and the distribution of digital products.

State of Metaplex Q1 2025

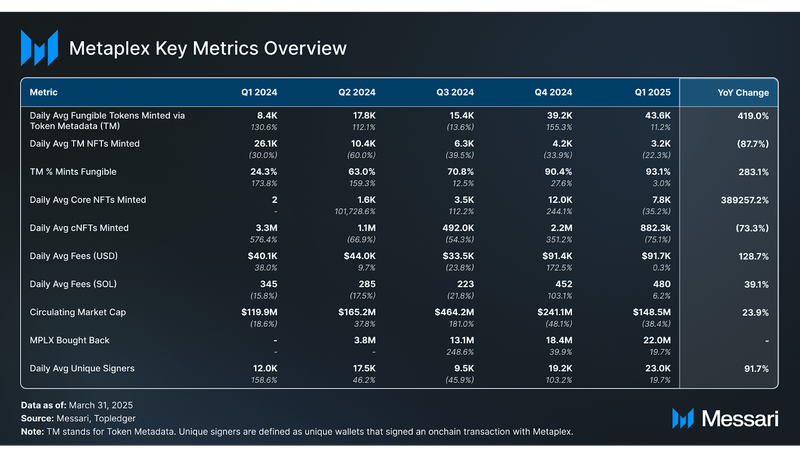

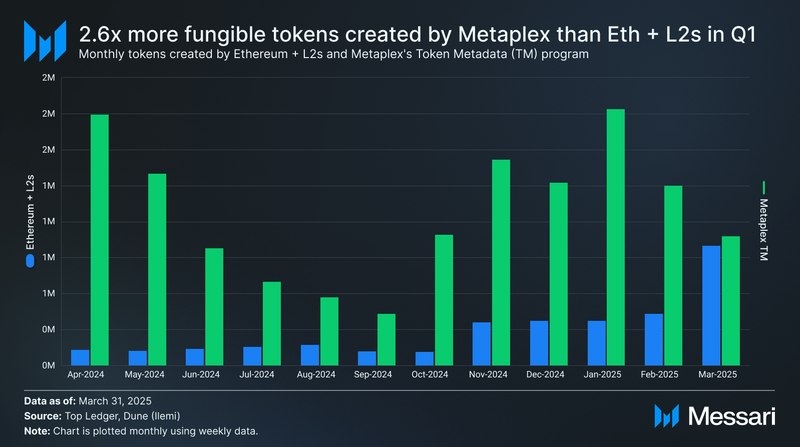

- In Q1, daily average fungible tokens minted via the Token Metadata program increased 11.2% QoQ from 39,219 to 43,619, representing a 419% YoY increase from 8,375 in Q1 2024.

- Daily average mints from Core NFTs declined 35% QoQ to 7,787, while daily average mints from Bubblegum (cNFTs) fell 75.1% QoQ to 882,290 following a surge in late 2024. Despite the cooldown, Core NFTs still maintained a higher baseline of issuance, growing 389,257% YoY.

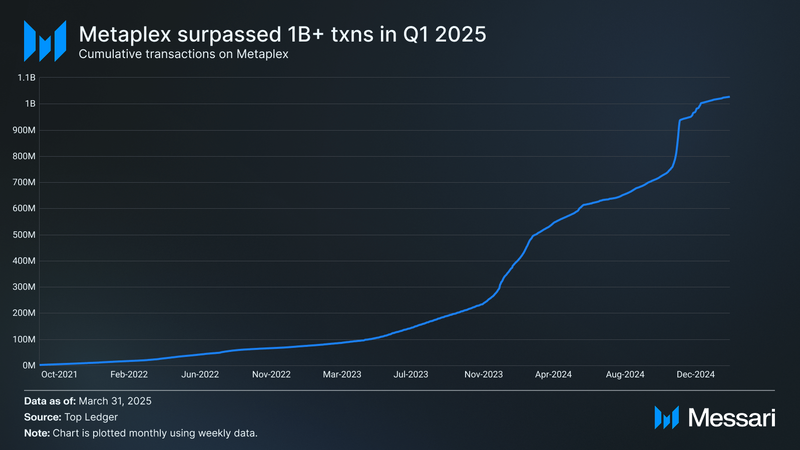

- In Q1, Metaplex surpassed 1 billion cumulative transactions and recorded a peak of 82.9k daily unique signers in January.

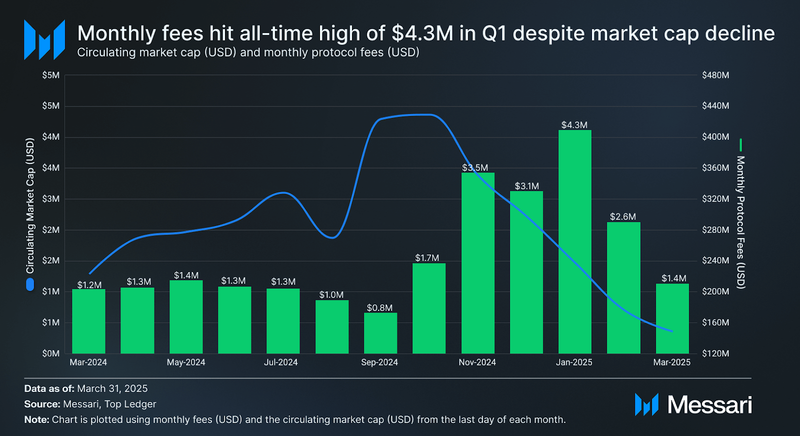

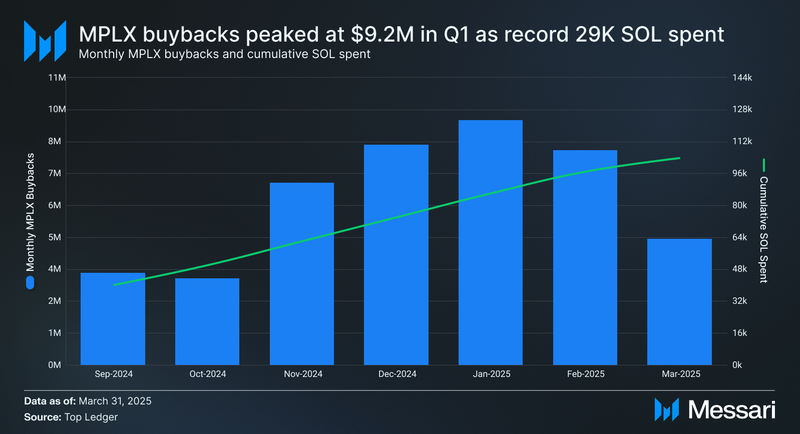

- Metaplex generated $8.3 million in protocol fees in Q1, matching the previous quarter's record despite broader market softness. January set a new monthly all-time high with $4.3 million in fees, while MPLX buybacks totaled 22 million tokens, equivalent to approximately 2.2% of the total supply.

- Metaplex’s Token Metadata (TM) optimization initiative, which reduces the size of TM accounts, led to the resizing of over 3 million NFTs, releasing more than 7,000 SOL back to users and saving 965 MB of onchain storage.

Metaplex (MPLX) is the leading digital asset protocol for Solana and the Solana Virtual Machine (SVM). The Metaplex Protocol is used to create and manage digital assets across a variety of industry verticals, including NFTs, memecoins, RWAs, gaming, DePIN, and more. First launched in June 2021, Metaplex accounts for over 99% of NFT issuance on Solana and more than 90% of fungible token issuance on the network.

Metaplex’s Digital Asset Standard (DAS) is its standardized interoperable framework that establishes the necessary schemas, behaviors, and system architecture for various types of digital assets. Developers implement the DAS onchain via the Metaplex Program Library (MPL), which enables them to create and manage digital assets. Key components of the MPL include Metaplex Core (NFTs), Bubblegum (compressed NFTs), Token Metadata (data attachment for fungible and non-fungible tokens), and Candy Machine and Core Candy Machine (minting and distribution of NFT collections and Core assets). Metaplex’s Developer Platform provides a comprehensive suite of tools, software development kits (SDKs), and reference interfaces for effective use of the DAS and MPL.

The Metaplex protocol is governed by the Metaplex DAO, which is made up of MPLX tokenholders, and administered by the Metaplex Foundation, a non-profit organization dedicated to supporting and growing the Metaplex ecosystem. For a full primer on Metaplex, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Protocol AnalysisFungible and Non-Fungible Asset Creation

Protocol AnalysisFungible and Non-Fungible Asset Creation

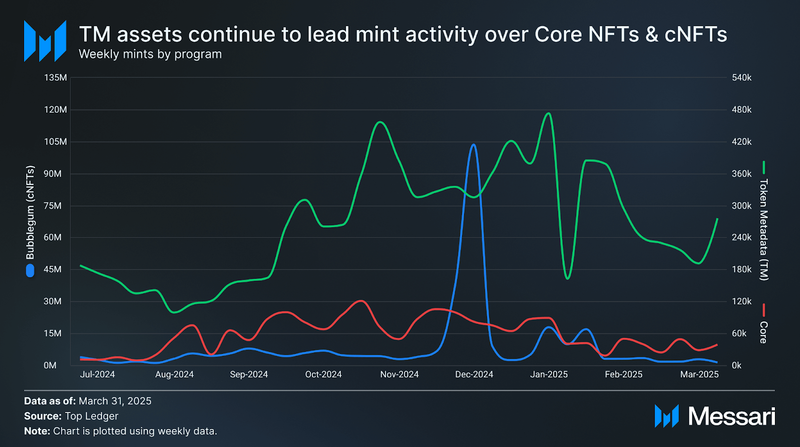

In Q1, mint activity for both Core NFTs and cNFTs declined following record highs in the previous quarter. Daily average Core NFT mints fell 35% QoQ to 7,787, down from a peak of 12,011 in the previous quarter. Similarly, daily average cNFT mints through Bubblegum dropped 75.1% QoQ to 882,290, reflecting a broad cooldown in high-volume issuance (including some spam) after a surge in late 2024. This decline follows an outsized spike in mid-December 2024, during which projects like DRiP contributed to nearly 40 million cNFT mints, volume that drove the ecosystem to new highs before activity normalized.

Daily average mints from the Token Metadata program, including both fungible tokens and NFTs, rose 9.1% QoQ from 43,396 in Q4 2024 to 46,863 in Q1 2025, and increased 55.7% YoY from 34,500 in Q1 2024. The YoY growth was driven primarily by a 419% increase in fungible token issuance.

Each of these programs has been designed to optimize asset creation and management for particular use cases.

- Core: In contrast to legacy NFT standards built on top of such as Solana Program Library (SPL) Token or Token extensions, which rely on multiple accounts, Metaplex Core features a single account design. This architecture significantly reduces minting costs and improves the overall network load on Solana. For instance, minting an NFT with Metaplex Core is estimated to cost 0.0029 SOL, compared to 0.022 SOL using the Token Metadata program. Additionally, Metaplex Core features an advanced plugin library, which is a modular collection of features that either store data or provide additional functionality to the asset. Examples of functionality that can be added are built-in staking or asset-based point systems. The combination of Core’s single account design and the plugin library make it the most advanced NFT standard on Solana to date.

- Bubblegum: By using Merkle Trees and only storing the Merkle root and essential data onchain, Bubblegum significantly reduces the cost of onchain storage for NFTs by using Merkle Trees and only storing the Merkle root and essential data onchain. This strategy enables devs and creators to scale NFT minting while minimizing costs. For instance, minting 1 billion uncompressed NFTs without using Bubblegum would cost ~12 million SOL, making large-scale NFT applications economically unfeasible. In contrast, minting 1 billion cNFTs through direct transactions costs as low as 5,000 SOL.

- Token Metadata: On Solana, Mint Accounts are responsible for storing a token’s global information, while token accounts store the relationship between a wallet and a Mint Account. The Token Metadata program uses Program Derived Addresses (PDAs) derived from the addresses of Mint Accounts to attach additional data to fungible and non-fungible tokens.

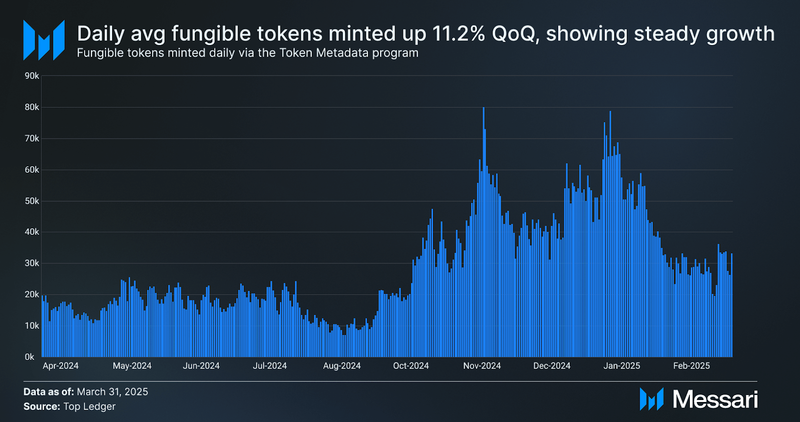

Daily average fungible tokens minted via the Token Metadata program increased 11.2% QoQ from 39,219 to 43,619. The continued growth reflects strong and sustained demand for fungible token issuance on Solana. Token launchpads like Pump.fun, Moonit, Boop.fun Meteora’s Mint, and Raydium’s Launch Lab, as well as AI agent toolkits like Griffain and SendAI use the Token Metadata program to create fungible tokens.

While daily mint activity declined from its January peak, it remained elevated through February and March relative to mid-2024 levels. This trend suggests that issuance demand has normalized at a higher baseline, indicating a broader and more consistent use of the standard. The sustained throughput beyond early-quarter spikes points to adoption that extends beyond isolated campaigns or launch events.

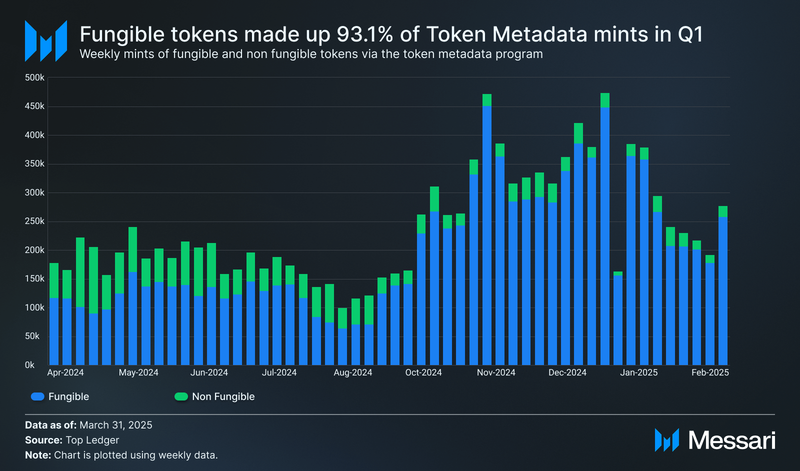

In Q1, fungible tokens accounted for 93.1% of all mints using the Token Metadata program, up from 90.4% in the prior quarter. This continues a trend that began in March 2024, when fungible tokens overtook NFTs as the dominant use case for Token Metadata. The share of fungible token mints peaked above 95% during several weeks in January before stabilizing around 93% by quarter’s end. The consistent dominance of fungible token creation is driven by the proliferation of tokens on Solana and their ability to serve as a more efficient vehicle for capital formation. Meanwhile, non-fungible token usage via Token Metadata continued to decline, with daily average NFT mints falling 22% QoQ to 3,244.

Fungible token creation via the Token Metadata program continued to outpace Ethereum and its Layer 2s in Q1 2025, with Metaplex facilitating 2.6x more mints, totaling 3.93 million compared to 1.50 million on Ethereum + L2s. Despite a late-quarter uptick in ETH +L2 based issuance, Metaplex maintained a clear lead throughout the period. This sustained advantage underscores Solana’s role as a hub for low-cost, high-throughput asset creation, with Metaplex serving as the primary standard for launching fungible tokens across the network.

Onchain Activities

In Q1 2025, Metaplex surpassed 1.026 billion cumulative transactions, adding more than 88 million new transactions during the quarter. This follows a year of rapid expansion in 2024, where transaction counts tripled to over 705 million. While Q1 did not match the historic highs of December 2024, when daily transactions peaked above 23 million due to high cNFT mint volume, the network maintained elevated activity levels, consistently adding 700,000 to over 1 million transactions per day. Growth was supported by continued usage of Token Metadata for fungible token creation and steady Core NFT activity. By the end of Q1, Metaplex had averaged approximately 980,000 daily transactions for the quarter, reflecting a more normalized but sustained level of protocol engagement.

In Q1 2025, Metaplex recorded a peak in daily unique signers, reaching 82.9k on January 30. This surge aligned with a short-lived uptick in cNFT mints early in the quarter. While signer counts declined through February and March, daily averages still reached over 23,000, up 91.7% year-over-year, indicating sustained engagement across Metaplex programs.

Analyzing user activity at a quarterly level, Q1 2025 saw a cumulative total of approximately 2.8 million daily unique signers, up 160% from 1.1 million in Q1 2024. This increase reflects not just short-term spikes but sustained growth in user participation across the quarter, indicating a stronger and more engaged base of activities interacting within the Metaplex ecosystem.

Financial

In Q1, MPLX’s circulating market cap declined 38% QoQ to $148.5 million, down from $241.1 million Q4 2024. Despite the market cap contraction, protocol activity remained resilient. Metaplex generated $8.3 million in protocol fees during the quarter, down 1.8% from the previous quarter, while daily average revenue increased slightly by 0.3% QoQ to approximately $91,666. YoY, total fees rose 129.2% from $3.6 million in Q1 2024, reflecting continued expansion in network usage.

January contributed the majority of Q1 revenue, setting a new monthly all-time high of $4.3 million in protocol fees. This resilience in fee generation reflects continued demand for fungible token creation via Token Metadata, even as NFT minting volumes declined from Q4 peaks.

All Metaplex protocol fees on Solana are paid in SOL and are listed below. Notably, fees on other networks are priced equivalently but charged in the native currency of each network (e.g., ETH on Eclipse, SOL on Sonic, etc.).

- Core: Create (0.0015 SOL), Execute (0.00004872 SOL)

- Token Metadata: Create (0.01 SOL)

- Bubblegum: Create (Free)

- MPL Hybrid: Swap (0.005 SOL)

- Fusion (Trifle): Swap (0.005), Combine (0.002), Split (0.002 SOL), Edit constraint (0.01 SOL)

Half of all fees generated on Solana are used to purchase MPLX which is subsequently contributed to the Metaplex DAO treasury. This is in stark contrast to many other protocols, which have to pay a large portion of fees to third parties such as liquidity providers, lenders, or validators and thus cannot afford to allocate such a high ratio to token buyback.

In Q1 2025, Metaplex spent approximately 29,684 SOL on MPLX buybacks, down from 34,000 SOL in Q4 2024. Despite the lower SOL outlay, January marked the largest monthly buyback to date, with 9.2 million MPLX repurchased using 12,000 SOL. February followed with 8.1 million MPLX purchased on 10,859 SOL, and March activity declined to 4.7 million MPLX on 6,825 SOL. In total, Q1 buybacks amounted to 22 million MPLX, or ~2.2% of the total token supply, bringing the cumulative amount repurchased to ~74.5 million MPLX, or 7.45% of supply.

Outside of buybacks, the MPLX token has a number of functions within the Metaplex protocol:

- Governance: MPLX tokens confer voting rights to holders, enabling them to participate in decision-making processes concerning protocol development, allocation of treasury funds, and protocol ownership. To facilitate governance, the Metaplex DAO has two types of governance proposals: Metaplex Improvement Proposals (MIPs) for proposing protocol changes and MPLX Grant Proposals for MPLX token grants.

- Earn: As approved by the Metaplex DAO, MPLX is used to reward community members who provide onchain liquidity for MPLX.

Since September 19, 2024, the entire MPLX supply of 1.00 billion tokens has been fully unlocked. Of that, 160 million (16%) was allocated to the Metaplex DAO for protocol changes, ecosystem grants, and strategic initiatives. The remaining allocations of MPLX were to various key parties including “Creators & Early Supporters” (21.90%), “Metaplex Foundation” (20.31%), “Strategic Round” (10.20%), founding development partners “Everstake” (10.00%) and “Metaplex Studios” (9.75%), “Community Airdrop” (5.40%), “Founding Advisors” (3.34%), and “Founding Partners” (3.10%).

Qualitative AnalysisToken Metadata Resizing Optimization and Adoption ProgressIn October 2024, Metaplex released its Token Metadata (TM) optimization initiative, reducing the size of TM accounts, and thereby making Solana more efficient and cost-effective for its users. In November 2024, Metaplex handed off upgrade authority for the TM program to three security firms performing audits over the next six months.

As of Q1 2025, over 3 million NFTs have been resized, releasing more than 7,000 SOL back to users and saving 965 MB of onchain storage. These outcomes reflect growing adoption of the new standard and measurable improvements in network efficiency.

Earn CampaignsIn December, the Metaplex DAO approved Metaplex Earn Season 1, an eight-week program that allocates 1 million MPLX (~0.10% of the total token supply) to reward liquidity providers providing MPLX liquidity across DEXs on Solana. The program began in January and will return any unused MPLX to the DAO treasury at completion. Launched in January, the program drove a nearly 4x increase in MPLX’s onchain liquidity, with the DEX liquidity-to-market-cap ratio rising from 1% to 3.42%. TVL peaked near $8 million, led by the MPLX-JitoSOL pool on Orca which reached ~$4 million and became the leading liquidity source for MPLX. Retail LPs collectively earned over $47,000 in fees in addition to token reward.

Building on this momentum, the DAO approved Season 2 on March 28, allocating 2 million MPLX over three months starting in April. The campaign introduces dynamic reward mechanisms aimed at sustaining deep liquidity, supporting DeFi integrations, and encouraging a gradual shift toward organic market depth.

Partnerships and GrantsMetaplex has made significant strides enhancing its utility through numerous other upgrades and strategic integrations:

- One Mug Coffee grant (Feb. 10) - The Metaplex DAO awarded a grant to One Mug Coffee to support its integration with Metaplex Core.

- Solana Global Creator Competition (Feb. 14) – Metaplex sponsored a track in the $115K Solana Creator Competition, supporting onchain content and design.

- Solana Contentathon (Mar. 17) – Metaplex sponsored a track in Solana Collective’s Contentathon, offering 52k MPLX in prizes for educational content.

- Momentum Accelerator Partnership (Mar. 18) – Metaplex partnered with Drift Protocol to launch Momentum, a five-week accelerator supporting 5–7 post-product, pre-Series A DeFi projects on Solana.

- Pump.Swap Launch (Mar. 20) – Pump.fun launched PumpSwap, a new AMM with instant migrations, enhanced liquidity, and creator revenue sharing. Metaplex supported the launch as a strategic partner, extending its earlier integration for memecoin creation via Metaplex Token Metadata.

- weRate Grant Award (Mar. 20) – The Metaplex DAO awarded a grant to weRate to support its integration of Metaplex Core for a blockchain-based review platform.

- Binance Wallet added support for MPLX (Mar. 26) – Binance Wallet added support for MPLX and launched an exclusive trading competition.

Some of the most notable companies (by category) to integrate Metaplex since Q1 2025 include:

- AI - aiPool (uses Core Execute to power AI-run token launches), Virtuals(uses Metaplex infrastructure for digital asset creation and ownership)

- NFT Launch and Trade - Dripster (Dripster leveraged Core, Candy Machine, and Token Metadata programs to mint NFTs and fungible tokens that represent physical good), OWLS (minted using Metaplex Core), Portals (minted using Metaplex Core)

- Gaming - Rubians (Added support for Core assets), Dungeon.Cash (uses Metaplex cNFTs to track AI prompts), DeFi Dungeons (uses Metaplex Core assets for its idle-MMORPG)

- RWAs - Remora Markets (Brought tokenized securities to Solana using Metaplex’s TM standard)

- Token Launches- Donald Trump (the President of the United States launched $Trump using Metaplex Token Metadata)

- (Feb. 10) Ian de Borja (formerly Yuga Labs) joined Metaplex as Head of Communications.

- (Jan. 28) Nicholas Strange (formerly Crypto Talent) joined Metaplex as Business Development and Partnerships Manager.

- (Feb. 5) The Metaplex Evangelist Campaign concluded after five weeks, distributing 95,000 $MPLX to top community posts. The campaign generated 1.33M impressions across topics related to Metaplex’s product suites.

In Q1, Metaplex sustained high levels of protocol usage amid a normalization in asset creation following record highs in late 2024. Daily average fungible token mints via the Token Metadata program rose 11.2% QoQ to 43,619, while Core and cNFT daily mints stabilized at 7,787 and 882,290, respectively, remaining well above early 2024 levels. Protocol activity remained resilient, with $8.3 million in fees generated, flat QoQ, and 29,684 SOL used to repurchase 22 million MPLX tokens, equivalent to 2.2% of total supply.

At the infrastructure level, Metaplex advanced its Token Metadata optimization, resizing over 3 million NFTs, releasing more than 7,000 SOL back to users, and saving 965 MB of onchain storage. Meanwhile, cumulative transactions surpassed 1.026 billion, and Q1 recorded a 160% year-over-year increase in signer participation, totaling approximately 2.8 million daily unique signer instances. Looking ahead, Metaplex remains well positioned to build on these foundations as the primary digital asset protocol for Solana and the SVM, supporting scalable and diverse asset creation across emerging use cases.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.