and the distribution of digital products.

State of Hedera Q4 2024

- HBAR’s circulating market cap increased 375% QoQ to $10.3 billion. Its market cap amongst all tokens rose 28 spots from 46 to 18, outperforming similarly priced cryptoassets.

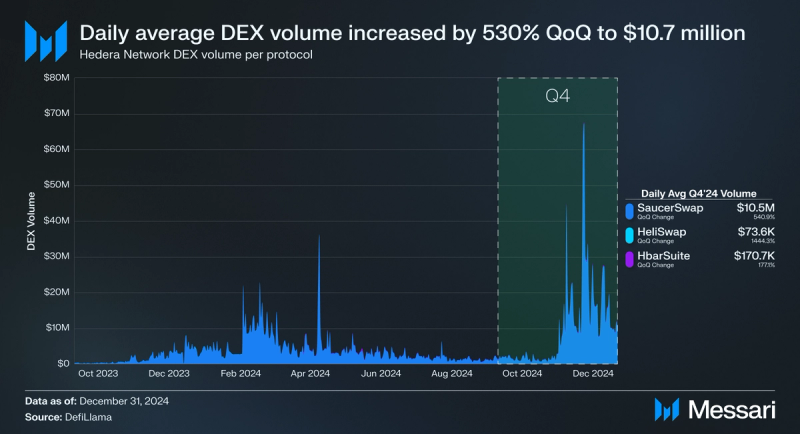

- DEX volumes on Hedera hit ATHs in Q4, averaging $10.7 million per day. Representing a 530% QoQ increase in average daily DEX volumes.

- Karate Combat users prefer using Hedera over Ethereum. Karate Combat’s events in Q4 saw 81% of all KARATE tokens played via the Hedera Network. The total number of KARATE played also increased as Karate Combat introduced the Hedera Network to new users.

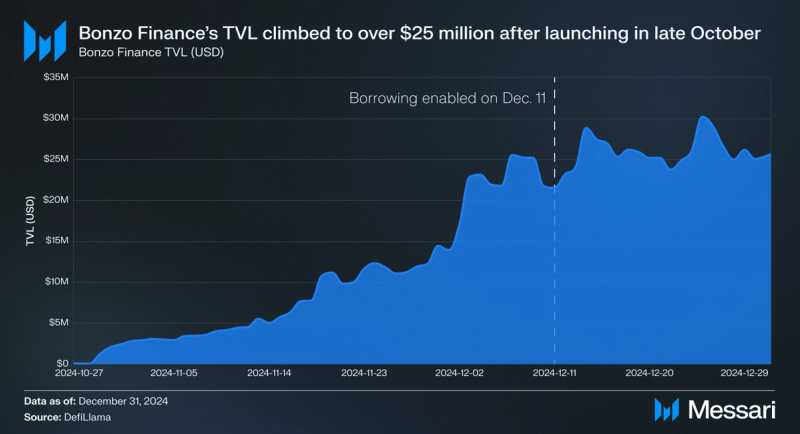

- Bonzo Finance launched at the end of October and closed Q4 with over $25 million in TVL. Bonzo Finance is an Aave V2-based non-custodial money market optimized to run on Hedera’s EVM and natively utilizes Hedera’s Token Service infrastructure.

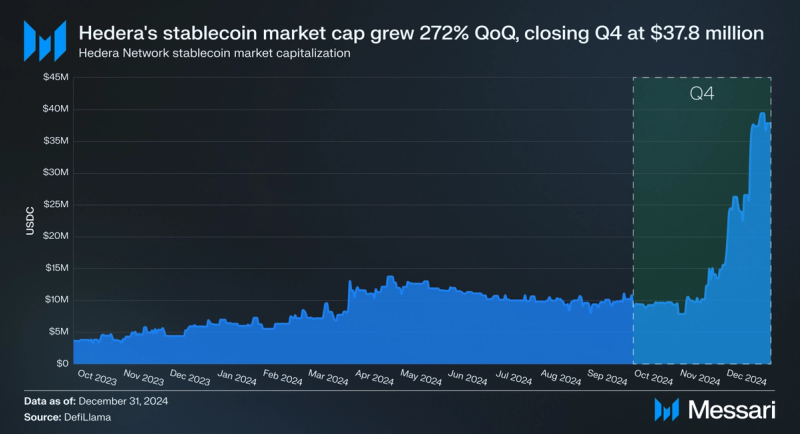

- Hedera’s stablecoin market capitalization increased 272% QoQ, closing Q4 at $37.9 million. Led by growth in natively issued USDC, stablecoins continue to make their way into DeFi on Hedera, with over $3 million worth of USDC in Bonzo Finance alone.

Hedera (HBAR) is a high-performance, secure, and sustainable public, permissioned DLT network. Hedera is governed by a council of up to 39 of the world’s leading institutions, with community input on the network’s features and ecosystem standards via Hedera Improvement Proposals (HIPs). While anyone can submit a transaction and view the network history and data, only pre-approved entities run the nodes that validate transactions and participate in consensus. Members of the Council operate Hedera’s validator nodes while the network has public plans to transition to fully permissionless node operation over time. Although Hedera's network operation is currently permissioned in nature, the division of responsibility across 30 geographically and industry-diversified (collusion-proof) council members is unique among public networks.

The Hedera Network offers an optimized version of the Besu EVM for smart contracts (Hedera Smart Contract Service) alongside a native tokenization service (Hedera Token Service) and a high-throughput data writing and verification service (Hedera Consensus Service). These services are known as the Hedera Network Services, which developers can use in a permissionless fashion to build decentralized applications in a variety of programming languages. The Hashgraph Consensus Algorithm powers the network, delivering high throughput, fair ordering, and low-latency consensus for all transactions.

Website / X (Twitter) / Discord

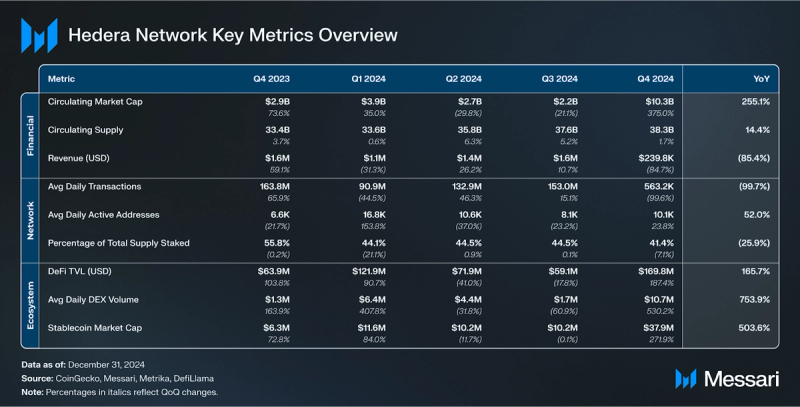

Key Metrics Financial Overview

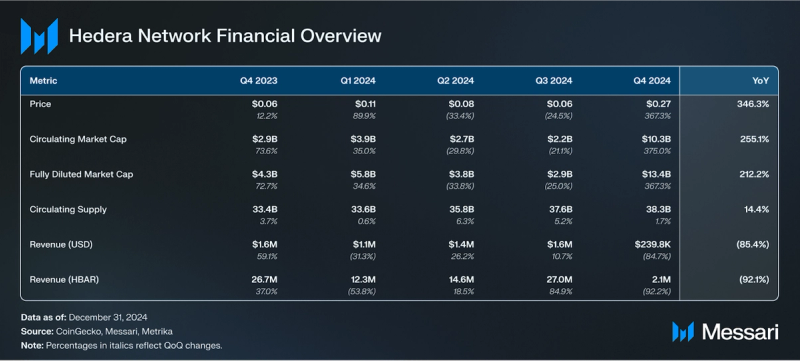

Financial Overview Market Cap and Revenue

Market Cap and Revenue

The circulating market capitalization of HBAR reversed its correction from the prior two quarters in Q4, rising 375% QoQ from $2.2 billion to $10.3 billion. Furthermore, HBAR’s market cap amongst all tokens increased 28 spots from 46 to 18, outperforming similarly priced cryptoassets. The circulating supply of HBAR increased less than the previous quarter, only increasing 1.7% this quarter to 38.3 billion HBAR. The price of HBAR increased substantially this quarter, increasing 367% QoQ from $0.06 to $0.27. The increase in HBAR’s price can partially be attributed to the election of Donald Trump, as US-based cryptocurrencies experienced a rally after the election.

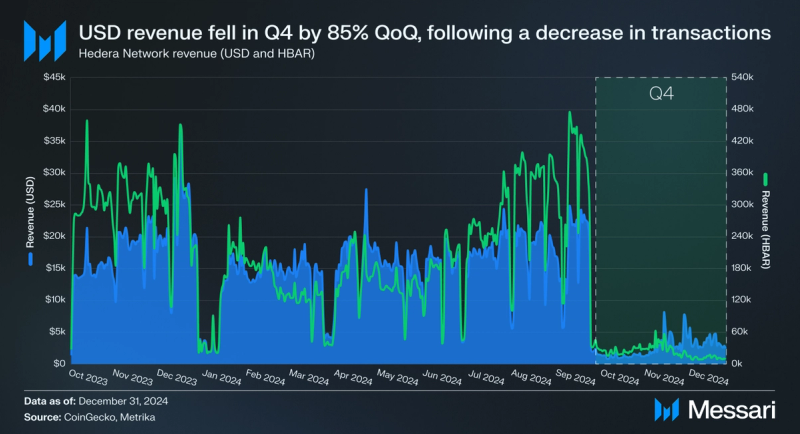

Hedera Network’s revenue, generated from network transaction fees, hit a yearly low of 2.1 million HBAR this quarter. Revenue decreased 92% QoQ following a decrease in transactions. Additionally, dollar-denominated revenue decreased 85% QoQ to $239,800. The decrease in Hedera Network’s revenue can be attributed to a significant decrease in Hedera’s Consensus Service transactions (Discussed in Network Overview).

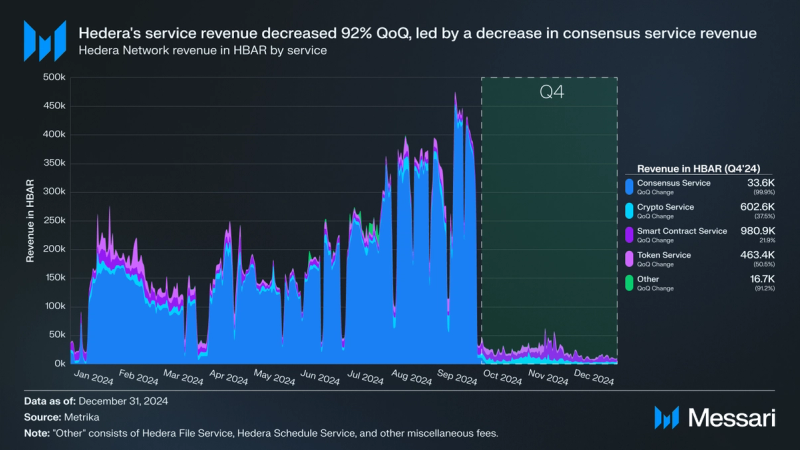

Almost all of Hedera’s network services experienced revenue contraction in Q4. Hedera’s Consensus Service revenue decreased 99% QoQ, generating 33,600 HBAR in revenue in Q4. The Hedera Token Service decreased 51% QoQ to 463,400 HBAR, while Hedera’s Crypto Service revenue decreased by 38% QoQ to 602,600 HBAR. The Smart Contract Service was the only network service to experience growth in revenue QoQ, rising 22% to 980,900. All other sources of HBAR revenue decreased 91% QoQ to 16,700 HBAR.

Supply DynamicsThe Hedera Network’s native token, HBAR, serves multiple essential functions to the network. It facilitates payment of network usage fees and rewards Proof-of-Stake validators for operating and securing the network. Users can delegate their HBAR to participate in network validation and earn staking rewards. In the future, the network aims to enable staking for permissionless public validators.

At the end of Q4, 38.3 billion HBAR was in circulation, representing 76.6% of the fixed total 50 billion supply. HBAR is distributed each quarter as reported through the Hedera Treasury Management Report. The report forecasts that the circulating supply will increase by just under 3.9 billion HBAR next quarter (Q1’25). Over 3.6 billion of this supply growth will be used to foster the ecosystem and support open-source development.

Network Overview Usage

Usage

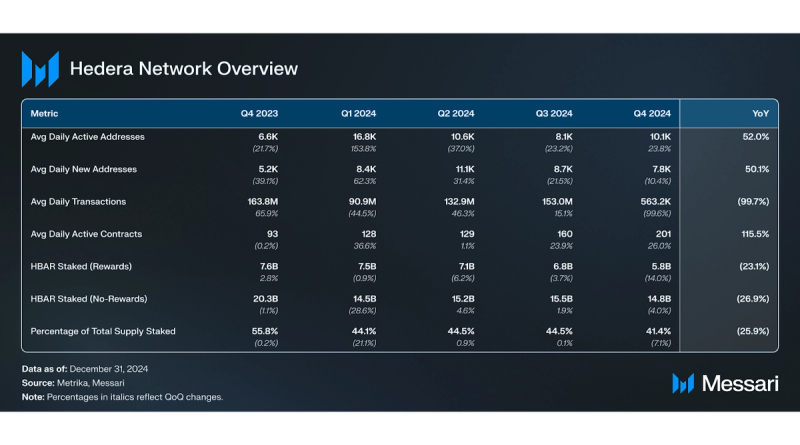

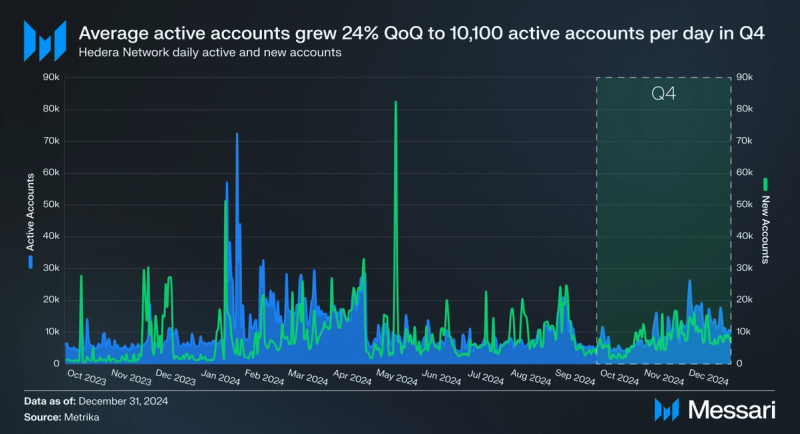

The daily average number of new accounts declined in Q4, down 10% QoQ from 8,700 to 7,800. However, active accounts on the Hedera Network saw a 24% increase in Q4, growing from 8,100 to 10,100.

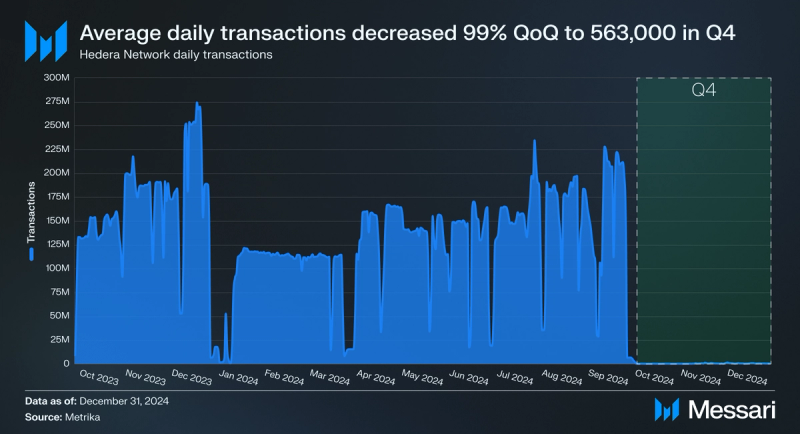

Transactions in Q4 fell by 99% following a 99% decrease in Hedera’s Consensus Service transactions. Overall, average daily transactions fell from 153 million to 563,000 in Q4. Transaction activity is now more evenly distributed across all of Hedera’s network services, with the Q4 percentage share of average daily transactions broken down by the following:

- Consensus Service: 26.3%

- Crypto Service: 39.1%

- Smart Contract Service: 21.9%

- Token Service: 12.4%

- Other: 0.3%

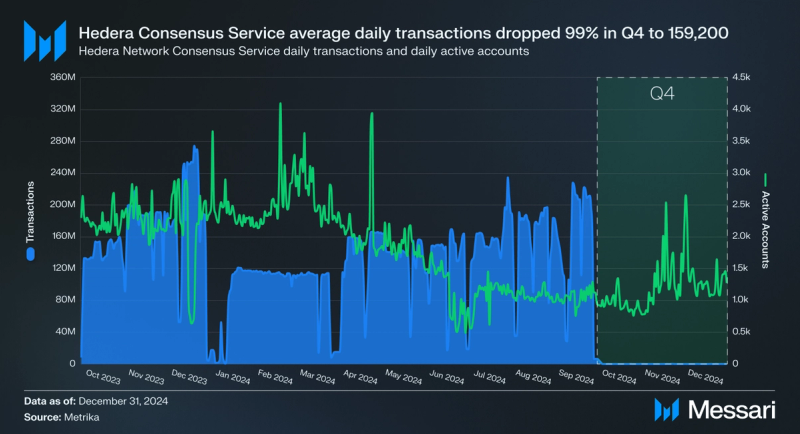

The decline in Hedera’s Consensus Service transactions can largely be attributed to Avery Dennison's atma.io platform ceasing use of Hedera’s Consensus Service. Messari has previously reported that they represented the majority of transactions on Hedera.

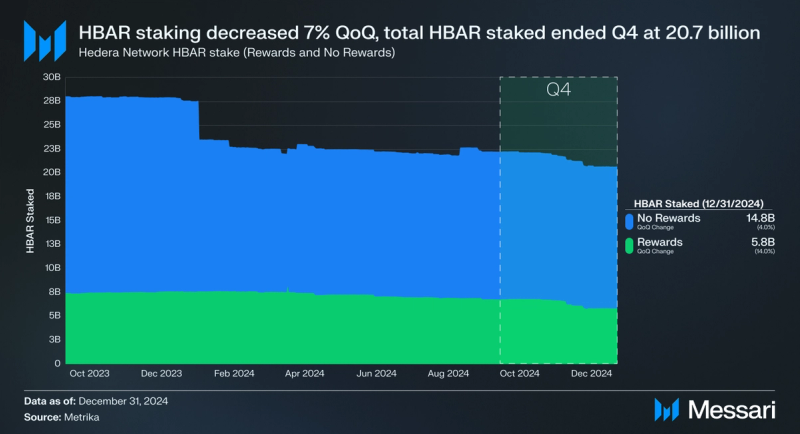

In Q4, the Hedera network reported 20.6 billion HBAR staked, representing 54% of the circulating and 41% of the total supply. This high staking percentage relative to the circulating supply can be attributed to entities such as Hashgraph. They stake their HBAR allocations and the Hedera Treasury to assist validators in meeting the minimum staking threshold to participate in network consensus. It’s worth mentioning that these entities have chosen not to collect staking rewards. Notably, 72% of staked HBAR do not receive rewards.

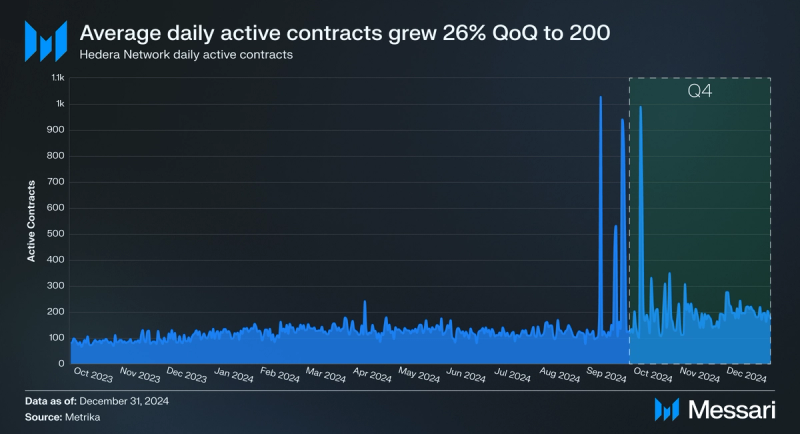

Development

Daily average active contracts increased by 26% in Q4, growing from 160 to 200 active contracts. This growth represents a yearly high and 116% YoY growth in average active contracts. Throughout the quarter, Hedera has actively introduced improvements in various developer-focused tools and products, such as:

- V0.54 Upgrade (October 23) - his release introduces significant improvements through HIP-904 and HIP-1010:

- HIP-904 streamlines token distribution via airdrops, empowering token creators and projects to efficiently reach a broader audience.

- HIP-1010 enables smart contracts to manage token custom fees for fungible and non-fungible tokens via updateFungibleTokenCustomFees and updateNonFungibleTokenCustomFees system contract functions, providing greater flexibility in token management.

- V0.56 Upgrade (December 11) - This release introduces several significant improvements through HIP-869, HIP-904, HIP-632, and Block Streams preview:

- HIP-869 implements the Dynamic Address Book, allowing node operators to update their node details and address books via Hedera transactions, simplifying network operations and enhancing user management.

- HIP-904 adds support for Hedera Token Service capabilities, specifically enabling frictionless airdrops, token rejection, and automatic token association configurations to optimize token management functionality.

- HIP-632 enhances the Hedera Account Service, allowing smart contracts to verify signatures against Hedera accounts using ECDSA, ED25519, and complex keys, fostering better compatibility with Ethereum-based systems.

- Additionally, a developer access preview for Block Streams introduces a consolidated output stream designed to replace existing event and record streams, integrating both transaction and state data in a unified approach for enhanced data consumption and verification by the community.

On October 18, 2024, Hashgraph announced NFT Studio, an open-source platform on the Hedera Network that simplifies the creation, management, and distribution of NFTs and token-based projects. It addresses key challenges in the NFT space by offering a comprehensive suite of tools to help with metadata standards compliance, risk assessments, token distribution, and community engagement. These tools include:

- A metadata validator to ensure adherence to Hedera standards.

- An NFT rarity inspector for analyzing collectible value.

- An NFT risk calculator to evaluate project security.

- An Airdrop list verifier for smooth token distribution.

- A token holders list builder for effective community targeting.

- A token balance snapshot tool for tracking ownership over time.

Together, these integrated tools streamline the NFT lifecycle, making it easier for creators and developers to launch and maintain successful NFT projects, while leveraging the unique benefits of NFTs on Hedera, e.g. protocol enforced royalties.

Chainlink IntegrationThe HBAR Foundation joined Chainlink’s Scale Program to work towards integrating Chainlink’s Data Feeds and Cross-Chain Interoperability Protocol (CCIP) on Hedera. No time was wasted as Hedera added support for Chainlink Data Feeds and Proof of Reserves as part of Chainlink’s SmartData suite this quarter. This provides developers with tamper-proof, high-quality data essential for secure DeFi and tokenized asset applications. By integrating these Chainlink standards, Hedera enables seamless access to decentralized oracle services that aggregate financial market data from numerous premium sources, ensuring accurate, volume-weighted market prices that resist manipulation. Additionally, Chainlink Proof of Reserve brings real-time reserve verifications onchain, enhancing transparency and security by allowing protocols to verify collateralization and prevent risks such as malicious minting. This integration aims to empower developers on the Hedera Network with robust, decentralized data and reserve monitoring capabilities, paving the way for innovative and scalable onchain markets.

LayerZero IntegrationLayerZero expanded to support Hedera in late October 2024, aiming to help enhance the network’s interoperability and strengthen its position as an enterprise-grade platform for institutional DeFi. The integration enables Hedera to connect with additional liquidity sources by providing a new destination for EVM-based liquidity while allowing developers to deploy omnichain apps that extend to over 70 chains. Key benefits of this integration include asset-level interoperability via LayerZero’s omnichain fungible token standard, improved decentralized application connectivity through a dedicated Hedera endpoint, and the groundwork for supporting Hedera-based assets. Overall, this integration builds on previous infrastructure investments and furthers Hedera network’s goal of facilitating seamless, permissionless cross-chain interactions.

Ecosystem Overview DeFi

DeFi

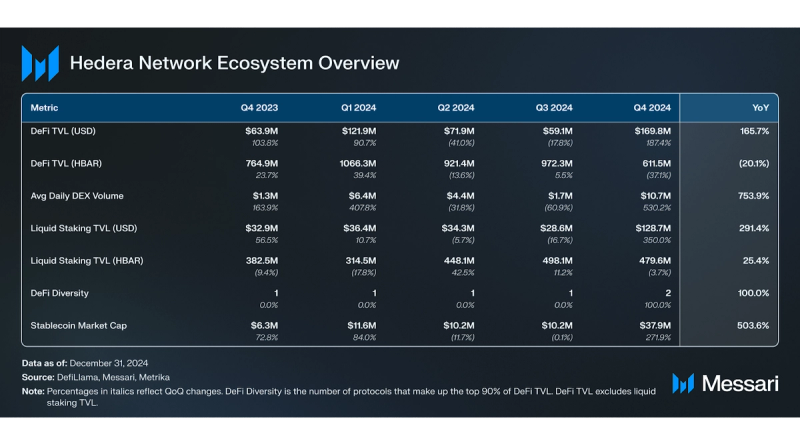

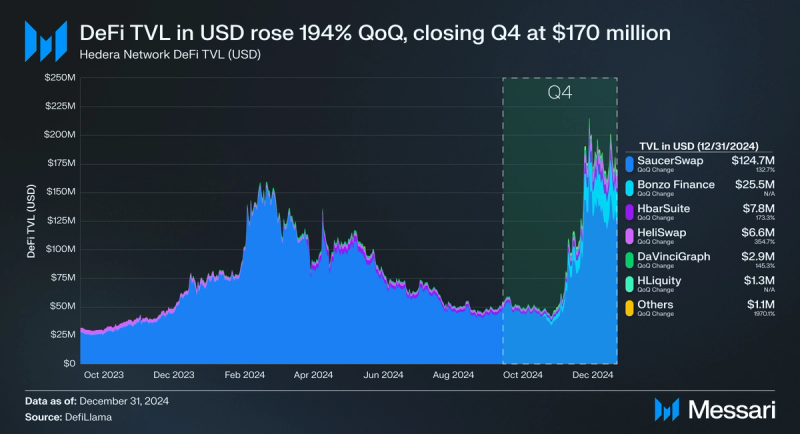

This quarter, DeFi total value locked (TVL) on Hedera hit an ATH in USD, closing Q4 at $169.8 million. However, TVL in HBAR decreased 37% QoQ from 972.3 million to 611.5 million. Furthermore, the delta between the increases in USD TVL and decreases in HBAR TVL suggests that the majority of the USD TVL increase was due to the appreciation in the price of HBAR, not capital inflows. At the end of the quarter, Hedera ranked #38 by TVL among blockchain networks, up 10 spots QoQ.

Bonzo Finance, a non-custodial lending and borrowing protocol, launched on Hedera at the end of October. Bonzo Finance, based on Aave V2, is optimized to run on Hedera’s EVM and natively utilizes Hedera’s Token Service infrastructure. Bonzo Finance initially only allowed users to supply assets as it aimed to hit its target liquidity thresholds before enabling borrowing. Those thresholds were hit on December 11, 2024, and subsequently, borrowing was enabled. Bonzo Finance saw its TVL in USD grow steadily since its launch, eventually closing Q4 at $25.4 million in TVL.

SaucerSwap remained the top DeFi protocol on Hedera Network and experienced a 133% QoQ increase in USD TVL, closing Q4 with $125 million in TVL. The rest of Hedera’s DeFi TVL is split across HbarSuite, HeliSwap, DaVinciGraph, and HLiquity. HbarSuite continues to solidify its position as a top DeFi protocol in the Hedera Network ecosystem. In Q4, HbarSuite ended the quarter with $7.8 million in TVL, a 173% increase in TVL QoQ. HeliSwap and DaVinciGraph both saw uptrends in TVL as well, increasing 355% QoQ to $6.6 million and 145% to $2.9 million, respectively.

DeFi Diversity measures the number of protocols constituting the top 90% of DeFi TVL. A higher DeFi Diversity score implies a larger distribution of TVL across protocols, not including liquid staking. A higher score also suggests a lower risk of widespread ecosystem contagion resulting from adverse events like exploits or protocol migrations. The Hedera network ended Q4 with a DeFi Diversity score of 2, up 100% from last quarter's score of 1. The change in Hedera’s score is due to the launch of Bonzo Finance and its rapid TVL growth. Liquid staking is not included in DeFi TVL.

DEX volumes on Hedera hit ATHs in Q4, with the average daily volume increasing 530% QoQ. Daily average DEX volumes in Q4 were $10.7 million, with SaucerSwap accounting for $10.5 million. On December 3, 2024, DEX volumes hit their highest daily volume ever at $68 million.

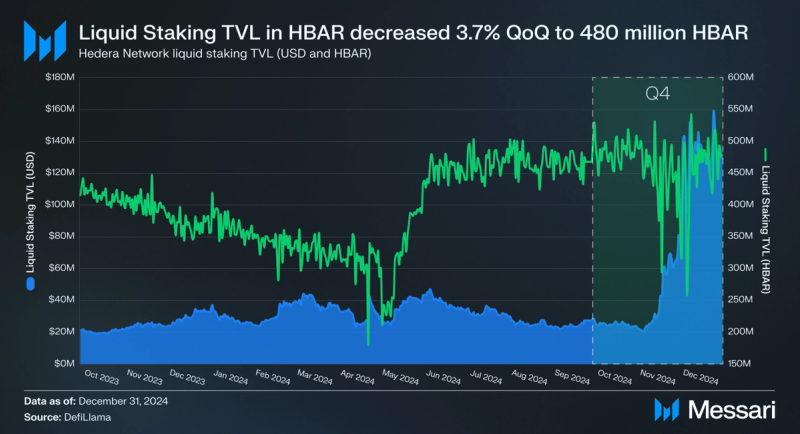

Although liquid staking TVL is not included in the DeFi TVL figure, it remains a relevant metric with growing significance. Stader is the only provider of liquid staking on the Hedera network, with $128.7 million in TVL. Liquid staking USD TVL was up 350% QoQ, moving from $28.6 million to $128.7 million. This increase in USD TVL was due to the 367% increase in HBAR price experienced in Q4 and not capital inflows. However, liquid staking TVL in HBAR only experienced minor capital outflows QoQ, decreasing 4% from 498.1 million to 479.6 million HBAR staked at the end of Q4.

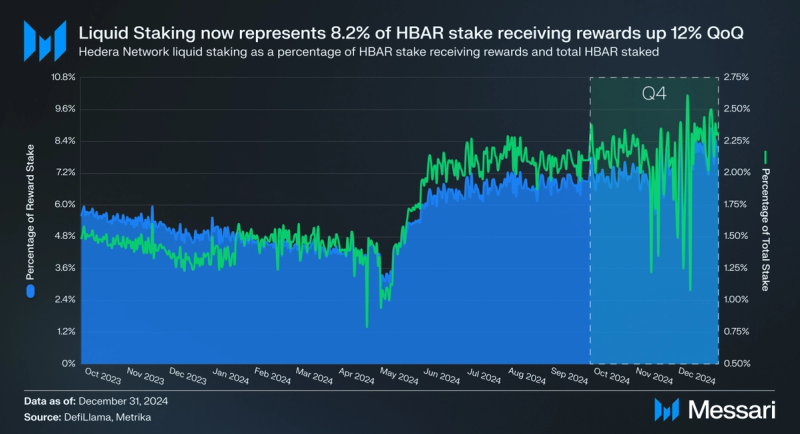

The HBAR Foundation’s DeFi growth initiative made liquid staking a priority of the program, and it appears to have spurred the growth of liquid staking on Hedera. Liquid staking as a percentage of HBAR stake receiving rewards increased 12% QoQ, ending the quarter representing 8.2% of the total HBAR stake receiving rewards on Hedera.

The only natively deployed stablecoin on the Hedera Network is USDC. USDC on Hedera experienced strong growth QoQ, increasing its market cap from $10.2 million to $37.9 million. As of writing, 943,000 USDC, 277,000 USDT, and 100,000 DAI have been bridged to Hedera, representing roughly 3% of the natively issued USDC market cap. A significant portion of natively issued USDC and bridged stablecoins are used in Hedera’s DeFi ecosystem, with roughly 10% of natively issued USDC supplied in Bonzo Finance alone.

Gaming

Karate Combat is a full-combat karate league that offers fans a unique entertainment experience and has contributed to a large amount of activity on the Hedera network. Fans vote on who they believe will win a match via Karate Combat’s mobile application, the web application, or on Snapshot. This voting process is called “playing” by the protocol and uses KARATE tokens. When fans correctly predict the winner of a match, they are rewarded with KARATE tokens, and if they are wrong in their prediction, they lose nothing.

The KARATE token is available on Hedera and Ethereum, but there are some differences depending on where users have their tokens and how they want to play. Fans who cast their votes on the Karate Combat mobile application will be using the Hedera network to do so. In contrast, both Hedera and Ethereum wallets are available to users of the web application. Fans with KARATE tokens on Ethereum can also vote through Snapshot if they want to. Additionally, fans voting on Ethereum will need to claim their KARATE token rewards after correctly predicting the outcome of a match, whereas fans using the mobile application powered by Hedera will have their KARATE tokens airdropped to them.

The KARATE token is also used as the league's governance token. After suggestions for the league's ruleset are fleshed out in the governance forum, KARATE holders can vote on the proposals. The most recent rule change was KICK-10, which sought to allow elbow strikes.

Karate Combat events are free to watch and can easily be found on their YouTube channel, amongst other platforms. They have amassed over 750,000 subscribers and frequently get 100,000 views on their event streams. In Q4, the average amount of KARATE played on each Karate Combat event on Hedera increased by 38% QoQ, rising from 4.2 billion HBAR to 5.9 billion HBAR. Furthermore, Karate Combat’s users increasingly choose to play on Hedera, with Hedera’s market share rising to 81% of all KARATE played.

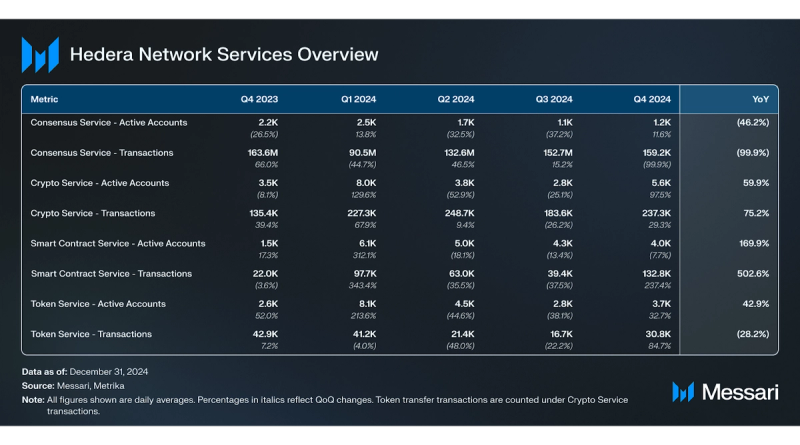

Network Services Overview

The Hedera Network Services are the core offerings of the Hedera network. These services include the Consensus Service, Smart Contract Service, and Token Service. All these services are supported by the Hashgraph algorithm and offer official SDKs for accessing the API in programming languages such as JavaScript, Java, Go, and Swift, as well as community SDKs supporting .NET, Python, and Venin SDK for JavaScript. Each service has its intended use and primary users, and usage frequency varies depending on the service.

Consensus Service

The Hedera Consensus Service enables the verifiable time-stamping and ordering of events for Web2 and Web3 applications. Users submit messages to the Hedera Network, where the messages are time-stamped and ordered by the Hashgraph algorithm. These messages form an auditable history of verifiable and trustless events. The Consensus Service is utilized by various applications such as tracking supply chain provenance, logging asset transfers between blockchain networks, counting votes in a decentralized autonomous organization (DAO), monitoring Internet of Things (IoT) devices, and more.

In Q4, the Hedera Consensus Service daily average transactions decreased 99% QoQ to reach a yearly low of 159,200. This drastic decline can largely be attributed to Avery Dennison's atma.io platform ceasing use of Hedera’s Consensus Service. On the flip side, daily average active accounts increased 12%, rising from 1,100 to 1,200.

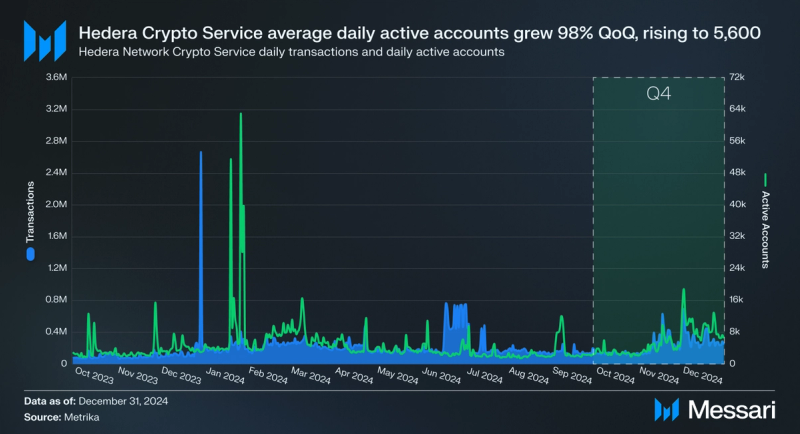

Crypto Service

The Hedera Crypto Service plays a vital role in tracking the flow of HBAR throughout the ecosystem, making the asset more liquid and mobile. Through this service, users can perform essential operations on the Hedera Network, including creating and managing accounts, transferring HBAR, fungible, and non-fungible tokens, rotating account keys, and approving account allowances.

After decreasing in Q3, Hedera’s Crypto Service transactions increased in Q4. Daily average transactions grew 29% QoQ from 183,600 to 237,300. Moving in tandem were active accounts using Hedera’s Crypto Service, which increased by 98% QoQ from 2,800 to 5,600.

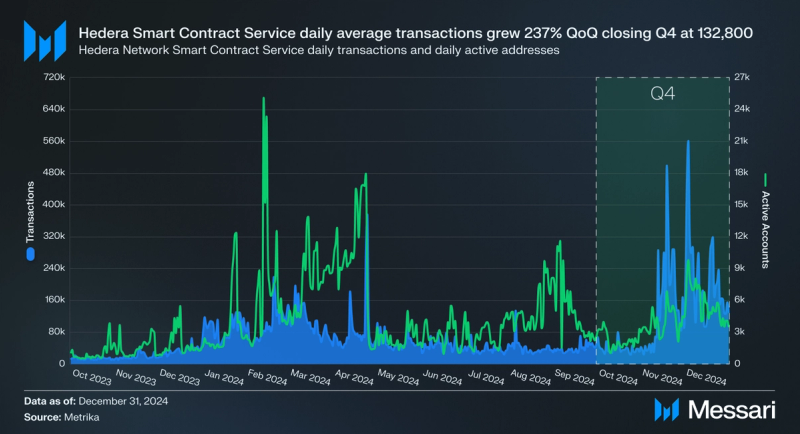

Smart Contract Service

The Hedera Smart Contract Service enables developers to create and deploy smart contracts on Hedera. The service works with the Hedera Token Service to enable users to create and deploy fungible and non-fungible tokens. The service is also EVM-compatible via the HyperLedger Besu EVM client, providing support for Solidity-based smart contracts and core Ethereum tooling.

Over the past year, Hedera has been focused on improving both the developer and user experience for the Hedera Smart Contract Service. As a result, daily average transactions and active accounts increased significantly. In Q4, daily average transactions grew 237% QoQ from 39,400 to 132,800, while daily average active accounts dipped 18% QoQ from 4,300 to 4,000. Despite the downward trend, both daily average active accounts and transactions in Q4 saw impressive YoY growth of 170% and 75%, respectively.

Improvements around the Smart Contract service continue to be worked on, as seen through a variety of HIPs. For example, HIP-904 adds support for Hedera Token Service capabilities, specifically enabling frictionless airdrops, token rejection, and automatic token association configurations to optimize token management functionality.

Token Service

The Hedera Token Service allows users to mint and manage custom fungible and non-fungible tokens on Hedera. Tokens issued on Hedera are also configurable with customizable parameters such as account KYC verification, freeze, token supply management, transfer, etc. Token transfers on Hedera always cost a transaction fee of $0.0001 USD, paid in HBAR.

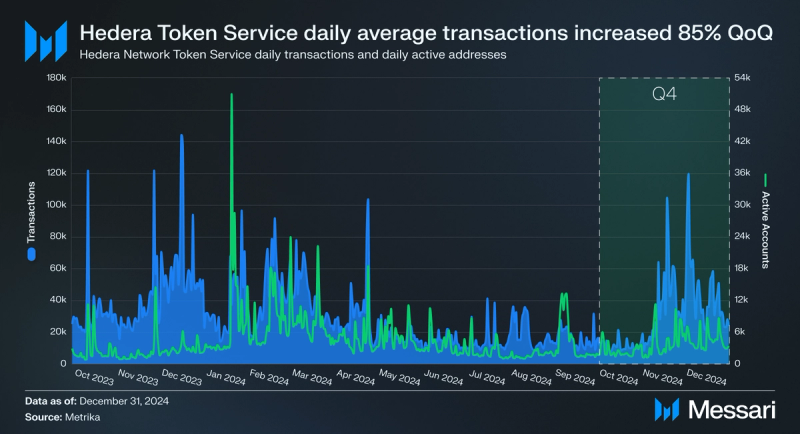

The average daily transactions for Hedera’s Token Service increased 85% QoQ, rising from 16,700 to 30,800. The average daily active addresses followed this upturn and increased 33% QoQ from 2,800 to 3,700.

Closing SummaryHedera achieved notable momentum in Q4, with the circulating market cap increasing 375% to $10.3 billion and HBAR price climbing 367% from $0.06 to $0.27. Network revenue declined due to a drop in Hedera’s Consensus Service transactions. Daily active accounts grew by 24% QoQ, despite a 10% QoQ decrease in new account creation. Average daily DEX volumes increased 530% QoQ, rising from $1.7 million to $10.7 million in Q4. Hashgraph launched its NFT Studio, Chainlink Data Feeds, and Proof of Reserve were integrated into Hedera Network along with LayerZero to extend cross-chain liquidity. Bonzo Finance launched at the end of October, closing Q4 with over $25 million in TVL as a non-custodial money market built on Aave V2 and optimized for Hedera’s EVM and Token Service. Meanwhile, Hedera’s stablecoin market cap grew 272% QoQ to $37.9 million, driven by native USDC growth, with Bonzo Finance alone hosting over $3 million in USDC.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.