and the distribution of digital products.

State Of Manta Q1 2025

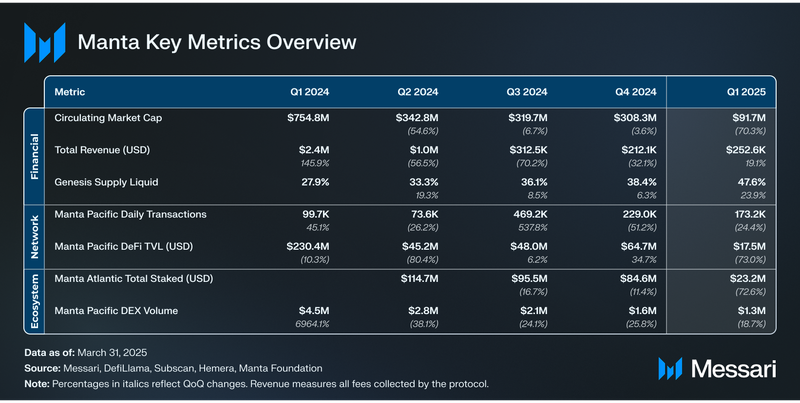

- Manta increased protocol revenue 19.1% QoQ to $252,600. Manta reversed a three-quarter decline, even as broader market conditions and user activity trended downward.

- Manta Pacific integrated Symbiotic and Babylon to establish a dual-layer fast finality system. These integrations combine MANTA restaking and BTC staking to reduce withdrawal times using the Manta Pacific native bridge and to enhance network-level cryptoeconomic security.

- Manta announced it will deprecate Manta Atlantic in July 2026. With most activity now on Manta Pacific, the team plans to sunset its Polkadot-based L1 when its parachain lease expires, consolidating development and resources around its modular Ethereum L2.

- Manta launched the Trophy Room, consolidating campaign engagement into a single portal for claiming rewards, tracking progress, and increasing user participation across the ecosystem.

- Manta CeDeFi maintained $117.7 million in TVL across BTC, ETH, and stablecoins. Despite a broader decline in DeFi activity across the network, Manta CeDeFi maintained user participation by continuing to offer competitive yields.

Manta Network (MANTA) is an ecosystem of networks offering scalable execution environments for applications. It consists of two distinct networks: Manta Pacific, a modular EVM-compatible Ethereum L2, and Manta Atlantic, an L1 chain on Polkadot. Since the launch of Manta Pacific, network activity has migrated away from Manta Atlantic, and in Q1 2025, Manta Network officially announced that Manta Atlantic would be deprecated. All ecosystem activity is now consolidated on Manta Pacific, which continues to serve as the primary execution environment.

Since launching in 2023, Manta Pacific has relied on a campaign-driven growth strategy to bootstrap liquidity, onboard users, and incentivize usage across DeFi, GameFi, and infrastructure protocols. These initiatives began with New Paradigm and later included zkLink Aggregation Parade, Restaking Paradigm, Renew Paradigm, Manta Expedition, and Gas Gain. Each campaign was designed to reward user activity such as bridging, staking, and interacting with dApps. In March 2025, Manta introduced the Trophy Room, a centralized portal for users to track and claim rewards across campaigns and engage with the broader ecosystem through a unified interface.

Manta Pacific also continued to expand its modular infrastructure in Q1 2025. The network introduced fast finality through MANTA restaking in collaboration with Symbiotic, reducing withdrawal times and improving settlement speed. Manta also integrated with Babylon to introduce Bitcoin staking as an additional layer of cryptoeconomic security. Manta Network has raised over $60 million across multiple funding rounds, including a Series A at a $500 million valuation. For a full primer on Manta Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis Market Cap

Market Cap

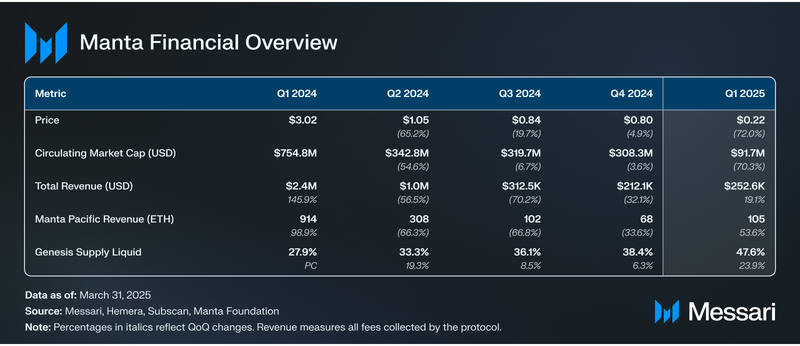

During Q1’25, Manta’s market cap fell 70.3% from $308.3 million to $91.7 million, bringing its rank among all cryptocurrencies down to 326th by quarter’s end. Over the same period, MANTA’s price declined 72.0%, dropping from $0.80 to $0.22. Meanwhile, the circulating supply continued to increase, with liquid supply rising to 47.6% of the genesis supply, a 23.9% QoQ increase.

RevenueManta Network’s total revenue, i.e., all fees collected by the protocol, experienced a 19.1% increase QoQ, rising from $212,100 in Q4’24 to $252,600 in Q1’25, ending a three-quarter streak of revenue decline. The increase came despite a broader slowdown in user activity. While Q1’25 saw a rebound in revenue generation, Manta Pacific’s longer-term fee compression, driven by its integration of Celestia and the prevalence of low-cost GameFi transactions, has continued to shape the network’s revenue profile. Celestia’s modular data availability architecture helps reduce gas fees, enhancing user experience.

Since its inception, Manta Pacific has consistently generated the majority of Manta Network's revenue as network activity and application development have migrated away from Manta Atlantic to Manta Pacific. Manta Atlantic accounted for a negligible portion of Manta Network’s total revenue in Q4’24, but it remained the hub for MANTA staking and emission distribution. However, on Jan. 24, 2025, the Manta team announced the deprecation of Manta Atlantic once its Polkadot parachain slot expires in July 2026. Manta Atlantic will remain operational until then. As of March 31, 2025, only MANTA staking and Bifrost, a liquid staking protocol, are supported on Manta Atlantic. The initial surge in Manta Pacific's revenue coincided with the Token Generation Event (TGE) on Jan. 18, 2024, while subsequent peaks in Manta Atlantic’s earnings aligned with the token unlock schedule.

Toward the end of Q4’23, Manta Pacific began integrating Celestia for data availability to provide higher throughput and cheaper transaction fees on the network. As of this writing, Manta Network estimates a total savings of approximately $19.0 million on transaction fees attributable to this integration.

Manta Network’s transaction fees are allocated as follows:

- 10% is directed to block producers.

- 18% supports Manta Network’s community treasury for development initiatives.

- 72% is reserved as incentives for projects within the Manta ecosystem.

On Sept. 30, 2024, Manta announced the Gas Gain program, the first program to repurpose L2 gas fee profits as gas fee rebates. This program incentivizes onchain activity by rewarding MANTA to users who engage with various dApps on the network. With Gas Gain, 50% of Manta Pacific’s gas fee profits will be converted to MANTA and distributed among the top 400 participants based on a points system. Participants can view their rank on the global leaderboard here. During Q1’25, Manta Network completed the second and third epochs of the Gas Gain program. Gas Gain epoch 4 began on March 30, 2025.

Token Emissions

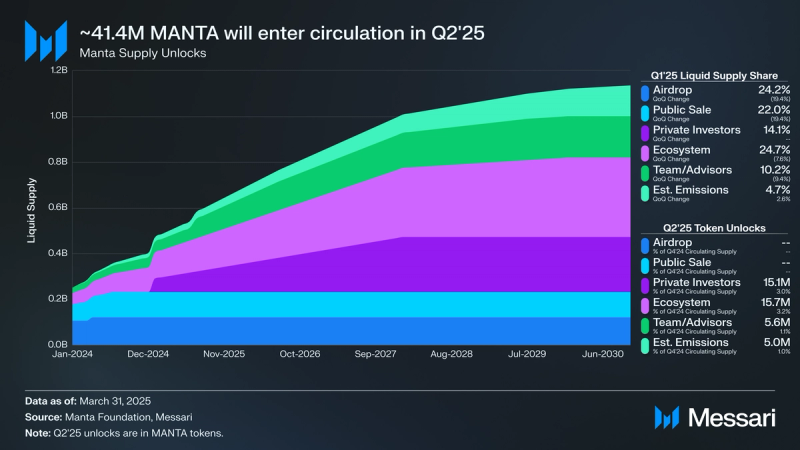

According to Manta’s Vesting schedule, by the end of Q1’25, 47.6% of MANTA's genesis supply was liquid, marking a 23.9% QoQ increase. This liquid supply is part of the 1 billion MANTA initially allocated during the token's launch in January 2024. Looking ahead to Q2’25, an additional 36.4 million MANTA, or 3.6% of Manta’s genesis supply, will unlock.

MANTA has an annual inflation rate of 2%, which accrues entirely to Manta Atlantic block producers. During Q1'25, an additional 5 million MANTA were minted and emitted as block rewards.

The key components of the Q2’25 genesis supply unlocks include:

- Private Investors (41.4% of Q1 unlocks): Approximately 15.1 million MANTA tokens will unlock to private investors.

- Ecosystem/Treasury (43.2% of Q1 unlocks): Approximately 15.7 million MANTA tokens will unlock to the ecosystem, supporting community-driven initiatives like grants, ambassador programs, and boosted yield, along with allocations to the protocol’s treasury held by the Manta Foundation.

- Advisors (15.4% of Q1 unlocks): Approximately 5.6 million MANTA tokens will be unlocked for Manta Network advisors. The team has an 18-month cliff and will begin receiving tokens on July 18, 2025.

Usage

Usage

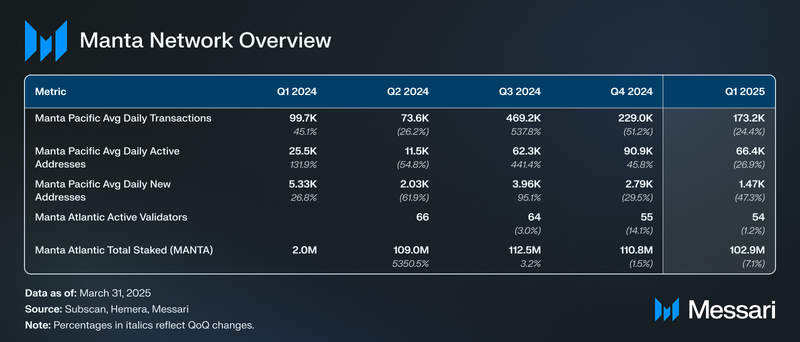

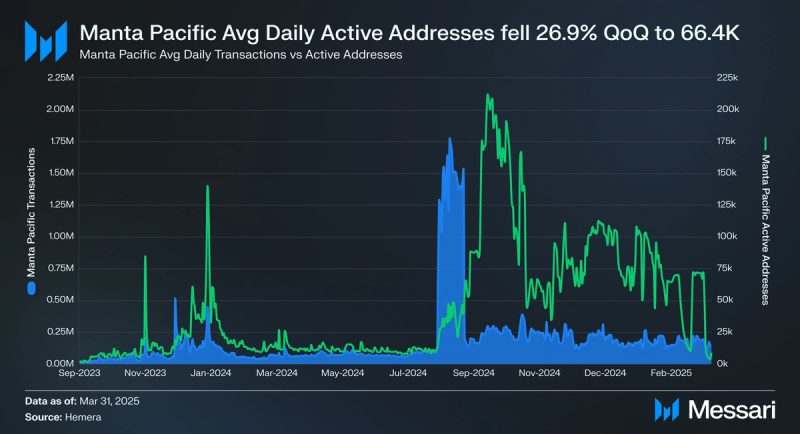

In Q1 2025, Manta Pacific experienced a 26.9% QoQ decrease in average daily active addresses, which fell from 90,900 in Q4’24 to 66,400. Average daily transactions on Manta Pacific also fell 24.4% QoQ from 229,000 in Q3’24 to 173,200 in Q1’25, marking the second consecutive quarter of declining transaction volume on the network.

The creation of a new address on Manta Pacific also slowed in Q1’25. Average daily new addresses fell 47.3% QoQ from 2,792 in Q4’24 to 1,472 in Q1’25.

SecurityAs of the end of Q1’25, Manta Atlantic had 54 collators and 101.0 million MANTA staked. The Manta Atlantic parachain is connected to Moonbeam, Bifrost, AssetHub Polkadot, Acala, and the relay chain.

MANTA’s annual 2% inflation entirely accrues to Manta Atlantic block producers. To qualify as a collator, users must post a minimum of 400,000 MANTA as bonds and meet the network's hardware requirements. Staking operations on Manta Atlantic remain active and unchanged as of March 31, 2025.

Deprecation of Manta AtlanticOn Jan. 24, 2025, Manta announced that Manta Atlantic would be deprecated due to several factors, including the substantial overhead cost to maintain a parachain slot, limited ecosystem growth, and growth opportunities with alternative staking platforms such as Symbiotic and Babylon. Manta Atlantic’s parachain slot is set to expire in July 2026, which means Manta Atlantic and staking operations will remain operational until that time.

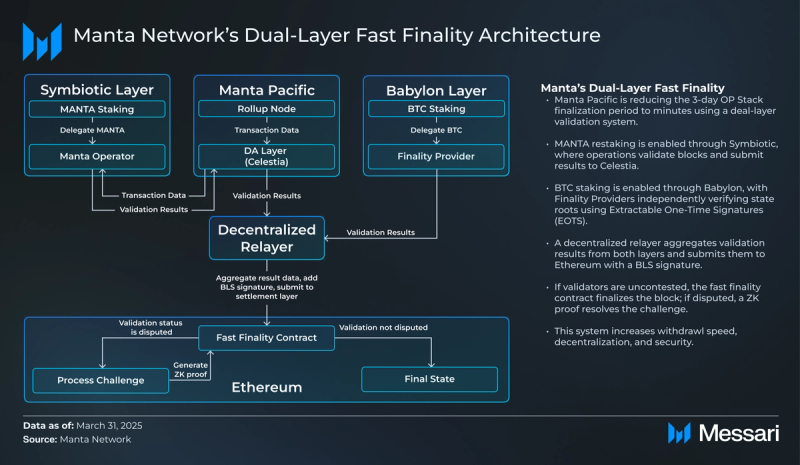

SymbioticIn Q1’25, Manta Pacific advanced the rollout of its fast finality system through an integration with Symbiotic, a shared security protocol for modular networks. This upgrade marks the first deployment of fast finality on an OP Stack Layer 2 (L2) using restaked native tokens. It reduces Manta Pacific’s standard 3-day optimistic rollup finalization period to just minutes, enabling faster cross-chain communication, improved user experience, and greater protocol responsiveness.

The fast finality mechanism allows network operators to stake MANTA through Symbiotic’s permissionless vault system. Operators commit to the finality of specific blocks, and their staked tokens serve as collateral against any fraudulent claims. Once a sufficient threshold of staked weight validates a block, it is treated as finalized without waiting for the full challenge period. These cryptoeconomic guarantees are enforced by a decentralized network of validators who aggregate signatures and verify block finality in real time.

As part of the rollout, MANTA prestaking officially launched in January 2025, allowing token holders to delegate their tokens to Symbiotic operators who commit to block finality. As of the end of Q1’25, the full integration of fast finality on Manta Pacific is still in development.

BabylonIn Q1 2025, Manta Pacific implemented the first phase of its integration with Babylon, a Bitcoin staking protocol designed to enhance L2 security without requiring BTC to be bridged or wrapped. Babylon enables native Bitcoin holders to delegate BTC to a decentralized set of Finality Providers (FPs), who validate state roots from Manta Pacific using a cryptographic technique called Extractable One-Time Signatures (EOTS).

This integration introduces a second layer of cryptoeconomic security to complement MANTA restaking via Symbiotic. While Symbiotic operators secure fast finality through native token commitments, Babylon’s Finality Providers independently attest to block validity using BTC as collateral. Once validated, EOTS signatures are posted to the Babylon network, aggregated, and relayed to Ethereum via a decentralized relayer system. These attestations support early confirmation of Manta Pacific’s L2 state before the expiration of the standard OP Stack challenge period.

The addition of Bitcoin-based validation strengthens decentralization, adds asset diversity to Manta’s security model, and reduces reliance on optimistic assumptions. It also reinforces Manta’s broader vision of modular cryptoeconomic security, where restaking across multiple networks underpins execution-layer guarantees. As of the end of Q1’25, Babylon’s integration is in early-stage development, with further rollout and validator coordination expected in the coming quarters.

Dual-Layer Fast Finality Architecture

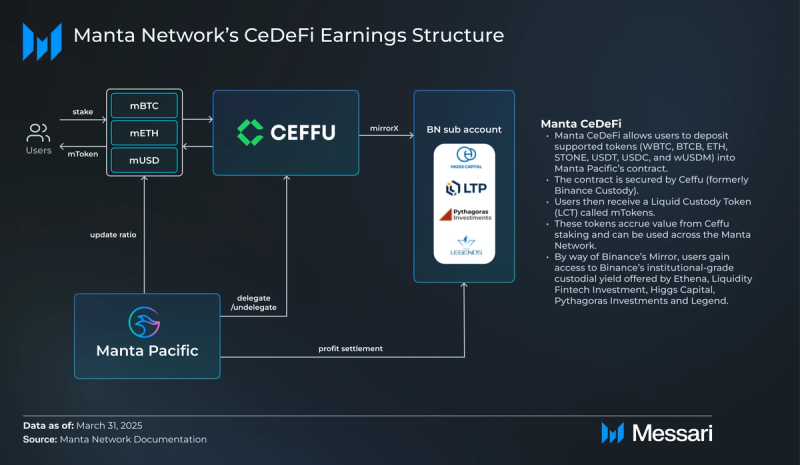

The diagram above illustrates the architecture of Manta Pacific’s dual-layer fast finality system. In this architecture design, MANTA holders restake their tokens through Symbiotic and delegate to operators who validate transaction data stored on Celestia. BTC holders restake through Babylon and delegate to finality providers who independently verify the same state roots. Validation results from both systems are collected by a decentralized relayer, aggregated with BLS signatures, and submitted to Ethereum’s settlement layer through a fast finality contract. If the validation is uncontested, finality is achieved within minutes. In the event of a challenge, a zero-knowledge proof can be generated to resolve the dispute. This framework reduces withdrawal latency, enhances cryptoeconomic security, and enables scalable cross-chain settlement while keeping assets on their native chains.

Ecosystem Overview DeFi

DeFi

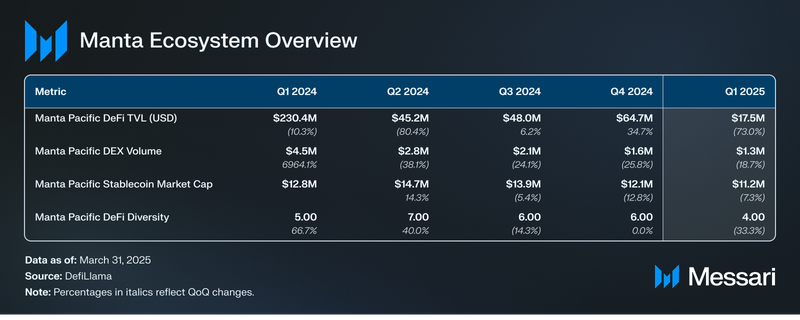

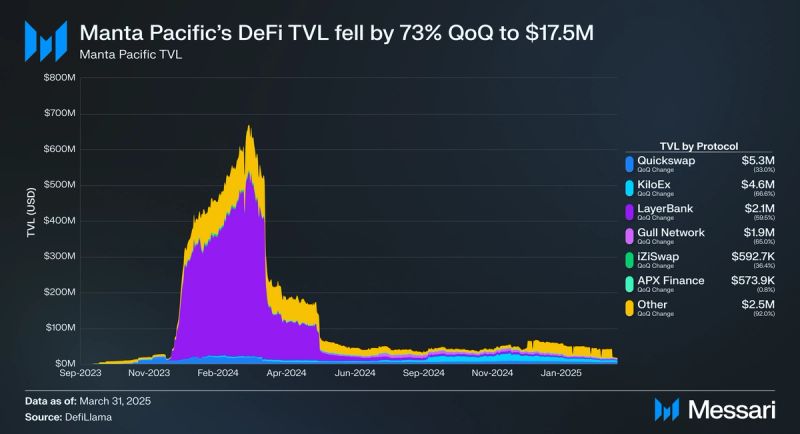

In Q1’25, Manta Pacific’s DeFi total value locked (TVL) declined 73% QoQ, falling from $64.9 million at the end of Q4’24 to $17.5 million. The drop marks the lowest DeFi TVL level on Manta since Q4’23. This decline in DeFi TVL indicates a broad contraction in speculative liquidity and the unwinding of airdrop farming campaigns. Notably, Cytonic, which accounted for $27.2 million in TVL at the end of Q4, retained only $2.9 million by the end of Q1 as users rotated out of the campaign late in Q1’25.

All protocols with over $575,000 of TVL experienced double-digit percentage TVL declines over the quarter. KiloEx, the leading perpetual DEX on Manta Pacific, saw its TVL drop by 66.6% QoQ. LayerBank and Gull Network each fell more than 59%, while Quickswap, Manta’s leading DEX by volume, declined 33%. Of the top 6 protocols by TVL on Manta Pacific, only APX Finance held relatively steady, losing less than 1% of its TVL QoQ.

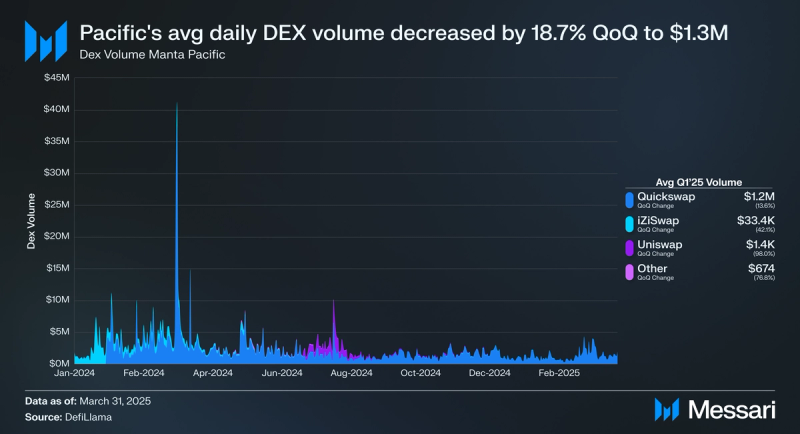

DEX Volume

Average daily DEX volume on Manta Pacific fell to $1.3 million in Q1’25, down 18.7% from $1.6 million in Q4’24. Despite this decline, Quickswap remained dominant, accounting for 97.2% of DEX volume on Manta Pacific in Q1’25. iZiSwap ranked second with $33,372 in average daily volume, representing 2.6% of total volume. Uniswap recorded negligible usage with just $1,431 in average daily volume, capturing less than 0.2% of network activity.

DEX activity on Manta Pacific remained highly concentrated, with QuickSwap continuing to serve as the primary liquidity venue. Other exchanges struggled to gain meaningful adoption as broader trading activity slowed across the ecosystem.

In Q1’25, Manta Pacific’s DeFi Diversity fell from 6 to 4, indicating that a smaller number of protocols made up the majority of DeFi TVL on the network. DeFi Diversity measures the number of dApps that collectively account for 90% of total DeFi TVL. This reduction signals increased concentration of liquidity in a few dominant applications, while smaller protocols saw a more pronounced drop in usage and capital retention.

Stablecoins

Manta Pacific’s stablecoin market cap fell 7.3% QoQ to $11.2 million in Q1’25. USDT remains the dominant stablecoin, with a market cap of $6.2 million, making up 55.2% of the stablecoin market. USDC, the second-largest stablecoin on Manta Pacific, declined 19.2% QoQ, dropping to a $2.4 million market cap. ZeUSD, a real-world asset-backed stablecoin issued by Zoth, was deployed on Manta Pacific during the quarter and ended Q1’25 with a market cap of $2.1 million. Shortly after the quarter closed, Zoth disclosed a security incident involving a compromised sub-vault that resulted in the loss of roughly $8.45 million in assets. ZeUSD operations were paused pending an investigation and recovery plan. Other stablecoins like USDz, GAI, and USDe continued to see minimal adoption in Q1’25.

Perpetual FuturesKiloEx remained the primary perpetual futures DEX on Manta Pacific in Q1’25, processing $301.2 million in cumulative trading volume. However, KiloEx’s $301.2 million in trading volume was a decline of 49.0% QoQ from $590.1 million in Q4’24. Despite the decrease, KiloEx maintained a steady pace of monthly trading volume growth throughout the quarter, achieving $56.9 million of volume in January 2025, $111.2 million in February 2025, and $133.0 million in March 2025.

On March 27, KiloEx launched the KILO token following its postponed Token Generation Event (TGE), allocating 10% of the 1 billion supply to an airdrop and 27% to the ecosystem. Notably, KiloEx chose to deblow the KILO token on BNB Chain.

After the quarter ended, the KiloEx team disclosed a multichain security incident involving misconfigured access controls. The hacker agreed to a 10% bounty retention and returned all other funds.

Liquid StakingBitfrost’s vMANTA remains the largest LST on Manta Pacific. As of quarter end, the product has 8.6 million MANTA staked and offers 22.4% APY. This yield is comparable to natively staking MANTA on Manta Atlantic, where yield ranges from 10% to 27% APR.

The other LST on Manta Network is stMANTA, offered by Accumulated Finance. Accumulated Finance only has 504,880 MANTA staked and offers a 19.5% APR.

Manta ExpeditionThe Manta Expedition campaign, launched in Q4’24, concluded on January 23, 2025. The campaign incentivized bridging and usage across more than 10 DeFi protocols on Manta Pacific by awarding points that were redeemable for MANTA token rewards.

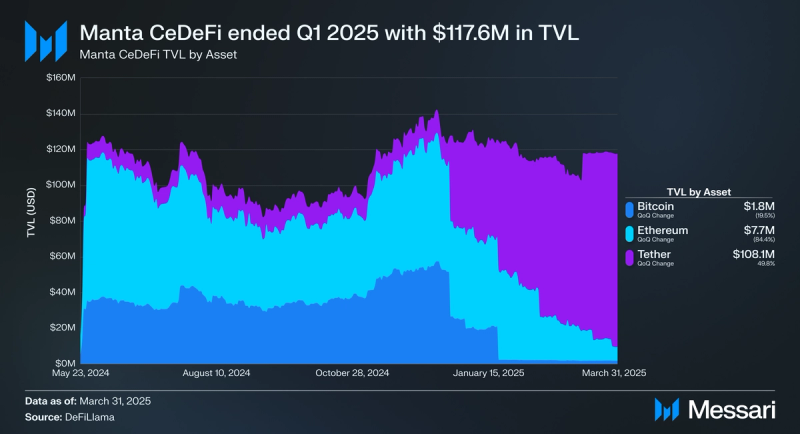

Manta CeDeFi

Manta CeDeFi, first introduced in Q2’24, is a hybrid yield platform that combines custodial security with onchain accessibility. Users deposit supported assets into contracts secured by Ceffu (formerly Binance Custody) and receive mTokens, which function as liquid staking tokens representing their deposits. In Q3’24, Manta enabled staking for mTokens, allowing users to earn points redeemable for MANTA rewards. While no new features were added in Q1’25, the platform continued distributing rewards to participants and maintained stable TVL across BTC, ETH, and stablecoin pools.

The fourth round of MANTA rewards was made available on Jan. 27, 2025, followed by a fifth round on March 28, 2025. These distributions supported ongoing user engagement and positioned CeDeFi as a consistent yield-generating option despite reduced campaign activity.

At the end of Q4, the CeDeFi program had $117.6 million in TVL and, as of this writing, offers the following APRs:

- BTC: 8.0% APR with $2.8 million TVL

- ETH: 1.5% APR with $5.6 million TVL

- USDT/USDC/wUSDM: 3.8% APR with $114.7 million TVL

GameFi remained a visible but quiet segment of the Manta Pacific ecosystem in Q1’25. While titles like World of Dypians, Elfin Games, 0xAstra, and Taman continued to be recognized as part of Manta’s gaming roster, there were no notable campaign announcements, updates, or ecosystem grants related to gaming projects during the quarter.

Ecosystem GrowthIn Q3'24, the Manta Foundation announced the launch of a $50 million EcoFund to accelerate development on Manta Pacific, including $10 million allocated for ecosystem grants. While the EcoFund remains active, no new grant recipients or related announcements were made in Q1’25. The most recent known grant was awarded to 0xAstra in Q4’24 to support game development. Builders can apply for support through the EcoFund.

Ecosystem ExpansionIn Q1’25, Manta Pacific continued to expand its ecosystem with the addition of two new infrastructure projects. These projects enhance Manta Pacific’s utility, bringing innovative financial tools, cross-chain solutions, and engaging onchain experiences to the network. Below are the key additions that joined the Manta Pacific ecosystem this quarter.

- DAR ID: Manta Network integrated DAR ID in Q1’25. DAR ID is a social login and unified account management system that enables dApps to integrate social logins.

- Entangle: In Q1’25, Entangle integrated Manta. Entangle provides a programmable interoperability layer for trustless cross-chain communication and real-world data verification.

Community Events

In Q1’25, Manta Network continued to expand its ecosystem and engage with its community through a series of key industry events, dedicated community meet-ups, and online events. At these events, Manta’s team discussed Manta’s evolution beyond L2 infrastructure through the development of consumer-focused applications for real-world adoption. Notable events and initiatives from the quarter included:

- Manta Network Community Townhall

- Innovate’25 Conference in Nigeria

- Manta Network Community Townhall

- ETH Denver

- Cryptomeria Capital Hack Seasons Conference

- DeepBrain Chain Decentralized AI Ecosystem Conference

- DeFi 2025: Unlocking On-Chain Opportunities

- KuCoin Web3: Friends Gathering

- Padang Web3 Connect Event

- Binance Thailand Blockchain Event

- Hackathon - Indonesia

During Q1’25, Manta Network’s market cap declined 70.3% from $308.3 million to $91.7 million, while MANTA’s price fell 72.0% to $0.22. Despite the downturn in market valuation and user activity, Manta Network reversed a three-quarter revenue slide, increasing protocol revenue by 19.1% QoQ to $252,600. Meanwhile, DeFi TVL contracted sharply, falling 73.0% to $17.5 million amid the unwind of campaign-driven liquidity. Stablecoin market cap fell 7.3% QoQ to $11.2 million, while perpetual futures volume also dropped, with KiloEx recording $301.2 million in volume, down 49.0% from Q4.

Manta Pacific made significant strides in modular infrastructure and security. The network began rolling out a dual-layer fast finality system, integrating native token restaking via Symbiotic and Bitcoin-based validation through Babylon. These integrations shorten Manta’s 3-day finalization window to minutes and position Manta as the first OP Stack L2 to implement modular cryptoeconomic finality using both MANTA and BTC. While ecosystem growth slowed, campaign activity continued with the conclusion of Manta Expedition and ongoing Gas Gain and CeDeFi distributions. New infrastructure partners like Entangle and DAR ID joined the ecosystem, and Manta maintained a global presence at developer and industry events. As the network enters Q2’25, its focus on restaking infrastructure, modular security, and user incentives sets the foundation for renewed ecosystem growth.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.