and the distribution of digital products.

RWAs Reborn: Plume’s Vision for Onchain Value

- Plume is building a real-world asset (RWA)-focused blockchain and ecosystem for crypto-native users. The network focuses on access, usability, and integration to make tokenized assets functional from day one within DeFi environments.

- Most RWAs today fail to create real utility. Often, they are merely traditional assets tokenized on a blockchain, rather than being built with inherent crypto-native design. This fundamental difference leads to their illiquidity, gating, and siloed nature.

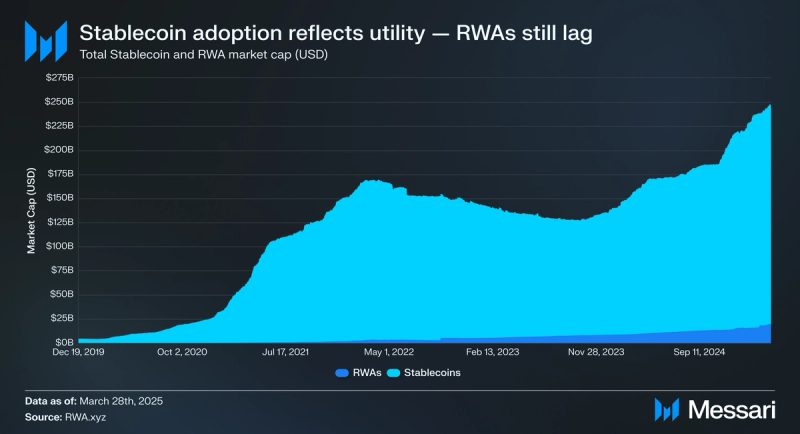

- Stablecoins offer a proven model for adoption. Stablecoins gained traction by solving crypto-native problems first, then expanded into broader use cases after establishing product-market fit.

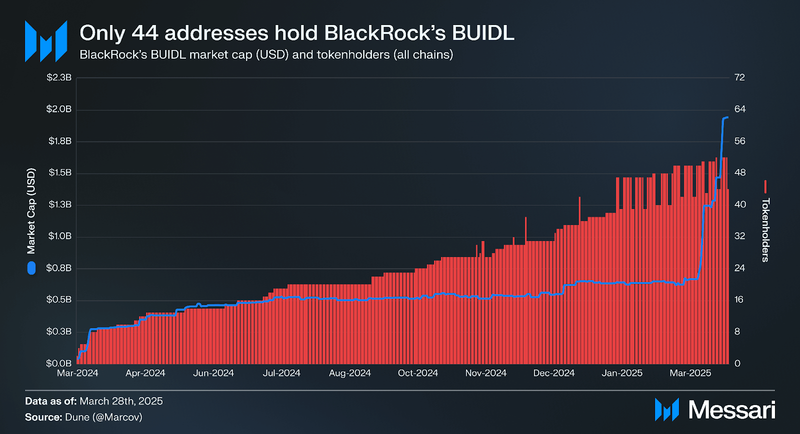

- Institutional backing does not guarantee participation. RWA products like BUIDL show limited usage because they lack distribution, composability, and user alignment.

Tokenization is often described as one of crypto’s largest opportunities — particularly the tokenization of real-world assets (RWAs). While capital continues to flow into RWAs, most implementations today fail to serve users who are active onchain. RWAs are brought onchain without clear demand, which results in illiquid, gated, and siloed products. This has led to a growing gap between institutional interest and crypto-native utility.

Stablecoins demonstrate how tokenized assets can succeed when they are built for crypto from the start. They addressed core needs such as stable pricing, liquid settlement, and interoperability across protocols, and became foundational to DeFi as a result. Plume (PLUME) applies the same principle to RWAs by providing infrastructure for developers and cultivating a community that supports application development and usage. Its architecture supports tokenized assets that can move freely across protocols, plug into existing DeFi systems, and serve users from day one. This stands in contrast to RWAs that prioritize institutional packaging over practical onchain utility.

Tokenization Without Demand Is a Dead EndIssuing real-world assets (RWAs) onchain represents one of the largest opportunities in crypto. Yet, framing RWAs as merely digital versions of traditional assets misses the potential of distributed ledger systems. The internet unlocked value by facilitating peer-to-peer connections and new forms of interaction. Platforms like Uber, YouTube, and X succeeded by building new networks between riders and drivers, creators and audiences — not by replicating legacy systems.

Crypto follows the same pattern. Decentralized applications create utility by establishing new markets via tokenization, not simply digitizing existing assets. Many define tokenization as representing value onchain, but this definition fundamentally misunderstands the innovation. The most successful applications in crypto tokenize value and create new markets that serve crypto-native demand.

Polymarket, one of the most active consumer apps of 2024, tokenizes event outcomes. Pump.fun, the 10th most profitable crypto app, tokenizes attention via instantly deployable memecoins. These projects didn’t grow by importing traditional assets onto a network, they grew by meeting the needs of crypto-native users through liquid, accessible, and composable tokens.

Institutions Are Coming (But Won’t Save Us)Asset tokenization refers to the process of issuing digital tokens that represent physical or traditional financial assets, commonly referred to as RWAs. Most RWA implementations today, however, do not benefit crypto-native users. They are illiquid, permissioned, and not composable across DeFi. In other words, they lack crypto-native context.

Consider BlackRock’s BUIDL fund. Many cite its rapid rise to a $1.5 billion market cap as evidence that institutional adoption is underway. But a closer look reveals limited participation. The token is held by just 44 wallets, with over 25% of the supply on Ethereum concentrated in a single address controlled by Ondo Finance. Other RWA funds, such as Ondo’s OUSG, show similar patterns. These aren’t vibrant markets. They are siloed instruments with formal onchain presence without meaningful crypto-native engagement.

Lack of participation is a byproduct of how these products are structured. Despite being issued as an ERC-20 token on Ethereum, BUIDL’s functionality is restricted to whitelisted wallets, and its integration into onchain protocols is limited. Smart contracts must be approved by the transfer agent, which makes permissionless use across DeFi infeasible. Yield accrues through an offchain process and is distributed monthly in-kind, complicating basic integrations such as lending or automated strategies. Even with a USDC liquidity facility, BUIDL operates more like a tokenized wrapper around TradFi infrastructure than a natively onchain asset. These constraints may satisfy institutional requirements but offer little to crypto-native users who rely on composability and interoperability for meaningful engagement.

In comparison to assets like DAI, which has a $3.2 billion market cap distributed across half a million tokenholders. The difference lies in design. DAI is permissionless, composable, and liquid. As a result, DAI is widely used across DeFi protocols.

Stablecoins Are the Blueprint for RWA AdoptionMany successful applications in crypto, from Polymarket to pump.fun, serve crypto-native users first. If RWAs are to succeed, they must prioritize crypto-native users. The most successful RWA to date is the stablecoin, though few frame it that way. Stablecoins are tokenized fiat currencies. But unlike most RWAs, they weren’t designed to mirror traditional finance. They were built to solve crypto-native problems.

Stablecoins improved spreads on centralized exchanges, created a stable unit of account for DeFi trading, and offered a liquid settlement layer across protocols. These were core pain points for crypto users, and stablecoins solved them. Only after being battle-tested and widely adopted within crypto did stablecoins expand into non-crypto use cases such as payments in emerging markets where access to stable currency is limited and inflation is high. For example, Nigeria and Turkey have seen sharp increases in stablecoin usage as alternatives to local fiat.

Today, with deep liquidity and long-term product-market fit in crypto, stablecoins are being adopted by traditional institutions. Banks and governments are now launching their own stablecoins. But this is a second-order effect. Adoption came after utility was proven within crypto-native environments.

This is the correct sequence. Utility comes first and adoption second. RWAs must follow the same path. If they don't create value for crypto-native users, they will remain siloed even if institutions get involved.

From Tokenization to Utility: Plume’s Approach

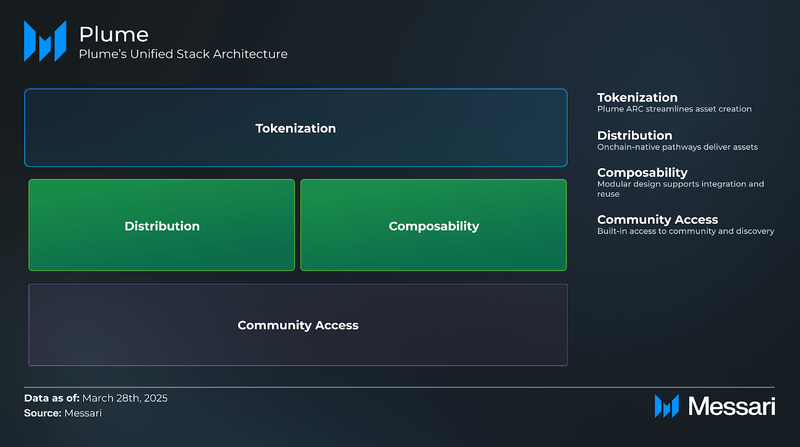

From Tokenization to Utility: Plume’s ApproachPlume builds on the same principles that made stablecoins successful: utility must come before adoption. Rather than uploading traditional assets to a blockchain and expecting participation, Plume structures its approach around creating conditions where tokenized assets can function within crypto-native environments.

Plume’s approach is twofold. First, it provides the technical infrastructure for institutions to issue assets onchain. Second, it cultivates the network of users and applications that give those assets relevance. This is the rationale behind Plume’s purpose-built Layer-1 network. A chain optimized for real-world assets, but designed around crypto-native use cases.

The emphasis is on grounding the experience in crypto-native activities, such as earning, trading, and speculating with new asset types. Projects building in the Plume ecosystem include:

- Mineral Vault – representing the first instance of US mineral rights onchain, as detailed in Plume’s case study

- GAIB - tokenized access to real-world AI compute yields from staked GPU infrastructure

- Colb - unlocks exclusive wealth management and pre-IP opportunities through tokenization

- Music Protocol - infrastructure for tokenizing, managing, and distributing music rights and royalties

- Matrixdock - tokenized access to institutional-grade RWAs like U.S. Treasury bills and gold

Each of these applications brings a different type of RWA onchain, but they share a common focus of orienting around the crypto user. Adoption to date includes:

- Over 180 projects with $4 billion in committed assets

- 18 million wallets conducting over 280 million transactions on testnet

- Over 1 million followers, signaling alignment with crypto-native culture and behavior

Plume frames itself as an RWA network — not just a platform for token issuance, but a coordinated ecosystem that includes applications, liquidity, and users. This reflects a key lesson from recent crypto history, technical capability is not enough. Network density of users, culture, and composability is what gives assets meaning onchain.

The success of pump.fun on Solana is instructive. Its growth was not purely a function of tooling, but of context: an existing user base, active liquidity, and aligned protocols. Replicating the product on other chains hasn’t worked, because most lack one or more of those conditions. Plume is designed to provide all three. The goal is not simply to make tokenization easier, but to create an environment in which tokenized assets can be used.

Plume’s progress is driven by a team with a mix of crypto-native and institutional experience:

- Chris Yin: Co-founder & CEO – formerly at Scale Venture Partners and Coupa

- Teddy Pornprinya: Co-founder & CBO – previously at Binance (BNB Smart Chain) and Coinbase Ventures

- Eugene Shen: Co-founder & CTO – previously at dYdX and Robinhood Crypto

The broader team includes around 30 members distributed globally. Plume’s backers include Apollo Global Management, YZi Labs, Haun Ventures, Galaxy, HashKey, Superscrypt, A_capital, and SV Angel, with over $30 million raised to date. The company also manages a $25 million ecosystem fund to support RWAfi application development.

Closing SummaryTokenization alone does not create value. Without integration into crypto-native systems where assets are liquid, composable, and actively used, most RWAs will remain static representations rather than functional components of a larger financial network. Stablecoins proved that adoption follows utility, rather than the other way around. Stablecoins succeeded because they solved real problems for crypto users, not because they resembled familiar financial instruments.

Plume is built with that principle in mind. By focusing on infrastructure, applications, and community, it aims to create an environment where tokenized real-world assets can be used from day one. Rather than porting traditional finance onchain, the goal is to enable new types of financial activity that emerge because assets are onchain — not in spite of it. The result is not just tokenized RWAs, but usable onchain assets that align with how crypto actually works.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.