and the distribution of digital products.

DM Television

The Path to a Real Decentralized Order Book Protocol

Bridging On-Chain Liquidity with Real-Time Trading Infrastructure

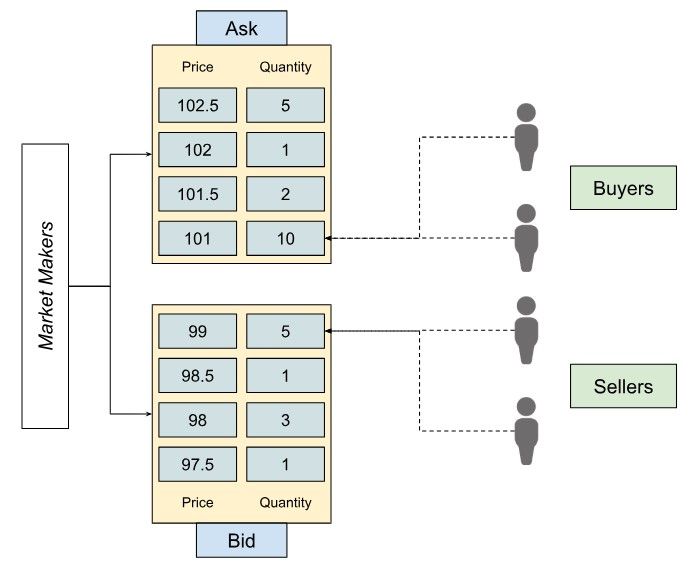

\ In traditional finance and centralized exchanges (CEXs), order books are the lifeblood of price discovery. They match buyers and sellers dynamically, relying on fast infrastructure and deep liquidity. However, bringing this mechanism on-chain within decentralized finance (DeFi) is significantly more complex - primarily due to latency, gas costs, and liquidity fragmentation.

In this article, we explore a novel Decentralized Order Book (DOB) protocol design, leveraging Layer 2 infrastructure and on-chain liquidity pools structured as programmable market makers. The goal of this DOB protocol: to enable a high-performance, transparent, and secure trading layer that mimics the efficiency of centralized order books, without compromising on decentralization or custody.

\

Why DeFi Lacks a True Order BookDespite its innovation, the only real order books that we can find in the crypto space are offered by centralized exchanges; DeFi hasn't yet replicated the robustness of traditional order books. Instead, it has adopted two predominant models: Liquidity Aggregators and RFQ Systems - AMMs are not offering order books.

Liquidity AggregatorsThese services stitch together liquidity across DEXs (e.g., 1inch, Matcha) to simulate an order book. While they improve execution via smart routing and can integrate CEX/DEX arbitrage, they lack precision in pricing and face challenges with fragmented liquidity and timing mismatches.

Some services, like dYdX, are aggregating DEX liquidity and try to offer enhanced liquidity and\or tighter slippage based on their own contributions. Nonetheless, these order books are not CEX-like order books.

Request-for-Quote (RFQ) SystemsUsed by protocols like 0x, or dYdX, these systems provide “static” quotes from market makers. They're simple and efficient for large trades, but they don’t reflect real-time market dynamics and offer limited transparency.

Hence, with current technologies and services, DeFi:

- Lacks of competitive spreads

- Doesn’t allow to manage impermanent loss optimally

- Suffer from reduced transparency in price formation

\

A real DOB protocol aims to bring the benefits of traditional order books (i.e. depth, price competitiveness, and fairness) into the decentralized realm. To achieve this, three core innovations are required:

New wallet standard for Layer 2 protocolLayer 2s bring scalability but introduce asynchronous trade execution and commitment risks. A new wallet architecture is necessary, fulfilling the following:

- Non-custodial asset management: users remain in control of their tokens

- Collateral locking: temporarily locks assets until the trade cycle completes

- Timeout safety: users can always reclaim assets after a timeout, preventing lockups

- Delegation capabilities: wallet owners can authorize third parties to trade within defined limits—enabling institutional access, bot integration, or proxy trading

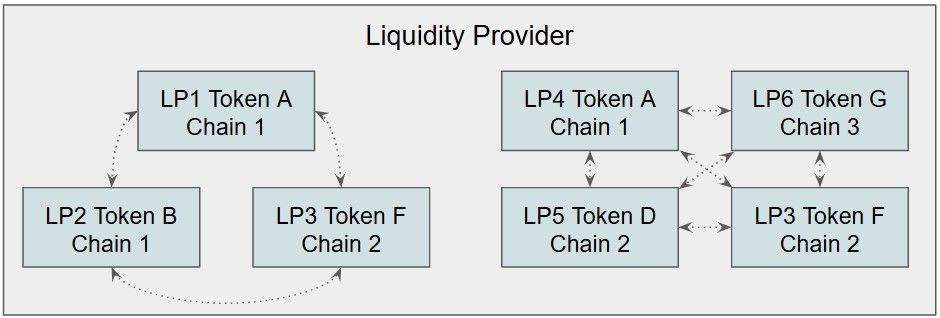

To replicate the price ladder of an order book, liquidity must be more granular and programmable. DMMPs introduce structured, token-specific pools with custom parameters:

Single-token liquidity: each pool holds one asset on a given chain

Cross-chain / routes “mappability”: routing logic matches pools across chains (e.g. with Chart 2 below, Token A on Chain 1 → Token F on Chain 2)

Programmable elasticity: Liquidity Providers (LPs) shall be able to define how their pool reacts to market movements, embedding custom spreads and response curves

These new DMMPs turn passive LPs into configurable market makers.

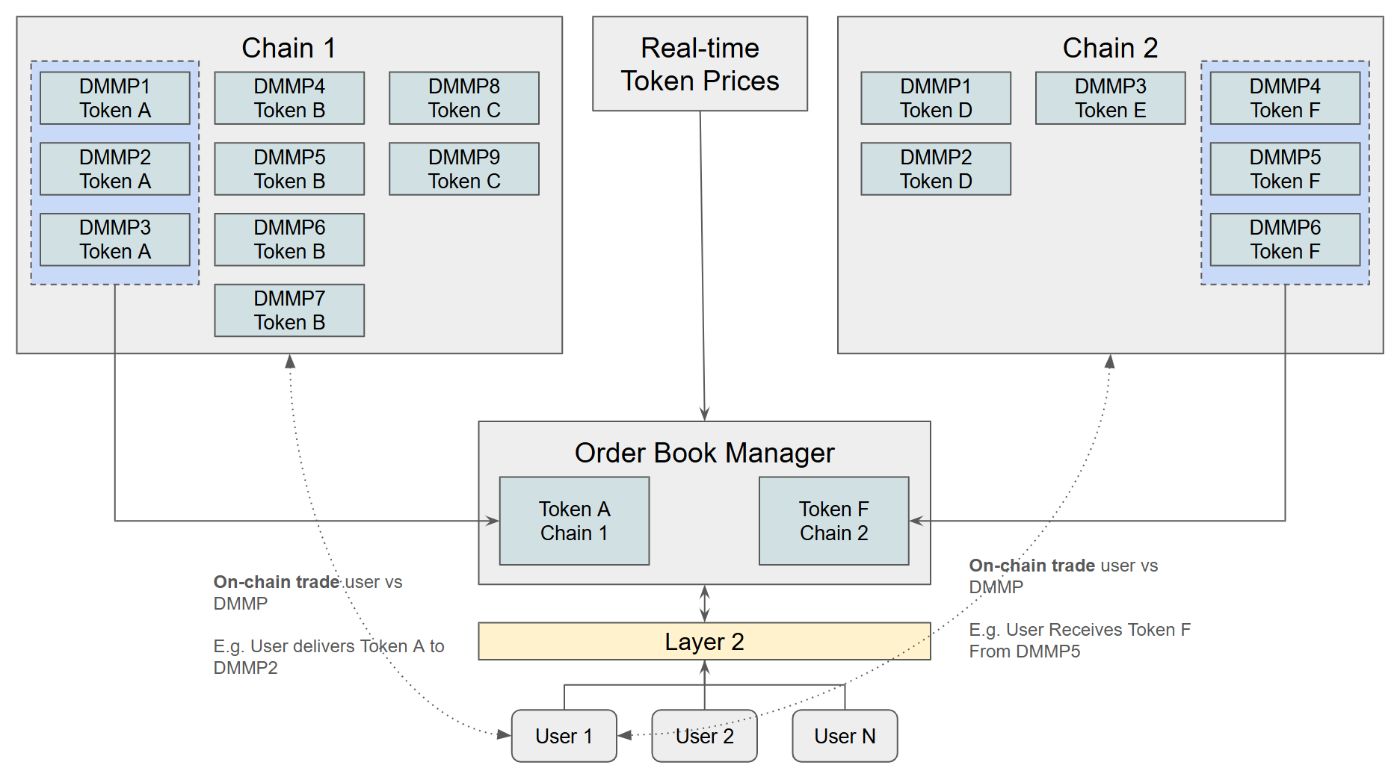

A Layer 2 Order Book ManagerThe computational engine of the DOB is a dedicated Layer 2 protocol that:

- Aggregates all DMMPs to build a composite order book across routes

- Ingests real-time price feeds from centralized exchanges for reference pricing

- Computes orders dynamically, based on each pool’s elasticity and spread

- Updates positions and commitments, syncing with on-chain settlement at intervals

This layer transforms static pools into an active, globally routed order book—while maintaining decentralization principles.

\

Real-Time Elasticity and PricingOne key DOB innovation is its elastic pricing engine, which adjusts spreads and pricing sensitivity dynamically based on market demand, mimicking slippage curves:

Where:

- DOBPricet is the effective trade price

- MarketPricet is the oracle-based market price

- ε is a dynamic elasticity/spread function

This enables:

- Price reactivity: Adjusts instantly to new data

- Reduced impermanent loss: Unlike AMMs, prices shift proactively

- Custom trading behavior: LPs can widen or tighten spreads per strategy

\

Benefits Over AMMs and CEXs| Feature | AMMs | CEXs | DOB Protocol | |----|:---:|:---:|:---:| | Real-time price updates | ❌ | ✅ | ✅ | | Non-custodial | ✅ | ❌ | ✅ | | Elastic pricing | ❌ | ✅ | ✅ | | Custom MM strategies | ❌ | ✅ | ✅ | | Gas-efficient atching | ✅ | ✅ | ✅ | | Full interoperability | ❌ | ❌ | ✅ |

\

Use Cases and Vision- Cross-chain spot trading with true market depth

- Decentralized market-making infrastructure for institutions

- Arbitrage-ready environments between DeFi and CEXs

- Custom liquidity strategies (e.g., risk-adjusted spread management)

Over time, DOB protocols can serve as the foundation for decentralized derivatives and advanced trading systems, without relying on opaque intermediaries.

\

Challenges and Next StepsWhile promising, the DOB approach must overcome key challenges:

- Asynchronous Trade Risk → solved via new wallet architecture

- High-speed computation → requires performant Layer 2 networks

- Fair auction mechanisms → to avoid front-running and ensure price-time priority

- Oracle reliance → ensuring robust, tamper-proof price feeds

Integrations with zk-rollups, intents-based systems, and decentralized identity (DID) standards could enhance its robustness and adoption.

\

The Decentralized Order Book protocol represents a leap forward in how we think about on-chain trading infrastructure. By blending real-time centralized exchange data with decentralized liquidity and Layer 2 scalability, it offers a vision of DeFi that is both secure, efficient, and user-centric.

While still in development, the groundwork laid by the DOB model could unlock the next generation of decentralized finance - bridging the gap between passive liquidity provisioning and active, capital-efficient trading.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.