and the distribution of digital products.

State of 1inch Q1 2025

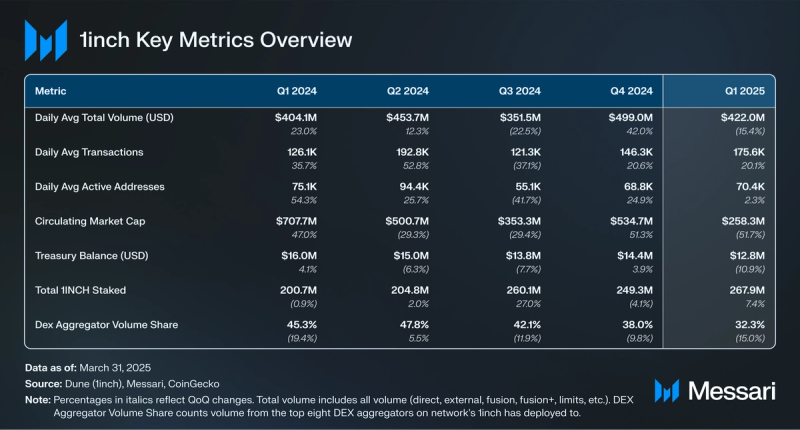

- Total daily average transactions across 1inch grew 20.1% QoQ from 146,300 to 175,600, while total daily average active addresses increased 2.3% QoQ from 68,800 to 70,400.

- Despite a 15.4% QoQ decrease in total volume, 1inch saw significant engagement on its L2 deployments, with Arbitrum and Base contributing 25.2% of Aggregation Protocol volume.

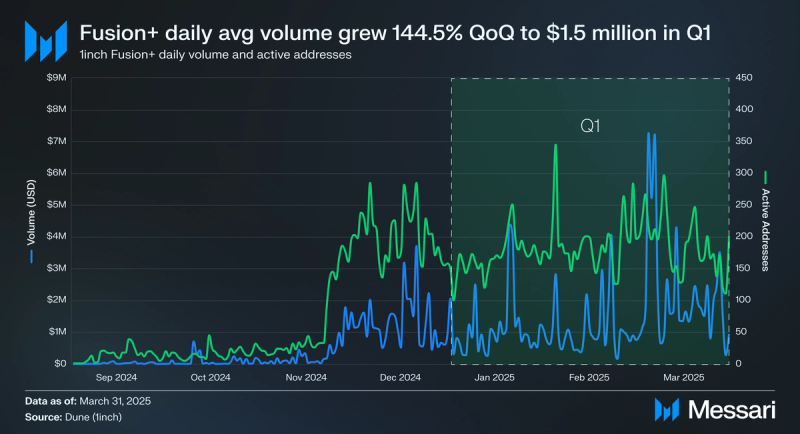

- Fusion+ daily average volume increased 144.5% QoQ, from $599,600 to $1.5 million. Daily active addresses and orders increased by 89.9% a nd 96.3%, respectively.

- 1inch expanded its ecosystem reach with integrations, including ZKsync, Linea, and Ledger Wallet, with the 1inch wallet now supporting Ledger’s Stax and Flex hardware wallets.

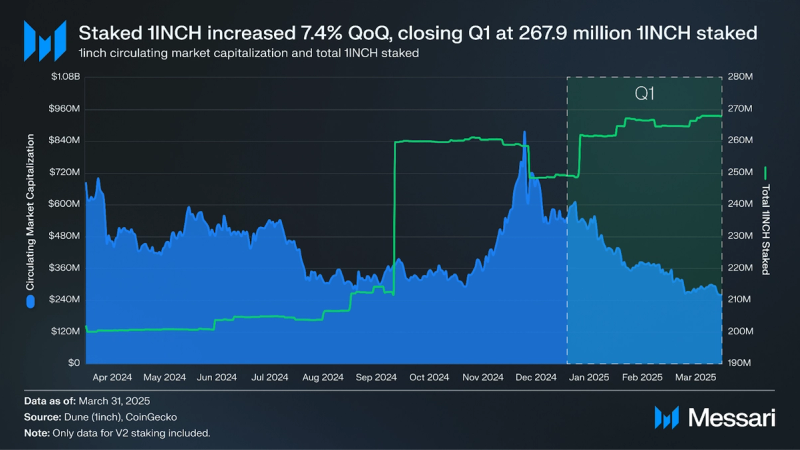

- 1INCH’s circulating market cap decreased 51.7% QoQ from $534.7 million to $258.3 million. Staked 1INCH increased 7.4% QoQ from 249.3 million to 267.9 million.

1inch (1INCH) is a decentralized finance (DeFi) DEX aggregator and intent-order protocol operating on Ethereum, Arbitrum, Optimism, Polygon, Base, zkSync Era, Avalanche, BNB Chain, Gnosis, Fantom, Kaia, and Aurora. Core protocols and technologies include the Aggregation Protocol (DEX aggregation), Limit Order Protocol (limit orders), Fusion mode (intent-based single-chain swaps), and Fusion+ (cross-chain swaps).

The 1inch team has built a suite of products that integrate these protocols and technologies for both DeFi users and developers. With the 1inch Swap web application, users can connect a wallet to swap tokens across networks supported by 1inch and place offchain limit orders. 1inch Wallet mobile application users can do the same while using the wallet to manage EVM-compatible assets and explore Web3. Additionally, 1inch Portfolio provides a dashboard for wallet and asset tracking, while the 1inch Developer Portal SaaS platform enables developers to build on top of 1inch’s APIs.

1inch is governed by the 1inch DAO using the network’s native 1INCH token.

Note: This report includes data from Ethereum, BNB Chain, Polygon, Base, Optimism, Arbitrum, Avalanche, Gnosis Chain, Fantom, Linea, and zkSync. Data from Kaia and Aurora are currently not included.

Website / X (Twitter) / Telegram

Key Metrics Protocol Analysis

Protocol Analysis Aggregation Protocol

Aggregation Protocol

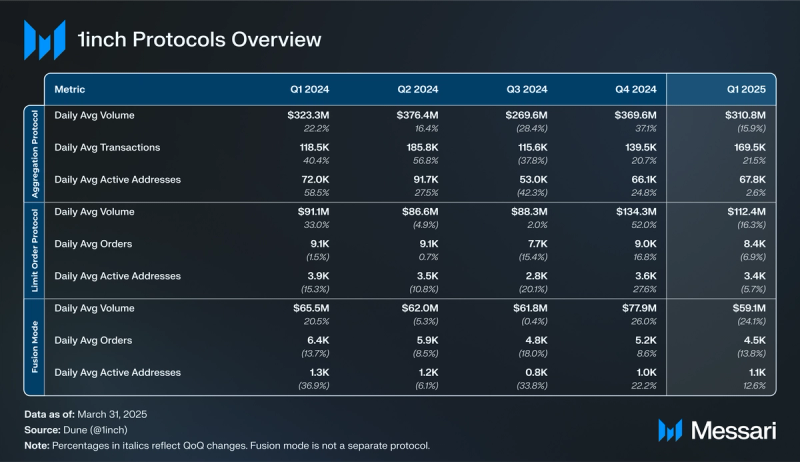

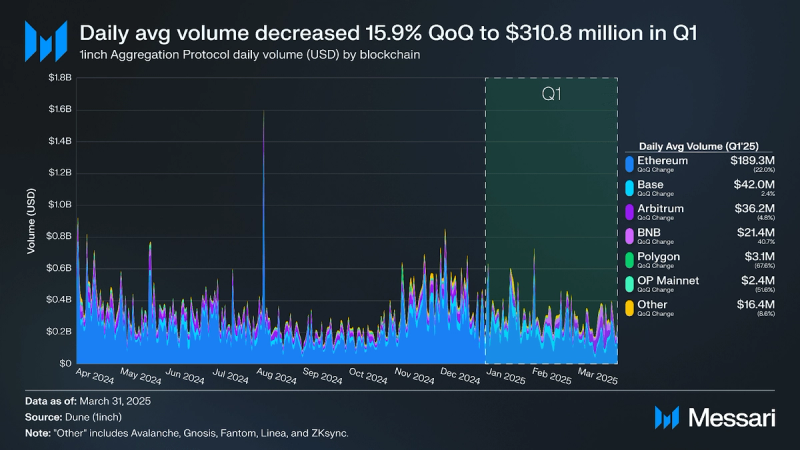

Of 1inch’s three protocols, the Aggregation Protocol is responsible for most of the volume routed through 1inch. In Q1, daily average volume on the Aggregation Protocol decreased 15.9% QoQ from $369.7 million to $310.8 million.

Ethereum represents the majority (60.9%) of volume on the Aggregation Protocol. Base and Arbitrum are the second and third largest blockchains by volume, accounting for 13.5% and 11.7% of all volume, respectively. Combined, these three blockchains accounted for 86.1% of the volume on the Aggregation Protocol.

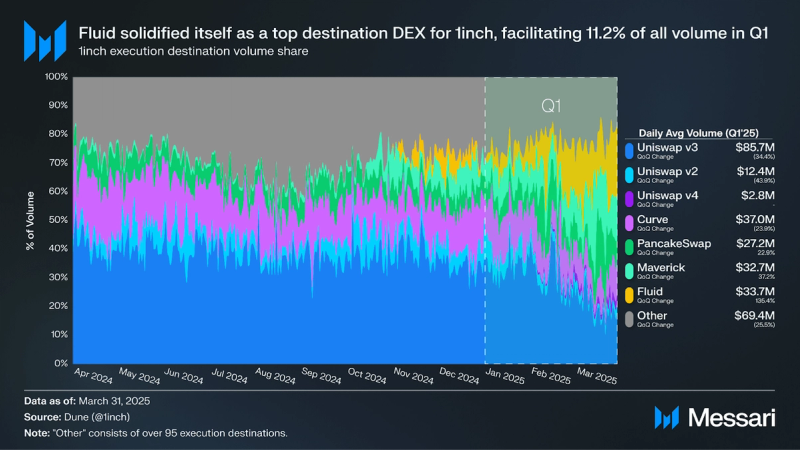

In Q1, volume by execution destination DEX on the Aggregation Protocol changed considerably. Daily average volume routed through Uniswap V3 decreased 34.4% QoQ from $130.6 million to $85.7 million. Furthermore, daily average volume routed through Curve decreased from 23.9% QoQ from $48.6 million to $37.0 million. In contrast, daily average volume on Fluid, Maverick, and PancakeSwap grew in Q1. Fluid’s daily average volume grew the most (+135.4% QoQ) from $14.3 million to $33.7 million, while Maverick increased 37.2% QoQ from $23.9 million to $32.7 million, and PancakeSwap increased 22.9% QoQ from $22.2 million to $27.2 million. Daily average volume for all other execution destinations decreased 25.5% QoQ from $93.1 million to $69.4 million.

QoQ changes in volume share by execution destination were largely due to the increased volume of Fluid and Maverick on Ethereum (the largest source of Aggregation Protocol volume) in Q1 amid Uniswap’s decrease. In Q1, Fluid’s total volume share on Ethereum grew from 2.7% to 11.0%, while Maverick’s total volume share increased from 1.3% to 4.0%. In contrast, Uniswap’s total volume share on Ethereum decreased from 72.8% to 62.7%.

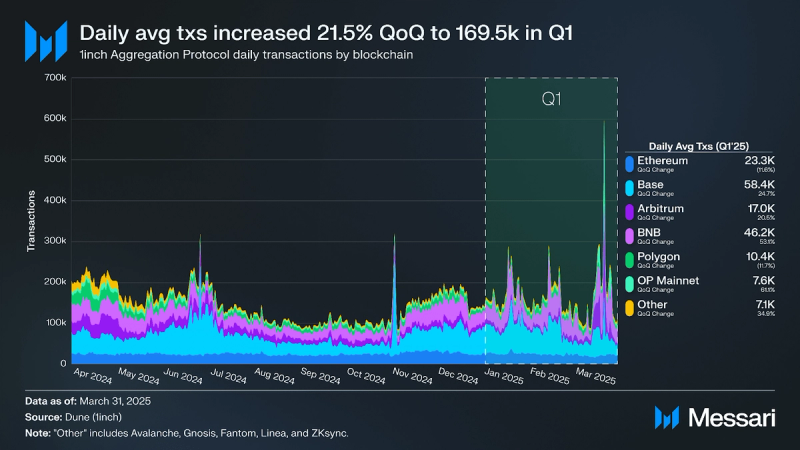

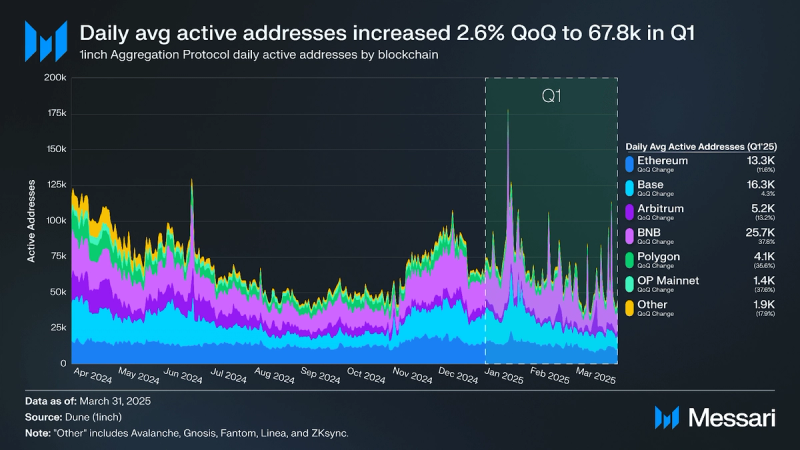

Daily average transactions on the Aggregation Protocol increased by 21.5% QoQ from 139,500 to 169,500. Base averaged the most daily transactions at 58,000 (+22.7% QoQ). OP Mainnet grew its daily average transaction count the most QoQ (+62.0% to 7,600). BNB Smart Chain daily average transactions grew 52.9% QoQ to 46,200, making it the second largest blockchain in daily average transactions, and its subsequent growth. Daily average transactions on Ethereum decreased 11.9% QoQ from 26,400 to 23,200.

Daily average active addresses on the Aggregation Protocol increased 2.6% QoQ from 66,100 to 67,800. BNB Smart Chain averaged the most daily active addresses of any deployment at 25,700 (+37.8% QoQ). The only other blockchain to grow daily average active addresses this quarter was Base at 16,300 (+4.3% QoQ).

Limit Order Protocol

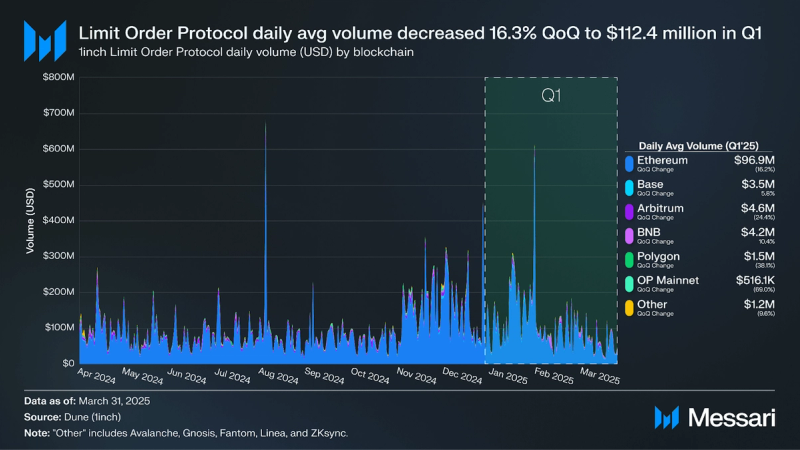

Daily average volume on the Limit Order Protocol (LOP) decreased 16.3% QoQ from $134.3 million to $112.4 million. Limit Order Protocol daily average volume decreased across all deployments except Base and BNB Smart Chain. Base’s daily average volume grew 5.8% QoQ from $3.3 million to $3.5 million, while daily average volume on BNB Smart Chain increased 10.4% from $3.8 million to $4.2 million. LOP daily average volume on OP Mainnet declined 69.0% QoQ from $1.7 million to $516,100.

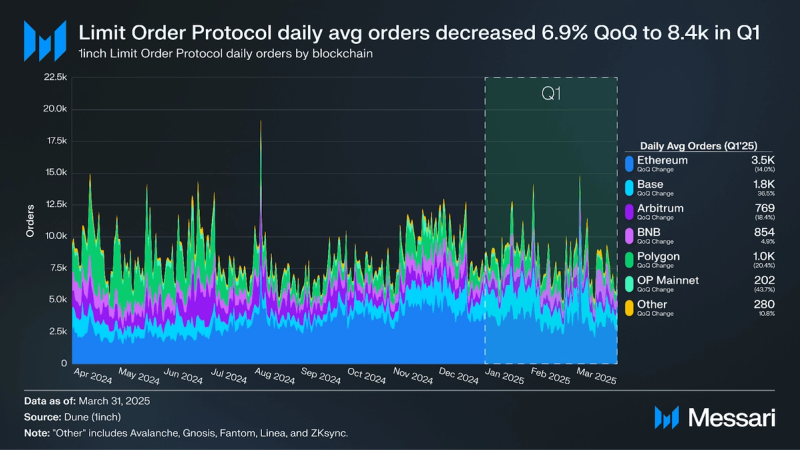

LOP daily average orders decreased 6.9% QoQ from 9,000 to 8,400 in Q1. Despite the collective decrease, LOP daily average orders increased on Base 36.5% QoQ to 1,800 and 4.9% QoQ to 854 on BNB Smart Chain. Additionally, Base’s share of LOP orders increased from 14.3% to 20.8% QoQ. Ethereum’s share of LOP orders decreased from 45.4% to 42.2%, the most of any deployment.

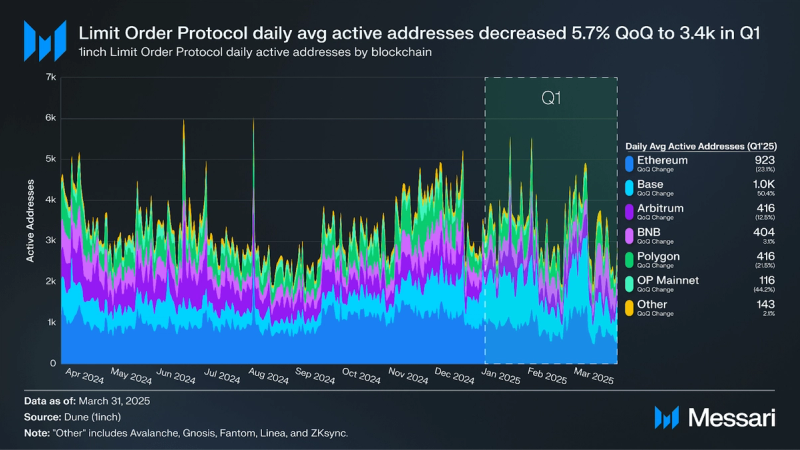

LOP daily average active addresses decreased 5.7% QoQ from 3,600 to 3,400. OP Mainnet and Polygon decreased the most in percentage terms. OP Mainnet declined 37.6% QoQ from 2,300 to 1,400, while Polygon decreased 35.6% QoQ from 6,300 to 4,100. Once again, BNB Smart Chain and Base increased amidst the overall decrease. BNB Smart Chain daily average active addresses increased 37.8% QoQ from 18,700 to 25,700, while Base increased 4.3% QoQ from 15,600 to 16,300.

Fusion Mode

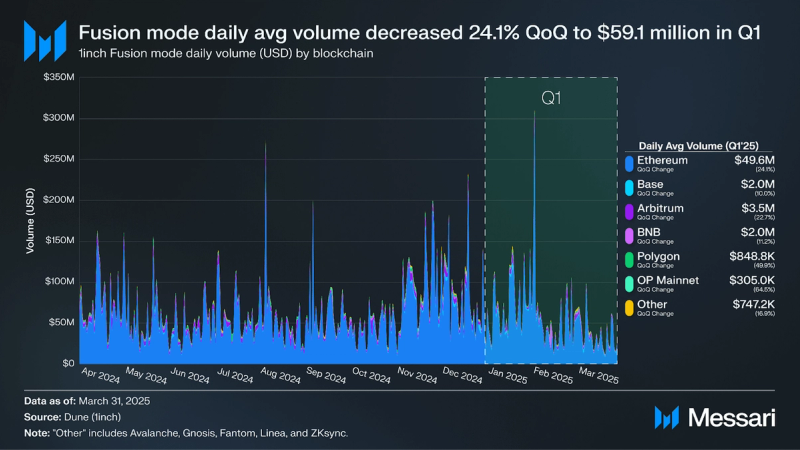

Fusion mode routes volume through the Aggregation Protocol and Limit Order Protocol, as well as external sources. Daily average volume associated with Fusion mode decreased 24.1% QoQ from $77.9 million to $59.1 million. In Q1, Ethereum accounted for 84% of all volume, followed by Arbitrum at 5.9%, Base at 3.5%, BNB Smart Chain at 3.4%, and all other blockchains at 3.2%. Daily average volume on the Ethereum deployment decreased by 24.1% QoQ from $65.4 million to $59.1 million. OP Mainnet was the chain that declined the most in percentage terms (-64.5% QoQ), as daily averaged volume decreased from $859,800 to $305,000. All deployments that accounted for at least 1% of Fusion mode volume had a QoQ decrease in Fusion volume in Q1.

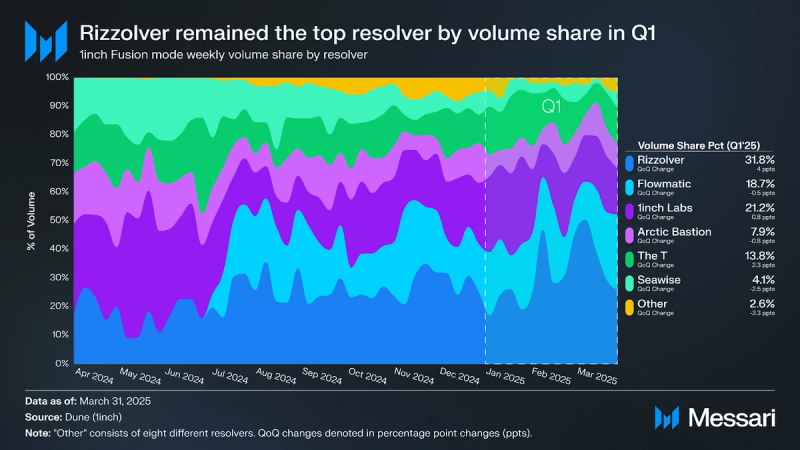

Resolvers are approved registered addresses that compete via a Dutch auction mechanism to fulfill 1inch Fusion and Fusion+ orders. Rizzolver maintained the top spot in Q1, accounting for 31.8% of the volume executed through Fusion. The T was the only other resolver to grow its Fusion mode volume market share in Q1, increasing from 11.5% to 13.8%. In contrast, Seawise’s market share decreased from 6.6% to 4.1% in Q1. Collectively, the top three resolvers (Rizzolver, 1inch Labs, and Flowmatic) accounted for 71.7% of the volume executed through Fusion in Q1.

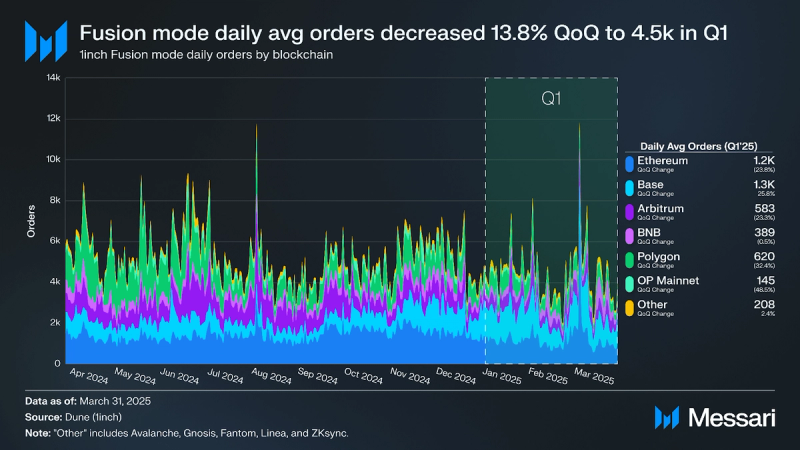

Daily average orders in Fusion mode fell 13.8% QoQ, from 5,200 to 4,500. Most of the decline came from Ethereum, where orders dropped 23.8%, from 1,600 to 1,200. In contrast, Base’s orders rose 25.8%, from 1,000 to 1,300. Collectively, Ethereum and Base accounted for 56.7% of Fusion mode orders in the first quarter.

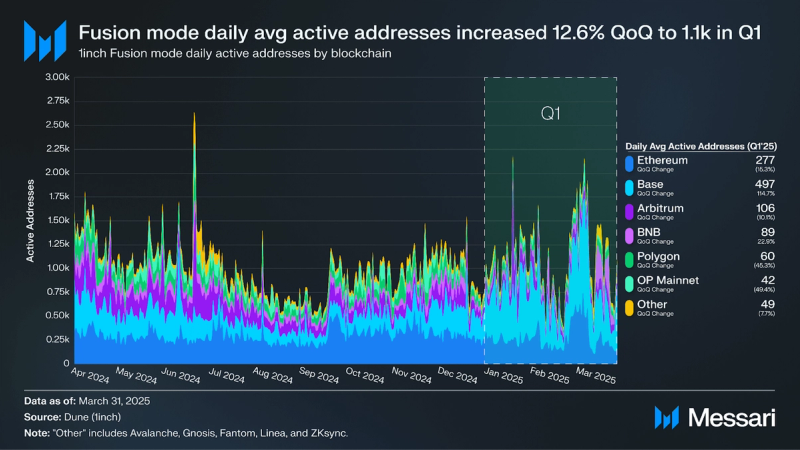

Fusion mode daily average active addresses increased 12.6% QoQ, from 995 to 1,100 in Q1 2025. However, activity varied across blockchains. Arbitrum decreased 10.1% QoQ, from 118.3 to 106.3. Ethereum declined 15.3% QoQ, from 327.4 to 277.2, reversing its Q4 gain (+17.5%). Optimism decreased 49.4% QoQ, from 82.7 to 41.8, while Polygon fell 45.3% QoQ, from 109.9 to 60.1. In contrast, Base rose 114.7% QoQ, from 231.4 to 496.9, and BNB increased 22.9% QoQ, from 72.1 to 88.5. Ethereum and Base remained the top sources for Fusion mode active addresses in Q1.

Fusion+ Mode

Officially released on Nov. 25, 2024, Fusion+ enables cross-chain swaps on networks supported by 1inch, building upon the 1inch Fusion and Limit Order protocols. Fusion+ uses an intent-based model, where users submit trade intents that resolvers can fulfill, rather than conducting instant transactions. The protocol employs a Dutch auction mechanism, in which the price gradually decreases until it becomes favorable enough for a resolver to fulfill the trade. Under this design, users sign offchain orders without paying gas fees in native tokens.

A critical component of Fusion+ is its use of Hashed Timelock Contracts (HTLCs) to facilitate trustless and secure cross-chain transactions. HTLCs allow trades to be executed only when specific cryptographic conditions are met, such as revealing a pre-agreed hash within a set timeframe. If these conditions are not met, the assets are returned to their original owners, preventing loss due to incomplete transactions. Fusion+ also allows for partial fills, where solvers can complete a portion of the trade if full liquidity isn’t immediately available. The 1inch DAO oversees parameters for the Fusion+ protocol, including settings like auction configurations, resolver participation rules, and minimum trade requirements.

Fusion+ daily average volume rose 144.5% QoQ, from $599,600 to $1.5 million in Q1. Meanwhile, daily active addresses on Fusion+ rose 89.9% QoQ, from 96.4 to 183.0, while daily orders rose 96.3% QoQ, from 139.5 to 273.9.

Market Analysis Market Cap and Staking

Staking 1INCH tokens involves locking your tokens in the staking contract to earn Unicorn Power (UP), which unlocks multiple benefits and rewards. By staking, you receive UP proportional to your staked amount and lock period (1 month to 2 years), represented as st1INCH tokens. You can delegate UP to resolvers to earn passive rewards from their profits in Fusion mode swaps, with the ability to claim and restake rewards for more UP. UP also grants voting rights in the 1inch DAO. Staked 1INCH increased 7.4% QoQ from 249.3 million to 267.9 million, while the circulating market capitalization of 1INCH decreased 51.7% QoQ from $534.7 million to $258.3 million.

Treasury

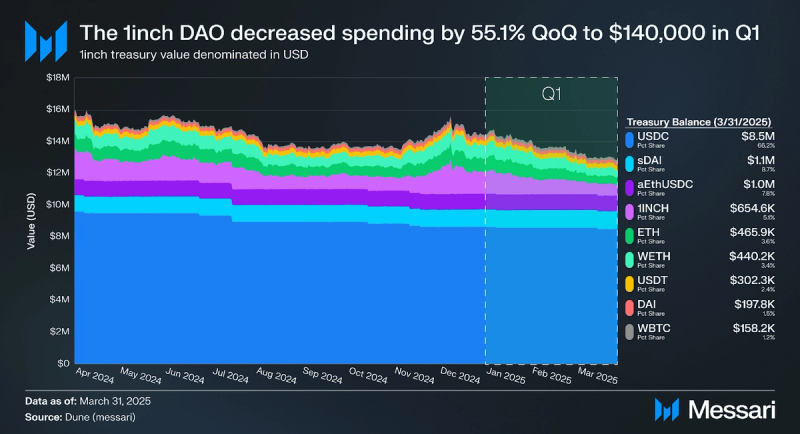

The 1inch DAO continues to be mindful of spending while allocating growth opportunities for all 1inch users and participants. In Q1, the DAO approved two new payments totaling $140,000:

- [1IP-74] Messari Protocol Services 1inch Proposal 2025 (March 18, 2025) – This proposal approved funding for Messari Protocol Services to produce four quarterly reports at a total cost of 90,000 USDC.

- [1IP-72] Engagement of New Legal Counsel for 1inch DAO (Jan. 9, 2025) - This proposal approved MME Legal AG as 1inch DAO’s new legal counsel, granted the firm power of attorney to represent 1inch DAO, and approved an initial advance payment to MME Legal AG of 50,000 USDC.

Outside of these disbursements, treasury allocations did not change, and the DAO continues to benefit from interest earned on $1.0 million in aEthUSDC and $1.1 million in Savings DAI (sDAI) held. Stablecoins, or stablecoin derivatives, account for most of the treasury’s value at 86.6%, while volatile assets account for 13.4%. At Q1 end, the treasury was valued at $12.8 million, down 11.2% QoQ from $14.4 million.

Market Share

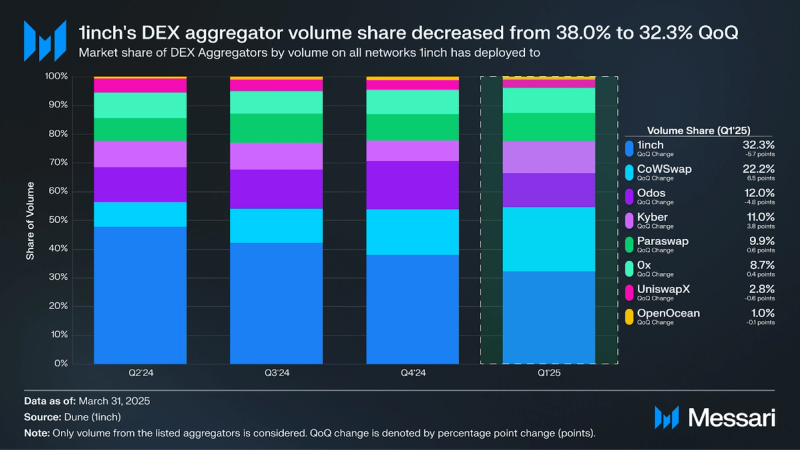

1inch has historically been the top DEX aggregator by volume within the Ethereum Virtual Machine (EVM) ecosystem. This trend continued in Q1, despite 1inch’s share of all DEX volume routed through an aggregator on blockchains 1inch is deployed on falling from 38.0% to 32.3% QoQ, mainly due to CoWSwap’s increasing market share. CoWSwap’s market share increased from 28.7% to 22.2%, while Odos decreased to 12.0%. Combined, the top three aggregators (1inch, CoWSwap, and Odos) accounted for 66.5% of volume.

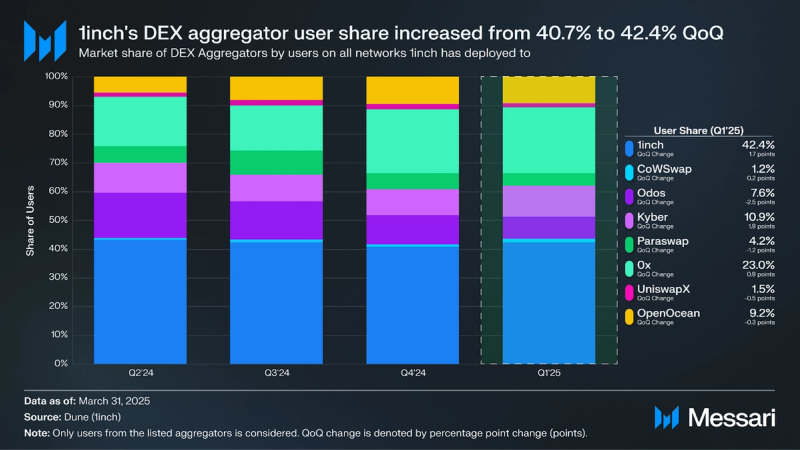

In addition to volume, 1inch has also historically been the top aggregator by users within the EVM ecosystem. In Q1, 1inch’s user market share grew from 40.7% to 42.4%. Alongside 1inch, 0x and Kyber had the largest QoQ gains in user market share, increasing from 22.1% to 23% and 9.0% to 10.9%, respectively.

Qualitative AnalysisIntegrations, Partnerships, Upgrades, & More1inch made significant strides in Q1 2025 through strategic integrations, partnerships, and security enhancements:

- ZKsync Integration (Feb. 6, 2025) – ZKsync was incorporated into Fusion+, 1inch’s cross-chain swap functionality, providing ZKsync users with efficient, gasless transactions and additional liquidity pathways across 1inch-supported networks.

- Ledger Wallet Integration (Feb. 13, 2025) – Ledger Stax and Ledger Flex hardware wallets integrated the 1inch Wallet. Users can now benefit from Ledger’s security alongside 1inch’s user-friendly interface.

- Linea Integration (March 13, 2025) – Linea, a zkEVM Layer 2 solution developed by Consensys, was integrated into the 1inch Network, enabling classic, Fusion, and Fusion+ swaps.

Additionally, 1inch addressed one notable security incident:

- Fusion V1 Settlement Contract Vulnerability (March 7, 2025) – A vulnerability was discovered in the Fusion V1 settlement contract that enabled unintended transactions to be executed. At the time of the discovery, the Fusion V1 settlement contract was obsolete as all resolvers were using the Fusion V2 settlement contract. No user funds were impacted. The vulnerability was patched, and the smart contract was redeployed.

In Q1, total daily average volume on 1inch declined 15.4% QoQ from $499.0 million to $422.0 million. However, daily average transactions/orders and active addresses grew 20.1% and 2.3% QoQ, respectively. 1INCH’s circulating market capitalization decreased 51.7%. Conversely, staked 1INCH increased 7.4% QoQ, from 249.3 million to 267.9 million. Additionally, 1inch remained the largest DEX aggregator on the blockchains it has deployed to; however, 1inch’s volume share fell from 38.0% to 32.3%. Likewise, the value of the 1inch DAO’s treasury fell 10.9% QoQ, mainly due to price changes in non-stablecoin holdings (e.g., 1inch). Even so, the DAO’s operations were unaffected as, at Q1 close, 86.6% of the value of the treasury is in stablecoins or stablecoin derivatives. Despite the overall decrease in volume, cross-chain swap volume via Fusion+ rose 144.5% QoQ, from $599,600 to $1.5 million. Additionally, 1inch made strategic progress through integrations with ZKsync, Linea, and Ledger Wallet. Overall, 1inch maintained its position as the leading DEX aggregator across its supported blockchains, reinforcing its role as a foundational layer for DeFi.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.