and the distribution of digital products.

Reminder: Bitcoin CAN Make Civilization Sane

Jason A. Williams, the author, gives us a lot of reasons to be optimistic about a Bitcoin-powered future. The author is a…

Bitcoin Maximalist

And you will be too after reading this book.

As we’ll discover, bitcoin is the best form of money ever invented. Not only that, it’s the best-performing financial asset on the planet, swallowing everything in its path. It will devour government currencies that are printing themselves into oblivion and it will establish itself as the next global reserve currency. It might take years, decades, but it’s happening. And there’s one simple reason why: Bitcoin is hard money you can’t f!*k with.

\ Bitcoin is the best performing asset in the last five years, the last ten years. Up 4,000% since 2015. Up 16,666,566% in the last decade.

\ Fascinatingly, that author operates a factory where he turns old tires into Bitcoin. Which the green crowd should really appreciate, but probably doesn't.

Bitcoin Will Be the Next Global Reserve CurrencyHere's why…

No-one controls it. No governments, no companies, no central banks, no money printing. It’s a revolution as big as the internet. And it’s never been hacked.

Not only was bitcoin the best-performing asset on the planet in 2020, it quietly established itself as the next global reserve currency as central banks around the world desperately printed their money into oblivion.

\ Hard Money You Can’t F*ck With explains bitcoin in simple, readable terms and maps out how this ‘magic internet money’ will grow into the best form of money we’ve ever had.

\ We'll revisit this topic a little later…

Bitcoin Is AntifragileBitcoin isn’t just a currency or financial system, it’s the strongest computer network in history. And it only has one job: protecting hard money. It’s a $280 billion bug bounty — the biggest reward for hackers in history if they could figure it out — and no-one’s broken it.

\ Why do so many people believe so much in Bitcoin? Bitcoin has NEVER been hacked. Exchanges, wallets, and even hardware wallets have been hacked but not Bitcoin. Hackers hack everything hackable if the reward is enough. And the reward for hacking Bitcoin would be billions. The fact that it hasn't happened speaks volumes about the antifragility of the blockchain. It's working the way Satoshi envisioned it in his whitepaper (which you can listen to here); it's more profitable to validate the blockchain than try to attack it.

https://www.youtube.com/watch?v=Q4GO6JVluP0&embedable=true

Bitcoin should be a store-of-value firstThis is one of the key things I want you to take away from this book. Bitcoin’s main use-case is not payments… yet. The best use-case for bitcoin right now is holding. It’s an emerging ‘store of value.’

\ New innovations like the “Lightning Network” are now being built on top of Bitcoin. The lightning network allows you to send small amounts of BTC instantly with almost zero fees. The transaction itself is batched with others and later settled on the Bitcoin blockchain. In other words, Bitcoin is the slow, steady, secure, reliable, settlement layer. A strong, impenetrable fortress. The foundation. And faster payment networks can be built on top of it.

\ This is not designed for buying coffee. It’s for settling gigantic payments on the most secure network ever invented. It’s designed to be a global reserve currency layer.

The world doesn’t need another super-fast payment system. We have Visa, Venmo, Cash-app, Mpesa. The revolution is bigger than that. We need a whole new system of money — one that’s fair and transparent and open to everyone, censorship-resistant, scarce and deflationary.

\ As Saifedean Ammous later wrote in 2017: “Using Bitcoin for consumer purchases is akin to driving a Concorde jet down the street to pick up groceries: a ridiculously expensive waste of an astonishing tool.”

\ Speaking of the Concorde, are you curious why you can't fly on it anymore, no matter how much Bitcoin you have? Check out this philosophical deep-dive on the book At Our Wits’ End…

The number of bitcoin addresses holding at least 0.1 BTC is over 3 million — a record high. And the number of “whales’ with over 1,000 BTC has swelled to highs of over 2,000. There are more people opting to store their wealth in bitcoin than ever before, validating its thesis as a store of value.

\ The arguments made in the book are compelling, until I'm convinced otherwise, I'm a "small-blocker;" we need an antifragile, bulletproof store-of-value that can't be f!*ked with a lot more than we need another digital payment tool. For fast, low-fee cryptocurrency transactions, we have Bitcoin Cash. Bitcoin's integrity should not be compromised so people can buy coffee with it.

Bitcoin Is ScarceOne point the book really drives home is the scarcity of Bitcoin. It's scarcer than you think. In fact, it's mathematically engineered to become scarcer with time, over the course of 4-year "halvening" cycles. If you're going to get into Bitcoin. you need to have at least a 4-year vision; it may crash and lose value temporarily, but through the halvening cycles, it grows in value. It must.

\

It is absolutely, completely finite. Only one other thing like it exists: time.

\ I often tell friends and family, that as long as governments are irresponsible, Bitcoin will rise in value. And, at this point in history, the one thing we can count on is governments being irresponsible.

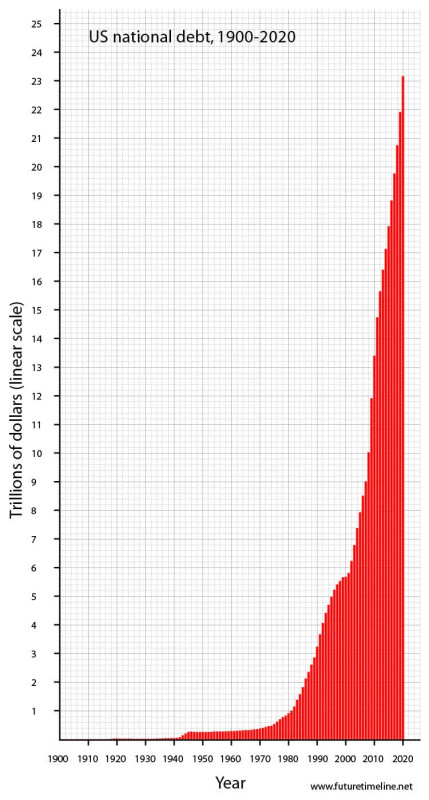

Inflation Is Coming…To America at least. It's hard to understate how badly the US government has screwed us all by printing so much bloody money…

About the 2008 financial crisis…

Bernanke printed $7.7 trillion in emergency loans for the banks in just a couple of years, in complete secrecy. That’s ten times more than the original bailout. If people knew this was going on, there would have been riots

\ Now, the national debt has soared to unprecedented heights.

We’re running at 128% debt-to-GDP as I write this. Historically, anything over 77% slows down growth according to the World Bank. And anything over 130% is game over. In the last 200 years, 51 out of 52 countries defaulted when they went over 130%. Either a ‘hard default’ or a massive currency devaluation. We are right on the cliff edge.

\ I'd disagree with the author by contending that a hard default would be great. Why should future generations of Americans be made to pay off the insane amounts of debt that our idiot politicians got us into? Debt is NOT sacrosanct, as Larry Kudlow, the Director of the National Economic Council, said - it's a risk that internationalist bankers choose to take on. I don't see how a sovereign hard default could be worse than the financial straights we are in now.

\ It's important to point out that the elites love inflation because they hold hard assets, namely real estate which just appreciates in value while the outstanding debt remains the same. Let's say you bought a house in Berlin at the end of WW1, you had a mortgage on the property that you had to pay interest on monthly, so ten years later, you could travel to America, sell your wedding ring to a pawnshop, take the dollars back to Germany and pay off your loan. You'd be pretty pro-inflation too.

\ The same economic incentive drives the behavior of politicians and financial "masters of the universe." The COVID crisis gave the Federal Reserve just the excuse it needed to go crazy with money printing.

\

The Fed printed more US dollars in those two months than it did in the first two centuries of America’s existence. Seriously. More money printing in a few weeks than almost 240 years. The balance sheet swelled to almost $7 trillion.

\ If you're an American reading this, please don't use government-issued stimulus checks to go on vacation, eat out, or buy the latest smartphone. Pay the bills you absolutely have to, and put as much as you can into a hedge-against-inflation investment like Bitcoin.

The Bitcoin Opportunity Has NOT PassedWhile I wish I had those two Bitcoins that I once spent in Barcelona two weeks back in 2015, the book makes me confident buying Bitcoin at $50,000.

Everyone thinks they’ve missed the boat when they first get into bitcoin. I started mining seriously in 2015 and I thought I was late. Bitcoin was trading around $300 at the time. I look back and can’t believe you could ever buy a whole bitcoin for $300, let alone $3. Trust me, if you’re reading this in 2020, 2021, 2022, 2023, 2024…. you are still early. This is a long game. Decades. Generations. Centuries. Expand your time horizon. We’re talking about the next global reserve currency of the world.

Today, we’re in another era of insane, experimental money printing. Like all others in history, it will be brief, and it will end badly. But when this one fails, we won’t go back to gold. We’ll turn to bitcoin. In almost every way, bitcoin is harder and better money than gold.

\ With each halvening, bigger and bigger players get in…

Barry Silbert — the head of Grayscale, an investment trust with $8 billion in crypto assets. He hit back pretty hard, “There’s a generation shift in investor mindset happening. Over the next 25 years, $68 trillion of wealth is going to be handed down from boomers… it’s not going to stay in gold.” A lot of it will go into bitcoin.

\ In 2020 it was institutions of high finance; banks, pension funds, and hedge funds. In 2024, it will be nation-states…

I guarantee someone out there — a president or central banker or treasury secretary — is nervous about their country’s fiat currency reserves. Nation-states are just a group of people. If you and I are worried about fiat devaluation, then so is someone in power. It’s going to happen. One day, a legitimate nation-state will announce a bitcoin reserve and it will shock everyone. Remember, there’s a huge first-mover advantage here. MicroStrategy’s bitcoin investment triggered a $100 billion profit in just a few months. The first legitimate nation-state to adopt bitcoin as a reserve asset will reap the rewards.

But it won’t be the US or China or the UK or Germany. It’ll be a country like the Ukraine. Nothing to lose. A f!*k it let’s try something different hail Mary. A bit like MicroStrategy itself. It was never going to be Facebook that added bitcoin to its reserves first. It was always going to be the quiet underdog. The forward-thinker looking for ways to break through and innovate.

\ The underdog I'm rooting for is Bulgaria, where I call home!

The Bitcoin network will become the ultimate global settlement layer of the new digital economy. No more power games and politics. It’s neutral and impartial, settled in hard currency, not credit or an IOU. No politics, no sanctions, no allegiances. It’s fair and transparent. A financial system that even enemies can agree has value. They can still convert back to their own currency at the other end. It’s the unf!*kable Bitcoin rails that matter.

\ The opportunity to buy Bitcoin, hold it, and get rich will have reached its zenith when it becomes the world reserve currency. Over the coming years and decades, as smart money flees the US Dollar and Western civilization learns a painful and prolonged lesson about socialism, those who buy Bitcoin at $50K or $100K will look pretty smart. So, what are you waiting for? You know what they say about the best time to plant a tree…

History is RhymingAll the countries fighting in World War I dropped the gold standard. Britain — with the world’s dominant currency — started borrowing money for the first time. Germany lost the war and the economy was crippled. Worse, they had to pay reparations, 132 billion gold marks (about $33 billion or 100,000 tonnes of gold at the time). On top of the black hole of debt they built up during the war, Germany now had to borrow even more to pay the reparations. It was a chokehold on the German economy and people lost all faith in the currency.

\ During the Trump Presidency, you probably grew weary of hearing Trump-Hitler comparisons. The much more accurate historical comparison is modern-day America and 1920's Weimar Germany. Insane amounts of debt, degeneracy, inequality, and inflation resulted in the worst war in human history; at least 50 million lives were lost.

On Bitcoin vs War

Throughout the 20th century, wars were fought on printed money and debt. No-one asked your permission to do it. They promised a quick, cheap invasion (Bush estimated $50 billion for Iraq). They printed the money, loaded up the deficit and went off to war. The costs always spiral out of control (Iraq ended up costing at least $2 trillion), but Bush never came back and asked you to approve the next check. They just printed more and added trillions to the national deficit. Future generations will pay it back, right? Under a bitcoin system, none of this would be possible. You can’t just print more bitcoin to raise a war chest. You’d have to go out and directly tax it from the people… or at least get agreement from the public to borrow it. If Bush burned through the first $50 billion for Iraq, he’d have to come back to the public and ask for more. What do you think they would say? Hell no.

\ Whenever people praise American democracy, I'm moved to retort that democracy is, at this point, a total farce. We've gone through several election cycles now with the vast majority of the population opposing our wasteful, pointless "forever wars" in the middle east and politicians promising the end of them. And what do we get? More wars that the public despises, that's not democracy. The really good news is that these sorts of wars simply couldn't be funded with Bitcoin.

\

Under a bitcoin system, there are consequences for acting irresponsibly. No money printer to bail you out. Banks, companies and governments would be better capitalized. Just like you’ve got an emergency fund for your family, institutions would be forced to run their books with a stronger emergency fund. It’s not much to ask.

\ Much of the insanity that civilization is currently plagued by is a trickle-down effect of the money-as-debt, fractional-reserve legacy financial system, like many I call it "the beast system" - it's the endgame boss that humanity must beat for a fighting chance at becoming a type-1 civilization. And while Bitcoin as the global reserve currency won't fix all that ails us, it will be a lot less beastly.

Dystopia IncomingOne of my favorite podcasters, philosopher Stefan Molyneux, often predicts that, in the future, society will be divided into two classes; those with Bitcoin and those without it. Those without it will subsist on scraps of universal basic income tossed their way by the elites - they'll own nothing and they really won't be happy.

\ The government will tax the middle class, those with real estate, stocks, and savings, out of existence and print dollars until they're toilet paper to try to pay for UBI. Those with Bitcoin will just have to do their best to avoid onerous taxation of their wealth. I know which class I'd rather be in!

\ On Christmas, 2020, I released a speech, The Winter Solstice of Civilization, about the "new dark age" we are entering…

https://rumble.com/vc6146-the-winter-solstice-of-civilization.html?embedable=true

But it's not all bad news…

\ If you can make yourself antifragile enough to survive this new dark age (and it will be brief, thanks to Bitcoin!), there's hope for a bright future.

The Golden Age of CapitalismHappened thanks to the ascendancy of the US Dollar in the second half of the last century.

\

There was stability around the world with gold and the dollar acting as a secure peg. And it was one of the most prosperous times in history. It’s known as the Golden Age of Capitalism. The post-war boom. And it’s because of the dollar. The world finally convened around a new global reserve currency, backed by gold. Trade flourished. As we know through history whenever rival tribes or countries agreed on a new universal form of scarce money — whether it was barley or gold coins or wampum, the economy boomed. As bitcoiners say, fix the money, fix the world.

\ And we can look forward to an even brighter golden age with Bitcoin as the world reserve currency. Stay healthy, avoid falling pianos, and you can expect to live long enough to see it. I, for one, intend to salsa dance with my wife on the peak of Olympus Mons on Mars, and dollars are not going to get me there!

\ There are a lot of reasons for pessimism about the near-term future, the next few decades, but after reading this book, I'm ultimately optimistic about this century. I think that cryptocurrency will be the vehicle that gets us to a freer, saner future.

I'd urge anyone interested in cryptocurrency to read this book. It's engaging, witty, and informative with really great chapter titles. It gives me the emotional fortitude to get through the shocking price swings that Bitcoin is prone to.

I made a Jazzy AI song to give you an audio dose of anarcho-libertarian techno-optimism to inspire your Hodling…https://youtu.be/LfyBVNevuV4?embedable=true

\

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.