and the distribution of digital products.

State of Boba Network Q2 2024

- Boba Ethereum underwent the Anchorage upgrade in April. The update introduced execution client diversity with Erigon as the sequencer and Geth as a verifying replica, proto-danksharding support, and account abstraction support.

- Boba’s Light Bridge also went live in April. The Light Bridge is a centralized solution that allows for direct fund bridging between different Layer-2 platforms and between L2s and Layer-1 networks, circumventing the typical 7-day challenge period.

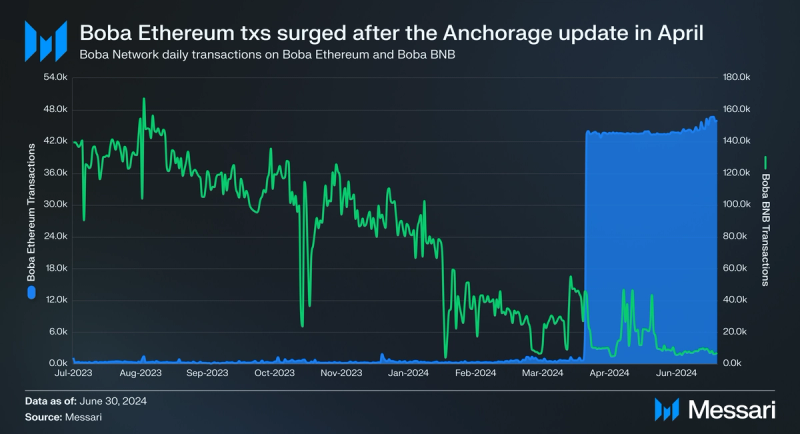

- Activity on Boba Ethereum surged after the Anchorage upgrade. Avg daily transactions on Boba Ethereum in Q2 were up 7,973% QoQ to 36,400.

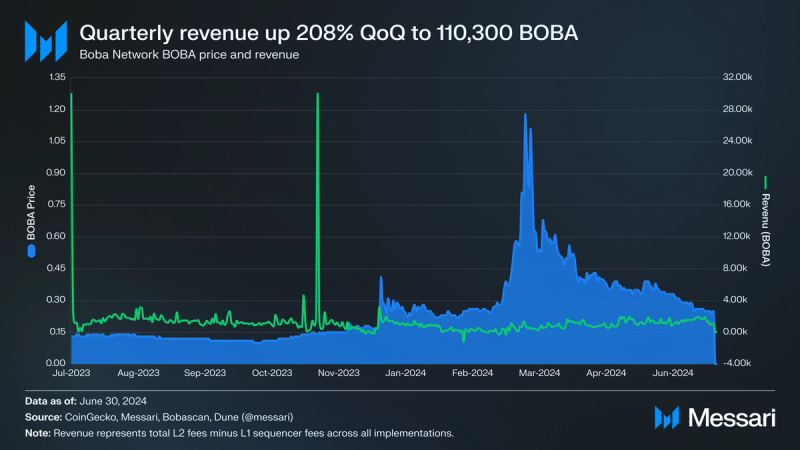

- Quarterly revenue also rebounded, in part due to reduced L1 settlement costs. Boba ended Q2 with a quarterly revenue of $39,200 across both implementations (up 174% QoQ).

Boba Network (BOBA) is a Layer-2 multichain scaling solution with a focus on DeFi, gaming, AI, and RWA. Boba operates on Ethereum and BNB, and it is maintained by Enya Labs. As an optimistic rollup (OR) based on Optimism’s software development kit (SDK) OP Stack, Boba offers reduced gas fees, increased transaction throughput, L1 security guarantees, and EVM compatibility for smart contracts, such as NFTs and decentralized finance (DeFi).

This network also has unique features that set it apart from other ORs and Optimism forks, such as Hybrid Compute — the ability to connect to offchain computational resources, data, and APIs, a multichain focus, and zkRand, a non-interactive distributed verifiable random function (NI-DVRF). Boba’s combination of features — specifically Hybrid Compute — enables decentralized applications (dapps) to run at a fraction of the cost of L1 dapps, leverage offchain computation such as generative AI, and provide the multichain solutions needed for blockchain applications. Boba Network was previously active on Avalanche, Fantom, and Moonbeam, but those implementations have since been deprecated. For a full primer on Boba Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

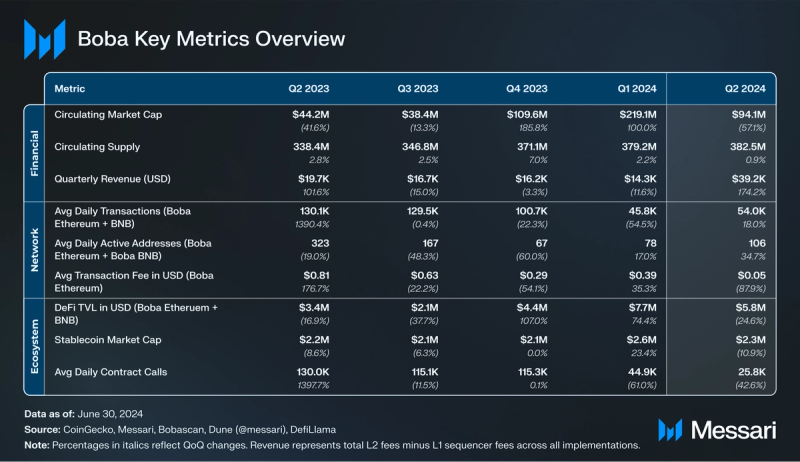

Key Metrics Financial Overview

Financial Overview Market Cap and Revenue

Market Cap and Revenue

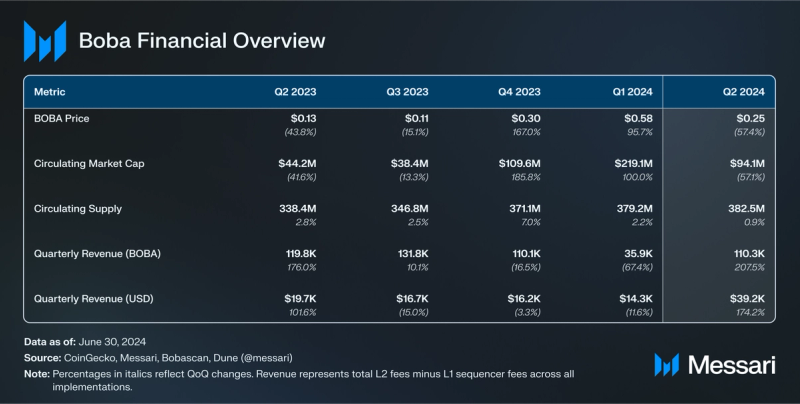

In Q2’24, the total crypto market cap experienced a pullback after two straight quarters of growth, largely driven by positive capital inflows to spot BTC ETFs. Amidst this backdrop, BOBA’s circulating market cap decreased 57% QoQ from $219.1 million to $94.1 million.

BOBA is the native asset of Boba Network, and its primary use cases include settling gas fees, governance, and invoking Hybrid Compute within smart contracts. BOBA is an ERC-20 on Ethereum, Boba Ethereum, and Boba BNB. BOBA ended Q2 with a circulating supply of 382.5 million. BOBA primarily experiences inflationary pressure due to staking rewards and unlocks from the initial allocation of the 500 million total BOBA. Each quarter, 30 million BOBA is unlocked, which will continue until all tokens are unlocked in June 2025.

As a rollup, Boba Network implementations mainly focus on execution while outsourcing other core functions — such as settlement, consensus, and data availability — to their respective Layer-1s (L1s). As such, its revenue is measured as total L2 fees minus L1 sequencer fees.

Last quarter, Boba Ethereum operated at a loss of -$7,300 due to expensive L1 settlement fees. This quarter, Boba Ethereum’s margins improved, as its net loss for the quarter was -$1000, an improvement of 86%. This improvement was largely due to the implementation of EIP-4844, which reduced L1 settlement fees for L2s, and Boba’s Anchorage update (more info under Technical Developments) in April. As for Boba BNB, which settles to BNB Smart Chain for low settlement costs, its revenue increased 53% QoQ to $40,200. In sum, for both implementations, revenue denominated in BOBA increased 208% QoQ to 110,300 BOBA, and revenue denominated in USD increased 174% QoQ to $39,200.

Network Overview Usage

Usage

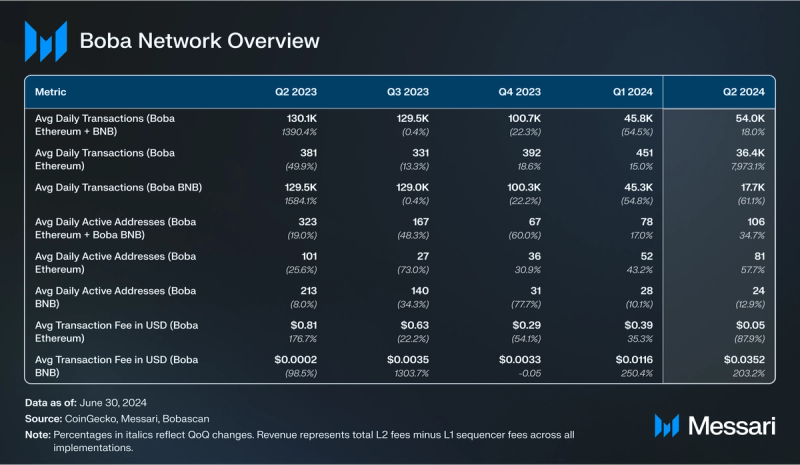

Average daily transactions across both implementations increased 18% QoQ from 45,800 to 54,000. Boba Ethereum accounted for more transactional activity for the first time since Boba BNB first went live in Q4’22. Due to the decreased onchain costs for transactions as a result of EIP-4844 and Anchorage, Boba Ethereum increases its average daily transaction count by 7,973% QoQ, from 451 to 36,400.

In prior quarters, a large driver of transactional activity on Boba BNB was ROVI Network, a multi-purpose “super app.” In May, ROVI Network announced that it is merging with the Layer-3 (L3) solution Habit Network. As a result of this Boba BNB’s average daily transactions fell 61% QoQ from 45,300 to 17,700.

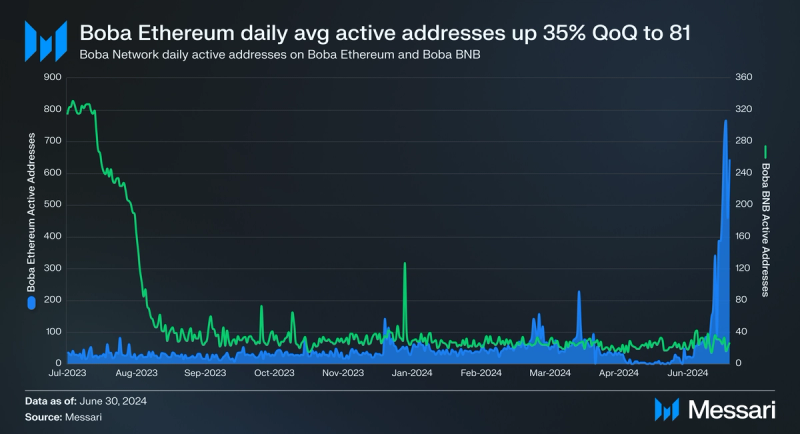

Average daily active addresses across both implementations increased 35% QoQ from 78 to 106. This was the second quarter in a row where there was a QoQ increase in average daily active addresses.

Boba Ethereum was responsible for this growth in active address activity, as its daily average active addresses increased 58% QoQ from 52 to 81. Active addresses on Boba Ethereum had its biggest increases over the last two weeks of June. This was perhaps due to a series of protocols integrating with Boba in Q2:

- Zoth (April 3) - RWA protocol Zoth launched a stablecoin pool on Boba Ethereum in April.

- Balmy (May 8) - DEX aggregator Balmy launched on Boba Ethereum, enhancing the UX for traders on Boba.

- Cryptio (May 14) - Crypto accounting, auditing, and tax software company Cryptio integrated with Boba.

- Metaverse HQ (June 11) - Metaverse HQ integrated Boba Ethereum for its questing protocol application, allowing users to receive NFTs and other rewards on Boba.

- Dmail (June 12) - Encrypted email and messaging protocol Dmail integrated with Boba to use it for blockchain-based interactions on its protocol.

- ZNS Connect (June 17) - Boba Network partnered with ZNS Connect to be the official name service provider on Boba.

- WeFi (June 27) - Multichain leveraged trading protocol WeFi went live on Boba Ethereum.

Average daily active addresses on Boba BNB continued to decline, decreasing 13% QoQ from 28 to 24.

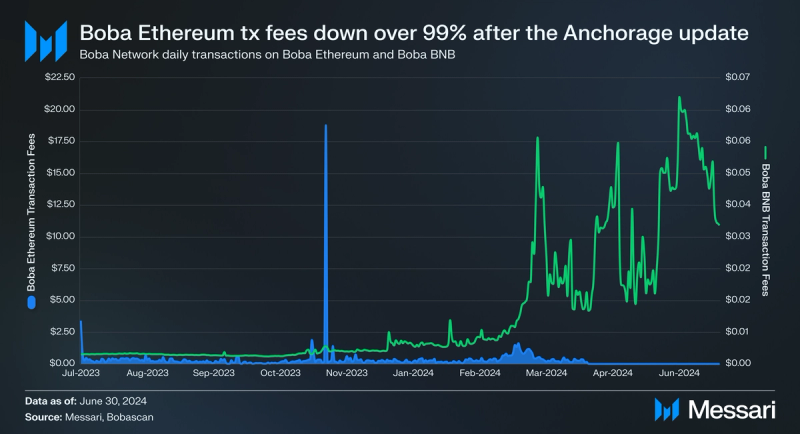

Transaction fees on Boba Ethereum are paid in ETH, while transaction fees on Boba BNB are paid in BOBA. The average transaction fee on Boba Ethereum in Q2 decreased 88% QoQ from $0.39 to $0.05. However, after the Anchorage update went live, the average transaction fee was $0.00077, a 99% decrease from Q1’s average transaction fee.

As for Boba BNB, the average transaction fee increased 203% QoQ from $0.01 to $0.04. This increase was due to less transaction activity on Boba BNB, requiring each transaction to pay a greater fee to cover the L1 settlement costs.

Technical DevelopmentsBoba Network underwent two significant technical changes in April.

On March 11, Boba Network proposed an upgrade to the Anchorage framework. The framework is based on Optimism's Bedrock architecture but includes enhancements for Boba Network. Key features of the upgrade include the following:

- Introduction of execution client diversity with Erigon as the sequencer and Geth as a verifying replica

- Proto-danksharding support

- Introduction of account abstraction

- Approximately a 40% reduction in gas fees

Voting for the proposal occurred from March 20 to 23, and the proposal passed with 1.1 million BOBA voting in favor (100% of the vote). The Anchorage update was then implemented on April 17.

On April 3, the Light Bridge was launched. The Light Bridge is designed as a centralized solution that allows for direct fund bridging between different Layer-2 platforms and between L2s and Layer-1 networks. This setup allows it to circumvent the standard 7-day challenge period typically associated with such transactions. The Light Bridge supports multiple bridging paths for BOBA, ETH, and BNB tokens, each with specific minimum and maximum transfer limits defined by smart contract parameters.

On May 7, Enya Labs, the core contributors behind Boba Network, released a demonstration on zkRand. zkRand is a distributed randomness beacon using threshold cryptography, zkSNARKs, and BLS signatures. It allows multiple members to collaboratively generate verifiable, pseudorandom outputs essential for decentralized applications like lotteries and consensus protocols. The process involves non-interactive distributed key generation and randomness generation, ensuring public verifiability, pseudo-randomness, and uniqueness.

Ecosystem Overview DeFi

DeFi

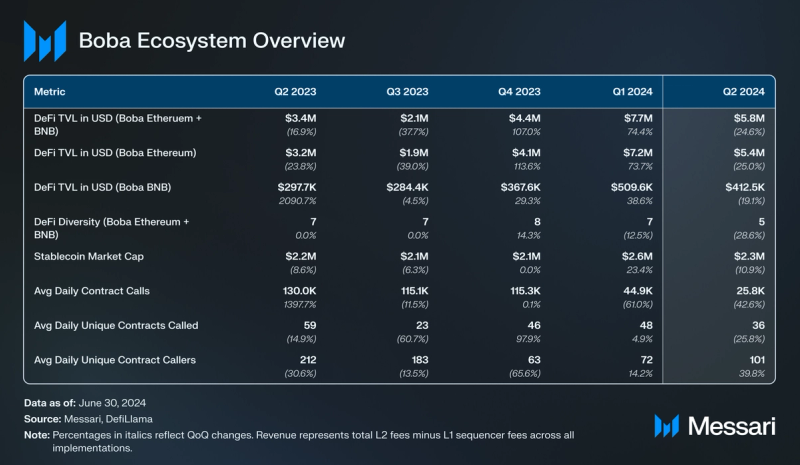

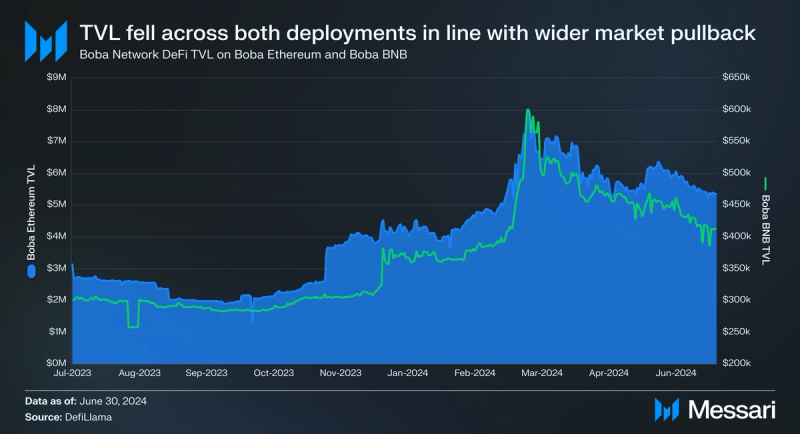

Boba Network TVL denominated in USD decreased from $7.7 million in Q1 to $5.8 million in Q2, a 25% QoQ decrease. Boba Ethereum continues to represent the majority of TVL (93%) on Boba Network. Boba Ethereum TVL decreased 25% QoQ from $7.2 million to $5.4 million. Boba BNB TVL reached an all-time high in Q1, and subsequently pulled back in Q2, ending the quarter at $412,500 (down 19% QoQ from $509,600).

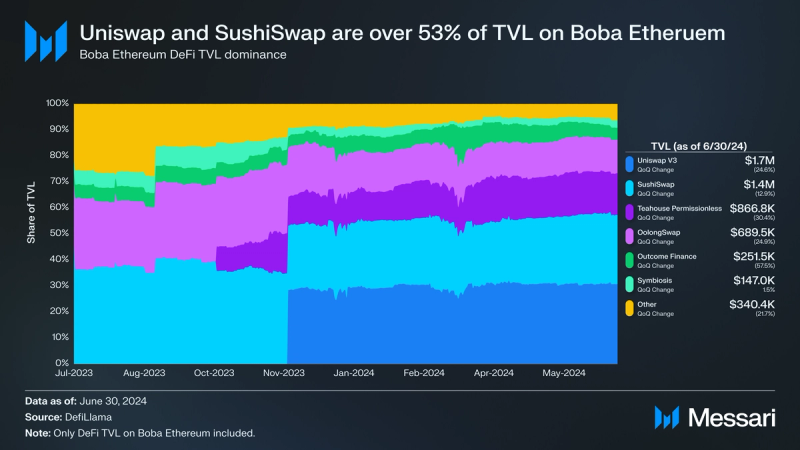

The top three protocols by TVL on Boba Ethereum continued to grow their share in Q2. Uniswap, the largest protocol by TVL on Boba Ethereum, fell 25% QoQ from $2.2 million to $1.7 million. Uniswap is a popular AMM on multiple EVM networks which launched its V3 AMM on Boba Ethereum in November 2023. By the end of Q2, Uniswap’s TVL dominance was 31% (flat QoQ). The second largest protocol by TVL is SushiSwap (another multichain AMM DEX like Uniswap), which saw its TVL decrease slightly less at 13% QoQ from $1.6 million to $1.4 million. As such, its TVL dominance increased 16% QoQ to 27%.

Rounding out the top three is Teahouse Finance. Teahouse Finance is a liquidity provision protocol, offering users easy liquidity management strategies through its vaults product. In Q2, its TVL fell 31% QoQ from $1.2 million to $866,800. Despite this drop, Teahouse Finance’s TVL is still up 69% year-to-date. This is because in January, Teahouse Finance launched a 24-week liquidity incentives program, offering 980,000 BOBA ($245,000 at Q2 end) in rewards to users that deposited liquidity to three pools (USDC-WETH, USDC-BOBA, WBTC-WETH).

In total, Uniswap, SushiSwap, and Teahouse Finance represented 73% of DeFi TVL on Boba Ethereum, a QoQ increase of 4%. The only protocol within the top six to experience a QoQ increase in TVL was Symbiosis, a cross-chain AMM DEX. Its TVL increased 2% QoQ from $144,800 to $147,000.

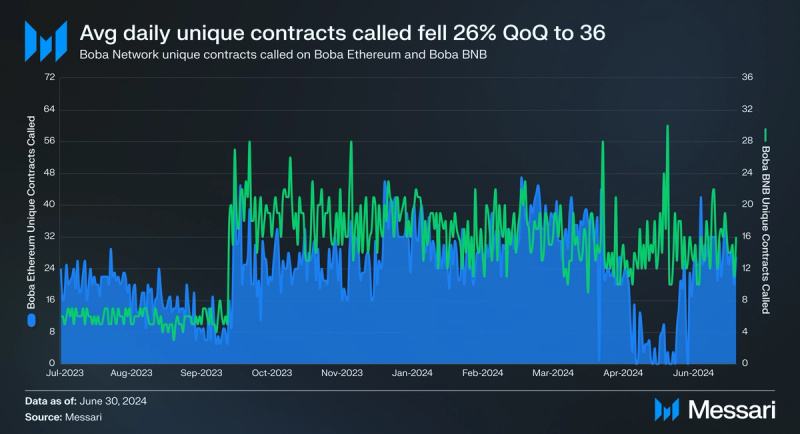

Contract ActivityAverage daily contract calls were down 43% QoQ from 44,900 to 25,800. As mentioned earlier, part of the reason for this decline is because ROVI Network migrated off Boba Network in Q2. However, average daily contract calls remain significantly higher than Q1’23 (8,700).

Unlike contract calls, average daily unique contract calls have remained relatively flat since Q2’23. In total, average daily unique contract calls were down 26% QoQ from 48 to 36. Furthermore, the average daily unique contract calls decreased across both Boba implementations. Boba Ethereum was down 35% QoQ to 21, while Boba BNB was down 12% QoQ to 14.

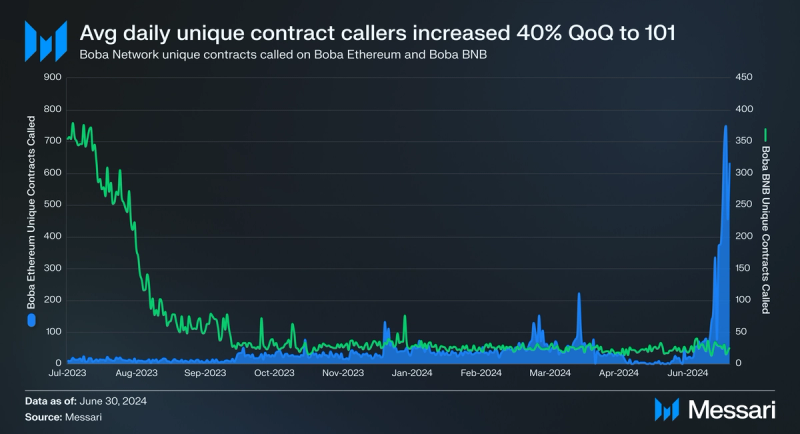

Despite the decrease in average daily unique contract calls, average daily unique contract callers increased, up 40% QoQ from 72 to 101. The majority of unique contract callers are on Boba Ethereum (up 65% QoQ to 77). Similarly to active addresses, the last two weeks in June saw a substantial increase in unique contact callers. As for Boba BNB, average daily unique contract callers were down 10% QoQ to 23.

Growth and DevelopmentErigon Client and OP StackEnya Labs, a core contributor to Boba Network, has made a significant contribution to Erigon, an L2 Bedrock OP SDK-compatible client. Boba Network was the first optimistic rollup on OP SDK to use Erigon as its sequencer client (implemented as a part of the Anchorage update). Enya’s contribution to Erigon includes implementing support for eth_getProof upstream, a complex feature that had remained unaddressed since November 2020. This enhancement allows projects to leverage Erigon as an execution engine in the Optimism ecosystem. It’s particularly noteworthy as other projects have only been able to support running Erigon as the replica. This distinction underscores the importance of Enya Labs’ work in augmenting the flexibility and diversity of the ecosystem.

Boba Network should benefit from compatible tooling from the Optimism ecosystem. Building with open-source technology is a positive-sum game, and Optimism has a large developer base which could be leveraged in the future. The greater L2 ecosystem would even benefit from the adoption of L2s that use zero-knowledge proofs or offchain data. As they push UX in multiple directions, L2s could bring about developments such as account abstraction from zkSync and Starknet, which align with Boba’s own initiatives.

Hybrid ComputeBoba Network aims to be the leading solution for gaming and metaverse applications via its Hybrid Compute feature. This feature intends to solve the problem of closed-off blockchain ecosystems. As it stands, blockchains cannot use any data or compute from outside of their ecosystem without an API or oracle. With Hybrid Compute, developers can:

- Augment their dapps with generative AI capabilities such as ChatGPT.

- Create advanced algorithms that are typically too expensive to run onchain.

- Get millisecond response times.

- Access low-cost storage, image, and audio processing.

- Connect to external gaming services such as Unreal Engine.

- Instantly mint NFTs based on game activity.

- View offchain price feeds (e.g., CoinGecko) to create variable pricing/actions.

With Hybrid Compute, developers can leverage legacy Web2 systems and solutions to build higher-quality blockchain applications.

Closing SummaryIn Q2'24, Boba Network made significant strides despite a 57% drop in its circulating market cap. Boba Ethereum saw a notable increase in activity, with daily transactions surging by 7,973% QoQ due to reduced onchain costs from the Anchorage update and Ethereum’s EIP-4844 upgrade. Although TVL on Boba Ethereum and Boba BNB declined, major protocols like Uniswap, SushiSwap, and Teahouse Finance maintained their dominance.

The Anchorage update and the launch of the Light Bridge marked key technical milestones, improving network efficiency and enabling easier cross-chain interactions. Boba’s focus on gaming and metaverse applications, supported by its Hybrid Compute feature, highlights its potential to lead in integrating offchain resources into blockchain ecosystems.

With these developments, Boba Network is well-positioned for continued growth, leveraging its technical advancements and expanding use cases in the evolving blockchain landscape.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.