and the distribution of digital products.

State of Ethereum Q4 2024

- Ethereum’s TVL surged 121.6% YoY, rising from $29.9 billion to $66.3 billion, demonstrating increasing capital inflows and sustained demand for its decentralized applications. Notably, Ethereum outperformed most major Layer-2s in Q4 TVL growth, reaffirming its dominance as the primary settlement layer for blockchain-based financial activity.

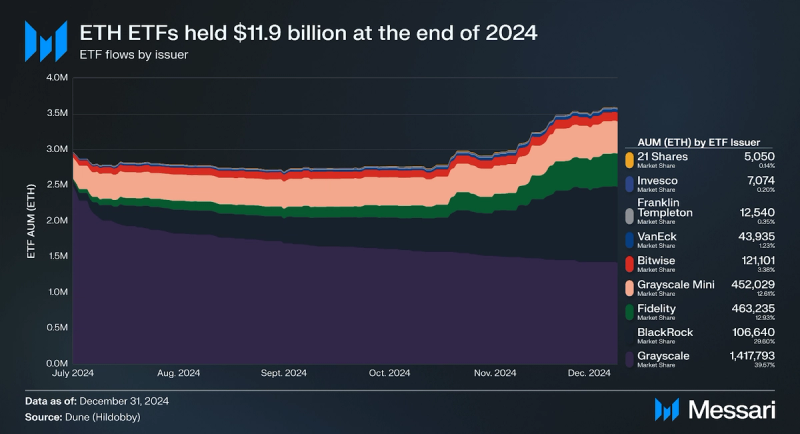

- ETH ETF holdings grew 63.6% QoQ, reaching 3.6 million ETH ($11.9 billion AUM), reflecting increasing institutional exposure to Ethereum. Additionally, proposals from Grayscale and 21Shares to integrate staking into ETFs could further boost staking participation and institutional ETH demand in 2025.

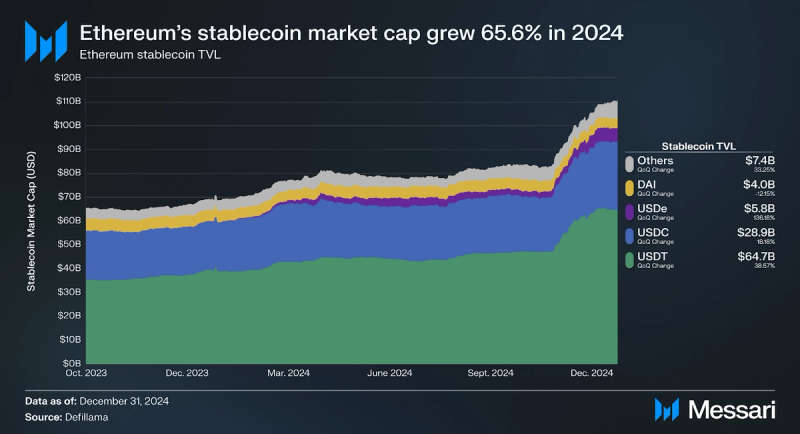

- Ethereum maintained its dominance in DeFi and stablecoins, with Ethereum-based stablecoins growing 65.6% YoY, accounting for over half of the total $210.5 billion stablecoin supply.

- The Pectra upgrade will introduce critical EIPs in March 2025, improving staking efficiency, transaction cost optimization, and Layer-2 scalability.

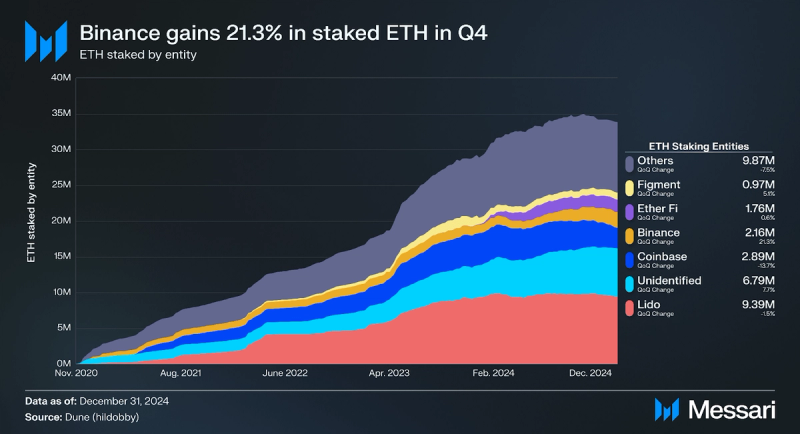

- For the first time since the Beacon Chain launch, total staked ETH saw a slight decline, suggesting that Ethereum staking may be reaching an equilibrium as rewards decrease.

Ethereum (ETH) is a distributed blockchain computing platform for smart contracts and decentralized applications. Ethereum’s smart contracts have enabled the creation of various new assets and industries, such as Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), Decentralized Autonomous Organizations (DAOs), and more. It features an execution engine optimized for smart contract processing, the Ethereum Virtual Machine (EVM).

Ethereum utilizes a Proof-of-Stake (PoS) consensus mechanism where users can run validators to secure the network and participate in block production. Users who meet the hardware requirements to run the latest execution and consensus clients and deposit 32 ETH into the Beacon Deposit Contract can permissionlessly operate an Ethereum validator.

Ethereum has chosen a scaling strategy using a network of Layer-2 networks to meet the growing demand for blockspace. Through this strategy, Ethereum plans to scale while maintaining a high degree of decentralization. These protocols rely on Ethereum security while solely focusing on transaction execution. Ethereum underwent the Dencun upgrade in Q1 2024 which introduced “blobs” for data storage, which significantly reduced Layer-2 transaction fees. The next major upgrade is Pectra, which is planned for March 2025 and will introduce EIPs that will improve staking efficiency and L2 scalability.

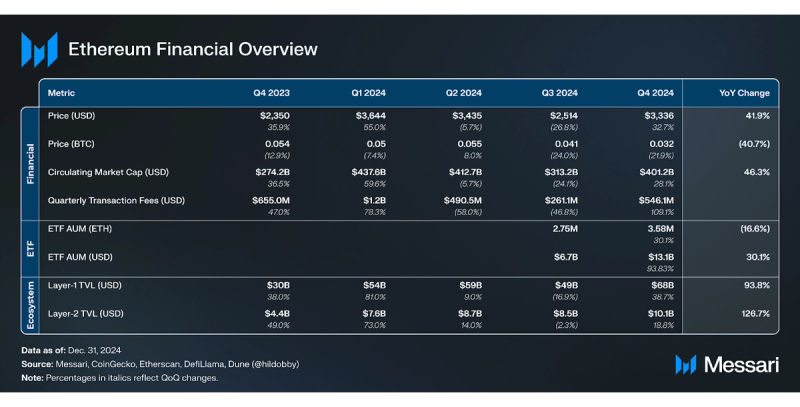

Key Metrics Financial Overview

Financial Overview

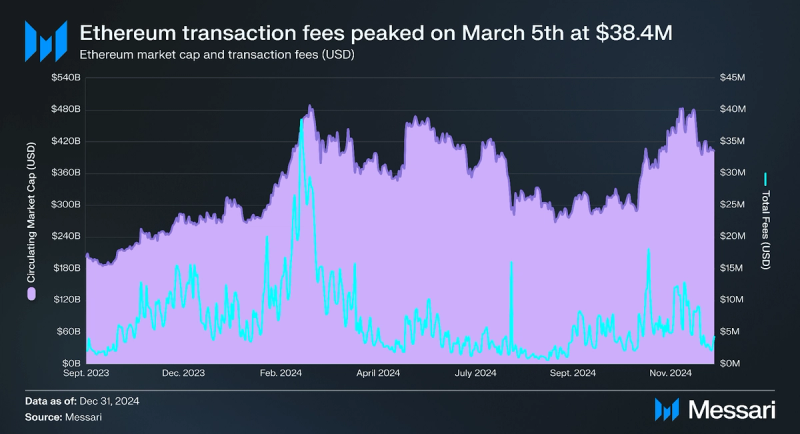

Over the past year, ETH’s price increased 41.9%, rising from $2,350 to $3,336. Despite this growth, ETH underperformed relative to BTC, which surged 119.7% YoY, climbing from $42,252 to $92,838—a 40.7% performance gap. Q4 2024 was particularly strong for ETH, with its price increasing 32.7% QoQ.

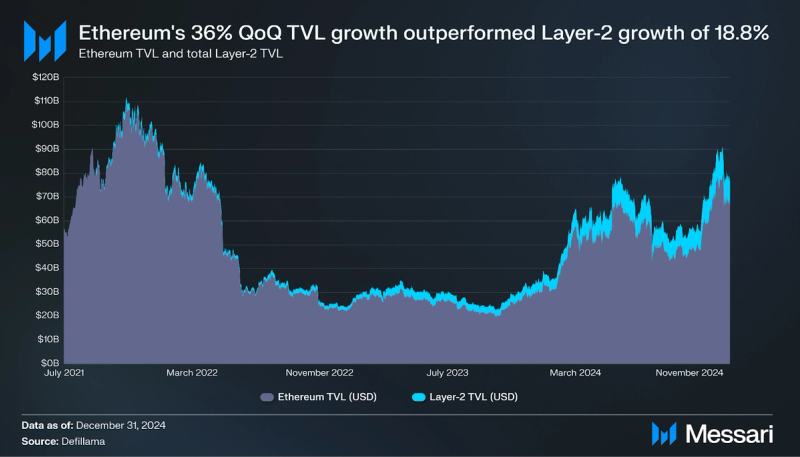

Total value locked (TVL) across Ethereum and its Layer-2 networks saw substantial growth in 2024. Ethereum’s TVL increased 126.7% YoY, rising from $30.2 billion to $68.3 billion, while Layer-2 TVL experienced a comparable 129.6% increase, growing from $4.4 billion to $10.1 billion. TVL increasing on both Ethereum and Layer-2s highlights the strong moat created by the EVM ecosystem and the continued demand for blockspace and applications in the Ethereum ecosystem.

Ethereum ETFs

Ethereum ETFs

After a relatively slow start compared to the BTC ETFs, ETH ETF inflows accelerated in Q4’24, with the total amount of ETH held in ETFs rising from 2.2 million to 3.6 million—a 63.6% QoQ increase—bringing total assets under management (AUM) to $11.9 billion. BlackRock continued to lead in inflows, closing the year with 1.06 million ETH ($3.5 billion) under management. Meanwhile, Grayscale experienced a decline, with its ETH holdings dropping 43.1% since the launch of spot ETH ETFs in July 2024. This loss in market share may be due to investors transitioning from Grayscale’s pre-existing ETHE trust to newly available ETH ETFs that offer lower fees than ETHE’s 2.5% expense ratio. However, the Grayscale Mini ETH ETF demonstrated strong performance, surging 52.4% and ending the year with 452,029 ETH ($1.5 billion).

Ethereum Staking LandscapeStaking Overview

In Q4 2024, Binance emerged as the dominant staking entity, increasing its market share by 21.3% QoQ, with staked ETH rising from 1.67 million to 2.02 million. Conversely, Coinbase experienced the most significant decline, with staked ETH dropping 13.8% QoQ, from 4.04 million to 3.49 million. The "Others" category also saw substantial outflows, posting a 7.5% QoQ decrease in staked ETH.

For the first time since the launch of the Beacon Chain, the total amount of staked ETH declined on a quarterly basis. However, a key potential catalyst for ETH staking in 2025 is the prospect of staking being integrated into existing ETH ETFs. With the changing regulatory landscape in the United States, the Securities and Exchange Comission has shown signs of a more open stance toward the inclusion of staking within ETF products.

On Feb. 15, 2025, the New York Stock Exchange filed a proposal with the U.S. SEC on behalf of Grayscale, seeking approval to incorporate staking into its spot Ethereum ETFs. If approved, Grayscale intends to stake Ether within its Ethereum Trust ETFs, though it does not plan to guarantee or advertise specific returns to investors.

Additionally, on Feb. 20, 2025, the Chicago Board Options Exchange (Cboe) submitted a similar proposal to the SEC, requesting approval to enable staking for the 21Shares Core Ethereum ETF. The SEC acknowledged the proposal, which, if approved, would make the 21Shares Core Ethereum ETF the first Ethereum ETF in the United States to incorporate staking. These developments signal a potential shift in institutional ETH staking, with broader implications for market structure and investor participation.

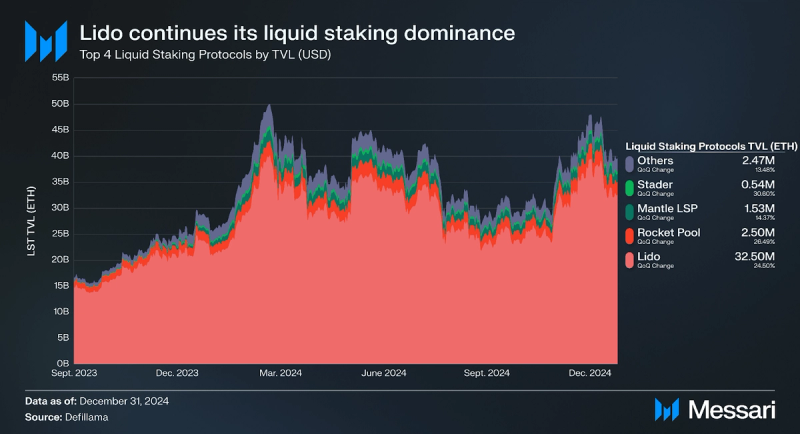

Liquid Staking

Despite an overall decrease in staked ETH, liquid staking continued a broad uptrend in deposits, reflecting the appeal of liquid staking solutions. However, the "Others" category, which includes a mix of smaller liquid staking protocols, grew at a moderate rate, rising from $2.2 billion to $2.5 billion—a 13.6% QoQ increase.

Despite this growth, Ethereum staking dynamics remain closely tied to broader market conditions. The sharpest increases in staked ETH coincided with periods of price appreciation, highlighting the continued interplay between Ethereum's market momentum and staking inflows. As Ethereum's staking ecosystem matures, competition among providers is expected to intensify, potentially driving further innovation in yield optimization and staking accessibility.

Network Overview Mainnet Activity

Mainnet Activity

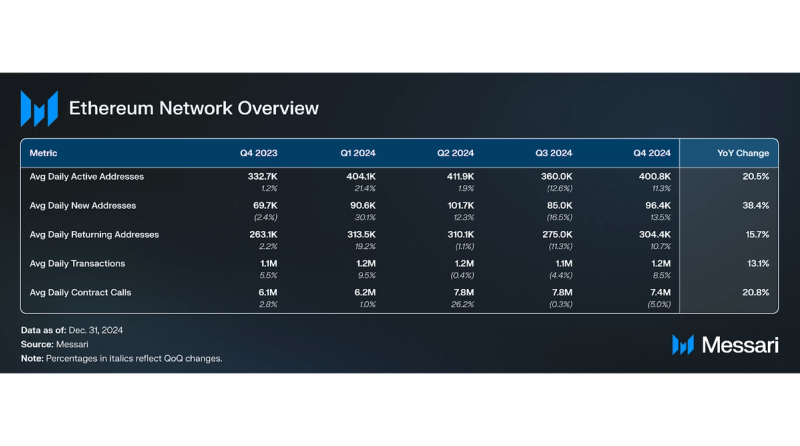

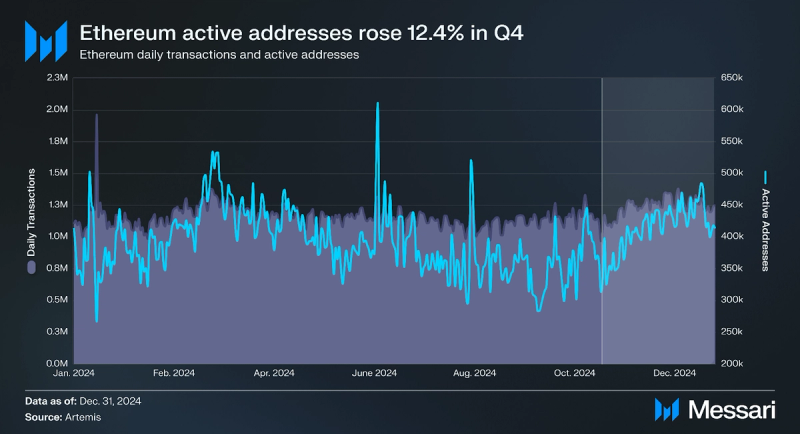

Ethereum activity remained relatively stable in Q4 2024, with average daily transactions increasing 4.43%, rising from 1.19 million to 1.25 million. However, average daily active addresses (DAAs) saw a more pronounced uptick, growing 12.4% from 367,570 to 413,230 over the quarter. YoY activity remained relatively stable too, with average daily transactions increasing 13.3% and average DAAs remaining virtually unchanged.

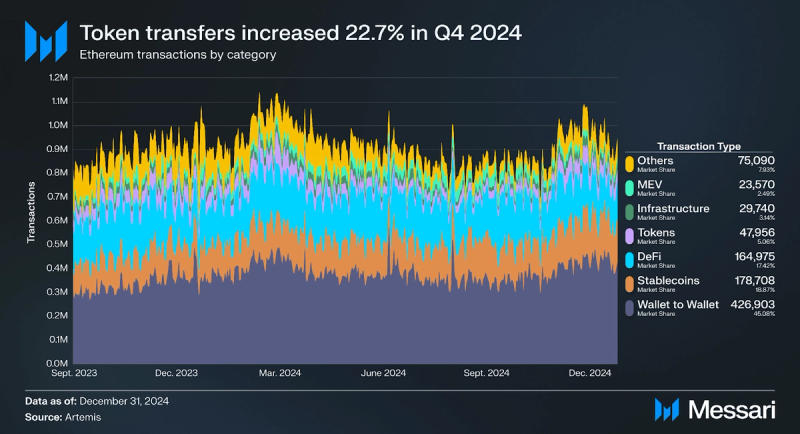

Activity was primarily driven by token movements, as wallet-to-wallet transactions rose 12.7%, stablecoin transactions increased 6.7%, and other token transactions surged 22.7%. In contrast, DeFi-related transactions declined 20.2%, while MEV-related transactions fell 33.9%, reflecting shifting dynamics within on-chain activity.

Q4 2024 saw a significant surge in total value locked (TVL) across Ethereum and its Layer-2 networks, with Ethereum outperforming in relative growth. Ethereum continued to dominate TVL across all networks in 2024, consistently holding over 50% of all TVL throughout the year. Ethereum’s TVL increased 36% QoQ, rising from $48.7 billion to $66.3 billion. Ethereum’s TVL increase was even more significant YoY, surging 121.6% from $29.9 billion to $66.3 billion. Meanwhile, the combined TVL of all Layer-2s also experienced notable growth, climbing 18.8% QoQ from $8.4 billion to $10.1 billion, and 133.3% YoY.

While Layer-2 TVL has historically grown at a faster rate relative to Ethereum, this trend saw a slight reversal in Q4. The proportion of Layer-2 TVL relative to Ethereum’s TVL declined from 17.4% to 15.2% QoQ, reflecting the L1’s stronger performance during the quarter.

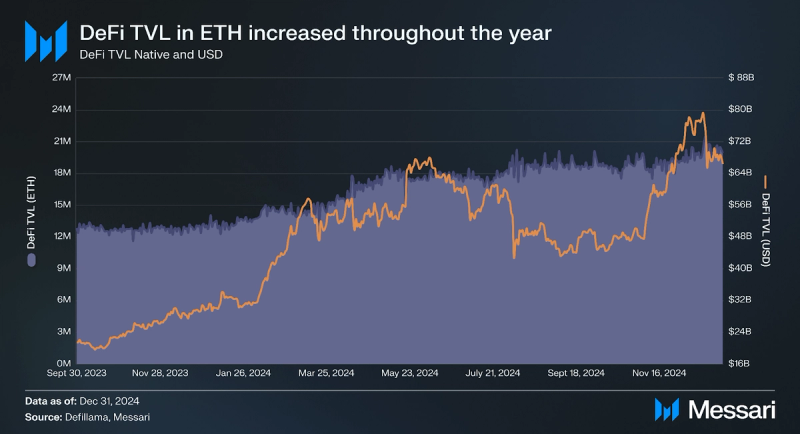

DeFi TVL on Ethereum experienced steady growth throughout the year, with TVL (ETH) increasing 56.6% YoY and TVL (USD) up 121.6%. In Q4’24, DeFi TVL (ETH) saw a modest 6.4% increase, rising from 18.7 million to 19.9 million. However, ETH’s strong price performance over the quarter amplified DeFi TVL (USD), which climbed 36.1% from $48.7 billion to $66.3 billion.

DeFi TVL peaked for the quarter on Dec. 7, 2024, reaching a high of $78 billion, underscoring the impact of both increased ETH valuation and sustained capital inflows into the ecosystem.

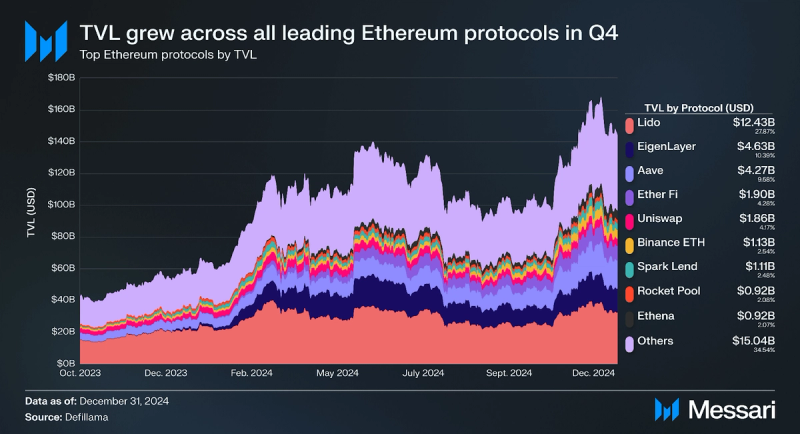

Many of Ethereum’s largest protocols experienced significant TVL growth in Q4 2024. Leading the surge was Ethena, a protocol that enables users to earn yield on USDe through delta-neutral hedging strategies. Ethena’s TVL skyrocketed 134.1% QoQ, rising from $2.5 billion to $5.9 billion. Aave also saw substantial growth, with its TVL increasing 60.8% QoQ. Meanwhile, Lido, Ethereum’s TVL leader, posted more moderate gains, expanding 24.5% from $26.1 billion to $32.5 billion.

While price appreciation of deposited assets contributed to the overall increase in TVL, the sharp growth seen in protocols like Ethena and Aave reflects a clear rise in demand for yield-generating products.

Historically, our methodology has excluded certain liquid staking protocols and protocols that deposit into other protocols to avoid double counting assets. However, for this section, we have chosen to include all protocol TVLs, as the rapid ascent of protocols like Ethena provides valuable insight into evolving user priorities.

Layer-2 Activity

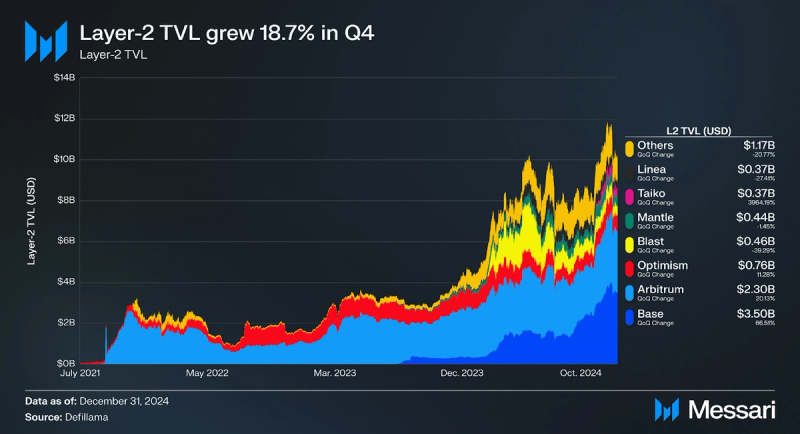

The competition for TVL among Layer-2 networks remains intense, with new entrants emerging each quarter and mercenary capital moving from chain to chain. Taiko, an Ethereum-based rollup launched in May 2024, saw remarkable growth in Q4, expanding its TVL from $9.1 million to $371.3 million, a 3964.1% increase. Meanwhile, the most established L2s continued to see TVL growth, with Base leading the pack, surging 66.5% QoQ, followed by Arbitrum with a 20.1% increase and Optimism up 11.2%.In contrast, Blast continued to lose TVL and market share, declining 39.3% QoQ from $757.8 million to $460.1 million.

Notably, Ethereum outperformed all major L2s in TVL growth aside from Base—a trend worth monitoring as it challenges the prevailing narrative t hat Layer-2s are “parasitic” to Ethereum.

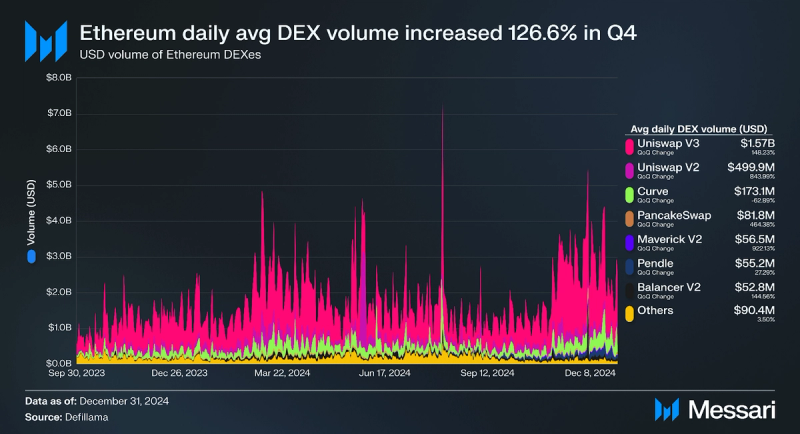

Ecosystem OverviewDecentralized Exchanges

Total daily DEX volume (USD) on Ethereum surged 126.6% QoQ, rising from $1.1 billion in Q3 to $2.6 billion in Q4. Uniswap remained the dominant DEX on Ethereum, with V3 averaging $1.4 billion in daily volume, while V2 maintained a daily average of $214.4 million. Together, Uniswap V3 and V2 accounted for 80.3% of all Ethereum DEX volume throughout the quarter.

Among major DEXs, Maverick V2 posted the most growth, skyrocketing 922% QoQ from $5.5 million to $56.5 million in average daily volume. Conversely, PancakeSwap was the only large DEX to experience a decline, with average daily volume dropping 62.9% from $220.6 million to $81.8 million.

The overall rise in DEX volume reflects increased demand for token-related onchain activity, underscoring growing engagement with decentralized trading platforms.

Stablecoins

Ethereum’s stablecoin supply expanded steadily throughout 2024, driven by a growing institutional interest in moving funds and real-world assets (RWAs) onchain. Total stablecoin market cap surged 65.6% YoY, rising from $66.9 billion to $110.8 billion, accounting for more than half of the total $210.5 billion stablecoin supply across all networks.

One of the most notable new entrants to the stablecoin space was Ethena’s USDe, which launched in December 2023 and closed out 2024 with a market cap of $5.7 billion. Centralized stablecoins USDT and USDC also posted strong growth, increasing 72.7% and 45.3% YoY, respectively.

Q4’24 saw particularly strong stablecoin expansion, with USDT increasing 38.6%from $46.7 billion to $64.7 billion, while USDC grew 18.2% from $24.4 billion to $28.9 billion. USDe continued to lead in growth, surging 136.2% from $2.4 billion to $5.7 billion, reflecting the increasing demand for onchain yield-bearing stablecoins.

Despite USDe’s rapid growth and USDC’s steady expansion, USDT dominance increased in 2024, rising from 55.9% to 58.3% of Ethereum’s total stablecoin supply. Tether, the issuer of USDT, reported over $13 billion in net profits for 2024, reinforcing its position as the dominant stablecoin provider in the market.

Prague-Electra (Pectra) UpgradeThe last few upgrades have delivered massive improvements for Ethereum. The transition to Proof-of-Stake in The Merge, staking withdrawals in Shapella, and blobs in Dencun significantly improved Ethereum’s fundamentals while also growing the network. The next planned upgrade is called the Prague and Electra upgrade, or Pectra for short.

Following All Core Devs Update 017, the final scope of the Pectra hard fork was confirmed, detailing the specific Ethereum Improvement Proposals (EIPs) set for inclusion. The finalized scope of Pectra consists of the following EIPs:

- EIP-7702: Set EOA Account Code

This proposal allows externally owned accounts (EOAs) to adopt the code of existing smart contracts, enabling features like transaction bundling and gasless transactions. It represents a step towards account abstraction, improving user experience and security. - EIP-7251: Increase the MAX_EFFECTIVE_BALANCE

This EIP raises the maximum effective balance for validators from 32 ETH to 2048 ETH, allowing validators to stake and earn rewards on any amount above the minimum. This change simplifies operations for stakers managing multiple validators and reduces network overhead. - EIP-7691: Blob Throughput Increase

Building upon the previous introduction of blobs for efficient Layer 2 rollup data storage, this proposal aims to increase blob throughput. The enhancement addresses the growing demand from Layer-2 solutions, aiming to reduce rollup fees and improve scalability. - EIP-6110: Supply Validator Deposits On-Chain

This proposal introduces a mechanism to supply validator deposits directly onchain, streamlining the staking process and enhancing transparency in validator operations. - EIP-7002: Execution Layer Triggerable Exits

This EIP enables validators to initiate exits from the execution layer, providing greater flexibility and control over staking positions. - EIP-7623: Increase Calldata Cost

To address network congestion and optimize resource usage, this proposal suggests increasing the gas cost associated with calldata, encouraging more efficient data transmission practices. - EIP-7685: General Purpose Execution Layer Requests

This EIP introduces a standardized method for the consensus layer to make requests to the execution layer, facilitating improved coordination and functionality between the two layers. - EIP-2537: Precompile for BLS12-381 Curve Operations

This proposal adds a precompiled contract for BLS12-381 curve operations, enhancing the efficiency of cryptographic functions essential for various applications, including those in Layer 2 solutions. - EIP-2935: Save Historical Block Hashes in State

This EIP proposes storing historical block hashes within the state, improving the accessibility and verification of past blockchain data for smart contracts and other applications. - EIP-7549: Move Committee Index Outside Attestation

This proposal suggests relocating the committee index from within attestations to an external position, aiming to streamline the attestation process and reduce complexity in consensus operations. - EIP-7840: Add Blob Schedule to EL Config Files

This EIP aims to incorporate the blob schedule into execution layer configuration files, ensuring better synchronization and planning for blob-related operations between the consensus and execution layers.

On Feb. 24, 2025, the Holesky testnet successfully upgraded to Pectra, marking a significant milestone in Ethereum’s ongoing development. However, shortly after the upgrade, Holesky encountered a finality bug at block height 3,419,723, affecting specific Execution Layer (EL) clients. The issue was swiftly diagnosed and resolved, with Ethereum core developer Parithosh providing details on the fix.

The root cause of the issue stemmed from EIP-6110, which migrated the deposit detection mechanism from the Consensus Layer (CL) to the EL. This change introduced new configuration values via system contracts, but the required reconfiguration of the deposit contract had not been applied. Since Holesky and other development networks were merged at Ethereum’s Proof-of-Stake (PoS) genesis, the absence of the updated deposit contract address led to configuration mismatches, ultimately causing finalization failures on certain EL clients.

The next All Core Devs call, scheduled for Feb. 27, 2025, will finalize the fork time for the Sepolia testnet and review the roadmap for mainnet deployment, setting the stage for Pectra’s broader rollout. A full timeline of all things Pectra can be found here.

Closing SummaryEthereum's growth throughout Q4 2024 was marked by strong performance across multiple key metrics, highlighting its continued dominance. ETH's price appreciation of 32.7% QoQ and a 121.6% YoY increase in TVL (USD) underscore the increasing demand for Ethereum’s infrastructure and applications. While ETH underperformed relative to BTC over the year, it remains the foundation for DeFi, stablecoins, and Layer-2s, solidifying its position as the leading smart contract platform.

The Ethereum staking landscape saw its first-ever quarterly decline in total staked ETH, with the staking ratio decreasing to 28.4% by year-end. However, the potential integration of staking within ETH ETFs in 2025 could be a game-changer, providing new institutional demand for staking participation. Developments such as Grayscale's proposal to incorporate staking into its Ethereum Trust ETFs and Cboe’s filing for the 21Shares Core Ethereum ETF suggest a shifting regulatory landscape that may further accelerate Ethereum’s staking adoption.

Ethereum’s Layer-2 ecosystem remains highly competitive, with Base leading in TVL growth and Taiko emerging as a notable new entrant. While Ethereum outperformed all major L2s except Base in Q4 TVL growth, the ongoing battle for capital allocation across networks highlights the growing importance of efficient scaling solutions. At the same time, the DEX market rebounded significantly, with 126.6% QoQ growth in total volume, driven by increased demand for onchain tokens.

The Pectra upgrade, Ethereum’s next major network improvement, introduces key EIPs aimed at scalability, staking efficiency, and transaction cost optimization. While the Holesky testnet successfully implemented the upgrade, it faced a temporary finality bug linked to EIP-6110, which was quickly resolved. The Feb. 27, 2025, All Core Devs call will determine the timeline for Sepolia’s upgrade and mainnet deployment, paving the way for Ethereum’s next evolution.

Looking ahead to 2025, Ethereum’s position remains strong as it continues to attract institutional capital, expand Layer-2 solutions, and refine its staking mechanisms. The potential for staking integration into ETH ETFs, coupled with advancements in scalability, will be key catalysts shaping Ethereum’s trajectory in the coming year.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.