and the distribution of digital products.

Pionex Arbitrage Bot | Earn through Spot – Futures Crypto Arbitrage

Pionex is one of the most popular trading bots providers, and it recently rolled out the crypto arbitrage bot. In this article, we will be covering all nitty-gritty of the arbitrage bot with the steps to create the bot.

Table of contents- Summary (TL;DR)

- What is Arbitrage?

- Problems with Manual Arbitrage Trading

- What is a crypto trading bot?

- What is the Pionex Spot – Futures arbitrage bot?

- What are perpetual futures contracts?

- Leverage for Pionex arbitrage bot

- How does the Pionex arbitrage bot work?

- What is the funding rate?

- Guide for spot-futures arbitrage bot

- Pionex Arbitrage Bot: Fees

- What are Pionex arbitrage bot SAFU funds?

- Rules for Pionex arbitrage bot

- Risks involved with crypto arbitrage trading

- Tips for using crypto arbitrage bot

- Pionex Arbitrage Bot: Pros and Cons

- Pionex Arbitrage Bot: Conclusion

- Frequently Asked Question

- Arbitrage allows you to buy and sell an asset simultaneously in different markets to gain returns from its price difference.

- Pionex Spot-Futures arbitrage bot is one of a kind in the crypto market, which allow arbitrage between Spot and Futures market.

- Perpetual futures contracts allow you to buy or sell an underlying commodity at any time in the future.

- The trading bot comes with maximum leverage of 3x and provides a steady funding rate.

- You can use the arbitrage bot on your desktop as well as your mobile phone.

- Pionex charges a 10% fee on your profits through the arbitrage bot.

- The platform deposits 50% of the 10% fees in the SAFU funds.

- Arbitrage trading comes with minimum risks; however, anything associated with crypto cannot be entirely risk-free.

Trading an asset on different markets and taking returns through the asset’s price difference in these other markets is called arbitrage.

There may be only a minor difference in the asset’s value on the two exchanges. Hence the returns are very tiny as compared to any other types of trading options. However, it is also considered one of the safest ways to gain returns through crypto trading.

If you’re a beginner, you can start by learning the basics of arbitrage. To do so, you can read our guide on how to make money as a beginner using arbitrage.

Problems with Manual Arbitrage TradingWithout a tool, usually, you need to keep an eye on a couple of exchanges and compare the price differences of a particular asset. You can then buy the asset at a specific price on one exchange and at the same time sell it at a higher price on another exchange.

It is a tedious task to look out for price differences of the same asset in various trading markets. Imagine if a bot can do this job for you and help you perform arbitrage.

Pionex recently came out with its arbitrage trading bot, so let us understand the trading bot and its various features.

However, Pionex Spot- Futures arbitrage bot is different because it opens a position on the Spot and Futures market at the same time and help you earn through difference of prices in these two markets.

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”] What is a crypto trading bot?Crypt trading bots exist to reduce your losses and risks in a particular trade. Its primary objective is to automate your trades. Trading bots place orders in your place and allow you some extra time to look at other essential matters.

If you wish to learn more about the crypto trading bots at Pionex, you can read our Pionex review.

What is the Pionex Spot – Futures arbitrage bot?Pionex recently came up with its Spot-Futures arbitrage bot, which helps you gain returns through an asset’s price difference in different markets. This bot provides a relatively higher return, which can go up to 50% and has a relatively lower risk.

Pionex Arbitrage Bot

Pionex Arbitrage Bot

However, you should realize that nothing in the crypto market is without risks. In arbitrage, if the market suffers extreme conditions or spot system and security contract system go down, you may lose your capital.

What are perpetual futures contracts?Perpetual futures contracts allow owning the rights of the underlying commodity, which you can buy or sell at any point in the future. A perpetual futures contract differs from a traditional futures contract. You can hold them for an indefinite period, and they still won’t expire.

Pionex allows you to trade in perpetual futures contracts and even leveraged tokens. To have a better understanding of leveraged tokens, you can read our ultimate guide to leveraged tokens.

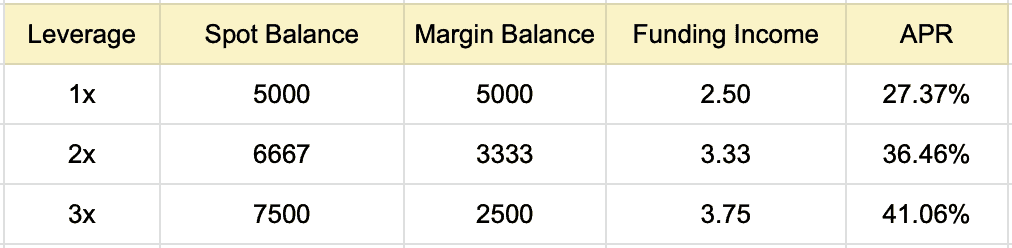

Leverage for Pionex arbitrage botYou can trade on leverage for up to 3x through the Pionex arbitrage bot. The higher the leverage you use, the higher your returns will be; however, with an increase in leverage, the chance of early liquidation of the futures contract part also increases.

Leverage On Pionex Arbitrage Bot

How does the Pionex arbitrage bot work?

Leverage On Pionex Arbitrage Bot

How does the Pionex arbitrage bot work?

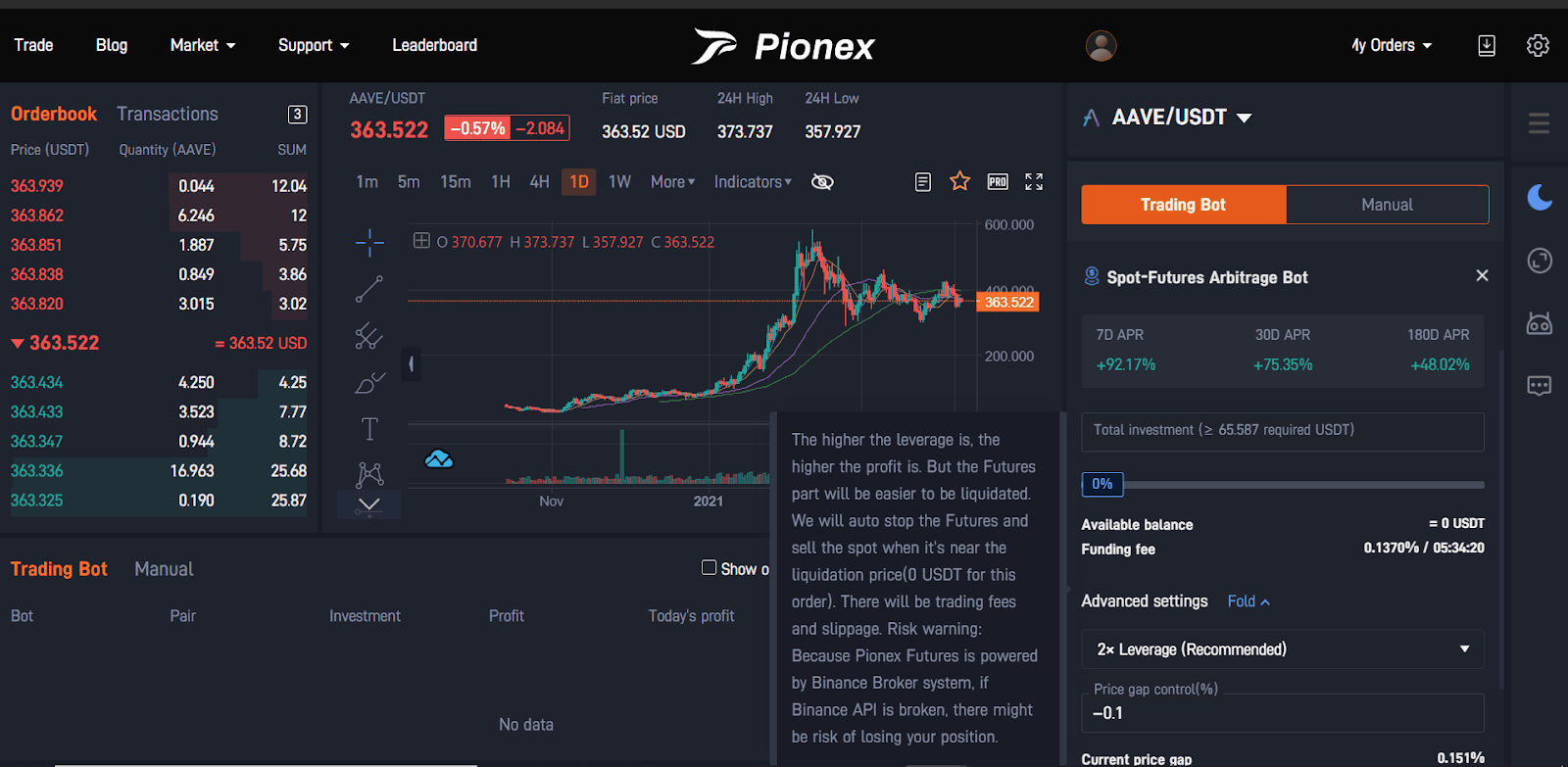

Pionex offers various bots, including the Pionex Spot-Futures arbitrage bot. You only have to create the bot by setting the leverage, total investment, and price gap control. The bot automatically provides you with the funding APR (Annual percentage rate).

Let’s assume that you are trading Bitcoin(BTC) with a leverage of 1x and an investment of 1000 USDT. Suppose the current price of BTC is 1000 USDT. When you create the Spot-Futures arbitrage bot, it automatically buys BTC of 500 USDT in the spot market and opens a short position of the remaining 500 USDT in the futures market.

Now, if the current funding rate is 0.06% every eight hours; hence your APR would be 0.06 * 0.5 * 3 * 365 = 32.85%.

You can increase this return by using leverage. If you use a 3x leverage, the bot will buy bitcoins worth 750 USDT in the spot market and open a short position worth 250 USDT in the futures market.

Arbitrage bot is one of the safest ways to trade on crypto. Since you are not holding the assets and buying and selling them simultaneously; hence there is a negligible chance of loss. Arbitrage bot provides you with a consistent return, and it can vary anywhere between 15% to 50% APR.

What is the funding rate?Pionex does not charge you any funding fee, and the funding rate ensures that the index prices and the futures prices converge frequently.

When the futures contract is trading higher than the spot market, and you open a short position, the longs will be paying you due to a positive funding rate. The short positions pay the longs when the futures price is trading below the index price.

You must better understand the platform before going long or short with crypto trading using bots. You can learn more about going short by reading our article on How to short bitcoin using leveraged tokens?

Guide for spot-futures arbitrage botPionex offers spot-futures arbitrage bot and many other types of bots, including different grid trading bots. You can use the arbitrage bot by creating it from the Pionex website or mobile app.

If you wish to learn more about the Grid trading bots at Pionex, you can read our article on the crypto grid trading bots.

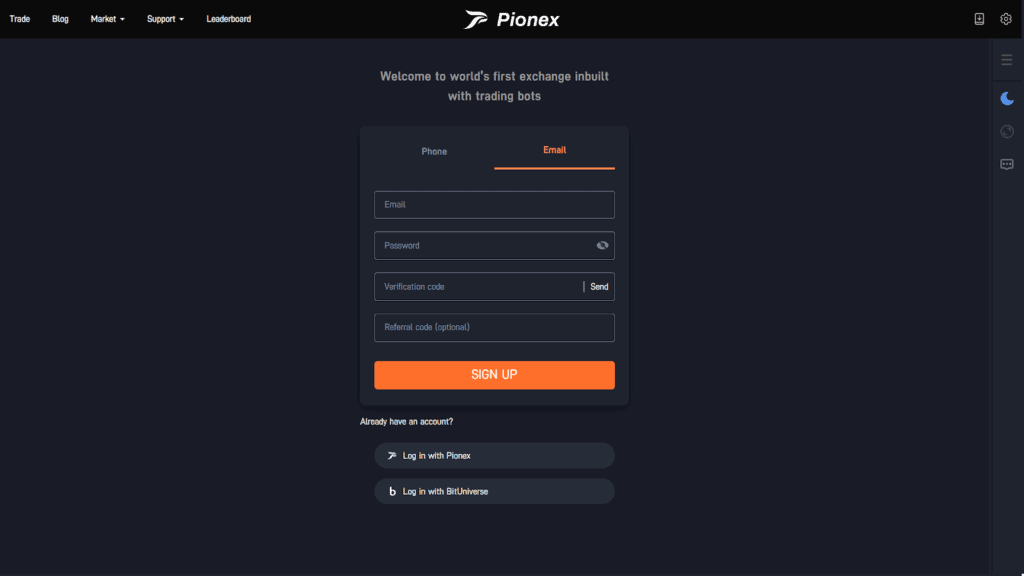

How to sign-up for Pionex?The first thing you’ll have to do is create an account on Pionex. You can follow the below steps to do the same:

- Visit the official website of Pionex or download the app.

- Now click on the sign-up button.

- Enter your email and password on the next window.

- Confirm your email through the code on your mailbox.

- Now log into your account and visit the funds’ section.

- From there, deposit some funds to proceed ahead.

Pionex Sign Up

How to create the Pionex arbitrage bot on desktop?

Pionex Sign Up

How to create the Pionex arbitrage bot on desktop?

The next step after creating an account would be to set up the trading bot. To set up the trading bot on the website, you can follow the below steps:

- Log into your Pionex account and visit the trade tab.

- Now click on the create button across the spot-futures arbitrage bot.

- Then choose the coin for which you wish to create the bot.

- Click on the create button after selecting the leverage, total investment, and price gap control.

Create the Pionex arbitrage bot

How to create the Pionex arbitrage bot on mobile?

Create the Pionex arbitrage bot

How to create the Pionex arbitrage bot on mobile?

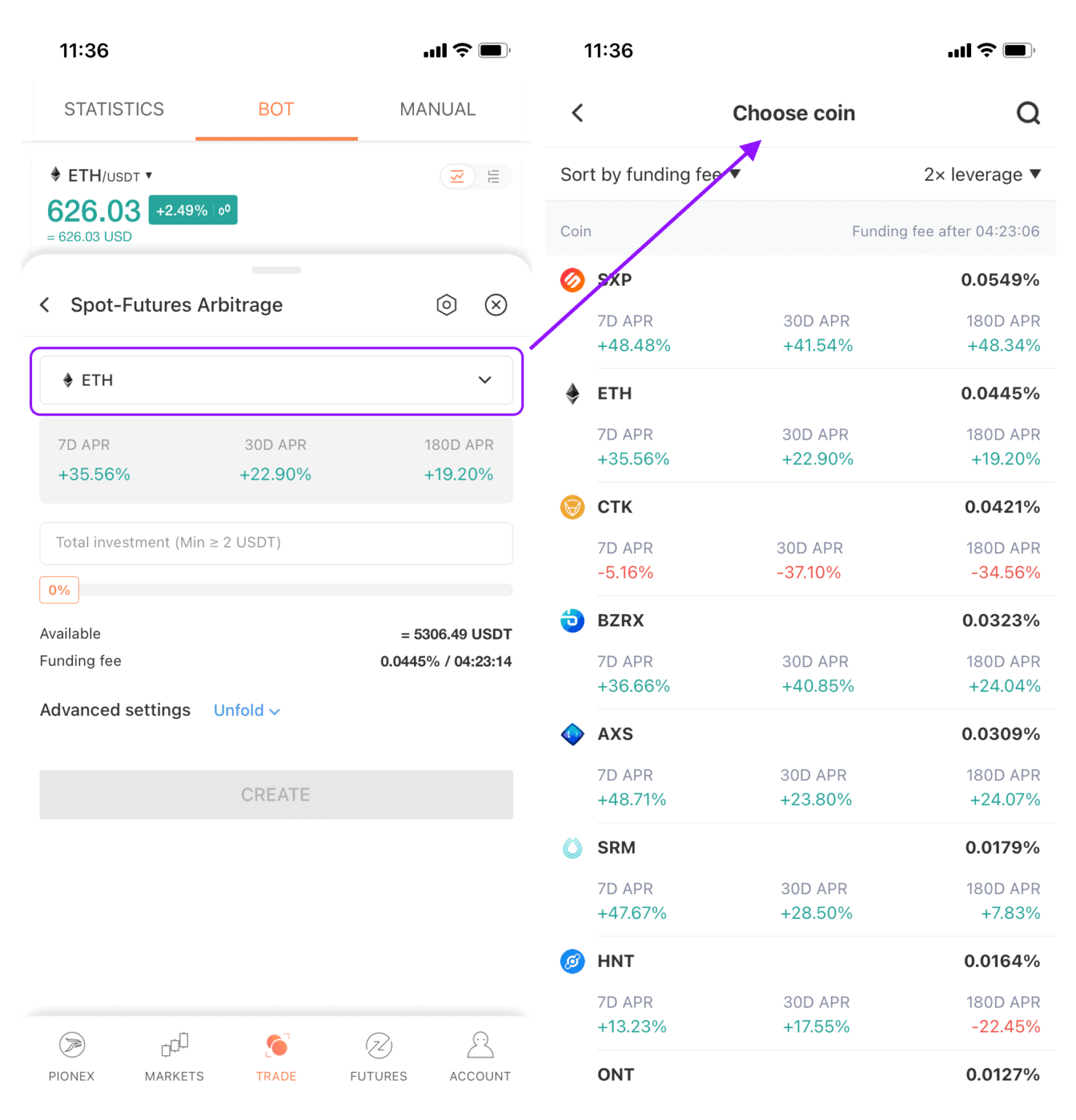

You can also use Pionex from your mobile phone, and to do the same, you can follow the below steps:

- The first step would be to download and install the Pionex app from the play store or app store.

- Log into your Pionex account or create one by following the above steps.

- Click on the trade button at the bottom of the screen.

- Then select the BOT tab from the top of the screen.

- Now click on the create bot button at the bottom of the screen.

- From the following menu, choose the Spot-Futures Arbitrage button and click on the create button across this option.

- Now select all the options with your preference.

- Finally, hit the create button at the bottom of the screen.

Pionex Spot-Futures Arbitrage Bot

Pionex Arbitrage Bot: Fees

Pionex Spot-Futures Arbitrage Bot

Pionex Arbitrage Bot: Fees

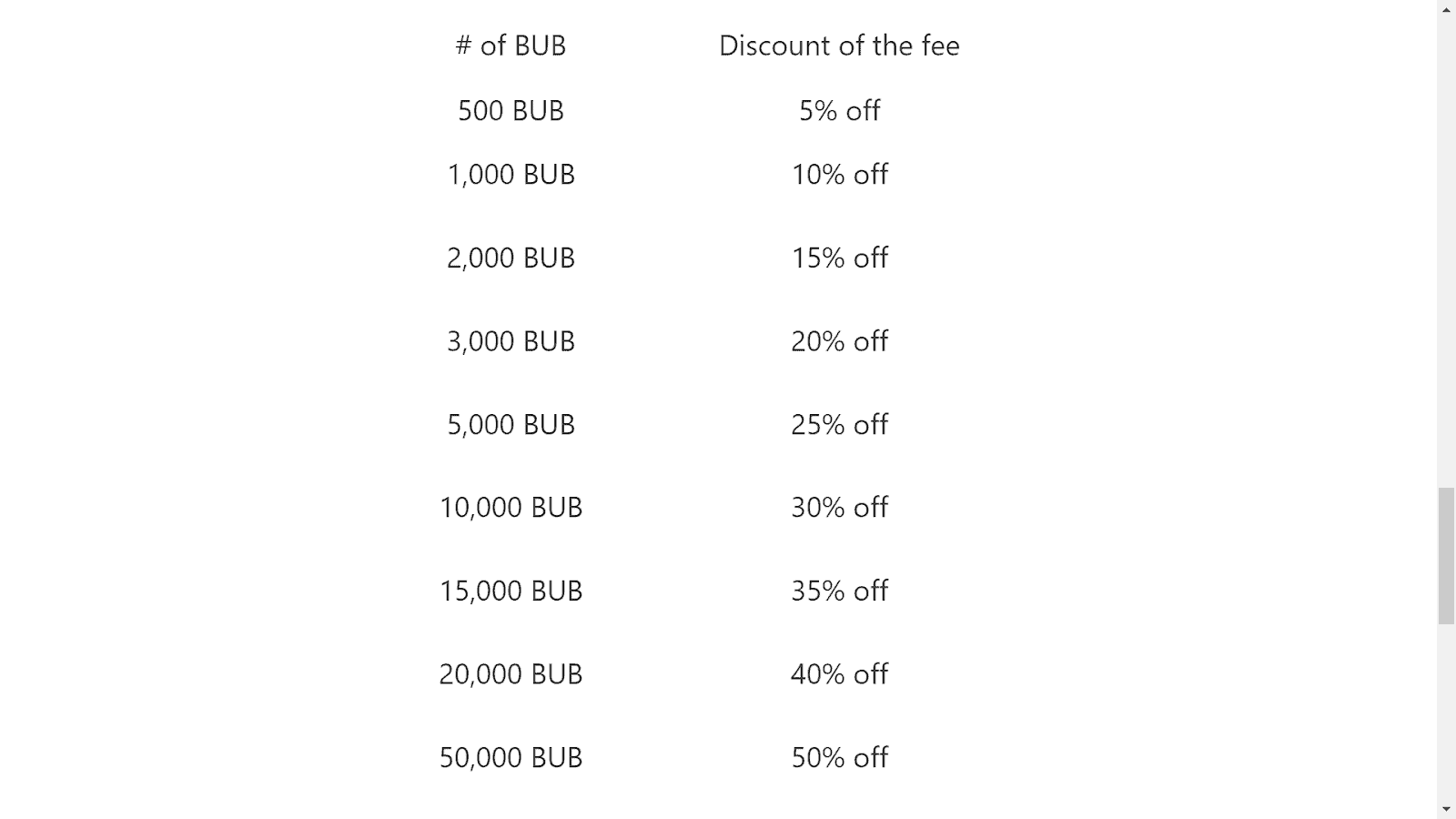

Pionex charges a fee of 10% from your profits from the arbitrage bot. However, holding BUB can help you get a discount on the service fee based on the below table:

Pionex Arbitrage Bot Fees

What are Pionex arbitrage bot SAFU funds?

Pionex Arbitrage Bot Fees

What are Pionex arbitrage bot SAFU funds?

The platform uses 50% of the fee it charges you to deposit to the SAFU funds. The crypto exchange uses the SAFU funds in events similar to Black Swan while using a spot-futures arbitrage bot.

Rules for Pionex arbitrage botPionex Spot-Futures arbitrage bot follows some specific rules, which are as follows:

- The platform will deduct the fee whenever you reduce the position or close the Spot-Futures arbitrage bot.

- Pionex charges you a fee of 10%, and 50% of this is used to deposit in the SAFU funds.

- The arbitrage insurance fund won’t cover issues if you face them in withdrawing your funds due to Binance or Huobi.

- The platform will not provide you with the total compensation if your SAFU fund is used up, and after applying for compensation, the new SAFU fund cannot cover all the losses.

There are always risks involved in crypto trading, and it would be a lie if someone says that anything related to crypto is completely risk-free (obviously apart from not investing at all). Below are some of the risks involved with the arbitrage trading bot:

- There can be cases such as the black swan, which can make you lose your capital.

- There is also a chance of suffering losses if Binance’s currency security contract system goes down.

- Pionex is not going to compensate you if the problem is not on their side.

- The arbitrage bot also depends on the robustness of the Binance Broker API.

You can learn more about how the bots of Binance and Pionex differ from each other by reading our article on Pionex vs. Binance.

Tips for using crypto arbitrage botUsing the crypto arbitrage bot can be confusing at times, so before you jump into, and create your arbitrage bot, let’s fill you up with some tips.

- If the price gap is negative, then this is not the time to start an arbitrage bot.

- When the price gap is negative or a lower value, then it a signal to close your positions and finish your arbitrage strategy.

- You shouldn’t switch between coins often; since you’ll have to pay a trading fee on starting and closing the bot.

- Similar to crypto investment, arbitrage 2 to 3 cryptocurrencies at a time.

- Use one bot with one coin at a time.

Pionex is considered one of the best crypto trading bot providers in the market, among others such as 3Commas and Cryptohopper. You can still read our comparison between Pionex, 3Commas, and Cryptohopper by clicking here.

Pionex Arbitrage Bot: Pros and Cons Pionex Arbitrage Bot: ConclusionPionex Spot-Futures arbitrage bot is designed to provide you with a risk-free trading experience. It comes with minimal risks and significant returns. This bot uses leverage to increase your returns, and you can set the leverage up to 3x. The platform also charges you a 10% fee. It provides you with the SAFU funds in case there are any high market fluctuations when you suffer a loss using the arbitrage bot.

Frequently Asked Question When does arbitrage trading occur?Crypto arbitrage trading occurs when there is a price difference of an asset in different markets. When you find this difference, you can use a bot to gain some returns or do it manually.

How to make a trading bot?First, you’ll have to visit Pionex and log into your account or create an account. Then see the trade tab and chose the bot option on the trade window. Finally, you can choose a bot, customize it accordingly and hit the create button.

What is arbitrage?Arbitrage means when you buy and sell the same asset at the same time at different prices. You can do this by purchasing the asset at a lower price in one market and then selling it at a higher price in some other market.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.