and the distribution of digital products.

Polygon Ecosystem Overview

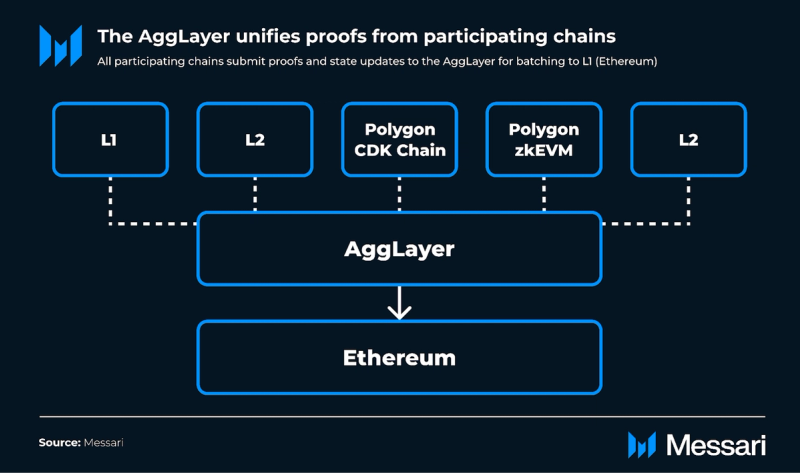

- Polygon made significant strides towards becoming an aggregated blockchain network with proposals to transition its PoS chain to a zkEVM validium and connect the network to the AggLayer.

- Polygon Labs integrated SP1, a zkVM built with Plonky3, to generate pessimistic proofs for the AggLayer. This integration ensures cryptographic security by preventing any chain from withdrawing more than its deposits, thus enhancing the network's overall connectivity, promoting safe and seamless asset transfers between chains.

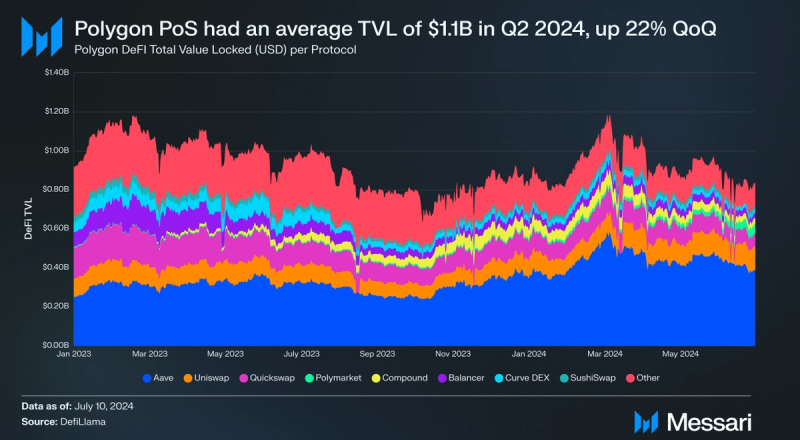

- Polygon PoS concluded Q2 2024 with a DeFi Total Value Locked of $1 billion. This places Polygon PoS among the top 10 largest networks by TVL and is expected to further accelerate with the synergies of the AggLayer.

- The Polygon Community Treasury launched a $1 billion Community Grants Program to support developers and projects within the Polygon network. Over the next decade, the CGP will distribute 100 million POL tokens annually, managed by an independent Community Treasury Board.

In October 2017, MATIC Network (now Polygon) was founded as a scaling solution to address blockchain scalability and usage issues, particularly on Ethereum. At its core, Polygon is built on the concept of blockchain modularity, that separating the core functions of a blockchain—execution, settlement, data availability (DA), and consensus—into different layers enhances scalability. This approach, however, has inadvertently led to two unattended consequences: fragmentation of state and liquidity.

Today, Optimistic Rollups require users to pay expensive fees, up to 0.5% of the transaction value, to third-party bridges to avoid the seven-day challenge period to withdraw from the bridge. Zero-Knowledge Rollups, which reduce these wait times by eliminating the need for a challenge mechanism, still face delays as users are required to round trip on Ethereum for cross-chain transactions. These delays and costs highlight the inefficiencies that arise from the current modular approach, underscoring the need for more innovative solutions.

Polygon has become an aggregated network with a number of scaling solutions, including public chains and a chain development kit to address scalability and interoperability challenges without compromising on trust assumptions. This technological landscape includes:

- Polygon Proof-of-Stake (PoS): A Proof-of-Stake (PoS) EVM-compatible scaling solution for Ethereum. Polygon PoS allows execution to be moved off Ethereum and onto Polygon PoS, where transactions are significantly cheaper and faster. With over 169m inscriptions Polygon PoS stands as one of the top used blockchains in the world supporting consumer-facing crypto apps including Polymarket. The recent Napoli upgrade has further enhanced the user experience and overall better performance, through its support for RIP-7212, improvements to parallelization (BlockSTM), and new op-codes related to Etheruem’s Cancun upgrade. In the aggregated context of joining the AggLayer, its importance is anticipated to further increase, pending community consensus.

- AggLayer: Enables interoperability between various blockchain networks, including the variety of different Ethereum L2s and independent L1s. The AggLayer allows chains to maintain their existing architectures and sovereignty while opting into a shared ecosystem for cross-chain interactions. By utilizing pessimistic proofs to ensure no chain can act maliciously, the AggLayer creates a unified environment for liquidity and shared execution. Developers can grow their dApps more effectively by leveraging the combined user bases of the aggregated network, making bootstrapping easier and accelerating the adoption and growth of new applications.

- Polygon Chain Development Kit (CDK): Open source software components that allows developers to build zero-knowledge blockchains to their specifications. Polygon CDK offers essential tools and components for various chain configurations, including Polygon zkEVM rollup and Polygon CDK validium, which enhance scalability and ensures data availability for users.

Polygon Proof-of-Stake (PoS) is the flagship Polygon protocol, one of the first chains that launched, explicitly designed to improve Ethereum's scalability and efficiency. It operates as an EVM-compatible scaling solution that utilizes its own set of validators through a Proof-of-Stake consensus mechanism.

As of Q2 2024, Polygon PoS has processed over 4.1 billion total transactions. Following this, Polygon has consistently maintained its cost-effective advantage over many L2s engineered to be more economical. In Q2 2024, Polygon's average transaction fee was around $0.01, down 41% QoQ, while Optimism’s Bedrock average transaction fee was $0.06.

Key Performance Metrics

As of July 2024, Polygon is the 4th largest Ethereum scaling solution in terms of TVL, trailing behind Arbitrum’s $2 billion, Base’s $1 billion, and Blast’s $1 billion but ahead of Optimism’s $709 million. Among all blockchain networks, Polygon boasts the 8th-highest TVL.

The largest protocols by TVL on Polygon PoS include Aave, Uniswap, QuickSwap, and Polymarket. Polymarket, a decentralized information markets platform that allows users to trade on real-world events, has particularly shown an impressive recent growth in TVL. The protocol has increased 237% quarter-over-quarter, from $17.04 million at the end of Q1 2024 to $40.2 million at the end of Q2 2024, driven by increased betting activity surrounding the upcoming US Presidential elections.

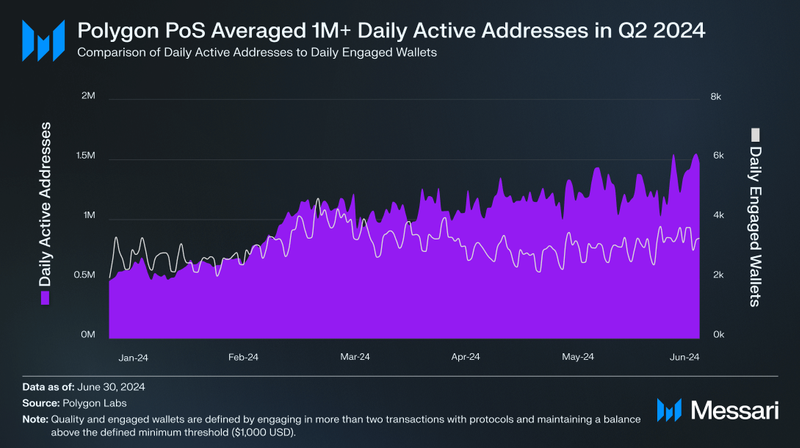

Additionally, daily active addresses on Polygon PoS are up 47% QoQ to 1.2 million. Over the past 12 months, Polygon PoS has processed 452 million DeFi transactions, more than Arbitrum, Base, and Optimism combined. These transactions include $1.5 billion in value from various DeFi use cases, e.g. trading and lending.

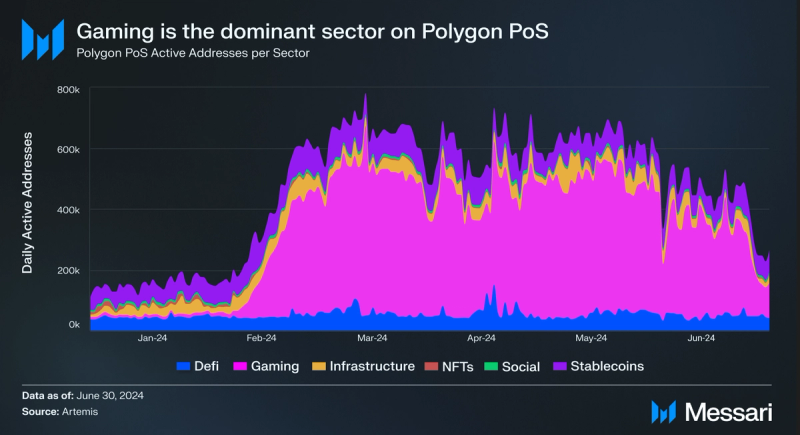

In Q2 2024, Polygon’s gaming sector experienced the highest network activity across its leading sectors, with 382,000 daily active addresses increasing by 85% QoQ. This growth is attributed to the popularity of Matr1x’s Matr1x FIRE game, a first-person shooter game. Matr1x accounts for 74% of the average daily active addresses among the top five applications on Polygon PoS.

The number of unique addresses active on Polygon PoS has risen by 205% YTD, while daily engaged wallets have also seen an increase of 50% YTD. In March 2024, the Ethereum network underwent the Dencun upgrade, implementing proto-dank sharding (EIP-4844) and improving data availability on Ethereum. This upgrade led to a substantial reduction in fees across the Ethereum ecosystem, including Polygon, where total transaction fees decreased by 41% QoQ to $4 million.

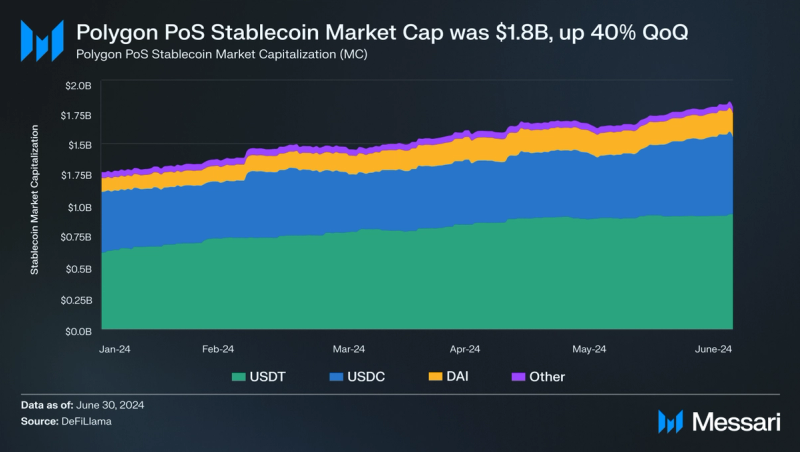

Stablecoins on Polygon continued to grow, with their total market cap increasing 40% QoQ, up to $1.8 billion by the end of Q2 2024. Daily active addresses in stablecoins also rose 35% YTD. Tether (USDT) and Circle's USDC maintained their dominance, collectively representing 80% of the stablecoin market cap on Polygon, with approximately 50,000 and 20,000 daily active addresses, respectively. In March 2024, a migration of native USDC on Polygon PoS began.

The Future of Polygon PoSToday, Polygon PoS relies on its own validators to secure the network, with each new block requiring more than two-thirds of stake-weighted validator signatures to be added. Three primary upgrades have reached community consensus and are scheduled for the coming months:

- Polygon PoS upgrades to a zkEVM validium.

- Polygon PoS connects to the AggLayer so that it can serve as the network’s finality for settling transactions.

- The MATIC to POL technical upgrade has reached community consensus and is scheduled for September 4th. A testnet upgrade to POL was successfully executed on July 17th.

Rollups aggregate large transaction volumes into batches and post them to a secure data availability (DA) layer. However, in a multichain ecosystem, L2s often opt for the cheapest DA layer, introducing vulnerabilities. An attack on an external DA layer's staking mechanism can disrupt data availability, allowing for potential state manipulation.

Protocols are developing new chain infrastructures for greater security, leading to various -iums (Optimiums, Validiums). Optimiums use fraud proofs for settlement on the L1 and publish transactions to an offchain DA layer, which can be secured by another blockchain or a Data Availability Committee (DAC). DACs ensure security as long as N-1 members are honest, bringing safety and liveness similar to that of a sidechain.

Validiums ensure transaction security and native L2-L1 bridges. Importantly, Validiums inherit safety from their proof mechanism while still relying on a separate DA layer for liveness, unlike Optimiums.

Phase 1: Polygon PoS transition to a full-zkL2The current security model on Polygon PoS relies on 107 validators with approximately $2.9 billion worth of MATIC staked. Within the past 12 months, a pre-PIP governance proposal from June 2023 outlined Polygon's plan to transition its PoS network to a zero-knowledge (ZK)-based validium. If approved, this proposal would enhance the network’s security by leveraging Ethereum's robust framework, supported by around $40 billion in staked ETH and over 600,000 validators.

In June 2024, a new pre-PIP proposal expanded on Polygon’s long-term vision of upgrading the network to a zk-powered L2 by integrating it with the AggLayer. This upgrade will be secured by a consensus proof generated by the Succinct Labs' SP1, a general-purpose zkVM built on the modular Polygon Plonky3 proving system. Of note, a new role is needed to submit the network's local bridge state and proof of consensus to the AggLayer, which could either start with an allowlisted address and become permissionless over time or be immediately permissionless, with network participants rewarded for their contributions.

Pre-PIP Proposals: Insights and Potential OutcomesThe proposed upgrades for the first phase of the connection to the Agglayer would introduce several direct benefits for users and developers:

- PoS Developers: The connection to the AggLayer means seamless access to a unified liquidity pool and user base across all connected chains (X Layer, Polygon zkEVM, Astar zkEVM, and many more connections). This aggregation of liquidity and user base will enhance network effects, enabling developers to tap into a broader ecosystem, and increase the potential reach and utility of their applications.

- PoS Users: With true chain abstraction and native asset support, users can seamlessly access liquidity and services across various connected chains. This integration eliminates the need for bridging different chains, allowing users to interact with applications and assets more intuitively.

Additionally, the pre-PIP proposals can pave the way for futher improvements. The zkEVM validium can eliminate chain reorganizations by supporting decentralized validator and sequencer sets with deterministic, single-block finality. This would significantly reduce transaction confirmation times from the current 256 seconds to just 2 seconds while still preserving Polygon PoS’ low fees, Ethereum-for-all ethos.

AggLayerThe AggLayer is a protocol designed to address blockchain fragmentation by enabling interoperability between diverse networks. It allows heterogeneous chains to interoperate while maintaining their existing architectures. Chains can opt into the AggLayer to achieve composability with other participating networks, creating an ecosystem of unified liquidity and shared state. The protocol’s design allows blockchain networks to benefit from cross-chain interactions without altering core structures. This approach aims to preserve sovereignty at the individual chain level while expanding the functionality of connected networks.

The AggLayer is currently optimized for asset fungibility among L2s and low-latency interoperability via asynchronous and synchronous composability across different chains. In the future, other L1s can opt in to the AggLayer to take advantage of the same benefits.

Key features and benefits of the AggLayer include:

- Unified Liquidity: The AggLayer enables seamless sharing of liquidity across all connected chains. This unified approach significantly improves capital efficiency by allowing assets to be utilized across multiple networks without the need for traditional bridging mechanisms.

- Cross-Chain Interoperability: It facilitates near-synchronous composability between rollups and chains. Users can execute transactions that span multiple chains, with the AggLayer ensuring the atomicity and security of these cross-chain operations.

- Flexible Integration: The AggLayer supports both ZK and non-ZK chains, allowing for a diverse ecosystem of networks to connect and interact seamlessly.

- Enhanced User Experience: From an end-user perspective, interacting with the AggLayer feels like using a single chain, despite the underlying complexity of multiple interconnected networks.

There currently exist three total chains connected to the AggLayer: Polygon zkEVM, Astar zkEVM, X Layer. Upon its launch on Feb. 23, 2024, the Polygon zkEVM chain was integrated into the AggLayer. On March 6, 2024, Astar zkEVM became the first external chain connected to the AggLayer. Soon after in April, blockchain gaming studio Moonveil announced their plans to launch their own dedicated Polygon CDK L2 and have prioritized opting into the AggLayer as part of their roadmap. OKX also announced the launch of the X Layer mainnet, a zkEVM L2 built with Polygon CDK, which integrated with the AggLayer on launch.

ArchitectureThe core components of the AggLayer are comprised of three main features:

Pessimistic proofs are specialized zero-knowledge proofs designed to guarantee that no single chain within the AggLayer ecosystem can compromise the deposits or assets of any other connected chain. This approach isolates potential security breaches, ensuring that even if one chain's security is compromised, it cannot drain funds from the unified bridge that connects all chains in the AggLayer. The technical implementation of pessimistic proofs revolves around the system of local and global exit trees and balance tracking. The AggLayer aggregates the local exit trees to construct a global exit tree, providing a comprehensive view of all withdrawals across the entire network of connected chains.

Each chain connected to the AggLayer maintains its own local exit tree, which is implemented as a Merkle tree. Each leaf of the tree represents a withdrawal transaction. When a user initiates a withdrawal, a new leaf is added to the tree containing details such as the token type, amount, and recipient address. The root of this tree serves as a compact representation of the entire withdrawal history for that chain.

The AggLayer constructs and maintains a global exit tree that aggregates information from all connected chains and their local exit trees. This tree is essentially a higher-level Merkle tree where each leaf corresponds to the root of a local exit tree from a connected chain. By using the roots of local exit trees, the global exit tree can represent the withdrawal state of the entire network in a single cryptographic commitment. The global exit tree is then periodically committed to the Layer-1 (typically Ethereum), serving as a secure checkpoint for the entire system.

Key Contributors to the AggLayerThe development of the AggLayer involves collaboration with several key collaborators, each bringing unique technologies to create a robust and interoperable ecosystem. Some notable contributors include:

- Developed SP1 zkVM, a general-purpose zero-knowledge virtual machine for ZK development, leveraging Polygon's Plonky3 proving system. The implementation of FRI (Fast Reed-Solomon Interactive Oracle Proofs) over the BabyBear field in Plonky3 provides the necessary soundness for the proofs generated by SP1.

- Enables developers to leverage zero-knowledge proofs while writing standard Rust code or any LLVM-compiled language.

- Features efficient precompiles, including keccak, optimizing blockchain operations.

- Allowed pessimistic proof program to be written in less than 1000 lines of Rust code.

- Provides sequencing marketplace and fast-finality layer.

- Enables specialized service providers (sequencers) to purchase the right to coordinate block construction across multiple rollups simultaneously. This mechanism enables efficient handling of AggLayer-secure message passing, optimizing the integrity of data exchange across Layer-2 networks.

- Implements HotShot consensus for fast transaction confirmations.

- Enhances user experience with reduced perceived transaction times.

- Developed Type 1 upgrade for the zkEVM prover following its acquisition by Polygon Labs.

- Allows any existing EVM chain to become a ZK L2 without modifications.

- Achieves efficient ZK proofs for Ethereum blocks at an average cost between $0.002 and $0.003 per transaction. This level of performance makes it economically viable to prove entire Ethereum blocks, containing hundreds of transactions, for $0.20-$0.50 per block.

- Bridges the Cosmos ecosystem to the AggLayer via Inter-Blockchain Communication (IBC) protocol integration.

- Enables asset transfers between IBC-enabled chains and AggLayer networks.

- Connects Celestia’s ecosystem to AggLayer as Celestia collaborator.

- Developing zkWasm L2 prover for the AggLayer.

- Aims to bridge the gap between Wasm-based chains and the Ethereum ecosystem.

- Expands options for developers building with Polygon CDK.

Polygon’s Chain Development Kit (CDK) is a modular technology stack that enables developers to launch their own zero-knowledge blockchains on Ethereum. The CDK functions to provide the necessary tools and components for different chain configurations based on their specific needs, including:

- CDK (zkEVM) Rollup: This framework leverages Polygon's ZK-prover to generate zero-knowledge proofs (ZK-proofs) for transaction batches. Each batch, along with their corresponding ZK-proofs, is submitted to the L1 (Ethereum) and verified.

- Validium Rollups (zkEVM + DAC): Typically, L2 chains store all transaction data to Ethereum as blobs and calldata—for Polygon zkEVM, posting calldata accounts for more than 80% of transaction fees. The Polygon CDK Validium addresses this scalability issue for projects by building on the core functionalities of the Polygon’s CDK rollup node and adding an offchain data availability layer. The validium uses a Data Availability Committee (DAC), a group of permissioned nodes that attest to the reliability and accessibility of L2 data, reducing expensive gas fees.

- Unified bridge: Chains built with Polygon CDK will be able to easily and natively connect to the unified bridge, which is at the heart of aggregating chains via the AggLayer. The bridge is secured through a novel ZK proof called the pessimistic proof. But because sovereignty is core to Polygon CDK, chains may opt out of unified bridge connection if they please.

- Applications: A number of projects are building using Polygon CDK, including OKX, TON, Ronin, Moonveil, Fox's Verify, Arianee, Libre, Gnosis Pay, Lumia (Orion) Protocol, Merlin Chain, Palm, Ternoa, Swell, Wirex, Witness Chain, zkFair, and Wilder World.

Tokenomics

Polygon's native token and staking token upgrade from MATIC to POL is scheduled for September 4, 2024, following successful community consensus and a testnet deployment on July 17. In the short term, for MATIC holders on Polygon PoS, the token upgrade will be automatic, requiring no action on their part. However, MATIC holders on Ethereum, Polygon zkEVM, or centralized exchanges (CEXes) will require some action from users to migrate their tokens.

In the long term, Polygon 2.0 tokenomics will introduce an enshrined restaking system (to be released in 2025). In this system, POL tokens are deposited in the staking hub and can be restaked to validate multiple chains and assume various roles. With the same investment capital, these stakes yield greater benefits. As a hyperproductive token, POL offers two key advantages:

- Decentralization: Enshrined restaking eliminates dependence on third-party protocols, significantly enhancing ecosystem security and mitigating centralization risks.

- Multifold Utility and Incentives: POL tokens significantly enhance the value proposition for validators, enabling them to perform a variety of functions—securing mutiple chains (AggLayer), block generation, transaction verification, zero-knowledge proof generation, and participation in Data Availability Committees (DACs).

The Polygon Community Treasury recently unveiled a $1 billion Community Grants Program (CGP) to support developers and projects within the Polygon community. Over the next decade, CGP will distribute ~100 million POL tokens annually, following a three-month-long season strategy. An Independent Community Treasury Board (CTB) oversees the Community Treasury, where CTB members are responsible for:

- Direct funding: Facilitate the selection process for individual project submissions to the CTB.

- Grant Allocator (GA): Ensure the effective execution of funds to grantees through Polygon’s onchain time lock mechanism, Governance Bravo.

Season 01, the CGP’s inaugural season, is already underway with 35M POL allocated for its two main tracks:

- General Grant: Open to all projects in the Polygon Ecosystem regardless of type—Dapps (Gaming, Real-World Assets, AI), developer tooling and libraries, protocol infrastructure, etc.

- Consumer Crypto: This category is for developers building consumer-led use case projects, including gaming and autonomous Worlds, NFTs, decentralized social, and the AI/Blockchain intersection

Most blockchains function independently, constrained by their own distinct governance models and consensus mechanisms, effectively impeding full interoperability. The growing need to make all blockchains interoperable has driven Polygon’s evolution from a single chain to a diverse aggregated network of blockchains. Beyond merely being interconnected, Polygon can scale Ethereum to the size of the internet. Polygon is poised to create a powerful flywheel effect: increased adoption leads to more liquidity and activity, which in turn attracts more developers and users, further driving adoption. The network is already expanding, with several projects building with Polygon CDK, including Ronin and TON.

Polygon has become a leading Ethereum scaling solution since the crypto boom of 2021, processing an average of 4 million daily transactions. The gaming sector, particularly driven by the popularity of Matr1x's FIRE game, has seen the highest network activity out of all sectors on Polygon, leading to an 85% QoQ increase with 382,000 daily active addresses. Matr1x accounts for 74% of the activity among top apps, including Circle, Tether, Projectgalaxy, and MakerDAO. Other sectors, such as stablecoins, have also gained traction, with market cap growing 40% QoQ to $1.8 billion.

While Polygon continues to receive community proposals for new potential upgrades, including connecting PoS to the AggLayer, it’s quickly becoming the leading aggregated network, unifying liquidity and enabling developers to grow without limits. This vision aims for a future where diverse chains can interact seamlessly, sharing liquidity and state, thereby creating a horizontally scalable network of interconnected chains.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.