and the distribution of digital products.

State of Flow Q1 2025

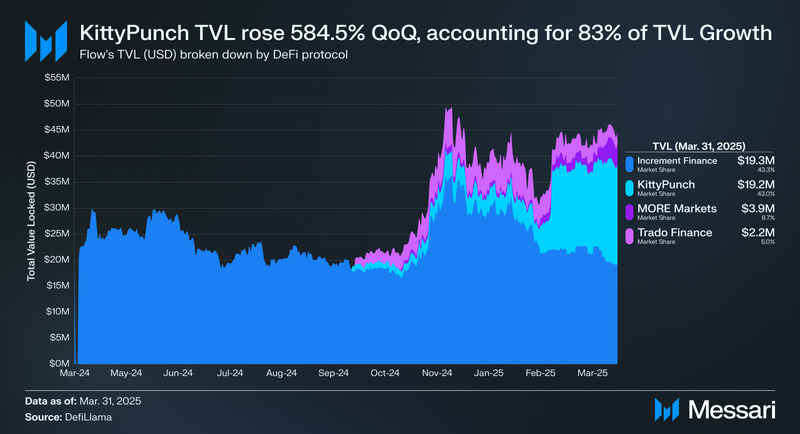

- Flow DeFi TVL hit a new all-time high, increasing 17.7% QoQ to $44.4 million, due to significant growth in DeFi projects such as KittyPunch and MORE Markets.

- Flow was the fastest-growing L1 ecosystem in weekly developer growth during Q1. Developer momentum shifted to core work, with the average weekly core devs rising 15.3% to 67.8, and core-repo commits rising 26.5% to 552.

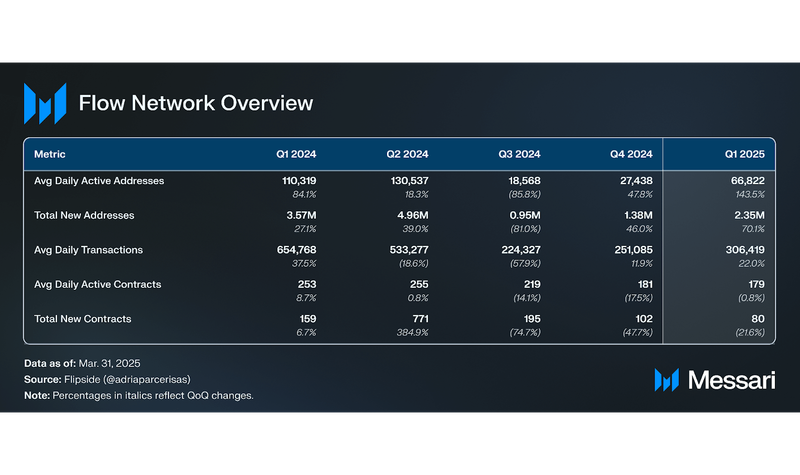

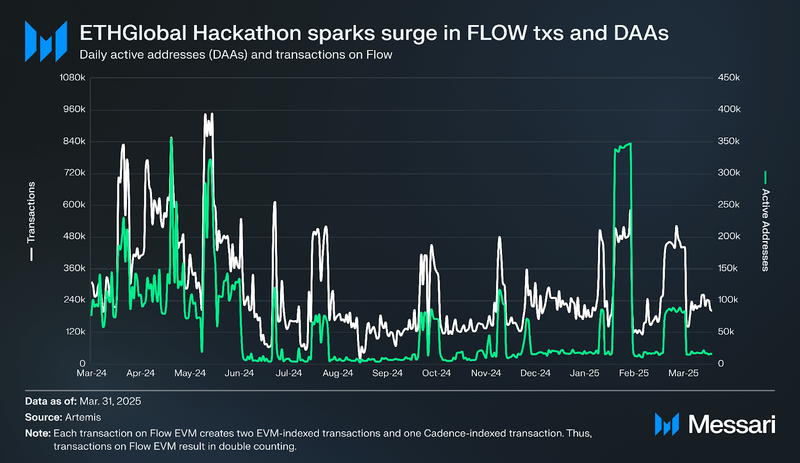

- Average daily active addresses jumped 144% to 66,822, while average daily transactions rose 10.6% to 277,782.

- LayerZero, Axelar, and deBridge deployed bridges to Flow EVM. Together, they connect Flow to more than 100 external networks, letting users move wrapped USDC, PayPal’s PYUSD (listed on Flow as USDF), and other assets directly into the ecosystem.

- OpenSea went live on the Flow blockchain as part of its OS2 beta, enabling users to trade NFTs and earn XP on the largest NFT marketplace using Flow Wallet.

- NBA Top Shot ranked in OpenSea’s top-five trending collections for four consecutive weeks after its OS2 debut, which opened with over 21,000 sales from more than 2,100 traders in the first week.

Flow (FLOW) is a Layer-1 network that was founded in 2018 by Dapper Labs and its co-founders, Roham Gharegozlu, Dieter Shirley, and Mikhael Naayem. Flow launched in May 2020 and was designed for “a new generation of games, apps, and the digital assets that power them.” Flow was one of the first networks to implement account abstractions and user experience enhancements that made it easier for developers to onboard consumers. Today, Flow’s top applications include those based on world-class brands, such as NBA Top Shot and NFL All Day.

On Flow, developers use “Cadence,” Flow’s novel programming language. Flow’s most recent development took place in March when Flow activated a rolling protocol upgrade system on mainnet. This mechanism coordinates behavior changes at predetermined block heights, so nodes can verify compatibility and upgrade without interrupting block production. By eliminating most downtime, rolling upgrades strengthen network resilience, streamline future releases, and let developers ship improvements faster. The new system builds on earlier Height-Coordinated Upgrades and marks Flow’s first major step beyond the Crescendo release. In September 2024, Flow introduced Cadence 1.0 with the Crescendo upgrade, bringing EVM equivalence to Flow via a separate Flow EVM environment. Now, developers can use Solidity to build on Flow EVM with block times of 800 milliseconds. Furthermore, developers can tap into existing tools and liquidity across the EVM, while users experience sub-cent transaction fees.

Flow has played a significant role in onboarding consumers into crypto by pioneering the ERC-721 token standard via CryptoKitties in 2017 and putting NFT collectibles into the mainstream via NBA Top Shot in 2021. Today, Flow continues to innovate and be a foundational part of the industry’s effort to bring new users into the space. For a full primer on Flow, refer to our Initiation of Coverage.

Website / X / Discord / Telegram

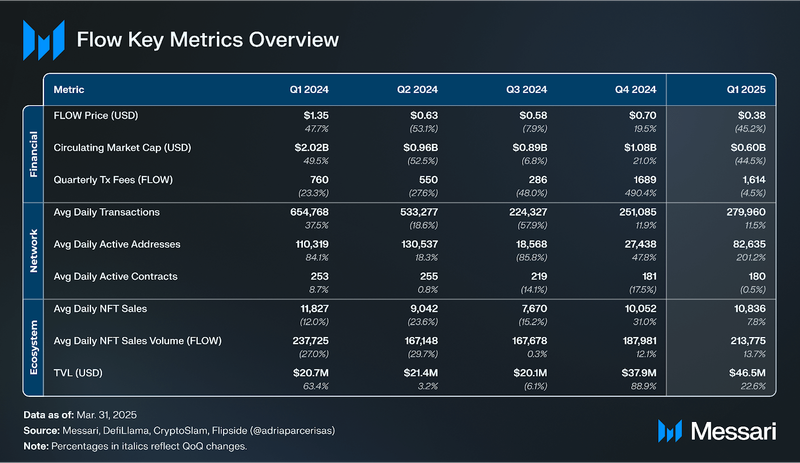

Key Metrics Financial Analysis

Financial Analysis

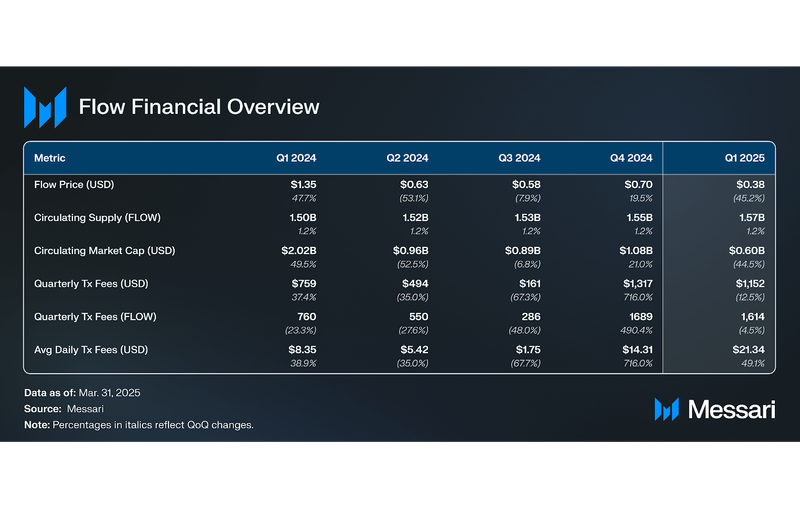

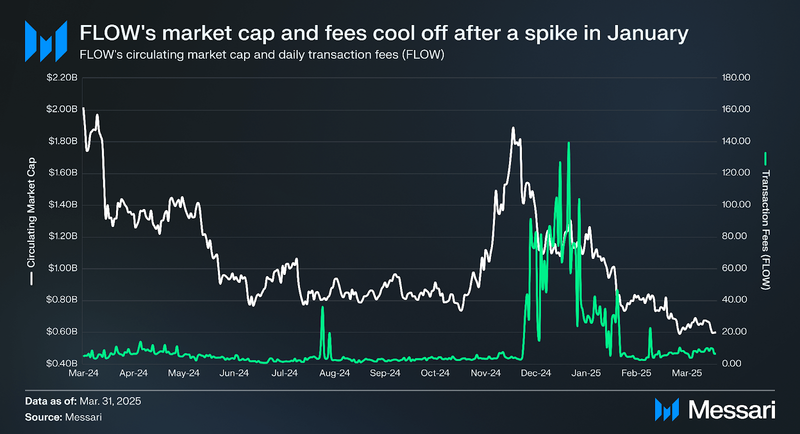

FLOW is the native token of Flow that is used (i) as the primary medium of exchange on Flow and (ii) for staking to facilitate various staking-related functions. In Q1 2025, FLOW’s price fell 45.2% QoQ to $0.38, its lowest close since Q3 2024. That pullback cut circulating market capitalization by 44.5% to about $0.6 billion, while circulating supply edged up 1.2% to 1.57 billion FLOW in line with the protocol’s weekly inflation schedule. FLOW’s circulating market cap ranking fell from 89th to 92nd.

FLOW is used to settle network transaction fees on Flow. The total transaction fee for any transaction on Flow comprises a variable “execution fee” plus a fixed “inclusion fee,” which is then multiplied by a “surge factor.” Network transaction fees cooled after the Q4 hackathon-fueled spike (discussed later in report). Total quarterly fees in USD dropped 12.5% to $1,152, and fees in FLOW slipped 4.5% to 1,614. Yet average daily fees climbed 49.1% to $21.34. A burst of activity in early January lifted the daily average even as transactions eased through February and March.

FLOW’s initial token supply was 1.25 billion upon Flow’s “Mainnet v1” launch in October 2020. However, the total token supply experiences inflation once per epoch (approximately once a week) due to inflationary staking rewards distributed to Flow’s validator nodes and delegators. Inflation over an annual period is equivalent to 5% of FLOW’s total token supply.

As explained in our Initiation of Coverage, combined weekly staking rewards comprise all network transaction fees, with any remaining amount being minted as inflationary staking rewards.

- Stakers, including validator nodes that have self-staked, receive 92% of weekly staking rewards proportional to their stake.

- Validator nodes also receive 8% of weekly staking rewards as commission.

As of March 31, 2025, FLOW’s total token supply has increased to 1.57 billion, and weekly inflation equates to approximately 1.47 million FLOW per week. 602.4 million FLOW (38.3% of the total token supply) was staked, down 10.1% from 670.5 million in Q4.

Network Analysis

Flow’s Q1 adoption demonstrated the network’s capacity to scale around major developer events. Average daily transactions reached 277,782, up 10.6% from 251,100 in Q4, while average daily active addresses climbed to 66,822, versus 27,438 in Q4. This left the average transactions‐per‐address ratio relatively unchanged at 9.1 (vs. 9.2 in Q4). This uptick in activity was driven by the ETHGlobal Agentic Virtual Hackathon (Jan 31 – Feb 10), during which transactions peaked at 581,066 and active addresses at 347,015.

By quarter‑end, active addresses settled to 7,707, below Q4’s year‑end level of 16,094, reflecting the tapering of the hackathon surge; yet transaction levels remained above Q4’s average even outside the event window. Leveraging similarly high‑impact, themed hackathons or developer initiatives could drive spikes in network adoption in Q2.

Protocol Autonomy RoadmapFlow was designed from its conception to be fully decentralized and Byzantine Fault Tolerant (BFT). Rather than relying on centralized components or human intervention for security, the Flow team has adopted a phased approach to the protocol implementation, incrementally opening up the platform and aiming to eliminate implementation shortcuts that still rely on humans for security. This long-term strategy is summarized in the Protocol Autonomy Roadmap.

This roadmap outlines the systematic process for enabling permissionless participation across all node types. The core motivation is to achieve true network autonomy and resilience against adversarial behavior by ensuring that the software running on nodes can effectively handle malicious actors (Byzantine nodes). While many existing Proof-of-Stake (PoS) networks still rely on human intervention for slashing in cases of malicious behavior, the Flow ecosystem seeks to capitalize on its vetted node operator network for resilience until the node-specific logic for each node type is fully BFT.

A fundamental element enabling this roadmap is Flow's unique multi-node architecture, which consists of five individual node types: Collection, Consensus, Execution, Verification, and Access Nodes. By splitting the work of a monolithic chain into specialized roles, Flow can dial security, throughput and hardware requirements independently for each tier, achieving scale without the usual trade-off against decentralization. This design underpins the gradual rollout of permissionless participation: low-risk Access Nodes opened first, while higher-impact roles move through rigorous BFT hardening and simulation before being thrown open to the wider validator community.

Today, a vetted validator set and limited manual fallbacks still provide defense to the chain, but the roadmap’s Consensus and Verification BFT upgrades and an end-to-end slashing framework will shift that burden to protocol logic. Once complete, Flow expects every node type to enter a fully autonomous regime, cementing the network’s resilience against coordinated byzantine behavior and supporting long-term, permissionless growth.

Cross-chain IntegrationsIn Q1, Flow partnered with several cross-chain bridges, including LayerZero, Axelar, and deBridge, integrating the network with over 100 chains. These new bridges sit alongside Flow Bridge, Celer cBridge, Hyperlane, and Relay.

Flow became the first chain to integrate via Axelar’s new Mobius Development Stack (MDS) kit, a toolkit that turns cross-chain infrastructure into a plug-and-play developer experience. Consumer apps gain permissionless access to external liquidity, users, and smart contract calls across 75 ecosystems without writing custom bridge code.

Stargate lets users move native assets through a single, unified liquidity pool instead of wrapped tokens, slashing slippage on large transfers. Stargate links the Flow network to 100+ chains through LayerZero’s omnichain messaging layer.

deBridge was integrated in March, providing near-instant settlement and secure asset custody. Flow is the tenth chain to subscribe to deBridge’s Interoperability-as-a-Service (IaaS), making it instantly composable with 19 networks on the protocol.

For developers, the net result is lower friction (one-click deposits, no wrapped assets), richer composability (cross-chain calls and swaps baked into smart-contract logic), and a larger addressable user base, all prerequisites for the consumer-scale apps Flow targets.

Ecosystem Analysis Consumer

ConsumerFlow continues to lean heavily into consumer-facing applications, especially in sports, gaming, and collectibles. The chain sustains momentum through partnerships with major entertainment and sports brands. NBA Top Shot, NFL All Day, and related IP-backed collectibles remain dominant collections in Q1.

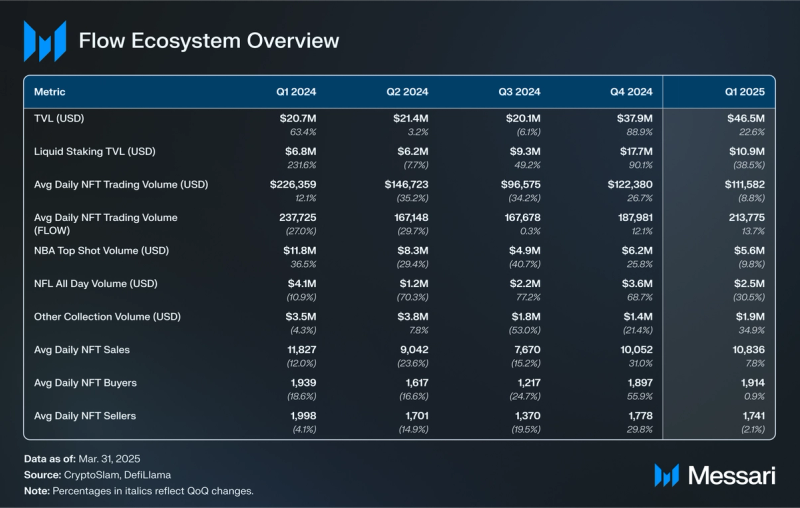

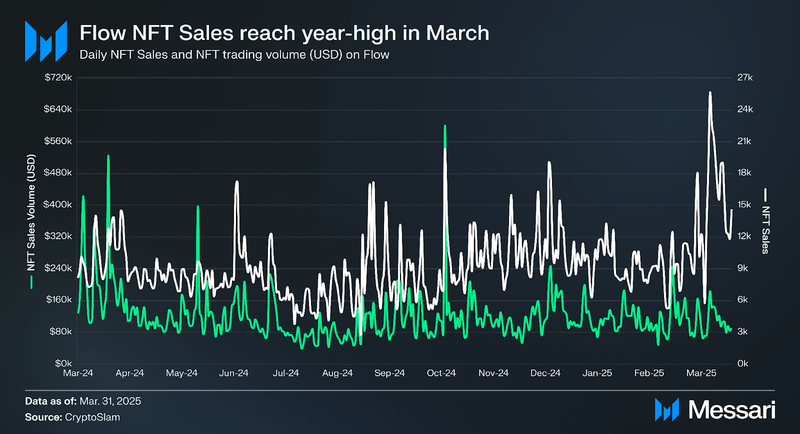

The NFT ecosystem on Flow is the most active sector on the network. Average daily NFT sales on Flow increased 7.8% QoQ to 10,835 in Q1 2025, while average daily NFT trading volume (USD) decreased 8.8% to $111,582.

Flow’s two native NFT marketplaces are Flowverse and Flowty. In February, OpenSea went live on the Flow blockchain as part of its OS2 beta, enabling users to trade NFTs and earn XP on the platform using Flow Wallet. In March, OpenSea announced that NBA Top Shot is now tradable on the platform, bringing the Flow network’s most successful NFT collection to the largest NFT marketplace. NBA Top Shot ranked in OpenSea’s top five trending collections for four consecutive weeks after its OS2 debut, which opened with 21,000+ sales from over 2,100 traders in the first week. Flow’s top collectible NFT projects include:

- The officially licensed Mattel Hot Wheels and Barbie collectibles.

- Hot Wheels Garage V2 trading volume increased 85.7% QoQ to $0.36 million.

- The officially licensed Disney, Pixar, and Star Wars collectibles via Disney Pinnacle.

- The officially licensed Dr. Seuss collectibles, Seussibles. Fans can snap up digital packs without setting up a wallet, then swap duplicate cards through an easy barter interface. Inside the app collectors organize, stack, and display stickers featuring the Cat in the Hat and the Grinch.

- FuggClub, Spin Master’s cult plush brand, under an exclusive license held by Libertas Brands and powered by Tibles. The app debuted in April and blends digital sticker packs, trading, and community chat with a physical-collection checklist so long-time collectors can track every toothy plush they own.

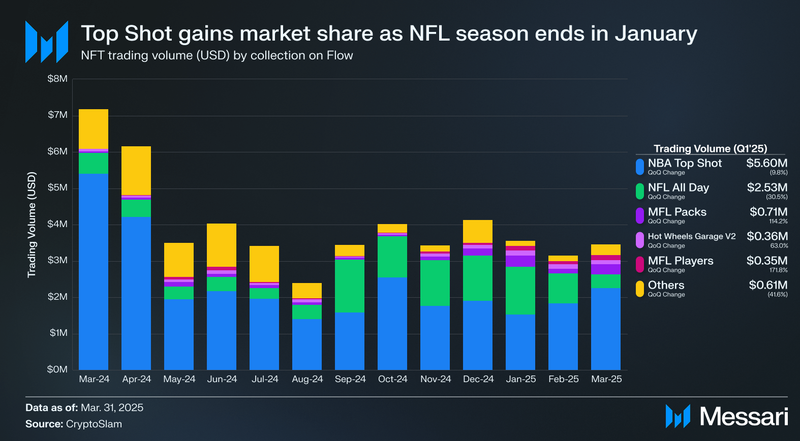

Flow’s most popular applications stem from some of the world’s largest Sports IPs. NFT trading volume on Flow is dominated by NBA Top Shot and NFL All Day, which made up 80.1% of all NFT trading volume in Q1 at $8.1 million. Activity on both apps is cyclical. Overall activity trends up during the NBA and NFL seasons, which span from September to April, and falls back down when neither league is active in July and August.

- NBA Top Shot: The most active app on Flow. Top Shot allows users to collect officially licensed NBA collectibles (moments) by purchasing packs or trading moments. Moments can also be used to compete and play in prediction competitions.

- March 2025 closed Q1 with $2.25 million in NBA Top Shot secondary volume, up 22% from February and the strongest month since the season-kickoff spike in October 2024. Across the quarter, total volume reached $5.60 million, a 10% pull-back from Q4 2024’s $6.21 million

- NFL All Day: Following the same concept, All Day allows users to collect officially licensed NFL collectibles (moments) by purchasing packs or trading the moments. Moments can also be used to compete and play in challenges and tournaments.

- NFL All Day booked $2.53 million in traded volume in Q1, down 30% QoQ from Q4’s $3.64 million season-driven high. Average monthly volume slipped to $0.84 million, below the $1.3 million in-season pace yet double the $0.42 million off-season baseline. Activity cooled each month (-31% from January to February and -53% from February to March) as post-Super Bowl interest faded.

Flow’s gaming sector emerged in 2023 with the launches of two initial games, one of which, the Metaverse Football League (MFL), remains the highlight of Flow’s gaming sector.

- Metaverse Football League: A soccer management game that lets users control their team, progress players, participate in tournaments, set tactics, and play matches. Users can purchase packs and trade players or clubs via the application, with MFL having seen over $1 million in all-time trading volume. The project also has a soul-bound MFL token, which serves to facilitate rewards and pack purchasing.

- Metaverse Football League closed Q1 with $1.06 million in secondary-market volume across Packs and Players, up 130 % QoQ. Combined, the two markets grabbed roughly 5% of total Flow NFT turnover, up from 2% in Q4.

- Packs accounted for $0.71 million (+114% QoQ); trading jumped after the Season 2 reward-day drop in early January, dipped in February, then increased again once the Season 3 pack wave hit and Community Clash quests kicked in. Player NFTs tallied $0.35 million (+172% QoQ), reflecting stronger demand for roster pieces as aging, development, and contract mechanics went live.

- FanCraze Cricket is the ICC-licensed home of Crictos: short, officially sourced video collectibles that immortalise the sport’s greatest plays and players.

- Collectors can acquire Crictos in several ways: buying fixed-price packs, bidding in time-boxed auctions, or generating new supply themselves through Mint Factory.

- Every collectible is verified onchain and slots directly into SuperTeam, FanCraze’s fantasy-style game where line-ups of six player Moments earn points from real-world match performance and compete for cash, game-coin, and collectible rewards.

- Q1 packed four big upgrades: a streamlined SuperTeam ruleset, the self-service Mint Factory for Essence-based minting, a transparent Auctions module, and a CP-gated Flash Marketplace for trading entry-level cards, making collecting, playing, and price-discovery faster and more accessible.

- UFC Strike is an officially licensed marketplace for video highlights from the Ultimate Fighting Championship. Fans can purchase packs of "Moments," which are digital video clips of iconic UFC fight moments. UFC Strike aims to create a new way for fans to engage with the UFC and connect with their favorite fighters through collecting and sharing Moments.

- UFC Strike generated $0.36 million in trading volume during Q1, a 63% jump QoQ from the $0.22 million recorded in Q4. The app accounted for ~1.5% of total Flow NFT volume in the quarter, reflecting a modest but growing share of NFT activity.

- During the quarter, UFC Strike released two collections, Maple Rush in late January and Lights Out II in early February, each limited to roughly 150 Elite packs and fewer than 4,000 Base packs, and debuting an ultra-scarce, 10-mint “Ultimate” tier that inherits Champion-level real-world perks. Off-chain engagement also ramped up: the Champion Club Lounge returned for UFC 311, while a new partnership with FightFi promised cross-platform XP, airdrops, and other loyalty rewards for Moment holders.

Flow’s total value locked (TVL) increased 17.7% QoQ to $44.4 million, pushing the network past its prior all-time high and continuing the rebound that began in late 2024.

The number of DeFi protocols that account for 90% of that TVL rose from three to four, signalling a broader, healthier liquidity base. Momentum was led by KittyPunch’s StableKitty, a Curve-style stable-swap protocol that cleared the $10 million TVL mark.

The new liquidity venues drove a measurable uptick in usage. Daily EVM transactions exceeded 300k by late March, illustrating that Flow is beginning to compete on DeFi and interoperability rather than relying heavily on its NFT franchises.

- Increment Finance: Historically, the lone DeFi protocol on Flow which comprised the entirety of TVL on the network. Increment is a full-suite DeFi protocol that allows for trading, lending/borrowing, liquid staking, farming, and a points program.

- Increment closed Q1 with $19.3 million in TVL, a 32.3% decline from Q4, and its market share fell to 43.3%. The pullback reflects a rotation of capital into newly launched protocols. Increment is still the largest pool on Flow, but its once commanding position is beginning to give way to a more balanced ecosystem.

- Trado Finance: A spot and perpetual decentralized exchange (DEX) that launched on Flow EVM testnet in September, before launching on mainnet on Oct. 5, 2024.

- Trado Finance finished Q1 with $2.2 million in TVL, a 40.2% drop from the previous quarter, and its share of Flow liquidity slipped to 5.0%. The pullback appears tied to the tapering of FLOW token incentives that had boosted deposits in late 2024.

- KittyPunch: A full-suite DeFi protocol that launched on Flow EVM on Sept. 8, 2024. KittyPunch offers (i) a spot DEX (PunchSwap), (ii) a stableswap DEX (StableKitty), (iii) a spot DEX aggregator (AggroKitty), (iv) a token launchpad (Trenches), (v) an NFT marketplace (Hoard), and (vi) a bridge powered by Hyperlane (KittyPunch Bridge).

- KittyPunch’s TVL climbed from $2.8 million in Q4 to $19.2 million in Q1, a 585% jump that lifted its share of Flow liquidity to 43 percent, second only to Increment. StableKitty went live with the “3kitty” tri-pool (wFLOW, WETH, USDF) acting as the base pair for every other KittyPunch product, concentrating deposits and routing most stable-asset trades on Flow.

- AggroKitty now links StableKitty, PunchSwap and external pools in a single interface, auto-selecting the best path for each swap and capturing fees for the KittyPunch treasury.

- Hoard is being built as a dedicated NFTfi marketplace for trading and earning yield on NFTs. All activity will center on the platform token BUX, which buyers must spend to mint “Hoarder” profile-picture NFTs or to attach onchain gear. Hoarders can be staked on the site for passive rewards, and locked BUX converts to non-transferable veBUX that confers voting power over future emissions.

- Rolled out at the end of February, FlowStrategy is a DAO-run treasury whose single mandate is to buy and hold as much $FLOW as possible, mirroring Strategy’s decade-long Bitcoin accumulation. Users deposit ETH, USDF, or wFLOW and receive the receipt-plus-governance token $FLOWSTR; the protocol then converts incoming assets into FLOW on KittyPunch’s own DEXs, stakes the tokens back into gauges, and compounds rewards, gradually concentrating circulating supply inside the treasury.

- MORE Markets: A borrowing and lending protocol launched on Flow EVM testnet in September, before launching on mainnet on Oct. 2, 2024. MORE Markets offered two initial vaults for FLOW and ankrFLOW, and has since expanded to stgUSDC, WETH, and USDF.

- MORE Markets ended Q1 with a TVL of $3.9 million, up 631%, lifting its share of Flow TVL to 8.7%. MORE Vaults are set to launch in Q2, with curation by SafeYields and 628Labs, aiming to simplify DeFi portfolio design.

In Q1, memecoin launchpads began launching on Flow blockchain, signaling an increased appetite for DeFi experimentation. Notable protocols include:

- Printr: Printr raised a $2.5 million pre-seed round backed by Flow Foundation and opened limited bonding for its first omnichain “memes.” Printr is a chain-abstracted meme launchpad, which taps Axelar and Squid Router so any token can list across roughly 70 networks. Every Printr meme launched on Flow automatically pushes the bonded LP tokens to Trado.

- FlowFun: Flowfun went live on mainnet in February. It is a public “MeFT” launchpad and exchange that fuses memecoin liquidity with NFT culture. Traders, collectors, and creators can now mint, trade, and redeem NFTs in one interface while benefiting from Flow’s low-fee throughput.

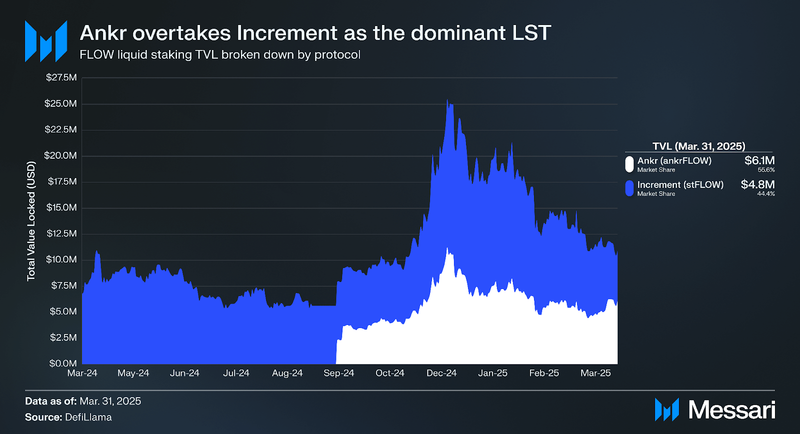

The total value of liquid staking tokens on Flow retrenched in Q1, sliding 38.4% from $17.7 million to $10.9 million as some stakers rotated into higher-yield DeFi and stablecoin pools. The tables seem to have turned in terms of market share amongst LSTs: Ankr’s ankrFLOW held relatively steady at $6.1 million but now commands 55.6% market share, up nearly 18 percentage points in market share since Q4. In comparison, Increment’s stFLOW fell to $4.8 million and a 44.4% share.

Development, Growth, and CommunityFlow Hackathons

Developer traction on Flow ticked higher in Q1 2025 after drifting lower through most of 2024. Average weekly core engineers increased to 67.8 from 58.8 in Q4 (+15.3% QoQ), and their weekly core-repo commits climbed to 552 from 436 (+26.5% QoQ). The inflection traces a January spike in contributions following the Flow Asia hackathon.

The upswing was confined to core work. Ecosystem contributors slipped to 67.8 from 104.5 (-35.1% QoQ) and their commits fell to 380 from 755 (-49.7% QoQ) as the spike of community activity logged during Q4’s hackathon season normalized. The Q4 surge in ecosystem devs/commits was driven by hackathons and quick-start experiments sparked by Crescendo’s launch. Q1’s pullback largely reflects the “cool-down” of hackathon projects. In addition to higher core commits, Flow recorded the highest weekly developer growth among all L1s in Q1, growing 89% QoQ!

The Flow Asia Hackathon, which ran online throughout January, drew 350 participants, generated 72 project submissions, and distributed a $10K prize pool across 10 winners. This was followed by the ETHGlobal Agentic Virtual Hackathon (Jan 31 to Feb 10), where Flow sponsored three prize tracks: Best Consumer Agent ($5k), No-Code Agent Launcher ($2k), and Best Flow Plug-in ($2k). As mentioned in the network analysis, active addresses and transactions spiked during this period, peaking at 347k active addresses and 581k transactions.

To keep that post-hackathon momentum rolling, Flow refreshed its developer portal in February as a one-stop hub that tackles idea vetting, Cadence tutorials, grant applications and more giving new entrants a clearer path while offering returning teams a single source for updated SDKs, guides, and EVM tooling. Together, the hackathon’s talent influx and the revamped documentation site suggest that Flow’s developer funnel is becoming more robust, with the launch of the EVM last September attracting more developers looking to build Dapps.

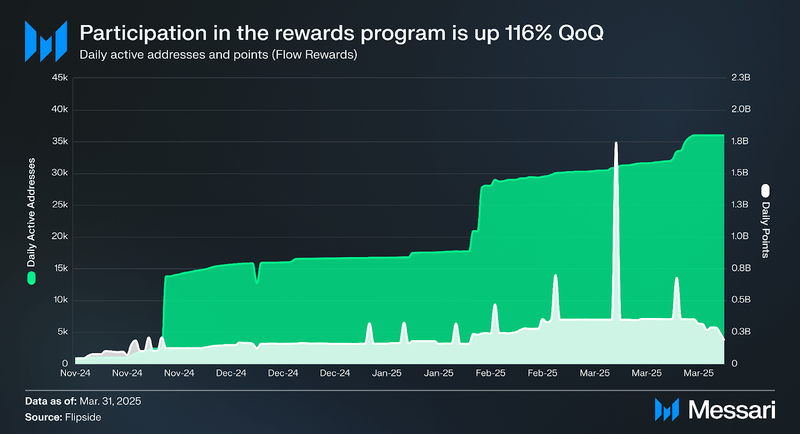

Flow Rewards

Flow Community Rewards continued to galvanize onchain engagement in Q1 2025. Daily active addresses in the program climbed from roughly 16,700 at the end of December to about 36,000 by quarter end, a 116% QoQ surge, while cumulative points in circulation increased 16.4% to nearly 1.9 billion.

Closing SummaryFlow’s first full quarter after Crescendo shows a network evolving towards increased DeFi activity, an increasingly robust developer ecosystem, and protocol autonomy. TVL held its ground at roughly $45 million despite sharp rotations between incumbent and newly-launched protocols, signaling that the capital now has multiple places to park rather than one dominant pool.

NFL All Day volumes softened with seasonality, but NBA Top Shot, MFL, and OpenSea’s Flow integration kept average daily NFT sales up 7% QoQ. The pipeline of sports and entertainment brands hints that Flow’s real moat is still cultural rather than purely technical. However, the rise of DeFi projects like Hoard, Flowfun, and StableKitty is worth watching as Flow evolves its user base beyond NFTs and consumer IP.

EVM parity is drawing liquidity and builders without derailing consumer traction, infrastructure and tooling are maturing, and rewards are scaling network participation. The coming quarters will dictate how effective these actions will be towards scaling adoption and cultivating a robust onchain ecosystem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.