and the distribution of digital products.

State of Avalanche Q4 2024

- Avalanche's Avalanche9000 upgrade, launched on Dec. 16, 2024, significantly advances Layer-1 blockchain technology, reducing L1 deployment costs by 99.9% and C-Chain usage costs by 96%, enhancing Avalanche's blockchain scalability and efficiency.

- The Avalanche ecosystem saw growth in DeFi, with total value locked reaching $1.6 billion and expansions including BlackRock's BUIDL fund extending to the Avalanche network, indicating increased institutional interest in Avalanche's DeFi capabilities.

- Avalanche gained traction in blockchain gaming and NFTs, as seen with "Off the Grid," which topped the Epic Games store's most popular free-to-play games list and won multiple awards at the 2024 GAM3 Awards, highlighting the platform's role in the expanding GameFi sector.

- The AVAX token increased from $17.72 in August to over $45 by December 2024, amid ecosystem expansion and broader market volatility.

Avalanche (AVAX) is a Proof-of-Stake (PoS) smart contract platform for decentralized applications. Avalanche differentiates itself by creating and implementing a consensus family known as "Avalanche consensus."

Following years of research, the Avalanche mainnet was launched in September 2020 and featured the release of a multichain framework utilizing three chains: the P, X, and C chains. Each chain plays a critical and unique role within the Avalanche ecosystem while providing the same capabilities of a single network, often called the Primary Network. Avalanche consensus and the Primary Network are designed to support sovereign, interconnected blockchains known as Avalanche L1s.

L1s are subclasses of Primary Network validators that run the same Virtual Machines (VMs) with their own rules. L1s enable different properties of reliability, efficiency, and data sovereignty. They allow the creation of custom blockchains for different use cases while isolating high-traffic applications from congested activity on the Primary Network.

Website / X (Twitter) / Discord

Key Metrics Financial Analysis

Financial Analysis Market Cap and Transaction Fees

Market Cap and Transaction Fees

AVAX’s growth continued in Q4, growing by 30% QoQ to $14.6 billion (3.7% increase YoY, from $14.1 billion). This growth increased its market cap amongst all tokens from 12 to 11.

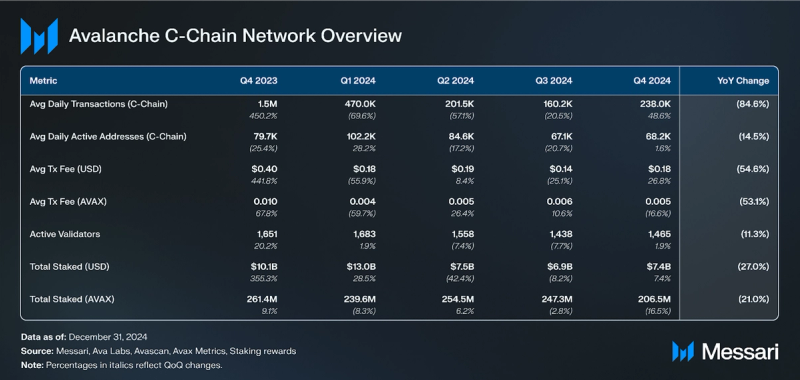

The network's transaction fees grew in Q4, mainly due to price appreciation. Transaction fees in AVAX increased by 24% QoQ from 85,200 to 105,600, and revenue in USD increased by 88% QoQ from $2.1 million to $4.0 million. Although Q4’s growth was substantial, transaction fees in USD and AVAX are down 93% YoY due to decreased transactions and the implementation of Avalanche9000, reducing C-Chain minimum base fees.

Supply DynamicsAll revenue on Avalanche is burned. Instead, validators and stakes are rewarded with newly minted tokens. AVAX currently has a fixed supply of 720 million tokens.

Half of these tokens are distributed as staking rewards, with a dynamic schedule depending on the amount staked and time staked. As more users stake AVAX for more extended periods, more AVAX is issued as staking rewards. The annualized inflation rate for Q4 was 3.9%, down 19% QoQ from 4.8%. Additionally, eligible supply staked was down 17% QoQ from 54.9% to 45.6%.

The other 360 million tokens were allocated to various buckets at launch. Genesis supply liquid measures the percentage of these tokens that have unlocked.

At the genesis block, 360 million AVAX was minted. This genesis supply was distributed to various allocations over differing vesting periods. Over 2024, the liquid genesis supply increased by 12%, from 81% to 91%. The genesis supply is projected to be fully vested by 2030. In Q3, an additional 9.5 million AVAX was vested in the team’s and foundation’s allocation. The Q3 token unlock was the last major unlock. There were only 1.4 million AVAX unlocked in Q4 to the foundation. A full breakdown of vesting schedules for AVAX can be found on Messari’s Token Unlock page in the new Avalanche Messari Portal.

Network Analysis

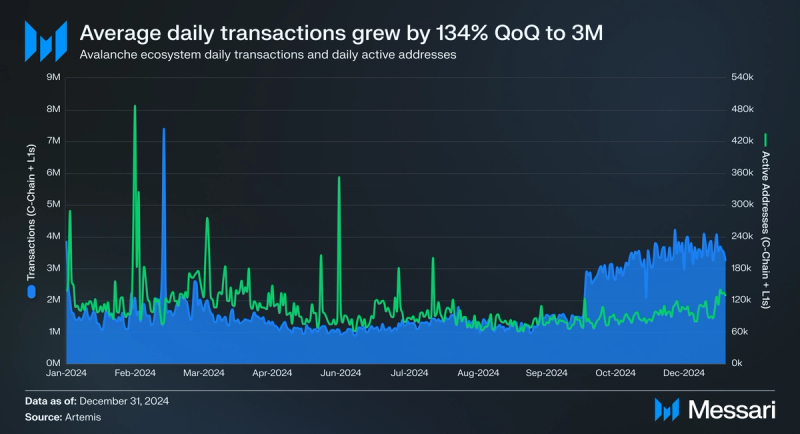

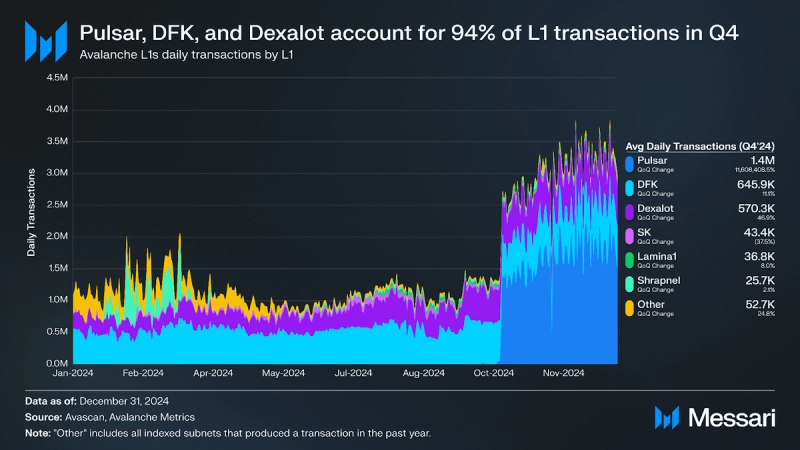

In Q4, when aggregating transactions across the C-Chain and all L1s average daily transactions grew by 134% QoQ to 3.0 million transactions from 1.3 million in Q3. This was led by the Pulsar L1, which launched in early October and finished the quarter with 1.4 million average daily transactions. Over the same period average daily active addresses increased by 7% QoQ to 92,300 addresses from 86,000 in Q3.

C-Chain Usage

Usage

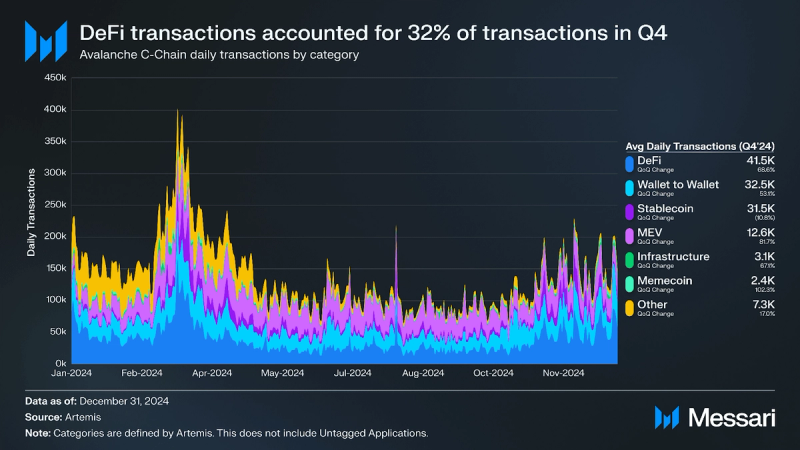

Memecoin and MEV-related transactions were the largest beneficiaries of the increase in C-Chain daily transactions. DeFi was the largest category, with a 32% market share and an increase of 69% QoQ from 24,600 to 42,500.

Wallet-to-wallet transactions were second, growing by 53% QoQ from 21,200 to 32,500. Closely behind wallet-to-wallet transactions were stablecoin transactions, decreasing by 11% QoQ from 35,300 to 31,500.

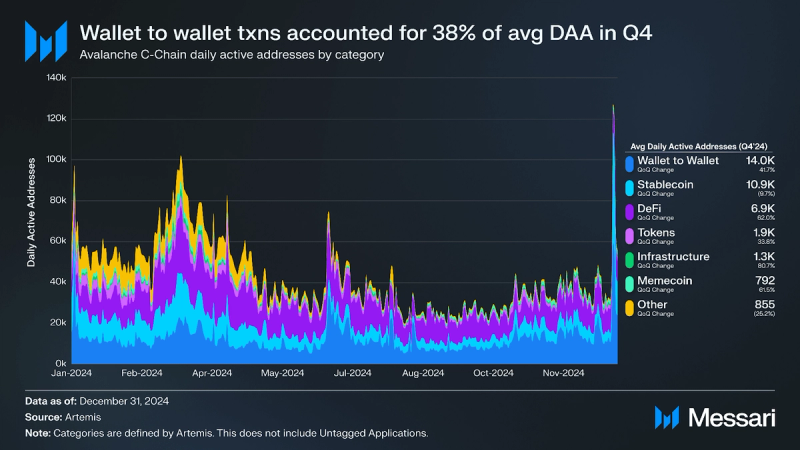

Similarly to transactions, daily active addresses interacting with protocols increased in Q4. Infrastructure was the largest gainer in daily active addresses, growing by 81% from 740 to 1,300. Wallet-to-wallet was the largest daily active addresses category, with a 38% market share and an increase of 42% QoQ from 9,900 to 14,000. Daily active addresses related to stablecoin transactions were second decreasing by 10% from 12,000 to 10,900.

Security and DecentralizationAvalanche uses a Proof-of-Stake consensus mechanism known as “Avalanche Consensus.” Avalanche’s P-Chain is responsible for validator coordination and staking operations. Both C-Chain and X-Chain utilize the entire P-Chain validator set for consensus. To determine if a transaction is valid, validators on Avalanche use repeated sub-sampling voting of a minor, random subset of all validators. Consensus occurs once a sufficient majority of validators agree over consecutive rounds. Both the necessary majority and consecutive rounds are configurable. Additionally, the more tokens staked/delegated to a validator, the more influential that validator is in the consensus process.

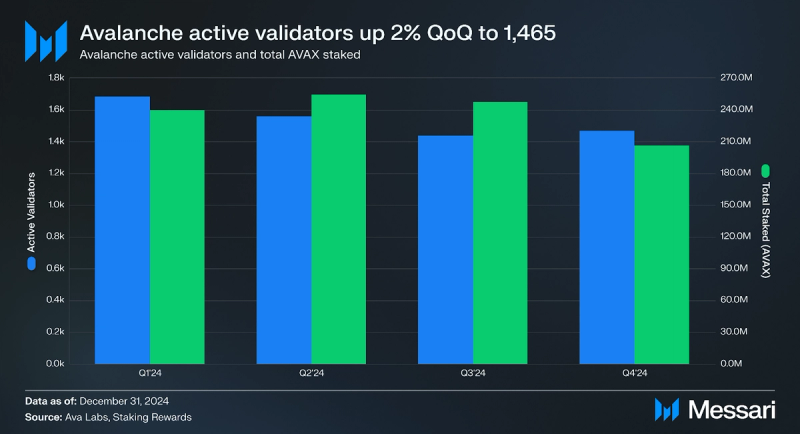

The active validator count increased by 2% QoQ from 1,438 to 1,465. AVAX staked decreased in Q4, down 17% QoQ from 247.3 million to 206.5 million. The Avalanche Foundation sought to improve AVAX staking metrics in Q2 by launching its Icebreaker Program, an initiative aimed at strengthening Avalanche’s onchain ecosystem. As a part of the first phase of this program, 500,000 AVAX was contributed from the program to several liquid staking solutions on Avalanche. AVAX staked was also partially bolstered by Coinbase, which launched native support for AVAX staking in May. As for AVAX staked in USD, it grew by 7% QoQ to $7.4 billion due to the price of AVAX increasing in Q4.

Technical DevelopmentsAvalanche9000

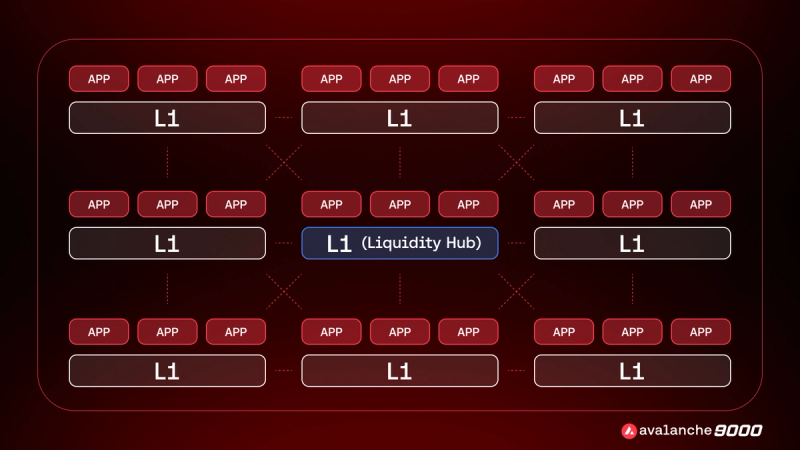

The Avalanche team introduced Avalanche9000 in early September and went live on Mainnet on December 16. This network upgrade has been labeled “the largest network upgrade since mainnet launch”. The upgrade made launching an L1 easier. The majority of the upgrade is the implementation of ACP-77. This ACP replaces ACP-13 and aims to rework how validation for Avalanche L1s works. Each L1 validator must first become a P-Chain validator, which requires staking 2,000 AVAX ($56K at Q3 end). Since the average L1 utilized eight validators in Q3, the approximate cost for initiating a validator set for an L1 in Q3 was 16,000 AVAX ($450K at Q3 end). This proposal removed the P-Chain validator requirement, thereby separating L1 validators from P-Chain validators. Instead, L1s will pay a dynamic fee to P-Chain validators. This new upgrade will combine the C-chain, the network of L1s, and Avalanche Interchain Messaging.

The primary chain will be the economic and foundational hub that powers Avalanche9000. Liquidity now flows easily between other L1s, allowing developers access to pre-built tools to use new L1s. The graphic above showcases how every L1 is connected through Avalanche Interchain Messaging (ICM). This architecture unlocks the following:

- Complete control to customize L1 staking economics, gas tokens, and more

- Open and permissionless validator sets to increase decentralization

- Regulatory compliance built-in with geo-restrictions and custom permissions

- Scale with any virtual machine to maximize performance

Avalanche9000 included the following:

- The Etna Uprage

- ACP-77

- ACP-125: Reduce C-Chain minimum base fee - This ACP reduced the minimum base fee from 25n AVAX to 1 nAVAX. Since implementing dynamic fees, the base fee for a transaction is pinned to the minimum, suggesting the minimum base fee is higher than the market demands.

- ACP-103: Add Dynamic Fees to the X-Chain and P-Chain - This procedure added dynamic fees to the P and X-Chains in preparation for multidimensional dynamic fees.

- ACP-113: Provable Virtual Machine Randomness - This ACP proposed a mechanism to generate verifiable, non-cryptographic random number seeds. This will allow developers to build more versatile applications since the current state of development is limited by the platform’s deterministic block execution limits.

- ACP-20: Ed25519 p2p - Implemented Ed25519 public keys and signatures into the network and ProposerVM.

- ACP-131: Activate Cancun EIPs on C-Chain and L1-EVM chains - Implemented five EIPs included in Ethereum’s Cancun upgrade.

- ACP-118: Standardized P2P Warp Signature Request Interface - This ACP changed how AppRequest payloads are sent so they are received in a VM-agnostic manner.

- Nomenclature changes

- Developer incentives and tooling

- Multichain solutions powered by Core

- Partner launches

Other Technical Developments:

In Q1, Avalanche successfully underwent the Durango upgrade, which enables any Avalanche network to natively communicate with one another by asynchronously calling smart contracts on EVM-enabled chains within Avalanche. Q1's report provides more details regarding the Durango update.

In Q4, other than the Avalanche9000 upgrade, one ACP was activated:

- ACP-151: Use current block P-Chain height as context for state verification - This ACP changed that the ProposerVM passes the current block height rather than the parent block height. This should remove unnecessary waiting periods while determining which validators should participate in consensus.

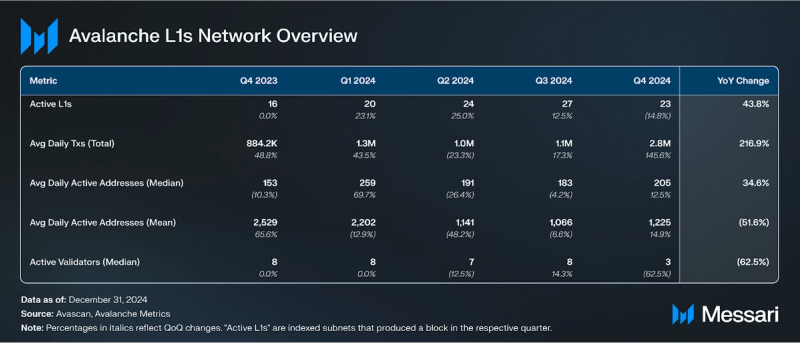

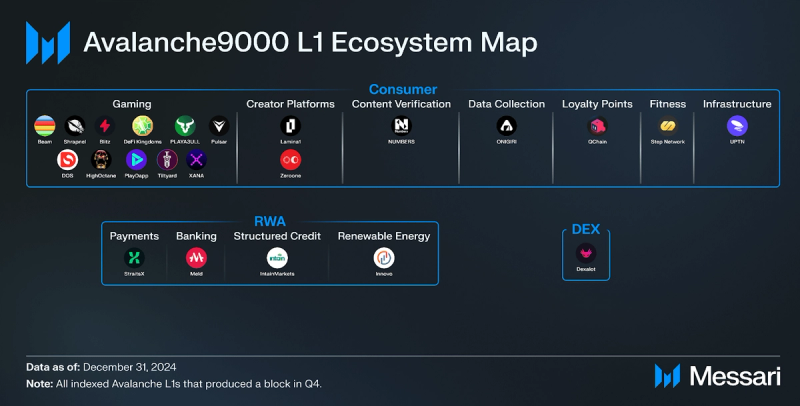

23 indexed Avalanche L1s produced a block in Q4:

- Beam

- Blitz

- Dexalot

- DFK

- DOS

- HighOctane

- Intain (Q4 Launch)

- Innovo

- Lamina1

- MELD

- NUMBERS

- ONIGIRI

- PLAYA3ULL Games

- PlayDapp

- PLYR PHI

- Pulsar (Q4 Launch)

- QChain (Q4 Launch)

- Shrapnel

- StraitsX

- Step Network

- Tiltyard

- UPTN

- XANA

- Zeroone

Transaction activity was up in Q4 for most L1s. Across all L1s, Q4’s daily average transaction count was 2.8 million, up 146% QoQ from 1.1 million. The largest gainer by far was Pulsar, up 11.6M% QoQ to 1.4 million average daily transactions for Q4. Pulsar is a new massive multiplayer online real-time strategy (MMO RTS) game that launched at the end of Q3. Dexalot was also a notable gainer (up 47% QoQ to 570,300).

Copilot Insights: What is Pulsar, a gaming L1 within the Avalanche ecosystem?

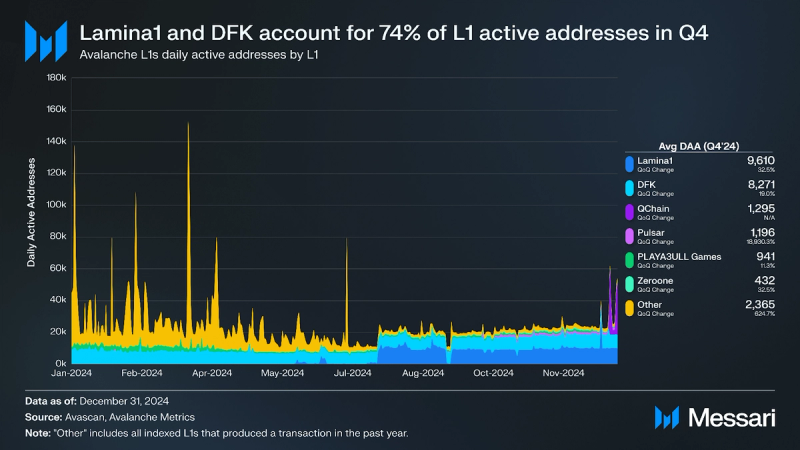

Active addresses on L1s were up in Q4, with the median (up 13% QoQ from 183 to 205 active addresses) and mean (up 15% QoQ from 1,066 to 1,225 active addresses) increasing. Most of the drawdown can be attributed to new L1s launching this quarter. The vast majority of active addresses continue to come from gaming L1s, with three of the top five L1s by active addresses being gaming-focused, and the largest L1 by active addresses is Lamina1, a digital content creation chai. DFK, Pulsar, and PLAYA3ULL Games accounted for 43% of all active addresses in Q4. QChain is the L1 for Quboid, a chain designed for real-time, compliant loyalty settlements. After a stealth launch at the end of Q4, they quickly rose to the third spot, growing to 1,295 daily active addresses.

Ecosystem Analysis DeFi

DeFi

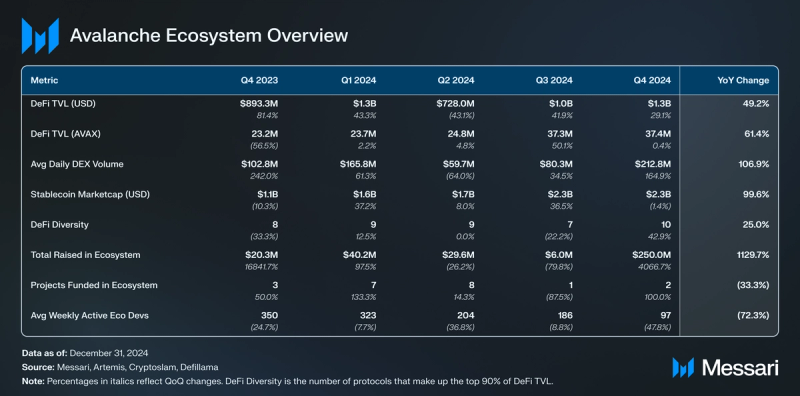

Avalanche DeFi TVL denominated in USD increased from $1.0 billion to $1.3 billion in Q4, a 29% QoQ increase. By the end of the quarter, this ranked Avalanche as the 10th highest chain by TVL denominated in USD. TVL denominated in AVAX stayed relatively flat QoQ, increasing 100,000 AVAX to 37.4 million.

The top three protocols by TVL continued to represent the bulk of TVL on Avalanche in Q4. Benqi, the largest protocol by TVL on Avalanche, increased by 25% QoQ from $598.5 million to $749.1 million. By the end of Q4, Benqi’s TVL dominance was 39% (down 6% QoQ from 42%).

Aave, the second largest protocol by TVL, also saw an increase in TVL. Its TVL grew by 29% QoQ from $387.1 million to $498.8 million. As for its TVL dominance, it decreased by 16% QoQ from 27% to 26%.

The third largest protocol by TVL, LFJ, grew by 19% QoQ from $122.0 million to $145.5 million. By Q4 end, LFJ represented 8% of TVL on Avalanche. When LFJ announced its rebranding in Q3, it also announced a roadmap. The roadmap highlighted Joe v3 and Joe v4. Joe v3 is a bonding curve AMM similar to Pump.fun, which launched in early Q4. Joe v4 will be a central limit order book; however, there are no announced details on when this will be released.

Benqi, AAVE, and LFJ accounted for 73% of DeFi TVL on Avalanche, a QoQ decrease of 6%. Outside of the top three, BlackRock’s BUIDL Fund, launched in Q4 and quickly grew to $57.1 million in TVL.

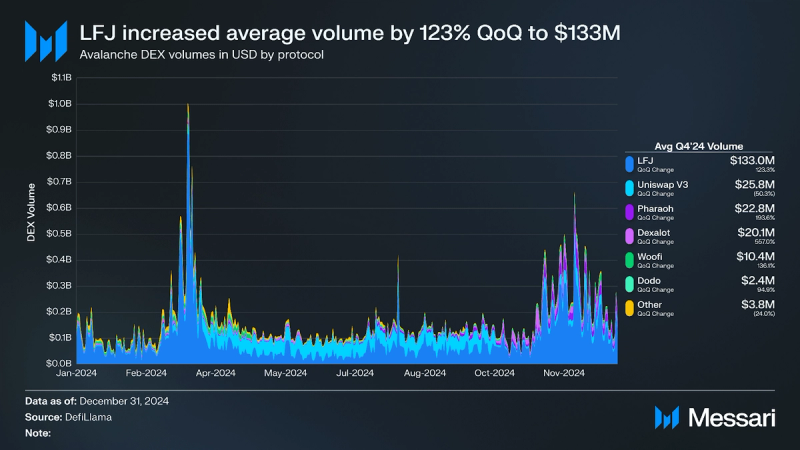

Average daily DEX volumes on Avalanche C-Chain increased in Q4, growing by 165% QoQ from $80.3 million to $212.8 million.

By the end of Q4, there were 39 different DEXs on Avalanche, adding one over the quarter. Despite the increased competition, leading DEX LFJ remained the dominant DEX on Avalanche. The average daily DEX volume on LFJ increased 123% QoQ from $59.6 million to $133.0 million. For Q4, the top five DEXs by average daily trading volume were:

- LFJ - $133.0 million (61% of Avalanche DEX volume)

- Uniswap V3 - $25.8 million (12% of Avalanche DEX volume)

- Pharaoh Exchange - $22.8 million (10% of Avalanche DEX volume)

- Dexalot - $20.1 million (9% of Avalanche DEX volume)

- Woofi - $10.4 million (5% of Avalanche DEX volume)

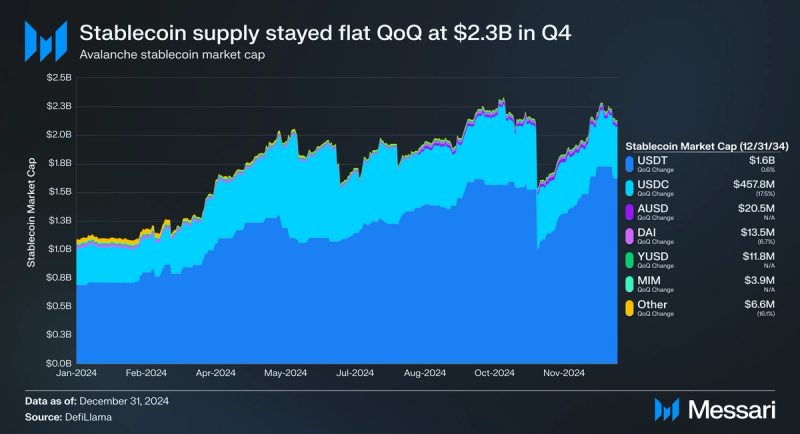

In Q4, stablecoins on Avalanche stayed relatively flat. By the Q4 end, the stablecoin market cap was $2.3 billion, down 1% QoQ from $2.3 billion. Compared to other chains, Avalanche had the 7th largest stablecoin market cap. Fiat-backed stablecoins like USDT and USDT represent 97% of the stablecoin supply on Avalanche. USDT increased by 1% QoQ to $1.6 billion (76% of Avalanche stablecoin supply), while USDC decreased by 18% QoQ from $554.8 million to $457.8 million (21% of Avalanche stablecoin supply).

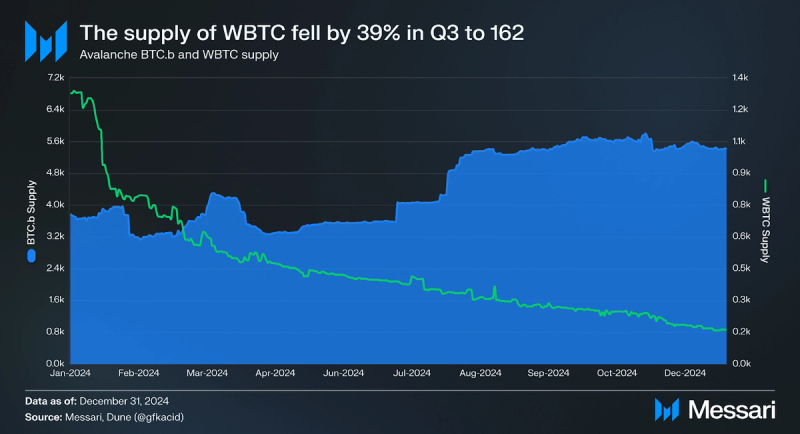

BTC.b is one of the largest assets on Avalanche besides AVAX and stablecoins. BTC.b is a token representing Bitcoin on Avalanche and can be automatically bridged in Core. Compared to other natively bridged Bitcoin assets, BTC.b allows users to freely transfer native Bitcoin without relying on custodians. The supply of BTC.b finished down 2% QoQ, from 5,490 to ,404 BTC.b. As for WBTC on Avalanche, its supply decreased by 39% QoQ from 267 to 162 WBTC.

Enterprise and RWAsOne of Avalanche’s primary initiatives for 2024 is to onboard institutions and enterprises onto the network. Last year, in Q2’23, Evergreen L1s launched, allowing anyone to create an L1 with customizable KYC/AML requirements and unique privacy capabilities. Since the launch of Evergreen L1s, Avalanche has onboarded several enterprises through partnerships, including J.P. Morgan, Citi, Republic, and Grayscale.

In Q4, Avalanche announced the following updates related to Evergreen and other enterprise and RWA adoption initiatives:

- Cavs Rewards- In October, the Cleveland Cavaliers launched their rewards program, Cavs Rewards, in partnership with Uptop on the Avalanche network. Cavs Rewards enhances the fan experience and turns fans’ everyday purchases into unforgettable Cavaliers experiences.

- RWA-Backed USDC Yield Product - In October, Colombian Neobank launched their RWA-backed USDC yield product on Avalanche. The product is powered by OpenTrade’s vaults and is only available to local customers.

- BlackRock’s BUIDL Fund - In November, BlackRock’s onchain fund announced support for the $500 million fund on Avalanche.

- Elixir’s deUSD- In November, in collaboration with Securitize, Elixir brought deUSD to Avalanche. This RWA institutional program brings over $1 billion of tokenized RWAs to Avalanche DeFi.

- MeWe- In November, the MeWe team announced their plans to launch their own L1 to power their decenralized social network.Approximately 1.3 million MeWe users are now fully on-chain and over 675,000 users own their social graphs.

- Sports Illustrated Tickets and the New York Red Bulls- In December, SI tickets and the New York Red Bulls announced a 13 year partnership to bring all live ticketing onchain powered by Avalanche.

- Uplink- The first decentralized physical infrastructure network (DePIN) Layer 1 project built on the Avalanche Blockchain, paves the way for global decentralized internet connectivity, bridging the gap between traditional enterprise connectivity and community-driven network models.

- Franklin Templeton’s Benji - Franklin Templeton launched its Franklin onchain U.S. Government Money Fund (FOBXX) on the Avalanche network in late Q3. This move was noteworthy as FOBXX, launched initially on Stellar in April 2021, became the first U.S.-registered mutual fund to utilize a public blockchain for transactions and share ownership. The FOBXX fund, which currently manages $420 million in assets, invests in low-risk U.S. government securities and allows for 24/7 peer-to-peer trading. Each share, represented by a BENJI token, maintains a stable price of $1 and is accessible via the Benji Investments app.

- Tixbase- Tixbase is creating Tixchain, an Avalanche L1 that is customized for ticketing systems. By bringing ticketing onchain, the user gains enhanced security, transparency of sales, built-in loyalty programs, reduced counterfeit tickets, secondary market revenue for sports teams and music IPs, and digital assets packages with the ticket. In December, the team announced they are apart of Retro9000.

Q4 was a busy quarter for gaming on Avalanche, with the following notable events:

- Off The Grid- In early October, the game had its early release on PC, Xbox, and PS5. Off The Grid is powered by an Avalanche L1 that is currently still in testnet, but will eventually be powered by the $GUN token. During the first two weeks of early release the game saw over 8 million new wallets created. The game also reached the top of the Epic Games store most popular free-to-pay list and secured multiple GAM3 Awards.

- FCHAIN- In October, The Faraway Gaming Ecosystem announced their Avalanche L1. This will fuel Faraway’s growing gaming ecosystem, which includes Shatterline, Villains: Robot Battle Royale, HV-MTL, Legends of the Mara, among other titles.

- In December, Shatterline became available on Epic Games.

- Beam L1- Beam, the gaming L1 run by The Beam Foundation, had a quartet of big announcements in December. The news included a global expansion to Abu Dhabi, a new AI division, their L1 going permissionless, and a node sale.

- Pulsar - At the end of Q3, Pulsar, a new massive multiplayer online real-time strategy (MMO RTS) game, launched and quickly became the largest L1 by average daily transactions (1.4 million). Pulsar is available to download on Windows and MacOS. In Q1’25, the team had their TGE for PLSR, launching at a $5 million market cap which grew to $6 million at the time of writing.

- Shrapnel- In 2024, the AAA first person shooter extraction game was nominated for Best Shooter by Gam3s.gg, two Telly Awards (Gold in People’s Telly for Social Video and Silver for Video Games and eSports), and a Webby Honoree award in Action and Adventure Games. In early Q1’25 the team announced that they will launch their free-to-play, always-on game in 2025.

Avalanche L1s are quickly becoming a destination to launch AAA games. This trend will only accelerate once the GUNZ blockchain (the home to Off The Grid) launches mainnet in Q1’25 and Shrapnel is officially released.

Ecosystem GrowthFunding and Institutional Support

The development and launch of Avalanche9000 were backed by financial and institutional support. The Avalanche Foundation raised $250 million through a private token sale led by firms including Galaxy Digital, Dragonfly, and ParaFi Capital. Despite Avalanche's treasury of approximately $3 billion in AVAX tokens, this investment highlighted the strategic importance of the Avalanche9000 upgrade.

Messari’s Avalanche Portal

In early Q1, Messari announced the Avalanche Portal, which allows users to find quantitative and qualitative insights into the Avalanche ecosystem.

ETF Developments and Institutional Products

One of the most notable regulatory developments of the quarter was the progress made in cryptocurrency Exchange-Traded Fund (ETF) approvals. Grayscale Investments filed with the Securities and Exchange Commission (SEC) to convert its existing Digital Large Cap Fund (GDLC) into an ETF. This multi-token fund, which includes Avalanche (AVAX) among other prominent cryptocurrencies, represented a significant step towards broader institutional access to diversified crypto investments.

Similarly, the New York Stock Exchange filed for the listing of the Bitwise 10 Crypto Index Fund, which also includes AVAX in its basket of assets. These filings highlighted the growing appetite for regulated crypto investment products and the increasing recognition of Avalanche as a key player in the institutional crypto landscape.

The regulatory environment showed signs of becoming more accommodating to crypto-based financial products. This was evidenced by the SEC's earlier approval of spot Bitcoin and Ethereum ETFs in 2024, which set a precedent for more complex, multi-asset crypto funds. However, the inclusion of altcoins like AVAX in these funds presented new regulatory challenges, particularly concerning the classification and treatment of tokens beyond Bitcoin and Ethereum.

Closing SummaryAvalanche’s Q4 2024 showcased significant advancements across technical infrastructure, ecosystem expansion, and institutional adoption. The launch of Avalanche9000 on December 16, 2024, marked a major milestone, drastically reducing L1 deployment costs and C-Chain transaction fees while enhancing network scalability and efficiency. This upgrade streamlined blockchain creation, fostering a more interconnected Avalanche ecosystem and positioning the network as a more attractive platform for developers and enterprises alike.

Beyond the core technical developments, institutional and DeFi activity surged, with Avalanche's DeFi TVL reaching $1.6 billion, supported by the expansion of BlackRock’s BUIDL fund onto the network. The ecosystem also saw heightened interest in tokenized real-world assets (RWAs) and enterprise partnerships, including MeWe’s transition to an Avalanche L1 and Sports Illustrated’s long-term partnership with the New York Red Bulls for onchain ticketing.

In gaming, Avalanche continued its momentum with Off the Grid, reaching the top of the Epic Games store’s most popular free-to-play list and securing multiple GAM3 Awards. The launch of Pulsar, a large-scale MMO RTS game, drove L1 transaction activity up 146% QoQ, reinforcing Avalanche's growing presence in the GameFi sector.

Despite broader crypto market volatility, AVAX surged from $17.72 in August to over $45 by December, reflecting confidence in the ecosystem’s expansion. The quarter also saw growing institutional recognition, as Grayscale and Bitwise ETFs included AVAX in their multi-asset funds, strengthening its position within the regulated investment landscape.

Avalanche's focus on scalability, enterprise integration, and gaming expansion positions it for continued growth. The success of Avalanche9000, combined with increasing institutional engagement and DeFi adoption, sets the stage for further network resilience and ecosystem diversification in 2025.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.