and the distribution of digital products.

Rubic Q3 2024 Brief

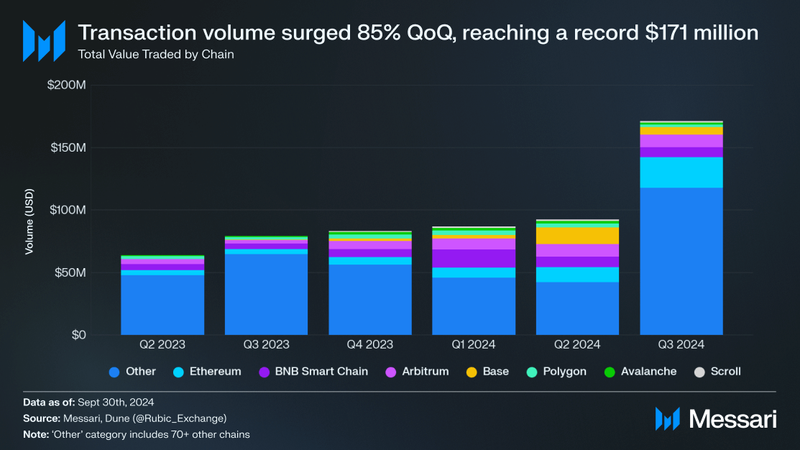

- Rubic achieved record-breaking trading volume of $171 million in Q3 2024, an 88% increase QoQ.

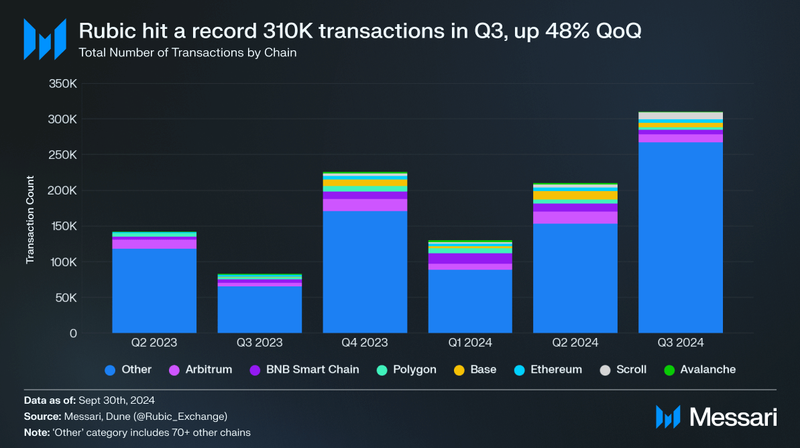

- Rubic processed a notable 310,000 transactions in Q3 2024, up 48% QoQ, surpassing the previous high of 225,000 in Q4 2023.

- The addition of 14 new integrations, including new chains, bridges, and DEXs, expanded trading routes and strengthened liquidity.

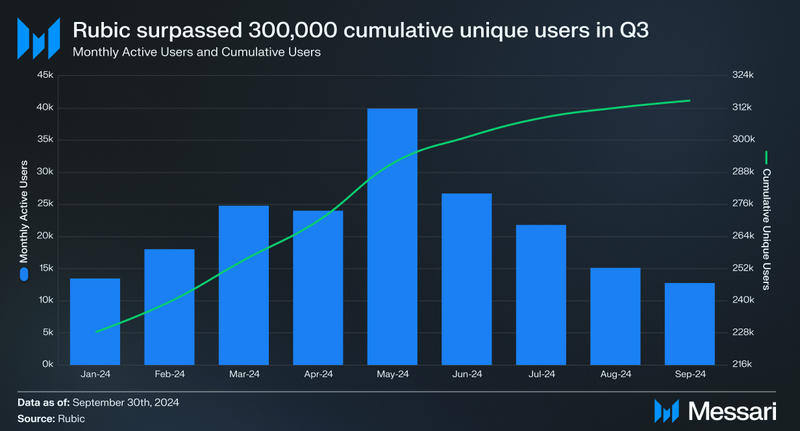

- In Q3 2024, Rubic surpassed 300,000 cumulative unique users. By late Q3, Taiko and Scroll emerged as the leading networks on Rubic, attracting 52% and 25% of its users in September, respectively.

- Rubic's token (RBC) outperformed the broader crypto market in Q3 2024, with an 11% increase in market cap and an 8% price rise, despite a generally challenging environment.

Rubic (RBC) is the Best Rate Finder tool, a cross-chain bridge and DEX aggregator that aims to offer efficient trading routes and competitive crypto exchange rates across 90+ blockchains. As a front-end application that doesn’t use external servers, Rubic routes all swaps through existing bridges and DEXs. To find the best swap for most cross-chain and onchain DEXs, Rubic routes to the exchange’s API and processes the data through the exchange’s services.

By leveraging multiple providers, Rubic can execute swaps and aggregate liquidity even if some exchanges stop operating. Rubic aggregates over 320 bridges and DEXs. It never holds funds on its front end, and every transaction is performed via API by sending calls to smart contracts. By not relying on external servers, Rubic reduces attack vectors (e.g., DDOS). Rubic’s SDK and widget service over 130 crypto projects.

Its architecture is structured around three core SDK modules, external API providers, and the RPC node. The RPC node facilitates interaction with other chains. The cross-chain manager queries the provider’s API, initiating transactions through Rubic’s smart contracts. These contracts, in turn, engage the contracts of cross-chain bridges and DEXs. For EVM-based swaps, Rubic’s SDK utilizes 1inch, OpenOcean, ODOS, XY Finance, and other natively integrated DEXs as its primary providers. In March, Rubic introduced the MetaMask Snap, named BestRateFinder, a tool that compares users’ trades against over 200 DEXs in real-time, ensuring the most favorable rates without having to search each DEX manually. The integration is directly available via MetaMask’s wallet.

In September, Rubic released an API for other protocols to access Rubic, with Holdstation Wallet being the first API integrator.

Website / X (Twitter) / Telegram

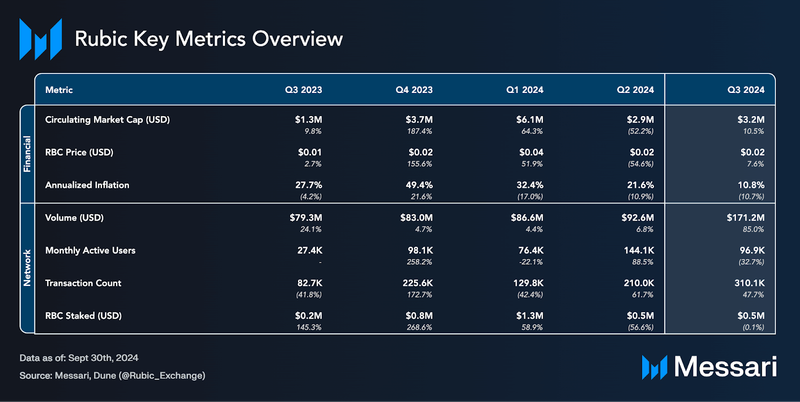

Key Metrics Analysis

Analysis

Rubic’s token (RBC) outperformed the broader crypto market in Q3 2024. Over the quarter, RBC’s circulating market cap rose by 11%, driven by an 8% price increase — from $0.016 to $0.018 — and annualized token emissions of 11%, which expanded the circulating supply from 178 million to 183 million tokens. This growth brought RBC’s market cap to $3.2 million, ranking it at 2,463 among digital assets. In contrast, Ethereum experienced a 25% decline, Bitcoin rose by 1%, and other aggregator tokens like FLIP, BANANA, and 1INCH saw declines of 5%, 7%, and 30%, respectively.

RBC derives its utility from several features, including governance rights, fee sharing, and loyalty programs. Users who staked RBC earned 50% of platform transaction fees, which were paid out in ETH.

Rubic set a new record in Q3 2024, routing over $171 million in volume — an 82% QoQ increase from $93 million in Q2. Ethereum accounted for the largest share, capturing 37% of the total volume. Among Layer-2 networks, Arbitrum and Base led with 14% and 9% of the volume, respectively. Binance Smart Chain was the most dominant alternative Layer-1, contributing 14% of the total volume.

Transaction volume wasn’t the only record Rubic set in Q3 2024. The protocol processed 310,000 transactions during the quarter, a 48% QoQ increase that surpassed the previous record of 225,000 transactions set in Q4 2023. Among origination chains, Arbitrum accounted for 17% of transactions, followed by Scroll with 15%.

Monthly Active Users (MAU), which tracks unique wallets interacting with Rubic contracts, surpassed 300,000 cumulative users in Q3 2024. This milestone reflects strong long-term growth, even as MAUs declined 33% QoQ from 144,055 to 96,909. In the final week of September, daily active users spiked to 3,200 — nearly triple the earlier quarterly average of 1,100 — suggesting a possible trend reversal leading into Q4. Scroll became the dominant network near the end of Q3, capturing 52% of Rubic’s users, a shift influenced by the Layer3 Rubic’s Birthday campaign hosted on the platform.

Additional DevelopmentsIn Q3 2024, Rubic completed 14 new integrations with chains, bridges, and DEXs, providing users with more trading routes and assets.

Rubic now supports trading across four new chains: Bahamout, CoreDao, Bitlayer, GravityChain, and added providers on TON. In addition, Rubic launched five bridge integrations: Owlto, Stargate v2, Eddy Finance, Retro Bridge and Router Nitro. Five new DEX integrations: Camelot, Ston.fi, DeDust, Coffee Swap and Eddy Finance, have also been added.

With additional cross-chain and on-chain providers for Ton, Rubic has become the first cross-chain and DEX aggregator on the network. These bridge and DEX integrations enhance the user experience by offering a broader range of assets and trading routes.

Rubic also formed four new partnerships:

- GM2 Social: A SocialFi platform that combines social networking and DeFi.

- DapDap: A platform that unifies the user experience across Ethereum Layer-2 solutions and various applications.

- HoldstationWallet: A multichain crypto wallet that focuses on account abstraction and streamlining the user experience across DeFi.

- Best Wallet: A non-custodial wallet that supports over 60 chains.

In September, Rubic issued a new API for other web3 projects to utilize Rubic’s services, with Holdstation Wallet being the first API integrator. Rubic's API is a robust interface that enables developers to integrate on-chain and cross-chain swapping functionality across 90+ networks and 320+ providers into their applications, saving time and money on development costs.

To drive user engagement in Q3, Rubic launched several campaigns. Its traditional Birthday Celebration kicked off on September 25, extending primarily into Q4. During the first week alone, the Scroll Quest on Layer3 generated over 70,000 transactions. The Intract Campaign’s BeraChain testnet attracted over 36,000 users, while Layer3 campaigns for Arbitrum and Season 3 were also significant highlights.

Roadmap

Rubic's roadmap outlines a series of key initiatives aimed at enhancing user experience, expanding accessibility, and improving interoperability across chains.

Rubic is working on implementing gasless transactions to enhance user experience, allowing transactions without the need for direct gas fee payments. Additionally, a multitoken selector will be introduced to streamline asset management by enabling users to interact with multiple tokens at once. Rubic also intends to offer a fiat on-ramp solution, simplifying the process of moving between fiat currencies and blockchain assets. To make Rubic's services more accessible, a mobile application and a Chrome extension are currently under development.

The protocol will be expanded to support more blockchains, which will increase reach and interoperability across various blockchain ecosystems. Additionally, Rubic plans to integrate additional bridges and decentralized exchanges (DEXs) to boost liquidity and cross-chain capabilities. The roadmap also involves chain abstraction, which will hide the complexities of different blockchain networks, creating a more seamless user experience. Lastly, Rubic will implement intent aggregation, analyzing different routes and options to help users achieve the most favorable transaction outcomes.

Closing SummaryDespite a challenging market environment in Q3 2024, Rubic demonstrated resilience and growth. The platform achieved record-breaking performance, routing over $171 million in trading volume during the quarter — an 88% increase QoQ. Rubic also processed a record 310,000 transactions, reflecting a 48% increase from Q2. RBC rose 7% during the quarter, outperforming Ethereum.

Rubic's progress in Q3 was driven by strategic integrations, partnerships, and campaigns. The addition of 14 new integrations — including Gravity, CoreDAO, and TON — expanded trading routes and liquidity. New bridge and DEX integrations, like Owlto, Camelot, Ston.fi and DeDust, further strengthened cross-chain and on-chain swap capabilities. Partnerships with GM2 Social, DapDap, Holdstation Wallet, and Best Wallet built a robust ecosystem, while successful campaigns with Layer3 and Intract boosted user engagement.

Looking ahead, Rubic's roadmap includes features like gasless transactions, a multitoken selector, and a fiat on-ramp to improve user experience. A mobile app and Chrome extension will streamline access while expanding blockchain support and adding new bridges and DEXs will boost liquidity and interoperability. Rubic aims to simplify cross-chain trading with chain abstraction and intent aggregation, delivering a seamless user experience.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.