and the distribution of digital products.

State of Manta Q2 2024

- Manta Network introduced several yield-boosting programs, including Renew Paradigm, Restaking Paradigm, and CeDeFi.

- Manta Network launched the $50 million EcoFund, the Moon Mission Meme Grants, and the introduction of Manta AI. These initiatives aim to support innovative blockchain projects, foster meme culture, and provide comprehensive AI tools.

- Manta Network formed strategic partnerships with prominent entities such as BlackRock’s BUIDL Fund. These collaborations strengthen the backing of the new stablecoin wUSDM on the network.

Manta Network (MANTA) is an ecosystem of networks offering scalable execution environments for ZK applications. It consists of two distinct networks: Manta Pacific, a modular L2 for Ethereum, and Manta Atlantic, a ZK-based L1 chain on Polkadot. Both networks offer ZK tooling to simplify ZK application deployment: Universal Circuits, zkSBTs, and Manta NPO on each network.

With the introduction of the New Paradigm bridge in December 2023, the L2 implemented native yield generation for ETH and supported stablecoins. Manta Network has raised over $60 million from a pre-seed, seed, community, and Series A round. The Series A round was held at a $500 million valuation. Notable investors across these rounds include Polychain Capital, Qiming Ventures, CoinFund, ParaFi Capital, Hypersphere Ventures, DeFiance Capital, and Multicoin Capital. Although the amount raised was undisclosed, Manta Network has also received a strategic investment from Binance Labs. For a full primer on Manta Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

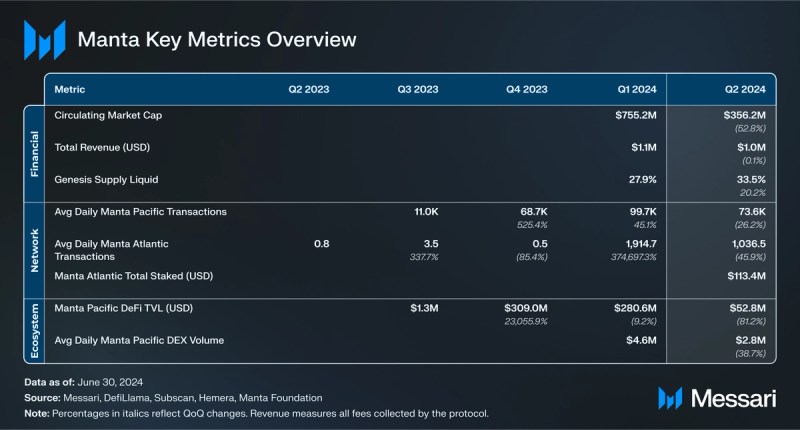

Key Metrics Financial Analysis

Financial Analysis

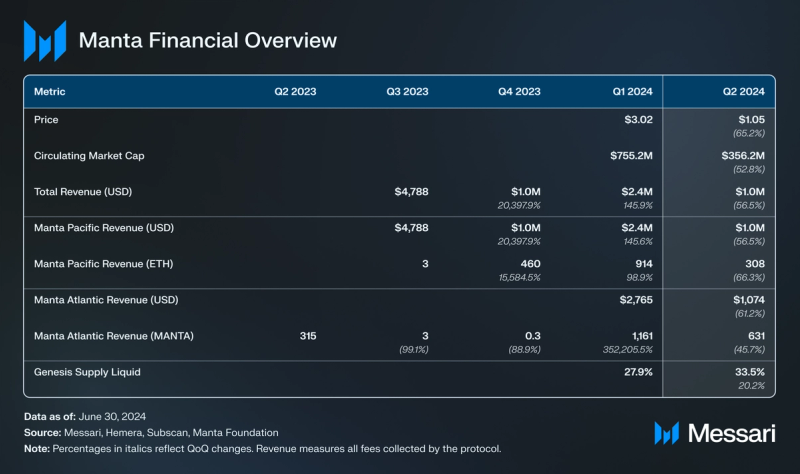

During Q2’24, Manta’s market cap fell by 52.8% from $755.2 million to $356.2 million. As of the end of the quarter, the total market cap ranks at 157. Due to the increase in liquid supply by 20.2% during this quarter, MANTA’s price fell by 65.2% to $1.05.

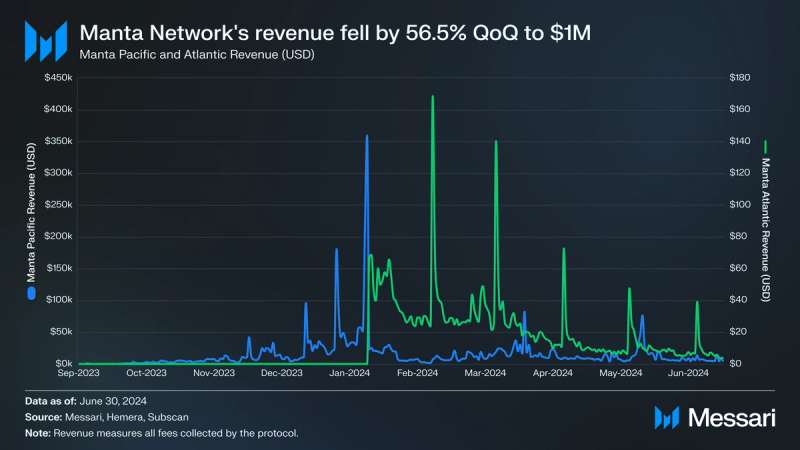

Manta Network’s revenue, i.e., all fees collected by the protocol, fell by 56.5% to $1.0 million. This can be broken down into a 56.5% decrease for Manta Pacific and a 61.2% decrease for Manta Atlantic QoQ. Since its launch, the majority of Manta Network’s revenue has been dominated by Manta Pacific. The first spike for Manta Pacific corresponds to MANTA’s TGE on January 18. Each following spike for Manta Atlantic’s revenue lines up with monthly token unlocks.

The network’s transaction fees are distributed as follows:

- 10% goes to block producers.

- 18% accrues to Manta Network's community treasury to bootstrap network development.

- 72% is reserved as incentives to be distributed to projects within the Manta ecosystem.

Beyond being used for staking and paying transaction fees, MANTA is used for governance. Manta Network's governance will evolve through two phases. In the first phase (Manta Governance 1.0), Manta Network established a community forum for stakeholders to propose and discuss project-related matters. However, the ultimate decision-making and execution of proposals rest with the Manta Foundation.

Subsequently, in the second phase (Manta Governance 2.0), the network will transition to a "Five Council" governance model:

- Legislative Council: This council, composed of MANTA tokenholders, makes decisions regarding the network's direction, vision, tokenomics, and intended use.

- Executive Council: Managed by the Manta Foundation, the Executive Council translates decisions made by the Legislative Council into actionable steps. It oversees network operations, educational initiatives, and research and development projects.

- Judicial Council: Responsible for overseeing grant distribution and implementing governance tools, the Judicial Council ensures that network resources are allocated fairly and democratically.

- Examination Council: This council manages the election process for Manta Foundation members, ensuring that the selection process is democratic and those in positions of authority are held accountable.

- Control Council: Serving as the audit branch, the Control Council oversees the entire governance process, guaranteeing transparency, fairness, and the integrity of the network.

As of the end of the quarter, the project team has yet to disclose when Manta Governance 2.0 will begin. Their development roadmap, along with important events, can be found here.

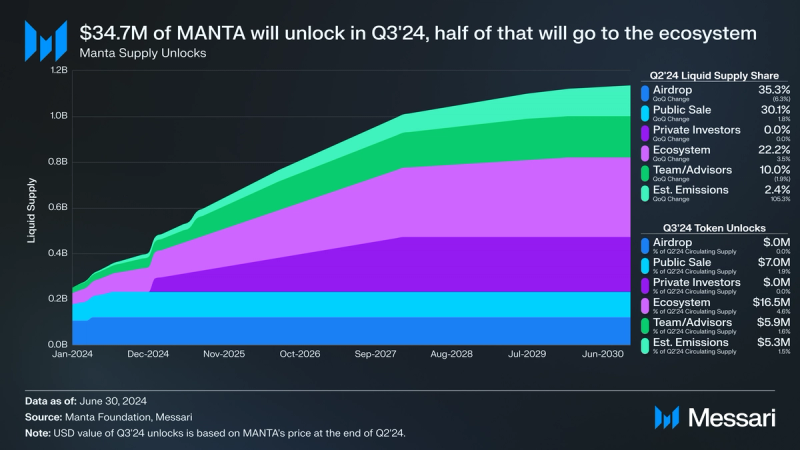

After launching in January, 33.5% of MANTA’s genesis supply was liquid by the end of Q2, a 20.2% QoQ increase. The genesis supply includes the 1 billion MANTA initially allocated but not staking rewards. MANTA allocates 2% of total issuance annually for staking rewards.

Another 3.3% of MANTA’s genesis supply is set to unlock in Q3’24:

- Ecosystem (56.2% of Q3 unlocks): Based on MANTA’s price at the end of Q2, $16.5 million will unlock to the ecosystem and treasury bucket in Q3. Of this, 64.3% will be allocated to the Community via grants, boosted yield, and ambassador programs. Also, 35.7% of this will allocated to the protocol’s treasury held by the Manta Foundation.

- Public Sale (23.8% of Q3 unlocks): Based on MANTA’s price at the end of Q2, $7.0 million will unlock to the public sale bucket. Public sale tokens will finish vesting on July 18.

- Advisors (20.0% of Q3 unlocks): Based on MANTA’s price at the end of Q2, $5.9 million will unlock to the advisors’ bucket. The team has an 18-month cliff and will not receive tokens until July 18, 2025.

Usage

Usage

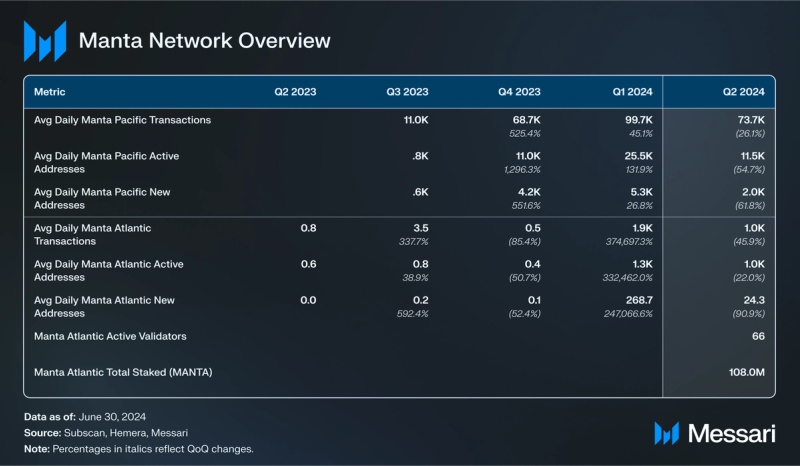

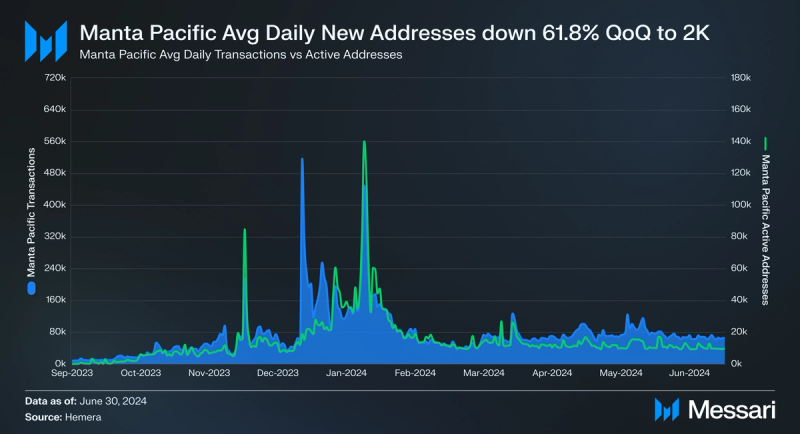

Network activity, measured by transactions and active addresses, decreased in Q2. Average daily transactions and addresses for Manta Pacific decreased QoQ by 26.1% to 73,700 and 54.7% to 11,500, respectively. Over the quarter, the average daily number of new addresses decreased by 61.8% to 2,000. In terms of dApp activity, the over 2.3 million dApp transactions on Manta Pacific over the past three months came from:

- DeFi – 1.3 million (58.6%) transactions from DeFi dApps like the ApertureSwap DEX, the PacificSwap AMM, LayerBank money market protocol, and the QuickSwap DEX.

- Bridges – 540,000 (24.3%) transactions from Bridges like Orbiter, dappOS, Rhinofi, and Owlto. As of writing, Manta Pacific has seen over $1.2 billion in total value bridged, and the L2’s official bridge has seen over 44,000 unique addresses.

- GameFi – 118,000 (5.3%) transactions from GameFi dApps like the Element NFT marketplace, the zkHoldem game, and the Gabby World virtual world.

- Social – 260,000 (11.7%) transactions from social dApps like the DMail Network notification service and the POMP onchain asset verifier.

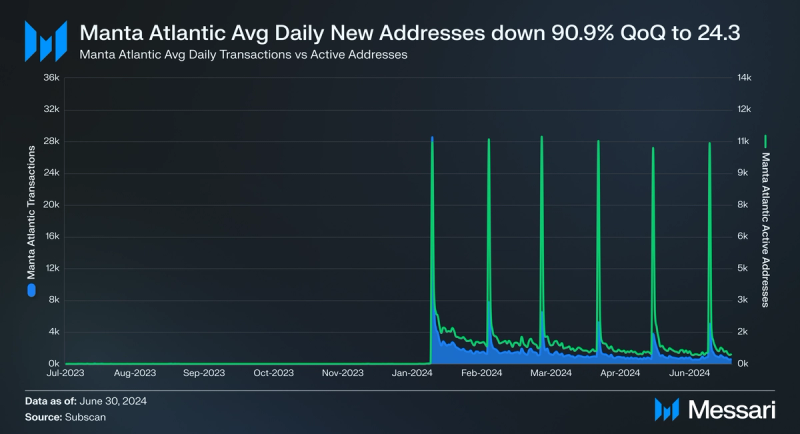

For Manta Atlantic, average daily transactions decreased QoQ by 45.9% to 1,000, while daily active addresses decreased by 22% to 1,000. The average daily number of new addresses also decreased by 90.9% to 24.3. Each spike on the Manta Atlantic chart corresponds to a token unlock via airdrop, public sale, ecosystem, or team/advisors.

SecurityBy the end of the previous quarter, Manta Atlantic had 66 validators and 108 million Manta staked. The Manta Atlantic parachain is connected to Moonbeam, Bifrost, AssetHub Polkadot, Acala, and the relay chain.

MANTA’s annual 2% inflation entirely accrues to Manta Atlantic block producers. Only the top 66 registered Collators by total stake can participate as block producers. To qualify as Collators, users must post a minimum of 400,000 MANTA as bonds and meet the network's hardware requirements.

Ecosystem Overview DeFiManta Pacific

DeFiManta Pacific

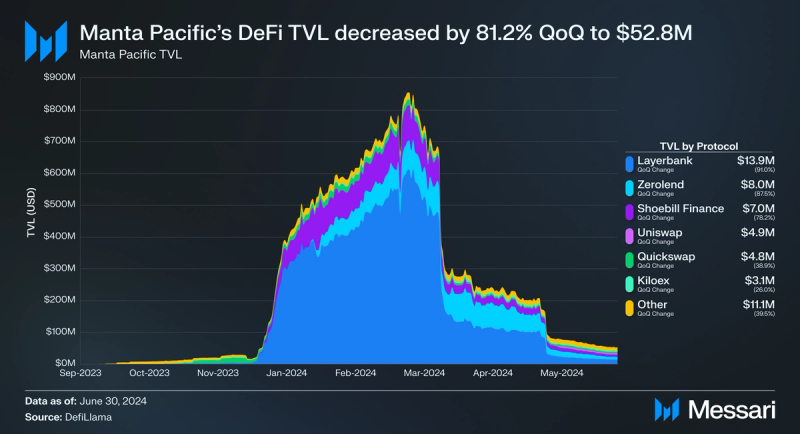

Manta Pacific’s DeFi TVL decreased by 81.2% QoQ to $52.8 million. After reaching $854.4 million on March 10, its TVL dropped by 93.8% by the end of Q2. The significant dropoff happened in late March when TVL went from $710.9 million on March 21 to $352.0 million on March 28, a week later. Some of the decrease can be explained by the ending of reward programs near the end of March and early April.

It is important to note that this TVL figure only includes assets on Manta Pacific’s network and excludes Manta CeDeFi. When accounting for bridged TVL and CeDeFi, the total TVL for Manta Pacific was $627.9 million at the end of Q2, a 55.2% decrease QoQ from $1.4 billion.

Manta’s Renew Paradigm ran from March 12 to April 11. By depositing MANTA token rewards, airdrop rewards, accumulated STONE points, and Eigenlayer points into Manta’s staking product, users could unlock boosted rewards for a MANTA airdrop. On April 24, Manta Network took a snapshot of all addresses that burnt eligible NFTs earned during the Renew Paradigm to boost potential MANTA rewards.

On March 16, Manta Network also announced their Restaking Paradigm, which allows users to use LRTs to generate more yield on Manta Pacific by depositing ETH or stETH into Manta’s pools. The first project announced was Ether.fi, where users could earn 2x Ether.fi points from launch till the end of May. Currently, there are four pools for the Restaking Paradigm:

- Ether.fi: This pool has $980,000 in TVL and grants users 1x ether.fi points and 1x EigenLayer points.

- Puffer: This pool has $1.26 million in TVL and grants users 5x Puffer points and 1x EigenLayer points.

- Kelp DAO: This pool has $89,000 in TVL and grants users 2x Kelp Miles and 1x EigenLayer points.

- Bedrock: This pool has $103,000 in TVL and grants users 4x Bedrock Diamonds and 1x EigenLayer points.

Manta Network has announced two other programs to boost yield opportunities for users within the New Paradigm program:

- Merlin Seal: Users can earn M-points by bridging from Merlin (Bitcoin L2) to Manta Pacific or vice-versa.

- zkLink Aggregation Parade: Manta joined the campaign with zkLink and Zerolend by allowing users to deposit assets from Manta Pacific to zkLink.

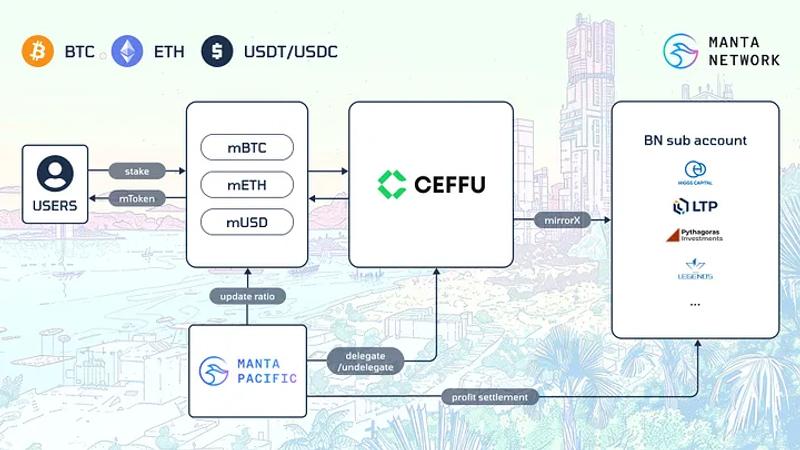

On May 19, Manta Network announced CeDeFi, another yield-boosting reward program. Manta CeDeFi allows users to deposit supported tokens into Manta Pacific’s contract, which will be secured by Ceffu (formerly Binance Custody). Users will then receive a Liquid Custody Token (LCT). The tokens accrue value from Ceffu staking the tokens on behalf of the users and can be used across the Manta Network. LCTs will be onchain and held by Ceffu. By way of Binance’s Mirror, users gain access to Binance’s institutional-grade custodial yield offered by Ethena, Liquidit Fintech Investment, Higos Capital, Pythagoras Investments, and Legend. Since this strategy is a custodial program, Manta Pacific has disclosed the address that custodies the assets.

At the end of Q2, the CeDeFi program had $113.2 million TVL while offering the following APRs:

- BTC: 3.0% APR with $33.7 million TVL

- ETH: 1.2% APR with $70.2 million TVL

- USDT/USDC/wUSDM: 7.0% APR with $9.3 million TVL

During June, Manta Network offered a 1.5x point boost program to CeDeFi deposits.

Liquid Staking

On May 21, Bitfrost launched vMANTA through its omni.ls product, which is currently the largest LST on Manta Pacific. As of quarter end, the product has 4 million MANTA staked and offers 22.8% APY. This yield is comparable to natively staking MANTA on Manta Atlantic, where yield ranges from 9% to 29%.

The other LST on Manta Network is stMANTA, offered by Accumulated Finance. Even though their product went live shortly after TGE on January 31, it only has 492,000 staked, offering a 29.7% APY.

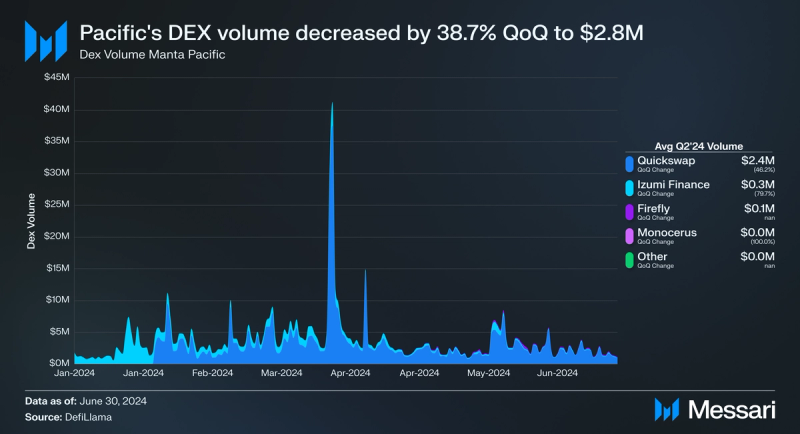

Manta Pacific’s average daily DEX volume decreased by 38.7% QoQ to $2.8 million. Of the Q2 volumes, Quickswap held 85.9% of the market even though its volumes decreased by 46.2% to $2.4 million. The second largest DEX was Izumi Finance, with a 10.3% market share and a volume of $289,000, which decreased by 79.7% QoQ.

Even though the DEX market has begun to monopolize, Manta Pacific’s DeFi Diversity increased by 125.0% QoQ to 9 due to the rise in lending protocols joining the network. DeFi Diversity is the number of dApps comprising 90% of a network’s total DeFi TVL.

Manta Pacific’s stablecoin market cap increased by 14.1% QoQ to $14.7 million, ranking it 40th among all networks. The growth was exclusively driven by USDT, whose Manta Pacific’s market cap grew by 58.1% QoQ to $9.3 million. USDT’s market share on Manta Pacific grew 38.6% QoQ to 63.7%, becoming the largest stablecoin on the network. USDC’s market share fell 32.3% QoQ to 35.8%.

On June 27, Manta Network announced the support of wUSDM, a wrapped version of USDM deployed by Mountain Protocol. The upgrade allows users to get access to an onchain yield-bearing stablecoin on Manta Pacific. USDM is backed by BlackRock’s BUIDL Fund. The BUIDL Fund, BlackRock’s first tokenized fund, invests in cash, U.S. Treasury bills, and repurchase agreements.

Manta AtlanticDuring Q2’24, Manta Atlantic’s DeFi TVL decreased 54.5% from $542,000 to $247,000. Most of this TVL has moved to another network, with 34.0% of transactions occurring around the monthly token unlocks. Manta Atlantic’s DeFi Diversity stayed at 1 this quarter, with MantaDEX containing all of the TVL.

Ecosystem GrowthOn April 9, Manta Network announced the first cohort for its ZK Accelerator program, which is in partnership with Celestia and Polygon. The program allows teams to access mentors and potential funding opportunities through grants, investments, and partnerships.

Applications are reviewed on a rolling basis, and teams can apply here.

The first nine projects to be listed are:

- Filemarket (DePIN): P2P platform to sell anything digital that can be a file - graphics, photos, videos, 3D models, music, sounds, documents, promo codes, and archives

- Firefly Dex (DeFi): DEX on Manta Pacific

- Gull Network (Infra): DEX that also allows no-code token launcher, liquidity setup, and managing rewards of pools

- Magpie Protocol (DeFi): Cross-chain DEX with 12 chains connected at the end of Q2

- Nimble Technology (AI): Infrastructure that can power GPU and AI task scheduling, as well as monetizing AI agents

- Reclaim Protocol (zk): Creates ZK proofs of users’ identity and reputation on any website

- Rivalz (AI): AI-driven Data Provenance DePIN RollApp on Dymension

- Vooi Trade (DeFi): Intent-based perp DEX aggregator

- Wallchain (Infra): Yield-bearing Wallet Infrastructure

Other ecosystem development announcements include:

- Manta Network joined Cyberport, a Hong Kong entrepreneurship incubator. This move aims to enhance Manta Network's presence in the Asian Web3 ecosystem. Manta Network will leverage Cyberport's resources to develop real-world applications in finance, education, and other sectors, bridging the gap between Web2 and Web3 technologies.

- Manta Network introduced Manta AI, a comprehensive suite of AI tools for the Manta Pacific platform. Manta AI was developed in collaboration with Celestia, ORA, and Hyperbolic. This suite encompasses the entire AI development lifecycle, including training, deployment, and inference. Key features include decentralized GPU access for efficient model training, advanced AGI models like Stable Diffusion and Llama integration, and streamlined AI toolkit integration through Manta’s Universal Circuits. This initiative aims to democratize access to AI tools, providing cost-effective and scalable solutions for developers to build and deploy AI-driven applications on Manta Pacific. The collaboration also leverages Celestia’s modular data availability.

- The Manta Foundation launched a $50 million EcoFund to support and accelerate the growth of the Manta Network ecosystem. This fund aims to provide financial support and resources for innovative blockchain projects, focusing on DeFi, gaming, and non-fungible tokens (NFTs). The EcoFund will offer grants of up to $50,000 for early-stage projects and significant investments for high-growth ventures. O June 15, applications were opened for one year. The fund is structured to allocate $35 million for direct investments, $10 million for ecosystem grants, and some additional funds for hackathons and AI/DePIN initiatives.

- Manta Network has announced the launch of its Moon Mission Meme Grants, dedicating $10 million to supporting and fostering meme culture within its platform. This initiative is part of the larger $50 million EcoFund. The program offers financial support and resources to help developers bring their meme projects to life on the Manta Network. Applications are currently open, with no projects backed so far.

During Q2 2024, Manta Network’s market cap fell by 52.8% from $755.2 million to $356.2 million. Much of the decrease was driven by token unlocks that saw 5.6% of Genesis supply hit the market. Manta Pacific’s DeFi TVL also decreased by 81.2% to $52.8 million, reflecting the end of several reward programs. Aiming to reverse these trends, Manta Network launched the $50 million EcoFund and the Moon Mission Meme Grants to support blockchain projects and foster meme culture within the platform.

Manta Network introduced several yield-boosting programs. Notably, the Restaking Paradigm program allows users to generate more yield by depositing ETH or stETH into Manta’s pools. Additionally, the network announced the support of wUSDM, a wrapped version of USDM backed by BlackRock’s BUIDL Fund.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.