and the distribution of digital products.

State of Kaia Q2 2024

- Kaia mainnet went live in Q3 on August 29. Kaia will bring the power of Web3 to the LINE and Kakaotalk superapps popular in Asia.

- Due to DeFi Kingdoms' Serendale realm, Kaia had the fourth most active gamers in June.

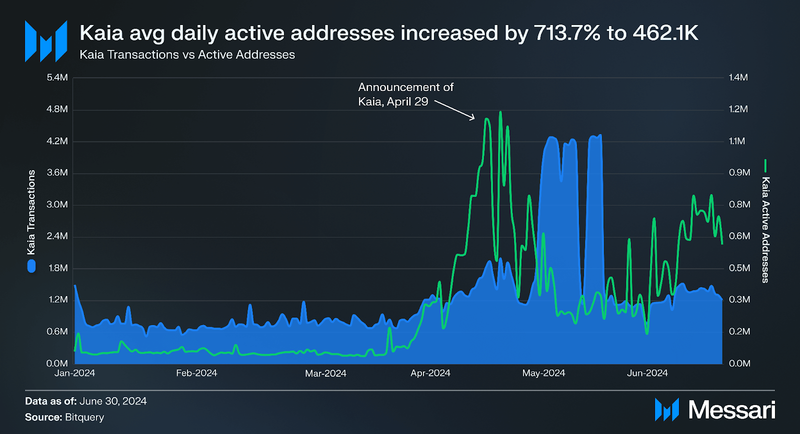

- The average daily transactions and average daily active addresses increased by 127.9% and 713.7%, respectively. Transactions increased to 1.8 million, and addresses increased to 462,100. Both increases were primarily due to Kaia's announcement on April 29.

Kaia (KLAY) is a new EVM-equivalent chain emerging from the Klaytn/Finschia chain merge proposal known as Project Dragon. Because Kaia is built on top of the Klaytn Network, it inherited the infrastructure and dApps within the Klaytn ecosystem and 1-second block time with immediate finality. In the future, the KLAY ticker will eventually be updated to KAIA.

Kaia integrates with messaging platforms like LINE and KakaoTalk, the dominant messaging super apps used by Japan, Thailand, Indonesia, Taiwan, and South Korea. 95% of Japan uses LINE, 77% of mobile internet users in Thailand use LINE, Indonesia is LINE’s second-largest market, and LINE has a 77% market share in Taiwan. 98% of South Korea uses KakaoTalk. By way of its mobile-friendly SDK, the chain aims to simplify blockchain integration, bringing Web3 to Web2 services.

Website / X (Twitter) / Medium

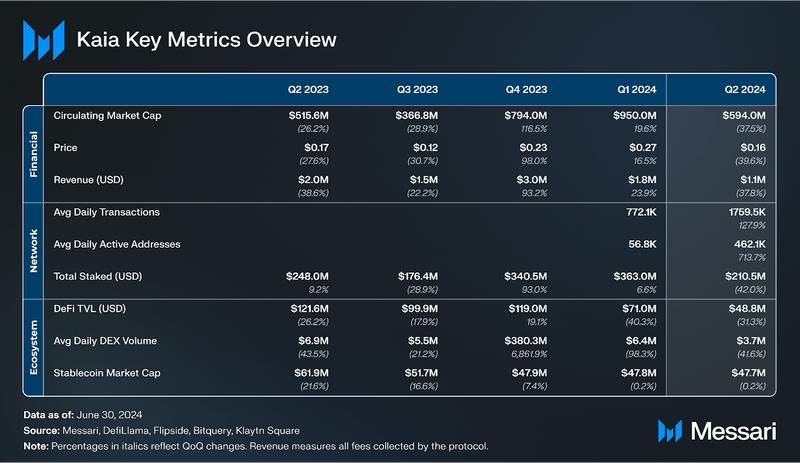

Key Metrics Financial Analysis

Financial Analysis

KLAY’s market cap fell by 37.5% QoQ from $950 million to $594 million. Its market cap rank went from 105 to 114. Similarly, KLAY’s price dropped by 39.6% QoQ to $0.16.

Kaia’s revenue, i.e., all fees collected by the protocol, decreased by 37.8% QoQ to $1.1 million. When denominated in KLAY, revenue decreased by 22.7% to 5.9 million.

Network AnalysisUsage

In Q2, average daily transactions increased by 127.9% QoQ to 1.8 million, and average daily active addresses increased by 713.7% QoQ to 462,100. Much of this increase came after the announcement of the merge.

Security

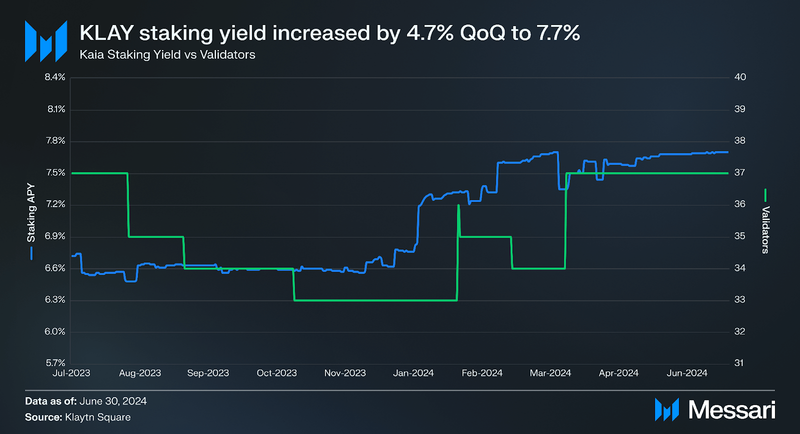

The total amount of KLAY staked decreased by 4.0% QoQ from 1.4 billion to 1.3 billion. The dollar amount staked decreased 42.0% QoQ from $363 million to $210.5 million, mainly driven by price depreciation.

The KLAY staking yield increased 4.7% QoQ from 7.35% to 7.70%. This trend continues as validators increased by 3 QoQ to regain their June 2023 numbers at 37, which is an all time high. This was an 8.8% increase in QoQ.

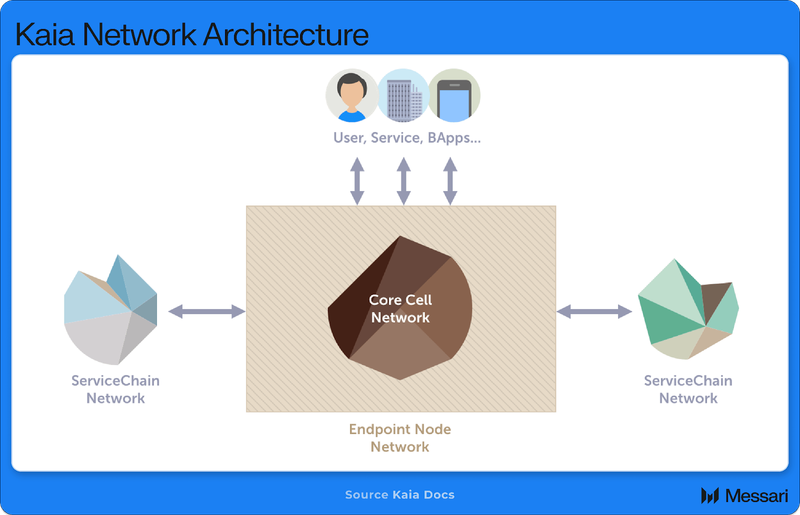

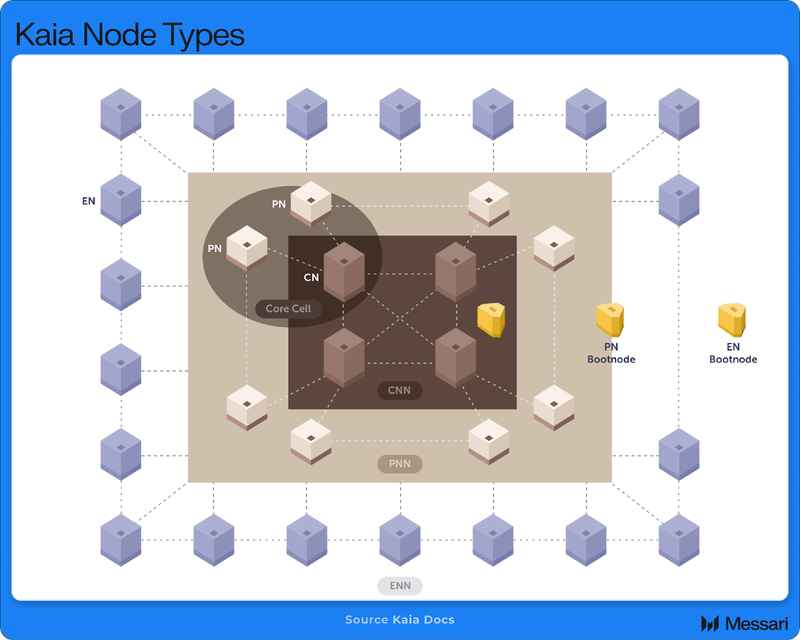

Kaia — The Merged ChainIn Q3 2024, the Klaytn/Finschia merge will occur with Kaia’s mainnet launch. Kaia will inherit much of the same technology as the Klaytn chain. This includes the network architecture (layout below) and its apps.

The Kaia blockchain is composed of three networks: the Core Cell Network (CCN), the Endpoint Node Network (ENN), and the Service Chain Network (SCN). The CCN and ENN work together to comprise Kaia’s Mainnet, while the SCN consists of auxiliary blockchains (i.e., sidechains) that are independently operated but connected to the mainnet through Endpoint Nodes (EN). Bootnodes are special nodes operated by Kaia to help new nodes join the network.

Core Cell NetworkEach Core Cell in the CCN consists of one Consensus Node (CN) and at least two Proxy Nodes (PN). The set of CN operators is a permission group known as the Governance Council (GC). They perform consensus, creating blocks with transactions that they verify and execute. PNs serve as a relayer for transactions and block information between CNs and ENs. Core Cells are split into CNs and PNs to shield CNs from adversarial network attacks like DDoS attacks.

Endpoint Node NetworkENNs connect the CCN with users, applications, and Service Chains. They create transactions, handle RPC API requests, process data requests from Service Chains, and broadcast block information to all Kaia network participants.

Service Chain NetworkService Chains allow applications and enterprises to have a dedicated, customizable execution environment. Service Chains give enterprises a level of decentralization and security that best fits their needs, whether that means higher TPS or private data. Service Chains can connect to Kaia Mainnet through data anchoring and multisig token bridges.

Kaia also inherits the optimized version of the Istanbul Byzantine Fault Tolerance (IBFT) consensus mechanism. IBFT builds on top of Practical BFT, introduced in 1999. As a result, Kaia Mainnet could theoretically handle 4,000 TPS, introduce immediate transaction finality, one-second block generation time, and attract over 50 CNs to participate in the consensus process.

Blocks are generated every second and require signatures from more than two-thirds of committee members. Kaia allows nodes to use up to two ports for communication. If connecting nodes both choose to do so, they can use two channels for communication. One channel is always used for consensus and block-related messages, while the other is for transaction-related messages. It facilitates new blocks to be mined even during congestion.

The Klaytn Virtual Machine (KLVM), now the Kaia Virtual Machine (KVM), was EVM-compatible upon launch, and after a series of updates in Q1’22, it became EVM equivalent. EVM equivalence is a much stronger version of compatibility. It allows protocols from other EVM environments to launch on Kaia with virtually no changes in the code.

Kaia blockchain supports a unique account model that separates the address from the public key. It allows registering a different public key or multiple public keys to an account. Users can assign each public key's role for finer access control. Also, the account model facilitates native gas fee delegation, enabling services to pay for the gas fee on behalf of users.

Kaia Token OverviewAt its mainnet launch, KLAY will continue to be the governance token of the Kaia chain until it is transitioned to KAIA. Once the Kaia Portal goes live in Q3, FNSA holders will be able to swap their FNSA to KLAY using it. The Kaia Portal will also be the central hub for Kaia DeFi.

At launch, the sum of transaction fees used in the block (block reward) and newly minted KAIA will be distributed as follows:

- Validators and Community: 50%

- Block proposer rewards: 20% of the 50% (10% of total)

- Staking rewards: 80% of the 50% (40% of total)

- Kaia Ecosystem Fund (KEF): 25%

- Kaia Infrastructure Fund (KIF): 25%

In every block, 9.6 KAIA will be minted, which results in a 5.2% annual inflation rate. This can be changed at any time via the Kaia Governance Process. A predetermined fee table determines the transaction fees at any given time.

The Kaia Ecosystem Fund (KEF) will aim to enable greater transparency and verifiability within the Kaia Ecosystem:

- Service Contribution Reward (SCR): The KEF will reward service developers or users operating on the integrated ecosystem for directly or indirectly contributing to the enhancement of the ecosystem's value.

- Building our Developer Community: The KEF will support various initiatives including hackathons, development education programs, collaborative research with academia, and collaboration with various DAOs to foster and grow the Kaia developer community.

- Fostering Ecosystem Services and Infrastructure: The KEF will support essential ecosystem infrastructure, develop services with clear utility, and provide marketing support.

- Kaia Eco Fund Indirect Investment: The KEF will make indirect mid-to long-term investments by entrusting specialized crypto VCs. A portion of the profits generated upon subsequent investment recovery will be either burned or returned to the Kaia ecosystem.

- Governance Committee Budget: This budget is allocated for committees in specific sectors such as Gaming, DeFi, and Community. These committees aim to grow the Kaia Blockchain ecosystem in their respective sectors.

- Other ecosystem and community-building activities

The Kaia Foundation will submit a quarterly budget proposal for each category, which will be reviewed and approved by the Governance Council (GC) on Kaia Square.

The Kaia Infrastructure Fund (KIF) will focus on three main categories:

- Mainnet and Essential Infrastructure R&D: This includes advancing research on the latest technologies related to mainnet and infrastructure, foundation-led service development, and infrastructure establishment.

- Ecosystem Acceleration: This includes token swap, financial support for small-scale Kaia Blockchain ecosystem partners, attracting new GC members, and providing market liquidity.

- Foundation Operations: This includes operating expenses such as development, accounting, legal affairs, IT infrastructure operations, marketing, and labor costs, as well as financial management and fundraising costs.

The foundation also controls the KIF but does not require approval from the GC as they do for (KEF). The foundation aims to maintain transparency by disclosing the budget before expenses and afterward.

Ecosystem Overview DeFi

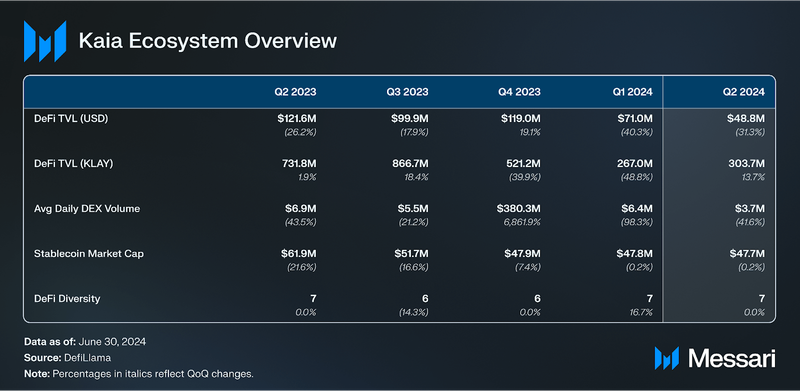

DeFiKlaytn’s DeFi TVL decreased by 31.3% QoQ to $48.8 million from $71.0 million. When denominated in KLAY, DeFi TVL increased by 13.7% QoQ to 303.7 million from 267.0 million. Klayswap continued to lead in TVL on Klaytn even though its market share decreased by 22.3% QoQ to 48.0%. Klayswaps’s TVL decreased by 46.7% QoQ to $23.4 million from $43.9 million. DragonSwap ended the quarter in second with 19.4% market share. The DEX’s TVL increased by 33.5% to $9.5 million from $7.1 million.

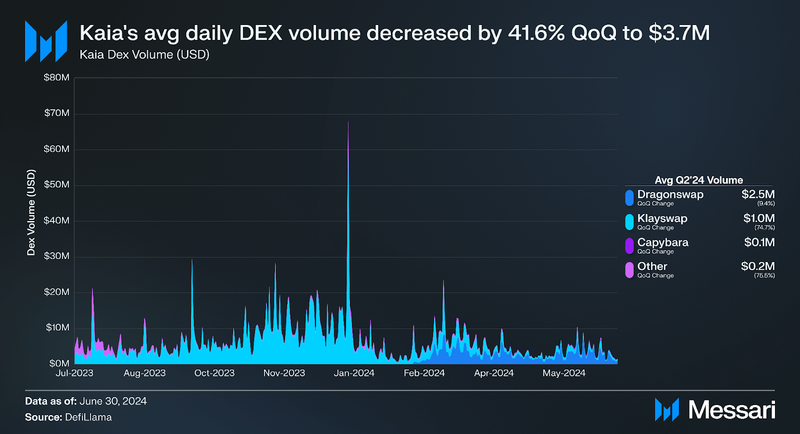

Klaytn’s average daily DEX volume decreased by 41.6% QoQ to $3.7 million. Of the Q2 volumes, DragonSwap held an average of 64.9% of the market even though its average volumes decreased by 9.4% QoQ to $2.5 million. The second largest DEX was Klayswap, with an average 27.6% market share and a volume of $1.0 million, which decreased by 74.7% QoQ. DragonSwap overtook Klayswap as the largest DEX by volume in Q2 despite having less TVL. DragonSwap’s market share increased 79.7% QoQ.

Klaytn’s stablecoin market cap decreased by 0.2% QoQ to $47.7 million, ranking it 33rd among all networks. USDT ended the quarter with $31.1 million on Klaytn’s chain, giving it a 65.2% market share. DAI was the second largest stablecoin on the network, with a $10.7 million market cap, giving it a 22.5% market share. There hasn’t been much change in the stablecoin market cap since Q4'23, as the market cap has only decreased 0.3% over H1’24.

NFT and GamingSince December 7, 2022, the Serendale Realm in DeFi Kingdoms has been running on Klaytn. In Q3, the game will move to Kaia as mainnet is launched. Also, in Q3, PvP will go live with a demo that can be tested now. This marks the first move for DeFi Kingdoms towards actual gameplay, with most interactions still being gamified DeFi. Throughout June 2024, there were 1,700 unique active wallets and over 1 million transactions within the Serendale Realm. This led Klaytn to finish fourth in blockchains with the most active gamers in June.

Also, in June, the NFT collection 7 Dragons minted out its collection of 77,777 NFTs, which SmartLayer powers. Each 7 Dragon NFT is a virtual pet on the blockchain, similar to Tamagotchi. Owners can interact and customize their Dragon through various in-game actions. Owning a 7 Dragon allows users to receive rewards across the Kaia blockchain via staking and early access to other events/experiences across the Kaia ecosystem.

Other ecosystem development announcements include:

- Pyth has officially integrated with the Klaytn/Kaia blockchain, allowing developers access to over 500 price feeds.

- All Klaytn and soon-to-be Kaia data is live on Flipside.

- The first launchpad in the Klaytn ecosystem went live in Q2. Capybara has not launched any tokens yet, but applications are now live.

The most significant announcement in Q2 was the upcoming Kaia mainnet to launch in Q3, officially merging Klaytn and Finschia. Kaia will bring the power of Web3 and blockchain to Web2 super apps LINE and Kakaotalk. Kaia will inherit Klaytn’s tech stack and eventually transition the KLAY token to KAIA.

Klaytn continued to be a significant player in the gaming space as DeFi Kingdoms continued to attract players and will continue to do so as it launch its PvP game. During Q2 2024, KLAY’s market cap decreased by 37.5% to $594.0 million, while revenue increased by 33.7% to $762,900. With the Kaia launch around the corner, average daily transactions increased by 127.9%, and average daily active addresses increased by 713.7% QoQ.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.