and the distribution of digital products.

State of LayerZero Q2 2024

- In Q2’24, LayerZero expanded its omnichain interoperability protocol, adding support for 12 new networks and facilitating $5 billion in crypto asset transfers. Average value transferred increased by 78% to over $400 per message in Q2’24.

- Ethereum saw a 26% QoQ increase in transfer volume from $725 million in Q1’24 to $913 million in Q2’24 thanks to lower gas fees due to Dencun upgrade and the introduction of omnichain restaking, which incentivizes the usage of LayerZero.

- The ZRO token launched on June 20, 2024, with an airdrop to 1.28 million eligible wallets, implementing anti-Sybil measures for token distribution and a “Proof-of-Donation” mechanism that can be claimed.

- Surpassing 50,000 omnichain application (OApp) contract deployments in Q2’24, LayerZero saw growth in application adoption across gaming, DeFi, AI, bridging, and other sectors utilizing its omnichain communication.

Though blockchains are designed to be secure, facilitating safe communication between networks is challenging. LayerZero is an interoperability protocol that allows secure communication between over 80 networks for omnichain applications, such as tokens.

It sends and receives messages via an immutable set of Endpoints, with verification and execution facilitated by a permissionless set of decentralized verifier networks (DVNs) and Executors. Executors carry out a message's instructions in the destination chain, while DVNs ensure end-to-end validity of messages. The security stack, including executors and DVNs – along with block confirmations – can be configured by each independent application built on LayerZero depending on the level of security required for sending and receiving messages.

LayerZero is a standardized communication protocol, allowing omnichain applications to communicate on distinct networks. Its primary use case is transferring arbitrary data between these networks, with asset transfer being the most popular type of data moved. Other use cases include any application that might need to send messages between multiple chains, including gaming, cross-chain governance, identity solutions, restaking, and Enterprise products.

LayerZero V2 went live in January 2024, featuring a common messaging system and common security properties to simplify cross-network communication and improve the developer experience.

LayerZero Labs is the initial developer and core contributor to the LayerZero protocol. In April 2023, it raised a $120 million Series B. LayerZero launched its native token, ZRO, in June 2024. For a full primer on LayerZero refer to our Initiation of Coverage.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisFinancial OverviewMarket Capitalization and Token Price

Performance AnalysisFinancial OverviewMarket Capitalization and Token Price

On June 20, 2024, LayerZero Foundation launched ZRO, the native token of the LayerZero protocol. As an Omnichain Fungible Token (OFT), ZRO grants holders governance control over a protocol fee switch, a permissionless mechanism that can collect fees on each message sent through LayerZero and burn ZRO fee tokens.

ZRO launched with a market cap of over $1 billion and price per token of $4.40. ZRO closed Q2’24 amongst the top three cross-chain messaging protocols by market cap with a market cap of over $860 million and a price of $3.30.

Messaging FeesMessaging fees are collected in the native token of the source chain. These fees serve three purposes:

- To distribute to DVNs and Executors for verification and execution, respectively.

- To pay for gas on the destination chain

- To burn on the source chain if the protocol fee accrual is activated, a decision controlled by tokenholder governance that is currently turned off

Revenue generated from these fees by DVNs and Executors pays for security. Each application chooses its own configurations of DVNs for validation. Simultaneously, Executors are also selected to deliver messages accurately. If the fee switch is activated, protocol fee accrual reduces the circulating supply of ZRO through a burn mechanism. This control over supply and market capitalization incentivizes ZRO holders to engage in governance.

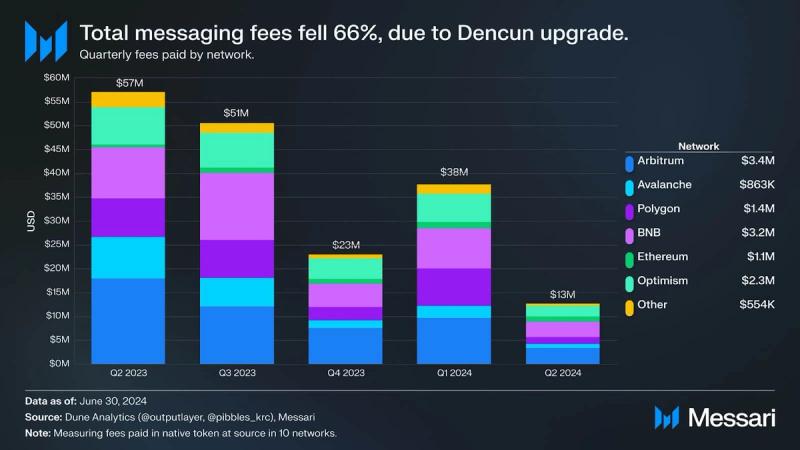

Total messaging fees paid by users dropped 34% QoQ to $12.7 million in Q2’24. The top source chains for messaging fees were Arbitrum ($3.4 million), BNB Chain ($3.2 million), Optimism ($2.3 million), and Polygon ($1.4 million). This decline followed the Dencun upgrade, which reduced Ethereum gas fees through EIP-4844, making LayerZero transactions cheaper. Additionally, the decrease in fees aligns with a 58% drop in message volume, from 29.6 million to 12.3 million, driven by a spike in Q1 2024 activity due to anticipation of the token launch.

The average fees metric calculates the fees collected per message sent on the network. A significant portion of these fees is used to cover gas costs on various networks. High-fee chains like Ethereum can increase the average fees collected due to their higher transaction costs. The lowest average cost of transactions on the networks measured was Polygon in Q2’24 at an average of $1 per message sent. The token launch may have contributed to a spike in transaction fees on chains supporting ZRO (for example, average gas fees rose from below 1 cent to 87 cents on Arbitrum). With the introduction of the Dencun upgrade, Arbitrum and Ethereum saw 63% and 45% QoQ reduction in average fees, respectively.

Value TransferredAs of Q2’24, LayerZero has over 54,000 contracts using its omnichain communication protocol and is live on over 80 different networks, including Ethereum, Optimism, Arbitrum, Polygon, Solana, BNB Chain, TRON, and Base. These contracts use LayerZero messaging for various use cases, supporting almost 300 user-facing applications.

Transferring assets between distinct networks (bridging) is one of the most common use cases for LayerZero. Other use cases include gaming, cross-chain governance, and identity solutions.

Using bridges built on LayerZero, assets can be transferred by swapping native assets on source chains for native assets on destination chains (e.g., Stargate) or via LayerZero’s token standards — called Omnichain Fungible Tokens (OFTs) and Omnichain Non-Fungible Tokens (ONFTs). The standard OFT is burned on the source chain and minted on the destination chain. Examples of native bridges using standard OFTs are: Aptos Bridge, Core DAO, and Harmony Bridge. For existing native tokens, bridges can adopt the OFT standard by locking the tokens on the native chain and minting equivalent tokens on the destination chain. Tokens are received by the destination chain issuing new tokens, 1:1 for each token locked or burned.

In Q2’24, the value of assets transferred via bridge applications using LayerZero across the top 10 networks totaled $5 billion, down 26% QoQ. This decline was primarily due to efforts to deter Sybil farming in the lead-up to the token generation event (TGE), reflecting a number that likely shows more legitimate usage of the network. Despite the decrease, this figure is still 42% higher than the yearly low observed in Q4’23.

By deterring Sybil farming, onchain data shows genuine users instead of inflated numbers from entities utilizing multiple wallets (defined as clusters of 20 addresses linked to the same individual by LayerZero Foundation in the lead-up to TGE). Although the total value of assets transferred decreased QoQ, the average value per message increased by 78.2% to over $400 per message. This indicates that genuine users are leveraging the LayerZero protocol to secure higher-value transactions compared to industrial Sybil farmers.

In Q2’24, Arbitrum ($1.2 billion), Ethereum ($913 million), and Optimism ($893 million) were the top three source networks in transfer volume for bridges built on top of LayerZero. Ethereum saw a 26% increase in transfer volume QoQ, from $725 million in Q1’24 to $913 million in Q2’24. A number of key factors incentivized users to use the Ethereum ecosystem including: lower gas fees on Ethereum due to the introduction of EIP-4844 and the introduction of omnichain native restaking, incentivizing users to use LayerZero.

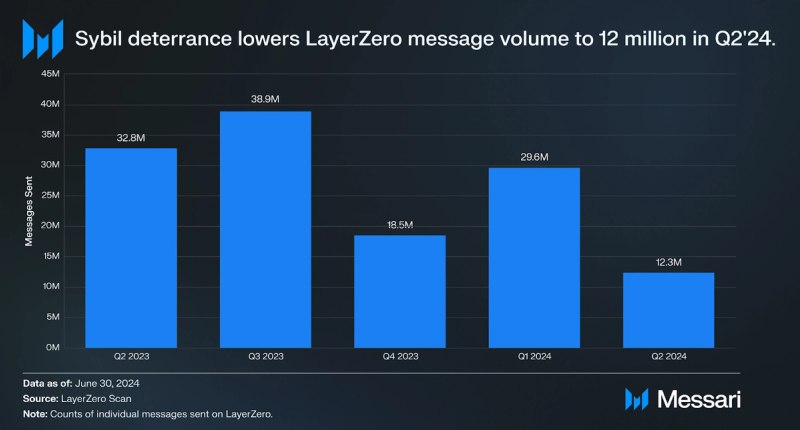

Protocol OverviewUsageMessages (packets of data) sent are a key indicator of LayerZero's total usage since they are user-initiated and used in all use cases, such as bridging (e.g., Stargate ), token issuance (e.g., PancakeSwap and ether.fi), cross-chain liquidity (e.g Orderly Network) governance (e.g., Angle), gaming (e.g., Nine Chronicles), cross-chain identity (e.g., Clusters), and fee/rewards distribution (e.g., Pendle). By excluding Sybil farmers from the token launch, LayerZero adjusted onchain usage metrics to reflect durable users instead of inflated numbers from entities using multiple wallets. Data from Q2’24 accurately represents real protocol usage.

The number of messages sent on LayerZero was over 12.3 million in Q2’24, down 58% QoQ. The Q1’24 figure was likely a consequence of the community’s anticipation of a native token launch.

Application Deployment

Application DeploymentApplications that send and receive messages over LayerZero are called Omnichain Applications (OApps). These applications consist of deployed smart contracts on either source or destination networks. OApps connect to LayerZero via endpoint contracts on their respective networks. These applications can have a host of functions, including asset/token transfers, voting in governance, distribution of fees/rewards, and items for gaming.

In Q2 2024, the LayerZero protocol surpassed the 50,000 milestone, ending with almost 55,000 OApps deployed. As part of the ZRO TGE, teams were invited to submit proposals and deploy OApps for the token. Teams included: GMX, Solidly Labs, DeFi Kingdoms, and Merkly.

Qualitative AnalysisKey DevelopmentsToken LaunchThe LayerZero Foundation launched its native token, ZRO, on June 20, 2024, with a total supply of 1 billion tokens. Of this, 23.8% was allocated to the community and builders, excluding the foundation and growth allocations, which received a separate 14.5%. On the first day, 8.5% of the token supply was distributed: 5% to core contributors, 3% through Requests for Proposals (RFP), and 0.5% to a separate community pool for content creators, artists, and researchers, distinct from the main community pool. Over 1.28 million wallets were eligible for this initial airdrop. The remaining tokens will be distributed over the next 36 months, with additional retroactive distributions every 12 months and further RFPs for future builders. The breakdown of the distribution is as follows:

- 38.3% to LayerZero Community (383 million ZRO)

- 32.2% to Strategic Partners (322 million ZRO)

- 25.5% to Core Contributors (255 million ZRO)

- 4.0% Tokens Repurchased (40 million ZRO)

To incentivize development on LayerZero, a request for proposal (RFP) was conducted before the token launch in May 2024. Developers had to launch an OApp on the LayerZero protocol to be considered for allocation. As of May 31, 2024, over 200 developer teams submitted applications for ZRO allocations and deployed their own OApp. The number of developers in the RFP alone was more than some major blockchains.

The launch of LayerZero’s ZRO token had a significant impact on the Arbitrum network, serving as the coordination chain for token claims. This event led to a surge in daily revenue, reaching $3.4 million. The token launch may have contributed to a spike in transaction fees on Arbitrum, with average fees rising from below 1 cent to 87 cents.

Protocol Fee SwitchThe primary function of the ZRO token is to allow holders to control the protocol fee switch through governance. Every six months, ZRO holders can vote on activating or deactivating the protocol’s fee switch via an immutable omnichain vote, where holders can vote on any chain, where ZRO is deployed. If activated, fees collected are used to burn ZRO by the Treasury Contract. This mechanism ensures that ZRO holders have direct influence over the protocol’s fee structure.

Proof-Of-DonationTo promote ecosystem growth during the distribution of ZRO, LayerZero developed a novel mechanism known as Proof of Donation. This method allowed participants to claim ZRO tokens by donating to Protocol Guild, a funding mechanism for Ethereum’s Layer-1 research and development. The donation was $0.10 in USD stablecoin or ETH. LayerZero Foundation matched all donations up to $10 million for Protocol Guild.

Sybil FilteringTo ensure fair token distribution, LayerZero implemented a three-step process to exclude Sybil users who exploit the system using multiple addresses. Sybil activities, such as industrial farming, moving valueless NFTs, and using specific farming apps, were targeted. Sybil users had the opportunity to self-report and receive 15% of their intended allocation. Those who didn't report were publicly listed and could be reported by others for a bounty. The Sybil detection process was a collaborative effort with LayerZero, Nansen, and Chaos Labs. This initiative successfully filtered Sybil farming, revealing the true usage of the protocol, as shown in this report.

Ecosystem Network IntegrationsIn Q2’24, LayerZero added support for over 12 new networks, bringing the total to 83 networks, including Solana, TRON, Sanko GameCorp, ebi.xyz, Sei Network, Taiko, Skale Network, Humanity Protocol, Merlin Chain, Camp, and Oasys. Support for Solana and TRON expands the number of non-Ethereum Virtual Machine (EVM) networks supported. Solana's integration initially supported eight networks, but expanded to the full mesh of networks LayerZero supports. LayerZero V2 realizes its vision of an omnichain protocol by expanding into networks with unique consensus and security models.

Application IntegrationSurpassing 50,000 OApp deployments in Q2, LayerZero saw growth in applications across gaming, DeFi, AI, token issuance, and other sectors utilizing its omnichain communications. Notable deployments included Woo Ecosystem, Soul Protocol, Phuture Finance, Anzen Finance, Myso Finance, Iskara, ether.fi, SatoshiSync, Ra1l, and Morpheus. Ether.fi, a liquid Ethereum restaking platform, supporting omnichain restaking on a number of L2s including Blast, Base and Linea. Ether.fi supports over $500 million in restaked ETH on L2s. Deploying OApps has become more streamlined with tools like LZ Genie from BCW Group, featuring project creation, deployment, and DVN configuration settings.

On May 28, 2024, Stargate Finance launched Stargate V2, featuring Transaction Batching for reduced costs, an AI Planning Module (AIPM) for optimized liquidity distribution, and Hydra Bridging-as-a-Service for asset bridging to newer chains. Stargate V2 supports 16 chains including Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, and Optimism. The launch introduced Kaia as the first Hydra Chain, enabling high-speed, low-fee asset transfers between Klaytn and other chains. Following successful governance approval and audits, V2 pools and incentives went live on May 27, with full bridging functionality enabled on May 28. Notably, Stargate, the first bridge launched on LayerZero, secured over $500 million in assets on July 1, 2024.

Enterprise IntegrationsIn May 2024, LayerZero Labs partnered with IntellectEU to facilitate the first Delivery vs. Payment (DvP) transaction using the LayerZero protocol. This transaction involved sending Swift MT messages between Hyperledger Besu (private) and Polygon (public) blockchains. The development of DvP transactions aims to integrate existing financial institution infrastructure with blockchain technology seamlessly. This collaboration adds to LayerZero's existing partnerships with major financial institutions, including J.P. Morgan Chase and Apollo's Onyx Digital Assets, and Avalanche’s Evergreen Subnet, Spruce.

Game developer Ubisoft has partnered with Oasys and is using LayerZero as the interop provider to develop its first blockchain-based game, Champion Tactics Grimoria. This partnership leverages LayerZero's omnichain interoperability protocol to enhance cross-chain capabilities, enabling players to own and trade unique digital assets securely across different blockchain networks.

DVN IntegrationThere are over 35 DVNs available to application builders on LayerZero. These include a diverse group of verifier solutions ranging from zk-tech like Polyhedra and Lagrange, validator-based teams running DVNs like Nethermind, multi-party computation (MPC) like Zenrock, enterprise verifiers like Google Cloud, and application-owned DVNs like Abracadabra and Tapioca. Symbiotic recently announced a DVN to facilitate L2 staking from Ethena Labs.

Additionally, teams can build DVN Adapters as a feature in V2, which enables applications built on LayerZero to leverage third-party validators (e.g., bridges, oracles, and middle chains), Chainlink, and Axelar as DVNs. LayerZero Labs provided the initial DVN Adapters for CCIP and Axelar; however, this is a permissionless task, as shown by the multi-bridge solution Hashi building its own DVN adapter. This provides a way to scale, by incorporating external validators in the LayerZero ecosystem.

Upcoming EventsExpansion to Cosmos EcosystemSolana Tron and Aptos are amongst the first non-EVM Layer-1s supported on the LayerZero protocol. LayerZero Labs has partnered with Initia Labs to explore expanding omnichain support to Cosmos chains. These expansions demonstrate LayerZero's commitment to standardize interoperability across diverse blockchain ecosystems.

Closing SummaryIn Q2’24, LayerZero made substantial progress, highlighted by the launch of its native ZRO token, which significantly impacted the Arbitrum network with a surge in daily revenue to $3.4 million and an increase in transaction fees from below $0.01 to $0.87. Efforts to deter Sybil farming resulted in a 26% QoQ decrease in the total value of assets transferred, yet the average value per message increased by 78.2% to over $400. LayerZero expanded its ecosystem by adding support for 12 new networks and surpassing 54,000 OApp (omnichain applications) deployments, reflecting a 10% increase in the total amount. These advancements in cross-chain interoperability, strategic partnerships, and innovative solutions continue to position LayerZero as a pivotal player in the omnichain messaging space.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.