and the distribution of digital products.

State of Boba Network Q4 2024

- Average daily transactions for both Boba implementations grew by 76% QoQ to 96,700, with Boba BNB surpassing Boba Ethereum for the first time in 2024, accounting for 53% of total transaction volume.

- Boba Network expanded ecosystem support through the Boba Liftoff Accelerator Program, selecting nine projects across DeFi, AI, gaming, and RWAs to receive funding, mentorship, and investor connections.

- DeFi TVL declined 3% QoQ to $2.3 million, with a 4% drop in Boba Ethereum’s TVL as the primary driver.

- Quarterly revenue for both Boba implementations decreased 16% QoQ to $5,700.

Boba Network (BOBA) is a Layer-2 (L2) multichain scaling solution focusing on DeFi, gaming, AI, and RWA. Boba operates on Ethereum (ETH) and Binance Smart Chain (BNB), which are maintained by Enya Labs. As an optimistic rollup (OR) based on Optimism’s software development kit (SDK) OP Stack, Boba offers reduced gas fees, increased transaction throughput, L1 security guarantees, and EVM compatibility for smart contracts, such as NFTs and decentralized finance (DeFi). Boba Network is also a part of Optimism’s Superchain ecosystem, providing interoperability across L2 networks within the Superchain.

This network also has unique features that set it apart from other ORs and Optimism forks, such as Hybrid Compute — the ability to connect to offchain computational resources, data, and APIs, a multichain focus, and zkRand, a non-interactive distributed verifiable random function (NI-DVRF). Boba’s combination of features — specifically Hybrid Compute — enables decentralized applications (dapps) to run at a fraction of the cost of L1 dapps, leverage offchain computation such as generative AI, and provide the multichain solutions needed for blockchain applications. Boba Network was previously active on Avalanche, Fantom, and Moonbeam, but those implementations have since been deprecated. For a full primer on Boba Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

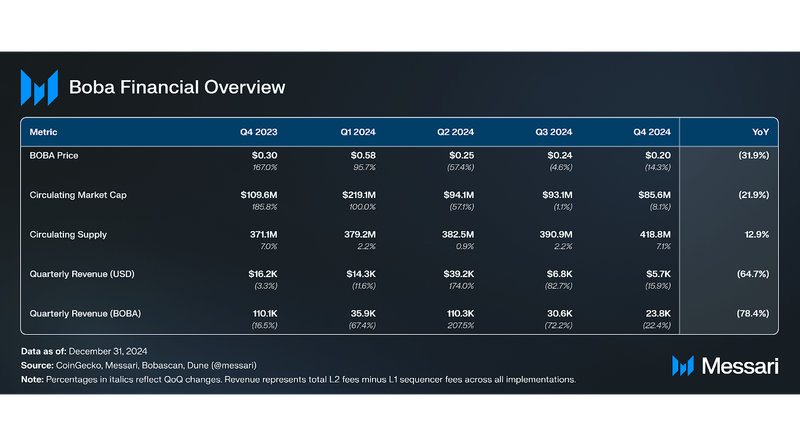

Key Metrics Financial Overview

Financial Overview Market Cap and Revenue

Market Cap and Revenue

In Q4 2024, BOBA’s market cap fell 8% QoQ from $93.1 million to $85.6 million. As the native asset of Boba Network, BOBA’s primary use cases include settling gas fees, engaging in governance, and invoking Hybrid Compute within smart contracts. BOBA is an ERC-20 on Ethereum, Boba Ethereum, and Boba BNB. BOBA ended Q4 with a circulating supply of 418.8 million. BOBA primarily experiences inflationary pressure due to staking rewards and unlocks from the initial allocation of the 500 million BOBA. Each quarter, 30 million BOBA is unlocked, which will continue until all tokens are unlocked in June 2025.

As a rollup, Boba Network implementations mainly focus on execution while outsourcing other core functions — such as settlement, consensus, and data availability — to their respective Layer-1s (L1s). As such, its revenue is measured as total L2 fees generated minus L1 sequencer fees, respectively, on Boba Ethereum and Ethereum Mainnet or Boba BNB and BNB Smart Chain.

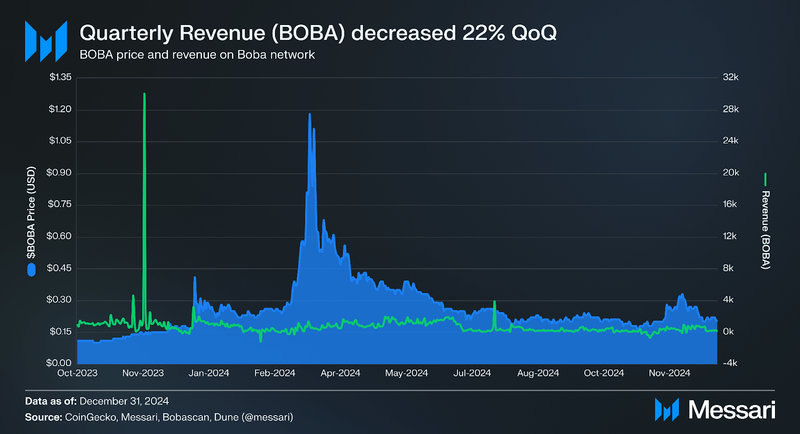

Over the past quarter, Boba Ethereum generated $874 of revenue, a 271% increase QoQ from the negative $510 revenue generated in Q3. This improvement was largely due to a sustained high number of transactions remaining steady on the Boba Ethereum network after the Anchorage update in April 2024.

Boba BNB, which settles on BNB Smart Chain for low settlement costs, saw its revenue decrease 29% QoQ to $4,800. This marks two consecutive quarters of a decrease in Boba BNB revenue greater than 25%.

While transactions and average transaction fees on Boba Ethereum increased, the high Ethereum L1 settlement costs offset a significant portion of potential transaction fee revenue. Boba BNB accounted for 85% of Q4 revenue. Across both implementations, revenue denominated in BOBA decreased 22% QoQ to 23,800 BOBA, while revenue in USD declined 16% QoQ to $5,700.

Network Overview Usage

Usage

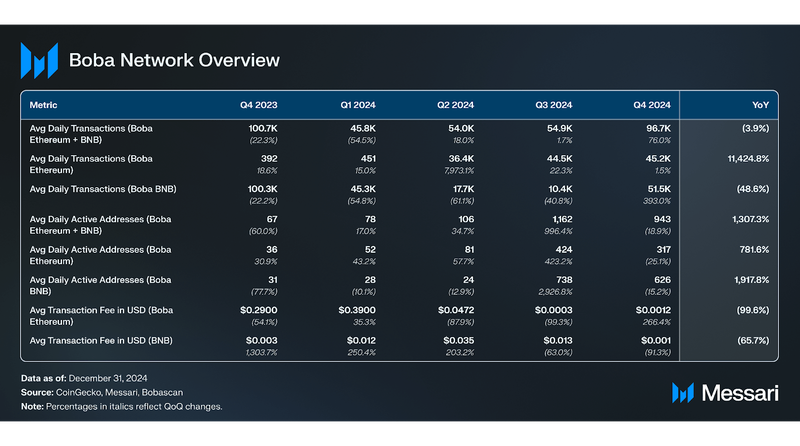

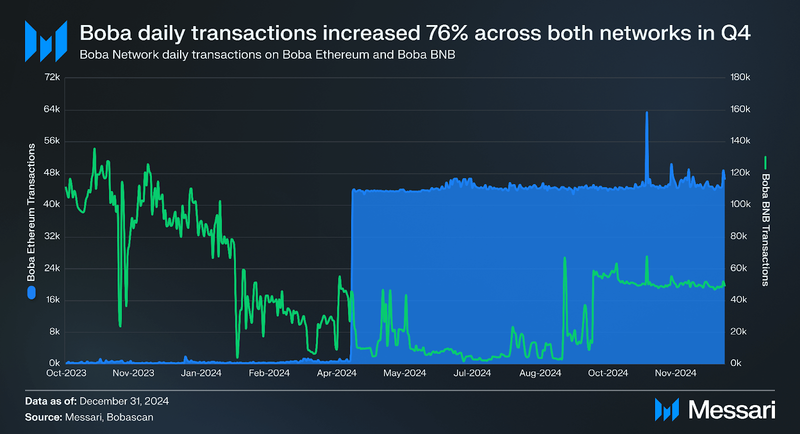

In Q4 2024, average daily transactions for both Boba Network implementations increased significantly by 76% QoQ, rising from 54,900 to 96,700. Boba BNB overtook Boba Ethereum for most transactions, a significant flip considering that in Q3, Boba Ethereum transactions were 4x greater than those of Boba BNB. Regarding daily transaction activity, Boba BNB accounted for 53% of the total transaction volume, while Boba Ethereum accounted for 47%.

Boba Ethereum’s average daily transactions increased by 2% QoQ. However, since the Anchorage update in mid-April, the daily transaction count has remained relatively stable. From mid-April to the end of Q2, Boba Ethereum averaged 43,900 daily transactions, compared to 45,200 in Q4 — a 3% increase.

In contrast, Boba BNB’s average daily transactions increased significantly by 393% QoQ, increasing from 10,400 to 51,500.

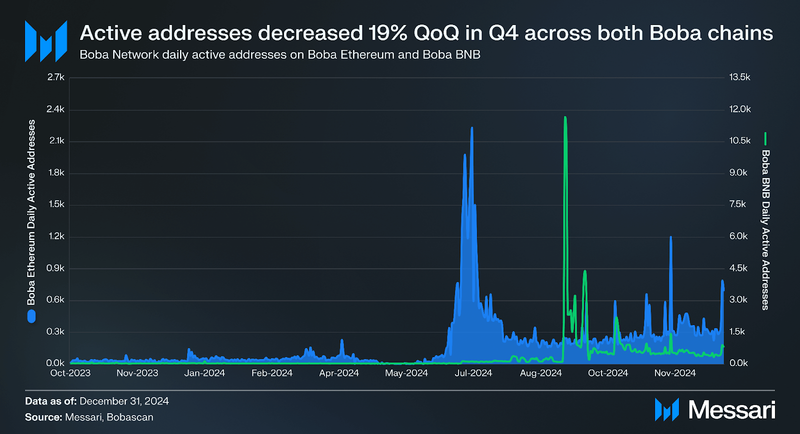

The average daily active addresses across both Boba implementations decreased by 19% QoQ, falling from 1,162 to 943. This marks the first decline in daily active addresses QoQ after three consecutive quarters of QoQ growth in active addresses. Boba Ethereum saw a more significant decrease than Boba BNB, with a 25% fall in daily active addresses from 424 to 317. Meanwhile, Boba BNB saw a 15% decrease in daily active addresses, from 738 to 626.

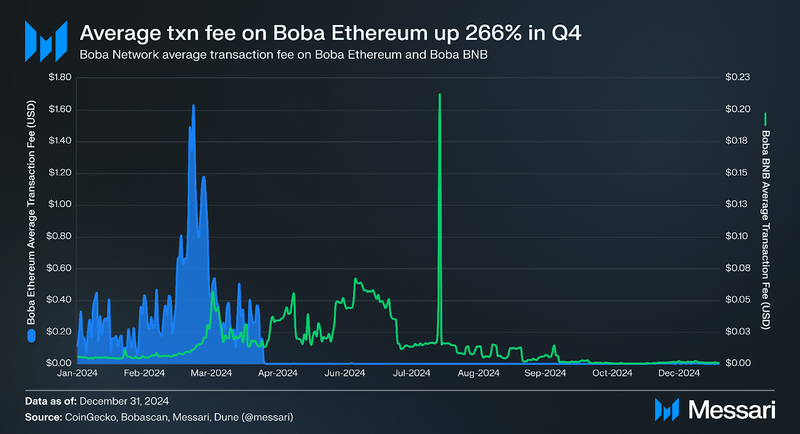

Transaction fees on Boba Ethereum are paid in ETH, while transaction fees on Boba BNB are paid in BOBA. In Q4, the average transaction fee on Boba Ethereum increased 266% QoQ from $0.0003 to $0.0012, marking a significant rise compared to the previous quarter. Yet, throughout 2024, the average Ethereum transaction fee has been 96% cheaper since the Anchorage update in April. Meanwhile, Boba BNB’s average transaction fee declined, dropping 91% QoQ from $0.013 to $0.001.

Technical DevelopmentsThis quarter, Boba Network announced four version upgrades, all of which were executed within the quarter. These releases reflect Boba Network’s ongoing commitment to improving its blockchain infrastructure. The updates introduced in these versions were designed to enhance scalability, efficiency, and overall network functionality, providing better support for decentralized applications and improving the developer experience. Details for each version release are as follows:

- V1.6.11 – Boba Mainnet Granite Upgrade: On October 24, Boba Network successfully deployed the Granite Mainnet Upgrade on Boba Ethereum. This update introduced improvements to data querying documentation, fixes for contract artifact releases to GCP storage, and a user guide for integrating Biconomy to enable gasless transactions on Boba Chain.

- V1.6.12 Upgrade: Released on November 5, this upgrade refined the network’s developer experience by updating subgraphs and automating the generation of subgraph.yaml files. Additionally, it incorporated the Graph documentation, added Boba testnet faucets to the Boba Faucet documentation, and enabled several protocol tests, including EIP-1559 compatibility.

- V1.6.13 Upgrade: Released on November 22, the update introduced the Boba Devnet Holocene activation, fixing semgrep issues, updating the Erigon dockerfile, and modifying the superchain-registry to support the upcoming Holocene hard fork.

- V1.6.14 Upgrade: Announced on December 6, this upgrade included preparations for the Boba Testnet Holocene Upgrade, which went live for activation on January 6, 2025. The upgrade impacted Boba BNB Testnet L2 and Boba Sepolia L2 while introducing a new whitelisting process and updating associated requirements.

These technical improvements reinforce Boba Network’s ongoing efforts to enhance its infrastructure, ensuring improved efficiency, security, and developer support across Ethereum and BNB environments.

Ecosystem Overview

DeFi

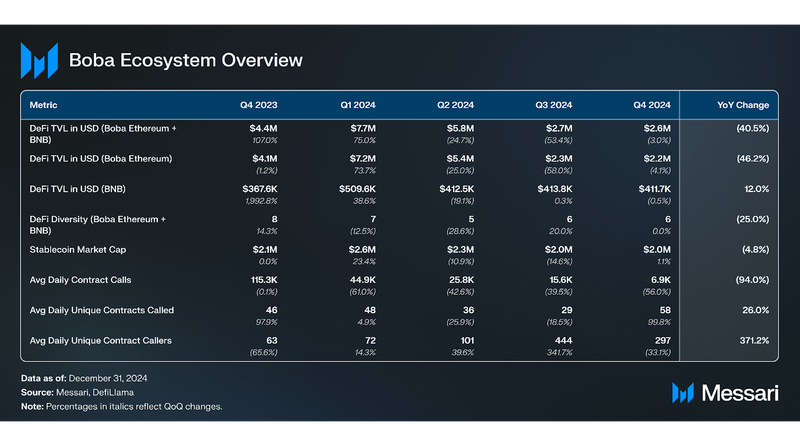

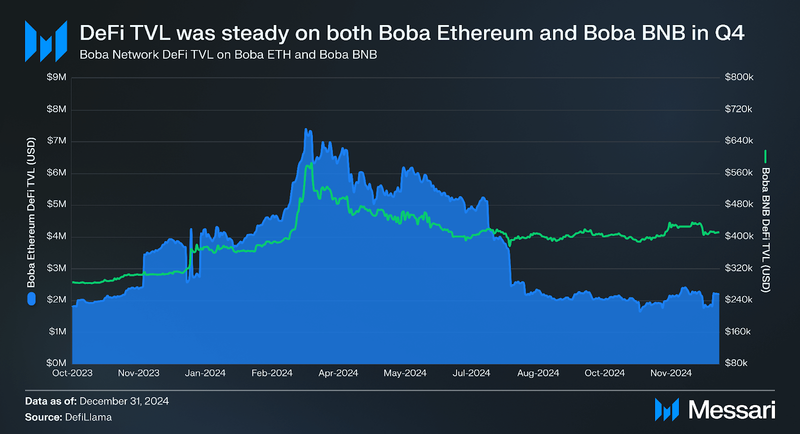

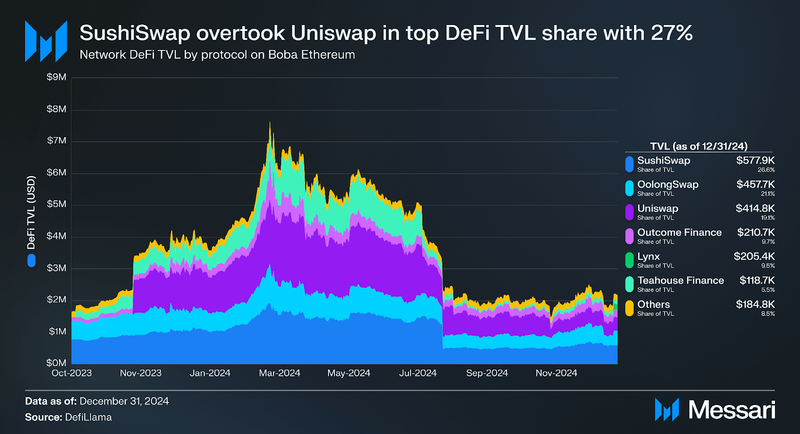

This quarter, DeFi total value locked (TVL) for both Boba implementations fell 3% QoQ, dropping from $2.7 million to $2.3 million. This decline was primarily driven by a reduced TVL on Boba Ethereum, which fell by 4% QoQ, from $2.3 million to $2.2 million. Boba Ethereum accounts for the vast majority of TVL on the network, so its performance was the main factor behind this overall decrease in Boba Network. As for Boba BNB's TVL, it slightly decreased QoQ from $413,800 to $411,700.

DeFi TVL declined 41% YoY in 2024, with most outflows coming from Boba Ethereum, which fell from $4.4 million at the start of 2024.

In Q4 2024, the top three protocols on Boba Ethereum remained the same as Q3. SushiSwap, OolongSwap, and Uniswap V3 accounted for a combined 67% of the total DeFi TVL. The order of these top three protocols changed, with Sushiswap overtaking the top spot and Uniswap V3 moving down to third-most TVL.

Note that Uniswap V3’s liquidity pools on Boba Network are accessed through Oku Trade’s front-end, as Uniswap did not deploy its own interface. For consistency, this report will refer to these pools as Uniswap V3.

SushiSwap became the largest protocol by TVL in Q4, holding a 27% market share, with its TVL increasing 9% QoQ from $529,200 to $577,900. OolongSwap, an AMM DEX forked from Uniswap V2, held the second-largest share at 21%, with its TVL rising 6% QoQ from $433,700 to $457,700. Meanwhile, Uniswap V3 fell to third place, experiencing a 40% QoQ decline in TVL from $691,800 to $414,800.

Outside of the top three, Lynx, a perpetual DEX that joined the network in Q3, climbed to the fifth-largest protocol by TVL, marking a notable rise in adoption.

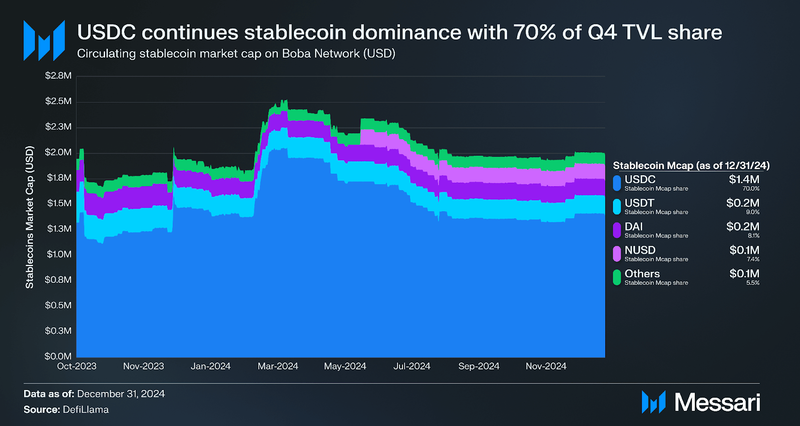

USDC continues to dominate the stablecoin market on Boba Ethereum, with a 70% market share, a 1% increase from Q3. All other top stablecoins on Boba Ethereum experienced little to no change QoQ, remaining within 1% of their end-of-Q3 value locked.

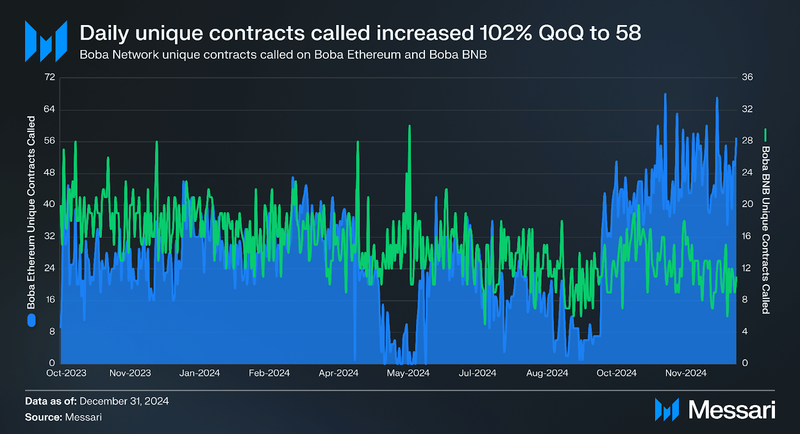

Contract Activity

The average daily unique contract calls for both Boba implementations increased by 99% QoQ from 29 to 58. Furthermore, the average daily unique contract calls increased for both Boba implementations. Boba Ethereum was up 164% QoQ from 17 to 45, while Boba BNB was up 8% QoQ from 12 to 13.

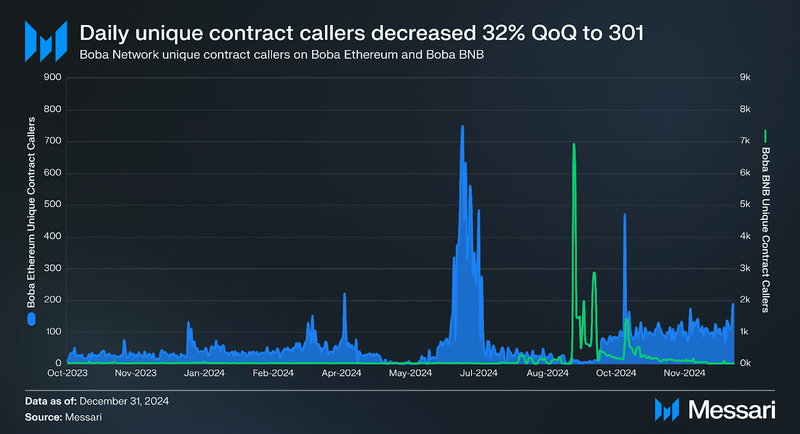

The number of unique contract callers decreased in Q4, down 33% QoQ from 444 to 297. The majority of unique contract callers were on Boba BNB, which was correlated to the significant increase in unique address activity on Boba BNB. Unique contract callers on Boba BNB decreased by 54% QoQ from 417 to 190, while on Boba Ethereum, they increased by 52% QoQ from 70 to 107.

Growth and DevelopmentThrive ProtocolOn October 18, Boba Network and Thrive Protocol launched the Thrive Boba Ecosystem Grants, a $200,000 BOBA token initiative to support Web3 innovation. The program offers grants ranging from $10,000 to $35,000 for projects in DeFi, Gaming, and Generative AI. Funding is distributed in phases—15% after the first two milestones and 70% upon final completion, though milestone specifics were not disclosed.

Applications were accepted until October 31, 2024, with grants awarded on November 19, 2024, and project completion proof due by February 25, 2025. Applicants were required to join the Thrive Protocol Discord, connect their wallet, and link their X/Twitter and GitHub accounts before submitting through thriveboba.com. The initiative aims to empower developers to leverage Boba’s HybridCompute technology to build innovative dapps within the Web3 ecosystem.

The GraphIn November 2024, Boba Network completed the Chain Integration Process (CIP) with the Graph, enabling active support for Boba subgraphs on the Graph’s decentralized network. The CIP is a community-driven initiative designed to extend the Graph’s multichain functionality. By completing this process, Boba Network fully integrates with the Graph’s decentralized indexing and querying services, providing improved infrastructure to create scalable, data-driven applications.

Key benefits include an enhanced developer experience, as builders can now leverage the Graph’s infrastructure to create faster and more cost-efficient dapps, potentially increasing adoption within the Boba ecosystem. Additionally, joining The Graph’s decentralized network enhances Boba’s security, reliability, and performance, offering a more robust infrastructure for developers building dapps in DeFi, gaming, and AI. This integration strengthens Boba’s position in the Web3 landscape while expanding opportunities for applications that require decentralized and high-performance data services.

Dune AnalyticsOn December 17, Boba Network went live on the Dune Analytics platform, providing analysts and developers access to Boba’s onchain data for deeper insights into its ecosystem. This integration allows users to analyze transaction volumes, wallet activity, and token flows to track network performance. This partnership can also be used to monitor the growth and cross-chain interactions of Boba ecosystem projects. The integration aims to enhance transparency and foster data-driven growth within Boba’s DeFi, gaming, and cross-chain landscape.

QTSNOn November 24, QSTN, an AI-powered Web3 survey platform, launched on Boba Network. The platform incentivizes survey participation with tokens or NFTs while allowing users to retain data ownership.

Users can sign up with just an email to lower entry barriers, and a crypto wallet is only required when redeeming rewards. ZK proofs ensure that responses remain anonymous, enhancing privacy and security. The platform also incorporates leaderboards and quests to encourage user engagement and sustained participation. By leveraging Boba Network’s L2 infrastructure, QSTN benefits from lower transaction costs and increased scalability, making it more efficient for onchain data collection. The project aims to provide a blockchain-based alternative to traditional survey platforms while prioritizing user privacy and control over personal data.

Boba Liftoff Accelerator ProgramBoba Network launched the Boba Liftoff Accelerator Program on July 22, 2024, as part of its expansion strategy in Q3 2024. Developed with Brinc, this program aims to support decentralized applications built on the Boba Network. The 10-week initiative focuses on innovation in key sectors, including DeFi, real-world assets (RWAs), gaming, and AI.

The accelerator offers a $1 million grant pool, distributed based on project milestones. The program provides additional support through remote workshops, mentorship, and investor connections. This approach aims to equip participants with financial resources, knowledge, and improved networks for the blockchain sector.

On October 23, Boba announced the nine projects selected for the program. Some include:

- Astra Nova: a Web3 MetaRPG that merges immersive role-playing, enabling players to earn the $RVV token while engaging in a narrative-driven gaming experience.

- Buk Protocol: a platform that tokenizes dynamic assets, enabling the creation of liquid secondary markets for expiring items like travel bookings and event tickets, enhancing their value and liquidity.

- Standard Protocol: a decentralized order-book exchange (CLOB) that enables efficient trading with complete user control, eliminating the need for intermediaries or AMMs.

- Meta Soccer: a soccer management game where players can own, trade, and develop assets as NFTs while competing in online leagues and earning rewards.

- OpenPad AI: an AI-powered launchpad that connects early adopters with high-potential projects. Their AI-driven analytics provide tailored investment insights and funding solutions, giving users a data-backed edge to support the next wave of crypto innovation.

- Chimp Exchange: a DEX that offers privacy-focused features, including end-to-end encryption and dark pools, to facilitate anonymous trading. It aims to prevent asset tracking and identity disclosure, providing a secure and private DeFi experience.

- QTSN: a Web3 survey platform that incentivizes users to participate in surveys by offering token or NFT rewards, including SOL, NEAR, and TON. It uses AI-generated surveys and ZK proofs to provide businesses with reliable insights and a secure user experience.

- Lunch Protocol: a DeFAI protocol that rewards users with “Eggs” for completing daily missions and engaging in activities across Web2 and Web3. These rewards can be used for token raffles, airdrops, and other incentives, while the platform integrates features like gamified walking rewards and social trading to enhance user engagement.

- The Guild: a Decentralized Autonomous Services Marketplace tailored for gig workers and professionals, opening up opportunities for those often excluded from traditional job markets. The protocol removes KYC requirements to broaden access for undocumented and unbanked users to fully leverage their networks. The protocol includes an onchain reputation system where users can build and manage their reputations transparently across platforms in Web3.

Boba Network experienced mixed performance across key metrics this quarter, with network usage rising but financial and DeFi metrics declining. BOBA’s market cap fell 8% QoQ, ending the quarter at $85.6 million. Network activity increased as average daily transactions rose 76% QoQ to 96,700, with Boba BNB surpassing Boba Ethereum in transaction volume.

On the technical side, Boba Network introduced several infrastructure upgrades, including the Granite Mainnet Upgrade, improvements to subgraph support, and preparations for the Holocene upgrade on testnet. Additionally, Boba Network completed its integration with the Graph, enabling decentralized indexing and querying services. DeFi TVL declined 3% QoQ, primarily due to a 4% drop in Boba Ethereum’s TVL, which accounts for the majority of liquidity on the network. The broader DeFi decline in 2024 totaled 40.5% YoY, reflecting capital outflows from the ecosystem.

Boba Network also continued its ecosystem growth efforts, including the Thrive Boba Ecosystem Grants and the Boba Liftoff Accelerator Program, which provide funding and mentorship for projects in DeFi, gaming, AI, and real-world assets. These initiatives, alongside technical upgrades and expanded developer resources, position Boba Network for further growth in 2025 as it navigates a competitive L2 landscape.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.