and the distribution of digital products.

State of Hedera Q2 2024

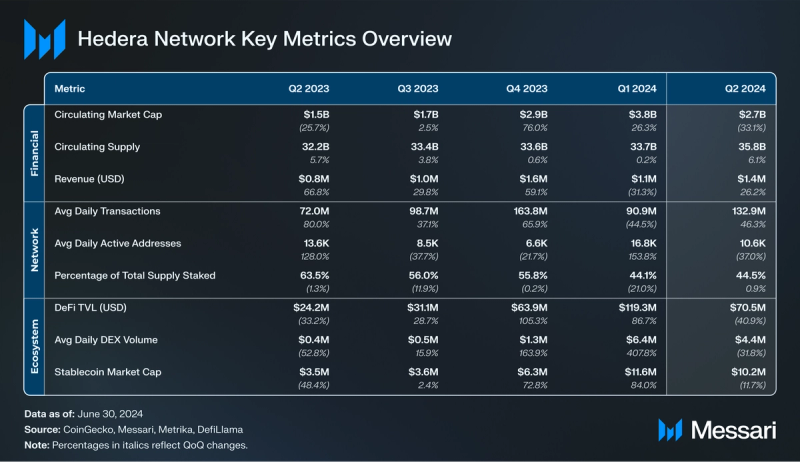

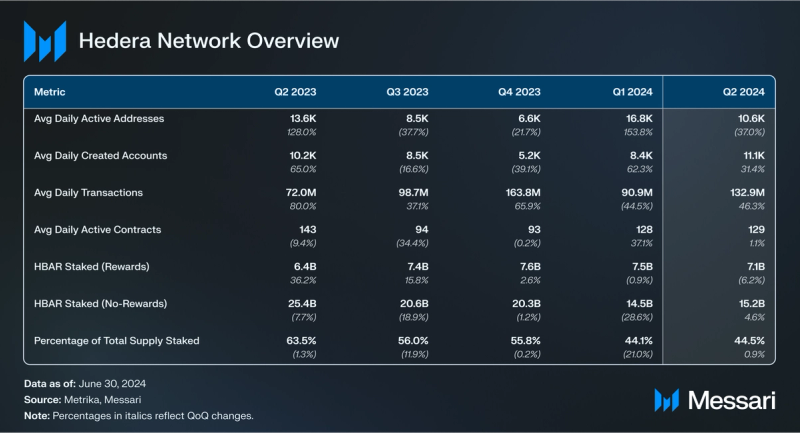

- In Q2, Hedera experienced QoQ growth across many key metrics, including revenue in USD (+26%), revenue in HBAR (+19%), average daily transactions (+46%), and average daily created accounts (+31%).

- HBAR’s circulating market cap decreased 29% QoQ to $2.7 billion. However, HBAR’s market cap amongst all tokens rose 6 spots from 36 to 30, outperforming similarly priced cryptoassets.

- Announced in May, the HBAR Foundation launched a DeFi TVL growth initiative. As a part of this initiative, 100 million HBAR was allocated to Hedera’s onchain DeFi economy in order to amplify awareness about Hedera’s DeFi ecosystem, accelerate access to DeFi products on Hedera, and catalyze liquidity and activity on Hedera.

- Archax, a digital asset exchange protocol that utilizes Hedera, tokenized shares of the BlackRock ICS U.S. Treasury Fund. This partnership showcases Hedera as an ideal blockchain for RWAs.

Hedera (HBAR) is an open-source, public-permissioned Proof-of-Stake (PoS) network. It is governed by 31 global organizations, known as the Hedera Council, with community input on the network’s features and ecosystem standards via Hedera Improvement Proposals (HIPs). The public-permissioned aspect of the network means that anyone can submit a transaction and view the network history and data; however, only pre-approved entities run the nodes that validate transactions and participate in consensus. Members of the Council operate Hedera’s validator nodes while the network has public plans to transition to fully permissionless node operation over time. Although Hedera's network operation is currently permissioned in nature, the division of responsibility across each of the 31 geographically and industry-diversified (collusion-proof) council members is unique among public networks.

The Hedera Network offers an optimized version of the Besu EVM for smart contracts (Hedera Smart Contract Service), alongside a native tokenization service (Hedera Token Service) and high-throughput data writing and verification service (Hedera Consensus Service). These services are known as the Hedera Network Services, which developers can use in a permissionless fashion to build decentralized applications in a variety of programming languages, including Solidity, JavaScript, and C++. The Hashgraph Consensus Algorithm powers the network, delivering high throughput, fair ordering, and low-latency consensus for all transactions.

Website / X (Twitter) / Discord

Key Metrics Financial Overview

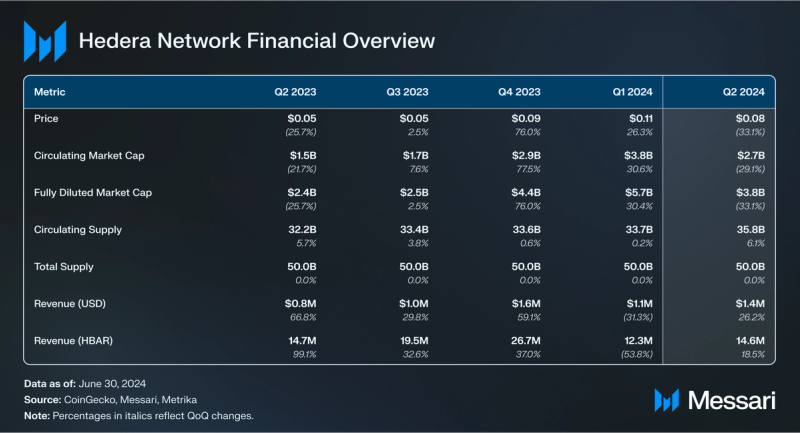

Financial Overview Market Cap and Revenue

Market Cap and Revenue

After rallying for three straight quarters, HBAR’s circulating market cap corrected in Q2, down 29% QoQ to $2.7 billion. However, HBAR’s market cap amongst all tokens rose 6 spots from 36 to 30, outperforming similarly priced cryptoassets. HBAR’s circulating market cap was also bolstered by an increase in circulating supply as the price of HBAR decreased 33% QoQ from $0.11 to $0.08.

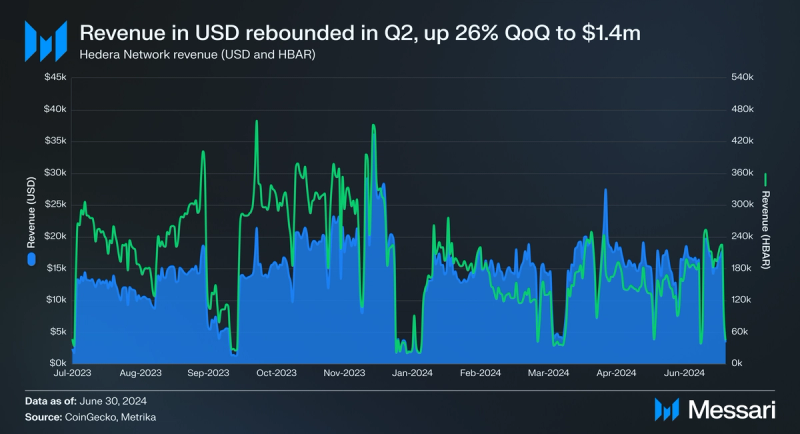

In Q2’24, Hedera Network’s revenue, derived from network transaction fees, reached its second highest quarterly mark yet (Q4’23 = $1.6 million). Revenue in USD was up 26% QoQ from $1.1 million to $1.4 million. Revenue in HBAR was also up, increasing 19% QoQ to 14.6 million.

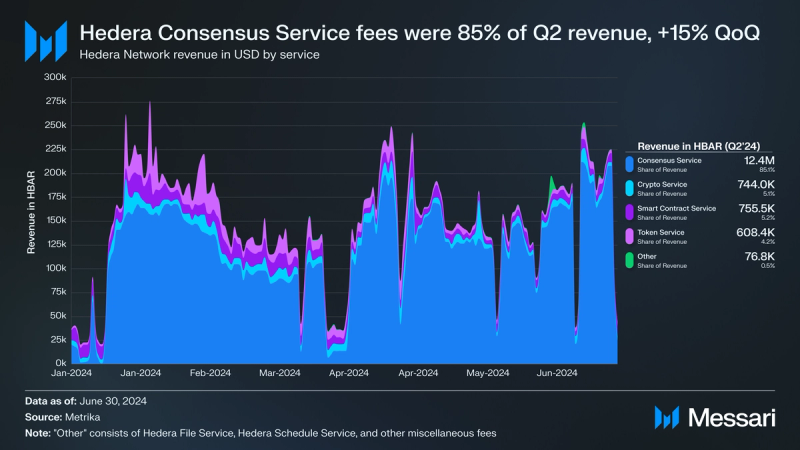

Revenue broken down by Hedera Services for Q2 was as follows:

- Hedera Consensus Service - 12.4 million HBAR, up 37% QoQ (85% of Q2 revenue)

- Hedera Token Service - 744,000 HBAR, down 5% QoQ (5% of Q2 revenue)

- Hedera Smart Contract Service - 755,500 HBAR, down 38% QoQ (5% of Q2 revenue)

- Hedera Crypto Service - 608,400 HBAR, down 50% QoQ (4% of Q2 revenue)

- Other - 76,800 HBAR, up 381% QoQ (0.5% of Q2 revenue)

HBAR, Hedera's native token, serves multiple purposes within the network. It is utilized to pay network gas fees and Hedera Network Services fees, delegate to validators, and secure the network. It also rewards Proof-of-Stake validators for operating the network. Anyone can delegate HBAR to participate in the network validation and receive a staking reward. In the future, the Hedera network will also enable staking for operating permissionless public validators and rewarding validators.

HBAR has a fixed total supply of 50 billion. At the end of Q2, 35.8 billion HBAR, representing 72% of the total 50 billion supply, was in circulation. The distribution of HBAR occurs quarterly and is reported through the Hedera Treasury Management Report. The report estimates that an additional 1.5 billion HBAR will be unlocked next quarter (Q3’24). Of this amount, 94% is allocated to ecosystem and open-source development.

Network Overview Usage

Usage

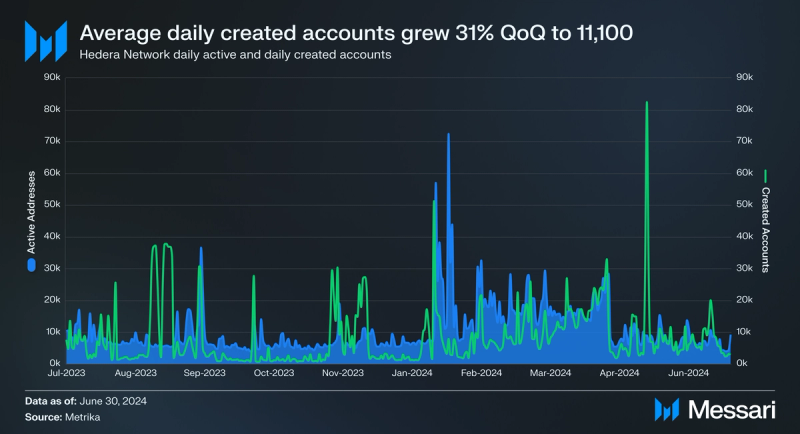

Average daily created accounts experienced a large increase in Q2, up 31% QoQ from 8,400 to 11,100. However, this did not correlate to an increase in active address activity. Average daily active addresses decreased 37% QoQ from 16,800 to 10,600. A newly created account is only treated as an active address if it paid a transaction fee for a transaction of any type, hence the disconnect in daily averages between created accounts and active addresses.One major driver of activity on Hedera is Karate Combat, a full-contact combat karate league that incorporates blockchain technology for its fan experiences. Through its KARATE token, fans can vote on the outcome of matches. The KARATE token exists on both Hedera and Ethereum, and votes can be cast on Karate Combat’s mobile app and webapp. Karate Combat events that took place in Q2 include:

- KC45 (April 20) - 1.74 billion KARATE tokens voted on Hedera (123.2 million on Ethereum) with 65,300 unique voters on Hedera and Ethereum combined.

- Up Only Poker Night (May 20) - 1.77 billion KARATE tokens voted on Hedera (347.5 million on Ethereum) with 26,700 unique voters combined.

- KC46 (May 30) - 2.31 billion KARATE tokens voted on Hedera (1.18 billion on Ethereum) with 91,600 unique voters combined.

- KC47 (June 28) - 3.17 billion KARATE tokens voted on Hedera (933.6 million on Ethereum) with 117,800 unique voters combined.

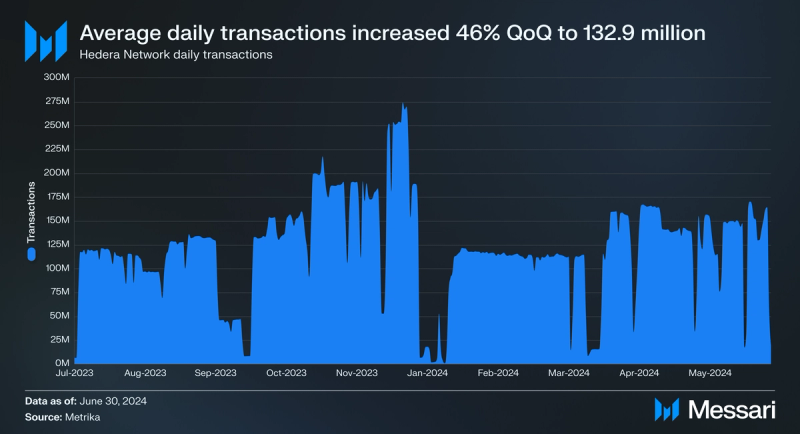

After a decrease in transaction activity in Q1, average daily transactions rebounded and increased 46% QoQ from 90.9 million to 132.9 million. The Hedera Consensus Service remains the predominant source of this activity, responsible for 99% of all transactions on the network.

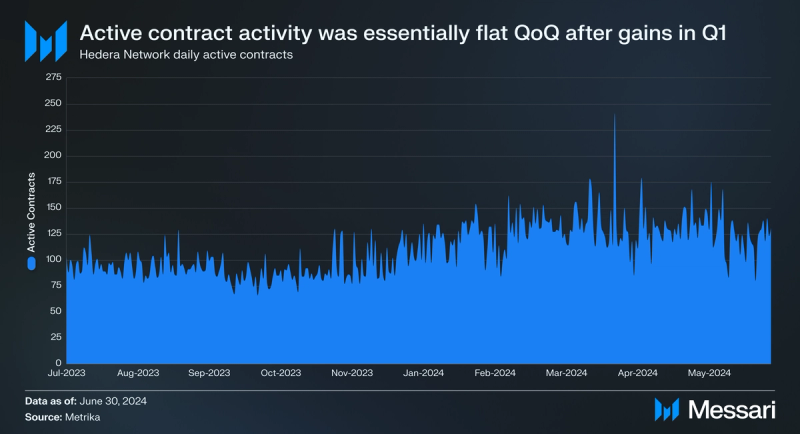

Development

In Q3’23, Hedera integrated the JSON-RPC codebase, allowing developers to use Ethereum Virtual Machine (EVM) tools. Additionally, HIP-729 was introduced, refining contract creation transactions to align more closely with EVM equivalence. These various developer-focused tools and products have helped development over the past year as average daily active smart contracts have trended upwards. Although this growth trend slowed down in Q2, average daily smart contracts slightly increased from 128 to 129.

The Hedera network underwent four onchain upgrades in Q2:

- V0.47 Upgrade (April 4) - This release included a configuration update, setting the hashesRamToDiskThreshold to 0 in MerkleDbConfig, and a backported fix for virtual map flushes. The complete list of changes can be found in the release notes.

- V0.48 Upgrade (April 25) - This release included the removal of the adjustments limit. The complete list of changes can be found in the release notes.

- V0.49 Upgrade (May 22) - This update simplified the code, enhancing scalability and collaboration, particularly for external developers. It also improved flexibility, allowing new features like synchronous mode operation and lowering entry barriers for developers familiar with other blockchain environments. Extensive testing was conducted to ensure reliability, including unit tests, end-to-end tests, performance tests, and migration tests. The update aimed to facilitate easier contributions and maintain high stability and security. The complete list of changes can be found in this blog post.

- V0.50 Upgrade (June 20) - This release brought several improvements and fixes, including a reorganization of the ISS wiring and enhancements to the differential testing scripts for better handling of modular representation in various data stores. Synchronization issues in the BreakableDataSource.saveRecords method were addressed, and the state was updated to be compatible with birth rounds. Additionally, the performance of the VirtualHasher was improved, and several fixes related to ERC-20 log events, custom fee calculations, and schedules-by-equality migration have been implemented. The update also included upgrades to the PBJ dependency and numerous other refinements to enhance system stability and performance. The complete list of changes can be found in the release notes.

Source: Hedera “X”

In Q2, no new members joined the Hedera Council, leaving the total count of members at 31 global institutions. As Hedera's network expands, the Council anticipates adding more public nodes to bolster its infrastructure. Council members serve three-year terms, are limited to two consecutive terms, and possess equal voting rights on network and platform decisions. The only permanent Council seat is held by Swirlds, the creator of Hashgraph. While it has an equal vote in decision-making, it lacks additional privileges. Current Council members include organizations like Mondelez, Dell, Google, LG, and Avery Dennison.

The Council primarily focuses on governance for network stability and Hedera Treasury management through various committees:

- TechCom: Oversees and provides insights on the Hedera Network's technological functionality, stability, and security.

- MemCom: Guides strategic decisions concerning Council membership, encompassing recruitment, selection methods, policies, and retention.

- CoinCom: Counsels the Council on treasury management, network pricing, and economic incentive structures, encompassing staking and node operations.

- CorpCom: Aids Members in identifying Hedera Network use cases and orchestrates Council-wide collaboration on market entry strategies.

- GovCom: Addresses public policy and regulatory matters impacting the Hedera Network, Council operations, or Member interactions with the network.

- MarCom: Supervises and advises the Council on marketing, public relations, and outreach initiatives.

Hedera Network consensus nodes are run by the Governing Council members. Many Layer-1 networks struggle with the geographical concentration of their nodes. Too many nodes in the same location could jeopardize the health of a network due to geopolitical risks, regulations, and acts of nature, among other reasons.

The geographical distribution of the Hedera network's validators is balanced and includes every continent except Antarctica. North America is home to 13 of the 31 consensus nodes, accounting for 40.63%, while Europe and Asia are home to 12 (37.50%) and 5 (15.63%), respectively.

In Q2, the Hedera network reported 22.2 billion HBAR staked, representing 62.2% of the circulating supply and 44.5% of the total supply. This high staking percentage relative to the circulating supply can be attributed to entities such as Swirlds and Swirlds Labs. They stake their HBAR allocations and the Hedera Treasury to assist validators in meeting the minimum staking threshold to participate in network consensus. It’s worth mentioning that these entities have chosen not to collect staking rewards. Notably, 32% of staked HBAR opted to receive rewards, down 6% QoQ from 34% in Q1’24.

Lastly, during Q3’23, the Hedera Council made modifications to the staking rewards structure. The prior staking reward rate of 6.5% was adjusted to 2.5% in August. Furthermore, a maximum of 13% of the total 50 billion HBAR supply (6.5 billion HBAR) can be staked and can qualify for the full 2.5% reward rate. The reward rate will proportionally decrease if the total staked amount exceeds 13% of the overall supply.

Ecosystem Overview DeFi

DeFi

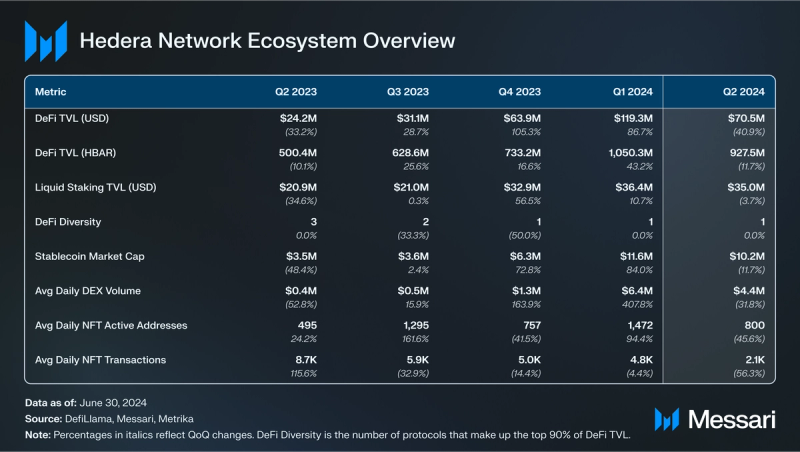

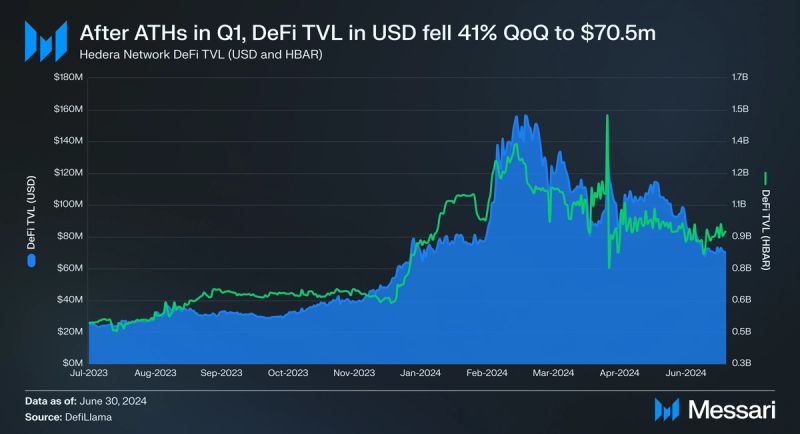

In Q1’24, DeFi Total Value Locked (TVL) on Hedera hit an all-time high in both USD ($119.3 million) and HBAR (1.1 billion). As for Q2, DeFi TVL pulled back in both USD (down 41% to $70.5 million) and HBAR (down 12% to 927.5 million). However, the delta between the decreases in USD TVL and HBAR TVL decreases suggests that the majority of he TVL decline was due to the depreciation in price of HBAR, not capital outflows. As of writing, Hedera is ranked #51 by TVL among blockchain networks (down 7 spots QoQ). Announced in May, the HBAR Foundation launched a DeFi TVL growth initiative. As a part of this initiative, 100 million HBAR is allocated to Hedera’s onchain DeFi economy. The initiative consists of three primary goals: (i) amplifying awareness about Hedera’s DeFi ecosystem, (ii) accelerating access to DeFi products on Hedera, and (iii) catalyzing liquidity and activity on Hedera.

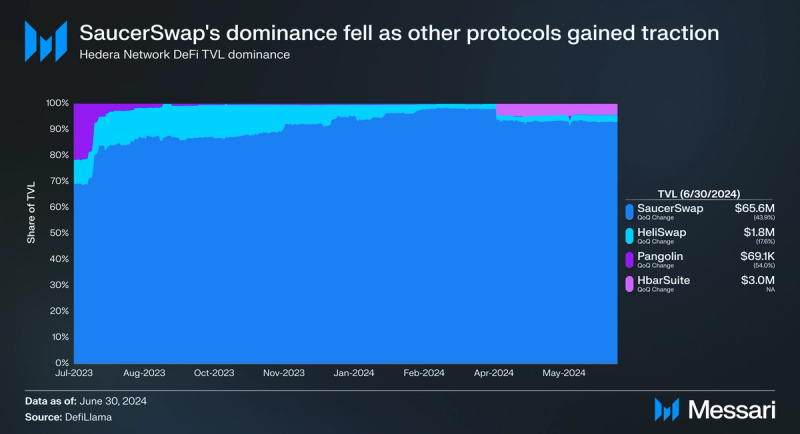

Hedera’s DeFi ecosystem, led by SaucerSwap, is off to a hot start in 2024. A year ago, SaucerSwap TVL stood at $17.3 million. Since then, SaucerSwap has innovated and improved its product offering. Highlights include the launch of SaucerSwap V2 in Q4, which introduced concentrated liquidity, MetaMask support, Tokenomics V2, and the Liquidity-Aligned Reward Initiative (LARI) to SaucerSwap.

Additionally, at the end of Q1’24, SauceSwap launched Auto Pools. Leveraging ICHI’s “Yield IQ,” Auto pools provide Active Liquidity Management (ALM) for SaucerSwap V2 liquidity pools. Auto pools efficiently rebalance deposited funds across specific price ranges, making liquidity provision simpler and more user-friendly. SaucerSwap’s TVL did, however, pull back in Q2, decreasing 44% from $117.0 million to $65.6 million. SaucerSwap benefited from the HBAR Foundation’s DeFi initiative, which allocated 23.2 million HBAR to SaucerSwap for liquidity incentives, fee rebates, and a token faucet. By the end of Q2, SaucerSwap consisted of 93% of Hedera’s DeFi TVL (down 5% QoQ from 98%).

The rest of Hedera’s DeFi TVL is split across HeliSwap, Pangolin, and HbarSuite. HbarSuite emerged as the #2 DeFi protocol in Q2, ending the quarter with $3.0 million TVL. HeliSwap and Pangolin both saw downtrends in TVL, down 18% QoQ to $1.8 million and down 54% to $69,100, respectively. DeFi Diversity measures the number of protocols that constitute the top 90% of DeFi TVL. A greater distribution of TVL across protocols reduces the risk of widespread ecosystem contagion resulting from adverse events like exploits or protocol migrations. The Hedera network ended Q2 with a DeFi Diversity score of 1 (flat QoQ).

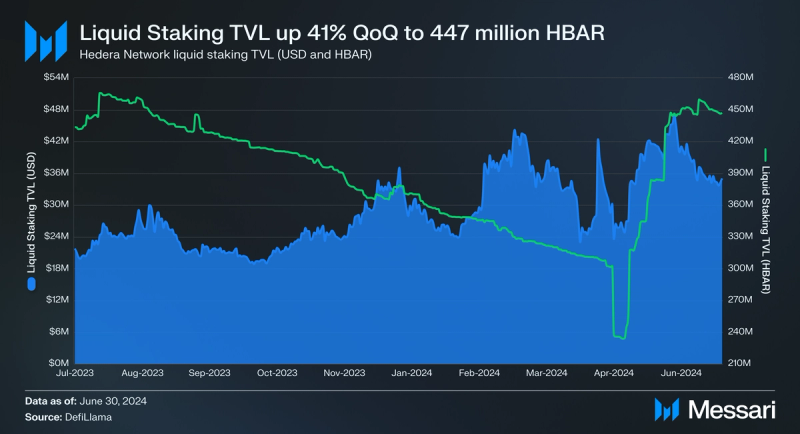

Liquid staking is not included in the TVL figure. Despite this, it remains a relevant metric with growing significance. Stader is the only provider of liquid staking on the Hedera network. Upon the introduction of the Hedera network's staking program, Stader's TVL peaked in Q1 2023. Following this peak, there has been a gradual net outflow of Stader's TVL in HBAR. This trend reversed in Q2 as liquid staking TVL increased 41% QoQ from 318.0 million to 447.0 million. Liquid staking TVL in USD decreased slightly QoQ due to HBAR price depreciation, falling 4% from $36.4 million to $35.0 million. Liquid staking TVL was bolstered by the HBAR Foundation’s DeFi growth initiative, which made liquid staking a priority of the program.

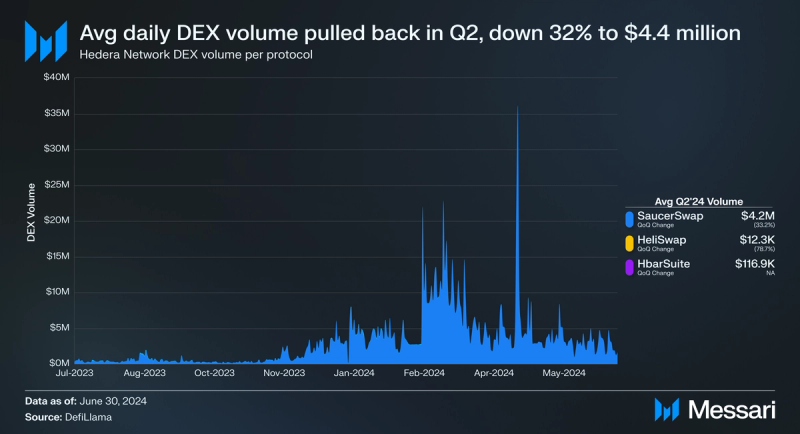

Similarly to the rest of the market, DEX volumes on Hedera pulled back after a bullish Q1. The average daily DEX volume decreased 32% QoQ from $6.4 million to $4.4 million. Notably, while Q1’24 set an all-time high for DEX volumes on Hedera, Q2 was the second highest to date. Compared to last year (Q2’23), average daily DEX volume was 960% higher in Q2’24.

Essentially all DEX volumes (97%) on Hedera occur on SaucerSwap. In Q4’23, SaucerSwap introduced a concentrated liquidity (CL) AMM to its product suite (SaucerSwap V2). Due to this, SaucerSwap can offer more efficient pricing for token swaps, leading to higher volume. For example, prior to the launch of V2, SaucerSwap averaged $438,500 daily volume in Q3'23 (10% of SaucerSwap’s average daily DEX volume for Q2’24).

The only natively deployed stablecoin on the Hedera Network is USDC. USDC on Hedera has been gradually trending upwards over the past year, with its first real pullback coming in Q2. By the end of the quarter, USDC on Hedera had a market cap of $10.2 million, down 12% QoQ from $11.6 million. Furthermore, a significant portion of this USDC is being used in Hedera’s DeFi ecosystem. As of writing, there was also $2.8 million USDC (27% of Hedera’s USDC supply) deposited into SaucerSwap liquidity pools. Additionally, USDT and DAI have been bridged to Hedera using Hashport. There was also $252,100 USDT and $93,000 DAI deposited into SaucerSwap liquidity pools.

NFTs and Gaming

As a part of the V0.49 upgrade, dynamic NFTs were enabled on Hedera through a series of Hedera Improvement Proposals (HIP):

- HIP-646: Fungible Token Metadata Field - Adds a standardized metadata field for fungible tokens, allowing updates by the admin key or a new metadata key.

- HIP-657: Mutable metadata Fields for Dynamic NFTs - Enables dynamic NFTs with updatable metadata, managed by a newly introduced metadata key, supporting automated or manual updates.

- HIP-765: NFT Collection Token Metadata Field - Introduces a metadata field for NFT collections, allowing updates by the admin key or metadata key to provide collection-wide information.

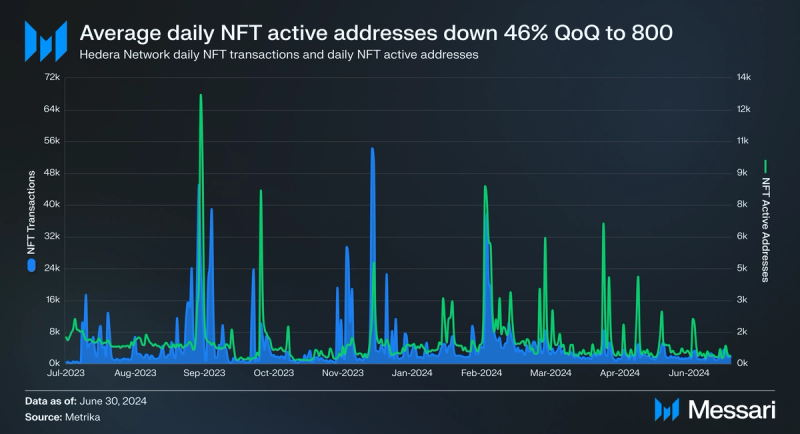

Despite these advancements in Hedera’s NFT space, NFT-related activity was down in Q2. In Q2, the network averaged 2,100 daily NFT transactions, a 56% QoQ decline. Additionally, average daily NFT active addresses were down 46% QoQ to 800.

As for gaming, two projects within Hedera’s gaming ecosystem announced fundraising rounds in Q2. Circle of Games, a Play-to-Earn (P2E) gaming project, raised $1 million from Nazara and The Hashgraph Association in April. Then, in May, a Web3 role-playing game (RPG) called Astra Nova raised $1 million with participation from Hashgraph Ventures, Oxbull, MoonEdge, Vision, Kanga, Spicy Capital, Equinox, BTS Labs, Sensei Capital, and MENA Investors from Saudi Arabia, Dubai, and Oman.

Ecosystem GrowthHedera experienced a series of positive ecosystem developments in Q2:

- Community DAO (April 9) - The HBAR Foundation announced it intends to fund a Community DAO for Hedera in April.

- Hashio DAO (April 10) - Developed and launched by Hashgraph, Hashio DAO is an open-source interfact for creating and managing DAOs on Hedera.

- Hashport Network Grant (April 11) - Bridging protocol Hashport Network received a grant from the HBAR Foundation in April.

- Archax Money Market Fund Offerings on Hedera (April 23) - Archax, a digital asset exchange protocol that utilizes Hedera, tokenized shares of the BlackRock ICS U.S. Treasury Fund.

- SKUx Signs Agreement with Visa (May 16) - SKUx, a digital payments firm that utilizes Hedera, signed an agreement with Visa. This agreement aims to accelerate digital payment adoption for merchants.

The Hedera Network Services are the core offerings of the Hedera network. These services include the Consensus Service, Smart Contract Service, and Token Service. All these services are supported by the Hashgraph algorithm and offer official SDKs for accessing the API in programming languages such as JavaScript, Java, Go, and Swift, as well as community SDKs supporting .NET, Python, and Venin SDK for JavaScript. Each service has its intended use and primary users, and usage frequency varies depending on the service.

Consensus Service

The Hedera Consensus Service enables the verifiable time-stamping and ordering of events for Web2 and Web3 applications. Users submit messages to the Hedera Network, where the messages are time-stamped and ordered by the Hashgraph algorithm. These messages are used to form an auditable history of verifiable and trustless events. The Consensus Service is utilized by various applications such as tracking supply chain provenance, logging asset transfers between blockchain networks, counting votes in a decentralized autonomous organization (DAO), monitoring Internet of Things (IoT) devices, and more.

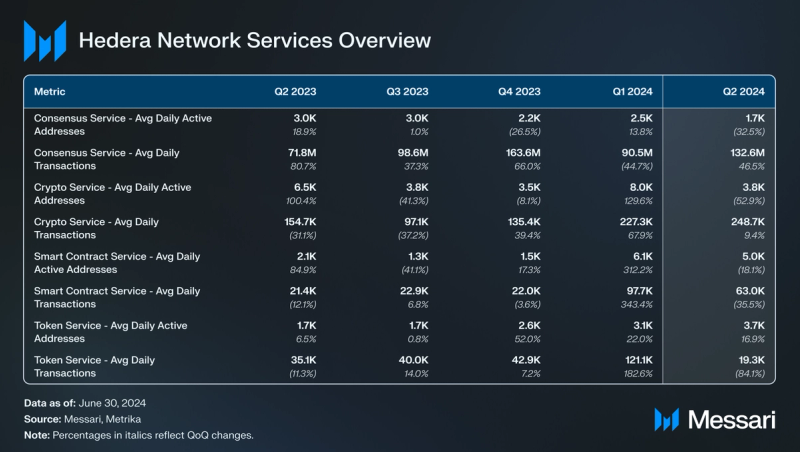

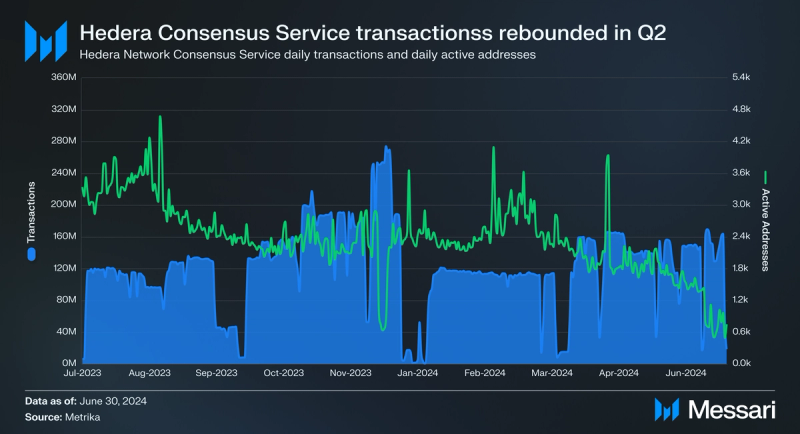

In 2023, the Hedera Consensus Service witnessed substantial growth, culminating with record-high transaction activity in Q4. After this all-time, average daily transactions dropped off in Q1. In Q2, average daily transactions rebounded from this dropoff, increasing 47% QoQ from 90.5 million to 132.6 million. However, daily average active addresses saw a QoQ decline, down 33% to 1,700.

One avenue of growth for the Hedera Consensus Service in 2024 has been inscriptions, specifically Hashinals (HCS-5). Hashinals enable metadata to be stored entirely onchain through the Hedera Consensus Service. Unlike traditional NFTs, Hashinals typically store metadata offchain. As of writing, over 132,300 Hashinals have been minted on the Hedera Consensus Service.

Crypto Service

The Hedera Crypto Service plays a vital role in tracking the flow of HBAR throughout the ecosystem, making the asset more liquid and mobile. Users can perform essential operations on the Hedera Network through this service, including creating and managing accounts, transferring HBAR, fungible, and non-fungible tokens, rotating account keys, and approving account allowances.

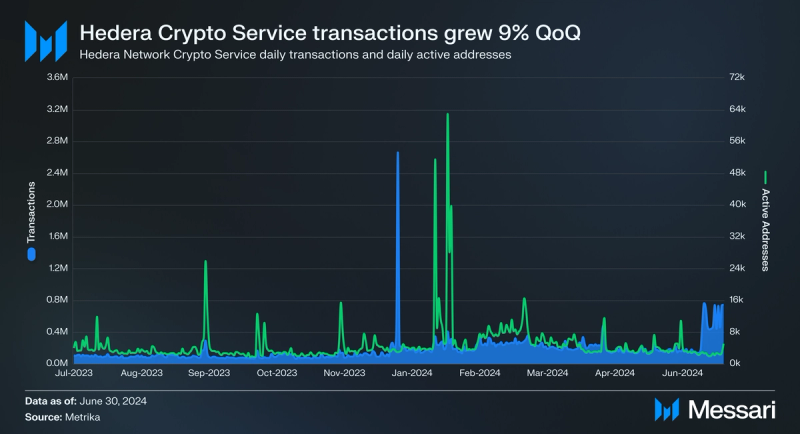

For the third straight quarter, transaction activity on the Hedera Crypto Service increased. Average daily transactions grew 9% QoQ from 227,300 to 248,700. However, average daily active addresses decreased by 53% QoQ to 3,800.

Smart Contract Service

The Hedera Smart Contract Service enables developers to create and deploy smart contracts on Hedera. The service works with the Hedera Token Service to enable users to create and deploy fungible and non-fungible tokens. The service is also EVM-compatible via the HyperLedger Besu EVM client, providing support for Solidity-based smart contracts and core Ethereum tooling.

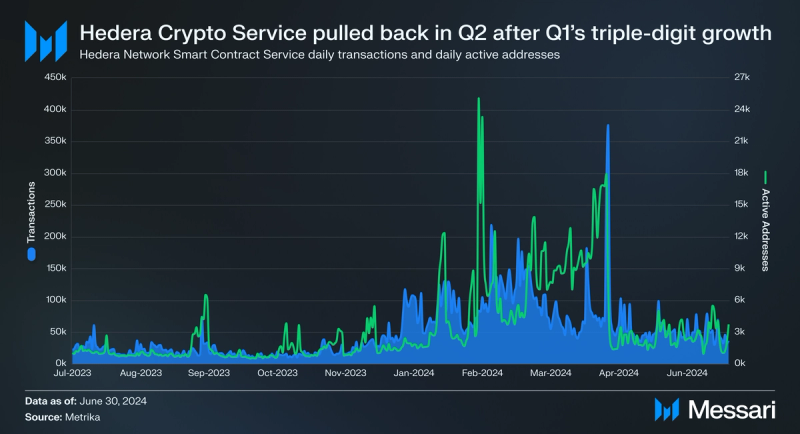

Improving both the developer and user experience for the Hedera Smart Contract Service has been a major initiative for Hedera over the past year. Starting in Q3’23, Hedera's core developers implemented an update that revamped the authorization process. This change prevents account key signatures from granting authorization for contract actions, limiting smart contracts to modifying only their own storage or that of delegate calls made to them. Additionally, the Hedera community unveiled developer-centric products and forged strategic partnerships to enhance EVM tooling and compatibility.

In Q4’23, Hedera core developers released two more important security updates for the Smart Contract Service. The first update, HSCS Security Model V2, enhanced security by refining authorization rules, introducing a three-level security approach, and addressing vulnerabilities. The second update was the introduction of Smart Contract Verification, aimed at enhancing trust among smart contract users. This feature enables the verification of smart contract source code, categorizing results as no match, partial match, or full match. Hedera hosts this service through Sourcify, ensuring accessibility at verify.hashscan.io and other Hedera blockchain explorers.

These efforts resulted in triple-digit QoQ growth in transactions and active addresses by the Hedera Smart Contract Service in Q1. In Q2, both metrics pulled back. Average daily transactions were down 36% QoQ from 97,700 to 63,000, while average daily active addresses were down 18% QoQ from 6,100 to 5,000.

Token Service

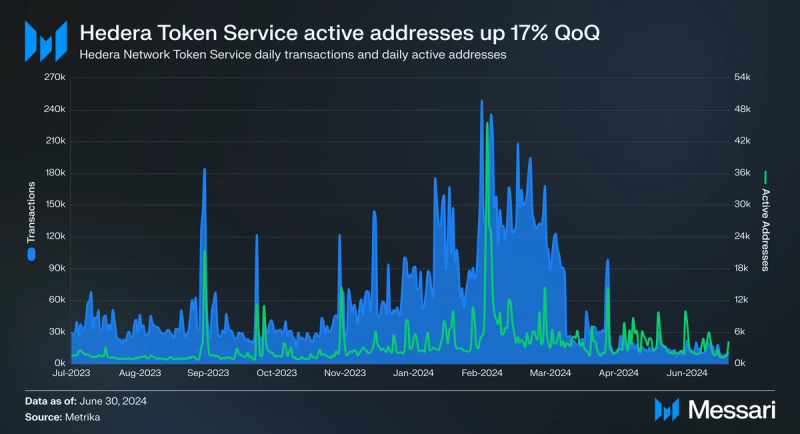

The Hedera Token Service allows users to mint and manage custom fungible and non-fungible tokens on Hedera. Tokens issued on Hedera are also configurable with customizable parameters such as account KYC verification, freeze, token supply management, transfer, etc. Token transfers on Hedera always cost a transaction fee of $0.0001 USD, paid in HBAR.

Similar to the Hedera Smart Contract Service, the Hedera Token Service exhibited impressive transaction growth in Q1 which subsequently pulled back this quarter. Average daily transactions were down 84% QoQ from 121,100 to 19,300, while average daily active addresses grew 17% QoQ to 3,700.

At the end of Q2, the 0.V50 Upgrade implemented HIP-540: Change or Remove Existing Keys From a Token. This upgrade brings more flexibility and security for token and NFT management on Hedera by introducing upgradeability to admin keys for a given token or NFT. Looking forward, this upgrade may have a positive impact on Hedera Token Service activities in the future.

Closing SummaryQ2'24 was both a period of growth and challenges for Hedera. HBAR’s market cap fell by 29% QoQ to $2.7 billion, but network revenue increased by 26% to $1.4 million, mainly from the Hedera Consensus Service. Daily transactions rose 46%, though active addresses dropped by 37%. Important upgrades, including V0.47 to V0.50, improved network functionality. DeFi TVL in USD declined by 41%, largely due to HBAR price drops, with SaucerSwap holding a major share. Staking remained robust, with 62.2% of the circulating supply staked. The HBAR Foundation's initiatives continued to support ecosystem growth. NFT activity decreased, but gaming projects like Circle of Games and Astra Nova received significant funding. Key developments included the launch of Hashio DAO and partnerships with Visa and Archax. Hedera's ongoing upgrades and initiatives position it for future growth in the blockchain landscape.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.