and the distribution of digital products.

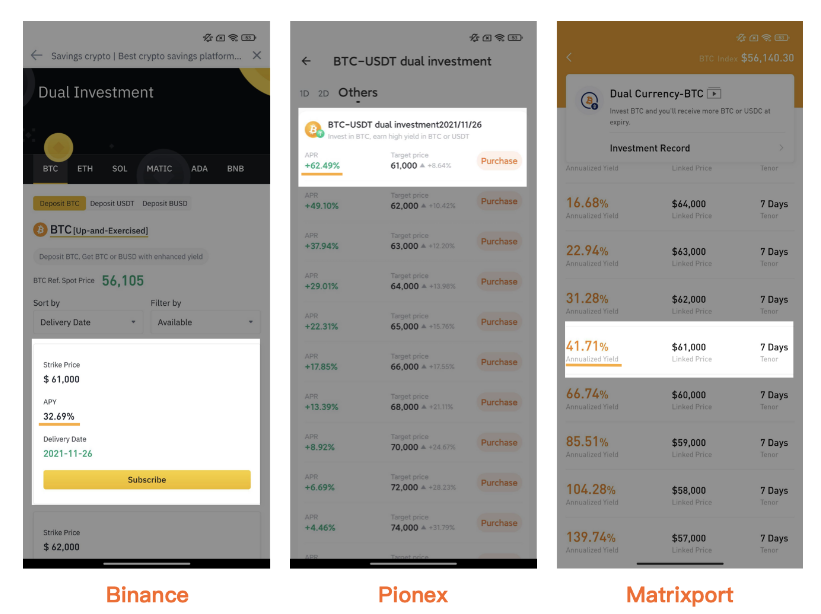

Pionex vs Binance vs Matrixport – Best Dual Investment Platform

Due to multiple crypto market crashes, the Luna fiasco, and a sudden drop in BTC value. As a result, people find it hard to find profitable opportunities in the crypto space. So here we are back with one of the techniques, i.e., Dual Investment, which can help our readers to increase their profitable opportunities and earn interest no matter which direction the market goes. There are multiple crypto exchanges and trading bots which provide Dual Investment Opportunities. In this article, we will compare Pionex, Binance, and Matrixport based on the basis of Dual Investment.

Summary What is Dual Investment, and How does it Work?Dual Investment allows users to buy or sell a cryptocurrency at their desired price and time in the future. Regardless of their position, Users will earn a high-interest income irrespective of market direction. This can be considered a definition in layman’s terms.

Alternatively, Dual Investment is a non-principal protected structured saving product with enhanced Yield, involving two different currencies. Here, users select an underlying asset, a deposit currency, subscription amount, and settlement date.

Pionex vs Binance vs Matrixport

Types of Dual Investment products:

Pionex vs Binance vs Matrixport

Types of Dual Investment products:

- Sell High: If the Settlement Price is above the Target Price, the product is “exercised”.

- Buy Low: If the Settlement Price is below the Target Price, the product is “exercised”.

For both types of Dual Investment products, users will receive the returns in deposit currency if the product is not exercised and receive the returns in alternate currency if the product is exercised.

Dual Investment allows users to buy crypto at a lower price or sell at a higher price in the future. It also allows users to earn a high-interest yield during the subscription period. Buy Low products provide the chance to buy crypto at a lower price in the future. Sell High products allows users to have an opportunity to sell the existing crypto at a higher price in the future.

Advantages of Dual Investment:- Buy Low or Sell High: It allows users to have a chance to buy crypto at a lower price or sell crypto at a higher price.

- High-Interest Yield (APY): Users can earn a high passive income.

- Wide Selection: Users can choose from a wide variety of assets and set the target date and price to their liking.

- Zero Trading Fees: No trading fees are charged when the target is reached and the buy or sell order gets executed.

Also read, 7 Best Zero Fee Crypto Exchange Platforms

Basic terminologies which would help- Annual Percentage Yield (APY): Interest earned if we lock our crypto in a Dual Investment Product for a year.

- Settlement Date: A set date when we want to buy or sell.

- Settlement Price: A market price average in the 30 minutes

- Subscription Amount: Amount deposited when subscribing to Dual Investment.

- Subscription Period: Number of days from the day of the subscription until the Settlement Date.

- Target Price: A set price at which we want to buy or sell. Before 08:00 (UTC) on the Settlement Date.

Here, we will take an example of how returns are calculated in a Dual Investment. This process

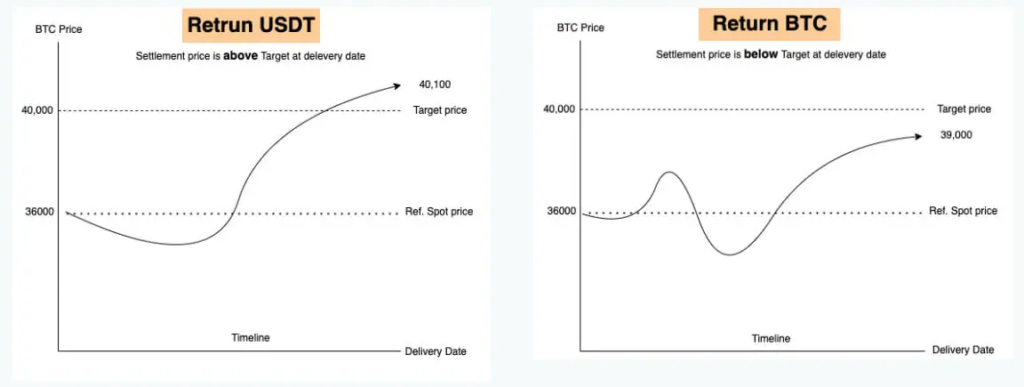

For Buy Low Dual Investment, there are two possible scenarios:

- When the Target Price is reached on the Settlement Date: Users’ Subscription Amount and Interest Income will be used to buy crypto at the Target Price.

Formula: (Subscription Amount + Interest Income) / Target Price

- When the Target Price is not reached on the Settlement Date: Users receive their Subscription Amount and Interest Income without any conversion.

Formula: Subscription Amount + Interest Income

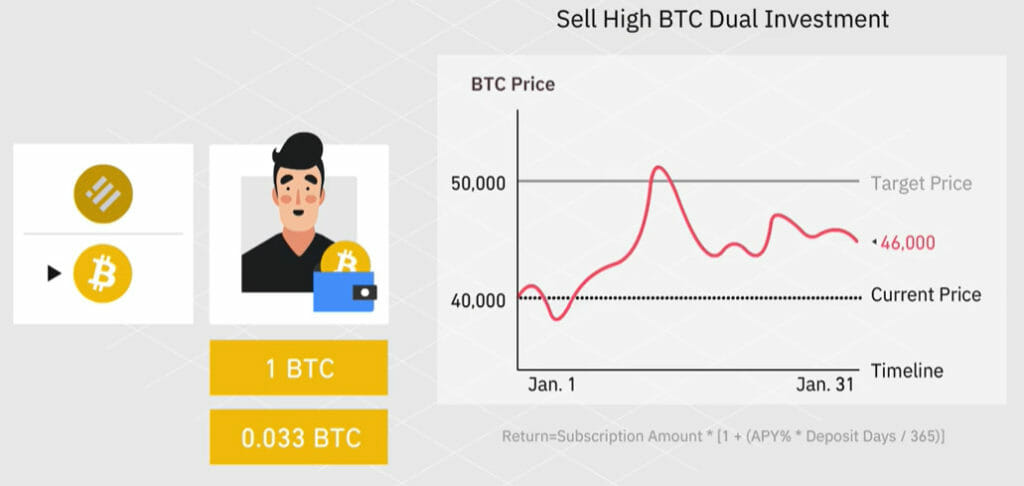

For Sell High Dual Investment, there are also two possible scenarios:

- When the Target Price is reached on the Settlement Date: Users’ Subscription Amount and Interest Income will be used to sell crypto at the Target Price.

Formula: (Subscription Amount + Interest Income) x Target Price

- When the Target Price is NOT reached on the Settlement Date: Users receive Subscription Amounts and Interest Income without any conversion.

Formula: Subscription Amount + Interest Income

For Example: On January 1st, Bob had 1 BTC, which he wanted to sell at $50,000 in the next 30 days. Now, BOB has subscribed to sell high BTC investment with a Target Price of $50,000 and with a Settlement date of January 31st. Bob is also entitled to receive 40% APY.

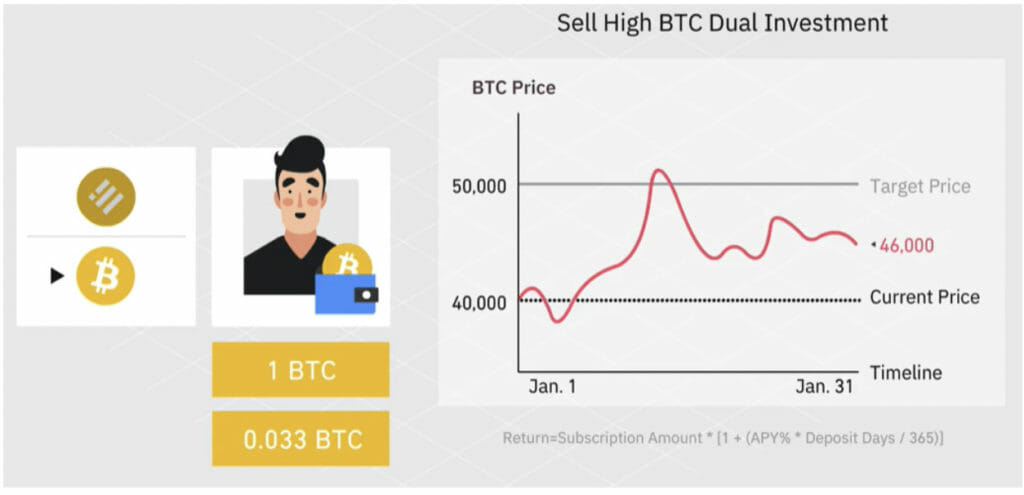

On the Settlement Date, there are two possible scenarios:

Scenario 1: Market price does not reach target price, and trade does not happen. So, Bob keeps his 1 BTC and also earns 0.033 BTC from 40% APY.

Scenario 1

Scenario 1

Scenario 2: Market price reaches the target price. Bob sells his 1 BTC and also earns 0.033 BTC from 40% APY. Now, Bob receives 51,650 BUSD.

Scenario 2:

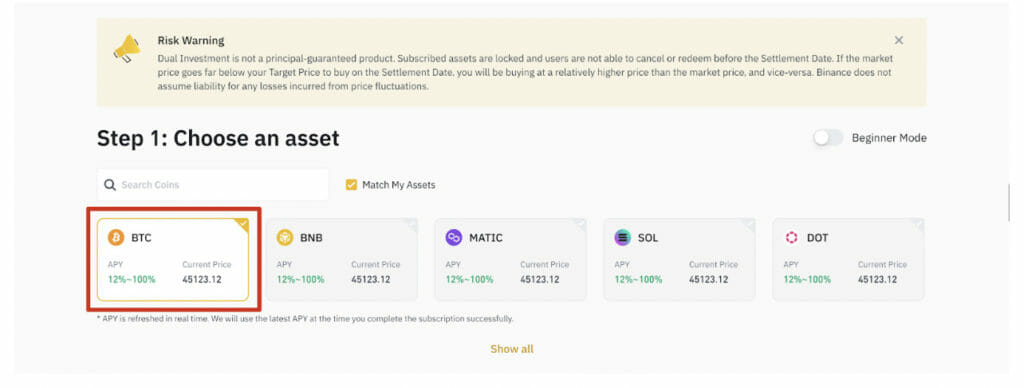

How does Dual Investment Work in Binance?

Scenario 2:

How does Dual Investment Work in Binance?

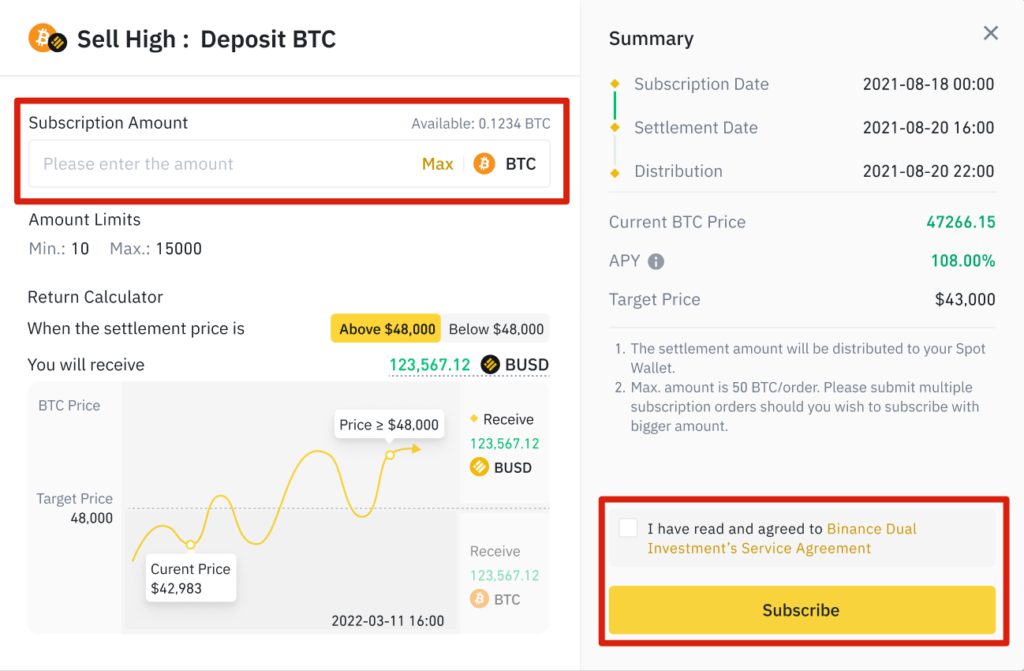

In this section, we will learn how Dual Investment Works in Binance in a step-by-step manner.

- Step 1: Go to Binance Dual Investment Platform and Choose the Asset for Dual Investment.

Choose an Asset

Choose an Asset

- Step 2: Complete the Dual Investment Quiz {This is for the new users of this product}.

- Step 3: Choose Sell High or Buy Low.

- Step 4: Select the Target Price and Settlement Date.

- Step 5: Enter the Subscription Amount, Agree to Binance Dual Investment’s Service Agreement and click Subscribe.

Enter the Amount of Subscription

Enter the Amount of Subscription

Disclaimer: On every Settlement Date, Binance uses 08:00 UTC as the checkpoint to decide whether the Settlement Price has reached the Target Price or not. The user’s funds will be returned within 6 hours after the Settlement Date checkpoint.

How does Dual Investment Work in Pionex?Pionex dual investment is a non-guaranteed investment tool with an increased annualized rate of return. With this tool, a dual investment bot allows us to purchase or sell cryptocurrency at our desired price and date, which can yield high returning profits. We can choose the underlying asset, investment, investment currency, and the delivery date upon buying. Our profit will be denominated in the alternate currency or investment currency depending on the given circumstances:

- The target is reached if Settlement Price > Target Price

- The target is not reached if Settlement Price ≤ Target Price

We will obtain our returns in USDT if the target price is achieved, and if the target price is not achieved, in that case, we will receive it in the target currency. There is a settlement date for every product that is bought.

Pionex Dual Investment

Pionex Dual Investment

Here is a complete guide by C3 Team with step-by-step explanations on How to earn more BTC/ETH/XRP coins? | Pionex Dual Investment.

How does Dual Investment Work in Matrixport?If we talk about Matrixport, then they have renamed this product as Dual Currency, which is described as a non-principal protected investment product with floating return.

The process of Dual Currency is similar to what we have seen earlier in the case of Dual Investment in Binance and Pionex. Here we have a BTC/USD product with the parameters as follows:

- Linked Price: 11,000

- Expiry Date: 25-Oct-2022

- Yield: 5%

- Annualized Yield: 51.4%

- Investment Currency: BTC

Alice bought 1 BTC of the above product on September 19th, 2022. On October 25th, 2022, Two scenarios are possible:

- If BTC weakens between September 19 and 25 and the Settlement Price is below USD 11,000, Alice receives her original Investment and the 5% yield in BTC. Therefore, she receives 1*(1+5%) =1.05 BTC.

- If BTC rallies between September 19 and 25 and the Settlement Price is at or above USD 11,000, Alice receives her original Investment and the 5% yield in USD. Therefore, she receives 11,000 + 11,000 *0.05 = USD 11,550.

Alice will be guaranteed a 5% yield on the expiry date. The only uncertainty is whether she will receive the return in BTC or USDC, depending on where BTC/USD stands on the expiry date.

Here are some basic terminologies which will be helpful for Matrixport Users.

- Investment Currency: Currency in which the Investment is made into the product.

- Settlement Currency: Currency that we will receive when the product expires.

- Expiry Date: The user’s return from the investment product will be automatically credited into his account on this day.

- Yield: Income returned on Investment.

- Annualized Yield: Equivalent annual return we get if we continue purchasing this product with the given Yield for a whole year.

- Linked Price: Benchmark/Target price. If the Settlement Price is below the Linked Price, the product will be settled in Investment Currency (i.e., BTC in this case); otherwise, it will be settled in USDC.

- Settlement Price: Settlement Price is the average of the Settlement Index in the last 30 minutes before 16:00 (UTC+8) on the Expiry Date.

- Settlement Index: Derived from 7 leading BTC-USD exchanges, including Bittrex, Bitstamp, Coinbase Pro, Gemini, Kraken, Itbit, and LMAX Digital.

Pionex offers one of the simplest and easy-to-use trading bots in the industry without any additional paid plans. Further, the Pionex Dual Investment also turns out to be one of the best in the industry as it provides the highest returns compared to Binance and MatrixPort. Therefore, in conclusion, Pionex is the best platform to offer the Dual Investment product out there!

Frequently Asked Questions Is Dual Investment in Binance good?Binance is one of the best crypto exchanges. Binance Earn’s products are an excellent place to start for users looking to diversify their investments. Dual Investment is one of the more advanced ways for users to earn profits on their crypto investments.

Is Dual Investment risky?Dual Investment has a high return, but some risks are associated with it. The annualized return is fixed, but the asset’s price will influence the final payout upon delivery and the strike price. High market volatility would wipe out the potential profit that can be gained from the Dual Investment.

Is Dual Investment the best profitable opportunity?It depends on different users’ personal choices and strategies. There are multiple investment opportunities in the crypto space like staking, lending, etc. So, instead of relying on one strategy, users should try out a combination of different strategies or use their own unique strategy.

Also read, 12 Golden Rules to include in a Trading Strategy

Also read,

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.