and the distribution of digital products.

DM Television

Rigetti stock rockets 47%: Is it time to cash out or hold?

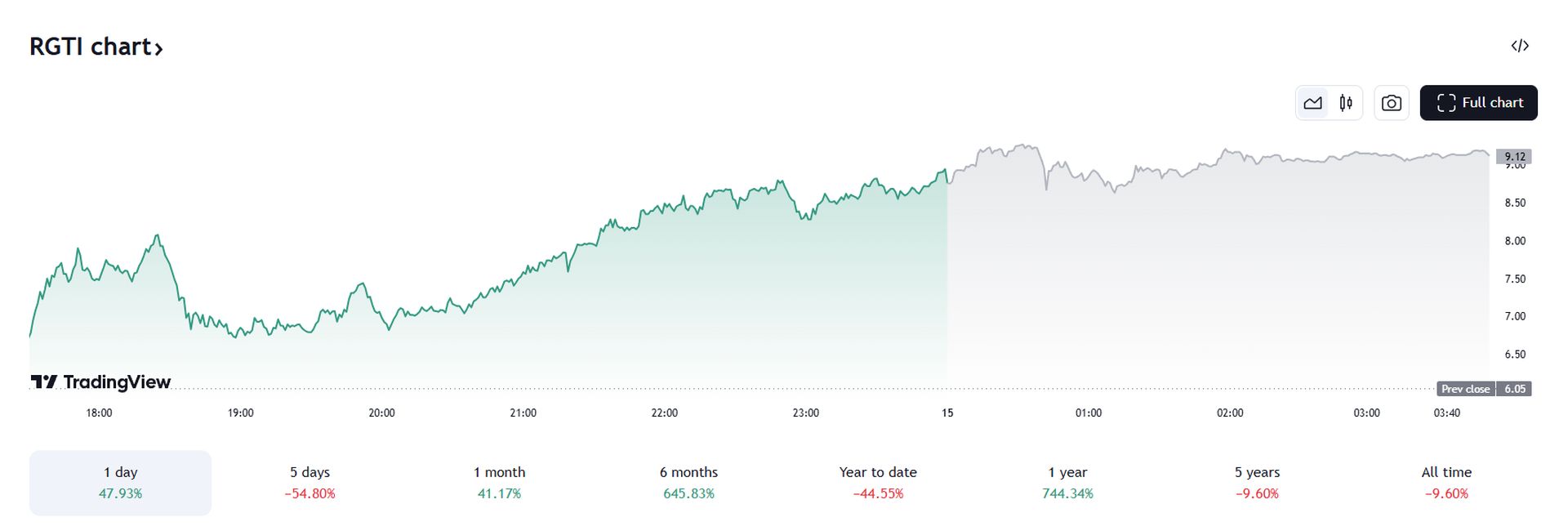

Rigetti Computing’s 47% surge is as much a story of speculative frenzy as it is about renewed interest in quantum computing. Jim Cramer’s remarks highlighted the unusual activity. While the jump signals enthusiasm, Cramer’s comments, tinged with sarcasm, hint at the speculative nature of the rally, calling it a “typical quantum bounce” and suggesting it’s an opportunity to exit. The rise follows a tough week for the sector, reflecting how quickly sentiment can flip, even amid long-term skepticism about quantum’s practicality.

Why Rigetti shares jumped 47% despite quantum sector skepticism?Rigetti Computing experienced a remarkable share price increase of 1,849% in the fourth quarter of 2024, rising from $0.78 on September 30 to $15.2 on December 31, 2024. The company is poised for growth as technology giants and the US government bolster their investments in quantum computing.

In the third quarter of 2024, Rigetti reported $2.4 million in revenue, although it has yet to achieve profitability. The company is anticipating the release of innovative quantum chips in 2025, which has sparked investor optimism.

On December 23, 2024, Rigetti launched its 84-qubit Ankaa-3 quantum system, boasting enhanced performance and 3D signal delivery capabilities. Despite this achievement, Rigetti’s shares had suffered a significant decline, losing over 70% of their value from a $20 closing high shortly before, largely due to comments from NVIDIA CEO Jensen Huang regarding the timeline for practical quantum computing applications.

Huang indicated that fully functional quantum computers capable of solving real-world problems could be 15 to 30 years away, with 20 years being the most likely estimate. This commentary, along with remarks from Meta Platforms CEO Mark Zuckerberg, who stated that quantum computing remains far from becoming a practical technology, contributed to increased caution about the industry’s short-term prospects.

Image: TradingView

Image: TradingView

Despite prior volatility, Rigetti saw its shares surge more than 1,000% in just over a month following Google’s announcement of a new quantum chip, Willow, prompting a rush among investors eager to capitalize on early investment opportunities. The enthusiasm around quantum technologies is expected to persist, as several companies have begun generating revenue from quantum computing products, contrasting with the industry’s long history of speculative investments.

On a technical level, Rigetti shares experienced a 47% increase, attributed to significant trading volume—the highest in the stock’s history. The company appears to be benefiting from a “double-barrel” technical support setup, identified at the stock’s 50-day moving average and the $7.50 price level.

Investors should scrutinize the recent spike carefully, as it might represent a short-term bounce rather than a sustained recovery. The stock is trending upwards in the long-term, evidenced by a rising 20-month moving average.

Year-to-date, Rigetti’s shares have surged 499.01%, outperforming the average annual return of -15.37%. The current Relative Strength Index (RSI) for Rigetti is 16.79, indicating oversold conditions. Whether investors choose to sell or hold will depend on individual strategies and risk tolerance.

Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

Featured image credit: Rigetti

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.