raydium’s share of global DEX volume increased more than 130% QoQ to over 10% as it flipped Orca to become the third-largest DEX by volume share in Q3, trailing only PancakeSwap and Uniswap.

- Q3 was Raydium’s first quarter since 2022 with the majority of Solana’s daily DEX volume and its second straight as the leader in daily DEX volume.

- In September, Raydium launched Burn and Earn, a feature that enables project teams to increase trust regarding liquidity provision by permanently locking liquidity while trading fees earned by the locked position remain fully claimable.

- Raydium launched support for creating Blockchain Links (Blinks) for all assets and a 1% referral reward in SOL for users each time their Blink is used on “X” (Twitter) to complete a trade.

Raydium (RAY) is the largest automated market maker (AMM) decentralized exchange (DEX) on Solana. First launched in 2021, Raydium allows users to permissionlessly create new liquidity pools, provide liquidity to existing pools, and swap tokens. Liquidity providers earn trading fees on each swap made in a pool as well as RAY (the protocol’s token) and/or other tokens if the pool is incentivized. RAY holders can also stake RAY to earn additional RAY tokens.

In May 2024, the Raydium V3 application launched alongside revamped constant product market maker (CPMM) pools that support the Token-2022 token program and include a built-in price oracle. In addition to CPMM pools and its legacy standard AMM pools (AMM V4), which offer uniform liquidity distribution, Raydium offers Concentrated Liquidity Market Maker (CLMM) pools that allow for liquidity concentration at specific price points. CLMM provides lower slippage for traders and higher fee earnings for LPs, though the risk of higher impermanent loss is magnified by this design. Trading and routing are also available via the Raydium API.

Website / X (Twitter) / Discord / Telegram

Key Metrics Performance AnalysisVolume and Market Share

Performance AnalysisVolume and Market Share

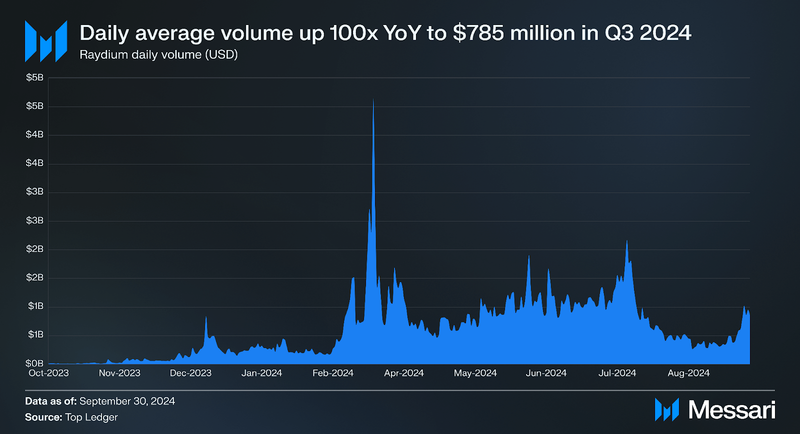

As the leading DEX on Solana, Raydium’s trading volumes are a key reflection of the network's overall activity. While the daily average volume on Raydium declined modestly (14%) QoQ to $785 million in Q3, it is up more than 100x year-over-year from roughly $6 million in the third quarter of 2023. Prior to this quarter, the daily average volume had risen in each of the past three quarters. Even with Q3’s decline, there have now been three straight quarters of more than 100x Q3 2023’s daily average volume, increasingly suggesting these levels of volume are the new norm on Raydium.

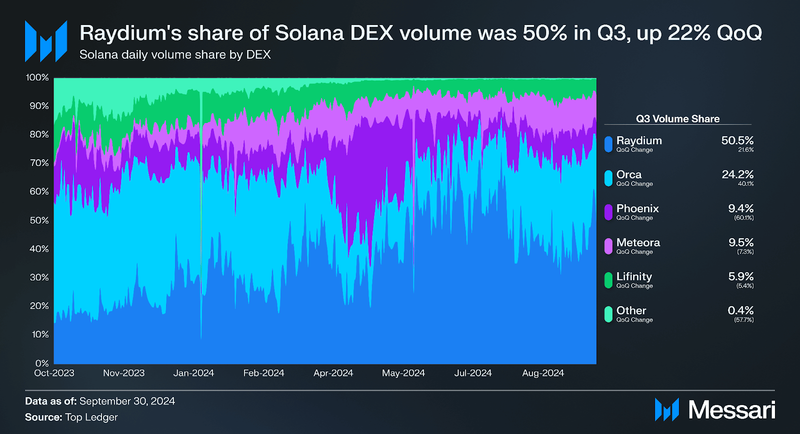

Q3 was Raydium’s first quarter since 2022 with the majority of Solana’s daily DEX volume and its second straight as the leader in daily DEX volume. Prior to March 2024, Orca was the leading DEX by volume on Solana largely because it was the first to offer concentrated liquidity pools, which were made fully available in April 2022. Concentrated liquidity pools provide lower slippage for traders and higher fee earnings for LPs, though the risk of higher impermanent loss is magnified by this design. Raydium made its Concentrated Liquidity Market Maker (CLMM) pools product fully available in November 2022.

From March 6, 2024, onwards, Raydium has had consistently more daily volume than Orca. At the same time, the token launch platform Pump.fun began its rapid growth. Pump.fun simplifies the process for deployers, who need only select a name, ticker, and image to commence trading on a bonding curve for just a few dollars. On Solana, when enough users buy the token to reach a market capitalization of $69,000, $12,000 is then added to a standard AMM pool on Raydium, which supports asset pricing between zero and infinity. These pools and subsequent ones with tokens first launched on Pump.fun have generated significant trading volume on Raydium.

Another catalyst came on March 26 when Raydium released its V3 user interface in beta. This interface introduced a new portfolio page for users to view and manage liquidity positions, a liquidity page that consolidates all Raydium liquidity pools in one place, support for exact swap amounts, and charts for all tradable token pairs. In May 2024, Raydium V3 fully launched alongside revamped constant product market maker (CPMM) pools that support the Token-2022 token program and include a built-in price oracle. Like Raydium’s legacy standard AMM pools, CPMM pools offer uniform liquidity distribution and asset pricing from zero to infinity.

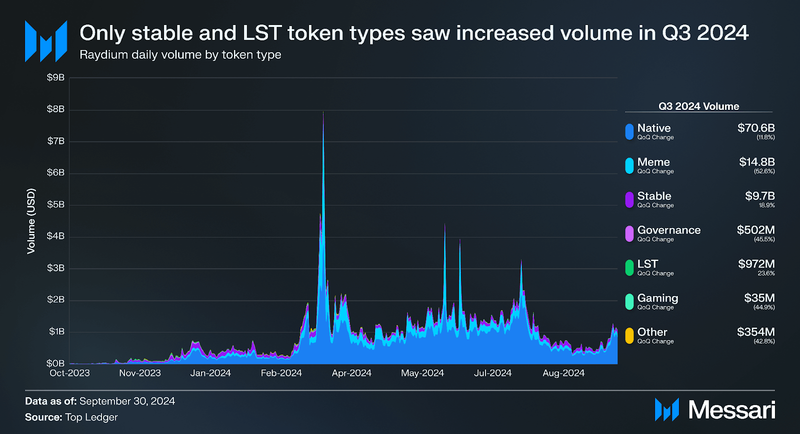

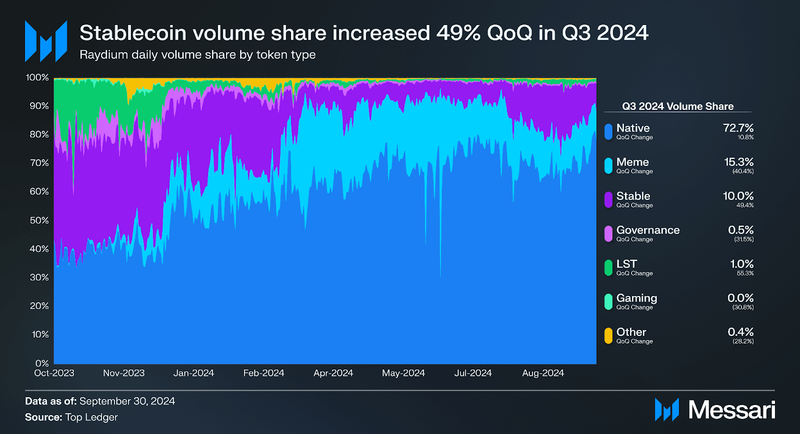

In the third quarter, stablecoins and liquid staking tokens (LSTs) were the only token types to see increased trading volume on Raydium. Stablecoin trading volume increased 19% QoQ to $9.7 billion while LST trading volume increased 24% to $970 million. In contrast, volume for the top two token types by volume, native (SOL) and meme(s), both declined. Trading volume for native SOL declined 12% QoQ to $70.6 billion, while meme declined 53% to $15.6 billion.

As a result, both stablecoin and LST token types saw roughly a 50% increase in Raydium volume share by token type, while native increased by 11% and meme declined by 40%. It is also worth noting that while quarterly volume for native and meme token types peaked in Q2, quarterly volume for stablecoins peaked in Q1 at $11.1 billion.

Raydium’s share of global DEX volume increased more than 130% QoQ to over 10%. Only Aerodrome on Base had a larger increase in volume share among the top six DEXs (global) in the third quarter. Additionally, Raydium flipped Orca to become the third-largest DEX by volume share in Q3, trailing only PancakeSwap and Uniswap. Raydium’s increased volume share reflects both the relative strength of Raydium to other DEXs on Solana as discussed above, and Solana’s increasing share of DEX volume across all chains. In Q3, Solana's share of weekly DEX volume across all chains surpassed Ethereum three times and was second to Ethereum all other weeks. This trend of Solana challenging Ethereum’s weekly DEX volumes first emerged in December 2023 following airdrops like JTO that brought millions in liquidity to the network spurring a wealth effect that resulted in a massive uptick in network activity.

Financial

In the third quarter, RAY’s circulating market cap increased 4% QoQ to $486 million, in line with its parent network Solana (SOL +6% QoQ). Year-over-year, RAY’s market cap is up more than ten times from $40.4 million at the close of Q3 2023. Likewise, daily average fees are up more than 300 times year-over-year from an average of $5k in Q3 2023 to $1.8 million. As such, the multiple between the two figures has compressed approximately thirty times, while the multiple between daily average volume (discussed above) and market cap has compressed approximately ten times. The difference in multiple compression reflects that RAY’s market cap has remained relatively flat since the first quarter even as the protocol has collected increased fees relative to trading volume.

On Raydium, the RAY token has a number of functions.

- Stake RAY to earn RAY: RAY holders can stake RAY to earn additional RAY tokens at an APR of approximately 5%.

- RAY Liquidity Provision Rewards: Liquidity providers can earn RAY when allocated by the project team to reward liquidity providers in a particular pool. Pools incentivized with RAY and/or a third-party token can easily be seen on Raydium’s Liquidity Pools page.

- Governance: Raydium has an offchain governance process facilitated via Realms, where users must deposit RAY to participate. A minimum of 1.00 million RAY is required to create a proposal, while each token equals one vote for active proposals. As of the close of Q3, there have been two proposals.

Of RAY’s 555 million maximum supply, 188.7 million RAY (34%) is allocated to a mining reserve, with ~1.9 million emitted each year. At the end of Q3, approximately 263 million RAY (48% of the maximum supply) was circulating. The project’s documentation states that the “Team” and “Seed” allocations, which together make up 25.9% of the maximum supply, fully vested in February 2024. Additionally, the documentation states “The majority of the locked supply remains allocated to the Mining Reserve, Partnership & Ecosystem, and Advisors.” Together these allocations make up 66% of the maximum supply (366.3 million RAY).

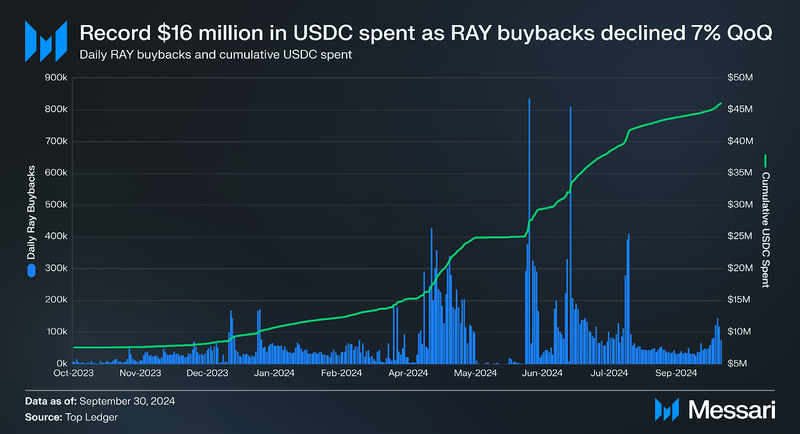

In the third quarter a record $16 million in USDC (+5% QoQ) generated from protocol fees was spent buying back RAY from the open market. Despite this, the amount of RAY bought back in Q3 declined 7% as the price increase of the RAY token outpaced the amount of USDC spent.

On Raydium, pool creators can select the pool’s trading fee from a number of fee tiers depending on the pool type:

- Standard AMM (AMM V4): 0.25%

- Concentrated liquidity (CLMM): 0.01%, 0.02%, 0.03%, 0.04%, 0.05%, 0.25%, 1%, 2%

- Constant Product (CPMM): 0.25%, 1%, 2%, 4%

For all pool types, 12% of the fee is allocated to RAY buybacks. Trading fees allocated to buybacks are automatically claimed when the value reaches $10 and transferred to intermediary wallets to “programmatically” buyback RAY. For AMM V4, the remaining 88% of the fee is distributed to the pool’s liquidity providers pro rata, while for CLMM and CPMM it is 84%, with the remaining 4% allocated to the treasury. Treasury fees for CLMM and CPMM pools are automatically swapped to USDC and held in treasury accounts controlled by the protocol multsig. $570,000 was deposited to the treasury in Q3, a 45% decline QoQ from an all-time high of $1 million in Q2. Still, treasury deposits are up nearly three times from their Q4 2023 total of $194,000.

On Jan. 1, 2024, a trial pool creation fee of 0.68 SOL was instituted for standard AMM pools to prevent pool spamming. This pool creation fee was reduced to 0.4 SOL on Feb. 16, 2024, while a 0.15 SOL fee was implemented for CPMM, which fully launched in May. Fees are held in accounts controlled by the protocol multisig and reserved for protocol infrastructure costs. By the end of this year’s third quarter, Raydium had generated more than 161,000 SOL in pool creation fees.

Qualitative AnalysisBlinksOn July 1, 2024, Raydium announced support for creating Blockchain Links (Blinks) for all assets. Blinks are shareable links that convert Solana Actions into metadata-rich URLs and were first launched by the Solana Foundation in partnership with Dialect at the end of Q2. On the Raydium website users can copy their unique trading link and earn 1% rewards in SOL when it’s used on “X” (Twitter) with Blink to complete a trade. The referral fee is part of the transacting user’s swap from SOL and then sent to the referrer account.

New Fee TiersOn Aug. 1, 2024, the protocol introduced additional fee tiers of 0.02%, 0.03%, 0.04%, 2% for CLMM (concentrated liquidity market maker) and 1%, 2%, and 4% for CPMM (constant product market maker). For both CPMM and CLMM, 84% of the trading fee for each swap goes to liquidity providers, 12% to RAY buybacks, and 4% to the treasury. The 4% allocated to the treasury is automatically swapped to USDC and transferred to two accounts controlled by the protocol multisig.

Burn and Earn LaunchOn Sept. 11, 2024, Raydium launched Burn and Earn, which allows any liquidity provider to permanently lock the NFT representing the underlying position while all trading fees earned by the position remain claimable. In doing so, Burn and Earn enables project teams and token creators to increase community trust regarding liquidity provision while still allowing for the claiming of fees. Initially, Burn and Earn only supported CLMM pools. Support for CPMM was added on Oct. 23, as were transferable NFTs for fee claiming of underlying locked positions. Transferable NFTs are minted to the wallet that locked the position, and are “meta-agnostic,” allowing the NFT holder to distribute or transfer fee-claiming rights. API support is also enabled for users and third parties seeking to track burnt liquidity for any pool (CLMM or CPMM).

TeleportOn Oct. 2, 2024, Raydium announced the launch of Teleport, a new feature enabling token transfers from EVM networks to Solana. Teleport integrates Circle’s Cross-Chain Transfer Protocol (CCTP) for the stablecoin USDC via CCTP’s native mint and burn mechanism, as well Wormhole Connect, a React widget for cross-chain asset transfer via Wormhole.

Integrations, Partnerships, and UpgradesRaydium has made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations, partnerships, and upgrades:

- Moongate Integration (July 6) - Moongate integrated with Raydium enabling users to sign into Raydium via Apple, Google, or an Ethereum account.

- Moonke.biz Integration (July 10) - Moonke.biz, a memecoin launchpad, integrated the Raydium API as part of its “stake-to-meme” mechanism to deploy pools on Raydium for newly launched memecoins.

- Padre Integration (July 12) - Padre, an onchain trading platform, integrated Raydium to support trading on Solana.

- Moonpay Integration (July 12) - Raydium integrated Moonpay, which allows anyone to buy crypto via traditional payment rails, so that anyone can onboard to Solana to use Raydium.

- SolarMint Integration (July 26) - SolarMint, a free token minting platform, announced it had begun integrating Raydium CPMM (constant product market maker).

- 21BTC Partnership (Sept. 26) - 21.co, the issuer of 21BTC, a wrapped BTC token on Solana, announced a partnership with Raydium for its 21BTC-jitoSOL liquidity pool on Raydium.

- UNCX Network Integration (Oct. 11) - UNCX Network, a multichain service provider, integrated Raydium’s “Burn and Earn” feature, which allows users to lock liquidity.

Despite a 14% QoQ decline to $785 million, Raydium’s daily average trading volume is still up more than 100x year-over-year for the third consecutive quarter, increasingly suggesting these levels of volume are here to stay. Q3 was also Raydium’s first quarter since 2022 with the majority of Solana’s daily DEX volume and its second straight as the leader in daily DEX volume. Moreover, Raydium’s share of global DEX volume increased more than 130% QoQ to over 10% as it flipped Orca to become the third-largest DEX by volume share in Q3, trailing only PancakeSwap and Uniswap.

Additionally, a number of upgrades were undertaken to improve the overall user experience and network functionality. Key among them, Raydium launched its Burn and Earn feature so that pool creators can increase trust by permanently locking liquidity while trading fees earned by the locked position remain fully claimable. Additionally, Blockchain Links (Blinks) support was added for all assets as well as a 1% referral reward for users each time their Blink is used on “X” (Twitter) to complete a trade.

From its journey as the first AMM on Solana to capturing the majority of Solana’s DEX volume in Q3, Raydium is positioned well as it seeks to overtake Uniswap and become the number one DEX by volume across all chains.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.