and the distribution of digital products.

State of Nervos Network Q3 2024

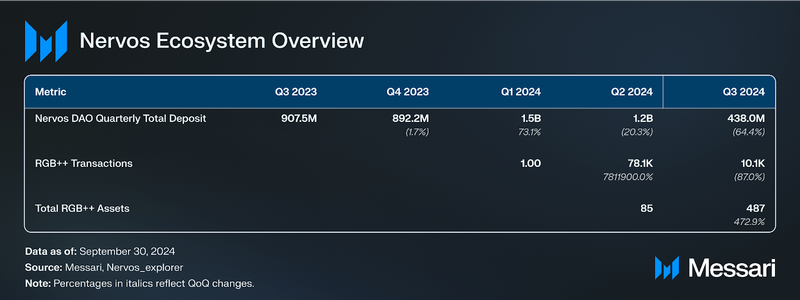

- The launch of the RGB++ Layer in Q3 2024 facilitated the development of DeFi applications on Nervos CKB, positioning Layer-1 as an emerging hub for decentralized finance (BTCFi) within the UTXO ecosystem.

- Since the launch of the RGB++ Layer, CKB has witnessed a surge in the number of RGB++ assets issued on CKB, up 487% QoQ from only 85 assets in Q2’24 to 487 assets in Q3’24.

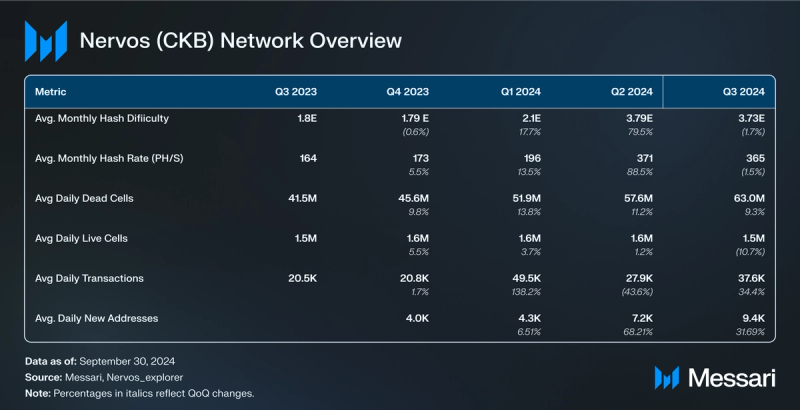

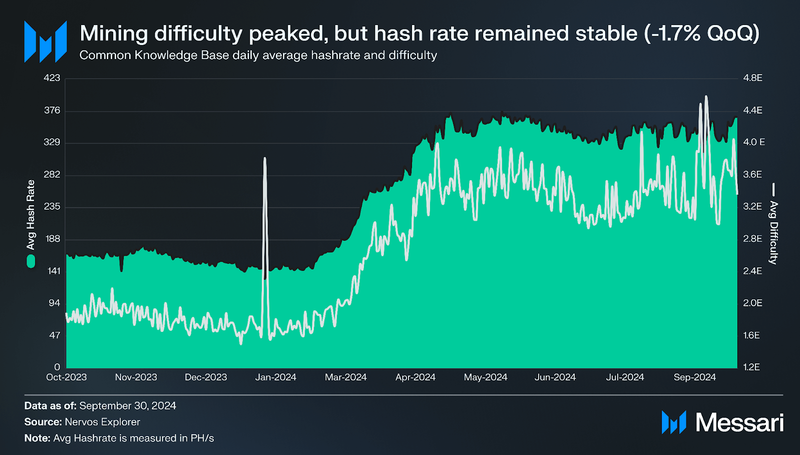

- Common Knowledge Base transactions and new addresses rose 34% and 32%, respectively. This growth was largely driven by CKB’s exchange listing event in September and core development releases (RGB++ Layer and the Fiber Network launch) in Q3’24.

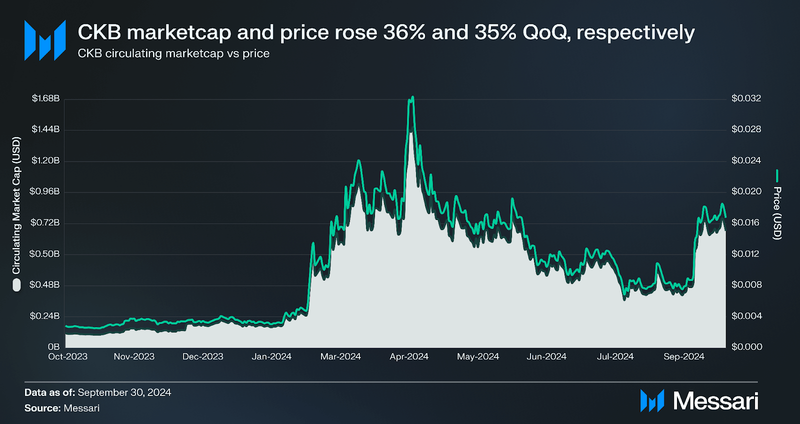

- Despite broader market contractions and mixed price sentiments in Q3’24, CKB’s price and marketcap remained resilient in Q3’24, increasing by 35% and 36% QoQ, respectively.

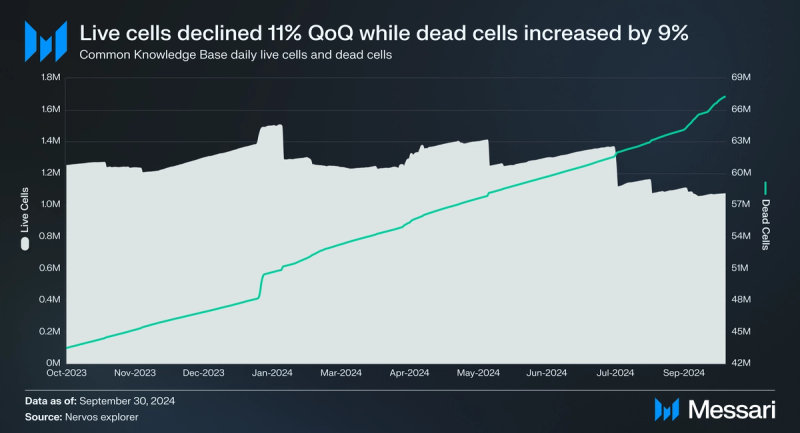

- In Q3 2024, the CKB network achieved a record mining difficulty of 4.4EH/s while the hash rate remained stable, declining by just 1.7% QoQ in September, reflecting heightened miner competition as CKB’s price appreciated.

Nervos Network aims to expand on Bitcoin’s core technological primitives with (Common Knowledge Base (CKB) a scalable Layer-1 blockchain that enables Layer-2 support for Bitcoin. CKB employs a Proof-of-Work consensus mechanism like Bitcoin but generalizes Bitcoin’s limited UTXO model and scripting capabilities by allowing more flexible data storage and verification. To improve Bitcoin’s arbitrary programming limitations, Nervos Network leverages a custom Cell Model for state storage and a virtual machine (CKB-VM) for transaction execution. The cell model is core to CKB’s data structure and features a dual script model that allows any data to be stored and verified onchain. CKB-VM is CKB's execution engine for running smart contracts and decentralized applications. The VM utilizes the RISC-V instruction set, a flexible and simple open-source hardware architecture set (ISA) that supports multiple programming languages, including popular ones like C and Rust.

Launched on mainnet in November 2019, Nervos Network has since evolved into one of the few independent blockchains scaling Bitcoin. Nervos scales Bitcoin through RGB++, an asset issuance protocol inspired by the RGB protocol. RGB++ allows users to issue assets on Bitcoin mainnet that are mapped to CKB cells through isomorphic binding. Although CKB serves as the data storage and verification layer for RGB++ assets and transactions, these assets inherit Bitcoin security. That is, these assets cannot be double spent as each asset is mapped to a UTXO on Bitcoin. Beyond asset issuance, Nervos aims to enable improved programmability for Bitcoin with the RGB++ layer, an extension of the RGB++ protocol that enables RGB++ assets to be mapped across other UTXO blockchains. The RGB++ layer serves as the smart contract and interoperability layer for RGB++ assets, enabling developers to build and deploy more flexible decentralized applications similar to those in EVM-compatible environments.

For a full primer on Nervos, refer to our Initiation of Coverage report.

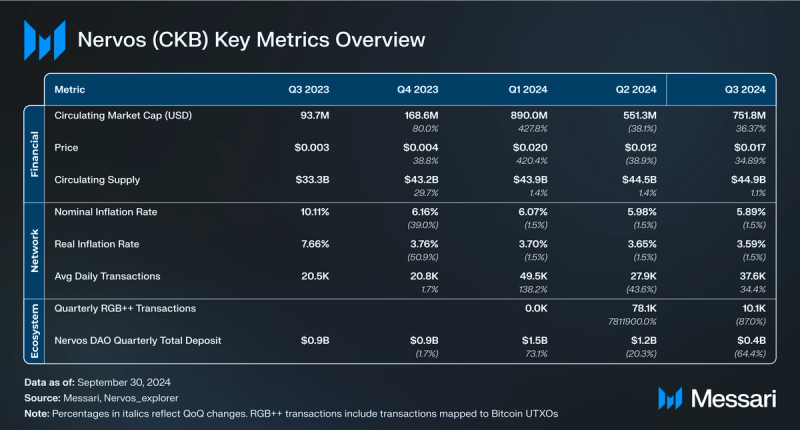

Key Metrics Financial Analysis

Financial Analysis

Nervos Network’s native token CKByte (CKB) plays an essential role in maintaining the network’s security and incentivizing efficient storage. CKB serves the following key functions on the network:

- Grants tokenholders data storage rights.

- Expended as network fees for transacting on the network.

- Issued as block rewards to miners for securing the network.

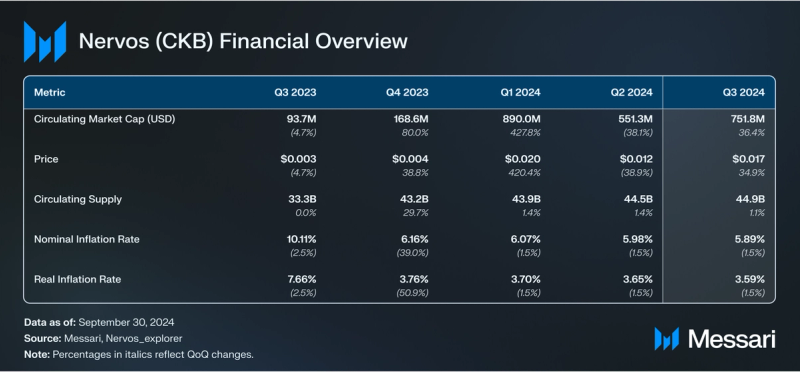

In Q3’24, CKB’s marketcap rose 36% QoQ to ~$752 million, recovering from a 38% decrease in Q2’24. Despite broader market contractions and mixed price sentiments in Q3’24, CKB’s price remained resilient in Q3’24, with its price rising by 35% QoQ to $0.017. This growth in marketcap and price was largely fueled by CKB’s exchange listing event in mid-September by the South Korean exchange Upbit. The listing reignited significant market interest in CKB, especially from the asian market, driving the token’s price to a quarterly high of $0.018. Consequently, CKB’s marketcap ranking improved from 119 in Q2 to 89 by the close of Q3’24.

Secondary IssuanceCKB manages state bloat through two methods. Firstly, to store data onchain, users must lock CKB tokens. Rather than directly charging a fee for users locking CKB tokens to pay for state rent, CKB indirectly charges fees through an inflationary mechanism known as secondary issuance. Each year, 1.344 billion CKB tokens are minted through secondary emissions and distributed to miners, Nervos DAO depositors, and eventually, an onchain protocol treasury. As such, the network’s secondary issuance introduces inflation targeted at users storing data, as locked CKB tokens are automatically exposed to value dilution, which is an indirect way of paying for State Rent. As of Q3’24, over 700 million CKB tokens have been distributed to miners as state rent, ~1.20 billion CKB tokens have accrued to Nervos DAO depositors, and over 4.7 billion CKB tokens meant for the proposed Treasury Fund have been burned since the protocol’s treasury remains inactive as of Q3’24.

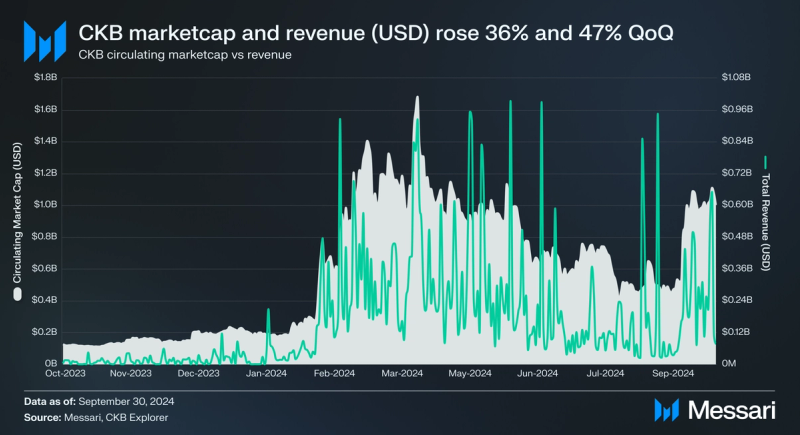

Nervos CKB revenue is measured as total transaction fees and is distributed to Miners through Nervos CKB”s Proof of Work mechanism (along with a portion of the network’s secondary issuance. In Q3 2024, network revenue increased by 47% QoQ to $568 million, driven by a 36% QoQ rise in circulating market cap. This growth was also fueled by CKB’s exchange listing on Upbit in September, which boosted trading activity and price, significantly increasing transaction fees in USD terms. Additionally, the launch of key infrastructure developments, including the RGB++ Layer and Fiber Network, further enhanced network activity by enabling more smart contract transactions, particularly for BTCFi applications.

Network Analysis

Common Knowledge Base transactions and new addresses rose 34% QoQ to 37.6k, while new addresses rose 32% QoQ to 9.4k. This growth was largely driven by CKB’s exchange listing event in September and core development releases in Q3’24, including the launch of the RGB++ Layer and the unveiling of the Fiber network.

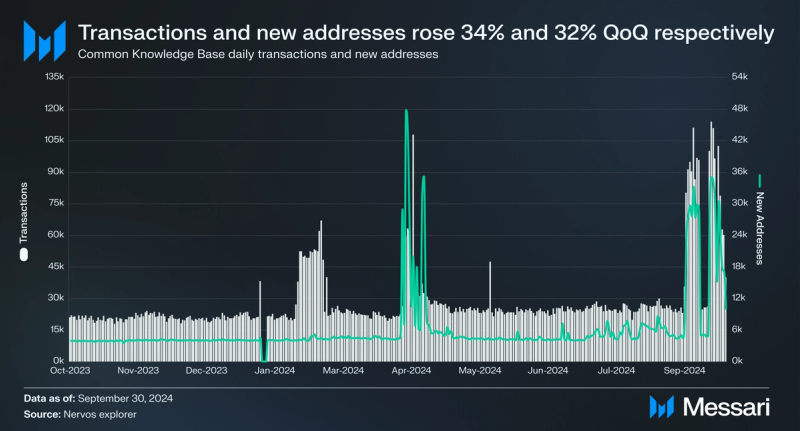

Cell activity is divided into live and dead cells. Live cells are available for future transactions, smart contract execution, and data storage. Whereas, Dead cells, are no longer usable as transaction inputs, still contain valuable data that can be accessed and referenced, contributing to the blockchain’s history and data traceability.

In Q3’24, CKB cell activity dynamics changed as live cells dropped 11% QoQ to 1.5 million, while dead cells rose 9% QoQ to 63 million, marking the first decline in live cell activity this year. This shift likely came from increased transactions tied to RGB++ asset issuances and smart contract use, which could consume live cells as part of updating states or transferring assets. The rise in dead cells reflects more network activity being finalized and stored permanently onchain as ongoing RGB++ releases continue to spur this growth.

As a PoW network, miners secure CKB by solving cryptographic puzzles to validate transactions and add new blocks to the blockchain. For every block mined, the miner receives that block's full 'base issuance' reward and a portion of its 'secondary issuance' reward. Miners also earn proposals or commit rewards from transaction fees for processing transactions on the network.

The hashrate measures the total computational power dedicated to mining on a Proof-of-Work (PoW) blockchain and directly reflects the security of the network. A higher hashrate indicates increased mining activity. In Q3 2024, the CKB network achieved a record mining difficulty of 4.4EH/s while the hash rate remained stable, declining by just 1.7% QoQ to 365 PH/s in September, reflecting heightened miner competition as CKB’s price appreciated. These increases were primarily driven by CKB’s listing on the South Korean exchange Upbit, which spiked its price and made mining more profitable. The improved profitability attracted more miners, intensifying competition, which elevated both the network’s hashrate and difficulty.

Additionally, sustained growth in hashrate and difficulty throughout the quarter was supported by ongoing developments and releases for the RGB++ protocol and Fiber Network.

RGB++ ProtocolNervos’ development efforts through 2024 have focused on scaling Bitcoin with the RGB++ protocol. Inspired by the RGB protocol, RGB++ leverages CKB as the client-verification and data storage layer for asset issuance. The original RGB protocol operates like a two-way payment channel built on Bitcoin Core that allows users to issue and manage assets without storing transaction data onchain for verification. Instead, users run client-side verification nodes to store RGB asset data offchain, bypassing Bitcoin’s consensus protocol. This system presents several limitations:

- The protocol relies on users to verify and store transaction data offchain.

- Dependence on a single user to maintain transaction data introduces the risk of mismanaged or altered data, affecting data integrity.

- Since users are solely responsible for storing transaction data, there is a risk that the data might not always be accessible, which could disrupt the system’s functionality.

- By relying entirely on client-side verification nodes, the protocol may struggle to scale efficiently with increasing user adoption and transaction volumes, as each user’s node must individually process and store transaction data.

RGB++ addresses these limitations by leveraging CKB as a decentralized third-party indexer providing data verification and storage for RGB++ assets. This improved design enables features like onchain data attestation, independent asset issuance, and more programmable asset management, which is not possible with the original RGB protocol. The RGB++ protocol maps Bitcoin UTXOs to CKB Cells through isomorphic binding, enabling seamless integration with CKB's Turing-complete smart contracts. Isomorphic binding ensures that RGB++ assets are not double spent so long as the UTXO on Bitcoin cannot be double spent, hence inheriting the security of Bitcoin’s blockchain. Additionally, users can also issue RGB++ assets on the CKB blockchain and leap it to the Bitcoin blockchain without any cross-chain bridges, inheriting Bitcoin’s security. In April 2024, the RGB++ protocol went live on the CKB mainnet, enabling users to issue and manage RGB++ assets, leading to a resurgence in network activity.

RGB++ LayerIn July 2024, the RGB++ protocol was upgraded to the RGB++ Layer, extending the protocol’s roles beyond functioning as an asset issuance layer to include serving as:

- Bitcoin’s asset issuance layer.

- The interoperability layer for the UTXO ecosystem

To function in this capacity, the RGB++ Layer combines isomorphic binding with a “Leap” concept to provide a "bridge-free" cross-chain interaction experience for RGB++ native assets or inscriptions/runes between BTC, CKB, and other UTXO-based blockchains like Cardano.

When an asset “leaps” from Bitcoin to CKB, it effectively rebinds its control permissions to a cell on the CKB chain while its data remains securely stored within CKB’s structure. For example, if a user’s assets were previously bound to Bitcoin UTXOs, they can now be re-bound to UTXOs on Cardano or any other UTXO-based chains. As a result, asset control permissions are transferred from BTC accounts to Cardano or other accounts.

A typical asset leap operation across multiple UTXO-based blockchains is as follows

- Each Bitcoin UTXO holding an RGB++ asset is mapped to a corresponding CKB cell. When an asset on Bitcoin leaps to CKB, the control script in the CKB cell adjusts to allow permissions from Bitcoin to transfer to CKB.

- The CKB chain stores the asset’s data persistently within its cells, which remain accessible regardless of which chain currently controls the asset.

- Instead of moving the asset data itself, the leap approach changes the unlocking condition in the cell. For example, after a leap to CKB, the asset can now be transferred using a CKB private key. If the asset leaps again to Cardano, for instance, the unlocking permissions update again to match Cardano’s key structure.

The RGB++ Layer also leverages CKB's Turing-complete smart contract environment (CKB VM) to enable decentralized application development. This spurred the emergence of BitcoinFi (BTCFi), similar to decentralized finance (DeFi) within the Bitcoin and UTXO ecosystem. As such, developers can build and deploy RGB++-compatible applications across several connected UTXO-based chains connected to the RGB++ Layer.

Fiber NetworkIn September 2024, Nervos unveiled the Fiber Network, a lightning network optimized to provide fast, low-cost, and decentralized multi-token payments and peer-to-peer transactions for RGB++ assets. The protocol’s design is inspired by Bitcoin’s Lightning network, building on two key technical concepts that compose the Lightning network stack:

- Payment Channels: The Fiber network leverages payment channels to enable multiple offchain transactions settled into a single transaction once the channel is closed. While the Lightning Network primarily supports payment channels for Bitcoin, the Fiber Network extends compatibility to multiple asset types, including RGB++ assets and CKB tokens.

- Hash Time-Locked Contracts (HTLC): To maintain compatibility with the Lightning Network, Fiber Network leverages HTLCs to secure fund transfers, mitigating counterparty risk. As such, even if offchain transactions fail, users can still secure their funds through onchain contracts. Since CKB is Turing complete, the Fiber network can implement much more flexible onchain contracts compared to Lightning Network HTLCs.

In addition to the above, Fiber Network also introduces two additional capabilities to the lighting technology:

- Multi-hop Routing allows users to send payments through multiple nodes without needing a direct channel with the recipient, making the network more flexible and accessible. It works by finding the best path between sender and recipient, locking funds securely at each step using HTLCs, and transferring the funds as the recipient unlocks them. This system also supports cross-chain payments, enabling compatibility with the Bitcoin Lightning Network through a cross-chain hub.

- Watchtower Service ensures the security and integrity of offchain payment channels. It performs real-time monitoring of channel states, including their opening, updates, and closures, while actively detecting anomalies such as attempts to close channels with outdated states or double-spending attacks. In response to malicious activities, the watchtower promptly broadcasts the latest channel state to the blockchain, safeguarding user funds and maintaining the network's reliability.

As of Q3’24, a prototype of the Fiber Network is live. It implements the basic functions of opening, updating, and closing channels between two nodes and also verifies cross-chain functionality with the Bitcoin Lightning Network.

Near-term future releases planned by the Nervos team include:

- Support for multi-hop routing and watchtower services,

- Improvements to the RPC interface and SDK to facilitate easier access for developers.

Nervos DAO

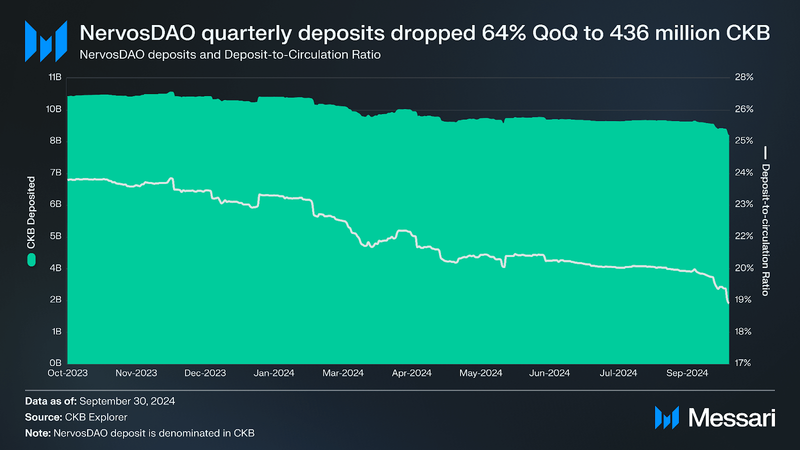

Nervos DAOCKB tokenholders are natively protected against the dilutive impact of the network’s ongoing issuance model via the Nervos DAO. By locking CKB token holdings into the Nervos DAO smart contract, users can earn rewards from secondary token issuance, ensuring their holdings are hedged against inflation. Depositors receive rewards at an APR equivalent to the annual secondary issuance rate, although the rate will continue to decrease as the total supply increases. While tokenholders with a minimum balance of 102 CKB tokens can deposit to the DAO anytime, withdrawals can only occur at the end of the 30-day deposit cycle.

By Q3’24 ending, total quarterly Nervos deposits declined by 64% QoQ to 438 million CKB, bringing the total Nervos DAO deposit balance to ~8.5 billion CKB, roughly 19% of the CKB circulating supply. Over the past two years, the deposit-to-circulation ratio has continued to trend downloads, declining by 10% QoQ to 19.5% in Q3’24. The decline is likely driven by increased onchain activity from developments like the RGB++ protocol and Fiber Network, which encourage users to withdraw funds to participate in new asset issuance programs and smart contract operations. Additionally, CKB’s price surge following its Upbit listing likely incentivized users to trade their holdings for better short-term returns. Declining relative incentives for DAO deposits and the need to cover state rent may have further contributed to the trend, signaling a shift towards increased liquidity and active participation within the Nervos ecosystem.

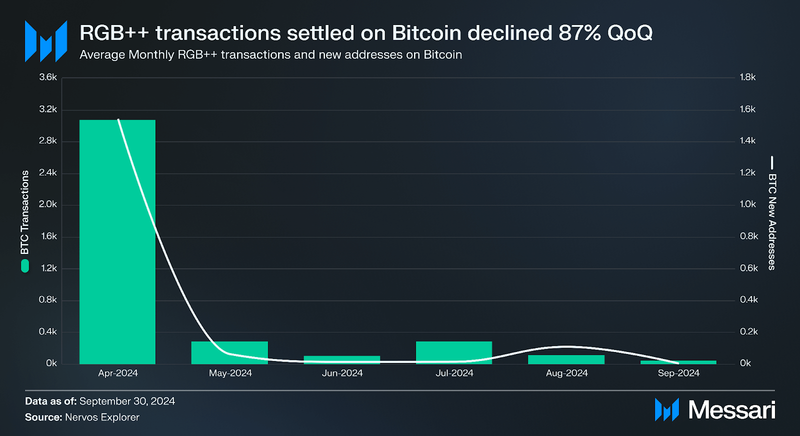

Since its launch in April 2024, RGB++ has processed over 80,000 transactions on CKB, with activity peaking in Q2 at 78,000. However, Q3 2024 saw a significant contraction, with transactions declining 87% QoQ to just 10,000. A similar downtrend was observed on Bitcoin, where RGB++ transactions and newly mapped addresses peaked in April at 3,050 and 1,500, respectively, but declined by over 60% and 97% QoQ in Q3, respectively, to reach new lows.

Unsurprisingly, this decline occurred during a development-focused period marked by upgrades to the RGB++ protocol, the launch of the Fiber Network, and additional tooling aimed at laying the groundwork for a BTCFi ecosystem across UTXO-based chains. For instance, foundational releases like the RGB++ Layer enable cross-chain decentralized applications, programmable assets, and broader UTXO-based DeFi use cases beyond CKB and across several UTXO chains like Cardano. While the immediate impact on transaction activity has been muted in these previous quarters, these infrastructure investments position the Nervos CKB for a rebound as developers deploy new applications on the RGB++ layer. This strategic focus on infrastructure should drive renewed transaction activity growth in subsequent quarters, reversing the recent downtrend.

Ecosystem Growth

Nervos Network continues to promote ecosystem development with funding, infrastructure, and tooling support. At the mainnet launch in November 2019, ~5.7 billion CKB (17% of the Genesis allocation - $62.4 million as of writing) was set aside to fund these initiatives. Over the years, several ecosystem development programs have been seeded from this fund to drive the network’s growth initiatives. One such initiative is the CKB Eco Fund (prev. InNervation), an ecosystem fund focused on incubating and investing in pre-seed and seed projects connecting CKB and Bitcoin using RGB++. The fund supports ecosystem projects building critical infrastructure and decentralized applications across various sectors, including DeFi, gaming, tooling, NFT marketplaces, and more. Ecosystem projects building across eligible verticals can apply for ongoing grant programs organized by the CKB Eco Fund or the CKB Community Fund DAO.

BTCKBIn January 2024, the CKB Eco Fund launched BTCKB, a development initiative to enhance integration between the Bitcoin and CKB blockchains through shared PoW consensus and the UTXO model. BTCKB intends to advance the capabilities of the Bitcoin blockchain by introducing new smart contract functionalities and leveraging BTC, Taproot, and RGB++ assets into the CKB blockchain. As part of this initiative, CKB Eco Fund has also incubated CELL Studio, a blockchain software company led by Nervos’ co-founder Cipher Wang that also spearheads the BTCKB initiative. CELL Studio develops infrastructure and applications that enhance and expand the Nervos ecosystem, similar to how ConsenSys has built foundational tools for Ethereum, such as Infura and Metamask. As of writing, notable ecosystem tools developed by CELL studio include:

- CoTA: Token aggregation protocol for fungible and non-fungible tokens on CKB.

- ForceBridge: Cross-chain interoperability protocol for bridging CKB to other networks. It currently supports Ethereum and BNB Smart Chain.

- Spore: Onchain Digital Object protocol backed by CKB.

The RGB++ Layer extends smart contract capabilities beyond Nervos (CKB) and Bitcoin to other UTXO-based chains, positioning CKB as the verification and data storage layer for the entire UTXO ecosystem. Since its launch in Q3 2024, the number of RGB++ assets issued on CKB surged by 487% QoQ, increasing from 85 in Q2 to 487 in Q3. Additionally, over 35 ecosystem projects have utilized the protocol for asset issuance, with several projects actively building across diverse verticals, further demonstrating its growing adoption and versatility within the ecosystem. A few notable projects across different ecosystem verticals are detailed below.

Infrastructure and Tooling- UTXO Stack: A Bitcoin L2 “OP Stack” introduced in July 2024 that leverages the RGB++ protocol to scale Bitcoin through UTXO-based “branch chains” that provide a programmable execution environment for decentralized applications. As of Q3’24 ending, the protocol is transitioning into a Lightning Network Staking Layer, although additional information on the protocol’s new offering has yet to be published.

- RGB++ enabled Wallets: Notable wallet applications with support for RGB++ assets include:

- JoyID: A non-custodial passkey wallet that leverages biometrics for user authentication and supports multiple networks, including Ethereum, Bitcoin, and RGB++ assets.

- Rei Wallet: A native Nervos CKB browser extension wallet that integrates the RGB++ protocol, enabling users to manage and transact RGB++ assets seamlessly.

- UTXO Global Wallet: A DeFi-focused wallet application optimized for digital asset management and with support for multiple UTXO-compatible assets.

- Gate wallet: A popular multichain wallet (Gate wallet) released by Web3 exchange Gate.io, Gate wallet has also introduced support for RGB++ assets.

Notably, in September 2024, the Nervos developer relations team launched NervDAO, a wallet interface that streamlines and simplifies the user experience for CKB’s Nervos DAO. As such, users can easily interact with and initiate deposits and withdrawals from the DAO from any CKB-compatible wallet with support for NervDAO, like the JoyID wallet.

DeFi (BTCFi)

The launch of the RGB++ Layer in Q3’24 has spurred the emergence of a decentralized finance ecosystem on Nervos CKB and across other UTXO-based networks. As of Q3’24, notable projects building across DeFi (BTCFi) verticals like decentralized exchanges, non-custodial money markets, real-world tokenization protocols, and stablecoins on the RGB++ Layer include:

- Decentralized exchanges (DEXs): Two notable decentralized exchanges on the RGB++ Layer are namely:

- UTXOSwap: A DEX protocol leveraging intent-based trading to offer the best features of AMMs and order books. It supports trading for RGB++ and CKB ecosystem assets, with plans to expand to other Bitcoin assets like Runes. UTXOSwap uses a hybrid model with offchain matching and onchain verification, offering innovations such as ultra-low fees, customizable pricing curves, and seamless multi-chain wallet compatibility. Notable among other roadmap items, in Q4’24, the protocol intends to introduce customizable fee tiers for specific asset types, like stablecoins and exotic pairs, and launch a token airdrop program to reward early users and liquidity providers.

- HueHub: A DEX and launchpad that facilitates the issuance, minting, and trading of RGB++ assets. Through HueHub, users can issue RGB++ tokens, participate in fair minting events, and trade these assets on both Bitcoin's Layer-1 and Nervos' Layer-2 (CKB) blockchains.

- Stablecoins: In Q3’24, Stable++, the first RGB++-enabled, overcollateralized stablecoin protocol, went live on the RGB++ layer (in beta). The protocol mints the USD-pegged stablecoin RUSD using BTC and CKB as collateral. Leveraging RGB++'s leap function, Stable++ also facilitates seamless cross-chain asset transfers within the Bitcoin ecosystem, enhancing its utility and accessibility. Stable++ leverages Nervos’ CKB VM to create secure overcollateralized vaults and efficient liquidation mechanisms, ensuring the protocol’s stability.

As of writing, users can currently open vaults to borrow RUSD against BTC or CKB collateral or redeem RUSD for CKB/BTC at a 1:1 USD value.

- Marketplaces: Notable marketplaces with support for RGB++ assets include:

- Omiga: An inscription protocol on Nervos CKB that enables users to inscribe digital assets directly onto the blockchain. By leveraging the RGB++ protocol, Omiga enhances asset issuance and management, providing Turing-complete contract capabilities and facilitating seamless cross-chain interactions. This integration allows for the creation of complex, programmable assets within the Nervos ecosystem.

- Dobby: A digital objects (DOB) platform that allows users to create, buy, sell, manage, and discover exclusive digital objects. By utilizing RGB++, Dobby ensures efficient and secure transactions, enhancing the user experience in the digital asset marketplace.

- Element NFT Marketplace: A multichain NFT marketplace that announced support for RGB++ assets in September 2024.

WORLD3 is an AI and blockchain-based gaming project that aims to merge autonomous virtual worlds with environmentally intelligent AI agents to create dynamic, interactive ecosystems. World3 is a blockchain-based platform designed to create interconnected ecosystems for digital goods and AI-driven virtual environments. WORLD3 leverages Nervos’ capabilities to automate economic interactions, ensure reliable data storage, and facilitate cross-chain transactions. WORLD3 operates a modular platform comprised of three layers:

- Protocol Layer: Establishes interaction standards for AI agents, users, and virtual environments while enabling asset creation and trade using W3C tokens and AI-generated Assets (AGA)s.

- Visualization Layer: Provides 2D, 3D, VR, and AR interfaces for immersive interaction and customizable visualization tools.

- Blockchain Layer: Utilizes Nervos CKB for secure storage, automated economic processes, and cross-chain interoperability.

WORLD3 executes its vision of autonomous worlds via an ecosystem of applications that include:

- Crystal Caves: A fully onchain, resource-mining game that introduces users to WORLD3’s decentralized economy, allowing them to earn Lumen's convertible to W3C tokens. AI agents dynamically adapt to user actions, creating immersive gameplay scenarios that integrate with the broader WORLD3 ecosystem.

- QUEST: A gamified mission platform where users undertake tasks to earn Lumens and customize AI agents, fostering consistent engagement within the ecosystem. For agents, QUEST serves as a learning hub to develop goal-oriented behaviors and autonomy through structured missions.

- Matrix World: A 3D immersive environment that integrates AI agents and users in decentralized social, economic, and collaborative activities. It supports VR and AR experiences, offering dynamic spaces where users and agents engage in resource management, trade, and co-creation. The platform evolves continuously, serving as a scalable foundation for new divisions and ecosystem applications.

Other notable ecosystem applications include:

- Nervape: Multi-chain Composable Digital Objects Built on Bitcoin with “Base Assets” issued on Bitcoin and “Accessory Assets” issued on CKB.

- Haste: Asset management solution for RGB++ assets.

- d.id: Decentralized identity protocol for Bitcoin.

- Cellular: A fully onchain artificial life simulation game.

- Mobit. App: An asset management solution for RGB++ assets

Notable ecosystem partnerships secured in Q3 include:

- ZenGate: In July 2024, ZenGate and Nervos Nation announced a strategic partnership to bring Palmyra, a tokenized commodities trading platform, to the Nervos CKB blockchain. This collaboration aims to develop a decentralized identity (DID) system and a real-world asset (RWA) lending platform on Nervos, enhancing financial inclusion and supply chain efficiency. By leveraging Nervos' secure and scalable infrastructure, Palmyra seeks to streamline global commodity trading and provide competitive lending opportunities to underserved markets.

- Bool Network integration: On Aug.2, 2024, Bool Network announced RGB++ support for BRC-20 and Rune tokens, enabling users to access the emerging BTCFi ecosystem built around RGB++ assets.

- Gamebuild and CKB Eco Fund: In August 2024, CKB Eco Fund announced a partnership with Gamebuild to develop a software development kit (SDK) to seamlessly integrate Bitcoin-native assets into games. By leveraging the RGB++ protocol and Bitcoin’s robust security, this SDK will enable developers to create innovative gaming experiences where in-game assets are secured and transferable within the Bitcoin and Nervos ecosystems.

- CKB Eco Fund and APRO Oracle: On Aug. 7, 2024, CKB Eco Fund announced a partnership with APRO Oracle to introduce a Bitcoin-native (BTC L1) price oracle on the Nervos blockchain. By leveraging APRO Oracle technology across 15 blockchain ecosystems and over 100 assets, the partnership aims to enhance financial tools within the Bitcoin and Nervos ecosystems, driving innovation in decentralized finance (BTCFi).

- CKB, Cross Chain Tokens, and Merson Merson Finance: In November 2024, Merson Finance and Cross Chain Tokens partnered with the Nervos CKB blockchain to launch ccBTC, a cross-chain Bitcoin solution fully backed by 1:1 Bitcoin reserves. By integrating ccBTC, the partnership aims to drive cross-chain liquidity and expand DeFi(BTCFi) opportunities within the Nervos ecosystem, offering users an efficient and decentralized means of accessing Bitcoin-backed assets.

Q3 2024 marked a pivotal period for the Nervos Network, highlighted by the launch of the RGB++ Layer and Fiber Network, which solidified its position as an emerging hub for BTCFi within the UTXO ecosystem. These advancements catalyzed significant ecosystem growth, with the issuance of RGB++ assets surging by 487% QoQ to 487 assets and notable project integrations across DeFi, gaming, and real-world asset tokenization. Concurrently, network activity expanded as transactions and new addresses rose by 34% and 32% QoQ, respectively, fueled by September's Upbit exchange listing and sustained development momentum. Despite broader market contractions, CKB defied the downtrend with its price and market cap increasing by 35% and 36% QoQ, respectively, supported by record-breaking hashrate and mining difficulty levels.

Strategic ecosystem partnerships, such as those with GameBuild and ZenGate, expanded Nervos’s reach into gaming and real-world asset markets. While a temporary decline in transaction activity was observed due to infrastructure build-out, the investments in decentralized finance (BTCFi), scalable Layer-2 solutions, and cross-chain applications position Nervos for a strong rebound.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.