and the distribution of digital products.

State of Nervos Network Q4 2024

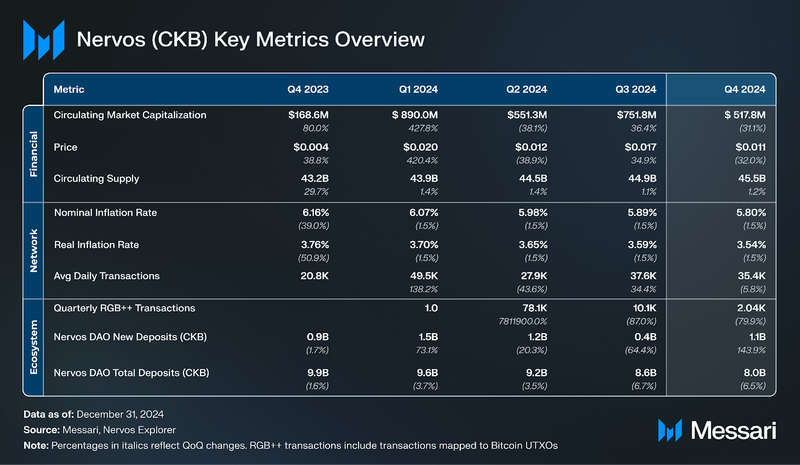

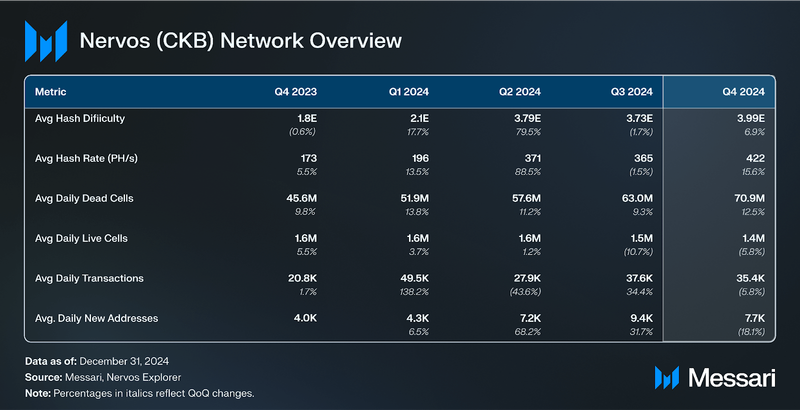

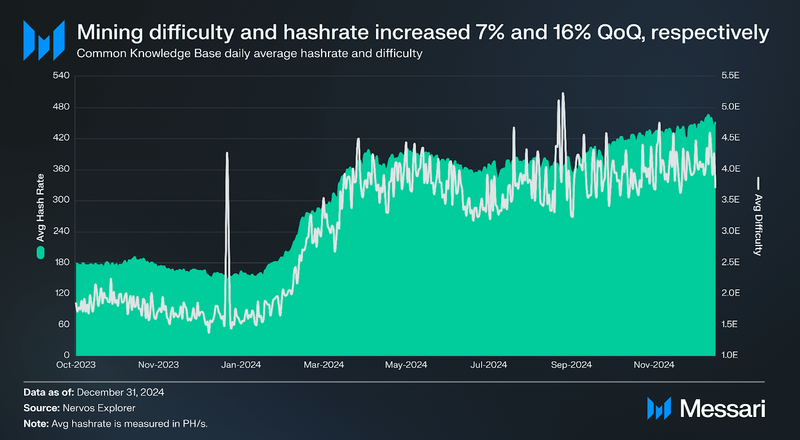

- The CKB network achieved a record average hash rate of 423 PH/s (+15.62% QoQ), while the average difficulty rose 6.89% QoQ to 4.0 EH.

- The total number of fungible RGB++ assets issued on CKB grew to 572 in Q4, marking an 17.45% QoQ increase.

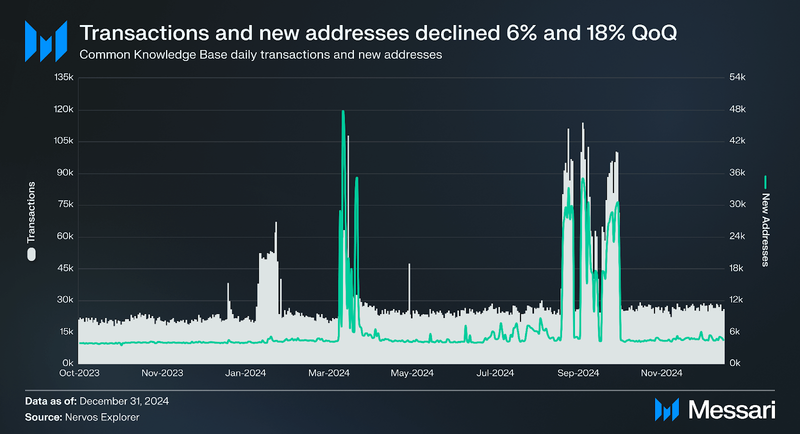

- Common Knowledge Base’s average daily transactions and new addresses declined 5.80% and 18.12% QoQ, respectively. At the end of Q4, CKB finished with a cumulative total of 5.4 million unique addresses used.

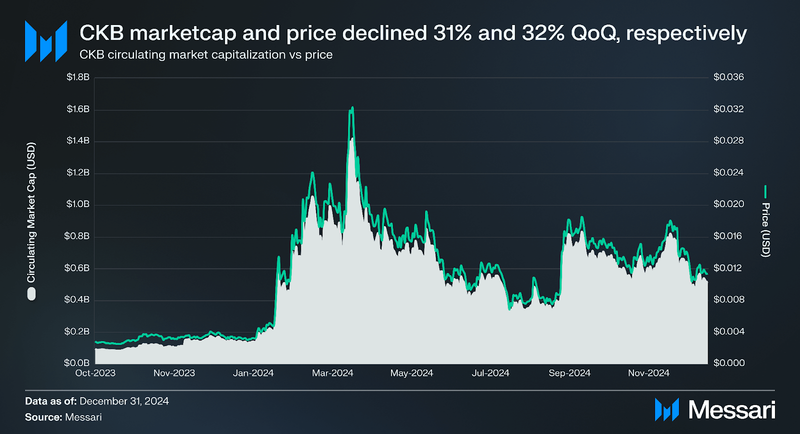

- CKB’s token price decreased 31.97% QoQ to $0.011, while its circulating market cap declined 31.92% to ~$518 million. As a result, its market cap rank fell from 89 to 150.

- In November 2024, the Nervos Foundation hosted the inaugural Common Knowledge Conference (CKCON) in Chiang Mai, Thailand. The conference took place during CKWeek, a week-long community gathering featuring events and social activities for CKB community members.

Nervos Network aims to expand on Bitcoin’s core technological primitives with Common Knowledge Base (CKB), a scalable Layer-1 blockchain that enables Layer-2 support for Bitcoin. CKB employs a Proof-of-Work consensus mechanism like Bitcoin but generalizes Bitcoin’s limited UTXO model and scripting capabilities by allowing more flexible data storage and verification. To improve Bitcoin’s arbitrary programming limitations, Nervos Network leverages a custom Cell Model for state storage and a virtual machine (CKB-VM) for transaction execution.

The cell model is core to CKB’s data structure and features a dual script model that allows any data to be stored and verified onchain. CKB-VM is CKB's execution engine for running smart contracts and decentralized applications. The VM utilizes the RISC-V instruction set, a flexible and simple open-source hardware architecture set (ISA) that supports multiple programming languages, including popular ones like C and Rust.

Launched on mainnet in November 2019, Nervos Network has since evolved into one of the few independent blockchains scaling Bitcoin. Nervos scales Bitcoin through RGB++, an asset issuance protocol inspired by the RGB protocol. RGB++ allows users to issue assets on Bitcoin’s mainnet that are mapped to CKB cells through isomorphic binding. Although CKB serves as the data storage and verification layer for RGB++ assets and transactions, these assets inherit Bitcoin security. That is, the assets cannot be double spent as each asset is mapped to a UTXO on Bitcoin.

Nervos aims to improve Bitcoin’s programmability with the RGB++ Layer, an extension of the RGB++ protocol that enables RGB++ assets to be mapped across other UTXO blockchains. The RGB++ layer serves as the smart contract and interoperability layer for RGB++ assets, enabling developers to build and deploy decentralized applications with enhanced programmability and flexibility on UTXO-based chains.

For a full primer on Nervos, refer to our Initiation of Coverage report.

Key Metrics Financial Analysis

Financial Analysis

CKByte (CKB) is the native token of Nervos Network, used to maintain the network’s security and incentivize efficient data storage. Specifically, CKB is employed to (i) grant tokenholders data storage rights, (ii) settle network transaction fees, and (iii) distribute block rewards to miners for securing the network.

CKB’s price fell 31.97% from $0.017 in Q3 to $0.011 by the end of Q4. The circulating market capitalization followed a similar trend, decreasing 31.12% QoQ to ~$518 million. This price decline pushed CKB’s circulating market cap rank down from 89 to 150 in Q4.

This decline can be largely attributed to an end-of-Q3 price surge. CKB’s mid-September listing on Upbit drove the token to a quarterly high of $0.018, temporarily inflating its quarter-end price and making the subsequent Q4 drop appear more pronounced. However, on a quarterly average basis, CKB’s price still rose 27% QoQ to $0.014, reflecting sustained market interest. Continued momentum following the Upbit listing, the introduction of CKB perpetual futures on Kraken in October 2024, and anticipation surrounding the upcoming Fiber Network release likely contributed to this overall growth trend.

Secondary IssuanceCommon Knowledge Base (CKB) addresses state bloat through two methods. Firstly, users must lock CKB tokens to store data onchain. Secondly, rather than directly charging a fee for users locking CKB tokens to pay for state rent, CKB indirectly charges fees through an inflationary mechanism known as secondary issuance. Each year, 1.344 billion CKB tokens are minted through secondary emissions and distributed to miners, Nervos DAO depositors, and eventually, an onchain protocol treasury (this issuance is currently being burned). As such, the network’s secondary issuance introduces inflation targeted at users storing data, as locked CKB tokens are automatically exposed to value dilution, which is an indirect way of paying for state rent.

By the end of Q4 2024, over ~750 million CKB tokens have been distributed to miners as state rent, ~1.30 billion CKB tokens have accrued to Nervos DAO depositors, and over 4.9 billion CKB tokens meant for the proposed Treasury Fund have been burned.

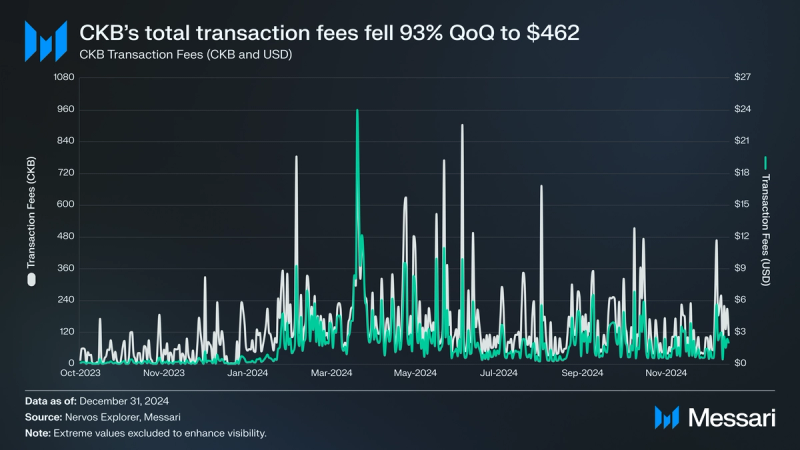

Nervos CKB revenue is measured as total transaction fees and is distributed to miners through Nervos CKB’s Proof-of-Work mechanism, along with a portion of the network’s secondary issuance. In Q4 2024, total transaction fees denominated in USD dropped 93.44% QoQ to ~$462, while total fees in CKB declined 94.30% to ~36,200.

Network Analysis

Transactions on CKB declined 5.80% QoQ to 35.4k, while average new addresses fell 18.12% QoQ to 7.7k. This decrease reflects a natural stabilization following several Q3 developments that triggered a surge in network activity, such as CKB's Upbit listing and the RGB++ Layer launch.

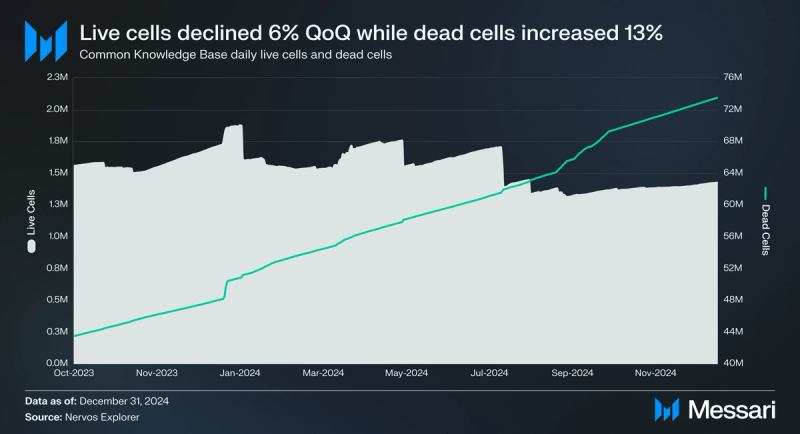

Cell activity is divided into live and dead cells. Live cells are available for future transactions, smart contract execution, and data storage. Dead cells, while no longer usable as transaction inputs, contain valuable data that can be accessed and referenced and still contribute to the blockchain’s history and data traceability.

In Q4 2024, average daily live cells decreased 5.79% QoQ to 1.4 million, while dead cells increased 12.54% QoQ to 70.9 million. This marks the second consecutive quarter of decline in live cell activity, likely due to a decrease in transactions involving RGB++ asset issuances and smart contract interactions, which consume live cells for state updates and asset transfers.

Security and DecentralizationAs a Proof-of-Work (PoW) network, miners secure CKB by solving cryptographic puzzles to validate transactions and add new blocks to the blockchain. For every block mined, the miner receives that block's full 'base issuance' reward and a portion of its 'secondary issuance' reward. Miners also earn proposals or commit rewards from transaction fees for processing transactions on the network.

The hashrate measures the total computational power dedicated to mining on a PoW network and is a key indicator of a network’s security against attacks by malicious actors. A higher hash rate indicates increased mining activity and network security. Difficulty measures how hard it is to mine new blocks and adjusts periodically to ensure that blocks are mined at a consistent rate.

In Q4 2024, CKB’s average difficulty increased 6.89% QoQ to 4.0 EH. The average hashrate increased 15.62% QoQ to 422 PH/s, reaching a record 465 PH/s on December 26, 2024.

The average hashrate surged 143.93% during 2024, reflecting growing miner confidence in the long-term valuation potential of CKB. This trend was likely driven by developments such as the release of RGB++ Protocol, upgrading RGB++ to RGB++ Layer, and the anticipated release of Fiber Network. Other contributing events like Binance launching a CKB mining pool in April 2024, CKB listing on Upbit in September 2024, and Kraken listing CKB perpetual futures in October 2024 may have also contributed to the growth.

Meepo Hard ForkThe Meepo Hard Fork went live on the CKB testnet in October 2024 and is expected on the mainnet in 2025. This upgrade introduces CKB-VM V2 and several enhancements to CKB script development, such as the “Spawn” syscall.

Currently, developers rely on the 'exec' syscall in the CKB-VM to load and run external logic. However, the “exec” discards the calling script's state with each invocation, complicating workflows that rely on retaining or interacting with this state. The “Spawn” syscall addresses inefficiencies in cross-script interactions and modularity by enabling one script to directly invoke another. This resolves the complications created by the current syscall, as it allows the calling script to preserve its execution context when invoking another script, enabling developers to build more efficient and modular decentralized applications (dApps) on CKB.

RGB++ ProtocolInspired by the RGB protocol, RGB++ leverages CKB as the client-verification and data storage layer for asset issuance. The original RGB protocol operates like a two-way payment channel built on Bitcoin Core that allows users to issue and manage assets without storing transaction data onchain for verification. Instead, users run client-side verification nodes to store RGB asset data offchain, bypassing Bitcoin’s consensus protocol. This system presents several limitations:

- The protocol relies on users to verify and store transaction data offchain.

- Dependence on a single user to maintain transaction data introduces the risk of mismanaged or altered data, affecting data integrity.

- Since users are solely responsible for storing transaction data, there is a risk that the data might not always be accessible, which could disrupt the system’s functionality.

- By relying entirely on client-side verification nodes, the protocol may struggle to scale efficiently with increasing user adoption and transaction volumes, as each user’s node must individually process and store transaction data.

RGB++ addresses these limitations by leveraging CKB as a decentralized third-party indexer that provides data verification and storage for RGB++ assets. This improved design enables features like onchain data attestation, independent asset issuance, and more programmable asset management, which is not possible with the original RGB protocol.

The RGB++ protocol maps Bitcoin UTXOs to CKB Cells through isomorphic binding, enabling seamless integration with CKB's Turing-complete smart contracts. Isomorphic binding ensures that RGB++ assets are not double spent so long as the UTXO on Bitcoin cannot be double spent, hence inheriting the security of Bitcoin’s blockchain. Additionally, users can also issue RGB++ assets on the CKB blockchain and leap it to the Bitcoin blockchain without any cross-chain bridges, inheriting Bitcoin’s security. In April 2024, the RGB++ protocol went live on the CKB mainnet, enabling users to issue and manage RGB++ assets, leading to a resurgence in network activity.

RGB++ LayerThe RGB++ Layer extends the RGB++ protocol roles beyond functioning as an asset issuance layer to serve as Bitcoin’s asset issuance layer and the interoperability layer for the UTXO ecosystem. To function in this capacity, the RGB++ Layer combines isomorphic binding with a “Leap” concept to provide a "bridge-free" cross-chain interaction experience for RGB++ native assets or inscriptions/runes between Bitcoin, CKB, and other UTXO-based blockchains like Cardano. When an asset “leaps” from Bitcoin to CKB, it rebinds its control permissions to a cell on the CKB chain while its data remains securely stored within CKB’s structure.

A typical asset leap operation across multiple UTXO-based blockchains proceeds as follows:

- Each Bitcoin UTXO holding an RGB++ asset is mapped to a corresponding CKB cell. When an asset on Bitcoin leaps to CKB, the control script in the CKB cell adjusts to allow permissions from Bitcoin to transfer to CKB.

- The CKB chain stores the asset’s data persistently within its cells, which remain accessible regardless of which chain currently controls the asset.

- Instead of moving the asset data itself, the leap approach changes the unlocking condition in the cell. For example, after a leap to CKB, the asset can now be transferred using a CKB private key. If the asset leaps again to Cardano, for instance, the unlocking permissions update again to match Cardano’s key structure.

The RGB++ Layer also leverages CKB's Turing-complete smart contract environment (CKB-VM) to enable decentralized application development. This spurred the emergence of BitcoinFi (BTCFi), similar to decentralized finance (DeFi) within the Bitcoin and UTXO ecosystem. As such, developers can build and deploy RGB++-compatible applications across several UTXO-based chains connected to the RGB++ Layer.

In November 2024, a CKB ecosystem developer announced that the RGB++ Layer will integrate with DOGE. This will extend BTCFi capabilities to its UTXO-based chain by enabling support for programmable assets and cross-chain decentralized applications. Additionally, a memecoin launchpad will be built on DOGE to position it as a hub for meme projects within the Bitcoin ecosystem. The CKBers’ Codebase integrated with DOGE in December 2024, enabling interoperability between CKB and DOGE chains and providing the infrastructure necessary to support future capabilities.

Fiber NetworkThe next step in the Nervos Network’s evolution is the Fiber Network, a payment channel network compatible with Bitcoin’s Lightning Network. Fiber Network will be optimized to provide fast, low-cost, and decentralized multi-token payments and peer-to-peer transactions for RGB++ assets. The protocol’s design is inspired by Bitcoin’s Lightning Network, building on two key technical concepts that compose the Lightning Network stack:

- Payment Channels: The Fiber Network leverages payment channels to enable multiple offchain transactions settled into a single transaction once the channel is closed. While the Lightning Network primarily supports payment channels for BTC, the Fiber Network extends compatibility to multiple asset types, including RGB++ assets and CKB tokens.

- Hash Time-Locked Contracts (HTLC): To maintain compatibility with the Lightning Network, Fiber Network leverages HTLCs to secure fund transfers, mitigating counterparty risk. As such, even if offchain transactions fail, users can still secure their funds through onchain contracts. Since CKB is Turing complete, the Fiber Network can implement much more flexible onchain contracts compared to Lightning Network HTLCs.

In addition to the above, Fiber Network also introduces two additional capabilities to the lightning technology:

- Multi-hop Routing allows users to send payments through multiple nodes without needing a direct channel with the recipient, making the network more flexible and accessible. It works by finding the best path between sender and recipient, locking funds securely at each step using HTLCs, and transferring the funds as the recipient unlocks them. This system also supports cross-chain payments, enabling compatibility with Bitcoin’s Lightning Network through a cross-chain hub.

- Watchtower Service ensures the security and integrity of offchain payment channels. It performs real-time monitoring of channel states, including their opening, updates, and closures, while actively detecting anomalies, such as attempts to close channels with outdated states or double-spending attacks. In response to malicious activities, the watchtower promptly broadcasts the latest channel state to the blockchain, safeguarding user funds and maintaining the network's reliability.

As of Q4 2024, Fiber Network is live on testnet. It implements multi-hop routing and watchtower services, along with essential functions of opening, updating, and closing channels between two nodes and verifying cross-chain functionality with Bitcoin’s Lightning Network. The mainnet launch will coincide with the release of the USDI stablecoin, UTXO Stack, and JoyID support for Fiber Network. At the end of Q4 2024, the network awaits the integration of the JoyID Protocol and release of UTXO Stack.

The Fiber Network will initially support four tokens—CKB, USDI, ccBTC, and SEAL—and integrate with RGB++-enabled wallets like JoyID to provide a seamless onboarding experience. By leveraging cross-chain functionality, it will introduce stablecoins issued through the RGB++ Protocol (i.e., USDI) into Bitcoin’s Lightning Network via atomic swaps.

UTXO Stack is intended to launch in tandem with Fiber Network, and will be a joint liquidity pool across both Fiber Network and the Lightning Network. The primary function of this hybrid network is to enable the use and seamless exchange of stablecoins across the underlying networks. UTXO Stack will support atomic swaps and optimize channel liquidity through its multi-token liquidity pool, automatically aggregating user deposits and dynamically allocating them across each network’s payment channels based on demand. Users that deposit assets (BTC, CKB, or stablecoins) into this pool will earn yield from liquidity rental fees and a share of routing fees, while also receiving liquid staking derivatives for use in BTCFi protocols. To borrow liquidity from the pool, routing nodes will be required to stake UTXO Stack’s utility token as collateral. This model will also lower entry barriers to using Bitcoin’s Lightning Network by covering the initial onchain fees to open channels, enabling users to repay upfront costs after receiving sufficient inbound payments.

Additional developments aimed at enhancing the Fiber Network and expanding the RGB++ Protocol’s capabilities include: (i) Real World Assets (RWAs), (ii) decentralized exchanges, (iii) AI agent protocols, and (iv) onchain Telegram games. At the time of writing, release dates for these developments are not publicly available.

Ecosystem Analysis Nervos DAO

Nervos DAOCKB tokenholders are natively protected against the dilutive impact of the network’s ongoing issuance model via the Nervos DAO. By locking CKB token holdings into the Nervos DAO smart contract, users can earn rewards from secondary token issuance, ensuring their holdings are hedged against inflation. Depositors receive rewards at an APR equivalent to the annual secondary issuance rate, although the rate will continue to decrease as the total supply increases. While tokenholders with a minimum balance of 102 CKB tokens can deposit to the DAO anytime, withdrawals can only occur at the end of a 30-day deposit cycle.

NervDAO is a wallet interface that streamlines and simplifies the user experience for CKB’s Nervos DAO. It enables users to interact with and initiate deposits and withdrawals from the DAO using CKB-compatible wallets like Metamask, UTXO Global, and JoyID.

In December 2024, NervDAO integrated with the iCKB Protocol, enabling CKB depositors to earn Nervos DAO rewards without a 30-day lockup requirement. Users that deposit CKB into the protocol receive iCKB, a liquid staking token redeemable for locked CKB and accrued rewards.

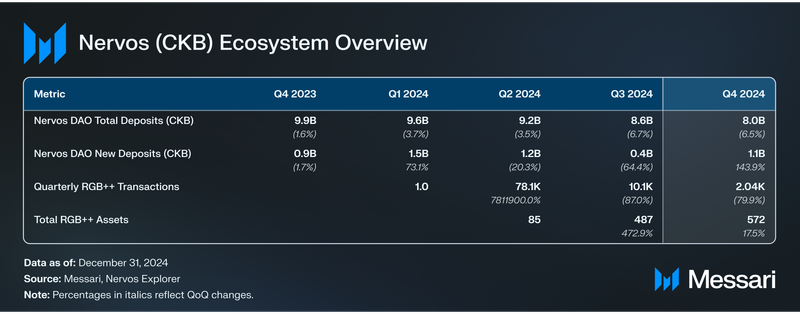

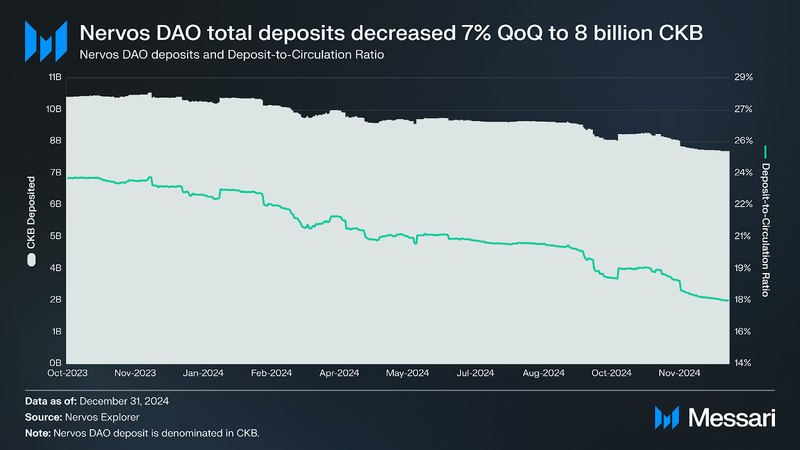

In Q4 2024, total Nervos DAO deposits decreased 6.53% QoQ to ~8 billion CKB, bringing the deposit-to-circulation ratio to 17.59% (-7.86% QoQ). Despite this decline, new deposits increased by 143.88% QoQ, with nearly 1.1 billion CKB deposited into Nervos DAO during Q4. The decline in total deposits likely reflects a combination of rising onchain activity driven by recent advancements like the release of the RGB++ Layer, the need to cover state rent, and diminishing relative incentives. In contrast, the sharp rebound in new deposits represents a return to 2024's average levels (~1.1B per quarter) following a significant drop in Q3, indicating renewed depositor confidence and alignment with Nervos' long-term growth trajectory.

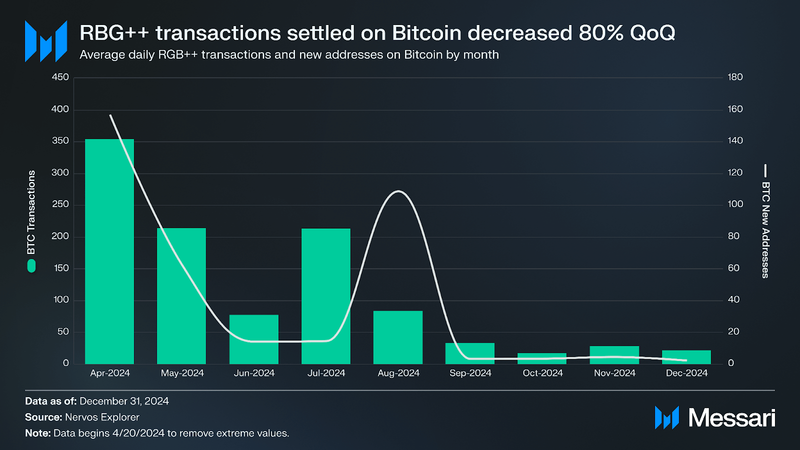

RGB++ has processed over 90,000 transactions on CKB since launching in April 2024. In Q4 2024, activity dropped 79.93% QoQ to 2,000 processed transactions. A similar decline occurred in newly mapped BTC addresses, which fell 92.15% QoQ to 302.

Ecosystem GrowthCKB Eco Fund

The CKB Eco Fund (previously InNervation) is an ecosystem fund focused on incubating and investing in pre-seed and seed projects connecting CKB and Bitcoin using RGB++. The fund supports ecosystem projects building critical infrastructure and decentralized applications across various sectors, including DeFi, gaming, tooling, NFT marketplaces, and more. Ecosystem projects building across eligible verticals can apply for ongoing grant programs organized by the CKB Eco Fund or the CKB Community Fund DAO.

Notable developments during Q4 2024 include:

- In October 2024, CKB Eco Fund partnered with Alchemy Pay to provide a CKB on-ramp, enhancing the accessibility and ease of acquiring tokens for users.

- In December 2024, CKB Eco Fund announced an investment in SilentBerry, a Web3 publishing platform built on RGB++ Protocol. With SilentBerry, authors can publish books as NFTs and monetize their work by selling fractional IP rights, granting buyers printing rights and a share of ongoing royalties.

The RGB++ Layer extends smart contract capabilities beyond Nervos (CKB) and Bitcoin to other UTXO-based chains, positioning CKB as the verification and data storage layer for the entire UTXO ecosystem. The total number of fungible RGB++ assets issued on CKB grew to 572 in Q4, an 17.45% QoQ increase from 487 in Q3.

Several notable RGB++ project developments in Q4 2024 include:

Infrastructure and Tooling

- UTXO Stack: Transitioned from a Bitcoin L2 “OP Stack” to a liquidity staking layer on the Fiber Network and Bitcoin’s Lightning Network, providing liquidity management and Bitcoin-native staking solutions. The protocol team released the new whitepaper in December 2024, outlining its upcoming infrastructure, use cases, and utility token.

- UTXO Global Wallet: A DeFi-focused wallet application optimized for digital asset management and with support for multiple UTXO-compatible assets. In Q4 2024, UTXO Global launched a Telegram wallet mini-app with password protection and CKCat, its first Telegram mini-game.

- Wizz Wallet: A wallet application that supports multiple Bitcoin-based assets, such as Atomicals, Ordinals, and Runes. In October 2024, the wallet introduced support for RGB++ assets through its integration with the RGB++ Protocol.

The RGB++ Layer has spurred the emergence of a decentralized finance ecosystem on Nervos CKB and across other UTXO-based networks. This includes projects building across DeFi (BTCFi) verticals like decentralized exchanges, non-custodial money markets, real-world tokenization protocols, stablecoins, and more. Notable project developments across BTCFi verticals in Q4 include:

Stablecoins

- Stable++: The first RGB++-enabled, overcollateralized stablecoin protocol went live on CKB in October 2024. The protocol mints the USD-pegged stablecoin RUSD using BTC and CKB as collateral. Leveraging RGB++'s leap function, Stable++ also facilitates seamless cross-chain asset transfers within the Bitcoin ecosystem, enhancing its utility and accessibility. Stable++ leverages Nervos’ CKB-VM to create secure overcollateralized vaults and efficient liquidation mechanisms, ensuring the protocol’s stability. Users can open vaults to borrow RUSD against BTC or CKB collateral or redeem RUSD for CKB/BTC at a 1:1 USD value.

- Interstellar Payment Network (IPN): An RGB++-enabled payment network on Bitcoin that deployed USDI in December 2024. USDI, the first programmable stablecoin on Bitcoin, is compliant with AML/KYC/CFT regulations and fully backed by IPN's reserves, which utilize high-credit and highly liquid assets, such as Matrixdock’s STBT. As an RGB++ asset, it supports cross-chain transfers across connected UTXO-based chains. Furthermore, the Fiber Network will support it as the first stablecoin, enabling its introduction into Bitcoin’s Lightning Network through cross-chain atomic swaps.

RGB++ Asset Marketplaces

- Element NFT Marketplace: A multichain NFT marketplace that announced support for RGB++ assets on CKB September 2024. The marketplace launched on Bitcoin in November 2024, enabling users to list and trade NFTs on both chains.

Memecoin Launchpads

- CKB.Fi: An RGB++-based memecoin launchpad that enables users to launch memecoins directly on the platform or via “X” posts. In October 2024, CKB.Fi introduced a prediction market feature enabling users with 1 million tokens of any memecoin to create markets, where others place bets with that memecoin.

Digital Object Collections

- Nervape: Multi-chain Composable Digital Objects (DOBs) built on Bitcoin, with “Base Assets” issued on Bitcoin and “Accessory Assets” issued on CKB. Nervape released a bundle feature in December 2024, giving holders greater control over their RGB++ assets. Holders can “leap” Nervape DOBs from Bitcoin to CKB to equip Accessory Assets and compose them into a tradeable bundle, seamlessly move bundles between chains, and decompose them back into individual assets.

Notable events and initiatives in Q4 2024 included:

CKCON

In November, the Nervos Foundation hosted the first Common Knowledge Conference (CKCON) in Chiang Mai, Thailand. The conference highlighted developments in the CKB ecosystem and included broader topics such as institutional blockchain adoption. CKCON was part of the larger CKWeek, which included events like the Nervape’s Color Vibes Pop Up Store and social activities for attendees.

RGB++ NFT Trading Fest

Element NFT Marketplace and CKB Eco Fund hosted the RGB++ NFT Trading Fest in November 2024. The event offered over $14,400 in rewards for listing and trading Cellula, Nervape, WORLD3, d.id, and Unicorn NFTs on Element NFT Marketplace. Rewards were distributed to traders with the highest volumes in each project category, while 500 randomly selected NFT listers shared 2,000 USDT.

Happy Rate Cut Festival

CKB Eco Fund and Meson Finance launched the Happy Rate Cut Festival in October 2024, offering 0% bridge fees and rewarding users with Meson Points and over $20,000 in CKB for bridging ccBTC from Bitcoin to CKB.

Closing SummaryQ4 2024 marked a transformative period for the Nervos Network, driven by notable ecosystem and technical advancements. iCKB’s integration into NervDAO enabled Nervos DAO depositors to receive rewards without a 30-day lockup requirement. The inaugural Common Knowledge Conference (CKCON) highlighted innovations like the upcoming Fiber Network’s capabilities and fostered engagement within the CKB community.

Mining activity set record highs with an average hashrate of 423 PH/s, peaking at 465 PH/s in late December. In contrast, network activity and new addresses declined QoQ, reflecting a stabilization to average 2024 levels after a surge in Q3. The RGB++ ecosystem demonstrated sustained growth, with fungible asset issuance on CKB increasing ~18% QoQ to a cumulative total of 572 assets. Although RGB++ transactions and new Bitcoin addresses declined QoQ, these metrics are poised for recovery with the Fiber Network’s launch and the continued expansion of the RGB++ Layer.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.