and the distribution of digital products.

State of Pyth Q4 2024

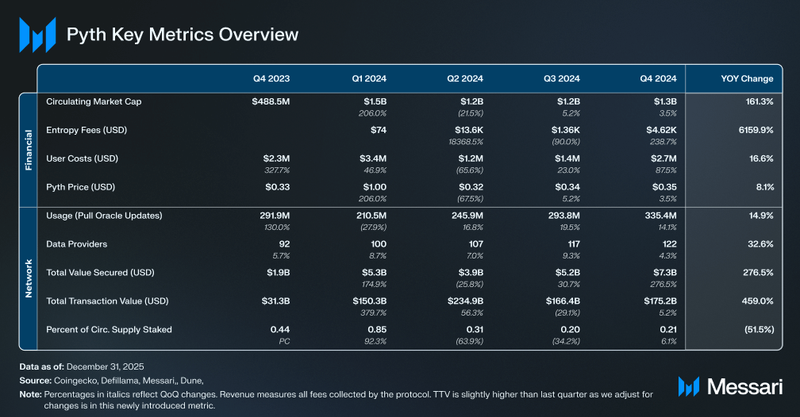

- Total Transaction Value (TTV) increased 459.1% YoY, rising from $31.3 billion in Q4’23 to $175.2 billion in Q4’24, reinforcing Pyth’s position as the dominant oracle by transaction volume.

- Total price updates grew 67.5% YoY, reaching 336.2 million updates, up from 200.7 million in Q4’23. Sui and Aptos continued to lead, contributing to the overall increase, while Solana saw a decline as update distribution shifted.

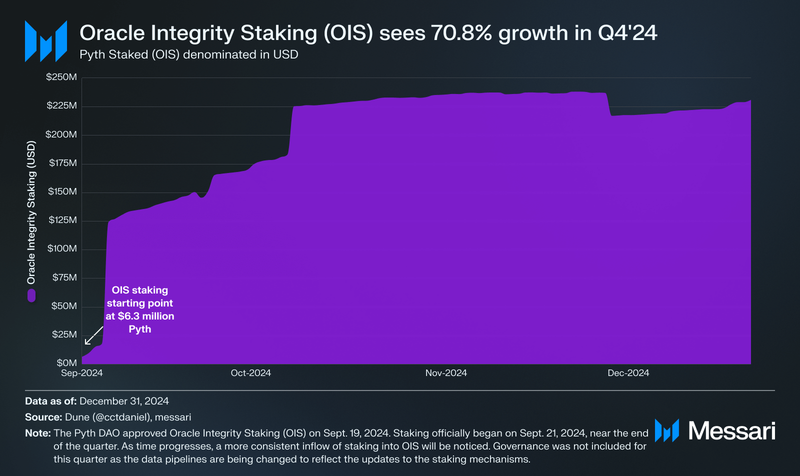

- Oracle Integrity Staking (OIS) staking volume grew 70.8% QoQ, rising from $135.2 million at the end of Q3'24 to $230.9 million in Q4'24, highlighting continued growth since its inception on Sept. 21, 2024.

- Pyth expanded its DeFi integrations with Kamino Swap's Express Relay and Redemption Rate Feeds (RRF) for real-time pricing. It also launched real-time oil price feeds, becoming the first oracle to support oil as commodities.

- Pyth expanded institutional accessibility with the launch of the VanEck Pyth ETN and the 21Shares Pyth ETP, providing European investors with regulated exposure to the PYTH token through traditional financial products.

Pyth (PYTH) is an oracle network that aims to offer accurate prices for cryptocurrencies, equities, foreign exchange pairs, ETFs, and commodities. Oracle networks aggregate external data and make it available for onchain application use. Pyth fosters a network of first-party (primary source and aggregator) data providers and coordinates a “pull” oracle model. This model scales price feeds across many chains and lowers network costs by offloading update fees to data consumers (applications and developers). Pyth offers four core products:

- Price Feeds (live updates for smart contracts)

- Benchmarks (historical market data)

- Express Relay (priority auction to eliminate MEV)

- Pyth Entropy (secure random number generator)

The integrity of Pyth’s data is dependent on its contributing publisher network, which comprises over 110 data providers from global exchanges, trading firms, market makers, institutions, and DeFi. A few notable providers include Jane Street, Cboe Global Markets, Binance, Raydium, Osmosis, Galaxy, and 0x. Pyth is focused on making financial market data available to developers on an expanding list of blockchain networks (97+ chains as of writing). For a full primer on Pyth, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisTotal Transaction Value (TTV):

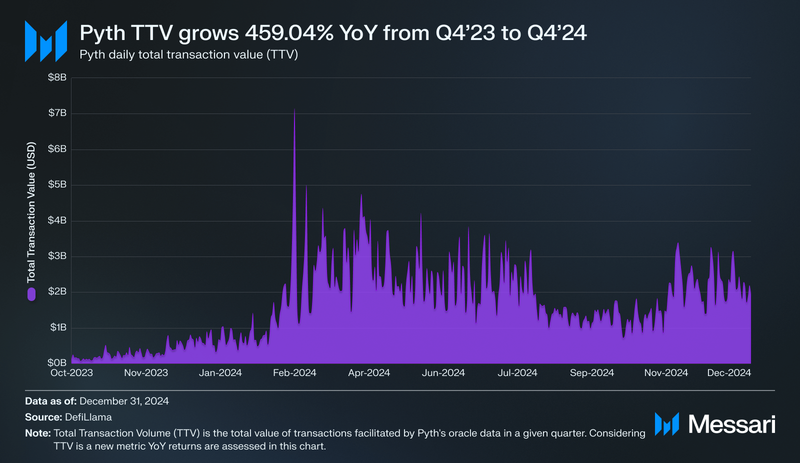

Performance AnalysisTotal Transaction Value (TTV): Total Transaction Volume (TTV) provides a more precise measure of an oracle’s activity by capturing the actual transaction volume it enables rather than just the value of secured assets. Unlike Total Value Secured (TVS), which reflects static asset value, TTV highlights the frequency and scale of transactions relying on an oracle’s data—making it particularly relevant for high-frequency DeFi applications like DEXs and derivatives platforms. By tracking the total volume facilitated across integrated protocols, TTV offers a clearer picture of oracle demand, market share, and revenue potential in the evolving DeFi landscape.

Total Transaction Value (TTV) in Q4'24 reached $175.2 billion, reflecting a 5.2% increase from $166.5 billion in Q3'24. Year-over-year, TTV saw a 459.1% surge, rising from $31.3 billion in Q4'23. This continued expansion highlights the increasing reliance on Pyth’s oracle services for transaction-intensive DeFi applications. As TTV remains a relatively new metric, it will continue to be evaluated to track long-term trends in oracle activity and market adoption.

TTV vs. TVSWith Q4'24 marking the second quarter of reporting Total Transaction Value (TTV), its role as a key metric in evaluating oracle activity is becoming clearer. At the same time, Total Value Secured (TVS) remains an important measure of the sector’s overall stability. Moving forward, TTV and TVS will continue to be assessed quarterly, offering insights into both transaction volume and the value secured by top oracles. As TTV gains wider industry adoption, TVS will still provide valuable context for tracking the broader oracle market. Given Pyth’s high-frequency transaction model, TTV remains particularly relevant in capturing its real-time usage and network demand.

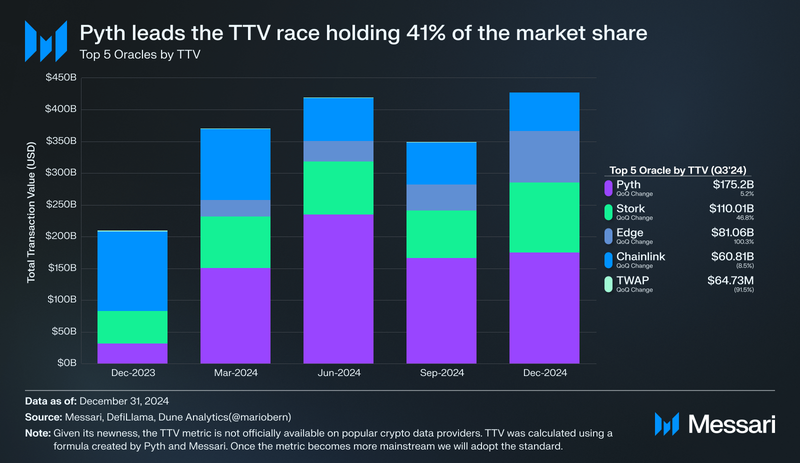

In Q4'24, Pyth maintained its lead in TTV, growing 5.2% QoQ from $166.5 billion to $175.2 billion, securing 41.0% of the total market share despite a 6.7 percentage point decline from Q3. Stork followed in second place, experiencing a 46.8% increase in TTV from $75.0 billion to $110.1 billion, strengthening its market position. Meanwhile, Edge recorded the largest quarterly TTV growth, surging 100.3% to $81.1 billion, overtaking Chainlink, which saw its TTV decline 8.5% from $66.4 billion to $60.8 billion. TWAP, a smaller oracle provider, faced the steepest drop, with TTV declining 91.5% QoQ from $757.9 million to $64.7 million.

While TTV reflects Pyth’s dominance in transaction volume, TVS remains stable, with Pyth increasing its TVS by 41.2% QoQ to $7.3 billion, reinforcing its position in the top three among oracles by secured asset value. Chainlink led the TVS market, growing 40.2% to $36.7 billion, while Chronicle and RedStone saw TVS increases of 29.2% and 49.5%, respectively. In contrast, WINkLink’s TVS declined 11.6%, marking the only major decrease among top oracles.

Overall, these shifts highlight diverging trends in the oracle space—TTV-heavy oracles like Pyth and Edge prioritize transaction-driven applications, while Chainlink continues to dominate in TVS, securing high-value assets. The oracle market is becoming increasingly specialized, with protocols carving out distinct niches in data provisioning across DeFi, derivatives, and traditional finance integrations.

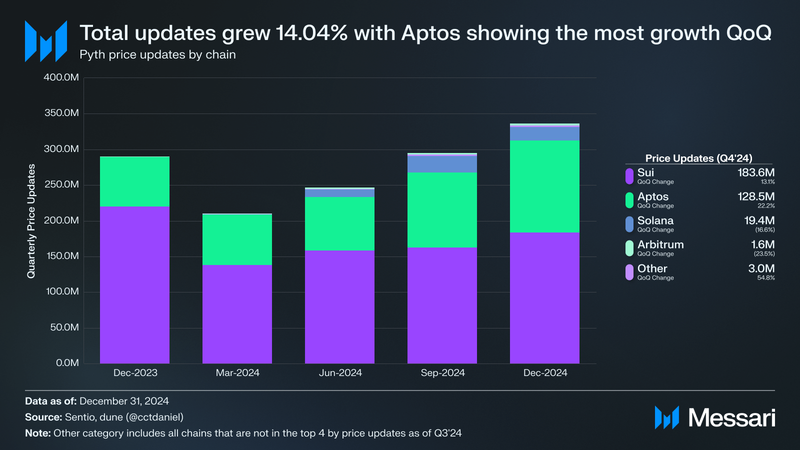

Price UpdatesAs a pull oracle, Pyth’s demand is reflected by the volume of price updates it provides. In Pyth-secured applications, DeFi users initiate smart contract calls that simultaneously request the latest Pyth price data within the same transaction. This means that each time a DeFi protocol requires updated price information, a call is made to Pyth, and the oracle publishes a real-time price update directly within the transaction.

Pyth oracle demand continued to rise in Q4'24, with total price updates increasing 14.04% QoQ, reaching 336.2 million updates, up from 294.8 million in Q3'24. Sui Mainnet remained the largest contributor, growing 13.2% to 183.7 million updates, while Aptos Mainnet saw a 22.2% increase, reaching 128.5 million updates. Solana experienced a 16.6% decline, dropping to 19.4 million updates, while Arbitrum decreased by 23.5%, totaling 1.56 million updates. Other Chains saw a 54.8% increase, rising to 3.02 million updates.

In terms of overall update distribution, Sui Mainnet accounted for 54.6%, followed by Aptos at 38.2% and Solana at 5.8%. Arbitrum and Other Chains contributed 0.5% and 0.9%, respectively. These trends reflect continued demand for Pyth’s price feeds, with variations across chains highlighting shifts in network activity and integration patterns.

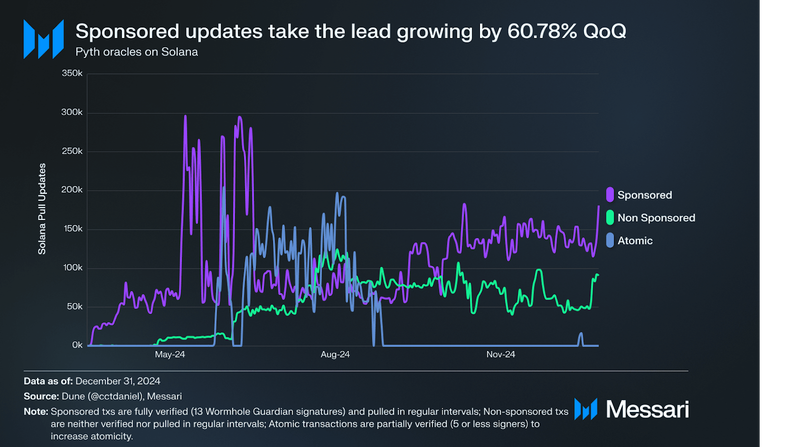

In Q3’24, the Pyth Network experienced a shift in the composition of its price update transactions on Solana, with notable changes across sponsored, non-sponsored, and atomic updates. Sponsored updates (calculated as the sum of quarterly updates) took the lead in Q4’24, growing from 7.7 million updates in Q3’24 to 12.38 million in Q4’24, increasing by 60.78%. Sponsored updates are those executed at regular intervals using the Pyth Scheduler, a permissionless off-chain application that ensures continuous price updates for applications requiring consistent data refreshes. These updates are fully verified by 13 Wormhole Guardian signatures, ensuring high levels of security and reliability.

Despite being the fastest-growing transaction type in Q3'24, atomic updates saw a significant decline in Q4'24, dropping from 7.7 million transactions to just 28,242—a 99.6% decrease quarter-over-quarter. While atomic updates had previously gained traction due to their efficiency and partial verification mechanism, this sharp reduction suggests a shift in application preferences or network usage patterns in Q4'24.

Non-sponsored updates, which grew significantly in Q3'24, saw a moderate decline in Q4'24, dropping from 6.8 million to 6,2 millions—a 8.1% decrease quarter-over-quarter. These manually triggered smart contract calls, which bypass the Scheduler, remain widely used but appear to be consolidating as applications shift toward sponsored updates. This transition suggests an increasing preference for automated and cost-efficient data retrieval mechanisms.

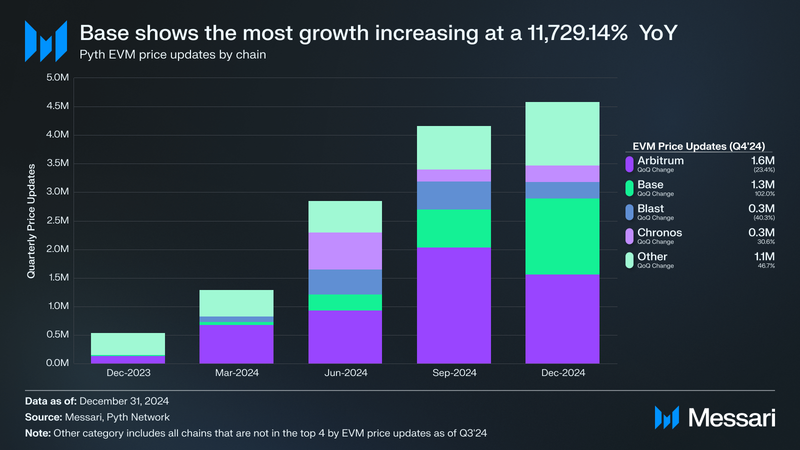

Pyth’s EVM-compatible integrations showed divergent trends in Q4'24, with Base leading in growth, while Arbitrum and Blast saw declines. Base price updates surged 102% QoQ, rising from 659,315 in Q3'24 to 1.3 million in Q4'24, reflecting its expanding role in Pyth’s network. Conversely, Arbitrum price updates fell 23.4%, decreasing from 2.03 million to 1.56 million, marking a shift in update distribution. Blast recorded the largest decline, dropping 40.3%, from 490,415 to 292,836.

Cronos entered the top five EVM chains this quarter, replacing zkSync, with a 30.6% increase, reaching 285,513 updates. Other EVM chains collectively grew by 46.7%, from 757,069 to 1.11 million updates, indicating shifting usage patterns across the ecosystem.

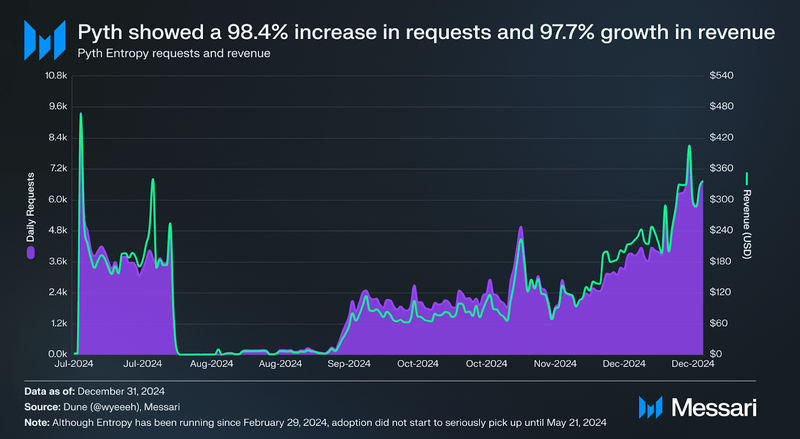

EntropyPyth Entropy offers developers a secure way to generate random numbers on the blockchain, leveraging two-party randomness to ensure trustworthy outcomes. This randomness solution supports applications requiring unpredictability, such as NFT mints, gaming, and consensus mechanisms.

Pyth Entropy's availability has grown QoQ; it is now accessible on 17 EVM networks, up from 16 in Q3’24. In Q4'24, Pyth processed 279,742 requests, generating $13,646 in revenue, marking a 98.4% increase in requests and a 97.7% rise in revenue from Q3'24’s 141,000 requests and $6,900 revenue. While still in its early stages, this third consecutive quarter of data suggests that request volume and revenue are beginning to stabilize. If this trend of steady growth continues, it could indicate long-term sustainability and adoption of Pyth’s pricing model.

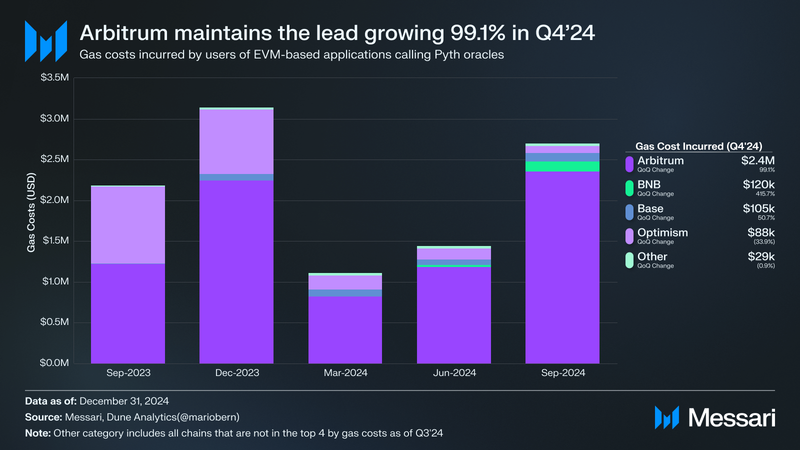

User Costs (EVM)While the cost of pulling a Pyth update is minimal, users are still responsible for the gas fees associated with their DeFi transactions. These gas costs apply solely to users, with no expense incurred by Pyth.

The upward trend in gas costs following the Dencun/EIP-4844 upgrade persisted in Q4'24, with overall costs nearing pre-upgrade levels. Arbitrum maintained the lead, with gas costs increasing 99.1%, from $1.2 million to $2.4 million. Meanwhile, Optimism saw a 33.9% decline, dropping from $133,157 to $88,026, suggesting lower costs despite continued network activity. BNB Chain experienced the largest percentage growth, surging 415.7%, from 23,102 to 119,139, marking the most significant increase among all chains. Base also saw a 50.7% rise, with costs growing from 69,782 to 105,164, indicating sustained expansion in oracle integrations.

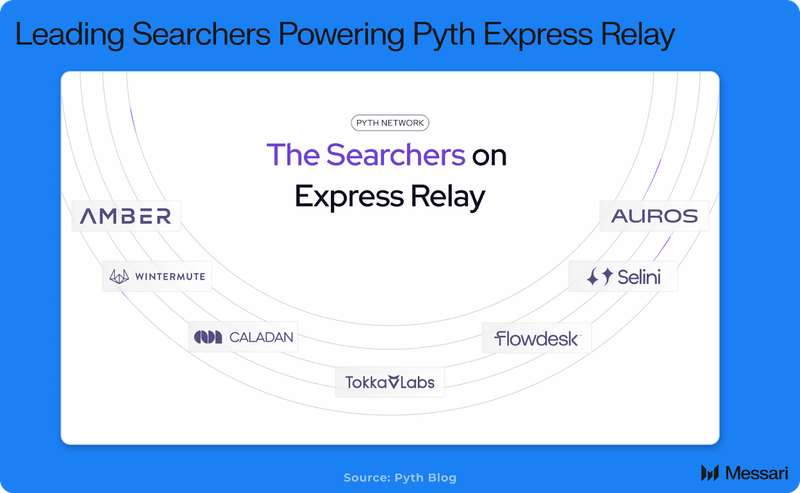

Express Relay on Solana (Kamino Usage)Launched in Q3'24, Express Relay addresses Maximal Extractable Value (MEV) in DeFi by using isolated priority auctions to determine transaction priority off-chain, reducing MEV-related costs and improving efficiency. This mechanism allows searchers to bid for sequencing rights, ensuring transactions are processed more effectively without inflating costs for end-users.

In Q4'24, Kamino Finance integrated Express Relay to power Kamino Swap on Solana, enabling limit orders with plans to add market orders. This setup eliminates MEV, slippage, and extra fees by having searchers compete to fill orders at the best price while providing SOL tips directly to users. The integration highlights Pyth's infrastructure capabilities in delivering efficient, CEX-like execution on-chain, making DeFi more competitive without sacrificing decentralization.

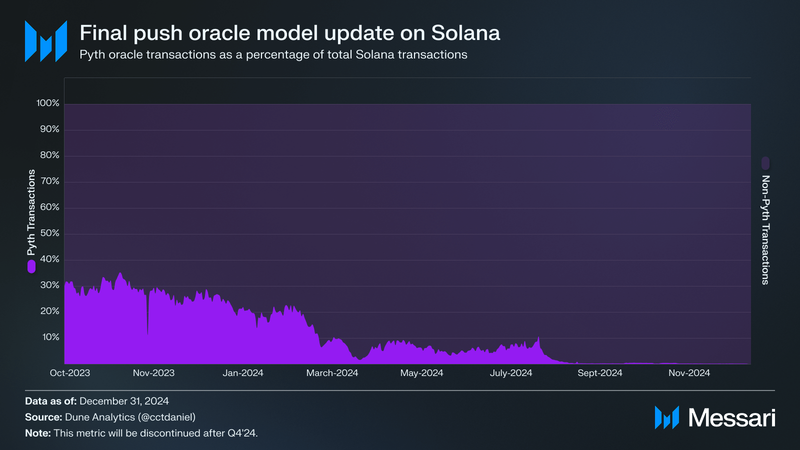

Solana Transaction Share

In Q4'24, Pyth’s share of Solana transactions declined further from 3.09% in Q3'24 to 0.24%, reflecting the near-complete transition from a push oracle model to an on-demand pull oracle. Previously, under the push model, Pyth’s transactions accounted for a significant portion of Solana’s total activity, reaching as high as 48% to 60% on certain days. However, with updates now published only as needed by applications, transaction volume has stabilized at significantly lower levels.

As anticipated, this metric has become less relevant in assessing Pyth’s growth and adoption, and this will be the final report that includes Solana transaction share. Future updates will focus on more representative metrics, such as Total Transaction Value (TTV) and price update volume, which better capture Pyth’s activity and network demand.

Oracle Integrity Staking (OIS)Oracle Integrity Staking (OIS) was introduced on Sept. 21, 2024, as a key addition to Pyth Network’s staking framework, designed to enhance data reliability through economic incentives. OIS enables participants to stake PYTH tokens toward specific data publishers, aligning financial incentives with price accuracy. Stakers allocate their tokens to publishers, who are rewarded for providing high-quality data and penalized for inaccuracies. This model ensures that all current and future Pyth price feeds are secured by an incentive-driven mechanism, reinforcing the integrity of oracle data.

In Q4'24, total PYTH staked in OIS grew 70.8% QoQ, rising from $135.2 million in Q3'24 to $230.9 million. This increase reflects continued adoption and participation in OIS, with more users engaging in staking as a means to support data accuracy while earning rewards.

Qualitative AnalysisProtocol UpdatesIntroducing Redemption Rate Feeds (RRF)

In Q3'24, Pyth Network introduced Express Relay, a protocol enhancement designed to reduce latency in delivering real-time data to blockchain platforms. Express Relay laid the foundation for subsequent advancements, including the announcement of Redemption Rate Feeds (RRF) on Oct. 27, 2024.

RRF addresses a growing demand in decentralized finance (DeFi) for accurate data related to liquid staking tokens (LST), liquid restaking tokens (LRT), and yield-bearing stablecoins. These feeds enhance market efficiency and transparency for increasingly prominent financial instruments in the DeFi ecosystem.

The initial rollout included 19 redemption rate feeds, such as CDCETH and USDY, which expanded rapidly to 28 feeds shortly after launch. This quick expansion demonstrates Pyth's adaptability to evolving market requirements. Key integrations include leading DeFi platforms such as:

These integrations highlight the adoption of RRF by platforms focused on diverse DeFi use cases, including lending, trading, and yield optimization.

Kamino Swap Integrates Pyth’s Express Relay

Kamino Swap Integrates Pyth’s Express RelayOn December 5th, Kamino Finance launched Kamino Swap, leveraging Pyth’s Express Relay to power a high-performance, on-chain trading platform on Solana. Express Relay serves as the backend auction system, where searchers—including major firms like Amber Group, Auros, Flowdesk, and Wintermute—compete to fill user swap orders at the best price, eliminating MEV, slippage, and unnecessary fees.

Kamino Swap is designed to provide CEX-like execution within a decentralized framework. By integrating Express Relay, the platform enables traders to access deep liquidity, enjoy fast, cost-efficient fills, and execute limit orders with pricing precision comparable to centralized exchanges. Market orders will also be introduced soon, further expanding Kamino’s capabilities.

How It Works:

- Token Selection: Users pick their buy/sell tokens and set their preferred price.

- Auction-Based Execution: Searchers bid competitively to fill orders at the best possible price, ensuring users receive optimal execution.

- User-Captured Value: Instead of MEV extractors profiting, searchers add a SOL tip that goes directly to users.

Kamino Swap’s plug-and-play liquidity solution demonstrates how DeFi can compete directly with CeFi and TradFi, offering self-custody, transparency, and efficiency while eliminating the inefficiencies of traditional DEXs.

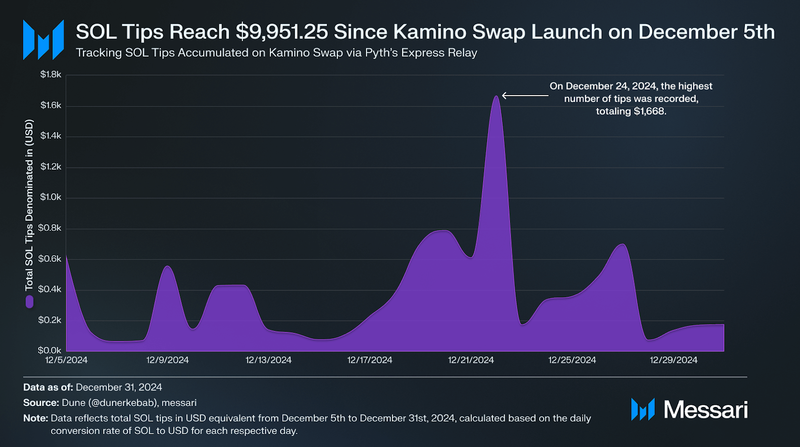

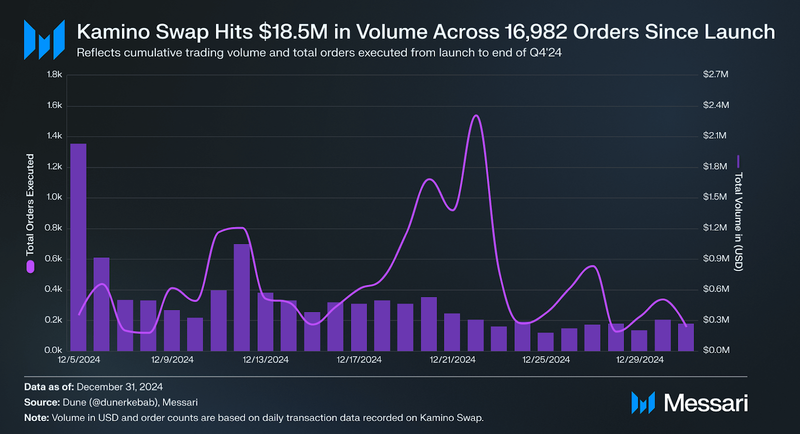

All metrics for Kamino Swap, including Total SOL Tips in notional as a USD equivalent, orders by day, and volume by day in USD, are based on data collected from December 5th, the day of Kamino Swap's launch, through the end of Q4'24.

In this context, tips refer to the SOL amounts that searchers pay as incentives during the auction process on Express Relay for the right to execute user limit orders. These tips are directed back to users, effectively enhancing the value received per trade by offsetting MEV and slippage that would typically be extracted by other market participants. By analyzing these metrics, we aim to assess Kamino's growth trajectory, user adoption, and its overall impact on Pyth's transaction volume and liquidity efficiency.

Given that these are new metrics introduced this quarter, they are included in the qualitative section of this report. However, in the coming quarters, these metrics will be presented in a dedicated section within the quantitative portion of the report to provide a more detailed and data-driven analysis of Kamino Swap's performance.

Since its launch on December 5th, Kamino Swap has accumulated a total of $9,951.25 in SOL tips and processed $18.5 million in transaction volume across 16,982 orders. These figures highlight a promising start for Kamino Swap, demonstrating the utility of Pyth's Express Relay in facilitating high-frequency trading with reduced MEV and improved execution efficiency.

Interestingly, the data suggests no clear correlation between the number of orders executed and the total volume traded. For instance, some days with fewer orders saw higher total volumes, while other days with a greater number of orders contributed less significantly to the overall volume. This pattern indicates that the average trade size varies considerably, likely influenced by the nature of assets traded and user behavior on the platform. As Kamino Swap continues to evolve, further data will be essential to understanding these dynamics and optimizing the use of Pyth’s Express Relay.

Perpetual Futures and DerivativesPyth Network's real-time price feeds continue to enable the development of sophisticated financial instruments across multiple blockchain ecosystems. These accurate and high-speed data feeds are integral to platforms offering derivatives and complex DeFi products.

Some new introductions in Q4’24 include:

- Synthetix Integration: Synthetix utilized Pyth's oracle services to launch Multi-collateral Perpetual Futures (Perps) on Arbitrum. This integration supports diverse collateral options and enhances risk management for derivatives trading.

- Kamino Finance on Solana: Kamino Finance introduced institutional-grade limit orders on Solana, leveraging Pyth's Express Relay for precise and efficient trading execution on decentralized exchanges.

- Synonym Finance's Multi-Ecosystem Lending Platform: Synonym Finance launched a cross-chain lending platform, integrating Pyth Network alongside Wormhole, Arbitrum, and Solana. This platform enables lending and borrowing across multiple blockchains, increasing flexibility and interoperability in decentralized lending.

The PYTH token is an SPL token on Solana. The core utility of PYTH is governance. PYTH holders can guide protocol development by staking the asset and voting on Pyth Improvement Proposals (PIPs). Pyth DAO also consists of the Pythian Council and the Price Feed Council. Both councils are responsible for voting for and implementing certain operational PIPs.

Pyth DAO has two types of PIPs: Constitutional and Operational. Constitutional PIPs involve protocol updates, determining structure, and guiding the administration of the Pyth DAO. They require greater than 67% support for implementation. Operational PIPs involve elections and the management of the treasury, Pythian Council, and Price Feed Council. Voting on these PIPs can be delegated to Council members and require greater than 50% support for implementation.

PIPs

Throughout Q4, Pyth did not approve any new Constitutional PIPs despite two being suggested. On the other hand, 13 Operational PIPs were approved, reflecting its continued governance activity on Solana. The relevant proposals are listed below, showcasing the ongoing development and improvements within the Pyth ecosystem.

Operational:

- OP-PIP29: This proposal delegates 100,000 PGAS to 10 new Pythnet validators to enhance reliability and decentralization. Each validator is operated by a dedicated publisher, ensuring alignment between validator roles and publisher responsibilities. This builds on the framework established in OP-PIP-20.

- OP-PIP30: This proposal discontinues the operations of 10 Pythnet validator nodes, reallocating their delegated stake to other validators. This change is part of an ongoing effort to optimize network operations and improve decentralization.

- OP-PIP31: Continuing efforts from OP-PIP-20, this proposal delegates 100,000 PGAS to 4 newly onboarded Pythnet validators. Each validator is directly connected to a publisher, enhancing network decentralization and reliability.

- OP-PIP32: This proposal upgrades the Pyth oracle program on Pythnet to introduce a unique index ID for each feed, improving space efficiency. Enabling publishers to send 47 price updates per transaction (up from 12) optimizes data compression and enhances the parallelism of oracle computations, marking a significant step toward more efficient publishing and aggregation processes.

- OP-PIP33: Continuing decentralization efforts, this proposal delegates 100,000 PGAS to a newly onboarded Pythnet validator. This addition aligns with the framework established in OP-PIP-20, ensuring publishers operate their own dedicated validators to improve network reliability and decentralization.

- OP-PIP34: This proposal discontinues the operations of 37 Pythnet validator nodes, reallocating their stake to other validators. The decision aims to streamline network operations and enhance the efficiency and reliability of Pythnet's validator ecosystem.

- OP-PIP35: This proposal approves the formation of the second Price Feed Council, which oversees the governance and management of price feed operations on Pythnet. The council plays a critical role in ensuring the accuracy and reliability of Pyth's data infrastructure.

- OP-PIP36: This proposal discontinues the operations of three Pythnet validator nodes, redistributing their stake to improve the efficiency and decentralization of the network.

- OP-PIP37: Delegates 100,000 PGAS each to three new Pythnet validators. The initiative continues efforts to enhance decentralization and reliability by requiring publishers to operate their own dedicated validators.

- OP-PIP38: Approves the deployment of Express Relay on Solana mainnet. Express Relay reduces latency in delivering real-time price data, enhancing the efficiency and responsiveness of DeFi applications on Solana.

- OP-PIP39: This proposal upgrades the Pyth oracle on the TON testnet, introducing enhancements to improve performance and compatibility. The upgrade supports the ongoing integration of Pyth's real-time price feeds into the TON ecosystem.

- OP-PIP40: Discontinues the operations of one Pythnet validator node, reallocating its stake to enhance the network's overall efficiency and decentralization.

- OP-PIP41: Upgrades the Pyth oracle on the TON mainnet, improving its performance and ensuring seamless integration with TON's ecosystem for real-time price feed delivery.

Pyth Network Gains Exposure Through VanEck and 21Shares

Two prominent financial institutions, VanEck and 21Shares, have launched investment products providing European investors with access to Pyth Network’s decentralized oracle services.

VanEck introduced the VanEck Pyth ETN, an exchange-traded note listed on Euronext Amsterdam and Euronext Paris, accessible across 15 countries. The ETN tracks the performance of the MarketVector Pyth Network VWAP Close Index, offering exposure to the PYTH token without requiring direct ownership. Fully collateralized, the ETN relies on Bank Frick for secure custodial services.

Similarly, 21Shares launched the 21Shares Pyth Network ETP (PYTH), which is also listed on major European exchanges. Fully backed by PYTH tokens, this exchange-traded product provides regulated access to Pyth’s high-frequency, real-time market data services. Both offerings reflect growing institutional interest in decentralized oracle technology and Pyth’s expanding presence in traditional finance.

Pyth Continues a Strong Relationship with SuiPyth Network remains at the core of Sui's rapidly growing DeFi ecosystem, supporting its innovative architecture and enabling advanced decentralized applications. As Sui continues to expand with its horizontally scalable and low-latency infrastructure, Pyth plays a crucial role by providing accurate, real-time price feeds for various tokens and assets, including native and ecosystem-specific coins.

This partnership has allowed Sui to attract a wide range of DeFi builders, fostering growth in lending, trading, and liquid staking applications. Pyth’s integration supports protocols such as Suilend, NAVI Protocol, and Scallop by delivering reliable data feeds critical for token pricing, asset valuation, and seamless transaction execution.

Real-Time Oil FeedsPyth Network has introduced real-time oil price feeds for West Texas Intermediate (WTI) and Brent Crude Oil, available across over 80 blockchain ecosystems. These feeds aggregate data from exchanges, market makers, and index providers, enabling DeFi developers to create energy-linked financial instruments like perpetual futures, derivatives, and hedging tools.

The feeds support pricing for front-month, second-month, and third-month futures contracts, as well as non-expiring contracts for difference (CFD) prices. By sourcing data from multiple trusted institutions, Pyth reduces reliance on single-source feeds, improving reliability for DeFi protocols.

Storm Trade, a Telegram-based perpetual futures trading platform, is the first to integrate Pyth’s oil price feeds. The platform supports leveraged trading across commodities, crypto, and forex, showcasing the potential of onchain oil data for retail and institutional users.

Community Support and Engagement

Pyth Network continues to expand its community engagement efforts through education, content initiatives, and active participation in industry events. A key focus has been educating users on interacting with Pyth’s ecosystem, including tutorials on the OIS program and ongoing promotion of community-generated content. Users are encouraged to join Pyth’s Discord for direct support and discussions.

One of Pyth’s most impactful initiatives has been its weekly DeFi Digest series on Twitter, which provides updates on DeFi trends and Pyth’s role in the evolving landscape—shared every Sunday throughout December 2024.

Beyond digital engagement, Pyth has been actively involved in blockchain industry events and developer conferences, including the Injective Summit and other technical meetups. These efforts reinforce Pyth’s commitment to collaborating with developers, industry leaders, and projects across multiple ecosystems, strengthening its role within the broader blockchain space.

Closing SummaryPyth Network continued to expand its role as a leading oracle provider in Q4'24, demonstrating resilience and growth across key performance metrics. Total Transaction Value (TTV) increased 5.2% QoQ, reaching $175.2 billion, highlighting Pyth’s continued dominance in transaction volume. Meanwhile, Total Value Secured (TVS) remained stable, with Pyth being the only major oracle to record a positive increase. Price updates also grew by 14.04% QoQ, totaling 336.2 million, as demand for Pyth’s real-time price feeds remained strong across Sui, Aptos, and other major blockchain ecosystems. Additionally, Pyth's Oracle Integrity Staking (OIS) saw a 70.8% QoQ increase in total PYTH staked, reinforcing the network’s commitment to securing data accuracy through incentive-driven staking mechanisms.

The quarter was also marked by notable partnerships and integrations, further cementing Pyth’s presence in both DeFi and traditional finance. The launch of real-time oil price feeds expanded Pyth’s data offerings beyond crypto markets, enabling the development of energy-linked financial instruments. The introduction of VanEck’s Pyth ETN and 21Shares’ PYTH ETP provided regulated investment access to Pyth's oracle services, signaling increased institutional interest. Additionally, Kamino Swap integrated Pyth’s Express Relay, leveraging its auction-based system to eliminate MEV and improve trade execution on Solana. These integrations illustrate Pyth’s ability to support diverse financial products, reinforcing its role as a foundational data provider for high-frequency trading applications.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.