and the distribution of digital products.

State of MultiversX Q3 2024

- In Q3, MultiversX passed the Spica Upgrade with a record 99% approval rate. This is the first major proposal passed since the Vega upgrade, which features several user and developer experience upgrades.

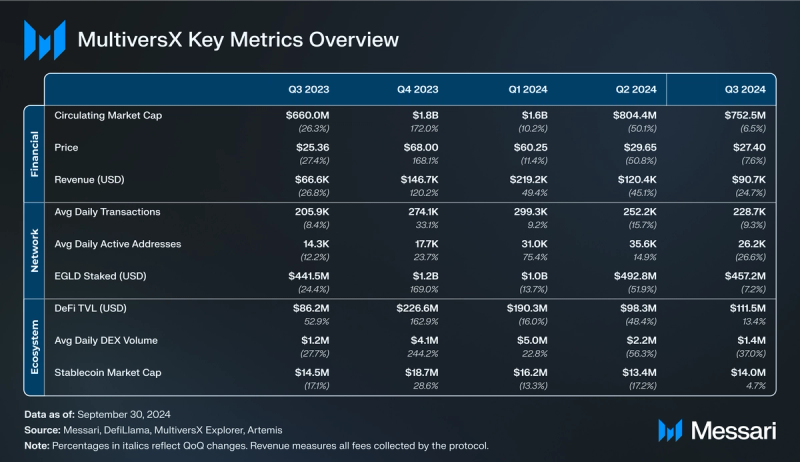

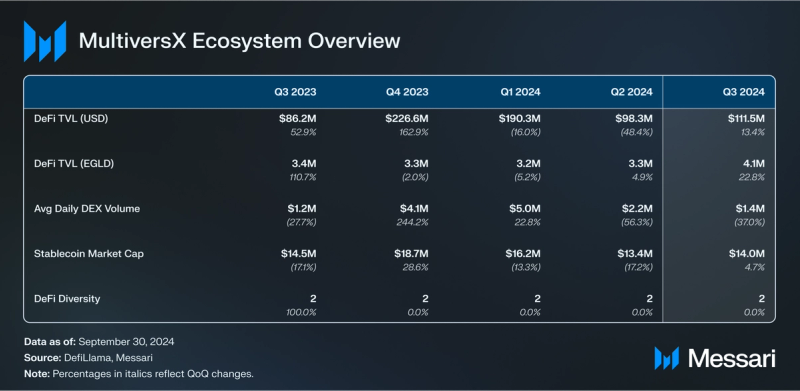

- DeFi TVL (EGLD) increased 23% QOQ to 4.1 million EGLD tokens. DeFi TVL, denominated in USD, increased by 13.4% QoQ to $111.5 million.

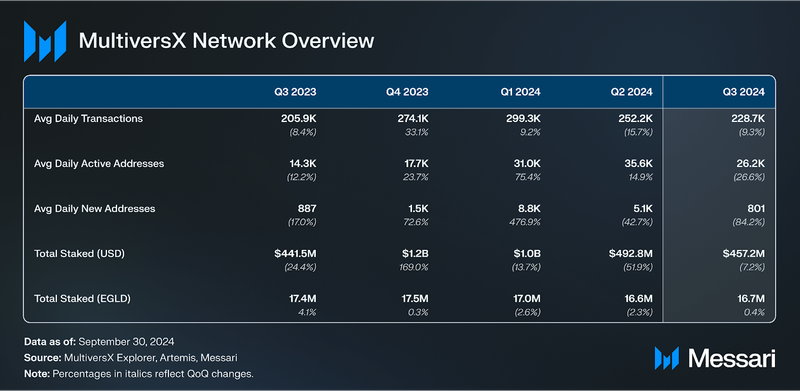

- Total Staked (EGLD) increased 0.4% QoQ. This comes despite a 9% QoQ decrease in average daily transactions and a 27% QoQ decrease in average daily active addresses.

- OneFinity goes live on the test net. It is a scalable multi-VM blockchain that integrates EVM and SpaceVM.

MultiversX (EGLD), formerly known as Elrond, is a blockchain platform that aims to provide a highly scalable, fast, and secure blockchain network for distributed apps, enterprise use cases, and the new internet economy. 3,200+ nodes operate the distributed platform, and its main development contributor is MultiversX Labs S.R.L., a company incorporated in Romania in May 2018 and with operations in St. Julians, Malta.

MultiversX uses Proof of Stake, adaptive state sharding, and a WASM-based virtual machine to power its network. The foundation has partnered with Coinbase, DefiLlama, Alchemy, AWS, Google Cloud, Tencent Cloud, and many other leaders in the space to help their infrastructure. The MultiversX ecosystem has projects across many sectors, including DeFi, gaming, tools & infrastructure, NFTS, and payments.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis

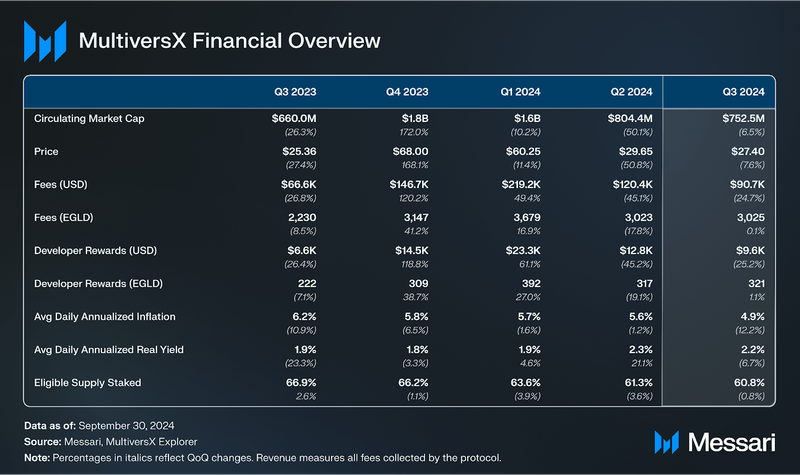

In Q3, market capitalization fell 7% QoQ to $752.5 million, and the price of EGLD dropped 8% QoQ to $27.4. The market cap rank decreased from 86 to 88. The total market cap of the crypto market decreased by 4% QoQ, and the total altcoin market cap (all coins other than BTC) decreased by 5% QoQ. In aggregate, BTC outperformed small-cap cryptocurrencies this past quarter, with BTC dominance (the ratio between the market cap compared to other coins in the top 10 ranking by market cap) concurrently increasing by 7% QoQ to 54%.

The circulating supply of EGLD tokens increased 1% QoQ, which resulted in an additional 332,000 tokens being unlocked due to network inflation. 92% of the total token supply has been unlocked as of Q3. EGLD inflation is offset by the sum of the transaction fees, so inflation was reduced by approximately 3,000 EGLD tokens this quarter.

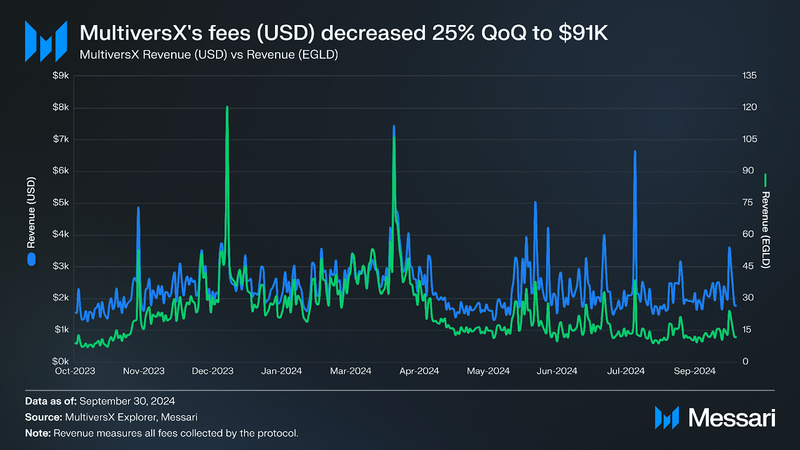

MultiversX’s revenue, i.e., all fees collected by the protocol, decreased by 24% QoQ to $90,700 Most of this can be attributed to the decreasing token price, as fees denominated in EGLD only declined by 0.1% to 3,000 EGLD. Developer rewards were down 25% QoQ to $9,600. When denominated in EGLD, rewards increased by 1% QoQ to 321 EGLD. Developer rewards are a unique feature of the MultiversX ecosystem, where developers get 30% off gas fees every time someone calls their smart contract.

EGLD’s average daily nominal yield was 7% in Q3. Annualized inflation decreased by 12% QoQ to 5%, and average daily annualized real yield decreased by 7% QoQ to 2%. 61% of all eligible EGLD was being staked at the end of Q3, which is a 1% decrease from Q2.

Network Analysis Usage

Usage

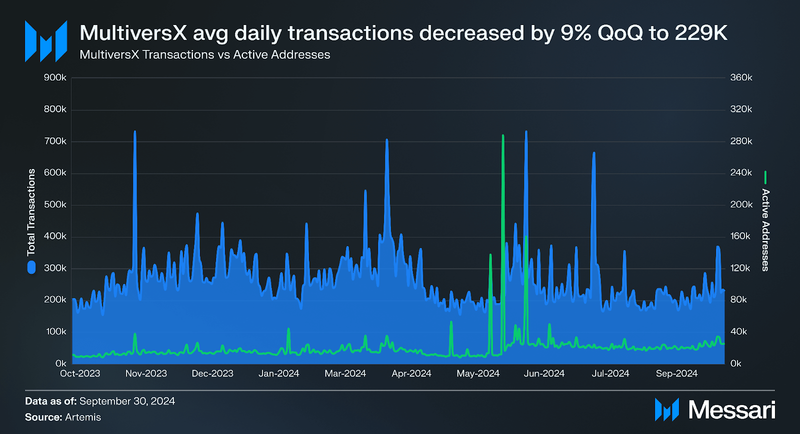

In Q3, average daily transactions decreased by 9% QoQ to 228,700, while average daily active addresses decreased by 27% QoQ to 26,200. Additionally, the average daily number of new addresses fell by 84% QoQ to 800. There were 316 new smart contracts created on the network in Q3, a 49% increase from Q2.

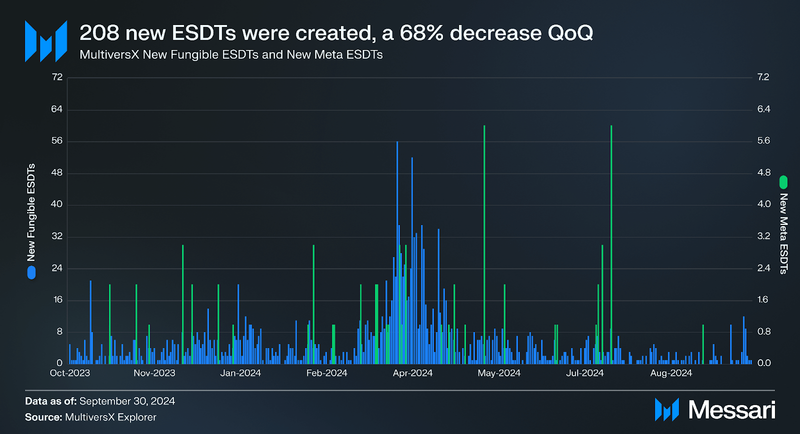

The MultiversX network natively supports the issuance of custom tokens, unlike Ethereum, which needs ERC-20. MultiversX’s standard is the eStandard Digital Token (ESDT). 208 new tokens were created throughout Q3, a 68% decrease QoQ. 13 of those tokens were Meta ESDTs, which are regular ESDT fungible tokens with properties similar to the new token extensions on Solana. XMEX, the time-locked equivalent of the xExchange token MEX, is an example of a Meta ESDT.

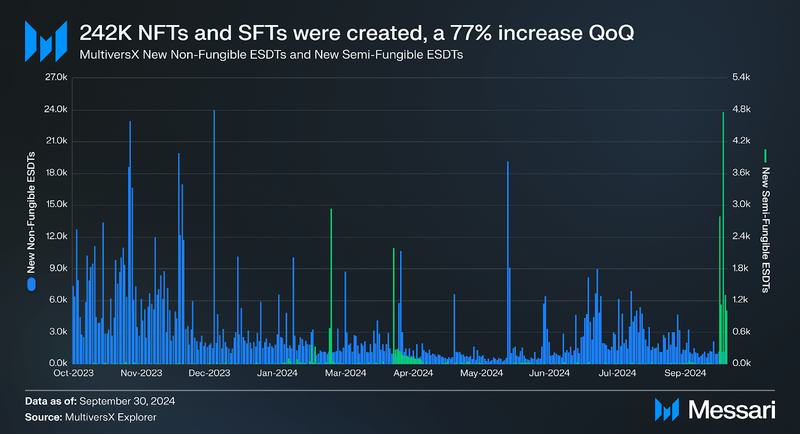

The network also natively supports NFTs by adding metadata and attributes to the fungible ESDT. MultiversX’s NFTs can be broken down into non-fungible and semi-fungible (SFTs). Meta ESDTs are a subset of the semi-fungible tokens. The difference is that SFTs will have a Uniform Resource Identifier (URI), whereas a Meta ESDT will not. In total, new NFTs increased by 77% QoQ to 242,400. 5% of these were SFTs, with the rest being non-fungible. Also, there were 977,400 NFT transfers during Q3, an increase of 12% QoQ.

Security

Total EGLD staked denominated in USD dropped by 7% QoQ to $457.2 million. This was mainly led by token depreciation as the total amount staked denominated in EGLD rose 0.4% QoQ to 16.7 million.

At the end of Q3, MultiversX had over 120,000 addresses staking to over 3,200 different validators. According to MultiversX, 59% of validators were hosted in Europe, followed by North America at 34%.

In Q3 2023, MultiversX introduced Guardians, a security layer that offers an additional safeguard for user accounts. Guardians act as trusted cosigners, enabling a multi-signature implementation at the protocol level. This means that transactions must be accepted by both you and the Guardian, which occurs upon completing a 2-factor authentication. Guardians is compatible with traditional authentication services like Google and Microsoft’s authenticator apps. As of August 23, 2024, 25% of daily transactions on MultiversX use Guardians.

On August 18, the Spica upgrade was passed with a record 99% approval rate and 28% participation. This is the first major proposal passed since the Vega upgrade in April 2024. The Spica upgrade included the following updates:

- Passkeys: A low-cost solution that protects users against potential attacks using passkeys (i.e., authenticator apps, biometrics, PINs) instead of lengthy passwords and secret phrases.

- Relayed V3: A more efficient and cost-effective way to handle relayed transactions that allow multiple full transactions. Relayers pay the fee in relayed transactions, so the user requesting the transaction is not required to have any EGLD for fees. V1 and V2 will be removed once all applications have completely transitioned to V3.

- ESDT improvements: Enhances the eStandard Digital Token (ESDT) to support dynamic NFTs and adds new roles and configuration options.

- EGLD in MultiESDTTransfer: Enables native EGLD transfers within MultiESDTTransfer transactions.

- Crypto API & New Opcodes: Adds new opcodes and crypto VM endpoints for developers, including support for signature verification.

The main team developing the MultiversX blockchain released its technical roadmap in early April. The team has split the roadmap into five key areas and highlighted updates for each:

- Core Network: Includes updates to the distributed transactional computation protocol, consensus, and performance. As of Q3, twenty tasks are done, nine are in progress (including updates from the Spica upgrade, such as EGLD multi-transfer and Relayed V3), and ten are upcoming.

- SpaceVM: Includes changes made to the MultiversX virtual machine, which is responsible for executing smart contracts. As of Q3, six tasks are done, two are in progress (restaking and timestamps as blockchain hooks), and three are upcoming.

- Developer UX: Includes developer tooling, testing frameworks, and SDKs. As of Q3, two tasks are done, nineteen are in progress (including an explorer for Sovereign Chains, a wallet for Sovereign Chains, and a Tag Builder), and six are upcoming.

- Sovereign Chains: Includes changes made to the Sovereign Chains SDK that allows developers to create custom L2s connected to the global MultiversX network. As of Q3, ten tasks are done, eight are in progress (including an economics paper, a testing framework, and cross-chain mint and burn functionality), and three are upcoming.

- Interoperability: Includes efforts by MultiversX to connect to other blockchains. As of Q3, one task is done, two are in progress (technical support for EVM Compatible Sovereign Chains and Native IBC (Cosmos standard) Development), and six are upcoming.

DeFi

DeFi

MultiversX TVL denominated in USD increased from $98.3 million in Q2 to $111.4 million, a 13% QoQ decrease. However, TVL denominated in EGLD increased QoQ by 22% from 3.3 million to 3.8 million. This dynamic indicates that the TVL decrease in USD was driven by EGLD price depreciation, not capital outflows.

Hatom led in TVL at $81.7 million, a 20% QoQ decrease. Hatom represents 62% of MultiversX TVL, and their market share increased by 2% QoQ. Hatom allows users to lend, stake, liquid stake, and bridge on MultiversX’s network. xExchange’s market share increased by 1%, representing 30% of TVL on MultiversX, bringing its TVL to $39.7 million. xExchange is a DEX that was built by the MultiversX team. With these two protocols comprising over 90% of MultiversX’s total DeFi TVL, MultiversX had a DeFi Diversity (i.e., the number of protocols making up 90% of a network’s TVL) score of two.

XOXNO, which is absent from this list because TVL is not an applicable measurement, is the leading NFT marketplace on MultiversX. They launched their first ticketing product to support the fitness event Sense4Fit on September 7, which had over 6,000 attendees, of whom reportedly only 1% of attendees were crypto-native, and 99% downloaded the xPortal wallet for the first time.

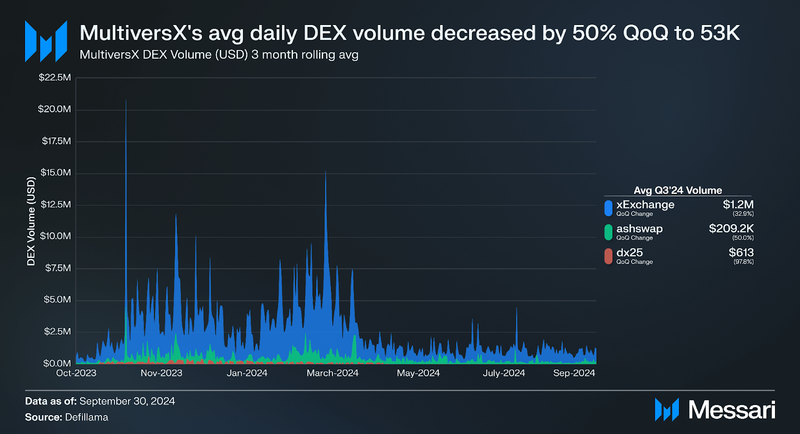

MultiversX’s average daily DEX volume decreased by 37% QoQ to $1.4 million. Of the Q3 volumes, xExchange was 84% of the market, a 5% increase from last quarter. xExchange launched their V3 on September 12, 2024. This introduced keyboard shortcuts, a revamped UI, boosted staking options, and 1-click liquidity provision. The update also features advanced trading tools, an updated analytics and portfolio page, direct trading URLs, and new concepts like "charge" and a redefined "energy."

The second largest DEX was Ashswap, which had a 15.0% market share, a 22% decrease QoQ in market share.

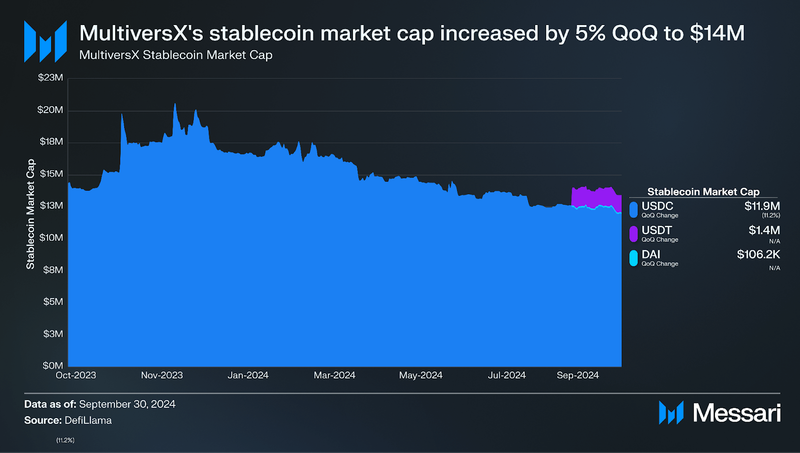

MultiversX’s stablecoin market cap increased by 5% QoQ to $14 million, ranking it 41st among all networks. On May 15, Hatom Labs announced its plans to mint a native stablecoin, USH. Hatom USD (USH) addresses the liquidity issues in the MultiversX ecosystem by introducing a native stablecoin with innovative minting methods. Users can mint USH through two facilitators: the Lending Protocol, offering fixed rates based on collateral, and Isolated Pools, where users deposit $EGLD or $sEGLD with no minting fees, leveraging Liquid Staking. USH's stability is maintained via two peg mechanisms: a Soft Peg Mechanism that ensures USH is valued at $1 within the Lending Protocol regardless of market price, and a Hard Peg Mechanism activating Redemption Mode if USH trades significantly below $1, allowing users to seize collateral to restore the peg. The project is still in development, with plans to launch in Q3.

Ecosystem GrowthLast quarter, MultiversX introduced the Sovereign Chains SDK, enabling developers to launch custom L2s or app chains natively interoperable with the MultiversX ecosystem. Currently, Sovereign Chains support Bitcoin, Ethereum, Solana, and Move-based chains, with more coming. MultiversX aims to redefine the network as an L0 interoperability layer for large blockchains while keeping the mainnet and current smart contracts live. Sovereign Chains can opt for shared security by staking 1000 EGLD, plus 100 EGLD per validator node. Users can access MultiversX dApps with composability, interoperability, and single addresses across chains. Compared to other L2s, Sovereign Chains offer the following unique properties:

- Double settlement on two chains

- Native interoperability with no security assumptions (no admin keys or centralized sequencers)

- Multiple VM implementations (to choose from and run simultaneously)

- Onchain 2FA

- Performance of 70k TPS per chain (to be improved further)

- Application composability with the MultiversX mainnet

- Developer-friendly SDK

- Cheap hardware machines (inexpensive infrastructure maintenance)

- Integrated UX of a single-chain

- 1s block times / 2s finality

There are currently three sovereign chains in development:

- CyberNetwork: Gaming-specific chain

- OneFinity Network: EVM compatible

- Pi Squared: ZK interoperability layer

MultiversX has also launched a $1 million grant program to incentivize more sovereign chains to be developed. Interested teams can apply here.

Other ecosystem developments include:

- Protocol:

- An upcoming network upgrade scheduled for MultiversX is reported to increase the blockchain throughput and bring improvements to latency & finality, getting the protocol to sub-second blocktimes.

- Wallets and fintech Apps:

- EGLD integration with SafePal: This integration provides over 13 million users access to the MultiversX ecosystem via hardware, mobile, and upcoming browser-extension wallets. This partnership aims to expand EGLD's reach to new markets across 200+ countries, leveraging SafePal's support for 100+ blockchains and asset management tools.

- MultiversX Snap integration with MetaMask: This allows users to seamlessly create a MultiversX wallet from their existing MetaMask account and interact with the MultiversX ecosystem

- OneFinity Testnet goes live: This is the first Sovereign Chain to reach testnet. OneFinity is a scalable multi-VM blockchain integrating EVM and SpaceVM.

- HeliosConnect by HeliosStaking live on beta: HeliosConnect uses smart contract logic deployed on the supported chains (currently MultiversX and Injective) with the goal of creating a universal Web3 identity layer.

- Trading and Exchanges:

- OneDEX DCA (dollar cost averaging) goes live: OneDEX has introduced a new tool to equip users with a dollar cost average trading strategy.

- xExchangeApp launches v3: The new version introduces a number of updates aimed at simplifying DeFi workflows, offering enhanced trading support, liquidity features, and a UI/UX revamp.

- Developer Tools and Support:

- Chainlink adds support for EGLD in its datastreams: Users can monitor the EGLD / USD datastream for market data powered by Chainlink’s decentralized oracle network.

- Gaming and Entertainment:

- Gods of Fire live on Steam: Gods of Fire is a Play-to-Earn PC game where players can earn $EGODS tokens while owning and monetizing in-game assets.

- Integrations and Partnerships:

- Partnership with Zealy: Zealy is a platform helping to enhance community engagement by providing Web3 community building tools to organize, track, and incentivize user participation via challenges.

- Axelar live on testnet: Axelar is a decentralized network designed to enhance interoperability through cross-chain communication.

- Education and Community Initiatives:

- MultiversX celebrated their 4 year anniversary in Q3.

- 50% of Colombia Staking Node traffic goes through Starlink: Their goal is to make MultiversX more decentralized by operating nodes using technology such as solar energy, Starlink, low-earth-orbit (LEO) satellites, fiber optic, load balance systems, and off grid battery power.

- MultiversX participated in OmniOpenCon 2024 to discuss good coding practices, their release process, and building peer-to-peer networks.

- MultiversX published and presented two research papers during Roedunet International Scientific Conference, : (1) WASMGuard: a framework to reduce security risks of SCs and improve their reliability; (2) MultiversX case study of blockchain scalability and performance

- Hosted 100 college students for a certified blockchain program through eCornell (the online education arm of the prestigious American institution and part of the Ivy League group of top-ranked US colleges)

- This summer, MultiversX has run an internship program that welcomed 14 college students to a first-hand blockchain learning experience

In Q3 2024, MultiversX implemented the Spica Upgrade, which received 99% community approval. This upgrade included enhancements to user experience, improvements to token capabilities, and a more efficient system for sponsored transactions. Despite a decline in metrics such as average daily transactions and active addresses, the platform recorded positive developments in DeFi, including a 23% increase in DeFi TVL denominated in EGLD and progress in its Sovereign Chains initiative.

The ecosystem experienced further growth as OneFinity became the first Sovereign Chain to go live on the testnet, supporting MultiversX’s Layer-0 interoperability objectives. Integrations with SafePal and MetaMask expanded wallet support, and the team continued its technical roadmap, focusing on core network improvements, developer experience upgrades, and sovereign chain development. Although the market cap and token price declined, the community-driven upgrades and partnerships provided a basis for further growth and development in Q4 and beyond.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.