and the distribution of digital products.

State of Aptos Q2 2024

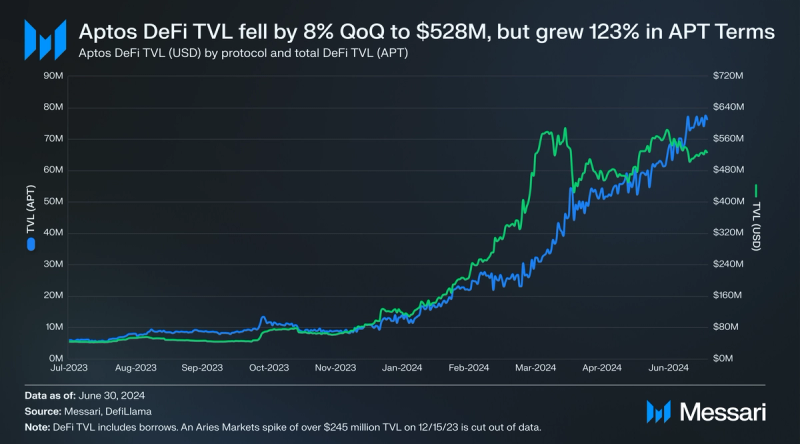

- Aptos’ DeFi TVL increased by 123% QoQ in APT terms to 75 million APT, demonstrating increasing adoption of the network’s DeFi ecosystem in spite of the price of APT declining 59% QoQ.

- In May, Aptos set the record for the highest daily transaction count in Layer-1 blockchain history (156 million) following the launch of the viral clicker game Tapos Cat.

- The Aptos Foundation announced in May that Chainlink Data Feeds and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will be integrated on Aptos.

- In June, Aptos Labs unveiled the next-generation consensus protocol, Shoal ++, which sets new industry performance milestones with 100,000 transactions per second (TPS) throughput at sub-second latency.

- Aptos Labs introduced Aptos Connect, which uses Aptos Keyless Accounts to offer a self-custodial wallet with one-click account creation, no private keys and no wallet applications or extensions required.

Aptos (APT) is a Layer-1 blockchain designed around the core tenets of scalability, safety, reliability, and upgradeability. Aptos was born out of Meta’s Diem and Novi projects, eventually launching in October 2022. Core developer Aptos Labs raised about $400 million in two 2022 private investor rounds.

Aptos’ technological stack features many novel aspects, including the AptosBFTv4 consensus mechanism, the Quorum Store mempool protocol, the Block-STM parallel execution engine, and the programming language Aptos Move. Aptos Move, which builds on the original Move language created by the Diem and Novi teams, offers enhanced flexibility and safety compared to other Web3 programming languages. Aptos Move is being co-developed by multiple protocols.

Other key features aim to improve user experience and safeguards, including accounts where private keys are decoupled from public keys, transaction pre-execution to explain the outcome of a transaction before a user signs it, and transaction expiration time and sequence numbers. Development of the Aptos network and growth of the Aptos ecosystem is primarily led by Aptos Labs and the Aptos Foundation. For a full primer on Aptos, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

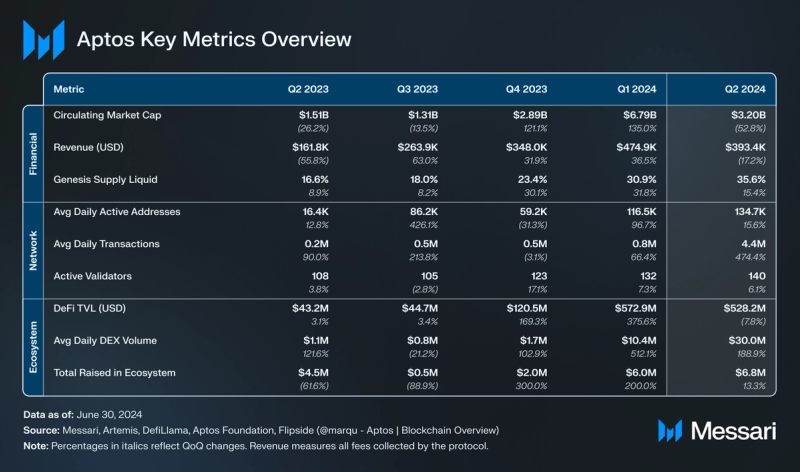

Key Metrics Financial Analysis

Financial Analysis

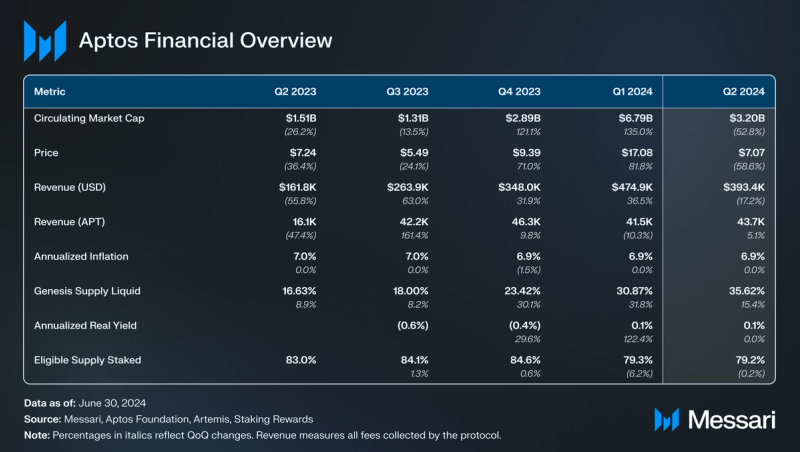

After peaking in Q1’24 the circulating market caps of BTC and ETH declined by approximately 12% and 6% in Q2’24. APT followed the same trend, albeit more steeply. Its circulating market cap decreased by 53% QoQ to $3.2 billion, while its market cap rank dropped five spots from 22 to 27. APT’s price dropped 58.6%, as token unlocks continued in Q2, detailed further below.

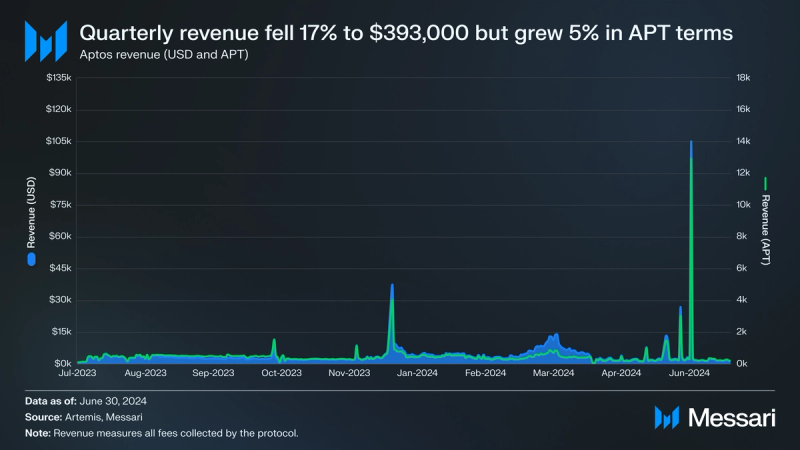

Aptos revenue, i.e., all fees collected by the protocol, fell by 17% to $393,400 but increased by 5% when denominated in APT. Q2’s figure was driven by a spike on June 8 possibly due to transactions attempting arbitage on lending via Aptis Finance. Currently, Aptos burns all revenue generated. At the moment, these burned tokens have not significantly reduced inflation.

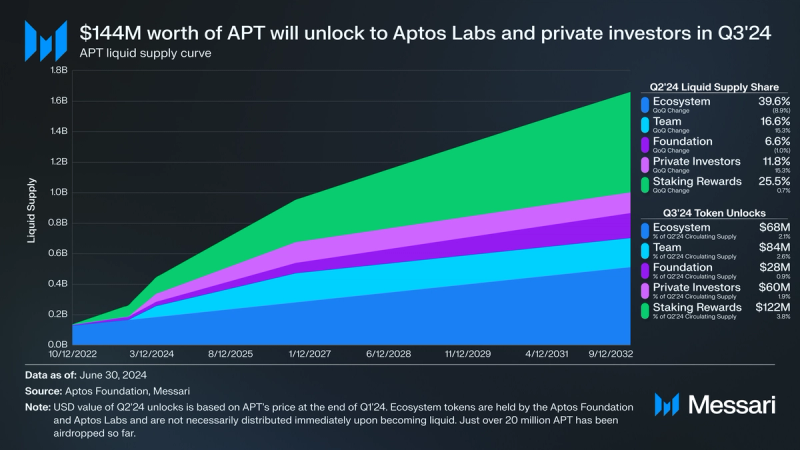

APT staking rewards are inflationary and began at a 7% annualized rate in 2022 and will decrease by 1.5% each year until reaching 3.5%. This yearly change occurred in mid-October, reducing the staking reward rate to just under 6.9%. Note that this rate is based on the initial total supply of 1 billion APT. The APT circulating supply experienced other inflationary pressure coming from genesis supply unlocks. The genesis supply includes the 1 billion APT initially allocated but not staking rewards. By the end of Q2, over 35% of the genesis supply has unlocked a 15% QoQ increase.

Another 3.4% of APT’s genesis supply is set to unlock in Q3’24:

- Team (35% of Q3 unlocks): Based on APT’s price at the end of Q2, $84 million will unlock to core contributors in Q3.

- Private Investors (25% of Q3 unlocks): Based on APT’s price at the end of Q2, $60 million will unlock to private investors in Q3, representing 1.9% of APT’s circulating supply at the end of the quarter. FTX Ventures participated in Aptos Labs’ first fundraising round and co-led its second.

- Ecosystem (28% of Q3 unlocks): Based on APT’s price at the end of Q1, $68 million will unlock to the ecosystem bucket in Q2, although these tokens will not necessarily be immediately distributed upon becoming liquid. Note that before any distribution, 80% of these tokens were held by the Foundation and 20% by Aptos Labs. These tokens are used for grants, incentives, and other initiatives. So far, just over 20 million APT from this allocation has been airdropped.

- Foundation (12% of Q3 unlocks): Based on APT’s price at the end of Q1, $28 million will unlock to the Aptos Foundation in Q2. The Foundation plans to use these tokens to host events, fund legal support, sponsor research, and more.

At the end of Q2, 79% of supply eligible to be staked was staked, a less than 1% QoQ decrease. Note that locked tokens can still be staked and earn liquid staking rewards. In this case, the supply eligible to be staked is APT’s total supply rather than its circulating supply.

Network Analysis Usage

Usage

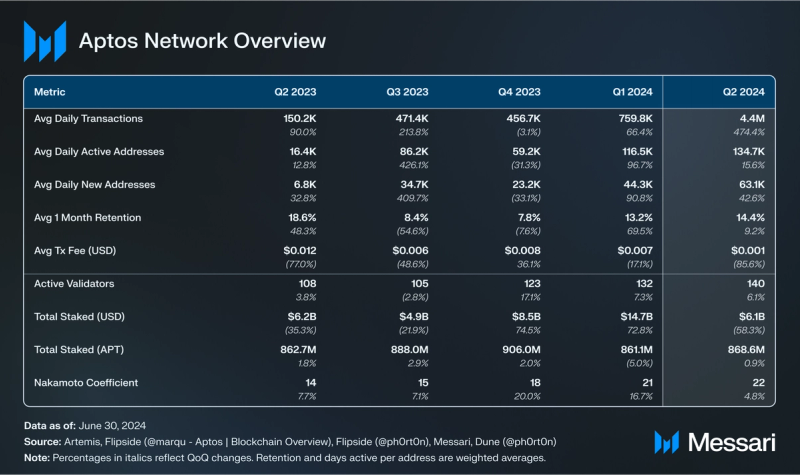

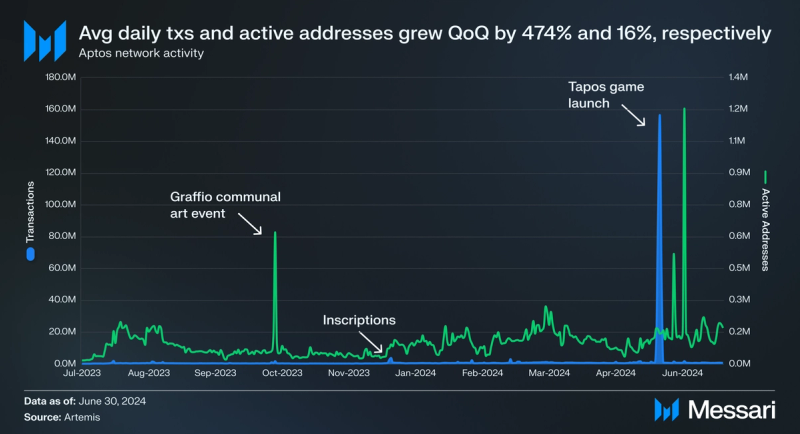

Network activity, measured by transactions and active addresses, increased in Q1. Average daily transactions and addresses increased QoQ by 474% to 4.4 million and 16% to 135,000, respectively.

In Q2, Aptos saw the highest daily transaction count in the history of Layer-1 blockchains. Transactions peaked May 23-26 (peaking at 156 million on May 25) following the launch of Tapos, an onchain game developer whose first game allows users to tickle a digital cat, with each tickle resulting in one transaction. In late June, Tapos announced plans for a second game which launched in mid-August and led to Aptos topping its previous daily transaction record.

Tapos overtook social media platform Chingari to lead Aptos smart contracts activity, averaging 3.6 million daily transactions in Q2. Meanwhile, Chingari fell to the second spot, averaging 180,000 daily transactions in Q2, roughly the same as what it averaged in Q1. Overall, despite increased transaction activity, the average transaction fee decreased by 86% QoQ to 0.007 APT ($0.001) as the costs of Tapos transactions are low.

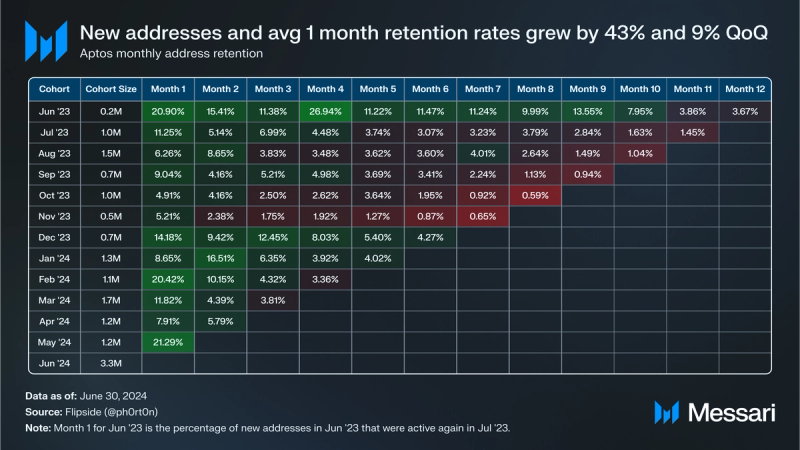

Average daily new addresses also increased by 43% QoQ to 63,000. Likewise, the weighted average one month retention rate increased by 9% QoQ to 14%.

Security and Decentralization

APT staked grew slightly (1%) to 869 million, but fell by 58% QoQ when denominated in USD to just over $6.1 billion. Regardless of the decline in USD terms, Aptos further secured its place as a top network by staked market cap. As noted above, locked tokens can be staked and earn liquid rewards. Along with Aptos not having a slashing mechanism, staking for the ~64% of APT’s illiquid genesis supply becomes a very attractive option.

Aptos active validators continued to grow, up 6% QoQ to 140. Around 24% of the validators accept in-protocol delegated stake, a feature that launched near the end of April 2023. AIP-50, implemented in the 1.9.0 update, enables delegation pool owners to change their commission rate after creating the pool.

The majority of stake for the other validators comes from out-of-protocol delegation from the Aptos Foundation and private investors’ locked tokens. The Aptos Foundation holds a majority of the total supply between its own allocation and the tokens on behalf of the Ecosystem allocation. As such, it can help distribute stake rather equally among validators. As a result, Aptos has a Nakamoto coefficient of 22, up 5% QoQ, which is above the median of other networks.

Upgrades and RoadmapAptos is designed to support frequent protocol upgrades. This ability stems from validator management occurring onchain, allowing validators to easily sync to a new upgrade. Parts of Aptos are also written in Move, which can improve the time-to-market for developers.

The Aptos protocol continued upgrading in Q2 to 1.11.1 through to 1.14.0. These upgrade series implemented several Aptos Improvement Proposals (AIPs), as well as improvements to the Aptos blockchain.

- 1.11.0 implemented allowlisting for delegation pool owners (AIP-31), enhanced multisig V2 functionality (AIP-77), and added functions to the Aptos token object framework such as a function to change a token’s maximum supply (AIP-78).

- 1.12.0 implemented a number of AIPs including AIP-79 introducing instant onchain randomness via API and keyless accounts (AIP-61). Keyless accounts enable users to secure accounts using Web2 logins like Google, Github, or Apple via the OpenID Connect (OIDC) standard. Keyless accounts are application-specific, as they are bound by both the user’s OIDC account and the managing application (i.e. a dapp’s website or wallet’s mobile phone app). Mempool parallel transaction validation was also introduced to increase mempool throughput and reduce latency.

- 1.13.1 implemented the dispatachable token standard (AIP-73) for developers to define custom ways for withdrawing and depositing fungible assets and framework-level untransferable fungible asset stores (AIP-83) allowing developers to prevent transfers of objects constructed in such a way.

- 1.14.0 introduced a number of AIPs including parallel fungible balance (AIP-70) to track fungible asset balances correctly for accounts that opt-in, and (AIP-85) which made improvements to the performance of fungible assets.

One of the major network upgrades in development as of Q2 is a new consensus mechanism, Shoal++. Shoal++ combines DAG and BFT qualities, reducing latency and increasing throughput. In June, Aptos Labs demonstrated a consensus-only performance of 100,000 transactions per second (TPS) throughput at sub-second latency via a comprehensive internal testnet.

Lastly, the Aptos Foundation announced in May that Chainlink Data Feeds and Chainlink’s Cross-Chain Interoperabiity Protocol (CCIP) will be integrated on Aptos.

Ecosystem Overview DeFi

DeFi

Despite Aptos’ DeFi TVL decreasing by 8% in USD terms to $528 million, its DeFi TVL in APT terms increased by 123% QoQ to 75 million APT, demonstrating increasing adoption of the network’s DeFi ecosystem in spite of the price of APT declining 59% QoQ.

Echelon Market, a permissionless lending protocol launched in March of Q1 emerged in Q2 and closed the quarter as the third protocol by total-value-locked (TVL) on Aptos with $73 million. The top two protocols by TVL remained unchanged QoQ. Aries Market, which supports a number of activities including lending, asset swapping, and spot margin trading, closed Q2 in the top spot with $255 million in TVL, up just over 2% QoQ. In contrast, Thala Labs TVL declined 48% QoQ to $78 million. Thala features a suite of DeFi products, including a CDP, an AMM, a liquid staking protocol, and a token launchpad. Other top protocols by TVL include Liquidswap ($31 million), Cellana Finance ($30 million), and Aptin Finance ($23 million).

Aptos’s average daily DEX volume grew by 189% QoQ to $30 million. Cellana Finance led with almost $13.5 million average daily volume, followed by Liquidswap at almost $6.5 million.

The opportunity cost of not staking is ~7% due to token dilution. As such, liquid staking protocols will be crucial for Aptos’ DeFi ecosystem to continue growing. Aptos’ liquid staking rate increased by 70% QoQ to 3.2%. Amnis Finance maintained its position as Aptos’s top liquid staking protocol with $107 million in TVL. Amnis has been running a points program for the airdrop of its upcoming token AMI. In late May, TruFin announced it would launch a TruStake Aptos vault to enable liquid staking via the APT liquid staking token (LST) TruAPT. The vault is audited by audited by Movbit and Ottersec, while TruAPT liquidity pools are intended to be bootstrapped from partner AMMs.

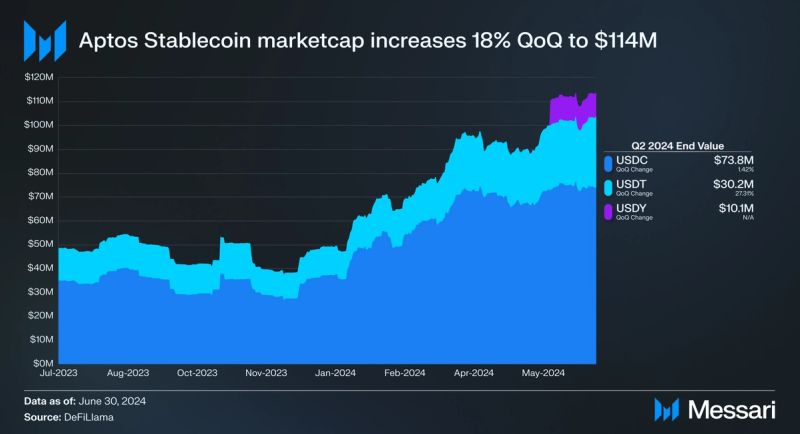

Aptos’s stablecoin market cap increased 18% QoQ to $114 million. The majority of the increase came from the appearance of Ondo Finance’s USDY stablecoin on Aptos in preparation for the stablecoin’s upcoming launch on the chain. USDC’s market cap on Aptos also increased a little over 1% to $74 million while USDT’s increased more than 27% to $30 million.

Aave V3In July, a proposal introduced by the Aptos Foundation to deploy lending and borrowing protocol Aave V3 on Aptos passed an initial temperature check via Aave’s Snapshot. The proposal still needs to pass an Aave Request for Final Comments (ARFC) on Snapshot and onchain Aave Improvement Proposal (AIP) before Aave V3 can be deployed on Aptos. Once deployed, it will be the first instance of Aave on a non-EVM blockchain. The Aptos team is currently sponsoring and collaborating on security reviews with Aave Labs and a number of other partners to ensure security standards are met before deployment. Notably, Aave V3 will not be launched on Aptos until after ChainLink’s Price Feeds are deployed on Aptos as ChainLink will act as the protocol’s oracle provider.

ConsumerGamingGaming has been a core consumer-related focus for Aptos Labs and the Aptos Foundation. Previously, Aptos Labs and the Aptos Foundation formed partnerships with several notable gaming companies and conglomerates, including NPIXEL, NEOWIZ, and the Lotte Group. New partnerships and developments from Q2 include:

- MON Protocol: In April, the Aptos Foundation announced a partnership with MON Protocol for Aptos game developers to use the protocol’s developer tools for marketing and user adoption.

- Undying City: The mobile shooter game was beta-launched in April.

- Aptos Arena: The arcade style-shooter game hosted a tournament in April.

- Aptos Victors: Liquid staking protocol AmnisFinance announced a partnership with AR enabled runner game Aptos Victors to provide incentives for its users.

- Eragon x Wapal: Aptos game publishing platform Eragon announced a co-marketing partnership with NFT marketplace Aptos for its upcoming NFT collection release.

In Q1, there was $1.5 million in total NFT trading volume, a 53% QoQ decline. Of this volume, 54% occurred through marketplace Wapal, an NFT marketplace for “pro traders,” similar to Blur and Tensor. Wapal’s volume share of 54% was followed by Topaz (35%), and Mercato (10%). Notably, Wapal’s volume grew 126% QoQ following the release of its NFT aggregator protocol in late March, while Topaz’s declined 78% and Mercato’s declined 49% following the completion of its Mercaot Mania campaign in February, which featured free and gasless NFT mints of numerous collections.

Other notable events include VibrantX Finance’s release of its NFT performance tracker, Renegades release of its Liquid NFT, an experimental fractionalized liquidity standard for NFTs via a mix of fungible and non-fungible token. And Aptos Labs’s partnership with Toymak3r to offer digital collectibles for artist deadmau5’s 25th-anniversary tour. Additionally, 26,000 unique wallets minted a total of 1 million NFTs on Aptos in ~4 hours during It’s an Aptos Thing in May. The speed of the mint was made possible by the ability of Aptos aggregators to execute sequential tasks in parallel.

Development and Growth

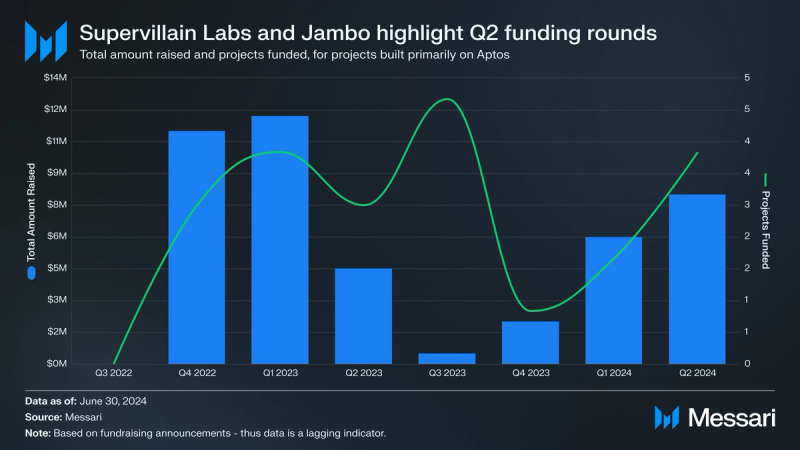

Multiple Aptos-based projects announced funding rounds in Q2 including Jambo and SuperVillain Labs. Jambo is developing the JamboPhone in partnership with the Aptos Foundation. In May, OKX Ventures announced a strategic investment in Jambo along with a partnership to integrate the OKX app into the phone. Supervillain Labs is an Aptos-based gaming studio in partnership with Aptos Labs. Supervillain Labs will launch metaverse Supervillain: Idle RPG, which will collaborate with several Aptos NFT projects as well as Intella X, NEOWIZ’s Web3 arm. Supervillain Labs announced its $4.5 million Seed Round in May co-led by Aptos Labs and Newiz’s Intella X. Also in May the Aptos Foundation announced a number of new grant recipients including Joule Finance (DeFi liquidity), Bitskewela (Web3 education), LoveAI (consumer AI), Ziptos (DeFi tooling), Uptos (meme), and Zona Tres (Move development in LATAM). Other notable funding rounds include:

- Merkle Trade: Merkle Trade is a gamified futures trading platform that offers crypto, forex, and commodities trading. In April, it announced a $2.1 million seed round.

- Qiro Finance: Qiro Finance is building a private credit underwriting protocol and announced a 1.2 million pre-seed round in June.

Aptos averaged 134 weekly active ecosystem developers in Q1, a slight 2% QoQ increase. As highlighted in Electric Capital’s annual Developer Report, Aptos has one of the top developer communities among new, non-EVM networks.

Aptos Labs, the Aptos Foundation, and other organizations will look to continue this recent trend through developer resources and infrastructure as well as grants, hackathons, accelerators, and other initiatives.

Notable infrastructure and developer-related initiatives in Q2 not mentioned elsewhere include:

- Aptos Connect: Aptos Labs introduced Aptos Connect, which uses Aptos Keyless Accounts to offer a self-custodial wallet with one-click account creation, no private keys or mnenomics and no wallet applications or extensions required.

- Shinami Gas Credits Program: The Aptos Foundation and Shinami are partnering on a gas credits program for sponsoring end user’s transaction via Shinami’s Gas Station product. Additionally, Shinami is bringing its entire produce suite of developer tools for application development on Aptos.

- Aptos Wallet Standard: Aptos Labs and Nightly co-developed the Aptos Wallet Standard, which allows developers to inject wallets into applications without integrating the wallet to the application manually.

- Elliptic: The Aptos Foundation partnered with Elliptic to integrate its compliance screening and risk services for projects on Aptos, including transaction screening, wallet screening and investigations to assess risk.

- HashKey Cloud: The Aptos Foundation and Hashkey Coud are partnering to integrate Hashkey DID, a multichain decentralized identity data aggregator as well as to explore other solutions including liquid node validation and security token offering solutions.

- Aptos Labs Performance Improvements: Aptos Labs released its 2024 throughput benchmark demonstrating sub-second end-to-end latency on testnet.

- Code Collision: The Aptos Foundation announced Code Collision, its first-ever global online hackathon taking place Aug. 1 to Sept. 30 with five deep-dive tracks, a $500,000 prize pool, and CodeJams in Seoul and NYC.

- Create-aptos-dapp: Aptos Labs reintroduced create-aptos-dapp, its starter kit that includes custom, ready-to-deploy application templates for developers building on Aptos.

- Specification Testing for Move: Aptos Labs and Eiger released two open-source tools: move-mutator and move-spec-test, to evaluate and improve the quality of formal specifications on Move. This release increases the robustness of the Move Prover tool, which allows smart contracts written in Move to be formally proven correct, but whose quality of correctness and security is reliant on user-provided specifications.

- Sentio, an Aptos Foundation grant recipient, released Sentio Debugger, its debugging tool in June.

- dWallet Network: DWallet Network announced it would expand to Aptos bringing its Zero Trust Protocols (ZTPs) that enable interoperable transaction signing across its supported networks including Bitcoin and Ethereum.

Beyond the grants and partnerships mentioned throughout the Ecosystem section, Q1 initiatives included:

- Alcove: The Aptos Foundation and Alibaba Cloub collaborated to launch Alcove, Asia’s first co-branded Move developer community, to promote Move smart contract development in the Asia-Pacific region. As part of the collaboration, the Aptos Foundation will host hackathons and euctaional events to using Alibaba Cloud’s technology.

- Overlai: In partnership with Aptos Labs, Overlai launched its mobile application and Adobe plugin powered by Aptos to protect intellectual property onchain.

- KYD Labs: The ticketing and events-solution company KYD Labs signed a four-year agreement with NYC venue Le Poisson Rouge for all shows and tickets to be powered by Aptos.

- DeFi Days: The Aptos Foundation hosted its second ecosystem summit of the year in Hong Kong bringing together ecosystem builders and investors.

- Aptos Ascend: A platform launched by Aptos Labs in April in collaboration with Microsoft, Brevan Howard, and SK Telecom. Aptos Ascend provides digital asset controls, permissioned network compatibilities, and security features for institutions to issue digital assets on Aptos.

- The Aptos Experience: Registration opened for The Aptos Experience, the Aptos Foundation’s inaugural conference.

- New Advisors: Pam Drucker Mann (Condè Nast) and Google’s David Lawee (ex-Google) joined Stanford’s Dan Boneh as Aptos Labs advisors. The announcement states Lawee brings expertise in “mainstream tech understanding,” while Drucker Mann brings “culture-fostering skills.”

- Aptos MoveMondays: MoveMondays live Twitter Spaces returned in May as a weekly open forum for community members and developers.

- Cripco: Aptos Labs partnered with Cirpco, a platform for bridging Web2 and Web3 for intellectual property aggregation, curation and payments for users to monetize intellectual property.

- Aptos Learn: New design and new tutorials for developers were added to Aptos Learn, the project’s developer education hub.

- Aptos Art Night: Took place in May as a meetup and opening party for Aptos Lab’s 15 phygital (physical and digital) art collection in NYC.

- Aptos Annual Community Meetup: The annual Aptos community network event took place in May in the Grand Cayman Islands.

- AssetDash: AssetDash an Aptos Foundation grant recipient, launched its portfolio tracking support on Aptos in June.

- NBC Universal Partnership: NBC Universal announced a long-term partnership with Aptos to bring Web3 fan experiences, customer loyalty programs and gaming to the Unversal Studios theme parks.

- SpringX Move Accelerator: The SpringX Move Accelerator took place in Q2 in collaboration with the Aptos Foundation, ABCDE Highlight, and SevenX Ventures. Participants received grants, marketing support, networking opportunities, and other mentorship.

The crypto market declined in Q2’24 after half a year of growth, and APT was no exception. Its circulating market cap declined by 53% QoQ to $3.2 billion. Despite the financial downtrend, there were both quantitative and qualitative markers of strength. For example, Aptos’ DeFi TVL decreased by 8% in USD terms to 528 million, but in APT terms increased by 123% QoQ to 75 million APT, demonstrating increasing adoption of the network’s DeFi ecosystem in spite of a downturn in price. To increase user onboarding, Aptos Labs introduced Aptos Connect, which uses Aptos Keyless Accounts to offer a self-custodial wallet with one-click account creation, no private keys and no wallet applications or extensions required.

Numerous additional initiatives were undertaken to improve the overall user experience and network functionality. Among them, the Aptos Foundation announced that Chainlink Data Feeds and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will be integrated on Aptos and Aptos Labs demonstrated consensus-only performance of 100,000 transactions per second (TPS) throughput at sub-second latency via a comprehensive internal testnet. Additionally in May, Aptos saw the highest daily transaction count in Layer-1 blockchain history (156 million) following the launch of the viral clicker game Tapos Cat. Aptos mainnet is now on the precipice of reaching its next target of 100,000 TPS and well along its journey to exceed 1 million TPS.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.