and the distribution of digital products.

Rubic Q1 2025 Brief

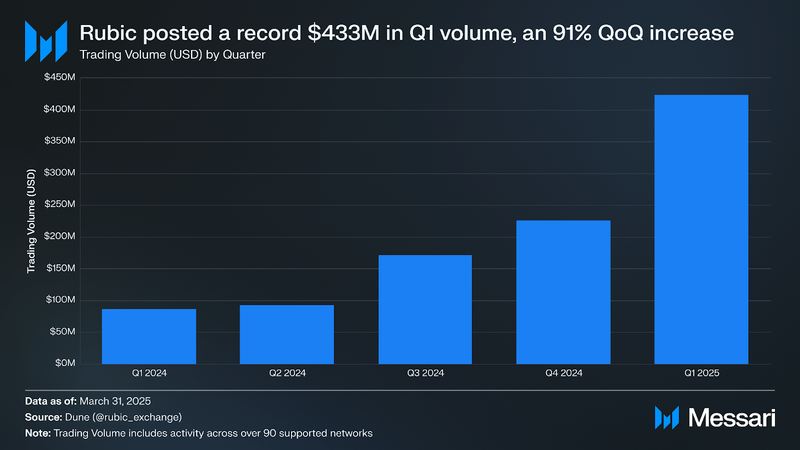

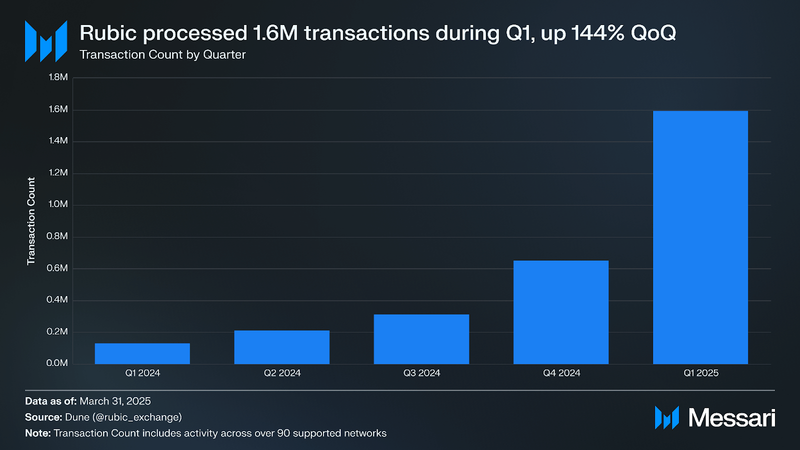

- Rubic had its strongest quarter to date, processing $433 million in trading volume and 1.6 million transactions on its main application. Those were increases of 91% and 144% QoQ, respectively.

- Rubic added support for nine new networks. New integrations included Sui, Berachain, Fraxtal, Soneium, Unichain, Monad (testnet), MegaETH (testnet), Morph, and Sonic Labs.

- Monad testnet was the breakout network, which attracted over 200,000 unique addresses, who have completed over 3 million swaps on the Rubic testnet applicaiton in less than 2 months.

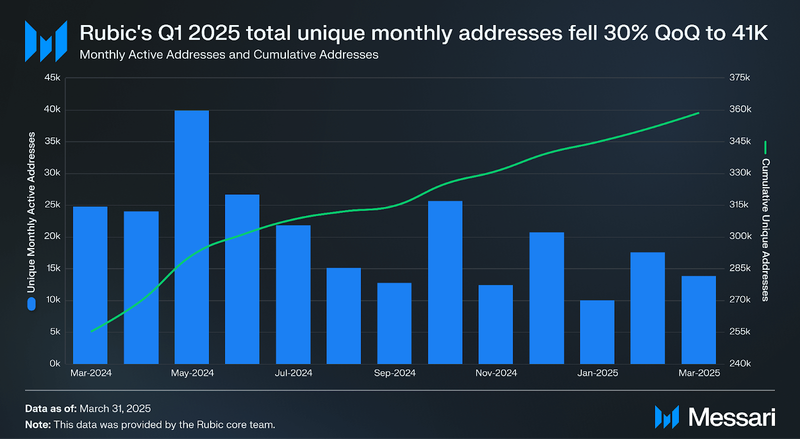

- Main app user growth continued as Rubic added more than 19,000 total unique addresses during the quarter, even as monthly active address numbers fluctuated.

- Rubic expanded its infrastructure and its reach through new network integrations, SDK and API upgrades, and new partnerships.

Rubic (RBC) is a crosschain bridge, intent protocol, and DEX aggregator that finds optimal trading routes and competitive exchange rates across over 100 networks. It operates as a front-end application without external servers, routing swaps through existing bridges and DEXs via their APIs.

By integrating over 360 bridges, intent protocols, and DEXs, Rubic aggregates liquidity across sources to route swaps through the most efficient paths for optimal execution. The protocol never holds user funds, with all transactions processed via API calls to smart contracts. This architecture reduces attack vectors like DDoS and enhances reliability. Rubic’s API, SDK and widget support over 130 crypto projects.

Rubic’s system is built around its API and SDK modules, external API providers, and an RPC node that facilitates interactions. The swap manager queries provider APIs and initiates transactions through Rubic’s smart contracts, which engage crosschain bridges, intent protocols, and DEXs. For EVM-based swaps, Rubic’s API leverages bridges and DEXs native to specific chains, as well as other aggregators like 1inch, OpenOcean, ODOS.

In September 2024, Rubic introduced an API for external protocols, with BestWallet and Holdstation Wallet as integrators. In March 2024, Rubic launched the BestRateFinder, a MetaMask Snap that compares trades across over 330 DEXs in real time, eliminating the need for manual searches.

Website / X (Twitter) / Telegram

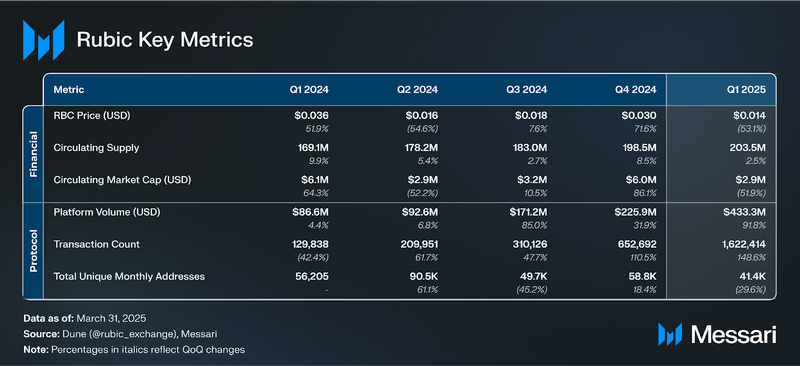

Key Metrics

Research Contents

Rubic Q1 2025 Brief

Analysis

Rubic’s token (RBC) derives its utility from governance rights, fee sharing, and loyalty programs. RBC declined alongside the broader market in Q1 2025. The circulating market cap dropped 52% QoQ, falling from $6 million to $2.9 million. RBC’s price fell 53% over the same period, from $0.030 to $0.014. A 2.5% QoQ increase in circulating supply slightly offset the market cap decline. For comparison, Ethereum declined 45% in Q1’25, while aggregator tokens 1INCH and BANANA posted losses of 51% and 47%, respectively.

Rubic set a new quarterly record in Q1 2025, processing $433 million in transaction volume across single chain and crosschain activity. This was a 91% QoQ increase, led mostly by same-chain swaps. Ethereum saw renewed engagement in February with $2.1 million in single chain volume, its highest monthly total of the quarter. Meanwhile, Base, Arbitrum One, and OP Mainnet delivered strong mid-quarter peaks before tapering off. Base reached $582,300 in February, while Arbitrum One and OP Mainnet crossed $918,130 and $997,800, respectively. Less-used networks like Fraxtal and Soneium saw brief spikes.

Trading volume wasn’t the only record-setting metric for Rubic, the platform also facilitated a record number of transactions. On its main application, Rubic processed 1.6 million transactions across single chain and crosschain activity during Q1’25, up 144% QoQ from 652,690. Also, Rubic processed over 3 million transactions on the testnet app, mainly for the Monad testnet.

Fraxtal and Soneium also contributed meaningful spikes in February, processing 3,870 and 14,280 transactions, respectively. Base maintained strong early-quarter momentum with 1,690 transactions in January, followed by 1,440 in February, before slowing in March. Arbitrum One, OP Mainnet, and Ethereum recorded their highest engagement in February. Meanwhile, Rubic’s support for a wide range of smaller chains, from Linea and ZetaChain to Mode and Merlin, continued to attract crosschain users.

Address growth on Rubic’s main application remained steady in Q1’25, even as monthly activity fluctuated. However, on the testnet application over 200,000 addresses used Rubic in February-March mostly for the Monad test swaps, as well as for MegaETH.

Over 19,000 new addresses used the main protocol during the quarter, bringing the total quarterly active addresses to 358,570 . Monthly active addresses dipped to a twelve-month low of 9,960 in January, rebounded to 17,580 in February, and then moderated to 13,860 in March. These swings came on the heels of a broader downtrend that began after May 2024, when activity peaked at nearly 40,000 monthly active addresses.

Additional DevelopmentsRubic continued to expand its infrastructure and integration footprint throughout Q1 2025. Network additions, SDK and API improvements, and new partner integrations extended the platform’s utility and reinforced its position as a leading crosschain aggregator.

Rubic added support for several new networks during the quarter, bringing its total to 93 - on the main application, and over 8 chains on the testnet app. These included Sui, Berachain, Fraxtal, Soneium, Unichain, Monad (testnet), Morph Network, and Sonic Labs. The integration of Monad’s testnet was particularly active, with users executing over 219,000 swaps in a single week. Rubic also integrated MegaETH (testnet), further reinforcing its early support for next-gen chains.

The platform’s SDK and API received multiple updates to accommodate the expanding list of networks, adding compatibility for Sonic, Sui, and Unichain. On the infrastructure side, API upgrades improved swap routing and reliability across chains like TON, Flare, Gravity Chain, and Tron.

Liquidity and routing depth also improved through new integrations. In March 2025, TeleSwap was integrated to enable crosschain wrapped BTC swaps, while the Flare ecosystem gained access to swap functionality through OpenOcean. Bridgers.xyz introduced aggregation from six liquidity providers to TON, improving swap efficiency within that ecosystem. In January 2025, Rubic also added SimpleSwap to its growing list of exchange partners.

New integrators including Dodo.exchange, Emperor’s Seal, NFA Trading Bot began leveraging Rubic’s API to deliver crosschain trading to their user bases.

Campaigns remained a focus for user acquisition and engagement. Rubic collaborated with Layer3 on quests featuring Gravity, TeleSwap and Frax, and launched an ecosystem campaign with Holdstation Wallet. These campaigns reinforced Rubic’s presence in both incentive-driven and wallet-native experiences.

RoadmapRubic's 2025 roadmap focuses on chain abstraction, more chains and providers, and a smoother user experience. The team plans to introduce social login and gasless transactions, which removes the need for users to hold native tokens for fees. Enhanced swap tools, such as optimised slippage, dollar-based trades and better provider evaluation, aim to improve UX, routing and execution.

In 2025, Rubic is expanding its integrations and liquidity network. There will be a strong focus on wallets, DEXs, and aggregators to integrate the Rubic API and SDK. The platform will add support for new chains and liquidity sources including Coral, 0x and DODO. Also, Rubic plans to introduce strategic partnerships with intent providers to launch highly expected chains from Day 1.

The second half of 2025 will bring more customization and simpler access. Developers and integrators will gain access to customizable dashboards, and expanded SDK support, and users will get a lite app version.

Closing SummaryRubic entered 2025 with strong momentum. The platform set new records with $433 million in trading volume and 1.6 million transactions in Q1, up 91% and 144% QoQ, respectively. Growth was led by Monad, and increased activity on Ethereum, Base, Taiko, and Arbitrum One. Despite fluctuations in active addresses, Rubic added over 19,000 new addresses in the quarter on the main application, and over 200,000 addresses on the testnet app. Ongoing integrations across networks, liquidity providers, and API partners continued to expand Rubic’s reach.

The RBC token declined alongside the broader market. Its price fell 53% QoQ, as its circulating market cap dropped from $6 million to $2.9 million. A slight increase in circulating supply helped offset the decline in market cap.

Still, Rubic’s roadmap offers a clear direction. Chain abstraction, UX upgrades and more developer tools aim to improve access and usability. The platform is positioning itself for long-term growth as crosschain demand increases.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.