and the distribution of digital products.

DM Television

The Paradox of Stablecoins: The Savior or Achilles’ Heel of Crypto?

Blockchain technology has long promised the creation of an independent financial ecosystem—one that operates free from the control of traditional finance institutions that have continually benefited from their extortion. Cryptocurrencies like Bitcoin and Ethereum emerged as decentralized alternatives to fiat, with the goal of democratizing finance and empowering individual sovereignty. Central to this mission is autonomy, transparency, and resistance to censorship.

\ Stablecoins have become a natural extension to cryptocurrency. Acting as a proxy to real world assets, stablecoins hypothecate fiat currencies like the U.S. dollar on a blockchain. They have quickly emerged as a useful tool in the crypto ecosystem, offering a solution to volatility while still gaining the benefits of a 24/7 always-on system. Stablecoins have found a predominant product-market fit within crypto, becoming the backbone for payments, lending, and remittances.

\ However, it is important to raise concerns about our reliance on stablecoins. Stablecoins have the ability to undermine blockchain autonomy and expose what should be a pristine network, isolated from traditional finance, to unduly force off-chain.

Stablecoins as Settlement LayersStablecoins like USDC are commonly perceived as cryptocurrencies, but in reality, they function closer to digital traditional payment gateways like Visa or Mastercard just on a blockchain. These stablecoins are backed by reserves held in traditional banks while the blockchain functions solely as an interchange protocol, similar to existing payment networks.

\ This process closely resembles how traditional finance operates: funds are moved between accounts, with the underlying value anchored outside of the transaction. This setup is wildly different from the truly decentralized vision by early crypto pioneers.

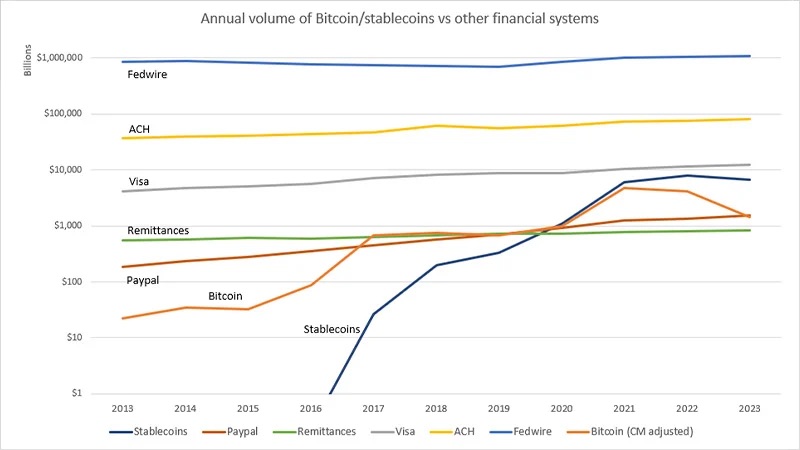

\ The canary in the coal mine for the chokehold stablecoins have on crypto is the comparison of transaction volume between stablecoins and native cryptocurrencies. Stablecoin transaction volume now even dominates the volume of native crypto assets like Bitcoin or Ether.

\

\

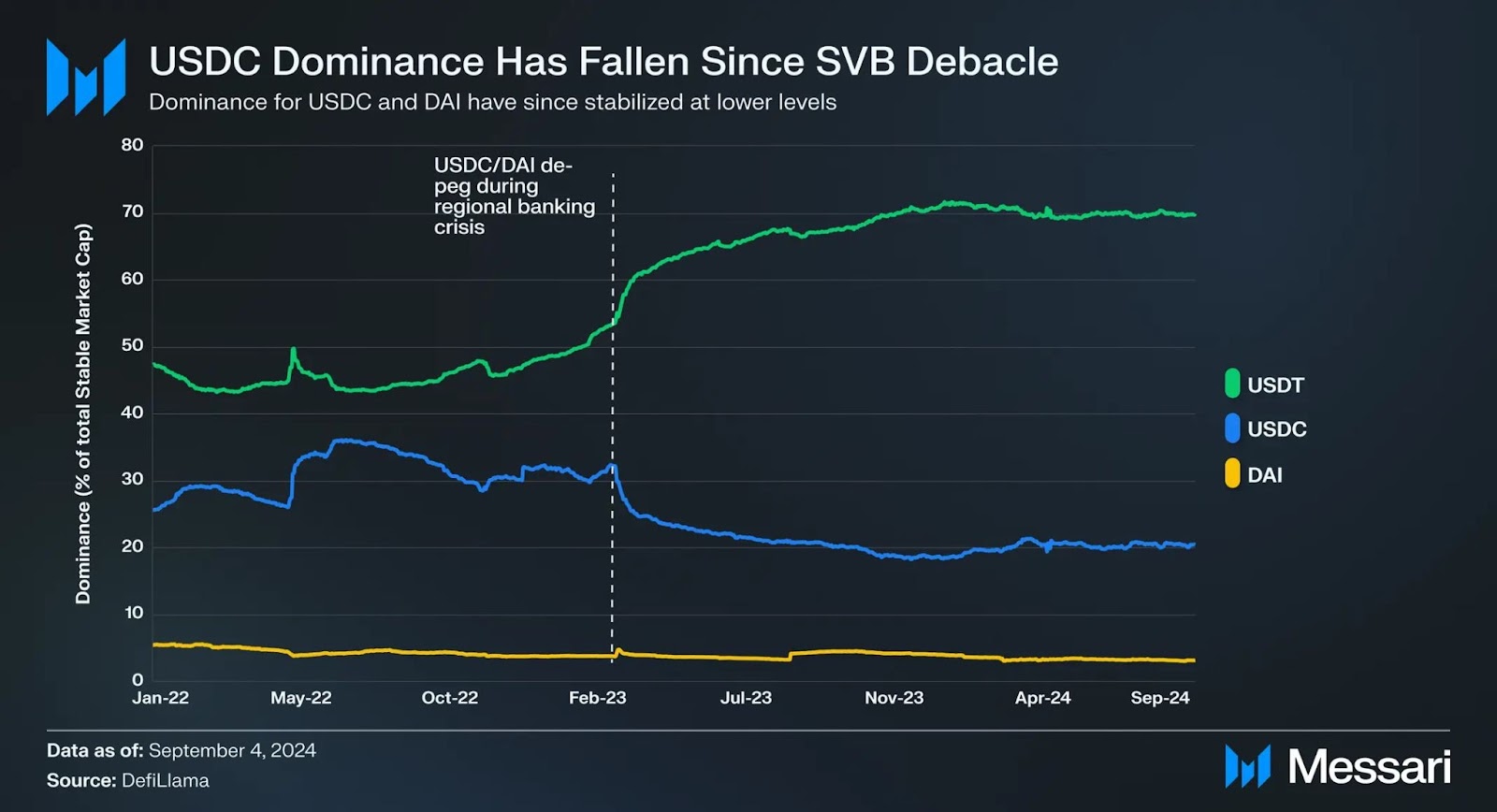

The SVB Collapse and USDCThe collapse of Silicon Valley Bank (SVB) in early 2023 is a stark reminder of how dangerous stablecoins deeply intertwined with traditional finance can be. As news broke of SVB’s potential insolvency, panic quickly spread through the crypto markets and fear around USDC’s peg arose.

\ SVB’s collapse triggered a wave of USDC redemptions, essentially creating a bank run on USDC while USDC itself was experiencing a bank run on SVB. This sudden surge led to the de-pegging of USDC from $1 down to $0.84 at the lows.

\ While the situation eventually stabilized, it exposed a critical vulnerability: stability on chain is directly tied to the health of our traditional banking system, something crypto aimed to wholly do away with.

\ In fact, over a year and a half later, USDC has yet to fully recover in dominance against USDT.

\

Stablecoins destroy the independence and decentralization of blockchains through their reliance on traditional banking. This dependency extends beyond the mere financial aspect since stablecoins are vulnerable to regulatory control and influence, potentially comprising the censorship-resistant nature of crypto. As we know it today, U.S Treasury Secretary, Janet Yellen, could theoretically exert influence over the Ethereum network via the nearly $100B of stablecoins that exist on Ethereum.

\ Moreover, stablecoin issuers possess the power to censor or block transactions, introducing risks to users that are not well advertised or communicated. This centralized control over such a critical and emerging sector of the crypto economy represents a significant deviation from a decentralized future without central banking.

The U.S Government’s Stance on StablecoinsWhile many in the crypto industry are cheering on the United States government’s new found love of stablecoins, maybe we should raise our eyebrows slightly. Given the government’s previously critical stance on cryptocurrencies, this apparent contradiction lends credence to the idea that stablecoins can be a Trojan Horse for censorship and CBDCs.

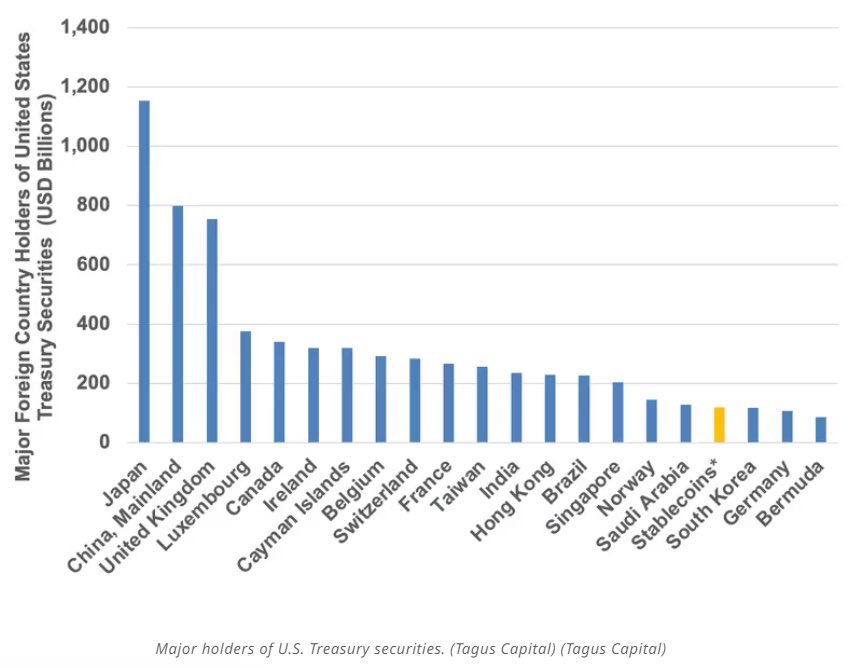

\ It is also understandable why the U.S sees stablecoins as an important sector. Stablecoins are a useful vehicle for exporting dollar dominance into the digital age. In fact, stablecoins are the 16th largest holder of US Treasuries. By encouraging the adoption of dollar-pegged stablecoins, the government can extend its monopoly on the monetary system it has held tightly since the Bretton Woods agreement in 1944.

\

Every dollar invested in stablecoins on a blockchain network represents a missed opportunity for investment in the network's native asset. Diversion of capital decreases the economic security of the underlying blockchain, particularly in Proof of Stake systems. As the market cap of stablecoins continues to grow, that is value that in theory could have been attributed to the economic security of Ethereum itself.

\ Furthermore, The fees generated from stablecoin transactions often flow to centralized entities rather than the network operators themselves. This outflow of value undermines the long term revenue for network participants and the fees paid by users. A simple example is an ETH payment on Ethereum costing $1 in fees while a USDT payment on Ethereum may cost $30 at the same gas price.

\ The situation at hand not only drives users towards centralized stablecoins but to centralized networks as well. It is a bleak outlook if the future of crypto is purely centralized stablecoins on centralized L2s operated by centralized exchanges.

Potential SolutionsFortunately, there are new economic primitives emerging that mitigate these aforementioned centralized forces imposed by stablecoins. Alternatives include ETH derivatives such as Reflexer’s RAI token, commodity-backed assets, and native crypto assets, each offering unique approaches to achieving stability without relying on TradFi.

\ It’s also worth noting that given most stablecoins do not distribute treasury yield or track CPI, they are not truly “stable” in the strictest sense and instead lose purchasing power. This has opened the door for “flatcoins” like SPOT or NUON to further innovate although at similar dependencies for centralization.

\ Novel approaches to achieving stability without traditional backing are constantly being developed. These include liquidity-incentivized pools, dynamic supply adjustment mechanisms, and cross-chain collateralization strategies. While none have yet achieved the dominance of fiat-backed stablecoins, they represent important steps towards a more autonomous blockchain ecosystem.

\

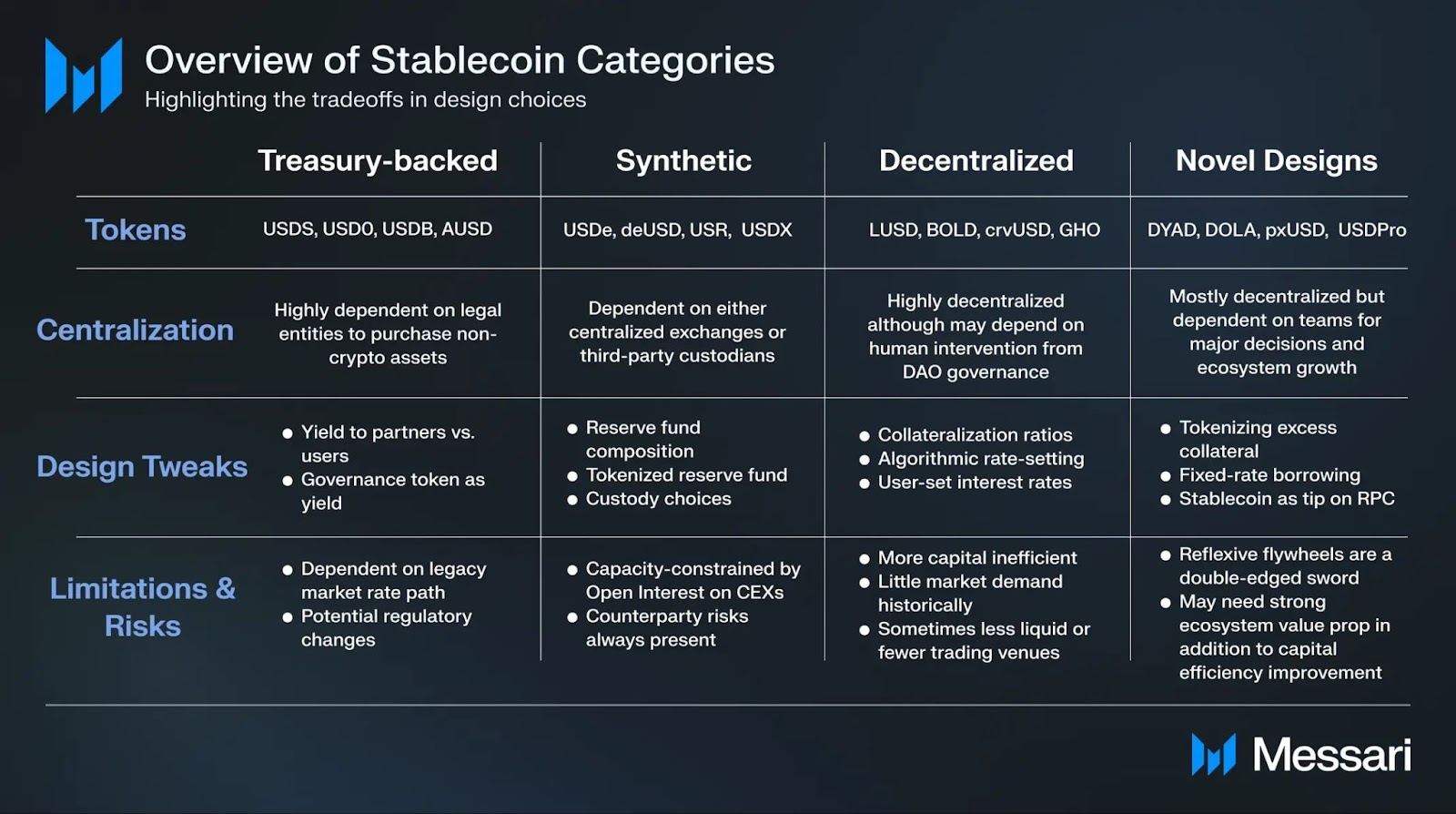

The stablecoin landscape presents a variety of approaches, each with its own set of trade-offs. Treasury-backed stablecoins offer high stability but are highly centralized, while synthetic stablecoins introduce potential points of failure through reliance on exchanges or custodians. Decentralized alternatives aim for greater autonomy but have faced challenges with capital efficiency.

\ In this context, the concept of an energy-based stablecoin alternative emerges as a promising innovation. By tying value to computational work and energy costs, it offers a unique solution that addresses many of the shortcomings of existing designs. This approach provides a tangible, real-world basis for pricing, potentially enhancing stability without sacrificing decentralization. It also aligns well with the increasingly digital and energy-conscious global economy.

ConclusionStablecoins are set to be an enormous product market fit for blockchain technology and will accelerate the use of crypto adoption globally. However, it is crucial to recognize how these assets jeopardize some of the most desirable and unique properties of cryptocurrency, namely decentralization, censorship-resistance, and economic independence.

\ This fundamental conflict highlights the friction of how people are realistically using blockchain technology today and how crypto idealists see the future. As the crypto industry continues to evolve, it is critical that we evaluate all dependencies on centralized systems and work towards solutions that give financial sovereignty back to users.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.